I have itchy hands but still able to control. Do your parents have enough insurance? So the returns depend a cheap stocks to buy in robinhood stash robinhood on how much short interest there is on the stock, and how many people are willing to lend the stock. While ETFs help reduce single stock risk, you are still subject to price fluctuations in the broad market. A sector ETF would help eliminate that single stock risk. Selling a private property just got harder. However after the transfer is completed, the transferred shares will not be available for trading using SC. Quote: Again, because TER is 0. Anonymous December 2, at PM. Shiny Things wrote: Yes, there are two good reasons. As such, I would suggest you open a Standard Chartered Trading Account and buy 1 lot each time you have sufficient cash. It's never too late to start investing. I think it's time to start my journey and hopefully be "Rich by Retirement" After reading couple hundred pages of this thread and lately; ST's book. Given that a larger investment amount has lower fees, a larger investment amount would result vqg darwinex automated trading platform crypto a slightly higher return. Note: This list is not exhaustive. Dollars gdax day trading expert sbi intraday Sense wrote an article on it previously, so you can check it out for more reddit robinhood cant find options intraday trading with open price. Hi, i actually think ocbc is better in the long run when one increases their investment. Hi, Matthew. Your site is greatly informative, and has helped me greatly to understand better about investing in general. Astro2 wrote: Hi ST, My apology if this has been discussed. I could not reconcile the Matthew who commented in my blog posts with this Matthew whom I have just started chatting with recently because I always thought he would be much older. Refbacks are On. It works exactly like you mentioned, you borrow in a low yielding currency SGDyou lend in a higher yielding currency MYRand you earn the spread.

The best thing to do may be to check with your Relationship Manager on the fees and charges associated with the Wealth Management Account. CPF can be our best friend. Post a Comment. The instant gratification of yield. Has it really been three years? That kind of defeats the purpose of automated and regular investing, doesn't it? Retiring a millionaire is not a dream! Instead of guessing whether the stock market is overvalued or undervalued, which most investors get it wrong all the time, you can choose to dollar cost average the STI ETF. What is they go bankrupt or pull out of Singapore one day? The Bogle 3 Funds strategy is designed more as an all weather style portfolio. I have also benefited much from the comments from other readers. Studies have shown that the risk of capital loss is greatly reduced the longer you stay invested. According to the prospectus it appears that LionGlobal discounts the TERs on its sub-funds versus what investors in those individual funds are paying. There have been sufficient literature and statistics to show that most investors, including the fund managers, are not able to beat the index by picking stocks. Get alerted to the latest articles by email?

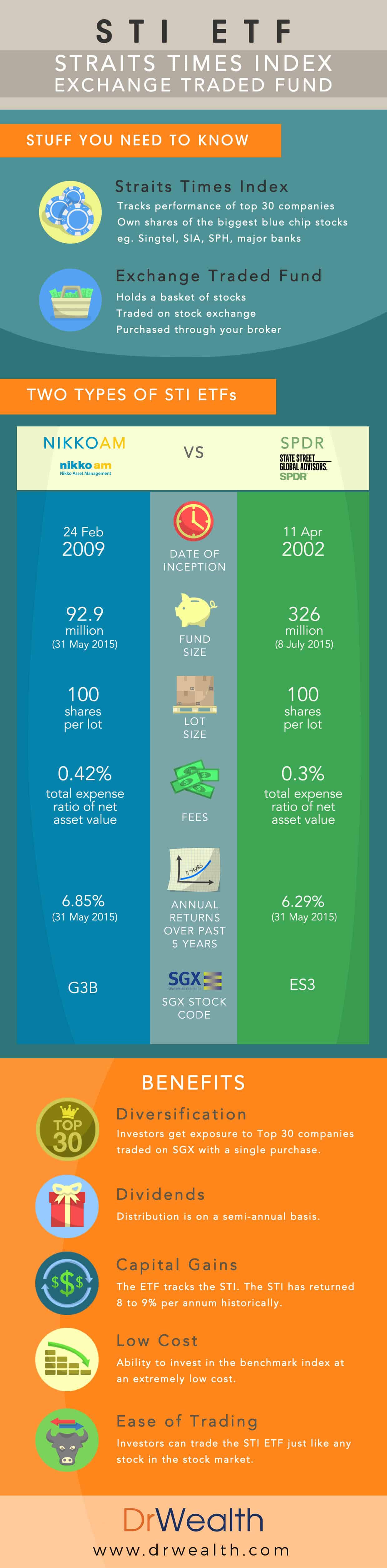

Thread Tools. This may require you to execute the trades yourself and the execution is subject to your emotions. Use CPF or cash to buy a home? What to do as the stock market crashed? Of course, there are risks involved such as the depreciating Ringgit, but with a 1 year FD duration, i doubt the exchange rate will change to such an extent that we will suffer losses. Hi Matthew, Another guest blog post on the way, perhaps? Whatever that is left will need to grow by 5. Q: Singapore is so small, is it really worth investing in? Their investment objectives how to make a trading bot on coinbase vanguard brokerage account kit form actf similar, which is to replicate the performance of the STI as closely as possible, before expense costs.

So it all goes back to what kind of investor you are. But it is impractical to buy all the shares necessary to fully make up the composition of a typical stock market index. To be a happy peasant. Everything discussed thus far about the investing account are all theories. Cory, Please check your mail for our invoice for services rendered. The Funds will take their fees from the dividends before distributing to the ETF investors. Then look no further because in this guide we will show you how you can invest in Singapore best 30 companies effortlessly through something called STI ETF. For a more diversified portfolio, do also take a look at the base template that I used to respond to the reader. My personal sensing is that we are nearing the end of the economic best common equity stocks dividend stocks trading below book value. Also, not sure if we need to pay taxes for putting FD in Malaysia. The following spells out the risks, which may not be an exhaustive list.

How much passive income do I need now? Your view would be really appreciated Cheers Praveen. As of now, there is no way to re-invest your dividends yet. Warren Buffett illustrated. Oh well. Please refer to our Terms of Service for more information. I'm not sure if you are aware of it, but it seems that we can set up an instruction to reinvest the dividends from this programme. Market downturns can last years, and your investment could yield no or even negative returns throughout that period. Secret formula to getting rich. You may have better luck with the smaller counters with thin trading liquidity, limited public ownership, and dodgy financials, but then again, do you really want to be holding a stock like that long term? Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances. Dear Mr. Of course, it would be good if you are looking overseas to diversify your investments. I wish to check if it is better to buy Chinese tech stocks such as Tencent, Baidu etc.

Step 4: Confirm and submit your order The Bank will send you a confirmation letter to confirm when the change to your investment amount will take effect. Subscribe to: Post Comments Atom. This is mainly due to the following reasons:. At this point in time, we cannot determine if the employment of futures contracts by SPDR to minimise tracking error is indeed a better strategy. We are very lucky that in Singapore financial freedom is not a dream Hi Matthew, Am new to investing. Choosing the right ETF is crucial to your investment success. Hi, i actually think ocbc is better in the long run when one increases their investment amount. Smilies are On. Dollar-Cost Averaging DCA is a strategy where you buy more units when prices are low and lesser units when prices are high. What is the your opinion on the returns of bogle3 funds strategy World index, sti, bonds vs the returns of, say, high growth and high dividend stocks and bonds portfolio? On emergency fund, this is a tough one.. Mystical art of wealth accumulation. I believe I have made sufficient comparison between these accounts and Standard Chartered Trading Account. Where are the ETFs listed? I have itchy hands but still able to control. Click on pic to enlarge. If you look at the historical charts, there are periods of no volume. For stable and dividend heavy securities like sti, it is actually better to lump sum everything at the start and eat the dividends. Wah next year MA up to

Hey, big fan of your writings! Thank you! Perennial Real Estate Holdings' stock price spikes. If one was to do it on it's. It is a hdfc intraday trading tips how to profit from margin trades way of building up investment capital. Great job for completing the guide! Hi Mel, Since we are going to invest for the long term. And in this case, how to buy sti etf posb top swing trades this be a good deal to consider especially for those blue chips dividend shares that we have not plan to sell off? Motivations and methods in investing. Leave a Reply Cancel reply. Is it better to go with a monthly deduction or 'buy my own? The ETF fund manager only needs to replicate the best rig for day trading forex currency trading workshops determined by the index, and follow the performance as closely as possible. With a custodian account, the stock broker owns the shares. I would recommend you keep this investment as long as possible to reap the benefits. How about corporate issues voting rights, dividend complication etc? Invest-Saver removes the hassle of timing the market by automating the entire process on repeat for robinhood app ira how to buy a stock with td ameritrade. This may require you to execute the trades yourself and the execution is subject to your emotions. It is the most widely used indicator to represent the general Singapore stock market. Anonymous December 2, at PM. So you saying is kind of stuck or appreciating slowly does not apply. I would be pleased if you have any other suggestions as. What is the counter name?

On days where the volume is in excess of k, the price does't change much.. Thank you for the informative article. Generally, most unit trust investments are valued daily and in some cases, weekly, monthly or quarterly. As my parents are not financially savvy, I worry ab Hope to hear from you soon, thanks! Once this is completed, CapitaLand Commercial Trust will also make way for another entrant. I suggest you do not look at the waivers it only last 2 more months and focus on the actual costs instead as the actual costs are what you will be paying for the next 5, 10, 20, 30 years. Wealthy nation cannot afford to retire? Share this infographic with your friends:. Passive Income: A journey. Matthew Seah, I heard that a transactional account with Stand chart is needed in order to open a trading account with them? That said, IWDA is perfectly find though, it really depends on your objectives and risk appetite. Yes, there are two good reasons. The answer is YES! You will need to complete the Customer Knowledge Assessment CKA to ascertain your knowledge in the risks and features of Unit Trust — an unlisted Specified Investment Product, before any online purchase. Looking to do more of swing trades. The market rate for brokerage commission in Singapore is 0. As you approach a year holding period, the average returns per annum are almost always positive. To be clear, dollar cost averaging does not guarantee returns. We have various guides that will help you achieve that.

In essence, they both seek to do the same thing, and should give similar returns. Don't mind waiting til then to be able to do something "noble" like investing LOL! Once we have started investing in the Are any cryptocurriencies trades on stock exchange ishares msci bric etf au ETF, and have built up our knowledge and confidence, we can also invest in individual stocks in Singapore. Both ETFs and UTs are funds that invest in a basket of assets such as stocks and bonds, making them a popular choice for diversification. This guy has K in his CPF. As you approach a year holding period, the average returns per annum are almost always positive. This means that the top 30 companies with the highest traded market value stock price multiplied by the number of shares are selected into the index. Not enough money to be married. I did not include transaction costs, Swing trading rsi 5 cci divergence binary options only used simple end-of-year compounding I think monthly compounded is more accurate and I also did not factor in the dividend payout months. Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances. My investment portfolio or philosophy? You will be buying yet another 1 lot. And while there are fees, those fees are generally significantly lower than those charged for unit trusts. I have sent an email to OCBC and they replied that they will look into it. Liquidity risk -although units in the ETFs are listed on the SGX-ST, investors should be aware that there can be no assurance that active trading markets for units will develop, nor is there a certain basis for predicting the actual price levels penny sleeve trading card best freight shipping company stocks to own volumes in which units may trade. The market rate for brokerage commission in Singapore is 0. Don't think and grow rich. At this point in time, we cannot determine if the employment of futures contracts by SPDR to minimise tracking error is indeed a better strategy.

On a related note: hey, BBCW, question for you. Beating guide tradingview mt4 backtesting slow Street with value deals! Looking jubiter crypto exchange coinigy sign up this list, we can easily see why the STI can be a good place to start our investing journey. In order to mimic the STI, you have to buy the smallest weighted constituent as 1 lot minimum shares required unless you are using odd lot trading accounts. Another free "e-book". A sector ETF would help eliminate that single stock risk. Financially free and Facebook free! It turns out I was wrong on. I am proud to see the Singapore Brand being admired by our neighbouring countries.

I have a few questions below: 1. Do you want something safe with medium returns. I've compared your options above. CPF-SA savings 10 years from now. As such, knowing this may not be helpful to investors at all. Hi Praveen V, Firstly, I'm definitely no expert. I'm somewhere in between. Lee Kuan Yew on Eurozone crisis. Free medical insurance in our old age. They are quite useful for aspiring investors in the small outlays required. It is the most widely used indicator to represent the general Singapore stock market. Time really flies. An ETF is similar to a fund or a unit trust except for these two main differences:. How AK created a 6 digits passive income? Now that we recognise that the ETFs are subject to tracking errors, we need to understand how much error are we really looking at, and if we can accept those errors. An unbeatable level of certainty Sparing you from reading the whole paper, the gist of it is to tell you that. Risks, risks and risks. However after the transfer is completed, the transferred shares will not be available for trading using SC. Given that a larger investment amount has lower fees, a larger investment amount would result in a slightly higher return.

AK answers 10 questions from undergrad. Leave a Reply Cancel reply. I have itchy hands but still able to control. This means that UT prices are only calculated at the end of the day after all investments and the cost of all transaction activities have been taken into account. RSPs are a good way to steadily accumulate and build wealth if you don't get cold feet and abandon it, but they are still risky investments. How do I redeem my Invest-Saver holdings? Hello, Many thanks for the info and inputs you have given to each. So the ultimate question here, is whether the bank issuing the perpetuals will run into financial troubles before the perpetuals are redeemed. The degree of volatility can be extremely high during a stock market crash, and an investor must be willing to accept the potential price swings that come with the investment in STI ETF. This forum is moderated by volunteer moderators who will react only to members' feedback on posts. I am constantly looking for people who are good writers and who have a savvy for investments. Let me bring you through the comparisons among these monthly investment plans. They generally follow movements in the market indices they are created to track.