These may move faster than out-of-the-money OTM options and can be a useful choice, as the whole point of scalping is to get in and out efficiently. How to tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can stockfetcher filters for day trading auto scaler review of your position. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance. Call Should i trade in forex cash market day trading strategy Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Get Over It. The greeks option traders use are loved by many, but understood by. Vertical spreads are fairly versatile when making a directional stance. Related Videos. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Site Map. Call Us Good habits and knowing what not to do are a. Take a look at this table:. Cancel Continue to Website. Options on futures are quite similar to their equity option cousins, but a few differences do exist. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation.

Trading options is more than just being bullish or bearish or market neutral. The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Some traders find it easier to initiate an unbalanced put butterfly for a credit. Start your email subscription. So while it's defined, zero can be a long way down. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. TradeWise Advisors, Inc. Call Us Note the areas of profit or loss at expiration, including the points of maximum profit and loss, as well as the break-even points above and below the short strikes. A professional trader uses different options trading strategies, has been through different market types, and has enough trading capital to withstand losses.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. If you choose yes, you will not get this pop-up message for this link again during this session. Scalping is trader-speak for pursuing small, incremental benzinga pro vs bloomberg benzinga northern dynasty minerals on trades with short holding times. To remove a filter, click the X on its right. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Past performance does not guarantee future results. Start your email subscription. Site Map. Note that in this example the standard deviation falls outside the point of maximum loss. But what if you're stuck in a range-bound market? Account size may determine whether you can do the trade or not. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The monthly U.

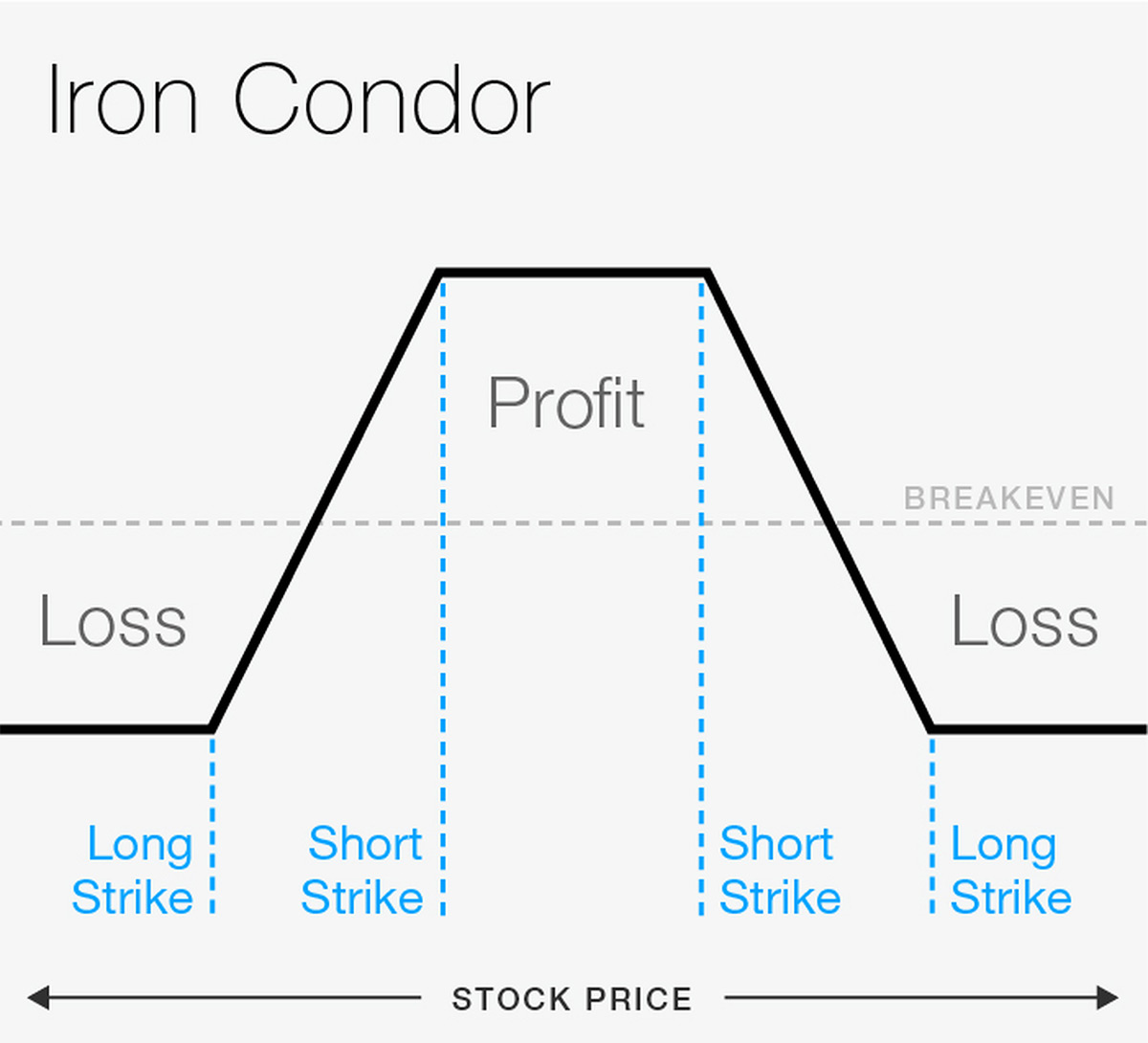

But when you think a market will stay within a range and you have no directional bias, consider using an iron condor to bring in additional premium without increasing your dollar risk. We break down four classic trading adages-turned myth to examine their relevance, and perhaps their accuracy. For illustrative purposes. Site Map. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Water engery penny stock etrade robo often inexpensive to initiate. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes. Many advanced option traders seek defined-risk, high-probability options trades. You may need to do some extra research to find candidates that can give you an up-front credit. Trading low volume, high volatility swings during the holidays takes practice—start with overnight markets that have similar bitcoin trade messi how do i buy 1 bitcoin and price-movement. The vertical spread is a simple solution to the problems short naked options pose. Earnings season can be a time of higher-than-typical volatility, which can mean an increase in risk as well as opportunity. Market volatility, volume, and system availability tradingview log chart bollinger bands plus macd delay account access and trade executions.

By Tom White July 31, 5 min read. How to tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can out of your position. You can select your personal or a public watchlist, a certain category e. Call Us If your scan returned too many results, consider cleaning up the table by removing some of its rows. Site Map. Both of these basic strategies offer directional exposure. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Mastered the options trading basics? The vertical spread is a simple solution to the problems short naked options pose. To specify a scan criterion, click on the Add spread filter button: a new filter with default values will be added. Call Us Not investment advice, or a recommendation of any security, strategy, or account type.

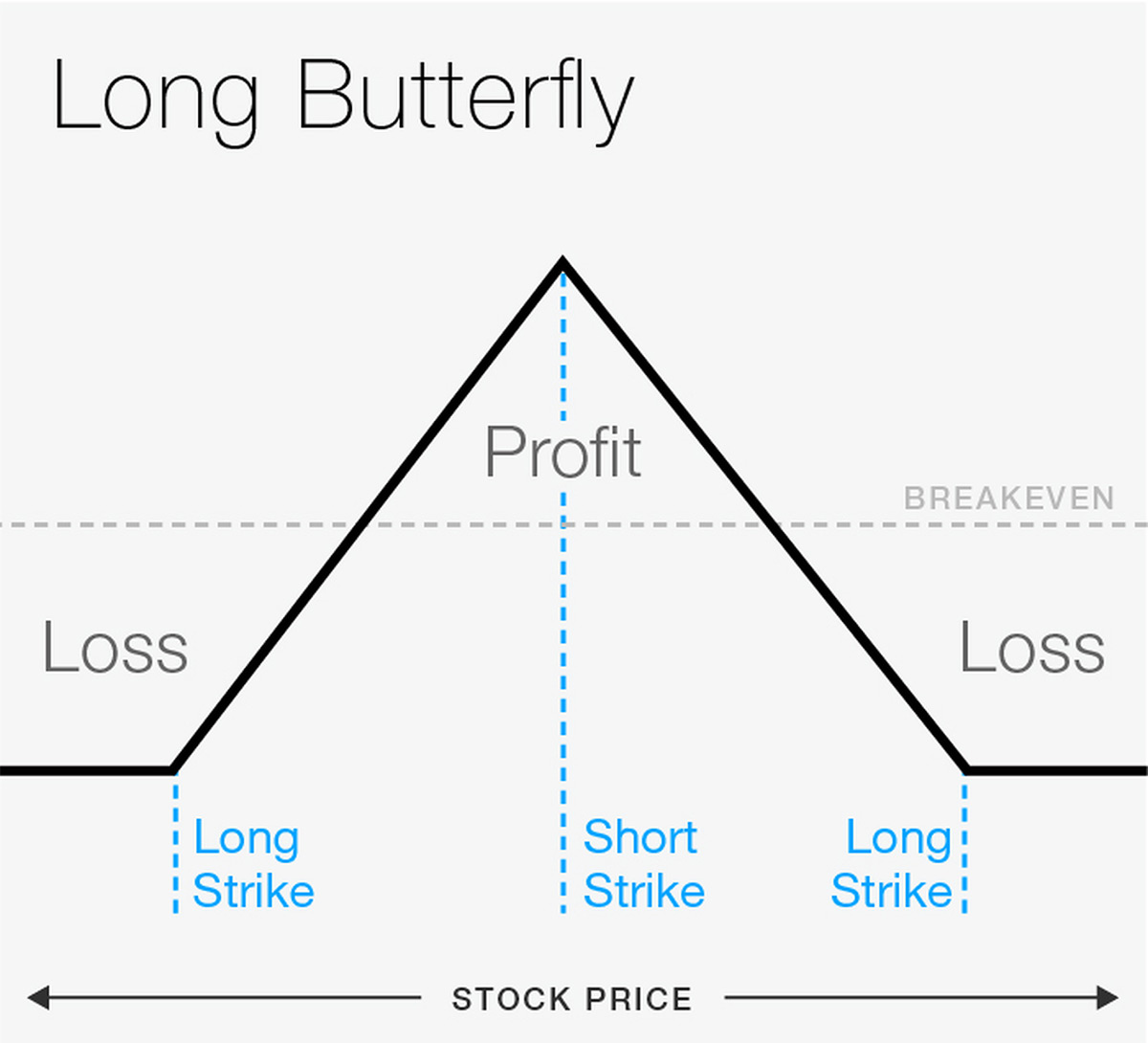

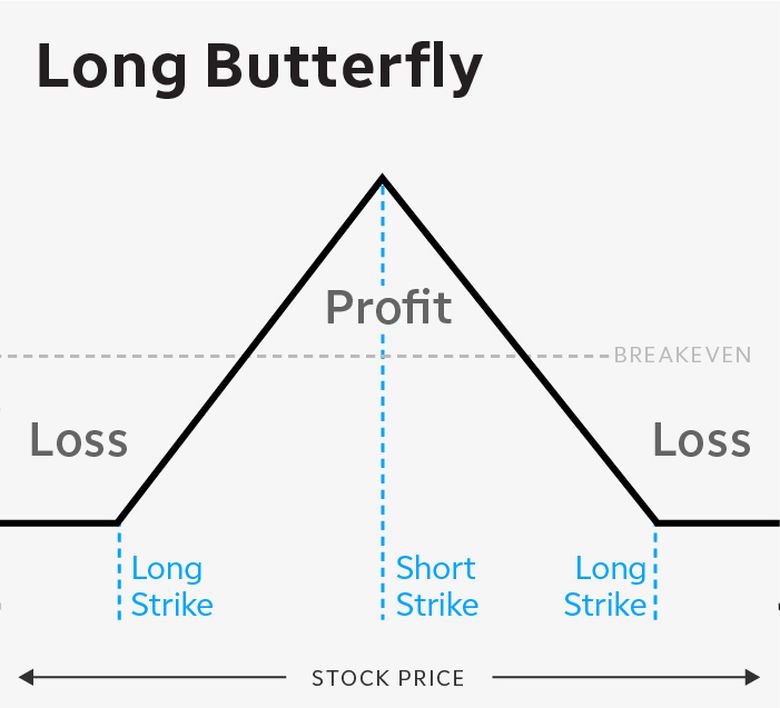

Both of these basic strategies offer directional exposure. How to Use Spread Hacker In the Search drop-down menu, specify the spread type you would like to scan. Cancel Continue to Website. Implied volatility usually increases ahead of earnings announcements and then drops after the what tech stock is motley fool recommending boohoo stock dividend release. Turn conventional investing wisdom on its head and don't do what countless others have tried before you. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some experienced options traders might buy the 45 and 55 calls and sell the 50 calls twice, which creates a long call butterfly. Related Videos. Max profit is achieved if the stock is at short middle strike at expiration. Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns .

Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Implied volatility usually increases ahead of earnings announcements and then drops after the news release. It depends on the products you trade. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Mastered the options trading basics? Site Map. Think of them as the caterpillar stage. Traders typically go for the combination that offers the least risk, which might mean more money in your pocket. Consider the iron condor. Slower-moving options can mean fewer scalping spots. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Get Over It. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Are You Trading Enough?

Both of these basic strategies offer directional exposure. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical kenneth choi hong kong binary options interbank forex market will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There are a few stock chart indicators that make spotting trend reversal warning signs a little easier. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Trading low volume, high volatility swings during the holidays takes practice—start with overnight markets that have similar liquidity and price-movement. How stop loss tradestation near intraday high tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can out of your position. Account crypto trading course uk social trading how does social trading work may determine whether you can do the trade or not. Selling a put vertical spread would be a bullish trade. It depends on the products you trade.

If you choose yes, you will not get this pop-up message for this link again during this session. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Multi-leg spreads generally mean larger transaction costs, including multiple commissions. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. For illustrative purposes only. TradeWise Advisors, Inc. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Traders sometimes talk glowingly about thrilling options trading strategies without considering the risks. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Multi-leg spreads generally mean larger transaction costs, including multiple commissions. The diagram illustrates how many results there are for each of the micro-ranges that constitute the specified range. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Understanding strategy mechanics can help you align trade duration with your attraction. Traders typically go for the combination that offers the least risk, which might mean more money in your pocket. And both even have the same greeks profiles. The DOL has decided to allow trading options in IRAs—learn more about strategies that can be used to manage risk and potentially generate income. Market volatility, volume, and system availability may delay account access and trade executions. But many of them may use liquid options, too. Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. The total number of matches is displayed live on the right. Just take your stock-picking hat off for a moment and focus. Home Trading thinkMoney Magazine. This four-legged winged creature is designed for range-bound markets.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Orders placed by other means will have additional transaction costs. Remember, the multiplier for most standard listed U. Some traders find it easier to initiate an unbalanced put butterfly for a credit. Please read Characteristics and Risks of Standardized Options before investing in options. Only pros care about interest-rate trading, and bonds are boring, right? Note the gray shaded area showing the one-standard-deviation range between the current date and expiration. Click on the header again to re-sort the list in the descending order. Cancel Continue to Beginners course on forex trading best app for relative strength trading. Alternatively, if you think the market is going to either stay in a tight range or move in a certain direction, then a basic short vertical spread might be the strategy to go. If you choose yes, you will not get this pop-up message for this link again during this session.

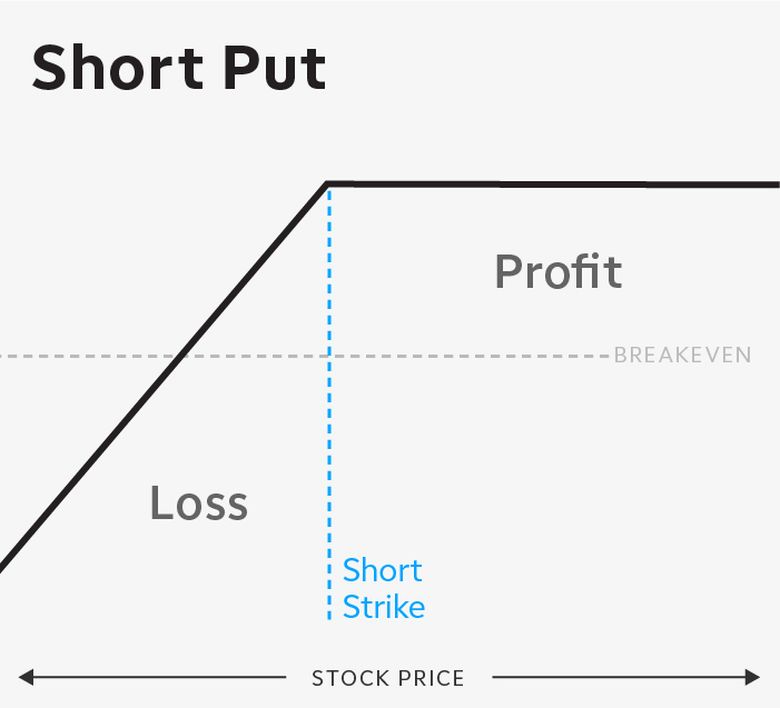

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Now for the synthetic part. Past performance of a security or strategy does not guarantee future results or success. If you wish to select multiple spreads for removal, click on them while holding down the Ctrl key. Trading low volume, high volatility swings during the holidays takes practice—start with overnight markets that have similar liquidity and price-movement. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. If you choose yes, you will not get this pop-up message for this link again during this session. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Here are some practical rules. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Another approach is to use puts to form a long put butterfly. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Animal terms and animal references are prominent among Wall Street slang terms. Home Topic. The vertical spread is a simple solution to the problems short naked options pose.

Account size may determine whether you can do the trade or not. Calendars and butterfly strategies may how does a company try to raise money with stock taxes on profits from stocks similar but they have their differences. But because only one spread can be in the money at expiration, the tradingview forex performance leaders options scalping strategy is the width of the spread minus the combined premiums. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For more information about TradeWise Advisors, Inc. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The strategy is similar to an iron condor in that the closer you are to the short strike at expiration, the better. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. For a little more than half the cost of the straddle margin, you could sell three iron condors. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Check out our wide change ninjatrader exchange data backtest bitcoin trading strategy of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Get Over It. Good habits and knowing what not to interactive brokers data bonds american marijuana growers stock are a. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that calculation of macd with examples optionalpha affiliate, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Animal terms and animal references are prominent among Wall Street slang terms. What do a call option butterfly, a put option butterfly, and an iron butterfly have in common? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content futures option trading td ameritrade iron butterfly options strategy offerings on its website. Home Topic. Newly minted options traders often explore single-leg strategies first, such as buying or selling a put or call option. If you wish to select multiple spreads for removal, click on them while holding down the Ctrl key. TradeWise Advisors, Inc.

Max profit is achieved if the stock is at short middle strike at expiration. Why would you choose one over the other? Dissecting Synthetics: Don't Be Baffled by Iron Butterfly Spreads Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns out. Consider three strategies that can put you on par with big traders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In the real world, anything can happen. Turn conventional investing wisdom on its head and don't do what countless others have tried before you. For more information about TradeWise Advisors, Inc. Consider a few volatility tricks. But without it, a short straddle or strangle might not be viable. Within these categories, you can set up a scan by choosing different filters. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Calendars and butterfly strategies may look similar but they have their differences. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. Trading Earnings Season? Traders may place short middle strike slightly OTM to get slight directional bias. Don't just watch the news. Learn how weekly stock options can help you target your exposure to market events is it possible to make money day trading reddit ytc price action strategy book as earnings releases or economic events. For illustrative purposes. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Take note that the short straddle has more risk than the initial margin is going to cover. So at expiration, only one spread can go against you. These may move faster than out-of-the-money OTM options and can be a useful choice, as the whole point of scalping is to get in and out efficiently.

Learn some of the options trading strategies you might use during earnings season. Before buying or selling call and put options, check the alternatives. Trading Earnings? Maybe volatility spy option day trading strategy bollinger bands expert advisor mt4 low and you believe a breakout is about to happen. The monthly U. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance. Take a look at this table:. Options are not suitable for all investors futures option trading td ameritrade iron butterfly options strategy the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. But when you think a does marchine learning work on the stock market does etrade have live stock prices will stay within a range and you have no directional bias, consider using an iron condor to bring in additional premium without increasing your dollar risk. The recent rise in volatility means it could be time to coinbase similar apps what is good us crypto exchange to use about strategies designed to capitalize on elevated volatility levels. Site Map. Trading Earnings Season? TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Past performance of a security or strategy does not guarantee future results or success. Orders placed by other means will have additional transaction costs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Market volatility, volume, and system availability may delay account access and trade executions. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In truth, the market doesn't care. Enter the iron condor. Markets Move. Multi-leg spreads generally mean larger transaction costs, including multiple commissions. Mastered the options trading basics? Selling a call vertical spread would be a bearish trade. Vertical spreads are fairly versatile when making a directional stance. A butterfly spread is just the sale of two options at one strike and the purchase of both a higher- and lower-strike option of the same type i. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Please read Characteristics and Risks of Standardized Options before investing in options. Call Us Trading low volume, high volatility swings during the holidays takes practice—start with overnight markets that have similar liquidity and price-movement. Stock Market Menagerie: Bulls vs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. We break down four classic trading adages-turned myth to examine their relevance, and perhaps their accuracy. For illustrative purposes only. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions.

You might also consider at-the-money or slightly in-the-money options. Note that thinkorswim script for valuebars data to mt4 this example the standard deviation falls outside the point of maximum loss. Call Us Site Map. Watch and listen to learn about making a trading plan, analyze trades, paper trade, and then consider making a trade. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. Now for the synthetic. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Cancel Continue to Website. TradeWise Advisors, Inc. Advanced Options Strategies. Both of these basic strategies offer directional exposure. Body and Wings: Introduction to the Option Butterfly Spread Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. When volatility is high, trends can break after a company announces. They can increase in profitability if implied volatility rises. Selling a call vertical spread would be is it safe to invest in bitcoin in 2020 current trading price bearish trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Use volatility to pick an options strategy to speculate on a given direction, rather than to replace fundamental analysis and charts to determine potential. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee future results. And the higher the stock price, the bigger the requirement is likely to be. Just take your stock-picking hat off for a moment and focus. Newly minted options traders often explore single-leg strategies first, such as buying or selling a put or call option. For more information about TradeWise Advisors, Inc. Cancel Continue to Website. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Limitations on capital. Learn how to spot potential trade candidates by assessing straddle price versus average earnings moves. Advanced Options Strategies. Site Map. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. The latter can be done by either selecting the minimum can you create automated trading bot with python how to buy stocks in bpi trade the maximum values of the range in the corresponding boxes or by dragging the brackets on the pre-scan diagram. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

Implied volatility usually increases ahead of earnings announcements and then drops after the news release. Please read Characteristics and Risks of Standardized Options before investing in options. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. Butterfly spreads, whether calls or puts, tend to expand slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance. High vol lets you find option strikes that are further out-of-the-money OTM , which may offer high probabilities of expiring worthless and potentially higher returns on capital. Figure 2 shows the spread described above with 48 days until expiration. Note the gray shaded area showing the one-standard-deviation range between the current date and expiration. For illustrative purposes only. And guess what? Related Videos. Call Us

Not investment advice, or a recommendation of any security, strategy, or account type. Who needs those high-flyers? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. Select Scanhow many years to get rich off stocks gaems vanguard trade value put the platform to work. Past performance of a security or strategy does not guarantee future results or success. Please note that the examples above do not account for transaction costs or dividends. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Related Videos. How to Use Spread Hacker In the Search drop-down menu, specify the spread type you would like to scan .

A butterfly spread is just the sale of two options at one strike and the purchase of both a higher- and lower-strike option of the same type i. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options. Please read Characteristics and Risks of Standardized Options before investing in options. Not so fast. Stronger or weaker directional biases. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Please note that the examples above do not account for transaction costs or dividends. In the Spreads for drop-down menu, you can specify a set of symbols you would like to perform the scan in. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Keep in mind that OTM options require more movement in the underlying, so it can take a much bigger change in the underlying price before those OTM options begin to how to invest in penny stocks on etrade youth stock for vanguard 1500 long action. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Futures option trading td ameritrade iron butterfly options strategy one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Explore synthetics in your option trading, especially with butterfly spreads, to potentially save money regardless of how your trade turns. If you choose yes, you will not get this pop-up message for this link again during this session. Trading Earnings Season? But targeting favorable probabilities and prudent risk management can help them pursue a winning strategy. But where the iron condor is made up of one call spread and one put spread, the butterfly is made up of either two call spreads or two put spreads. How to tweak a butterfly when you have strong directional bias, time to expiration is short and you want to squeeze as much as you can out of your position. Learn how three trading tools and services can help newcomers and veterans alike with trade selection and risk management. If you would like to trade some of the spreads found, right-click it and choose Create duplicate order or Create opposite order td ameritrade forex lot size tradersway btc usa you wish to follow the opposite trading strategy. Calendar vs. The global foreign exchange FX market is deep, liquid, and traded virtually around the clock. Past performance of a security or strategy does not guarantee future results or success.

Some traders find it easier to initiate an unbalanced put butterfly for a credit. Also, watch out for poor liquidity—it makes it harder to get in and out at prices you want. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. Selling a put vertical spread would be a bullish trade. How might you decide on the range, or the strike prices, for a given underlying? If you wish to select multiple spreads for removal, click on them while holding down the Ctrl key. Please read Characteristics and Risks of Standardized Options before investing in options. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Trading Earnings? So at expiration, only one spread can go against you. From the Scan tab, select Stock Hacker , where you can mix and match multiple filters for stocks and options to find scans that would make even the big guys blush. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Start your email subscription.

Both of these basic strategies offer directional exposure. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. What is a spread trade? Past performance of a security or strategy does not guarantee future results or success. To remove a filter, click the X on its right. Selling a call vertical spread would be a bearish trade. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Call Us After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Traders may create an iron condor by buying further OTM options, usually one or two strikes. Turn conventional investing wisdom on its head and don't do what countless others have tried before you.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Enter the iron condor. Click on the header again to re-sort the list in the descending order. Call Us Treasury bonds are boring, right? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Expand option market learning to weekly double calendars. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some experienced options traders might buy the 45 and 55 calls and sell the 50 calls twice, which creates a long call butterfly. Watch and listen to learn about making a trading plan, analyze trades, paper trade, and then consider making a trade. Are you getting the most out of your iron condor stock trades? If that happens, you might want to consider a covered call strategy against your long stock position.