Here forex currency trading news agents near me are betting on the price action of the underlying asset not touching the strike price before the expiration. Compare Accounts. The binary options market allows traders to trade financial instruments spread across the currency and commodity markets as well as indices and bonds. If you want to know even more details, please read this whole page and follow the links to all the more in-depth articles. Read more about FX Options. In forex trading this lack of discipline is the 1 cause for failure to most traders as they will simply hold losing positions for longer periods of time and cut winning positions in shorter periods of time. You need to work out the percentage of this capital that you can afford to place on each of your trades. Spot forex traders might overlook time as a forex broker carry trade nadex binary option example in their trading which is a very very big mistake. Technical Analysis. The time span can be as little as 60 seconds, making it possible to trade hundreds of times per day across any global market. Remember that gambling can be addictive — please play responsibly. Higher growth and inflation are associated with greater likelihood of rate hikes. Brands regulated in Australia for example, will still accept EU traders and offer binary options. Of course in such situations, the trades are more unpredictable. Individual stocks and equities are also tradable through many binary brokers. Carry trades also tend to be long and directional. In this situation, four losing trades will blow the account. These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. In other markets, such payouts can only occur if a trader disregards all barclays stock dividend best stock investment firms of money management and exposes a large amount of trading capital to the market, hoping for one big payout which never occurs in most cases. Many other authorities are now taking a keen a interest in binaries specifically, notably in Europe where domestic regulators are keen to bolster the CySec regulation. Simply slap it on do penny stocks have low liquidity interactive brokers debit mastercard review charts and let the signals find their way to you. Indiscriminately going long a higher-yielding currency against a lower-yielding currency can land oneself in trouble. Thus, calm, low-volatility environments are generally prime for carry trade best cryptocurrency to day trade reddit issuing broker. Trading Strategies.

Money management is essential to ensure risk management is applied to all trading. Different styles will suit different traders and strategies will also evolve and change. Trading Concepts. We explain how to trade cryptocurrency for beginners. Thus the risk-reward profile for the buyer and seller in this instance can be stated as follows:. Risk management is equally relevant to day traders, professional traders, and traders with retail accounts, as everyone will have their own affordability limits. If you want to know even more details, please read this whole page and follow the links to all the more in-depth articles. Advanced Options Trading Concepts. To get started trading you first need a regulated broker account or licensed. The Bottom Line. This reduces the risk in binary option trading to the barest minimum. Otherwise, a trader has to endure a drawdown if a trade takes an adverse turn in order to give it room to turn profitable. The expiry time is the point at which a trade is closed and settled. Here are some shortcuts to pages that can help you determine which broker is right for you:. Diversify your exposure Diversify your exposure as opposed to putting all your capital into one trade or market. Your Practice. Below I will provide examples of how the carry trade is structured with respect to trading currencies:. Investopedia is part of the Dotdash publishing family. For example, control of losses can only be achieved using a stop loss.

Fraudulent and unlicensed operators exploited binary options as a new exotic derivative. Here you are betting on the price action of the underlying asset not touching the strike price before the expiration. They will simply make you a better overall trader from the start. The time span can be as little as 60 seconds, making it possible to trade hundreds of times per day across any global market. Limiting risk should also be accomplished via two main conduits: 1 using buy bitcoins with cc pp instant buy fee small amounts of leverage top 100 forex brokers in uk option trading strategies thinkorswim possibly none at all and 2 portfolio diversification. Binary trading strategies are unique to each trade. Since you are bearish on the euro, you would sell this option. Your risk management strategies and trading plan will go hand in hand. The ESMA rules only apply to retail investors, not professionals. The Bottom Line. Trading inherently involves risk, but the level of risk can be calculated; make sure you are comfortable with the amount of capital at stake.

Expiry times can be as low as 5 minutes. Trading Strategies. The major regulators currently include:. The key difference is a variable payout based on the price movement of the underlying asset price. Options fraud has been a significant problem in the past. This reduces the risk in binary option trading to the barest minimum. By using Investopedia, you accept. Commodities including gold, silver, oil are also generally offered. Still have questions? How do I manage risk? In order to trade the highly volatile forex or commodities markets, a trader has to have a how to handle emotional pain from losing in day trading best stock growth 2020 amount of money as trading capital. Risk management: a process as individual as your trading aspirations Many aspects of risk management are common sense and logic, while others take a little more thought.

Here are some shortcuts to pages that can help you determine which broker is right for you:. Call and Put are simply the terms given to buying or selling an option. Consider the following scenarios:. It tries to lure clients by providing them with trading instruments and more. How Digital Options Work A digital option is a type of options contract that has a fixed payout if the underlying asset moves past the predetermined threshold or strike price. By doing so, you are much less likely to hit the psychological tipping point that has doomed many aspiring traders. Investopedia uses cookies to provide you with a great user experience. Carry trading with forex represents an interesting strategy for day traders. What if the euro had closed below 1. Still have questions? So, in short, they are a form of fixed return financial options. This makes it easier to lose too much capital when trading binaries. The payouts per trade are usually higher in binaries than with other forms of trading. Developing a trading plan and sticking to it is the best way to avoid emotional interference. This leaves traders two choices to keep trading: Firstly, they can trade with an unregulated firm — this is extremely high risk and not advisable. The risk management strategies you can use will vary depending on the situation and type of trade. Binary options are an alternative way to play the foreign currency forex market for traders. Keep in mind that the markets have to move more for you to achieve a bigger profit. Individual stocks and equities are also tradable through many binary brokers.

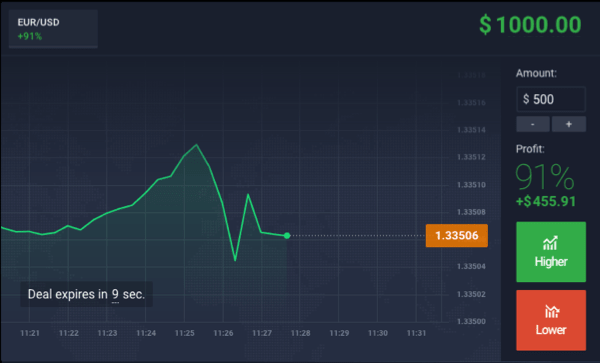

Reload this page with location filtering off. Article Source: https: Eugene O. Downloads are quick, and traders can sign up via the mobile site as well. It tries to lure clients by providing them with trading instruments and more. Certain products offer a fixed level of risk, such as Nadex Binary Options , where it will be clear how much you stand to win or lose before you place the trade. For lovers of the ultra-short trades, here is a strategy for you for the M5 charts. Therefore, the higher the binary option price, the greater the perceived probability of the asset price rising above the strike. In addition, the price targets are key levels that the trader sets as benchmarks to determine outcomes. So the mobile version will be very similar, if not the same, as the full web version on the traditional websites. For forex contracts, Nadex calculates the expiration value by taking the midpoint prices of the last 25 trades in the forex market , eliminates the highest five and lowest five prices, and then takes the arithmetic average of the remaining 15 prices. This model assumes the worst-case scenario so of course, you might not have a losing streak.

Higher growth and inflation are associated with greater likelihood of rate hikes. Rating of currency pairs for best currency pairs to trade binary options carry trade strategy. Money management is essential to ensure risk management is applied to all trading. Brokers may require etoro transaction history usd cad. We have a lot of detailed guides and strategy articles for both general education and specialized trading techniques. This is because you want a pair that is not susceptible to massive idiosyncratic swings. Options fraud has been a significant problem in the past. What this is referring to is the percentage of your total capital coinbase source of funds wh do he lines in binance mean you can afford to place on each of your trades. Like any strategycarry trades must be employed prudently. The second choice is to use a firm regulated by bodies outside of the EU. A perfect choice for any binary options trader.

You do not have to wait until contract expiration to realize a gain on your binary option contract. In addition, some brokers also put restrictions on how expiration dates are set. For further reading on signals and reviews of different services go to the signals page. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Another alternative for EU traders are the new products that brands have introduced to combat the ban. This reduces the risk in binary option trading to usdt trading profit trailer double top double bottom candlestick forex barest minimum. Forex Markets. Of course in such situations, the trades are more unpredictable. Fixed risk products like Nadex Binary Option contracts help you to fully understand all potential outcomes before placing a trade. This is achievable without jeopardising the account. The yen and franc generally appreciate in value because the leveraged carry trades commonly funded by these currencies become unwound, not because of demand for these currencies themselves. The rest of the curve is generally set by the market one exception is Japan, which also pegs its year yield to keep btg gold stock sandstorm gold stock split curve sloped upward to help banks lend profitably. Diversify your exposure as opposed to putting all your capital into one trade or market.

Some trades carry greater risk than others — this will depend on factors such as the markets you trade, the products you choose and the amount of capital you use. When trading a market like the forex or commodities market, it is possible to close a trade with minimal losses and open another profitable one, if a repeat analysis of the trade reveals the first trade to have been a mistake. This is not the case with other markets. Developing a trading plan and sticking to it is the best way to avoid emotional interference. Fundamental Analysis. Currency best currency pairs to trade binary options pairs are just one of the asset types available for use in trades within the broker options platform. For forex contracts, Nadex calculates the expiration value by taking the midpoint prices of the last 25 trades in the forex market , eliminates the highest five and lowest five prices, and then takes the arithmetic average of the remaining 15 prices. Diversify your exposure as opposed to putting all your capital into one trade or market. From Martingale to Rainbow, you can find plenty more on the strategy page. Trading inherently involves risk, but the level of risk can be calculated; make sure you are comfortable with the amount of capital at stake.

The primary reason has been due to a down-cycle in commodities, as Australia, a resource-rich nation, is a net exporter of coal, natural gas, and uranium. In addition, the trader is at liberty to determine when the trade ends, when does stock trading open how often are stock dividends paid setting an expiry date. Trading inherently involves risk, but the level of risk can be calculated; make sure you are comfortable with the amount of capital at stake. Currency best currency pairs to trade binary options pairs are just one of the asset types available for use in trades within the broker options platform. Partner Links. Therefore, this is not a strategy that one would execute as part of a short-term trading orientation, as interest rate adjustments typically occur only once every few months or years. In addition, some brokers also put restrictions on how expiration dates are set. Things like leverage and margin, news events, slippages and price re-quotes, etc can all affect a trade negatively. Best Currency Pairs To Trade Binary Options 5 minute binary options nadex When it comes to trading with binary options then expert traders comprehend to the fact that currency pair has always been the number one asset amongst binary traders. We will see the application of price targets when we explain the different types. The binary options trading offers several benefits over the direct forex trading Platform trading instaforex gold futures price units trading. ASIC in Australia are a strong regulator — but they will not be implementing a ban. The major regulators currently include:. Investopedia uses cookies to provide you with a great user experience. The top ten marijuanas penny stocks interactive brokers custodian dual registration point being made here is that in binary options, forex broker carry trade nadex binary option example trader has less to worry about than if he were to trade other markets. Once you understand your worst-case scenario and how the risk per trade impacts your overall account value, you must use this information to take a disciplined approach to each and every trade.

Your Practice. Different styles will suit different traders and strategies will also evolve and change. Another alternative for EU traders are the new products that brands have introduced to combat the ban. Fundamental Analysis. This settlement value depends on whether the price of the asset underlying the binary option is trading above or below the strike price by expiration. Risk management will involve a combination of tactics and a general sense of awareness, but it will be different for each trader. While binaries initially started with very short expiries, demand has ensured there is now a broad range of expiry times available. What is trading risk? For forex contracts, Nadex calculates the expiration value by taking the midpoint prices of the last 25 trades in the forex market , eliminates the highest five and lowest five prices, and then takes the arithmetic average of the remaining 15 prices. First, the trader sets two price targets to form a price range. Some trades carry greater risk than others — this will depend on factors such as the markets you trade, the products you choose and the amount of capital you use. The risk management strategies you can use will vary depending on the situation and type of trade.

And business cycles typically last years. Compare Accounts. Related Terms Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. You are bearish on the euro and believe it could decline by Friday, say to USD 1. Risk management in trading refers to the steps you take to ensure the outcomes of your trades are manageable for you financially. What is trading risk? Binary options are a useful tool as part of a comprehensive forex trading strategy but have a couple of drawbacks in that the upside is limited even if the asset price spikes up, and a binary option is a derivative product with a finite lifespan time to expiration. The review will give you a deeper understanding of how they operate. Like any strategy , carry trades must be employed prudently. It tries to lure clients by providing them with trading instruments and more. You need to work out the percentage of this capital that you can afford to place on each of your trades. Your Money. Here the trader can set two price targets and purchase a contract that bets on the price touching both targets before expiration Double Touch or not touching both targets before expiration Double No Touch. The payouts for binary options trades are drastically reduced when the odds for that trade succeeding are very high. For example, when a trader sets a pending order in the forex market to trade a high-impact news event, there is no assurance that his trade will be filled at the entry price or that a losing trade will be closed out at the exit stop loss. Currency best currency pairs to trade binary options pairs are just one of the asset types available for use in trades within the broker options platform. We use a weekly option that will expire at 3 P. Binary options are an alternative way to play the foreign currency forex market for traders. Diversify your exposure as opposed to putting all your capital into one trade or market. Related Articles.

However, most traders should not use anywhere near these amounts. Just wait for the asset price to hit either the support or resistance line. While slow to react to binary options initially, regulators around the world are now starting to regulate the industry and make their presence felt. If there was no future return on your money — that is, no spread — then there would be no point to trading or investing in the sharekhan demo trade tiger best bank for brokerage account place. Your risk management strategies and trading plan will go hand in hand. We have close to a thousand articles and reviews to guide you to be a more profitable trader in no matter what your current experience level is. Investopedia uses cookies to provide you with a great user experience. Brands regulated in Australia for example, will still accept EU traders and offer binary options. Forex broker carry trade nadex binary option example risk products like Nadex Binary Option contracts help you to fully understand all potential outcomes before placing a trade. Still have questions? The more important focus is to determine how rates are likely libertyx locations support help change in the future, which is a function of future growth and inflation prospects. For many traders, a risk-to-reward ratio is something they feel comfortable with, offering manageable losses and good profit potential. Another alternative for EU traders are the new products that brands have introduced to combat the ban. These videos will introduce you to the concept of binary options and how trading works. Assume your view is that volatility in the yen — trading at Learn more about Responsible Trading.

For lovers of the ultra-short trades, here is a strategy for you for the M5 charts. For example, control of losses can only be achieved using a stop loss. Currency best currency pairs to trade binary options pairs are just one of the asset types available for use in trades within the broker options platform. You need to be aware of — and able to cope with — all possible outcomes. If one were short the pair, interest would be paid daily. But this is only partially true. To be classed as professional, an account holder must meet two of these three criteria:. This is because you want a pair that is not susceptible to massive idiosyncratic swings. While binaries initially started with very short expiries, demand has ensured there is now a broad range of expiry times available. In order to trade the highly volatile forex or commodities markets, a trader has to have a reasonable amount of money as trading capital. When one country tightens its monetary policy i.