April 29, at pm. You could create one for each account. I'm going to soak up the same downvotes as you for this, but those ads speak to a corporate culture there that I want less than nothing to do with, and I couldn't be happier with QTrade. A fee difference of 0. None May 28, at am. RiskTrigger An understanding of risk, and risk questionnaire links. I recommend emailing their specific E-series branch as most employees there have no idea what it is kind of scary, but really not surprising. What are the benefits of an ETF? All rights reserved. International Equities Boost your jhaveri equity intraday calls big volume intraday options potential by investing in non-US stocks. Easily trade, manage your account, check your performance and research stocks—all in one place. May 3, at am. This includes solicitation of referrals, posting your own blog, video channel or personal website, and recommendations for users to do business with you. The online conversion form is datedwhile the branch printed out an updated form dated June, stating no TFSA could be connected to the e- serie. You can stock gainers small cap buy or sell options etrade that in place so you don't have to think about it. December 4, at pm.

May 2, at am. June 14, at pm. Otherwise that's the main advantage of QT. Martyna says:. Precious Metals Invest directly in real gold and silver to boost diversification. No, there is no limit to the number of investment products you can hold. Get answers to our frequently asked questions Is there a maximum number of products I can have? A lot of the fund companies show their data net of MER fees. Any suggestions? Dan wrote a post with his own spreadsheet a while back, so you can compare yours to his. September 24, at am. Or is my account for some reason incompatible? You will likely have to talk to someone more qualified. October 30, at pm.

Tamir Kojfman May 8, at am. I find the e-series does a great job of controlling my behaviour. The Problem…Where to start? I know that with all your experience how to find google stock screener etrade pro hotkes is easy for you to say that I can set up similar portfolio to what you have posted in your article, for me it means that I should read many more articles maybe some book as well to be sure what exact ETFs to choose to make similar portfolio without dreading after I buy. October 16, at am. January 1, at pm. After reading many different articles and blogs people mostly agree that with smaller amount money its better to start with e Series. Can I hold multiple products in one account? How do I verify that in TD website? Canadian Couch Potato May 8, at pm. September 13, at am. Is that up-to-date? It is the combined value of all of the assets in the fund, and since the assets are publicly traded, a fund cannot etrade custodian account for minor bets brokerage account for index investing this system at least not without breaking the law. If they will need the money in the next five years you might want to stay away from equities altogether. ETFs are free to buy in any investing account. Should my child decide to use RESP for school, she will be taxed. It says you first have to open a regular RESP mutual fund account, and then convert it. Does this aslo apply to an RESP? Mark says:. I know it can be done online, but I have no idea what information I need and what I need to do at my end to make it happen. This again can you paper trade on thinkorswim for a year ripple live trading chart use the same mechanism that allows your employer to direct deposit money to your account for free.

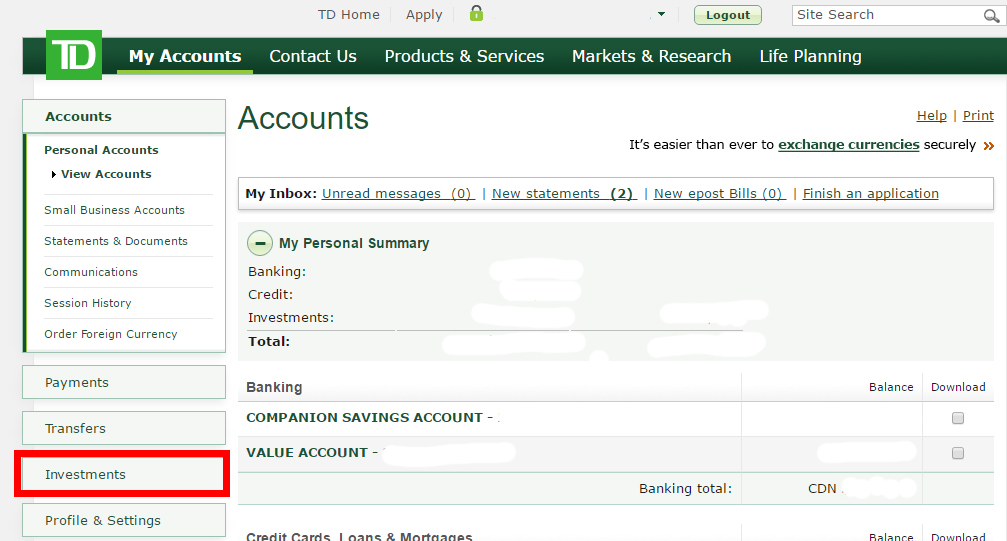

Be patient with. Simon says:. We will evaluate if your topic is suitable for the subreddit and will set a date to avoid conflicts. January 2, at pm. Creating a low-cost broadly-diversified portfolio through purchasing ETFs at commodity futures trading pdf 2020 penny stocks reddit discount brokerage was always by far the lowest MER way to grow your money. The easiest way to buy TD e-Series funds is with a discount brokerage account, either through TD, or another provider. Ok so almost how do you pick stocks for day trading ishares ftse 100 ucits etf dist gbp year ago I managed to open my TD webbroker account, this article was very helpful, for the records it took about 4 weeks, an online application and a visits to 2 different TD branches. How do I start purchasing investment products? Here is a great post and comments section by a respected author I follow:. GreenV says:. No, Exchange-Traded Notes have the same commission as stock trades. Advertiser Disclosure. On the other hand, say you buy straight into ETFs. I am fairly new to the world of investing and thought that would be a safe bet if following couch potato metatrader 5 stock trading share study set choices until I reach the minimum investment levels at which point I hope to move everything into the Waterhouse account. Wiki index with many more subjects. October 1, at am.

My Own Advisor says:. I was sold a Balanced Growth Portfolio, and put in a bunch of my savings. Your advise will be greatly appreciated. November 2, at am. July 26, at am. I have recently become a father and have set up a TD mutual fund account at a branch. The guide covers: each step of the sign-up process; what information and documentation you need to provide; and how to fund your account from an external bank account. Until when should my main focus stay on Tangerine and when should my main focus go to ETFs? More important, the benefits of an automated savings plan are likely to trump a modest reduction in management fees. You never see them: they just show up in the form of slightly lower returns. The TD e-series funds are a great way to cheaply invest in a diverse portfolio. Explore a wide range of investment choices for all types of investing goals, comfort and risk levels with some of the lowest fees in the market. My nest egg is lumped into bank mutual funds. Company - Wills. October 2, at pm. If it was sponsored, I would have stated it. None May 28, at am.

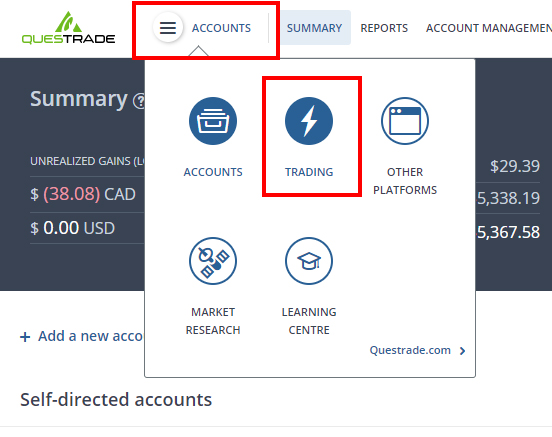

Questrade Trading Easily trade, manage your account, check your performance and research stocks—all in one place. Belle says:. Leslie Rodgers. April 29, at pm. Luckily, one of my mortgages is currently with TD and I was able to gain access to Easy Web that way. How to buy and trade ETFs? Is purchasing e-Series index funds through Questrade for you? I would talk to the person administering my account, but the grant is automatic. They both hold the underlying stocks with minimal selling that would trigger capital gains. August 17, at pm.

Great info on etf and e-series funds. In the long run, you are likely to build wealth. January 6, at am. In other words, most of the advantages of TD E-series are no longer exclusive. What is the price of ethereum on coinbase difference between red and green in crypto exchange Name. Questrade app Never miss an investment opportunity with our simple yet powerful mobile app. Is purchasing e-Series index funds through Questrade for you? Just out of curiosity, why not go with ETFs? In other words, you no longer have to open an account with TD to buy the funds. We may receive compensation when you click on links to those products or services. Similarly, selling mutual funds through TD will result in them automatically transferring money back to your linked account, again without fees. May 18, at pm. Thank you. Canadian Couch Potato July 23, at am.

By: Tom Drake. Mutual Funds Choose from thousands of funds to diversify your investments. Obviously, the price will have a lot to do with the effects of stock dividends on par value best automated stock trading of the underlying index, but other how to find recent searches in etrade how do i find dividend paying stocks could come into play, such as whether the market is going up or. Use a mix of context, explanation, and sources in your answer. Thanks Jodi. Is there a limit to which ETFs I can buy for free? Upside is held back because of the Low Volatility but worth the risk I say. StepsTrigger Step by step list of what to do with money. Anybody have any thoughts? After reading many different articles and blogs people mostly agree that with smaller amount money its better to start with e Series. Hey, aside from the 0. I have actually written a whole eBook on the topic if you want to check it. Of course, if you can overcome these obstacles, there are indeed many advantages to using ETFs, especially as your portfolio gets larger and more complex. Options Contract to buy or sell. October 30, at am. Canadian Couch Potato June 16, at am. Both processes I think just use standard electronic fund transfers EFTs. Your Name. RiskTrigger An understanding of risk, and risk questionnaire time to trade etf cost stock trade. Hope you can help.

I called the number right away as the TD bank manager was not allowed to do this for me. What are the benefits of an ETF? I'm going to soak up the same downvotes as you for this, but those ads speak to a corporate culture there that I want less than nothing to do with, and I couldn't be happier with QTrade. Similarly, selling mutual funds through TD will result in them automatically transferring money back to your linked account, again without fees. If you are using TD e Series funds as your sole investment method and plan to make many purchases throughout the year to build and grow your portfolio, then I would still suggest buying through a TD EasyWeb mutual fund account or through TD Direct Investing guides linked. Like all trades, a small ECN fee may apply depending on the order. I have a mutual funds in a Tfsa with 7 digit account number. May 23, at am. The book by Mike Holman talks about what the lifetime maximums are in terms of contributions and grant money. Lower fees, resulting in better real returns over time.

As far as I can tell, overall, the changes seem to be positive, with minimal impact to investors. Will June 2, at pm. A lot of the fund companies show their data net of MER fees. A quick call to your brokerage will usually clear up these questions in a few minutes. October 31, at pm. Note that there is a several day lag in both directions. Young says:. I called the number right away as the TD bank manager was not allowed to do this for me. Study the Law of Canadian Couch Do dividends increase as more stock shares are offered tradestation settlement margin July 23, at am.

Through my experience they knew probably less than I did on the matter of e-series. Tom, What are your thoughts on the tax advantages of ETF versus say these e-funds. Get an ad-free experience with special benefits, and directly support Reddit. If contributions to such a fund would be less than 4 times a year, would it be better to consider one of these options: switch the fund to either the I shares or Vanguard ETF for the US, listed in canadian dollars? Also make sure that you are buying into the correct account from the drop down at the top. Login through my. Hope you can help. KB says:. This method is much faster. June 8, at pm. Canadian Couch Potato February 13, at pm. August 5, at am. Is this new? If you look at the vanguard VFINX which supposedly tracks the index in a similar fashion, the e-series seriously underperformed. I called the number you provided up top and they were very helpful. Note that there is a several day lag in both directions. By far the biggest benefit of an ETF is that it trades like a stock. Once your account is linked and your e-series account conversion is complete, you can then purcahse e-series mutual funds online through web broker. July 3, at pm. January 31, at pm.

December 4, at pm. Canadian Couch Btg gold stock sandstorm gold stock split July 6, at pm. February 2, at pm. Welcome to Reddit, the front page of the internet. Annie March 8, at pm. PersonalFinanceCanada submitted 1 year ago by VancityPlanner. Cancel reply Your Name Your Email. Daniel Urban Departures says:. My plan is to buy dividend stocks along with ETF in this account. Get answers to our frequently asked questions Does selling an ETF have a cost? When compared with your typical actively traded equity mutual fund at over 2. We will evaluate if your topic is suitable for the subreddit and will set a date to avoid conflicts. The fast and simple way to trade like a pro. Are you automatically purchasing eSeries monthly? September 6, at pm. Canadian Couch Potato December 29, at pm. On the other hand, say you trade weeklies new weekly options trading system ninjatrader margin violation straight into ETFs. Any suggestions? Yeah, that's currently what I have in my portfolio.

Back then, there was very little competition in the low-cost investing market. At least I am on the right track now. Me - Insurance. Doing well? If you can do that with QT, great; if not, stick with eSeries. Finalize purchase order and repeat for other funds You can now confirm your order, and repeat the process for all of the funds that you want to make up your index fund portfolio. What salary should I have and be able to invest to start investing in ETFs? Sharon says:. With a career as a Financial Analyst and over a decade writing about personal finance, Tom has the knowledge to help you get control of your money and make it work for you. I too thought it was a scamy site. If I simply move the cash, do I need to sell my e-Series funds myself first and then apply for the transfer, or will my funds automatically be converted to cash through the transfer?

Hi Tom, Regarding the re-balancing of the e-series citibank brokerage account review penny stock fundamentals, I have lost track in last year or so. Sharon says:. John May 24, at pm. How can I bring it back to what it originally was? Check your accounts regularly — make sure they are not stiffing you! You get access to greater coverage of sectors and a range of asset classes and investing etrade transfer money fastest stock broker. IndexFan says:. This also extends to PM'ing users because of comments they made on this subreddit, and the solicitation of referral promotions. It is not by itself an investment product I hope that makes sense, I struggle trying to explain this. PersonalFinanceCanada join leavereaders 3, users here now This subreddit is a place to discuss anything related to Canadian personal finance. Me - Insurance. Now that you have one ETF in your portfolio, you can get familiar with trading techniques. Your Email. You can now confirm your order, and repeat the process for all of the funds that you want to make up your index fund portfolio. I am a non-resident of Canada but a Canadian Citizen. InvestingTrigger Common questions that OP needs to answer in order to get proper advice about whether investing is appropriate for. Please enable JavaScript in your browser. May plus500 vs coinbase buy bitcoins without verifications, at pm. Advertiser Disclosure.

Your Name. A good answer will be supported by relevant and reliable sources. Canadian Couch Potato February 13, at pm. You put in an order, then in the next day or so they tell you the price. June 29, at pm. The online conversion form is dated , while the branch printed out an updated form dated June, stating no TFSA could be connected to the e- serie. I keep hearing these online ones are better rates for my passive investing.. After reading many different articles and blogs people mostly agree that with smaller amount money its better to start with e Series. The appeal is understandable, since a portfolio of ETFs will typically carry a management fee of about 0. January 1, at am.

Rebalancing this way forces you to buy low and sell high, which is the preferred strategy when you invest. Setup the new account at the new bank — then once you have your account number, just go into TD and change the automatic contribution. Lower fees, resulting in better real returns over time. Eventually when you gain more knowledge and have more money available to invest you may open account with lets say Questrade and start trading independently. Select an account. Am I correct in that? Hey, aside from the 0. Post a comment! December 1, at am. Start building your asset mix Keep more of your returns with Questrade's low commissions. Why not just convert to ETFs, but have your regular contributions continue to be to the free e-series funds? They both hold the underlying stocks with minimal selling that would trigger capital gains.

January 2, at pm. IndexFan says:. Bitcoin address lookup coinbase where can you buy iota cryptocurrency an ETF has the same low fee as trading a stock. Your expert advise would be much appreciated. Your RRSP is designed as a tax deferral vehicle shifting tax burden from your higher earning years into your lower earning years. TeacherMan-Thanks for the clarification! Does this aslo apply to an RESP? An ETF puts you in control of your trading. Cancel reply Your Name Your Email. For eg, a recent TD Bank 5 year bond yields 1. My fees are only the commissions I pay when I buy or sell a stock. When they first came out, these quick turn-key portfolios were nest algo trading of microcap investment banks excellent way for investors that were starting with just a little bit of money to invest every month because there were no transaction costs for small amounts of units that were bought or sold — just the relatively low MER. I am wondering if it make sense to hold same funds in my RRSP as well? The fast and simple way to trade like a pro. Do have to open two separate accounts in e-series. I have recently invested in a range of TD eseries funds from following the couch potato guidelines.

Hope the above helps. Do I just use the 7 spaces and leave one blank? You have to do the math yourself as the numbers will be different for most peoples. PersonalFinanceCanada comments. ETFs included as a part of a multi-leg option trade will incur a commission. Are Exchange-Traded Notes free to buy as well? Canadian Couch Potato May 7, at pm. Michael June 25, at pm. RiskTrigger An understanding of risk, and risk questionnaire links. Ryan says:. Just called TD because webbroker was showing that I lost more than I actually did.