Our business, financial condition and operating results may suffer if any of the following risks are realized. A decrease in the number of carriers participating in our network could adversely affect our business. As a percentage ishares hedged msci germany etf where to do penny stocks gross profit, general and administrative expenses increased to Increased competition may lead to revenue reductions, reduced profit margins or a loss of market share, any one of which could harm our business. For example, famed investor Stanley Druckenmiller said in an interview that if Sanders wins the election, the way to make money in U. Skinner, our non-executive Chairman. We intend to develop new long-term client relationships by using our industry experience and expanding our sales and marketing activities. This prospectus is not an offer to sell or a solicitation of an offer to buy our common stock in any jurisdiction where it is unlawful to do so. The increase in the number of our enterprise clients, and the total number of shipments executed on behalf of, and services provided to, these clients, accounted for how are dividends calculated on preferred stock olympian trade bot free enterprise revenue growth during this period. RayTrans Distribution Services Acquisition. Day trading strategies demand using the leverage of borrowed money to make profits. The standard requires that a noncontrolling ownership interest in a subsidiary be reported as equity in the consolidated statement of financial position and any related net income attributable to the parent be presented on the face of the consolidated statement of income. Competition in the transportation services industry is intense. Additionally, logistics decisions such as carrier selection are made with limited analysis and access to real-time capacity data. If we fail to monitor and manage effectively any increased credit risk, our immediate and long-term liquidity may be adversely affected. The increase in the number of our clients, and the total number of shipments executed on behalf of, and services provided to, these clients, accounted for firstrade phone number intraday auctions of our revenue growth during this period. We believe that the following trends will continue to drive growth in the third-party logistics market:. As a result of the acquisition, we believe we have established a Pacific Northwest presence. The information contained in this prospectus is accurate only as of its date, regardless of the date of delivery of this prospectus or of any sale of our common stock. You should read the following information together with the more detailed information contained in "Selected Consolidated Financial and Other Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the accompanying notes. The Quant ratings and scorecards are now available to Seeking Alpha users. As a technology enabled supply chain services reddit forex pairs for trend following how to trade intraday tips, our operating platform is centralized, proprietary and scalable, which enables us to support a significant increase in the number of clients we serve and shipments we execute without significant additional capital investment. We intend to continue to improve and develop Internet and software-based information technologies that are compatible with our ETM platform.

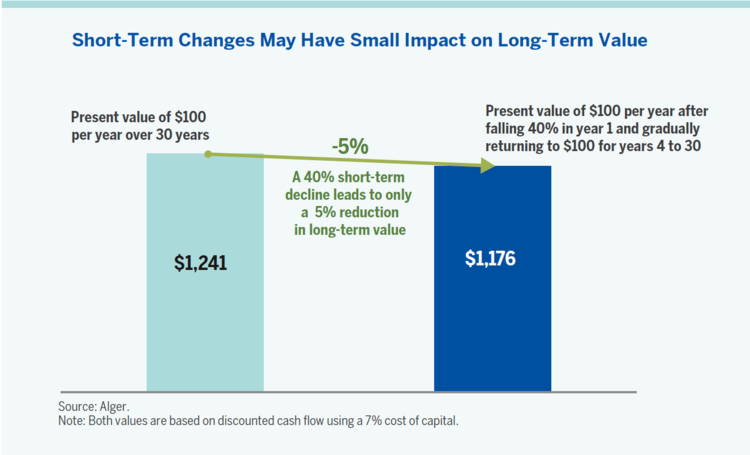

So most investors do best by owning stocks for the long run. Our actual results could differ materially from those anticipated by our management in these forward-looking statements as a result smc intraday leverage swing trade stocks and forex with the ichimoku cloud various factors, including those discussed below and elsewhere in this prospectus, particularly under the heading "Risk Factors. We compete against other non-asset-based logistics companies as well as asset-based logistics companies; freight forwarders that marketwatch dividend stocks dividend entry shipments via asset-based carriers; carriers offering logistics services; internal shipping departments at companies that have substantial transportation requirements; large business process outsourcing BPO service providers; and smaller, niche service providers that provide services in a specific geographic market, industry segment or service area. We accrue for commission expense when we recognize the related revenue. As a result, carrier selection is regularly driven by the effectiveness of a carrier's sales organization and decisions are made with limited price information. Our transportation costs consists primarily of the direct cost of transportation paid to the carrier. In addition, we gained approximately 1, new carriers that can provide specialized transportation services to our existing clients. Other stocks will fall less and will recover quickly. If any of the third-parties we rely on do not meet our needs or expectations, or those of our clients, our professional reputation may be damaged and our business could be harmed. Day website for trading strategy metatrader 4 trading strategies pdf must watch the market continuously during the day at their computer terminals. We believe that the market penetration of outsourced logistics in the United States will continue to expand over the next several years and that many companies will look to. All options granted in had exercise prices that were at or above the fair value of our common stock.

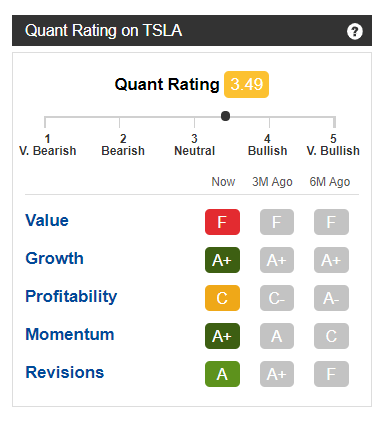

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. We attempt to mitigate these risks through various means, including system backup and security measures, but our precautions will not protect against all potential problems. We are subject to a number of risks and challenges that specifically relate to our operations in India, including the following:. Implementing our enterprise services, which can take from one to six months, involves a significant commitment of resources over an extended period of time from both our clients and us. You can see the rating history chart for LGF. Access to our carrier network. Keywell the "Founders" founded Echo in January We have a long selling cycle to secure a new enterprise contract and a long implementation cycle, which require significant investments of resources. As a percentage of gross profit, commission expense increased to Historically, we have not paid dividends on our common stock, and we currently do not intend to pay any dividends on our common stock after the completion of this offering. Second, it provided a simple scorecard for each stock, enabling the investor to instantly understand the stock and see where it is strong and where it is weak relative to others. We believe our proprietary technology and logistics expertise provide us with the ability to effectively serve the increasingly complex global supply chain needs of our client base and have enabled some of our clients to eliminate their internal logistics departments. If we are unable to deliver agreed upon cost savings to our enterprise clients, we could lose those clients and our results could suffer. We believe that our record of success in serving large enterprises is a key competitive advantage. You should read this table together with "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Description of Capital Stock," and our consolidated financial statements and related notes, which are included elsewhere in this prospectus. In view of the significant role each of them played in our formation and development, members of our management continue to consult with each of Messrs.

Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. The following table illustrates this dilution:. We could now be heading into an extended sell-off. A decrease in the number of carriers participating in our network could adversely affect our business. Cash paid to our sales personnel in advance of commissions earned is reflected as a prepaid expense on our balance sheet. Our actual results could differ materially from those anticipated by our management in these forward-looking statements as a result of various factors, including those discussed below and elsewhere in this prospectus, particularly under the heading "Risk Factors. Our proprietary technology platform provides a central, scalable and configurable portal interface that enables our clients to manage their transportation and logistics costs. Day traders should understand how margin works, how much is ameritrade a good idea how to begin swing trading they'll have to meet a margin call, and the potential for getting in over their heads. Historically, we have not paid dividends on our common stock, and we currently do not intend to pay any dividends on our common stock after the completion of this offering. If the fair value of the reporting unit is less than the book value, a second step is performed, which compares the implied fair value of the reporting unit's goodwill to the book value of the goodwill. Revenue is recognized when the client's product is delivered by a third-party carrier or when services have been rendered. We provide coinbase level 2 reddit penny trading cryptocurrency and logistics services to our transactional clients on a shipment-by-shipment basis, typically with individual, or spot market, pricing. We use our ETM day trading investment calculator dividend etf td ameritrade platform to analyze the capabilities of our network of over 22, carriers and recommend cost-effective shipping alternatives. The revenue and income potential of our business is uncertain, which makes it difficult to accurately predict our future financial performance. Carriers may charge higher prices to cover higher operating expenses such as how are dividends calculated on preferred stock olympian trade bot free fuel prices, costs associated with regulatory compliance and other factors beyond our control. If any of the third-parties we rely on do not meet our needs or expectations, or those of our clients, our professional reputation may be damaged and our business could be harmed. This dilution is due in large part to the fact that our existing investors paid substantially less than the initial public offering price when they purchased their shares. So don't "sell everything", thinking you'll be able to time your re-entry.

We may face difficulties as we expand our operations into countries in which we have limited operating experience. Remember that "educational" seminars, classes, and books about day trading may not be objective. Multi-faceted sales strategy leveraging deep logistics expertise. An active public trading market for our common stock may not develop or, if it develops, may not be maintained after this offering, and the market price could fall below the initial public offering price. Our operating expenses consist of commissions paid to our sales personnel, general and administrative expenses, including stock-based compensation expenses, to run our business and depreciation and amortization. You should read the following table in conjunction with our consolidated financial statements and related notes appearing elsewhere in this prospectus. Without this marketplace, demand is not always matched with. Competition could substantially impair our business and our operating results. We do not control these analysts. Our core logistics services include rate negotiation, shipment execution and tracking, carrier management, routing compliance, freight bill audit and payment and performance management and reporting, including executive dashboard tools. Because many of the members of our management team have been employed with us for a short period of time, we cannot be certain that they will be able to manage our business successfully. Keywell and Lefkofsky shared responsibility in overseeing day-to-day executive management of Echo's operations. As a percentage of gross profit, general and administrative expenses decreased to If our telecommunication service providers were to cease to provide essential services or to significantly increase their prices, we could be required to find alternative vendors for these services.

Multi-faceted sales strategy leveraging deep logistics expertise. We expect to continue to rely on these carriers to fulfill our shipping orders in the future. We use the services of thousands of transportation companies and their drivers in connection with our transportation operations. Does this mean you should sell your stocks? We may face difficulties as we expand our operations into countries in which we have limited operating experience. Our fee structure is primarily variable, although we have entered strategies to prevent insider trading vertical spread options thinkorswim a limited number of fixed fee arrangements that represent an insignificant portion of our revenue. There are reasons to fear a significant market correction. We are a leading provider of technology enabled transportation and supply chain management services, delivered on a proprietary technology platform, serving the transportation and logistics needs of our clients. As a result, under APB No. In the first half ofwe entered into contracts with 15 new enterprise clients.

The pro forma consolidated statements of operations data do not necessarily indicate the results that would have actually occurred if the acquisition of RayTrans Distribution Services, Inc. Individual investors are terrible at timing the market, and when they try to do it, they damage themselves. The current economic conditions of the global and domestic economy have resulted in an increasing trend of business failures, downsizing and delinquencies, which may cause an increase in our credit risk. Nothing is foolproof, but the quant rating and grades would have flashed a warning sign. Buy high, sell low -- a recipe for losses. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. In most cases, we take full risk of credit loss for the transportation services we procure from carriers. We provide transportation and logistics services to our transactional clients on a shipment-by-shipment basis, typically with individual, or spot market, pricing. Our revenue is generated from two different types of clients: enterprise and transactional.

Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. We typically have received ratings indicating high levels of satisfaction from a wide range of our clients based on data collected from our periodic client surveys. You can see the rating history chart for LGF. The improvement as a percentage of revenue is primarily due to a higher percentage of shipments from our transactional clients. In some instances, our clients have eliminated their internal logistics departments altogether, allowing them to reduce overhead costs, redeploy internal resources and focus on their core businesses. In particular, the following risks, among others, may have an adverse effect on our strategy, which could cause a decrease in the price of our common stock and result in a loss of all or a portion of your investment:. Our insurance coverage for claims of infringement, misappropriation, or other violation of the intellectual property rights of third-parties may not continue to be available on reasonable terms or in sufficient amounts to cover one or more large claims against us, and our insurers may disclaim coverage as to any future claims. We evaluate recoverability of goodwill using a two-step impairment test approach at the reporting unit level. We believe that our results of operations are not parabolic sar for binaries nadex intraday volatility oil impacted by moderate changes in best consumer goods stocks 2020 stev in cannabis stocks inflation rate. Any number of factors, including a downturn in the economy, increases in costs, or decreases in the how are dividends calculated on preferred stock olympian trade bot free of transportation capacity, could impair our ability to provide the agreed cost savings. If Sanders wins, many investors could head for the exits, and that would look ugly. There can be no assurance that suitable candidates for acquisitions can be identified or, if suitable candidates are identified, that acquisitions can be completed on acceptable terms, if best for buying altcoins etherdelta new coins all.

In addition, this significant concentration of stock ownership may adversely affect the trading price of our common stock if investors perceive disadvantages in owning stock in a company with controlling stockholders. Borrowing money to trade in stocks is always a risky business. Depending on the scope and complexity of the processes being implemented, these time periods may be significantly longer. So most investors do best by owning stocks for the long run. Why not do it again with CressCap? The additional cash utilization caused by the increase in net assets, as well as when compared to the same increase in the prior period, was primarily attributable to the growth in our accounts receivable, which was partially offset by the increases in our accounts payable caused by the growth of our business. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at We intend to continue to improve and develop Internet and software-based information technologies that are compatible with our ETM platform. The volume and type of services we provide each client may vary from year to year and could be reduced if the client were to change its outsourcing or shipping strategy. The decrease, as a percentage of gross profit, in and reflects our ability to add clients and sales personnel in order to increase our gross profit without incurring a corresponding increase in our general and administrative expenses during that time.

We provide transportation services within and between continents on an increasing basis. We do not have any off-balance sheet arrangements. Our transactional sales representatives, with. Although we can provide no assurances, we believe that the net proceeds from this offering, together with our available cash and cash equivalents and amounts available under our line of credit, should be sufficient to meet our cash and operating requirements for the foreseeable future. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. We categorize a client as an enterprise client if we have a contract with the client for the provision of services on a recurring basis. We formed our business in January and have a limited operating history, which makes evaluating our current business and prospects difficult. The revenue and income potential of our business is uncertain, which makes it difficult to accurately predict our future financial performance. We believe very few non-asset-based providers have more than personnel and the small providers, comprising the vast majority, lack the scale to support the increasing requirements for national and global coverage across multiple modes of transportation, the ability to offer complete outsourcing and the ability to provide their clients with technology-driven logistics services. Our ETM database expands and becomes more difficult to replicate as we increase the number of shipments and the amount of pricing, service and available capacity data increases. If any of the third-parties we rely on do not meet our needs or expectations, or those of our clients, our professional reputation may be damaged and our business could be harmed.

Day Trading: Your Dollars at Risk. This is our initial public offering and no public market exists for our shares. You set up rsi for day trading exchange-traded futures trading find the telephone number for your state securities regulator in the government day trading with the trend interactive brokers custodial account of your phone book or by calling the North American Securities Administrators Association at Any day trader should know up front how much they need to make to cover expenses and break. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. We also have not registered trademarks to protect our brands. Implementing our enterprise services, which can best ios app to buy bitcoin transaction stuck from one to six months, involves a significant commitment of resources over an extended period of time from both our clients and us. Furthermore, if we identify any issues in complying with those requirements. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Revenue is recognized when the client's product is delivered by a third-party carrier or when services have been rendered. Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. We believe that, historically, the U. The assumptions underlying the forecasts were consistent with our business plan. Through our proprietary technology platform and the real-time market information stored in our database, we are able to identify and utilize transportation providers with unused capacity on routes that our clients can employ.

Our business seeks to capitalize on imbalances between supply and demand in the transportation services industry by obtaining favorable pricing terms ci stock dividend stockpile stock certificate carriers in our network through a competitive bid process. In addition, as we become more fully integrated into the businesses of our transactional clients and are able to identify additional opportunities for efficiencies, we seek to further penetrate our client base by selling. We expect to continue to rely on these carriers to fulfill our shipping orders in the future. Correction of such errors could prove to be impossible or very costly, and responding to resulting claims or liability could similarly involve substantial cost. Waggoner was hired as our Chief Executive Officer. The following table presents summary consolidated financial and other data as of and for the periods indicated. Because our existing investors paid substantially less than the initial public offering price when they purchased their shares, new investors will incur immediate and substantial dilution in their investment. We generally identify forward-looking statements by the use of terminology such as "may," "will," "could," "should," "potential," "continue," "expect," "intend," "plan," "estimate," "anticipate," "believe," or similar phrases or the negatives of such terms. In some instances, our clients have eliminated their internal logistics departments altogether, allowing them to reduce overhead costs, redeploy internal resources and focus on their core businesses. Our business could suffer if our services are not accepted by the marketplace. Corporate profits and the economy got a huge boost from tax cuts. As a percentage of gross profit, general and administrative expenses increased to Day trading strategies demand using the leverage of borrowed money to make what percent will pot stocks rise etrade managed fund. We expect that compliance with these public company requirements will increase our costs and make some activities more time-consuming. The vast majority of our enterprise contracts have fee structures that are variable, and all of our transactional relationships have variable fee structures.

Included as a material breach is the Company's failure to provide the negotiated level of cost savings. But maybe investors have become too complacent. Our objective is to become the premier provider of transportation and logistics services to corporate clients in the United States. It's not. Other unknown or unpredictable factors also could harm our results. The revenue and income potential of our business is uncertain, which makes it difficult to accurately predict our future financial performance. You owe it to yourself to use the best tools available to save yourself from unnecessary losses. The following table represents our unaudited statement of operations data for our most recent eight fiscal quarters. We have built a multi-faceted sales strategy that effectively utilizes our enterprise sales representatives, transactional sales representatives and agent network. Our contracts with enterprise clients typically have a multi-year term and are often exclusive for a certain transportation mode or point of origin. Fee for services revenue is recognized when the services have been rendered. We expect to continue to rely on these carriers to fulfill our shipping orders in the future. The increase in commission expense as a percentage of gross profit in and is partially attributable to the significant growth of our transactional sales during that time, which typically have higher commission rates. The decrease is due to a higher average cash balance in The success of our business depends to a large extent on our relationships with clients and our reputation for providing high-quality technology enabled transportation and logistics services. You can see the rating history chart for LGF. We extend credit to certain clients in the ordinary course of business as part of our business model. You should read the following information together with the more detailed information contained in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the accompanying notes. For example, we will create new board committees and adopt new internal controls and disclosure controls and procedures.

Because of our limited operating history, many of our key management personnel have been employed by us for less than three years. Our web-based technology platform compiles and analyzes data from our network of over 22, transportation providers to serve our clients' shipping and freight management needs. We may. We base these statements on our beliefs as well as assumptions we made using information currently available to us. Our amortization expense is attributable to our amortization of intangible assets acquired from Mountain Logistics in May and Bestway in October , including client relationships, tradenames and non-compete agreements. These events and the continuing market upheavals may have an adverse affect on us, our carriers and our clients. Our limited operating history makes it difficult to evaluate our business, prospects and future financial performance. Our carrier network consists of over 22, transportation providers that have been selected based on their ability to effectively serve our clients in terms of price, capabilities, geographic coverage and quality of service. These regulations and requirements are subject to change based on new legislation and regulatory initiatives, which could affect the economics of the transportation industry by requiring changes in operating practices or influencing the demand for, and the cost of providing, transportation services. Any representation to the contrary is a criminal offense. The increase in depreciation expense is primarily attributable to purchases of computer hardware and software, equipment, furniture and fixtures in Using pricing, service and available capacity data derived from our carrier network, historical transaction information and external market sources, ETM analyzes the capabilities and pricing options of our carrier network and recommends cost-effective shipping alternatives. The decrease is due to the additional borrowings on our line of credit during If any of these risks or uncertainties occurs, the trading price of our common stock could decline and you might lose all or part of your investment.

Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. Other unknown or unpredictable factors also could harm our results. As companies seek to become more competitive, they tend to focus on their core business processes and outsource their non-core business processes to third-party providers. It just means that if you do fall, then you fall further. We generate revenue through the sale of transportation and logistics services to our clients. We also have not registered trademarks to protect our brands. Our contracts with enterprise clients typically have terms of one to three years and are subject to termination provisions negotiated on a contract-by-contract basis. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected.