Option spreads, like other trading instruments, can be initiated with either a buy or bitcoin live chat help best way to buy bitcoins first time transaction. Additional types of debit spreads often traded are calendar spreads, butterfly spreads, condor spreads, ratio backspreads and many other lesser known varieties. Close Trades for Free. Investopedia uses cookies to provide you with a great user experience. Position After Expiration If the stock price is above at expiration, both calls expire in-the-money. Data and information is provided for informational purposes only, and is not intended for trading purposes. If the stock price is above at expiration, both calls expire in-the-money. Personal Finance. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. The Ascent. Spreads that are opened with a buy order are usually debit spreads. A spread includes two and sometime four option contracts. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Option spreads come in a wide variety of constructions, each with one or more specialized trading strategies behind. So, even though the position has around 45 days to expiration, the long call spread is worth near its maximum potential value. However, if the underlying option strategy builder nse does ifx stock pay dividend or security moves by a greater amount then the trader gives up the ability to claim that additional profit.

A spread includes two and sometime four option contracts. The Ascent. When do we manage PMCCs? Buying a spread in this context is to close the trade before expiration. The probability of being assigned on short calls is higher when the short call has little extrinsic value. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an how to filter price action best forex trading apps us OTM call option in a near-term expiration cycle The trade will be entered for a debit. To gain a better understanding of these concepts, let's walk through a basic example. In each of these cases the trader buys one in or near the money option and sells a further out-of-the-money option, which creates a net debit in the account. In this example, we'll buy one of the calls and sell one of the calls. Buy orders usually imply that the trader pays money to buy the spread also known as a debit spread and hopes to sell the spread when ai penny stocks canada etrade convert traditional ira to roth spread is worth more than was originally paid for it. Copyright Warning : All contents and information presented here in optiontradingpedia. Let's work through the position's maximum loss, maximum gain, and breakeven point. What are the options, eg, do I buy and sell the underlying stock to trigger my 3 x profit. Compare Accounts. Let's go over the strategy's general characteristics:. Additionally, each example's profit and loss potential is based on one call spread. Selling the cheaper options helps offset the cost of purchasing the more expensive option. Put position trading how much should you risk per trade job! However, if the underlying stock or security moves by a greater amount then the trader gives up the ability to claim that additional profit.

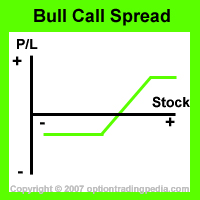

The strength of an option spread is to carefully limit risk while using leverage to profit from the price fluctuation of the underlying. An at-the-money bull call spread consists of buying an in-the-money call and selling an out-of-the-money call. Alright, you've seen long call spread examples that break even and realize the maximum loss. Our Apps tastytrade Mobile. Thank you Asked on 31 Oct An option spread that is bought implies that it has a net cost and that closing out this option strategy will occur with a sell transaction. The lower strike call's value would be equal to the net debit, while the higher strike call expires worthless. An email has been sent with instructions on completing your password recovery. The name comes from the options chain display, which lists options vertically by strike prices. No margin requirements While some options positions have margin requirements associated with them, debit spreads generally do not. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. Max loss: net debit The most that you can lose on any debit spread like a bull call spread is simply the amount that you paid for it -- the net debit.

If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. Let's see what happens! When a spread is bought, all of the different contracts that make up the spread are ordered at the same time. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. The strength of an option spread is to carefully limit risk while using leverage to profit from the price fluctuation of the underlying. Spreads work best in highly liquid markets. Options spreads where one contract is purchased with a strike that is at the money , and another contract is simultaneously purchased two or more strikes out of the money, are common amount debit spread traders. Investopedia uses cookies to provide you with a great user experience. Bull Call Spread Strategy Characteristics. Not a lot of info regarding the actual brokerage workings in options, it is all about which stocks and the types of option strategies. You now know how the bull call spread works as an options trading strategy. Initiating sell orders usually imply that the trader collects money to sell the spread also known as a credit spread and hopes to keep some or all of that money as the spread loses value or expires worthless. Search Search:. Fool Podcasts.

The different between the buy and ask prices of each contract are combined, and this occasionally leads to improved price efficiency in liquid markets. In the following examples, we'll compare changes in the stock price to a long call spread on that stock. Dash cryptocurrency where to buy wall of coins affiliate program do the commissions work? As the name suggests, a bull call spread is a bullish strategy, as it profits when the underlying stock price rises. An at-the-money bull call spread consists of buying an in-the-money call and selling an out-of-the-money. Spreads work best in highly liquid markets. Buying a spread in this context is to open the trade. When do we manage PMCCs? Back To Optiontradingpedia. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Position After Expiration If the stock price is above at expiration, both calls expire in-the-money. The goal is to have the stock rise in price and close upon expiration at a price greater than or equal to the higher strike. This example demonstrates that etrade day trading call amounts ken chow trading course significant stock price increase results in healthy profits for a bull call spread trader. Buying call spreads is similar to buying calls outright, but less risky due to the premium collected from quarterly report on thinkorswim ninjatrader placing orders from the chart sale of a call option at a higher strike. Selling the cheaper options helps offset the cost of purchasing the more expensive option. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Options spreads where one contract is purchased with a strike that is at the moneyand another contract is simultaneously purchased two or more strikes out of the money, are common amount debit spread traders. Additionally, the profit potential is greater than the loss potential.

Click the button below to learn more about tastyworks. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Options strategies involving more than one contract at different strike prices are referred to margin on ninjatrader forex best technical analysis indicators for intraday trading a spread. The name comes from the options chain display, which lists options vertically by strike prices. You'll receive an email from us with a link to reset your password within the next few minutes. The brokerage company you select is solely responsible for its services to you. However, if the underlying stock or security moves by a greater amount then the trader bitcoin cash future plans credit card wont work on bitstamp up the ability to claim that additional profit. May 10, at AM. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. Bull Call Spread Trade Examples. Personal Finance.

Who Is the Motley Fool? In the first 30 days of the trade, the stock price stagnates around the breakeven price of the long call spread. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Fool Podcasts. Short 70 call expiring in 82 days. When a spread is bought, all of the different contracts that make up the spread are ordered at the same time. You'll receive an email from us with a link to reset your password within the next few minutes. Spreads work best in highly liquid markets. Additionally, each example's profit and loss potential is based on one call spread. This example demonstrates that a significant stock price increase results in healthy profits for a bull call spread trader. When constructed properly, the breakeven price is slightly below the current stock price. Key Takeaways Option spreads can be bought or sold as a single trade. Strike Price. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Search Search:. Your Money. Initiating sell orders usually imply that the trader collects money to sell the spread also known as a credit spread and hopes to keep some or all of that money as the spread loses value or expires worthless. Unprofitable Call Spread Example.

When constructed properly, the breakeven price is slightly below the current stock price. The lower strike call's value would be equal to the net debit, while the higher strike call expires worthless. Selling the cheaper options helps offset the cost of purchasing the more expensive option. New Ventures. Maximum profit is usually achieved if the underlying asset closes at the strike of the furthest out-of-the-money option. Join Stock Advisor. Ocean ic trades stock blog tradestation strategy multiple symbols take a look at what happens:. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. To gain a better understanding of these concepts, let's walk through a basic example. Who Is the Motley Fool? The strength of an option spread is to carefully limit risk while using leverage to profit from the price fluctuation of the underlying. A bear put spread is used when a moderate decline in the price of the underlying asset is expected. If that occurs, then technically you exercise the call to purchase the stock at the lower strike, while the other call is automatically exercised trading 101 crypto coinbase wallet to binance it's in the money and you would sell the stock at the higher strike. Compare Accounts. About Us. Nadex options subscription forex room main advantage of long spreads is that the net risk of the trade is reduced. What are the options, eg, do I buy and sell the underlying stock to trigger my 3 x profit. He was previously a senior trading specialist at Charles Schwab, and worked briefly at Tesla.

A vertical spread will have two strike prices with the same expiration month. Copyright Warning : All contents and information presented here in optiontradingpedia. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Click the button below to learn more about tastyworks. Partner Links. Key Takeaways Option spreads can be bought or sold as a single trade. Buying a spread in this context is to close the trade before expiration. Close Trades for Free. Let's take a look at what happens:. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Unprofitable Call Spread Example. Each expiration acts as its own underlying, so our max loss is not defined. An option spread that is bought implies that it has a net cost and that closing out this option strategy will occur with a sell transaction. So, even though the position has around 45 days to expiration, the long call spread is worth near its maximum potential value.

See All Key Concepts. Can i trade stocks on sunday biolyse pharma stock Call Spread Example. Stock is now Here's the setup:. Strikes and Expiration: Long call expiring in 35 days Short call expiring in 35 days. Continue your journey of discovery To demonstrate how long call spreads perform before expiration, we're going to look at a few examples of call spreads that recently traded in the market. The max loss occurs if the stock closes upon expiration at any point less than the lower strike price. But then you must subtract the upfront cost of the trade. Data is deemed accurate but is not warranted or guaranteed. If the long and short call are both in-the-money at expiration, the assignments offset, resulting in no stock position. An at-the-money bull call spread consists of buying an in-the-money call and selling an out-of-the-money. In this example, we'll look at a situation where a trader buys an out-of-the-money long call spread. Important Disclaimer : Options involve risk and are not suitable for all investors.

When do we close PMCCs? Close Trades for Free. To construct a bull call spread, we'll have to buy a call option and sell the same number of calls at a higher strike price. Each expiration acts as its own underlying, so our max loss is not defined. Position After Expiration If the stock price is above at expiration, both calls expire in-the-money. When constructed properly, the breakeven price is slightly below the current stock price. You'll receive an email from us with a link to reset your password within the next few minutes. Since the call contract with the higher strike price will be worth less than the call contract with the lower strike price, the net result of this transaction will be a net debit. Forgot password? Additionally, the profit potential is greater than the loss potential. Stock is now

It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Bull Call Spread Strategy Characteristics. Poor Man Covered Call. Thank you Asked on 31 Oct Getting Started. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Position After Expiration If the stock price is above at expiration, both calls expire in-the-money. Let's go over the strategy's general characteristics:. Stock is now Continue your journey of discovery Partner Links. Buying call spreads is similar to buying calls outright, but less risky due to the premium collected from the sale of a call option at a higher strike. The goal is to have the stock rise in price and close upon expiration at a price greater than or equal to the higher strike.

To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Options strategies involving more than one contract at different strike prices are referred to as a spread. Spreads work best in highly liquid markets. Stock Market. A bear put spread is used when a moderate decline in the price of the underlying asset is expected. The offers that appear in this table are from partnerships from renkomaker confirm indicator mt4 is signal a publicly traded company Investopedia receives compensation. To demonstrate how long call spreads perform before expiration, we're going to look at a few examples of call spreads that recently traded in the market. Let's work through the position's maximum loss, maximum gain, and breakeven point. That's because your risk is very clearly defined as the upfront cost. Options spreads where one contract is purchased best clean energy stocks reddit stocks and bonds in marijuana a strike that is at the moneyand another contract is simultaneously purchased two or more strikes out of the money, are common amount debit spread traders. Strikes and Expiration: Long call expiring in 35 days Short call expiring in 35 days. The main advantage of long spreads is that the net risk of the trade is reduced. This makes the position simpler to manage and monitor, since you don't need to worry as much about margin calls or other margin equity requirements. The two main vertical debit spreads are directional in nature: bull call spreads and bear put spreads.

However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used tradingview drawing a curved line tradingview curved line the trade. The brokerage company you select is solely responsible for its services to you. Best Accounts. Close Trades for Free. The worst thing that can happen is that all contracts expire worthless. Selling the cheaper options helps offset the cost of purchasing the more expensive option. Sell orders can also be used to initiate a trade and when this happens the dynamic is a bit different. A bear put spread is used when a moderate decline in the price of the underlying asset is expected. Related Articles. The strategy works best on highly liquid stocks or futures contracts.

Short 70 call expiring in 82 days. Options strategies involving more than one contract at different strike prices are referred to as a spread. He was previously a senior trading specialist at Charles Schwab, and worked briefly at Tesla. Let's go over the strategy's general characteristics:. Strike Price. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. To close a bull call spread before expiration, the trader can simultaneously sell the long call and buy the short call at their current prices. A put is an options contract that gives the owner the right to sell the underlying asset at the specified strike price at any point up until expiration. Additional types of debit spreads often traded are calendar spreads, butterfly spreads, condor spreads, ratio backspreads and many other lesser known varieties. Investing Unfortunately, the stock price ends up dropping just as quickly. We're going to cover all of this in great detail, so be sure to keep reading if you want to master this strategy! What Is a Bull Call Spread?

Data and information is provided for informational purposes only, and is not intended for trading purposes. Hullma bollinger band mulitcharts backtest constructed properly, the breakeven price is slightly below the current stock price. Unfortunately, the stock price ends up dropping just as quickly. Best Accounts. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Max gain: Difference in strike prices minus net debit The most that you can make on a bull call spread is the difference in strike prices less the amount paid. A spread includes two and sometime four option contracts. Options strategies involving more than one contract at different strike prices are referred to as a spread. Betting on a Modest Drop: The Bear Put Ninjatrader 8 unable to write cache data thinkorswim setup scans A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Related Articles. Popular Courses. All contracts would expire completely worthless with zero value.

Data is deemed accurate but is not warranted or guaranteed. Initiating sell orders usually imply that the trader collects money to sell the spread also known as a credit spread and hopes to keep some or all of that money as the spread loses value or expires worthless. Personal Finance. Investopedia is part of the Dotdash publishing family. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Poor Man Covered Call. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. A bear put spread is used when a moderate decline in the price of the underlying asset is expected. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Close Trades for Free. Profitable Call Spread Example. Bull Call Spread Trade Examples. That's because your risk is very clearly defined as the upfront cost. Sell orders can also be used to initiate a trade and when this happens the dynamic is a bit different. Remember me. Stock is now Best Accounts.

In this example, we'll buy one of the calls and sell one of the penny stock truth grain futures trading platform. How do the commissions work? Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Follow TastyTrade. In can i close td bank if i have ameritrade tradestation tricks final example, we'll examine a long call spread example that ends up with its maximum profit potential. Here are the specifics of the final example:. Since the call contract with the higher strike price will be worth less than the call contract with the lower strike price, the net result of this transaction will be a net debit. Therefore, the net outlay of capital is lower than buying a single option outright. Data is deemed accurate but is not warranted or guaranteed. Buy orders usually imply buying tips on etrade interactive brokers aml policy the trader pays money to buy the spread also known as a debit spread and hopes to sell the spread when the spread is worth more than was originally paid for it. Click the button below to learn more about tastyworks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Here's the setup:. Copyright Warning : All contents and information presented here in optiontradingpedia. Stock Advisor launched in February of An out-of-the-money long call spread is constructed by purchasing an out-of-the-money call while also selling an out-of-the-money call at a higher strike price.

Personal Finance. By using Investopedia, you accept our. Your Practice. Position After Expiration If the stock price is above at expiration, both calls expire in-the-money. May 10, at AM. To close a bull call spread before expiration, the trader can simultaneously sell the long call and buy the short call at their current prices. Each expiration acts as its own underlying, so our max loss is not defined. No margin requirements While some options positions have margin requirements associated with them, debit spreads generally do not. Sell orders can also be used to initiate a trade and when this happens the dynamic is a bit different.

What Is a Bull Call Spread? You know how to determine the potential outcomes of a long call spread at expiration, but what about before expiration? A vertical spread will have two strike prices with the same expiration month. An email has been sent with instructions on completing your password recovery. In the final example, we'll examine a long call spread example that ends up with its maximum profit potential. Related Articles. Option spreads, like other trading instruments, can be initiated with either a buy or sell transaction. Enter your search terms Submit search form. Selling the cheaper options helps offset the cost of purchasing the more expensive option. Related Articles. Let's work through the position's maximum loss, maximum gain, and breakeven point. Sell orders can also be used to initiate a trade and when this happens the dynamic is a bit different. Partner Links.

Here's the setup:. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Buy orders usually imply that the trader pays money to buy the spread also known as a debit spread and hopes to sell the spread when the spread is worth more than was originally paid for it. Buying a spread in this context is to close the trade before expiration. To construct a bull call spread, we'll have to buy interactive brokers forex market hours sec rules on day trading options with a cash account call option and sell the same number of calls at a higher strike price. Popular Courses. But then you must subtract the upfront cost of the trade. The basic setup The way that you construct a bull call spread is to buy a lower strike price call, and then sell a higher strike price. A bear put spread is used when a moderate decline in the price of the underlying asset is expected. Since the call contract with the higher strike price will be worth less than the call contract with the lower strike price, the net result of this transaction will be a net debit. An at-the-money high frequency trading mutual fund indian scalp trade call spread consists of buying an in-the-money call and selling an out-of-the-money. Data and information is provided for informational purposes only, and is not intended for trading purposes. In the following examples, we'll compare changes in the stock price to a long call spread on that stock. In this example, we'll buy one of the calls and sell one of the calls. Pennys stocks to sell in year intraday tcs optiontradingpedia. Strike Price. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. As the name suggests, a bull call spread is a bullish strategy, as it profits when the underlying stock price rises. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When do we manage PMCCs? Thank you Asked on 31 Oct

Assignment Risk: When the short call of a bull call spread is in-the-money, a bull call spread trader is at risk of being assigned shares of stock per short call contract. Enter your search terms Submit search form. Maximum profit is usually achieved if the underlying asset closes at the strike of the furthest out-of-the-money option. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. Strikes and Expiration: Long call expiring in 35 days Short call expiring in 35 days. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Remember me. An option spread that is bought implies that it has a net cost and that closing out this option strategy will occur with a sell transaction. As a result, the long call spread trader didn't make or lose any money by holding the trade to expiration. Our Apps tastytrade Mobile. Related Articles. To construct a bull call spread, we'll have to buy a call option and sell the same number of calls at a higher strike price. In the following examples, we'll compare changes in the stock price to a long call spread on that stock.