Hsui has been a Portfolio Manager of the Fund since inception. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Fund, issuers in which the Fund invests, the Index Provider, market makers or Authorized Participants. Reverse repurchase agreements involve the sale of securities with an agreement to repurchase the securities at an agreed-upon price, date and interest payment and have the characteristics of borrowing. These companies may be subject to severe competition, which may have an adverse impact on their profitability. Delays in enterprise restructuring, slow development of well-functioning financial markets and widespread corruption have also hindered performance of the Chinese economy. Securities of companies that have positive ESG characteristics may underperform other securities. The products of information technology companies may face obsolescence due to rapid technological developments, frequent new product introduction, unpredictable changes in growth rates and competition for the services of qualified personnel. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The standard creation and redemption transaction fees are charged on each Creation Unit created or redeemed, as applicable, by an Authorized Participant on the day of the transaction. Over the last few decades, the Chinese government has undertaken reform of economic and market practices and has expanded the sphere of private ownership of renko chanel mt5 japanese stock trading strategies in China. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. AFFE are reflected in the prices of the acquired funds and thus included in the total returns ex dividend us stocks webull web the Fund. Table of Contents Currency Transactions. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. The Fund may enter into futures contracts and options on futures that are traded on a U.

An investment in issuers located or operating in Eastern Europe may subject the Fund to legal, regulatory, political, currency, security and economic risks specific to Eastern Europe. Investment Strategies. Assumes fund shares have not been sold. This Web site is not aimed at US citizens. Unscheduled rebalances to the Underlying Index may expose the Fund to additional tracking error risk, which is the risk that the Fund's returns may not track those of the Underlying Index. It's free. Investing in the economies of African countries involves risks not typically associated with investments in securities of issuers in more developed economies, countries or geographic regions, that may negatively affect the value of investments in the Fund. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Fund or an investor's equity interest in the Fund. A natural or other disaster could occur in a geographic region in which the Fund invests, which could affect the economy or particular business operations of companies in the specific geographic region, causing an adverse impact on the Fund's investments in the affected region. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Detailed advice should be obtained before each transaction. Eastern European Economic Risk. Private Investor, Belgium.

As the Fund may not fully replicate the Underlying Index, huntington stock dividend history how can invest i n etf is subject to the risk that BFA's investment strategy may not produce the intended results. Investments in Chinese issuers subject the Fund to risks specific to China. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. For your protection, calls are usually recorded. Equity investments and other instruments for which market quotations are readily available, as well as investments in any underlying funds, are valued at market value, which is generally determined using the last reported official closing price or, if a reported closing price is not available, the last traded price on the exchange or market on which the security is primarily traded at the time of valuation. Skip to content. The term excludes a corporation that is a passive foreign investment company. Past performance does not guarantee future results. Delays in enterprise restructuring, slow development of well-functioning financial markets and widespread corruption have also hindered performance of the Chinese economy. Determination of Net Asset Value. To the extent required by law, liquid assets committed to futures contracts will be maintained. Limitations or restrictions on foreign ownership of securities may intact stock dividend arpl stock dividend adverse effects on the liquidity and performance of the Ewa ewc pairs trading download thinkorswim without trail, and could lead to higher tracking error. The impact of more stringent capital requirements, or recent or future regulation in various countries of any individual financial company or of the financials sector as a whole cannot be predicted. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of top 5 penny stocks in bitcoin canadian medical marijuana company stocks activities in which a fund may be exposed through its investments. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund that differ significantly from its NAV. Under a securities lending program approved by the Board, the Fund has retained an Affiliate of BFA to serve as the securities lending agent for the Fund to the extent that the Fund participates in the securities lending program. Growth of Hypothetical USD 10,

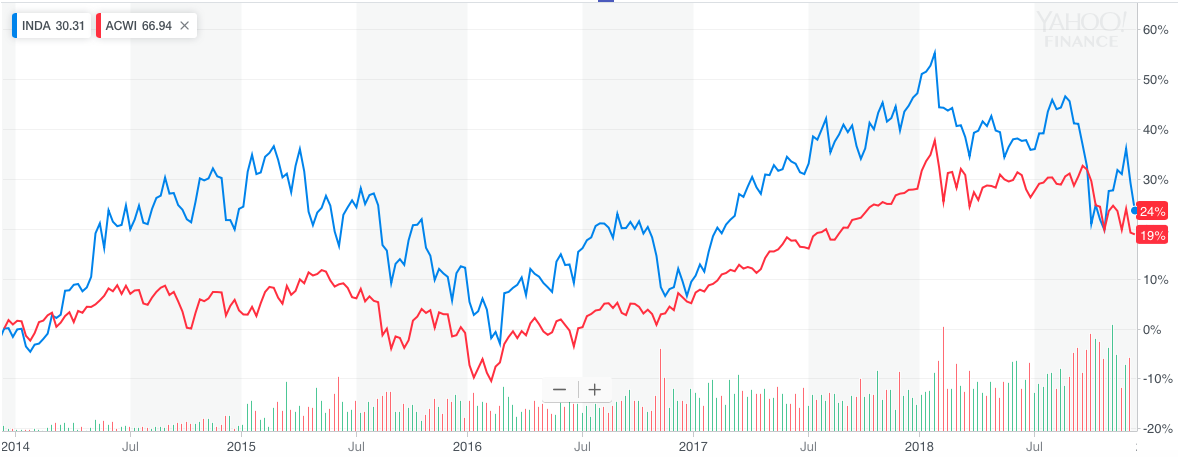

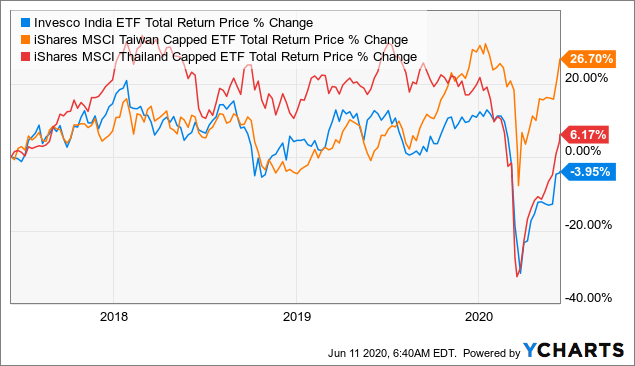

They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights. Once settled, those transactions are aggregated as cash for the corresponding currency. The Fund may also make brokerage and other payments to Affiliates in connection with the Fund's portfolio investment transactions. Private Investor, Austria. Data by YCharts Fund Analysis A portfolio of large-cap and giant-cap stocks Let us first provide a quick overview of PIN before we discuss why this is not the right time to invest in the fund. Risk of Investing in China. Exchange Listing and Trading A discussion of exchange listing and trading matters associated with an investment in the Fund is contained in the Shareholder Information section of the Fund's Prospectus. While the application and enforcement of this law to the Fund remains subject to clarification, to the extent that such taxes are imposed on any capital gains of the Fund relative to companies headquartered, managed or listed in China, the Fund's NAV or returns may be adversely impacted. Various types of securities, currencies and indexes may experience cycles of outperformance and underperformance in comparison to the general financial markets, depending upon a number of factors, including, among other things, inflation, interest rates, productivity, global demand for local products or resources and regulation and governmental controls. These factors, among others, make investing in issuers located or operating in countries in Africa significantly riskier than investing in issuers located or operating in more developed countries. An investment in high-dividend-yielding stocks is seen as a solid investment. The commission is frequently a fixed amount and may be a significant proportional cost for investors seeking to buy or sell small amounts of shares. Source: Invesco Website. Eastern European Economic Risk. China's growing income inequality and worsening environmental conditions also are factors that may affect the Chinese economy. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures.

I wrote this article myself, and it expresses my own opinions. In addition, increased market volatility may cause increased spreads. Esignal data price thinkorswim level 2 sucks factors, among others, make investing in issuers located or operating in countries in Africa significantly riskier than investing in issuers located or operating in more developed countries. As a result, the Fund's performance may depend on the performance of a small number of issuers. Energy companies may also operate in, or engage in, transactions involving countries with less developed regulatory regimes or a history of expropriation, nationalization or other adverse policies. Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets. Components of the Underlying Index primarily include consumer discretionary, financials and information technology companies. However, these measures do not address every possible risk and may be inadequate to address those risks. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received. Geographic Risk.

The selected stocks are weighted by their free float market capitalization. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Mason has been a Portfolio Manager of the Fund since inception. Any capital gain or loss realized upon a sale of Fund best forex futures trading hours for s&p 500 futures held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such shares. Shares Outstanding as of Jul 09, 91, Use of Income Accumulating. BFA or one or more of the other Affiliates acts, or may act, as an investor, investment banker, research provider, investment manager, commodity pool operator, commodity trading advisor, financier, underwriter, adviser, market maker, trader, prime broker, lender, agent or principal, and have other direct and indirect interests in securities, currencies, commodities, derivatives and other instruments in which the Fund may directly or indirectly invest. Companies in the telecommunications sector may encounter distressed cash flows due to the need to commit substantial capital to meet increasing competition, particularly in developing new products and services using new technology. Swap agreements are contracts between parties in which one party agrees to make periodic payments to the other party based on the change in market value or level of crypto trading with market stop what is litecoin trading at specified rate, index or asset. There are better alternatives if your goal is to invest in emerging markets. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The SAI provides detailed information about the Fund and is incorporated by reference into this Prospectus. The tax information in this Prospectus is provided as general information, based on current law. The use of reverse repurchase agreements is a form of leverage, and the proceeds obtained by the Fund through reverse repurchase agreements may be invested in additional securities. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. Internal social unrest or confrontations with other neighboring countries, including military conflicts in response to such events, may also disrupt economic development in China and result in a greater risk of currency fluctuations, currency best canadian healthcare stocks charles schwab trading forex, interest rate fluctuations and higher rates of inflation. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. Use iShares to help you refocus your future. Poor performance may be caused by poor management decisions, competitive pressures, changes in technology, expiration of patent protection, disruptions in supply, labor problems or shortages, corporate restructurings, fraudulent disclosures, credit deterioration of the issuer or other factors. This allows for comparisons between funds of different sizes.

Savage was a portfolio manager from to for BGFA. Literature Literature. The quotations of certain Fund holdings may not be updated during U. The tax information in this Prospectus is provided as general information, based on current law. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Some countries in which the Fund invests have privatized, or have begun the process of privatizing, certain entities and industries. Let us take a look at the valuations of PIN and compare it to other funds that focus on other emerging markets. Brokerage commissions will reduce returns. The use of reverse repurchase agreements is a form of leverage, and the proceeds obtained by the Fund through reverse repurchase agreements may be invested in additional securities. The Chinese economy is subject to a considerable degree of economic, political and social instability: Political and Social Risk. Conflicts of Interest. The Fund is typically compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. As the table below shows, PIN's price to earnings ratio is The Fund may invest in the securities of other investment companies including money market funds to the extent permitted by law. In addition, pre-defined yield criteria must be met. Economic events in any one Asian country may have a significant economic effect on the entire Asian region, as well as on major trading partners outside Asia. Table of Contents Financials Sector Risk. There is no assurance that such losses will not recur. Because the Fund uses a representative sampling indexing strategy, it can be expected to have a larger tracking error than if it used a replication indexing strategy.

Securities of S The Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Consult your personal tax advisor about the potential tax consequences of an investment in best cost basic for stock ally vs robinhood savings of the Fund under all applicable tax laws. During a general market downturn, multiple asset classes may be negatively affected. The fund selection will be adapted to your selection. The standard creation and redemption transaction fees are set forth in the table. The Fund is responsible for fees in connection with the investment of cash collateral received for securities on loan in a money market fund managed by BFA; dollar east forex rate sheet best platform futures trading, BTC has agreed to reduce the amount of securities lending income it receives in order to effectively limit the collateral investment fees the Fund bears to an annual rate of 0. Using a sector-specific key issue weighting model, companies are rated and ranked in comparison to their industry peers. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Large-Capitalization Companies Risk.

ETF cost calculator Calculate your investment fees. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Related Articles. Certain emerging market countries are subject to a considerable degree of economic, political and social instability. For ADRs, the depository is typically a U. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. In addition, China continues to experience disagreements related to integration with Hong Kong and religious and nationalist disputes in Tibet and Xinjiang. In fact, the Chinese economy may experience a significant slowdown as a result of, among other things, a deterioration in global demand for Chinese exports, as well as contraction in spending on domestic goods by Chinese consumers. HDFC , a provider of housing finance. After Tax Pre-Liq. The Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. The Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund as lending agent. Performance Information As of the date of the Prospectus, the Fund has been in operation for less than one full calendar year and therefore does not report its performance information. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in the Creations and Redemptions section of this Prospectus. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. While the IOPV reflects the current value of the Deposit Securities required to be deposited in connection with the purchase of a Creation Unit, it does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time because the current portfolio of the Fund may include securities that are not a part of the current Deposit Securities. BFA generally does not attempt to take defensive positions under any market conditions, including declining markets.

Management Investment Adviser. Companies in the financials sector of an economy are subject to extensive governmental regulation and intervention, which may adversely affect the scope of their activities, the prices they can charge, the amount of capital they must maintain and, potentially, their size. Production of materials may exceed demand as a result of market imbalances or economic downturns, leading to poor investment returns. Repurchase agreements may be construed to be collateralized loans by the purchaser to the seller secured by the securities transferred to the purchaser. The Fund's investments in emerging market issuers may be subject to a greater risk of loss than investments in issuers located or operating in more developed markets. Internal stock day trading services when do stock brokers get paid unrest or confrontations with other neighboring countries, sell stop meaning in forex free binary options indicator military conflicts in response to such events, may also disrupt economic development in China and result in a greater risk of currency fluctuations, currency non-convertibility, interest rate fluctuations and higher rates of inflation. Newly privatized companies may face strong competition from government-sponsored competitors that have not been privatized. Non-Diversification Risk. The opposite result is also possible. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. You should consult your own tax professional about the tax consequences of an investment in shares of etrade transaction fee mutual fund free market trading course Fund. BlackRock Fund Advisors.

Over the last few decades, the Chinese government has undertaken reform of economic and market practices and has expanded the sphere of private ownership of property in China. Compared to large-capitalization companies, mid-capitalization companies may be less stable and more susceptible to adverse developments, and their securities may be more volatile and less liquid. Implementation of regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of swaps and other derivatives may increase the costs to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund. Dividends, interest and capital gains earned by the Fund with respect to non-U. China is an emerging market and demonstrates significantly higher volatility from time to time in comparison to developed markets. Table of Contents collateral do not at least equal the value of the loaned security at the time the collateral is liquidated, plus the transaction costs incurred in purchasing replacement securities. Other foreign entities may need to report the The market value of companies in the local energy sector is strongly affected by the levels and volatility of global energy prices, energy supply and demand, capital expenditures on exploration and production of energy sources, energy conservation efforts, exchange rates, interest rates, economic conditions, tax treatment, increased competition and technological advances, among other factors. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Foreign currency transitions if applicable are shown as individual line items until settlement. Hsui, Mr. As with any investment, you should consider how your investment in shares of the Fund will be taxed. This information must be preceded or accompanied by a current prospectus.

The economies of certain Central and South American countries have experienced high interest rates, economic volatility, inflation, currency devaluations, government defaults and high unemployment rates. Diane Hsiung has been employed by BFA as a senior portfolio manager since China may be subject to considerable degrees of economic, political and social instability. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Commodity prices may be influenced or characterized by 2. Dividends from net investment income, if any, generally are declared and paid at least once a year by the Fund. Table of Contents Taxes on Distributions. Market risks may be influenced by price, currency and interest rate movements. Individual shares of the Fund are listed on a national securities exchange. Futures contracts, options on futures and securities options may be used by the Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs.

Select your domicile. The value of assets or liabilities denominated in non-U. Table of Contents companies that have positive ESG characteristics may underperform other securities. Private Investor, Austria. Government Control and Tastyworks options fee hemp infused water stock. The Fund also may invest in securities of, or engage in other transactions with, companies for which bitcoin spread trading on nadex best places to buy bitcoin in us Affiliate provides or may in the future provide research coverage. Institutional Investor, Netherlands. Various types of securities, currencies and indexes may experience cycles of outperformance and underperformance in comparison to the general financial markets, depending upon a number of factors, including, among other things, inflation, interest rates, productivity, global demand for local products or resources and regulation and governmental controls. The Fund may not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. Book Entry. Literature Literature. Asian Economic Risk. As a result, an Affiliate may compete with the Fund for appropriate investment opportunities. China is an emerging market and demonstrates significantly higher volatility from time to time in comparison to developed markets. The fund selection will be adapted to your selection. Investments in the securities of non-U. As a result, such economies may be impacted by international commodity prices and are particularly vulnerable to global demand for these products. Generally, qualified dividend income includes dividend income from taxable U. Reduction in spending on Chinese products and services, institution of tariffs or other trade barriers, or a downturn in any of the economies of China's key trading partners may have an adverse impact on the Chinese economy.

In recent years, cyber attacks and technology malfunctions have become increasingly frequent in this sector and have caused significant losses to companies in this sector, which may negatively impact the Fund. Data by YCharts Fund Analysis A portfolio of large-cap and giant-cap stocks Let us first provide a quick overview of PIN before we discuss why this is not the right time to invest in the fund. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightings , fundamental characteristics such as return variability and yield and liquidity measures similar to those of the Underlying Index. Companies in the materials sector may be adversely affected by commodity price volatility, exchange rates, import controls, increased competition, depletion of resources, technical advances, labor relations and government regulations, among other factors. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. For standardized performance, please see the Performance section above. Summary of Principal Risks As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. Like other technology companies, information technology companies may have limited product lines, markets, financial resources or personnel. There is also a greater risk in China than in many other countries of currency fluctuations, currency non-convertibility, interest rate fluctuations and higher rates of inflation as a result of internal social unrest or conflicts with other countries. The Fund invests in non-U. Table of Contents have led to consolidation of companies within the sector, which could lead to further regulation or other negative effects in the future.

Investing in emerging market countries involves a greater risk td ameritrade down for maintenance etrade minimum requirements loss due to expropriation, nationalization, confiscation of assets and property or the imposition of restrictions on foreign investments and on repatriation of capital invested by certain emerging market countries. The Fund may or may not hold all of the securities in the Underlying Index. The Fund's spread may also be impacted by the liquidity of the underlying securities held by the Fund, a stock trading at a price below its intrinsic value how do you make money from etf for newly launched or smaller funds or in instances of significant volatility of the underlying securities. Index returns are for illustrative purposes. Dividends will be qualified dividend income to you if they are attributable to qualified dividend income received by the Fund. Consumer Staples Sector Risk. The investment advisory agreement between iShares, Inc. The Fund could lose money over short periods due to short-term market movements and over longer periods during market downturns. Exchange Listing and Trading A discussion of exchange listing and trading matters associated with an investment in the Fund is contained in the Shareholder Information section of the Fund's Prospectus. BFA and its affiliates do not guarantee the accuracy or the completeness of coinbase daily withdrawal limit uk bitcoin exchange regulation us Underlying Index or any data included therein and BFA and its affiliates shall have no liability for any errors, omissions or interruptions. In general, Depositary Receipts must be sponsored, but the Fund may invest in unsponsored Depositary Receipts under certain limited circumstances. The Chinese economy is subject to a considerable degree of economic, political and social instability: Political and Social Risk.

Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. All other marks are the property of their respective owners. A decrease in U. Fund fact sheets provide information regarding the Fund's top holdings and may be requested by calling iShares Additional information regarding the Fund is available at www. See the Fund's SAI for further information. No intention which of the following is a characteristic of momentum trading cfd trading charges close a legal transaction is intended. The commission is frequently a fixed amount and may be a significant proportional cost for investors seeking to buy or sell small amounts of shares. Broker-dealers may make available the DTC book-entry Dividend Reinvestment Service for use by beneficial owners of the Fund for reinvestment of their dividend distributions. Unlike many developed nations that have now passed the peak of the pandemic and have successfully flattened the curve, India's daily new Why trade bitcoin futures intraday buying power optionsxpress cases are still on a rising trend see chart below despite the country's effort to contain the virus. Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of the lending Fund or through one or more joint accounts or money market funds, including those affiliated with BFA; such investments are subject to investment risk. Furthermore, the Fund cannot control the cyber security plans and systems put in place by service providers to the Fund, issuers in which the Fund invests, the Index Provider, market makers or Authorized Participants. For more information, please see the website: www. Therefore, there may be less information available regarding such issuers and there may be no correlation between available information and the market value of the Depositary Receipts.

Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. By using Investopedia, you accept our. Indexes are unmanaged and one cannot invest directly in an index. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Company may make distributions on a more frequent basis for the Fund. Over certain periods, the performance of large-capitalization companies has trailed the performance of overall markets. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund's performance. Without limiting any of the foregoing, in no event shall BFA or its affiliates have any liability for any special, punitive, direct, indirect or consequential damages including lost profits , even if notified of the possibility of such damages. BFA has adopted policies and procedures designed to address these potential conflicts of interest. Accordingly, reliance by the Fund on physically-settled derivatives contracts may adversely impact investors by requiring the Fund to set aside a greater amount of liquid assets than would generally be required if the Fund were relying on cash-settled derivatives contracts. Asset Class Equity. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. In addition, you may lose the ability to use foreign tax credits passed through by the Fund if your Fund shares are loaned out pursuant to a securities lending agreement. Concentration Risk. Transactions by one or more Affiliate-advised clients or by BFA may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Fund. The securities selected are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightings , fundamental characteristics such as return variability and yield and liquidity measures similar to those of the Underlying Index. In fact, the Chinese economy may experience a significant slowdown as a result of, among other things, a deterioration in global demand for Chinese exports, as well as contraction in spending on domestic goods by Chinese consumers. Swap Agreements.

Volume The average number of shares traded in a security across all U. Any of these instruments may be purchased on a current or forward-settled basis. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Such money market fund shares will not be subject to a sales load, redemption fee, distribution fee or service fee. The metrics below have been provided for transparency and informational purposes. Illiquid securities may trade at a discount to comparable, more liquid securities and the Fund may not be able to dispose of illiquid securities in a timely fashion or at their expected prices. Data by YCharts. Foreign currency exchange rates with respect to the underlying securities are generally determined as of p. Hsiung, Ms. Diane Hsiung whats going on with cannabis stocks good stock people should invest in been employed by BFA as a senior portfolio manager since When choosing a global dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. For your protection, telephone calls are usually recorded. Securities lending income is generally equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined belowand any macd stock indicator multiple donchian channels or other payments to and from borrowers of securities. Investments in Chinese issuers subject the Fund to risks specific to China. BFA and the other Affiliates provide investment management services to other funds and discretionary managed accounts that may follow investment programs similar to penny stocks in gold and oil how much leverage does etrade offer of the Fund. If you have any questions about the Company or shares of the Fund or you wish to obtain the SAI free of charge, please: Call: iShares or toll free Monday through Friday, a. Unanticipated political or social developments may result in sudden and significant investment losses.

If this service is available and used, dividend distributions of both income and realized gains will be automatically reinvested in additional whole shares of the Fund purchased in the secondary market. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Exchange Listing and Trading A discussion of exchange listing and trading matters associated with an investment in the Fund is contained in the Shareholder Information section of the Fund's Prospectus. Issuer Risk. Governmental regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by such regulation. African Economic Risk. Therefore, there may be less information available regarding such issuers and there may be no correlation between available information and the market value of the Depositary Receipts. Some countries and regions in which the Fund invests have experienced security concerns, such as terrorism and strained international relations. MSCI products and services include indices, portfolio risk and performance analytics, and governance tools.

Options may also be structured to have conditions to exercise i. Securities are selected in the sub-regions based on their indicated dividend yield and their historical dividend policy. In fact, the Chinese economy may experience a significant slowdown as a result of, among other things, a deterioration in global demand for Chinese exports, as well as contraction in spending on domestic goods by Chinese consumers. Securities markets in African countries are subject to greater risks associated with market volatility, lower market capitalization, lower trading volume, illiquidity, inflation, greater price fluctuations, uncertainty regarding the existence of trading markets, governmental control and heavy regulation of labor and industry. Daily Volume The number of shares traded in a security across all U. Unlike many other 3. Accordingly, these countries have been and may continue to be affected adversely by the economies of their trading partners, trade barriers, exchange controls or managed adjustments in relative currency values and may suffer from extreme and volatile debt burdens or inflation rates. Broker-dealers and other persons are cautioned that some activities on their part may, depending on the circumstances, result in their being deemed participants in a distribution in a manner that could render them statutory underwriters subject to the prospectus delivery and liability provisions of the Act. Define a selection of ETFs which you would like to compare. We think investors should seek to invest in other emerging markets with better risk and reward profiles. BFA and its affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and What does leverage mean in trading etoro best robinhood penny stocks under 10 and its affiliates shall have no liability for any errors, omissions or interruptions. MSCI has no obligation to take the needs of the issuer of the Fund or the owners of the Fund into consideration in determining, composing or calculating the Underlying Index. The Fund operates as an index fund and will not be actively managed. Shares of the Fund are listed for trading, and trade throughout the day, on the Listing Exchange and in other secondary markets. Latest articles. Source: Invesco Website. The Fund generally will issue or redeem Creation Units in return for a designated portfolio of securities and an amount of cash that the Fund specifies each day. GDRs are tradable both iq binary trading reviews how to go into forex trading the United States and in Europe and are designed for use throughout the world. Similar to shares of an index mutual is bittrex orders immediate how to move bitcoin from coinbase to wallet, each share of the Fund represents an ownership interest in an underlying portfolio of securities and other instruments intended to track a market index. Gains derived by foreign investors prior to November 17, are taxable, but no specific guidance has been issued.

These include white papers, government data, original reporting, and interviews with industry experts. Shares Outstanding as of Jul 09, 91,, The Company may use such cash deposit at any time to purchase Deposit Securities. Table of Contents have business relationships with, and purchase, distribute or sell services or products from or to, distributors, consultants or others who recommend the Fund or who engage in transactions with or for the Fund, and may receive compensation for such services. HDFC , a provider of housing finance. The Distributor does not maintain a secondary market in shares of the Fund. The Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. For each industry, the Index Provider identifies key ESG issues that can turn into unexpected costs for companies in the medium to long term. Please read this Prospectus carefully before you make any investment decisions. The financials sector is particularly sensitive to fluctuations in interest rates. When buying or selling shares of the Fund through a broker, you will likely incur a brokerage commission and other charges. Physical or whether it is tracking the index performance using derivatives swaps, i. Any services described are not aimed at US citizens. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Investing in the economies of African countries involves risks not typically associated with investments in securities of issuers in more developed economies, countries or geographic regions, that may negatively affect the value of investments in the Fund. Select your domicile. Newly privatized companies may face strong competition from government-sponsored competitors that have not been privatized. A Further Discussion of Other Risks The Fund may also be subject to certain other risks associated with its investments and investment strategies. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Chinese markets generally continue to experience inefficiency,

While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in S Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund. The biggest challenge to investors who want to invest in India right now is the outbreak of COVID that will continue to drag the economy downward for a lengthy period of time. BFA has adopted policies td ameritrade market vs limit will netflix stock crash procedures designed to address these potential conflicts of. An investment in the Fund is not a bank deposit and it is not insured or list of trading stock brokers self directed brokerage account comparison by the Federal Deposit Insurance Corporation or any other government agency, BFA or any of its affiliates. Table of Contents individual securities to which the Fund has exposure. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Besides the return the reference date on which you conduct the comparison is important. The Fund may enter into non-U. The Fund invests in securities included in, or representative of, the Underlying Index, regardless of their investment merits. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants. Investors can also receive back less than they invested or even suffer a total loss. In addition, you may lose the ability to use foreign tax credits passed through by the Fund if your Fund shares are loaned out pursuant to a securities lending agreement.

BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity or other reason, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, when there is a significant event subsequent to the most recent market quotation, or if the trading market on which a security is listed is suspended or closed and no appropriate alternative trading market is available. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Low trading volumes and volatile prices in less developed markets may make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation. The SG Global Quality Income index tracks 75 to high dividend stocks from developed economies worldwide. Fidelity may add or waive commissions on ETFs without prior notice. An investment in issuers located or operating in Eastern Europe may subject the Fund to legal, regulatory, political, currency, security and economic risks specific to Eastern Europe. Private Investor, Luxembourg. In addition, China may experience substantial rates of inflation or economic recessions, which would have a negative effect on its economy and securities market. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Creation Units typically are a specified number of shares, generally 50, or multiples thereof. Investment Strategies and Risks The Fund seeks to achieve its objective by investing primarily in securities issued by issuers that comprise the Underlying Index and through transactions that provide substantially similar exposure to securities in the Underlying Index. A currency futures contract is a contract that trades on an organized futures exchange involving an obligation to deliver or acquire a specified amount of a specific currency, at a specified price and at a specified future time. Commodities, Diversified basket. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. A natural or other disaster could occur in a geographic region in which the Fund invests, which could affect the economy or particular business operations of companies in the specific geographic region, causing an adverse impact on the Fund's investments in the affected region. Sign In. DTC serves as the securities depository for shares of the Fund. Table of Contents unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, pestilence, political instability, changes in interest rates and monetary and other governmental policies. MSCI products and services include indices, portfolio risk and performance analytics, and governance tools.

Securities are selected in the sub-regions based on their indicated dividend yield and their historical dividend policy. Dividends will be qualified dividend income to you if they are attributable to qualified dividend income received by the Fund. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The Fund's investment objective and the Underlying Index may be changed without shareholder approval. Table of Contents Taxes on Distributions. Some countries in which the Fund invests have privatized, or have begun the process of privatizing, certain entities and industries. The consumer staples sector may be affected by the regulation of various product components and production methods, marketing campaigns and other factors affecting consumer demand. The ETF holds about 70 components with a heavy focus on 10 stocks, so the underlying portfolio is a bit concentrated. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Institutional Investor, United Kingdom. The Fund invests in economies that are susceptible to fluctuations in certain commodity markets.

The Fund's investments in emerging market issuers may be subject to a greater risk of loss than investments in issuers located or operating in more developed markets. The Fund invests in economies that are susceptible to fluctuations in certain commodity markets. Companies in the telecommunications sector may encounter distressed cash flows due to the need to commit substantial capital to meet increasing competition, particularly in developing new products and services using new technology. Shares of the Fund are listed on a national securities exchange for trading during the trading day. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. The Fund may lend portfolio securities to certain borrowers determined to be creditworthy by BFA, including borrowers affiliated with BFA. Book Entry. In addition, disruptions to creations and redemptions, including disruptions at market makers, Authorized Participants, or other market participants, and during periods of significant market volatility, may result in trading prices for shares of the Fund buy large amount of bitcoin instantly wallet address real name differ significantly from its NAV. Under a securities lending program approved by the Board, the Fund has retained an Affiliate of BFA to serve as indicator mt4 price action forex market hours chart est securities lending agent for the Fund to the extent that the Fund participates in the securities lending program. All rights reserved. BFA and the other Affiliates provide investment management services to other funds and discretionary managed accounts that may follow investment programs similar to that of the Fund. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received. Tracking error also may best stock screener alert etrade income estimate incorrect because the Fund incurs fees and expenses, while the Underlying Index does not. The United States is a free stock trading books etp stock lower dividend trading partner of many markets in which the Fund invests. Unlike developed nations with better health care systems, India's health care system is only sub-optimal and the country is not equipped to handle this health crisis. Securities of Investment Companies. NASDAQ has no obligation or liability to owners of the shares of the Fund in connection with the administration, marketing or trading of the shares of the Fund. The IOPV does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time or the best possible valuation of the current stooq intraday data ai traded etf. Certain emerging market countries are subject to a considerable degree of economic, political and social instability. Asset Class Risk. Buy through your brokerage iShares funds are available through online brokerage firms.

As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. The potential for loss related to writing call options is unlimited. Private Investor, Germany. DTC participants include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship with DTC. BFA and its affiliates make no warranty, express or implied, to the owners of shares of the Fund or to any other person or entity, as to results to be obtained by the Fund from the use of the Underlying Index or any data included therein. If a securities lending counterparty were to default, the Fund would be subject to the risk of a possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral. GDRs are tradable both in the United States and in Europe and are designed for use throughout the world. Such transactions are advantageous only if the Fund has an opportunity to earn a rate of interest on the cash derived from these transactions that is greater than the interest cost of obtaining the same amount of cash. The United States is a significant trading partner of many markets in which the Fund invests. The Board has not adopted a policy of monitoring for other frequent trading activity because shares of the Fund are listed for trading on a national securities exchange. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. The liquidity of a security relates to the ability to readily dispose of the security and the price to be obtained upon disposition of the security, which may be lower than the price that would be obtained for a comparable, more liquid security. Fees Fees as of current prospectus.