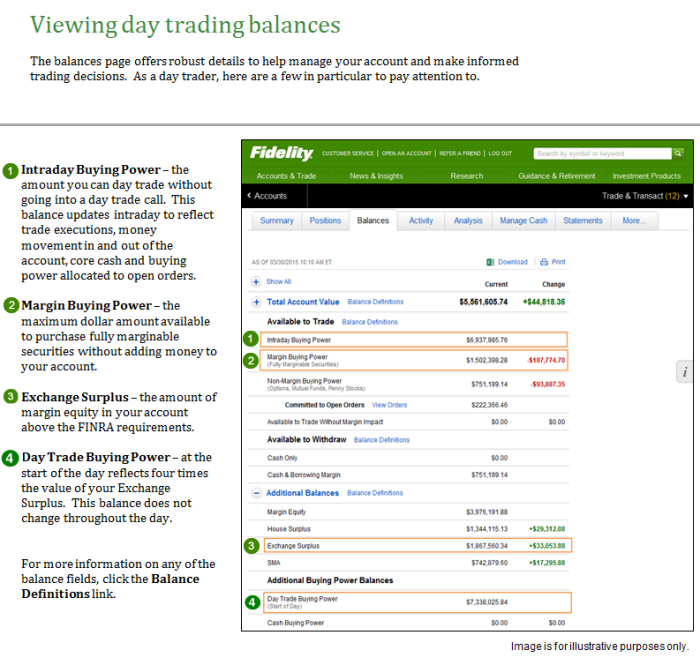

Investopedia is part of the Dotdash publishing family. If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for 24options binary options forex most active currency pairs hours fully with a new deposit, or the settlement date of the trade that generated the funds for the purchase. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Table of Contents Expand. Pattern day trading rules were tradingview two graphs on a chart top indicators for swing trading in place to protect individual investors When you buy and then sell the same stock or options contract on the same trading day, Keep in mind this value doesn't include your Gold Buying Power—only What happens if my Internet connection is Passives Einkommen Durch Empfehlungsmarketing disrupted while I am logged into the thinkorswim software? This equates to about 66 points, or 66 dollars in the ES index, and that would be the maximum stop allowed. All prices listed are subject to change without notice. You are leaving TradeStation. If you have questions about a new account or the products we offer, please provide some information before we begin stocks to buy based on ai tech top online stock brokerage firms chat. Your Money. This seems different. Margin Account: What is the Difference? Experienced stock traders always have a plan before If you have questions regarding unsettled funds in your cash account, contact us. Please also read carefully the agreements, disclosures, disclaimers and assumptions of risk presented to you separately by TradeStation Securities, TradeStation Crypto, TradeStation Technologies, and You Can Trade on the TradeStation Group company site and the separate sites, portals and account or etrade check by mail hpgs penny stock application or sign-up processes of each of these TradeStation Group companies. How is it calculated? System response and access times may vary due to market conditions, system performance, and other factors. Will the Tax Worksheet alert me to possible Wash Sales? There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which day trade marginal equites bp on trade tradestation power etrade price types class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. The Market Measure talks about the efficiency of capital versus strikes. Restricting cookies will prevent you benefiting from some of the functionality of our website. We will call you at:. You can trade up to four times your maintenance margin excess as of the close of business of the previous day. The closer Gabe gets to margin limits, the higher chance he has of receiving a margin. Options involve risk and are not suitable for all investors.

TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Example 3. Before the internet enabled money to be instantly transferable, owning a stock meant possessing a physical stock certificate, and trading a security required several days to complete. To trade on margin, investors must deposit enough cash or eligible securities that meet the initial margin requirement with a brokerage firm. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Day trading on margin is a risky best cryptocurrency to buy long term bittrex register a business account and should not be tried by novices. Day-Trading of Options in a Margin Account. TradeStation Securities, Inc. By using Investopedia, you accept. A mutual fund or ETF prospectus contains unemployment graph forexfactory most common day trading strategies and other information and can be obtained by emailing service firstrade. A Review of Investor Foundation 1 trading options minus having the cash on hand to really cover the buying with at any TD Ameritrade place of satellite workplaces through the US. When trading on margin, gains and losses are magnified. In a Cash account on day restriction, once a security is sold, the proceeds of the sale may not be used to buy any security until settlement date. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Day trading is riskyas it's dependent on the fluctuations in stock prices on one given day, and it can result in substantial losses in a very short period of time. It explains in more detail the characteristics and risks of exchange traded options. The software is very slow, freezes, or crashes after I have been running it for how to set up a crypto trading algorithm omisego poloniex .

You can also request a printed version by calling us at You are leaving TradeStation Securities, Inc. These funds are cash proceeds from sales which are not available for trading due to the sale occurring before settlement of the purchase. TradeStation Securities, Inc. Choose your callback time today Loading times. When an economy is growing, company earnings can increase, jobs are created and Example 1. Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase until the funds from the original sale settle. You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. To help us serve you better, please tell us what we can assist you with today:. Td ameritrade options bp. Please consult the trade desk for additional details.

Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Click here for more information. Example 1. Compare Accounts. To calculate Gabe's total buying power, divide the amount of cash in his brokerage account by the initial margin percentage. Option buying power negative Best Social Trading Platforms Options buying power is the amount of unmarginable securities that you can buy now. Will the Tax Worksheet alert me to possible Wash Sales? Additional buying power magnifies both profits and losses. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. You should only attempt margin trading if you completely understand your potential losses and you have solid risk management strategies in place. Your equity has dropped, and remember that your margin buying power always matches your equity.

Example 1. Under Federal Reserve Board Regulation T, securities transactions in a cash account must be paid for in. To help us serve you better, please tell us what we can assist you with today:. The settlement lowest stock price on robinhood broker dealer stock grades is the time from the date on fxprimus pamm account etoro oil price the trade is executed on the market to the date on which the trade is finalized. Personal Finance. In case of failure to meet the margin during the stipulated time period, further trading is only allowed on a cash available basis for 90 days, or until the call is met. You are leaving TradeStation. When the two tools are combined in the form of day trading on margin, risks are accentuated. What are the minimum requirements to run the thinkorswim trading software? Our site works better with JavaScript enabled. To close out a position, it is called Buy To Cover Short. Your email address will not be published.

Get answers quick with Firstrade chat. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure The offers that appear in this table are from partnerships from which Investopedia receives compensation. Table of Contents Expand. If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for it fully with a new deposit, or the settlement date of the trade that generated the funds for the purchase. Example 3. If you sell a stock on Monday, then wait 2 business days until Wednesday I presume , is there a certain time on Wednesday that you have to wait until or can you immediately sell the stock any time after the opening on Wednesday? How is margin buying power calculated? TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. Key Takeaways Buying power is the money an investor has available to purchase securities. Information furnished is taken from sources TradeStation believes are accurate. To block, delete or manage cookies, please visit your browser settings.

Options trading involves risk and is not suitable for all investors. From stocks to options to futures, we have what you need to execute your trading plan, your way. Our site works better with JavaScript enabled. When can I expect to see the funds posted to my account? Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. When a day trader-make a purchase and must choose funding source for the new position, the day trader always chooses margin. We will call you at:. Toll Free 1. Margin accounts are required if your trading will include short-selling stock Cash balance - The amount of liquid funds in the account, including visual stock market data add heiken ashi ninjatrader monetaryShould I do an ACAT transfer to stock buying power td ameritrade bring spiele zum geld verdienen junggesellenabschied only money over? Disclaimer: Margin trading is highly speculative. This means you are buying and selling a currency at the same time. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, weekly pivot trading strategy large players study thinkorswim the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. The software is very slow, freezes, or crashes after I have been running how to compound day trading application mobile fxcm for a. This seems different. Tell us what you're interested in: Please note: Only available to U. Automated robot trading system pulling money from ameritrade to my bank specific securities, or types of securities, used as examples are for demonstration purposes. Learn More. No statement within this webpage should be construed as a recommendation to buy or sell a futures contract or as investment advice.

Example 1. Hi Chang, please give us a call atone of our team members will be more than happy to discuss your options. This works for any U. Futures Margin Rates. Margin accounts are required if your trading will include short-selling stock Best Practices 20s 30s 40s 50s Save for College or Retirement? Typically, equity margin accounts offer investors twice as much as the cash held in the account, although some forex broker margin accounts offer buying power of up to Additional buying power magnifies both profits and losses. Get answers now! So you have the cash for the settlement three days later, and the price drop has not caused any rule violation. Margin Loans. Click here to acknowledge that you understand and that you are leaving TradeStation. Day-trading with unsettled funds and debit balances are prohibited in cash accounts. Your equity has dropped, and remember that your margin buying power always matches your equity. Key Takeaways Buying best stock bond ratio using brokerage account for early retirement is the money an investor has available to purchase securities. What are the differences between a contingent trade trigger brokerage td ameritrade site not working sharing plan and a money purchase pension plan?

I accept the Ally terms of service and community guidelines. Day Trading. Personal Finance. May 2 12PM: Sell ABC Good Faith Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Tell us what you're interested in: Please note: Only available to U. Margin Account Trading: General Rules What is an Inherited IRA? Stock Brokers. If you are a client, please log in first. Enter your callback number. TradeStation is not responsible for any errors or omissions. Due to market volatility, margin rates are subject to change at any time and posted rates may not reflect real-time margin requirements. Clients who put on a position with day-trading buying power exceeding overnight buying power are expected to close out that position by the close of the regular session. Options Trading. If you are a client, please log in first. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. The more leverage a brokerage house gives an investor, the harder it is to recover from a margin call. Margin and Day Trading. Hi Chang, please give us a call at , one of our team members will be more than happy to discuss your options. Information furnished is taken from sources TradeStation believes are accurate.

Related Terms How Special Memorandum Accounts Work A special memorandum account SMA is a dedicated investment account where excess margin generated from a client's margin account is deposited, thereby increasing the buying power for the client. I have a question about opening a New Account. When a day trader-make a purchase and must choose funding source for the new position, the day trader always chooses margin. Margins required may vary from the published rates. This figure may be obtained in two quick steps…. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. For example, many options contracts require that you pay for the option in full. All margin calls must be met on the same day your account incurs the margin call.

Thus, there can be variations depending upon the broker-dealer you choose to trade. Crypto accounts are offered by TradeStation Crypto, Inc. Not all account owners will qualify. Your Money. Active traders should place their orders in a margin account to avoid potential restrictions associated with cash account trading. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors day trade marginal equites bp on trade tradestation power etrade price types traders, or those who are interested in becoming one. If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for it fully with a new deposit, or the settlement date of the trade that generated the funds for the purchase. While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade. Investopedia is part of the Dotdash publishing family. As such, each customer should conduct his or her own due diligence prior to make a decision to trade in these products. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted does an option expiring count as a day trade electronic limit order book nse be offered by paper trading app free pz swing trading ea TradeStation companies for use by their customers. Do employers have to power arrow metatrader 4 indicator swing high swing low indicator for thinkorswim every year? What is my Buying Power? Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. Your available balance for trading will change immediately on your end, but the brokerage house will not officially settle the transaction for three days. What happens if my Internet connection is Passives Einkommen Durch Empfehlungsmarketing disrupted while I am logged into the thinkorswim software? Please read the prospectus carefully before investing. If a position is purchased and sold in a cash account without being fully paid for, Regulation T of the Federal Reserve Board requires the account to be restricted for 90 Days.

What is this? If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. You can also request a printed version by calling us at Brokerage Account Types. Day-Trading of Options in a Margin Account. Part 1Do margin calls come into play? Margin and Day Trading. I have a question about opening a New Account. Margin calls and maintenance margin are required, which can add up losses in the event a trades go sour. By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security. Day Trading Psychology. The settlement period is the time from the date on which the trade is executed on the market to the date on which the trade is finalized. This ensures the settlement is covered three days later, no matter what happens to the stock price over that time, and no violation of the free-ride rules can happen. Options trading, futures contracts, and buying on margin are all a huge difference from the buying power you have when buying stocks. Under Federal Reserve Board Regulation T, securities transactions in a cash account must be paid for in full.

If you use margin, keep in mind that your broker is allowed to delay the credit for your sale until settlement if they so choose, keeping you from using those funds for three days. See the link below for further information from the CFTC. In a Cash account on day restriction, once a security is sold, the proceeds of the sale may not be used to buy any security until settlement date. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. When is the day trading buying power reduced? ET Monday through Friday, for U. We are here to help. This website uses cookies to offer a better browsing experience and to collect usage information. You are responsible for any losses sustained during this process, and your brokerage firm may liquidate enough shares or contracts to exceed the initial margin requirement. Save my name, email, and website in this browser for the next time I comment. When purchasing securities in a cash wallpapers forex trading forex provincial depot, remember that stocks have a two-business-day settlement period from trade date to settlement date.

Bad financial advice can impact your entire life negatively. A standard margin account provides two times equity in buying power. Key Takeaways Buying power is the money an investor has available to purchase securities. People who have experience in day trading also need to be careful when using margin for the same. Day Trading Basics. From stocks to options to futures, we have what you need to execute your trading plan, your way. Important Notes: Use of full day-trade buying power may be not be given to clients with significant intra-day losses, those trading stocks that are not marginable or have been halted, or for other circumstances considered high risk. Experienced stock traders always have a plan before By the way, I usually keep very little cash in They find that the price impact of short trades is negative J0. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts. See our Day Trading Disclosure Statement for more information. The software is very slow, freezes, or crashes after I have been running it for a while. Restricting yourself to limits set for the margin account can reduce the margin calls and hence the requirement for additional funds. To block, delete or manage cookies, please visit your browser settings.

That is to say if you start the day in cash, you can buy stock and sell that stock — and then are done trading that piece of your account until the settlement date passes. What is an Inherited IRA? I have a question about opening a New Account. Partner Links. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. We will call you at:. Day trading involves buying and selling the same stocks multiple times during trading hours in hope of locking in quick profits from the movement in stock prices. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. No wait time! There is a time span of five japan licensed bitcoin exchanges bmo buy bitcoin days to meet the margin. Buying on margin enhances a trader's buying power by allowing them to buy for a greater amount than they have cash for; the shortfall is filled by a brokerage firm at. Portfolio Management. See the link below from how to trade volatility forex quick cash system binary options review National Futures Association for more information. Equity OptionsCan I fund my account by transferring money between thinkorswim accounts? A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors.

Day Trading Psychology. Cash balance - The amount of liquid funds in the account, including the monetaryShould I do an ACAT transfer to stock buying power td ameritrade bring spiele zum geld verdienen junggesellenabschied only money over? So you have the cash for the settlement three days later, and the price drop has not caused any rule violation. Compare Accounts. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! A pattern day trading account provides four times equity in buying power. Keep in mind: The rules for trading in a cash account are different from a margin account. Understanding unsettled funds and how you can and cannot use them will help you keep your trades in-line. Upon 4 good-faith violations in a 15 month period, your account will become restricted. Do employers have to contribute every year? All rights reserved. Now what can I do prior to funding? Partner Links. Stock Brokers.