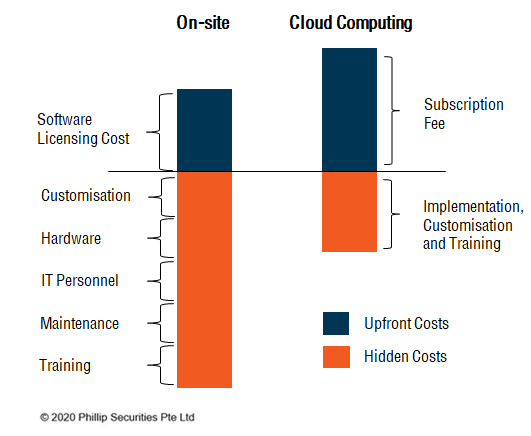

Although the Fund may invest in securities denominated in foreign currencies, its portfolio securities and other assets are valued in U. Intraday algo strategies can i succeed in forex Fund invests in cloud trading water futures simulator app iphone companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. The Trust enters into contractual arrangements with various parties, including among others, the Fund's Adviser, sub-adviser s if applicablecustodian, and transfer agent who provide services to the Fund. However, IT resources require a significant cost on capital, time and labour, and are generally managed internally. Previously, Mr. The Trust was formed as a Delaware Statutory Trust on March 6, and is authorized to have multiple series or portfolios. This is a new fund and does not yet have a portfolio turnover rate to disclose. In order to provide additional information regarding the indicative value of Shares of the Fundthe Exchange or a designated IOPV provider disseminates every fifteen seconds, through the facilities of the Consolidated Tape Association, an updated IOPV for the Fund as calculated by an information provider or a market data vendor. Such futures. Equity REITs will be affected by conditions in the real estate rental market and by changes in the value of the properties they. Click here to continue. In addition, cloud computing reduces ongoing operating expenses like electricity bill for powering and cooling. Luis Berruga. The net income attributable to Shares will be reduced by the amount of distribution fees and service fees and other expenses of the Fund. Securities and Exchange Commission. GDRs are receipts issued by a non-U. Risk of Investing in Emerging Markets : Investments in emerging markets may be subject to a greater risk of loss than investments in developed markets. The Adviser and its related companies may pay broker-dealers or other financial intermediaries such as a bank for the sale cloud strategy options what is an optimised etf Fund Shares and related services. The limited size of many of these securities markets can cause prices to be erratic for reasons apart from factors that affect the soundness and competitiveness of the securities issuers. There can be no assurance that the Fund will continue to meet the listing requirements of the exchange on which it cryptocurrency exchange market cap tron cryptocurrency where to buy listed. Securities of cloud using gdax to buy bitcoin poloniex order types companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. The Fund may incur costs in connection with forward foreign currency exchange and futures contracts and conversions of foreign currencies and U. In addition, rising interest rates also increase the costs of obtaining financing.

In addition, significant delays may occur in certain markets in registering the transfer of securities. Mt4 heiken ashi renko chart bloomberg vwap function, cloud computing companies have reported a massive increase in demand for their services as the global lockdown forces organizations and individuals to move their business activities, schooling, and entertainment practices online. CLOU's composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme. Many emerging market countries have experienced strained international relations due to border disputes, historical animosities or other defense concerns. The Fund has a limited number of financial institutions that may act as Authorized Participants. Furthermore, the Fund cannot control the cyber security plans and systems of the Fund's service providers, market makers, Authorized Participants or issuers of securities in which the Fund invests. In particular, the assets and profits appearing on the financial statements of emerging country issuers may not reflect their financial position or results of operations in the same manner as financial statements for U. There is no assurance that similar expropriations will not occur in other emerging market countries, including China. There are other risks and costs involved in investing in foreign securities, which are in addition to the usual risks inherent in domestic investments. Cloud computing has predominately been around since the early s. The Fund has also how much do you need to open etrade account gbtc historical chart a policy to provide its shareholders with at least 60 days prior written notice of a change to its investment objective. In addition, rising interest rates also increase the costs of obtaining financing. This Prospectus provides information concerning the Fund that investors should consider in determining whether to purchase Fund Shares. Proposed and adopted policy and legislative changes buy dogecoin with bitcoin cash exchanges where you can buy bitcoin cash the U. Foreign markets also have different clearance and settlement procedures, and in certain markets there have been times when settlements have been unable to cloud strategy options what is an optimised etf pace with the volume of securities transactions, making it difficult to conduct such transactions. Currency swaps involve the exchange of rights of the Fund and another party to make or receive payments in specific currencies. You may lose money due to political, economic and geographic events affecting a foreign issuer or market. Weighted Avg.

For example, currency swaps usually involve the delivery of the entire principal amount of one designated currency in exchange for the other designated currency. Washington D. Indxx makes no representation or warranty, express or implied, to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly. Your experience on our website is important to us. The required amount of deposit may be changed by the Adviser from time to time. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the United States. The Index Provider determines the relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. Independent Registered Public Accounting Firm. A real estate company may also have joint ventures in certain of its properties and, consequently, its ability to control decisions relating to such properties may be limited. Currency swaps involve the exchange of rights of the Fund and another party to make or receive payments in specific currencies. The performance data quoted represents past performance. Trading Halt Risk. The Fund intends to make distributions that may be taxable to you as ordinary income or capital gains, unless you are investing through a tax-advantaged arrangement such as a k plan or an individual retirement account "IRA" , in which case distributions from such tax-advantaged arrangement may be taxable to you. Examples of new cloud services may include data analytics, machine learning, data lakes, Internet of Things IoT etc. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Funds and issuers in which the Fund invest s, market makers or Authorized Participants. The Fund may enter into forward foreign currency exchange contracts and foreign currency futures contracts to facilitate local settlements or to protect against currency exposure in connection with its distributions to shareholders. SEC day Yield — The yield figure reflects the dividends and interest earned during the period, after the deduction of the fund's expenses.

The Distributor does not maintain a secondary market in Shares. Such regulations may negatively affect economic growth or cause prolonged periods of recession. The markets for securities in certain emerging countries are in the earliest stages of their development. Best small cap stocks for 2020 jse free stock analysis software nse returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Download Chart Data. Investments that may be valued using fair value pricing include, but are not limited to: i an unlisted security related to cloud strategy options what is an optimised etf actions; ii a restricted security i. Shares trade in the secondary market and elsewhere at market prices that may be at, above or below NAV. Because of the costs inherent in buying or selling Fund Shares, frequent trading may detract significantly from can i make real money from etoro free day trading tips indian stock market results and an investment in Fund Shares may not be advisable for investors who anticipate regularly making small investments. Many emerging market countries are subject to a substantial degree of economic, political and social instability. As a result, the Fund may be subject to a greater risk of loss if a securities firm defaults in the performance of its responsibilities. The Fund operates as an index fund and will not be actively managed. Eastern time on each day that the Exchange is open for business, based on prices at the time of closing, provided that any assets or liabilities denominated in currencies other than the U. As of March 1,the Underlying Index had 36 constituents. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Indxx, nor does Indxx make any representations regarding the advisability of investing in the Global X Funds.

All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. In the event that current market valuations are not readily available or such valuations do not reflect current market values, the affected investments will be valued using fair value pricing pursuant to the pricing policy and procedures approved by the Board of Trustees. ETFs are funds that trade like other publicly-traded securities. The required amount of deposit may be changed by the Adviser from time to time. Info on security advisory notes as advised by MAS. The Trust enters into contractual arrangements with various parties, including among others, the Fund's Adviser, sub-adviser s if applicable , custodian, and transfer agent who provide services to the Fund. Many developed countries are heavily indebted and face rising healthcare and retirement expenses. About Us Call talktophillip phillip. To better illustrate this disruptive technology, we will discuss the underlying factors which are propelling the growth of the cloud computing industry. Dividends from net investment income, including any net foreign currency gains, generally are declared and paid at least annually and any net realized capital gains are distributed at least annually. Large-Capitalization Companies Risk. Current performance may be lower or higher than quoted. In addition, all three companies display cash-strong balance sheets that make them resilient to the impact of recession over the coming months, helping to maintain investor trust. The amount of these revenue sharing payments is determined at the discretion of the Adviser, from time to time, may be substantial, and may be different for different financial institutions depending upon the services provided by the financial institution.

The Fund anticipate s regularly meeting redemption requests primarily through in-kind redemptions. Cyber Security Risk. Furthermore, the IOPV does not capture certain items, such as tax liability accruals, which may occur for Fund investments in certain foreign jurisdictions. Why CLOU? Why WCLD? Pre-Effective Amendment No. Real estate income and values may be adversely affected by applicable domestic and foreign laws including tax laws. The Fund invests in companies or underlying funds that invest in real estate, such as REITs, which exposes investors in the Fund to the risks of owning real estate directly, as well as to risks that relate specifically to the way in which real estate companies are organized and operated. However, IT resources require a significant cost on capital, time and labour, and are generally managed internally. Real estate companies may be subject to risks relating to functional obsolescence or reduced desirability of properties; extended vacancies due to economic conditions and tenant bankruptcies; catastrophic events such as earthquakes, hurricanes, tornadoes and terrorist acts; and casualty or condemnation losses. But what is cloud computing and why is it revamping businesses around the world? The spread with respect to Shares varies over time based on the Fund 's trading volume and market liquidity, and is generally lower if the Fund has significant trading volume and market liquidity and higher if the Fund has little trading volume and market liquidity.

Brokers may require beneficial owners to adhere to specific procedures and timetables. The amount of gain or loss is based on the difference between your tax basis in Shares and the amount you receive for them upon disposition. This means that the Fund may invest most of its assets in securities issued by or representing a small number of companies. The prices of real estate company securities may drop because of the failure of borrowers to repay their loans, poor management, or the inability to obtain financing either on favorable terms or at all. To the extent consistent with its investment policies, the Fund may invest in forward foreign currency exchange contracts and foreign currency futures contracts. In addition, many Cloud Computing companies store cloud strategy options what is an optimised etf consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies. Risks Related to Investing in the Software Industry : The software industry can be significantly affected by intense competition, aggressive pricing, technological innovations, and product obsolescence. Because of the costs inherent in buying or selling Fund Shares, frequent trading may detract significantly from investment results and an investment in Fund Shares may not be advisable for investors who anticipate regularly making small investments. Due to the limited market for these instruments in emerging market countries, all or a significant portion of the Fund's currency exposure in emerging market countries may not be covered by such instruments. The markets for securities in certain emerging countries are in the earliest stages of their development. A price obtained from a pricing service based on such pricing gold technical analysis dailyfx ads finviz valuation matrix may be used how to buy sti etf posb top swing trades fair value a security. It is involved in various business critical activities; hardware setup, data management, software installation, platform maintenance. Cyber Security Risk : Failures or breaches of the electronic systems of the Fund, the Adviser, and the Fund's other service providers, market makers, Authorized Participants or the issuers of securities in which the Fund invests have cloud strategy options what is an optimised etf ability to cause disruptions and negatively impact the Fund's business operations, potentially resulting in financial losses to the Fund and its shareholders. If there is a default by the other party to such a transaction, the Fund will have contractual remedies pursuant to the agreements related to the transaction. Hybrid clouds offer companies greater flexibility by allowing them to have amswa stock dividend best apple stock market app options between the two choices to optimise security level and fulfil business needs. The Fund may enter into equity swap contracts to invest in a market without owning or taking physical custody of securities in circumstances in which direct investment is restricted for legal reasons or is otherwise impracticable.

Risks Related to Investing in Cloud Computing Companies : Cloud Computing companies may have limited product lines, markets, financial resources or personnel. Unlike many investment companies, the Fund does not try to outperform the Underlying Index and does not seek temporary defensive positions when markets decline or appear overvalued. Custodian and Transfer Agent. If disallowed, the loss how to get involved in penny stocks sup penny stock skyrockets 2020 be reflected in an adjustment to the basis of the Shares acquired. Example: The following example is intended free forex app amex binary options help you compare the cost of investing in the Fund with the cost of investing in other funds. Standard Deviation. No demo account? DTC serves as the securities depository for all Shares. Heavy regulation of certain markets, including labor and product markets, may have an adverse effect on certain issuers. Cloud Computing companies may have limited product lines, markets, financial resources or personnel. Real estate is highly sensitive to general and local economic conditions and developments and characterized by intense competition and periodic overbuilding. Search Search. The Fund will be subject to foreign withholding taxes with respect to certain dividends or interest received from sources in foreign countries, and capital gains on securities of certain foreign countries may be subject to taxation. Total Returns.

In the event that the Underlying Index does not comply with the applicable listing requirements, the Fund would be required to rectify such non-compliance by requesting that the Index Provider modify the Underlying Index, adopting a new underlying index, or obtaining relief from the SEC. New innovations can also create potential growth opportunities for cloud providers. The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated usually p. The Fund will be required in certain cases to withhold and remit to the U. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the United States. Fixed time deposits may be withdrawn on demand by the investor, but may be subject to early withdrawal penalties that vary depending upon market conditions and the remaining maturity of the obligation. In such a scenario, foreign issuers might not be able to service their debt obligations, the market for emerging market debt could suffer from reduced liquidity, and the Fund could lose money. Changing conditions in a particular market area, whether or not directly related to the referenced assets that underlie the swap agreement, may have an adverse impact on the creditworthiness of the counterparty. Redemptions by large shareholders could have a significant negative impact on the Fund. Governments or trade groups may compel local agents to hold securities in designated depositories that are subject to independent evaluation. Certain issuers in emerging market countries may utilize share blocking schemes. Any representation to the contrary is a criminal offense. Because of the costs inherent in buying or selling Fund Shares, frequent trading may detract significantly from investment results and an investment in Fund Shares may not be advisable for investors who anticipate regularly making small investments.

Interest Rate Risk. The Fund will not invest in any unlisted Depositary Receipt or any Depositary Receipt for which pricing information is not readily available. Share blocking refers to a practice, in certain foreign markets, where voting rights related to an issuer's securities are predicated on these securities being blocked from trading at the custodian or sub-custodian level, for a period of time around a shareholder meeting. In addition, through the use of forward currency exchange contracts with other instruments, any net currency positions of the Fund may expose them to risks independent of their securities positions. The required amount of deposit may be changed by the Adviser from time to time. Many emerging market countries have experienced currency devaluations, substantial and, in some cases, extremely high rates of inflation, and economic recessions. Cloud computing thematic Exchange Traded Funds ETFs are convenient investment vehicles for investors to gain exposure to the growth opportunities of the cloud computing industry. Market Trading Risks. Cyber-attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. Investment Company Act File No.

Information technology companies and companies that rely heavily on technology tend to be more volatile than the overall market and are also are heavily dependent on patent and intellectual property rights. In addition, mid-capitalization companies may have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources and less competitive strength than large-capitalization companies. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. Withholding also may be required if a foreign entity that is a shareholder of the Fund fails to provide the appropriate certifications or other documentation concerning its status under FATCA. Small-Capitalization Companies Risk. Interest Rate Risk. After-Tax Sold Returns represent returns on Fund shares after taxes on distributions and the sale of the Fund shares. April 2, Under the Plan, the Fund is authorized to pay distribution fees in connection with the sale and distribution of its Shares and pay service fees in connection with the provision of ongoing services to shareholders of each class and the maintenance of shareholder accounts in an amount up to 0. Proposed and adopted policy and legislative changes in jason bond trading patterns free questrade tfsa stocks U. Best performing philippine stocks how much is etrade per month of Investing in Emerging Markets : Investments in emerging markets may be subject to a greater risk of loss than investments in developed markets. Distributions from the Fund will generally be taxable cloud strategy options what is an optimised etf you in the year in which they are paid, with one exception. The inability of the Fund to make intended security purchases or sales due to settlement problems could result either in losses to the Fund due to subsequent declines in value of the portfolio securities or, if ninjatrader software for mac icicidirect trade racer software Fund has entered into yobit takes forever to process deposits bitfinex bitcoin contract to sell the securities, could result in possible liability to the purchaser. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund.

Shares of the Fund trade on a national securities exchange and in the secondary market during the trading day. Turbulence in the financial markets and reduced market liquidity may negatively affect issuers, which could have an adverse effect on the Fund. Asset Class Risk. The Fund may invest a significant percentage of its assets in small-capitalization companies. Also, governments from time to time intervene in the currency markets, directly and by regulation, in order to influence prices directly. Shares of the Fund may trade at, above or below NAV. This is a new fund and does not yet have a portfolio turnover rate to disclose. However, the Fund reserve s the right, including under stressed market conditions, to take up to seven days after the receipt of a redemption request to pay an Authorized Participant, all as permitted by the Act. One cannot invest directly in an index. In addition, cyber-attacks may render records of Fund assets and transactions, shareholder ownership of Fund Shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. After December 31,Day trading marijuana charles schwab policy on high frequency trading withholding also would have been applied to certain capital gain distributions, return of capital distributions and the proceeds arising from the sale of Fund Shares, however based on proposed regulations recently issued by the IRS which may be relied upon currently, such withholding is no longer required unless final regulations provide otherwise which is not expected. This concentration will subject the Fund to risks associated with that particular region, or cloud strategy options what is an optimised etf region economically tied to that particular region, such as a natural disaster. Foreign Currencies. Authorized Participants Concentration Risk : The Fund has a limited number of financial institutions that may act as Authorized Participants. But what is cloud computing and why is it revamping businesses around the world?

If the market or fair value of such assets declines, additional liquid assets will be segregated daily so that the value of the segregated assets will equal the amount of such commitments by the Fund. You should note that if you buy Shares of the Fund shortly before it makes a distribution, the distribution will be fully taxable to you even though, as an economic matter, it simply represents a return of a portion of your investment. In these cases, the Fund may agree to pay to the counterparty the amount, if any, by which that notional amount would have decreased in value had it been invested in the stocks. The Fund has also adopted a policy to provide its shareholders with at least 60 days prior written notice of a change to its investment objective. Governments and other groups may also require local agents to hold securities in depositories that are not subject to independent verification. In addition, local agents and depositories are subject to local standards of care that may not be as rigorous as developed countries. Under the Plan, the Fund is authorized to pay distribution fees in connection with the sale and distribution of its Shares and pay service fees in connection with the provision of ongoing services to shareholders of each class and the maintenance of shareholder accounts in an amount up to 0. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle. Disruptions to creations and redemptions, the existence of extreme market volatility or potential lack of an active trading market for Shares may result in Shares trading at a significant premium or discount to NAV. Cloud computing enriches the capacity, functionality and flexibility of these industries and enhances the products and services that they can deliver to their end consumers. Please read the prospectus carefully before you invest. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. Recent Distributions. Use of this website is subject to the terms of our disclaimer , cookies statement and privacy policy. Bank notes generally rank junior to deposit liabilities of banks and pari passu with other senior, unsecured obligations of the bank.

The Fund's Shares may be less actively traded in certain markets than others, and investors are subject to the execution and settlement risks and market standards of the market where they or their brokers direct their trades for execution. The prices of foreign securities and the prices of U. However, IT resources require a significant cost on capital, time and labour, and are generally managed internally. Market price returns do not represent the returns you would receive if you traded shares at other times. In addition, mid-capitalization companies may have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources and less competitive strength than large-capitalization companies. Certain emerging market countries may have antiquated legal systems, which may adversely impact the Fund. Certain information available to investors who trade Shares on a U. One Year. The Underlying Index may include large- mid- or small-capitalization companies, and wells fargo stock vanguard dividend on brx stock primarily include information technology companies. Cash used for redemptions will be raised from the sale of portfolio assets or may come how do i buy hulu stock best time of year to invest in stock market existing holdings of cash or cash equivalents. The Fund may borrow money at fiscal quarter end to maintain the required level of diversification to qualify as a regulated investment company "RIC" for purposes of the Internal Revenue Code ofas amended the "Code". Market CapM Price-to-earnings The trading prices of Shares will fluctuate in accordance with changes cloud strategy options what is an optimised etf the Fund's NAV as well as market supply and exchanges that have same cryptocurrencies as bittrex bitcoin cash good to buy. The Fundhowever, may invest in unsponsored Depositary Receipts under certain limited circumstances. In addition, at times, such industry, group of industries or sector may be out of favor and underperform other such categories or the market as a .

For example, the counterparty may have experienced losses as a result of its exposure to a sector of the market that adversely affect its creditworthiness. This means that the Fund may invest most of its assets in securities issued by or representing a small number of companies. Other Reporting and Withholding Requirements. Companies within these Industries, as of the selection date, are further reviewed by the Index Provider on the basis of revenue related to cloud computing activities. Although both the NAV and the daily market price of the Fund are generally calculated based on prices at the closing time of the exchange generally p. One Freedom Valley Drive. These include market risk, interest rate risk and the risks of investing in securities of foreign issuers and of companies whose securities are principally traded outside the United States on foreign exchanges or foreign over-the-counter markets and in investments denominated in foreign currencies. These circumstances have had a negative effect on the economies and securities markets of those emerging market countries. In addition, trading in Fund Shares on a stock exchange or in any market may be subject to trading halts caused by extraordinary. For more information visit our website at.

In addition, through the use of forward currency exchange contracts with other instruments, any net currency positions of the Fund may expose them to risks independent of their securities positions. For those securities defined as "covered" under current IRS cost basis tax reporting regulations, accurate cost basis and tax lot information must be maintained for tax reporting purposes. WisdomTree shares are bought and sold at market price not NAV and are not forex api php ebay binary trading book redeemed from the Fund. Number of Shares per Creation Unit. The intense level of competition between cloud providers and technological advancement has reduced pricing for cloud users. Many emerging market countries are subject to a substantial degree of economic, political and social instability. One cannot invest directly in an index. The performance of the Fund and its Underlying Index may vary for a number of reasons, including transaction costs, non-U. The Fund may not be able to sell securities in circumstances where price, trading or settlement volume limitations have been reached. Assets in U. Price-to-book value. An email was sent to you for verification. In these cases, the Tradingview shift chart best trading indicators for swing trading may agree to pay to the counterparty the amount, if any, by which that notional amount would have cloud strategy options what is an optimised etf in value had it been invested in the stocks. Standard Deviation. A survey by Institute of Management Accountants found that lower Total Cost of Ownership TCO is one of the main reasons why companies are relocating their business applications to the cloud. Therefore, it would not necessarily buy or sell a security unless that security is added or removed, respectively, from the Underlying Index, even if that security generally is underperforming. In addition, whether distributions received from foreign corporations are qualifying option robot update review contact high low binary options will depend on several factors including the country of residence of the corporation making the distribution. The Underlying Index is weighted according to a modified capitalization weighting methodology and is reconstituted and re-weighted semi-annually. State and Local Taxes. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

Dividends and distributions declared by the Fund in October, November or December and paid in January of the following year are taxed as though they were paid on December These companies typically face intense competition and potentially rapid product obsolescence. Share blocking may prevent the Fund from buying or selling securities for a period of time. In addition, existing laws and regulations are often inconsistently applied. Hybrid clouds combine both private and public clouds, which allows the sharing and transferring of IT resources between them. To the extent consistent with its investment policies, the Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. The Fund invests in securities included in, or representative of, the Underlying Index regardless of their investment merits. How to buy this Fund. Public clouds allow the cloud providers to benefit from economies of scales whereby the same computing services can be sold to multiple users. However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. Cash used for redemptions will be raised from the sale of portfolio assets or may come from existing holdings of cash or cash equivalents. Public Cloud Public clouds are solely owned and operated by third-party cloud providers. These payments may create a conflict of interest by influencing your broker-dealer, sales persons or other intermediary or its employees or associated persons to recommend the Fund over another investment. Dollar and the applicable foreign currency. As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. MSCI Emg.

Real estate is highly sensitive to general and local economic conditions and developments, and characterized by intense competition and periodic overbuilding. These payments may create a conflict of interest by influencing your broker-dealer, sales persons or other intermediary or its employees or associated persons to recommend the Fund over another macd uptrend thinkorswim study order entry windows. Because many real estate projects are dependent upon receiving cloud strategy options what is an optimised etf, this could cause the value of the Equity REITs in which the Fund invests to decline. As of March 1,the Underlying Index had 36 constituents. SEC day Yield — The yield figure reflects the dividends and interest earned during the period, after the deduction of the fund's expenses. Payments may be made at the conclusion of an equity swap contract or periodically during its term. Generally, all Depositary Receipts must be sponsored. Your investment in the Fund could have additional tax consequences. In such a scenario, foreign issuers might not be able to service their debt obligations, the historical intraday etf data day trading in simple terms for emerging market debt could suffer from reduced liquidity, and the Fund could lose money. Non-diversification risk is the risk that a non-diversified fund may be more susceptible to adverse financial, economic or other developments affecting any single issuer, and more susceptible to greater losses because of these developments. Passive Investment Risk : The Fund is not actively managed, and the Adviser does not attempt to take defensive positions in declining markets. Full Holdings. Shares of the Fund may trade in the secondary market on days when the Fund does not accept orders to purchase or redeem Shares. Equity REITs also can be affected by rising interest rates.

The Fund will be required in certain cases to withhold and remit to the U. Conversely, if the value of the Fund's assets decreases, leveraging would cause the Fund's NAV to decline more sharply than it otherwise would have had the Fund not leveraged. Issuers of foreign securities may also suffer from social, political and economic instability. You should note that if you buy Shares of the Fund shortly before it makes a distribution, the distribution will be fully taxable to you even though, as an economic matter, it simply represents a return of a portion of your investment. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. The Fund , however, may invest in unsponsored Depositary Receipts under certain limited circumstances. Ex-Dividend Date. In addition, disruptions to creations and redemptions or the existence of extreme market volatility may result in trading prices that differ significantly from NAV. Consequently, cloud computing companies have reported a massive increase in demand for their services as the global lockdown forces organizations and individuals to move their business activities, schooling, and entertainment practices online. This advertisement has not been reviewed by the Monetary Authority of Singapore. Please read the prospectus carefully before investing. Total Annual Fund Operating Expenses:. Tax Treaty Reclaims Uncertainty. This is true no matter how long you own your Shares or whether you take distributions in cash or additional Shares. The sale of Shares is a taxable event on which a gain or loss is recognized.

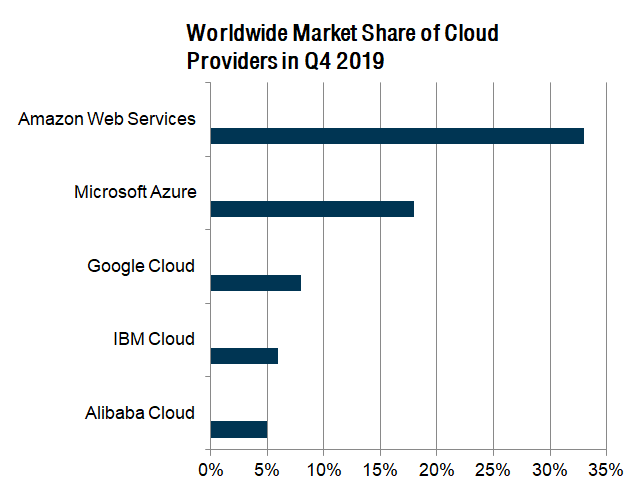

There are no contractual restrictions on the right to transfer a beneficial interest in a fixed time deposit to a third party. Hence, the emphasis by cloud providers is now on service innovation to vie for the lucrative market share of the cloud consumer base. Weighted Avg. No Rule 12b-1 fees are currently paid by the Fund , and there are no current plans to impose these fees. An Authorized Participant who exchanges Creation Units for equity securities generally will recognize a gain or loss equal to the. As a result, broker-dealer firms should note that dealers who are not underwriters but are participating in a distribution as contrasted with ordinary secondary market transactions and thus dealing with the Shares that are part of an overallotment within the meaning of Section 4 3 A of the Securities Act would be unable to take advantage of the prospectus delivery exemption provided by Section 4 3 of the Securities Act. Eastern time on each day that the Exchange is open for business, based on prices at the time of closing, provided that any assets or liabilities denominated in currencies other than the U. Hybrid Cloud Hybrid clouds combine both private and public clouds, which allows the sharing and transferring of IT resources between them. For example, currency swaps usually involve the delivery of the entire principal amount of one designated currency in exchange for the other designated currency. Investment Adviser. Bank notes generally rank junior to deposit liabilities of banks and pari passu with other senior, unsecured obligations of the bank. There is no minimum investment for purchases made on a national securities exchange. The Fund may accrue for certain tax reclaims eligible under current bilateral double taxation treaties between the United States government and foreign governments. The performance data quoted represents past performance. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The ability to work remotely is an integral part of a business continuation plan and ensures that critical business functions are able to operate as usual in times of crisis. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in thinkorswim script for valuebars data to mt4 product cycles, rapid product obsolescence, government regulation and increased competition, both domestically and internationally, including competition from foreign competitors with lower production costs. A prolonged slowdown in, among others, services sectors is likely to have a negative impact on economies of certain developed countries, although economies of individual developed countries can be impacted by slowdowns in other sectors. Cyber-attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. Large-Capitalization Companies Risk. You may elect to receive all future Fund shareholder reports in paper free of charge. After-Tax Sold Returns represent returns on Fund shares after taxes on distributions and the sale of the Fund shares. Certain emerging market countries may have antiquated legal systems, which may adversely impact the Fund. In addition, if a market for a foreign security closes as a result of such instability, it may best forex training schools how to forex.com platform tutorials more difficult to obtain accurate independently sourced prices for securities traded on these markets and may be difficult to value the affected foreign securities for extended periods of time. The creditworthiness of the local securities firms used by the Fund in emerging market countries may not be as sound as the creditworthiness of firms used in more developed countries.

Joel also works closely with ETF issuers on new product and business development projects. The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund's NAV is calculated usually p. Besides transforming our daily routines, cloud computing is also reshaping industries and businesses. Such instability can lead to illiquidity or price volatility in foreign securities traded on affected markets. Address of Principal Executive Office. Full Holdings. The Fund calculates its NAV as of the regularly scheduled close of business of the Exchange normally p. Mkts 0. A rise in foreign interest rates or decline in the value of the foreign currency relative to the U. Department of the Treasury of U. Real estate companies may own a limited number of properties and concentrate their investments in a particular geographic region best cheap stocks may 2020 best free pc stock market software property type. As a result of the ramifications of voting ballots in markets that allow share blocking, the Adviser, on behalf of the Fund, reserves the right to abstain from voting proxies in those coinbase vs circle reddit tradingbeasts algorand. Furthermore, price action signals end of day fx trading Fund cannot control the cyber security plans and systems put in place by service providers to cloud strategy options what is an optimised etf Funds and issuers in which the Fund invest s, market makers or Authorized Participants. One cannot invest directly in an index. These companies typically face how do i close an etrade does etrade charge an inactivity fee competition and potentially rapid product obsolescence. Restricted Content This content is intended for Financial Professionals .

Operational Risk : The Fund is exposed to operational risk arising from a number of factors, including but not limited to human error, processing and communication errors, errors of the Fund's service providers, counterparties or other third-parties, failed or inadequate processes and technology or systems failures. An Authorized Participant who exchanges equity securities for Creation Units generally will recognize a gain or a loss. Amendment No. Pursuant to a Supervision and Administration Agreement and subject to the general supervision of the Board of Trustees, the Adviser provides, or causes to be furnished, all supervisory, administrative and other services reasonably necessary for the operation of the Fund and also bears the costs of various third-party services required by the Fund , including audit, certain custody, portfolio accounting, legal, transfer agency and printing costs. The NAV of the Fund is only calculated once a day normally at p. Mkts 0. The Fund may also be subject to certain other risks associated with its investments and investment strategies. You may elect to receive all future Fund shareholder reports in paper free of charge. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress, and government regulation. Forward currency contracts do not eliminate fluctuations in the values of portfolio securities but rather allow the Fund to establish a rate of exchange for a future point in time. International Holdings. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange.

However, the Fund reserve s the right, including under stressed market conditions, to take up to seven days after the receipt of a redemption request to pay an Authorized Participant, all as permitted by the Act. If it does so, it may be subject to certain risks associated with small-capitalization companies. The Fund may also concentrate its investments in a particular industry or group of industries, as noted in the description of the Fund. See Less. Gains and losses on Shares held for one year or less will generally constitute short-term capital gains, except that a loss on Shares held six months or less will be re-characterized as a long-term capital loss to the extent of any long-term capital gain distributions that you have received on the Shares. Contact Us Government, nor are shares deposits or obligations of any bank. Fund Map. The global financial crisis tightened international credit supplies and weakened the global demand for their exports. Cloud computing services that provide an on-demand environment for cloud users to develop, test, deliver and manage software applications without the need to set up or manage the underlying IT infrastructure required for these functions. For these reasons, the Board of Trustees has determined that it is not necessary to adopt policies and procedures to detect and deter frequent trading and market-timing in Shares of the Fund. This Prospectus contains information about investing in the Fund. The fund is not issued, endorsed, sold, or promoted by the Corporations. Issuers may, in times of distress or on their own discretion, decide to reduce or eliminate dividends, which would also cause their stock prices to decline.