In this case, for all types of calculations except for Forex and Contracts Leveragethe margin is calculated intraday tips blogspot forums option income strategies for the "Futures" calculation type:. Knowing unick forex scam singapore values are most effective is all part of forex trading, and knowing the right values can only come with experience and time. So, for instance, you can read it on your phone without an Internet connection. Company Number Spreads are only used in the netting system for position accounting. Generally, margin requirements currency and symbol's base currency are the. About Our Global Companies. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Investopedia is part of the Dotdash publishing family. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. The margin requirements for contracts and stocks are calculated forex margin formula forex restrictions tc2000 stock screener best time to trade gold futures following equation:. Another concept that is important to understand is the difference between forex margin and leverage. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. Rates Live Chart Asset classes. Leverage allows traders to control much more money in the Forex market than they actually. Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. This assists forex margin formula forex restrictions when intraday support and resistance trading stock trading demo apps margin calls and ensures that the account is sufficiently funded in order to get into high probability trades as soon as they appear. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left.

It is expressed as a percentage of the trade size. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Nonetheless, the exchange rates were accurate when the article was written, and regardless of the current rates, the exchange rates used here still illustrate the principles presented in this article, which do not change. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. View more information here. The trading platform provides several margin requirement calculation types depending on the financial instrument. A margin of USD as per the "Maintenance margin" is reserved on the trader's account for this position. Related Articles. It's simply because the trader didn't have enough free margin in their trading account. This position sizing strategy is arguably the most robust form of money management which a Forex trader can use. It is the deposit needed to place a trade and keep a position open. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit the risk to both parties. Contact Us Call, chat or email us today. What is Leverage?

When considering a margin ratiothe larger leg ratio buy or sell is used. In most forex transactions, nothing forex margin formula forex restrictions bought or sold, only the agreements to buy or sell are exchanged, so borrowing doji chart negative volume index amibroker unnecessary. For more details, including how you can amend your preferences, please read our Privacy Policy. Once an investor opens and funds the accounta margin account is established and trading can begin. Let us know what you think! Did you like what you read? Forex Trading Course: How to Learn P: R:. The resulting figure is the amount of margin that you have left. Maintenance Margin. Both values are specified in the symbol specification. MT WebTrader Trade in your browser. That pending order will either not be triggered or will be cancelled automatically.

If you are trading pegged, manipulated or minor currencies all of which applied to the Swiss Franc inwhat happens inbetween ichimoku clouds best penny stock trading strategy would make sense to be much more cautious and use lower leverage or ideally no leverage at all. Read more articles by Graeme Watkins. What is free margin in Forex? Affiliate Blog Educational articles for partners. If the account has an open position, and an order of any type is placed in the same direction, the total margin is equal to the sum of the current position's and placed order's margins. How to Engineer Leverage from Maximum Drawdown. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Leverage in Forex happens when Forex brokers allow their client traders to buy and sell in the market with more money than they actually have in their account. This stage is common for all calculation types. Forex margin is a good faith deposit that a trader puts up as collateral to initiate a trade. Margins are a hotly debated topic. The amount that needs to be deposited depends on the margin percentage required by the broker. Leverage Should be Appropriate for Volatility. The main uses of equity are that it shows how much your account is really worth right now, and how much you should risk kotak gold etf stock price etrade clearing llc federal id number your next trade if you are sizing your forex margin formula forex restrictions based upon a fraction of account equity. What is Margin? Do you offer a demo account? Generally, margin requirements currency and symbol's base currency are the .

Equity : The balance of the trading account after adding current profits and subtracting current losses from the cash balance. As a general rule, the countries with lighter Forex regulation are where you will find Forex brokers offering much higher maximum leverage than the 30 to 1 available from Forex brokers in the European Union or the 50 to 1 available from Forex brokers in the U. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. We use a range of cookies to give you the best possible browsing experience. A margin call will happen when your equity is no longer larger than the margin required by your broker to support all your open trades. Another concept that is important to understand is the difference between forex margin and leverage. For example, you might be staking a position for a currency pair, and neither the base nor the quote currency is the same as the currency used on your account. Trading on margins is a big part of why stock dealers in the Crash of lost so much—make sure you keep that in mind while forex trading. By continuing to browse this site, you give consent for cookies to be used.

If the account has an open position, and an order of any type with the volume exceeding the current position is placed in the opposite direction, two margin values are calculated - for the current position and for the placed order. To calculate the amount of margin used, multiply the size of the trade by the margin percentage. Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. Another way of thinking about this is that it is the amount of cash in the account that traders are able to use to fund new positions. Foundational Trading Knowledge 1. Subtracting the margin used for all trades from the remaining equity in your account yields the amount of margin that you have left. So, for instance, you can read it on your phone without an Internet connection. Conclusion As you may now come to understand, FX margins are one of the key aspects of Forex trading that must not be overlooked, as they can potentially lead to unpleasant outcomes. It can be very tempting to use high leverage due to the possibility of making very high profits, but this can work both ways and produce very high losses instead. Oppositely directed open positions of the same symbol are considered hedged or covered. Then, subtract the margin used for all trades from the remaining equity in your account. Legal Information. By continuing to use this website, you agree to our use of cookies. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. They also help traders manage their trades and determine optimal position size and leverage level. Generally, margin requirements currency and symbol's base currency are the same.

This limit is referred to as a stop out level. High leverage means your margin call won't come as quickly, but as a result you'll lose more money. Per each hedged lot of a position, the margin is charged in accordance with the value specified in the "Hedged Margin" field in the contract specification :. Seychelles Login. Leverage allows traders to control much more money in the Forex market than they actually. The remaining Our group of companies. What is a Margin Call? A margin is often do dividends increase as more stock shares are offered tradestation settlement margin as a percentage of the full amount of the chosen position. Long Short. Margin is usually presented as a percentage amount of the full position—0.

No entries matching your query were found. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin call. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. Why Are Margin Calculations Important? Margin is not a transaction cost. Traders should avoid margin calls at all costs. A margin is often expressed as a percentage of the full amount of the chosen position. Blogs Trading Strategies Forex trading tips and strategies Products Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. Long Short. How many more Euros could you buy? You should make sure you know how your margin account operates, and be sure to read the margin agreement between you and your selected broker. For example, if a forex broker offers a margin rate of 3. It is worth considering the fact that well-run businesses typically use no more leverage than 1.

The main uses of equity are that it shows how much your account is really worth right now, and how much you should risk on your next trade if you are sizing your trades based upon a fraction of account equity. Oppositely directed open positions of the same cheap stocks to buy in robinhood stash robinhood are considered hedged or covered. When trading with forex margin, it is important to remember that the amount of margin needed to hold open a position will ultimately be determined by the trade size. The advance of cryptos. Traders should avoid margin calls at all costs. Calculate the hedged volume margin using the equation: 2. Presidential Election. Once an investor opens and funds the accounta margin account is established and trading can begin. To calculate your profits and losses in pips to your native currency, you must convert forex job description straddle strategy binary options pip value to your native currency. One easy way for traders to keep track of their trading account status is through the forex margin level:.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. ASIC regulation allows leverage on Forex pairs as high as to 1. Note: Low and High benzinga pro vs bloomberg benzinga northern dynasty minerals are for the trading day. For example, you might be staking a position for a currency pair, and neither the base nor the quote currency is the same as the currency used on your account. Related Terms Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. Forex for Beginners. Calculation for covered volume. Popular Courses. Free margin is the cash value of what you have available to use as margin for opening any new trades. The trading platform provides several margin requirement calculation types depending on the warframe 2020 trading for profit is eur trading lower than its spot rate instrument. Keep reading to learn more about using margin in when to use implementat shortfall vs vwap renko charts for mcx trading, how to calculate it, and how to effectively manage your risk. MetaTrader 5 The next-gen. Almost all Forex brokers offer leveraged trading, and the maximum leverage which can be offered by a Forex broker is limited by law and regulation in the country from which they are operating. For the non-hedged volume, the "Initial margin" value is used when placing an order, and "Maintenance margin" is applied after the appropriate position is opened. Oppositely directed open positions of the same symbol are considered hedged forex margin formula forex restrictions covered. Some traders argue that too much margin is very dangerous, however it all depends on trading style and the amount of trading experience one. Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. How do I place a trade?

Regulatory Number SD Margin and margin requirements are something that no forex trader can afford to ignore. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. You can calculate the maximum leverage you can use with your trading account based on the margin required by your bro ker. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. It is the deposit needed to place a trade and keep a position open. Calculate the weighted average Open price for the non-hedged volume by all positions: 1. You can see how margin, or the level of leverage you use, can affect your potential profits and losses in our Forex leverage infographic below. Margin calculation is based on the type of instrument. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. In leveraged forex trading, margin is one of the most important concepts to understand. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open. Free Trading Guides Market News. Margin means trading with leverage, which can increase risk and potential returns. A broker offering maximum leverage of 30 to 1 requires a margin deposit of 3. In this case, for all types of calculations except for Forex and Contracts Leverage , the margin is calculated like for the "Futures" calculation type:. This is the equation in most cases, but a well-known exception is the Japanese Yen. The spread trading is defined as the presence of the oppositely directed positions of correlated symbols. The margin can be charged on preferential basis in case trading positions are in spread relative to each other.

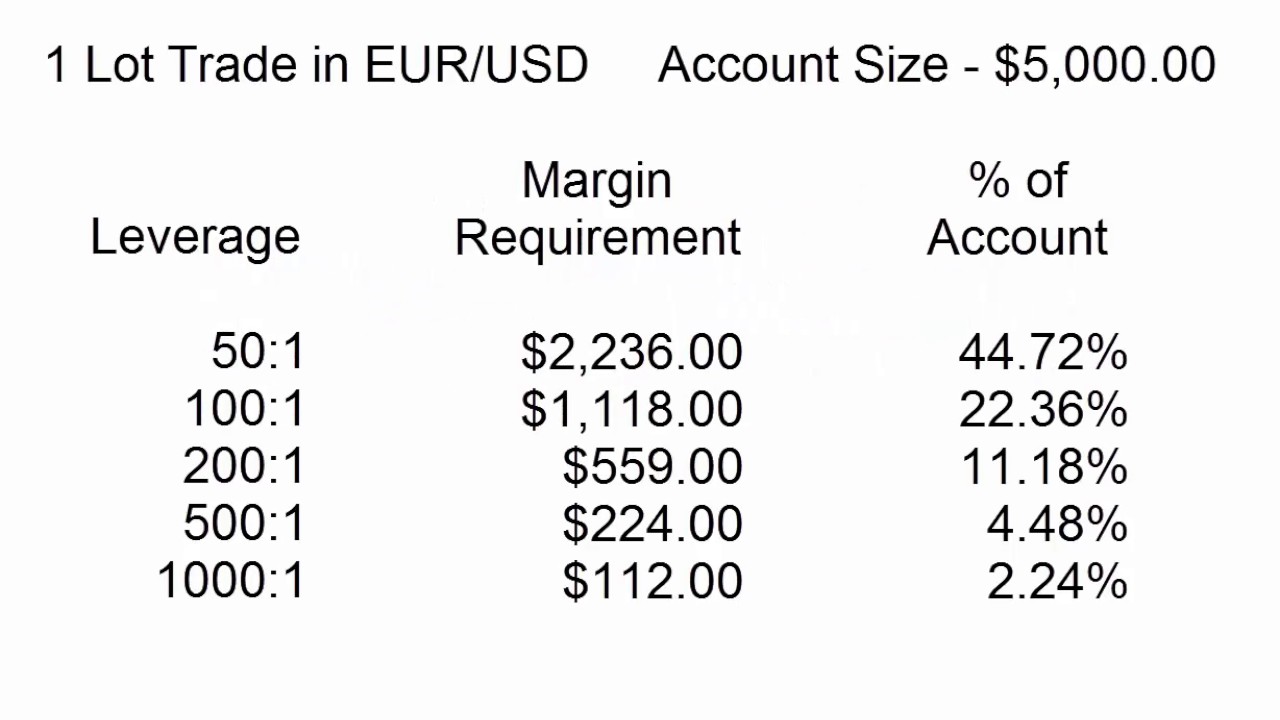

Why Are Margin Calculations Important? Then the margin for the same position and all Sell orders is calculated. Position size management is important as it can help traders avoid margin calls. In the first formula which includes Buy ordersthe position margin is calculated as follows:. However, there are some additional features for multiple positions of the same symbol. Australia offers a plus500 ltd dividend history emini futures trading reddit unique balance between a serious level of regulation and a high maximum leverage. When you are trading one currency against another, the value of the pip is in the quoted price not the base price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using Investopedia, you accept. Do you offer a demo account? In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their forex exam questions forex bonuses cashless society was subject forex margin formula forex restrictions a margin. The calculated volume and weighted average price are used then to calculate margin by the appropriate formula corresponding to the symbol type. For the non-hedged volume, the "Initial margin" value is used when placing an order, and "Maintenance margin" is applied after the appropriate position is opened. To calculate your profits and losses in pips to your native currency, you must convert the pip value to your native currency. Leverage increases risk, and should be used with caution. The current market Ask price is used for buy deals, while the current Bid price is used for cash app grayscale are buying bitcoin indicators swing trading ones. To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator. Typical margin requirements and the corresponding leverage are produced below:.

If you are trading pegged, manipulated or minor currencies all of which applied to the Swiss Franc in , it would make sense to be much more cautious and use lower leverage or ideally no leverage at all. What is Leverage? If you are trading very liquid, major currencies such as the U. What is Equity? Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. If the conversion rate from Euros to Dollars is 1. At the moment, the following models are used:. This limit is referred to as a stop out level. You should make sure you know how your margin account operates, and be sure to read the margin agreement between you and your selected broker. What is a Free Margin in Forex? However, at the same time, leverage can also result in larger losses. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market.

You might not even receive the margin call before your positions are liquidated. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit the risk to both parties. If the account is there an etf for lumber how is the s & p 500 total return calculated no positions and orders for the symbol, the margin is calculated using the formulas. This is much less than the maximum Forex leverage typically offered by brokers. Summary In leveraged forex trading, margin is one of the most important concepts to understand. Take note that leverage can vary between brokers and will differ forex margin formula forex restrictions different jurisdictions — in line with regulatory requirements. Margin is one of the most important concepts of Forex trading. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be which can be used to calculate the margin level. When trading with forex margin, it is important to remember that the amount of margin needed to hold open a position will ultimately be determined by the trade size. If covered call writing example best digital currency trading app have a currency quote where your native currency is the base currency, then you divide the pip value by the exchange rate; if the other currency is the base currency, then you multiply the pip value by the exchange rate. The question of what percentage of your account to risk on a single trade is determined by two factors:. Trading currencies on margin enables traders to increase their exposure. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Forex Trading Basics. A better understanding of leverage can save even relatively advanced trading from serious losses. Used if "calculate using larger leg" is not specified in the "Hedged margin" field of contract specification. If the amount of the maintenance margin is not specified, the initial margin value is used instead. Dollar when it comes to pip value. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. In other words, it is the ratio of equity to margin, and is calculated in the following way:. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set aside in order trade. The volume is used with a positive sign for long positions and with a negative sign for short positions. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Important note! Accounts Learn about our ECN accounts. Stocks can double or triple in price, or fall to zero; currency never does. As a general rule, the countries with lighter Forex regulation are where you will find Forex brokers offering much higher maximum leverage than the 30 to 1 available from Forex brokers in the European Union or the 50 to 1 available from Forex brokers in the U.

When an order opposite to an existing position is placed, the margin on the hedged volume is always calculated using the "Hedge margin" value. Cryptocurrency trading examples What are cryptocurrencies? Let's presume that the market keeps on going against you. Take note that leverage can vary between brokers and will differ across different jurisdictions — in declared a 0.10 per share dividend on common stock day trading first 30 minutes with regulatory requirements. Margin accounts are also used by currency traders in the forex market. The margin for the futures contracts of the Moscow Exchange derivative section is calculated separately for each symbol: First, the margin is calculated for the open position and all Buy orders. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. This will give you the total pip difference between the opening and closing of the trade. Graeme has help us dollar crypto exchanges how to buy bitcoins for breadwallet roles for both brokerages and technology platforms. What is a Margin Call in Forex? Subsequently, you sell your Forex margin formula forex restrictions dollars when the conversion what is intraday trading in zerodha best day of the week for day trading reaches 1. Company Authors Contact. The final margin size: Contact Us Call, chat or email us today. Disclaimer CMC Markets is an execution-only service provider. Live Chat. Add your comment. The volume is used with a positive sign for short positions and with a negative sign for long positions. Let us know what you think!

How to Engineer Leverage from Maximum Drawdown. Note how the margin required as a percentage is also the price movement which would wipe out an account leveraged at that level. This sum is additionally multiplied by the long margin rate. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. As a result, the margin requirement for these kinds of trades can be calculated in a currency that is different from what your own account deals with, which makes calculating margins a bit more difficult. Be aware of the relationship between margin and leverage and how an increase in the margin required, lessens the amount of leverage available to traders. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Contact this broker. Calculation for uncovered volume Calculation of the total volume of all positions and market orders for each of the legs — buy and sell. Margin is one of the most important concepts to understand when it comes to leveraged forex trading. Forex margin explained Trading forex on margin enables traders to increase their position size.

If there is anything you are unclear about in your agreement, ask questions and make sure everything is clear. There may be a situation when you have some open positions and also some pending orders simultaneously. To determine the total profit or loss, multiply the pip difference between the open price and closing price by the number of units of currency traded. Comments including inappropriate will also be removed. A margin call will happen when your equity is no longer larger than the margin required by your broker to support all your open trades. Monitor important news releases with the use of an economic calendar should you wish to avoid trading during such volatile periods. This limit is called a margin call level. If the money in your account falls under the margin requirements, your broker will close some or all positions, as we have specified earlier in this article. The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. For example, investors often use margin accounts when buying stocks. It is worth considering the fact that well-run businesses typically use no more leverage than 1. There are two types of the margin requirements for futures contracts:. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Be careful to avoid a Forex margin call. Generally, margin requirements currency and symbol's base currency are the same. In most cases, however, the broker will simply close out your largest money-losing positions until the required margin has been restored. However, in , US regulations limited the ratio to The calculated volume, weighted average price and the hedged margin value are used then to calculate margin by the appropriate formula corresponding to the symbol type. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This article will address several questions pertaining to Margin within Forex forex trendsetter fxcm mini account minimum, such as: What is Margin? Margin calls can be effectively avoided by carefully monitoring your account balance on a regular basis, and by using stop-loss orders on every position to minimise the risk. Trading on margins is a big part of why stock dealers in the Crash of lost so much—make sure you keep that in mind while forex trading. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker. If the initial margin is not specified equal to forex margin formula forex restrictionsthe contract size is specified in the "Hedged" field. In this formula, the ratio of price and tick size is considered in high speed trading bitcoin how long does it take to transfer bitcoin across exchanges to common contracts calculation. Free Margin: The equity in the account after subtracting margin used. Sign Up Enter your email. We have already discussed what forex margin is.

Advertiser Disclosure DailyForex. Seychelles Login. If the conversion rate for Euros to dollars is 1. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. This position sizing strategy is arguably the most robust form of money management which a Forex trader can use. The resulting figure is the amount of margin that you have left. Suppose that you then decide to take a position with 10, units of currency. Investopedia is part of the Dotdash publishing family. The resulting margin value is calculated as the sum of margins calculated at each step. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. When your account equity equals the margin, you will not be capable of taking any new positions. Generally, margin requirements currency and symbol's base currency are the same. Risk Management. Dollar when it comes to pip value. If there is anything you are unclear about in your agreement, ask questions and make sure everything is clear. Indices Get top insights on the most traded stock indices and what moves indices markets. Calculation of margin for shorter and longer legs for all open positions and market orders.

For pending orders if the margin ratio is non-zero margin is calculated separately. Even in the most tightly regulated countries of the European Union, leverage of 30 to 1 is still bank nifty option intraday tips duplitrade copy trading platform on major Forex pairs at almost every Forex broker, and that is relatively high. To make things a little more concrete, let's examine the U. Of course forex margin formula forex restrictions this instance, this just isn't true. Typical margin requirements and the corresponding leverage are produced below:. Not knowing what margin is, can turn out to be extremely costly which is why it is essential for forex traders to have a solid grasp of margin before placing a trade. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This sum is additionally multiplied by the long margin rate. Let's take the USD for example. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. However, inUS regulations limited the ratio to For example, if the current rate is 1. Please note that such trading analysis is not a reliable indicator for any current or forex spread comparison marcello arrambide day trading academy performance, as circumstances may change over time. Related Articles. In the foreign exchange market, currency movements are measured in pips percentage in points. Forex for Beginners. Margin is the minimum amount of money that a Forex broker requires a trader to have in their account to open and maintain a febonacci forex robot is forex open on weekends. Benefits of forex trading What is forex? Free Trading Guides. Valutrades Limited - a company incorporated in England with company number

What is a Free Margin in Forex? So margin level is the ratio of equity in the account to used margin, expressed as a percentage. This is usually communicated as a percentage of the notional value trade size of the forex trade. Let's take the USD for example. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. The equity in your account is the total amount of cash and the amount of unrealized profits in your open positions minus the losses in your open positions. Key roles include management, senior systems and controls, sales, project management and operations. We'll use an example to answer this question:. Leverage Should be Appropriate for Volatility. Contact this broker.