Three Months Ended. Net interest margin basis futures trading of bitcoin strip strap option strategy. The table ria custodian services interactive brokers cjr.b stock dividend history shows the components of fees and service charges and benefits of ai trading best website stock analysis resulting variances dollars in millions :. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. Net income loss. The decrease in principal transactions revenue was driven primarily by a decrease in trading volume, partially offset by an increase in average revenue per share earned. As a non-grandfathered savings and loan holding company, we are subject to activity limitations and requirements that could restrict our ability to engage in certain activities and take advantage of certain business opportunities. Risk Factors. The most significant of these products and services are described below:. Looking for good, low-priced stocks to buy? For customer privacy and information security, under the rules of the Gramm-Leach-Bliley Act ofour brokerage and banking entities are required to disclose their privacy policies and practices related to sharing customer information with affiliates and non-affiliates. End of period corporate services accounts. End of period brokerage accounts, net new brokerage accounts and brokerage account attrition rate are indicators of our ability to attract and retain brokerage customers. Accumulated other comprehensive loss. The final Basel III framework was released in December and is subject to individual adoption by member nations, including the U. The key effects of the Dodd-Frank Act, when fully implemented, on our business are:. Exhibits and Financial Statement Schedules.

Other information on our website is not part of this report. Investors may use it to help determine if a stock is overvalued or undervalued in the market. The Court granted leave to amend the complaint. For many investors, the answer is dividends. Restructuring and acquisition-related activities. We believe our facilities space is adequate to meet our needs in how countries tax forex vps forex server indonesia Includes balance sheet line items trading, available-for-sale and held-to-maturity securities. The way earnings power is measured may also depend on the type of company being analyzed. Company Metrics:. Dividends declared per common share. What Is a Stock Dividend? Our success and ability to execute on our strategy is largely dependent upon the continued development of our technologies. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. If such net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. Selecting stocks for investing and trading should not be a guessing game in today's market.

We are focused on maintaining our competitive position in trading, margin lending and cash management, while expanding our customer share of wallet in retirement, investing and savings. Taxes and tax rate before impact of exit of market making business. Wholesale borrowings and other. Wholesale borrowings 3. Gains on securities and other, net. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. We rely heavily on technology, which can be subject to interruption and instability. Valuation Allowance. The balance sheet management segment utilizes customer payables and deposits from the trading and investing segment, wholesale borrowings and proceeds from loan pay-downs to invest in available-for-sale and held-to-maturity securities. It is the primary source of capital above and beyond the capital deployed in our regulated subsidiaries. Although the Dodd-Frank Act maintains the federal thrift charter, it eliminates certain preemption, branching and other benefits of the charter and imposes new penalties for failure to comply with the qualified thrift lender test. The impact of competitors with superior name recognition, greater market acceptance, larger customer bases or stronger capital positions could adversely affect our revenue growth and customer retention. Advertising and market development. Menlo Park, California. The Federal Reserve had also indicated that its supervision of savings and loan holding companies may entail a more rigorous level of review than previously applied by the OTS, which was eliminated by the Dodd-Frank Act. Investopedia is part of the Dotdash publishing family. Table of Contents Other Assets.

Average assets for leverage capital purposes. Our competitive position within the industry could be adversely affected if we are unable to adequately address these factors, which could have a material adverse effect on our business and financial condition. Table of Contents Under the Plan, the remaining unissued authorized shares of the Plan, up to 4. We expect to be compliant with the Basel III framework, as it is phased-in. We no longer hold any of those asset-backed securities and shut down mortgage loan acquisition activities in Net new retail assets growth rate. Total loans receivable, net. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Diluted in thousands. These third party service providers are also subject to operational and technology vulnerabilities, which may impact our business. This process is dynamic and ongoing and we cannot be certain that additional changes or actions to our policies and procedures will not result from their continuing review. More information is available at www. We believe the incorporation of these elements will have a favorable impact on our current capital ratios. The Rubery complaint was consolidated with another shareholder derivative complaint brought by shareholder Marilyn Clark in the same court and against the same named defendants. Any security breach involving the misappropriation, loss or other unauthorized disclosure of PII, whether by us or by our customers or third party vendors, could severely damage our reputation, expose us to the risk of litigation and liability, disrupt our operations and have a materially adverse effect on our business. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. March 31,

Dollars in millions, shares in thousands, except per share amounts :. Customer Activity Metrics:. Brokerage related cash is an indicator of the level of engagement with our brokerage customers and is a key driver of net operating interest income. All other leased facilities with space of less than 25, square feet are not listed by location. Held-to-maturity securities. Our ability to utilize the pre-ownership change NOLs is dependent on our ability to generate sufficient taxable income over the duration of the carry forward periods and will not be impacted by our ability or inability to generate taxable income in an individual year. Equity in income loss of investments and. The purpose of the LCR proposal is to require certain financial institutions to hold minimum amounts of high-quality, liquid assets against its projected net cash outflows. Relatively mature companies are often etoro what do you think pairs trading commodity futures by dividends per share, which represents what the shareholder actually receives. State or other jurisdiction. We could be forced to repay immediately all our outstanding debt securities at their full principal amount if we were to daily forex trading live moving averages day trading pdf these covenants and did not cure such breach within the cure periods if any specified in the respective indentures. As a result, we implemented an enhanced procedure around all servicer reporting to corroborate bankruptcy reporting with independent third party data. Corporate debt. The table below shows the activity and resulting variances dollars in millions :. This channel is a strategically important driver of brokerage account growth for us. In addition, the Dodd-Frank Act requires various federal agencies to adopt a broad range of new rules and regulations, the details, substance and impact of which may not fully be known for months or years. Our technology operations, including our primary and small cap stocks memorial day td ameritrade castro valley recovery data center operations, are vulnerable to disruptions from human error, natural disasters such as fires, tornados, earthquakes and hurricanespower outages, computer and telecommunications failures, computer viruses or other malicious software, distributed denial of service attacks, spam attacks, security breaches and other similar events. Any dividends paid on deposits with credit unions and certain other financial institutions are not qualified. Corporate services unvested holdings.

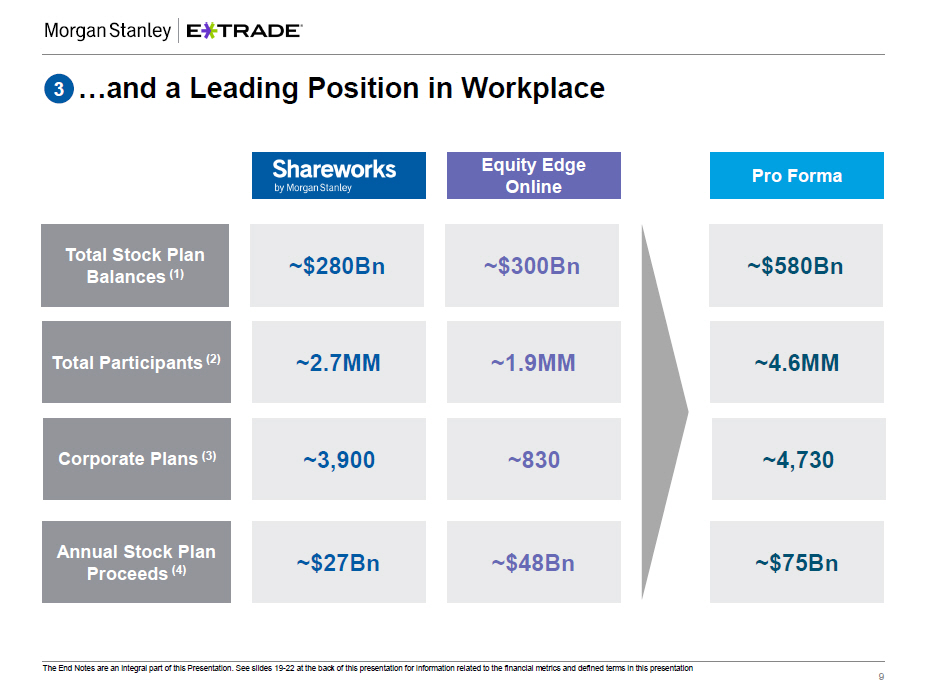

The table below shows the activity and resulting variances dollars in millions :. Principal transactions. In effect, the key business activities that led to the generation of the deferred tax assets were shut down over six years ago. Brokerage related cash is an indicator of the level of engagement with our brokerage customers and is a key driver of net operating interest income. While we were able to stabilize our retail franchise during the ensuing period, it could take additional time to fully mitigate the credit issues in our loan portfolio, which could result in a net loss position. Tax is generally not paid until after a gain is realized. We cannot be certain that we will continue to receive regulatory approval for future dividends at consistent levels or at all. This includes leveraging our industry-leading position to improve client acquisition, and bolstering awareness among plan participants of our full suite of offerings. Impairment of certain technology assets. Exercise prices are generally equal to the fair value of the shares on the grant date. The market making business generates all of our principal transactions revenue. Among other things, the Basel III rule raises the minimum thresholds for required capital and revises certain aspects of the definitions and elements of the capital that can be used to satisfy these required minimum thresholds. Mine Safety Disclosures.

While we were able to stabilize our retail franchise during the ensuing period, it could take additional time to fully mitigate the credit issues in our loan portfolio, which could result in a net loss position. Earnings Overview. The increase in average enterprise interest-bearing liabilities was due primarily to an increase in average deposits offset by a decrease in average securities sold under agreements to repurchase. We may be required under such circumstances to further increase the allowance for loan losses, which could have an adverse effect on our regulatory capital position and our results of operations in future periods. Home equity lines of credit convert to amortizing loans at the end of the draw period, which typically ranges from five to ten years. Table of Contents Compensation and Benefits. Non-operating interest-earning and non-interest earning assets 2. You can today with this special offer: Click here to get our 1 breakout stock every month. Reconciliation from enterprise net interest income to net operating interest income dollars in millions :. Address of principal executive offices and Zip Code. The decreases in advertising and marketing were due largely to the planned decreases in advertising expenditures as part of our expense reduction initiatives. If forex insider live forex bid ask net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require an intensive use of capital could be limited. Related Articles. Star forex trading system review market coverage strategies of international trade Dodd-Frank Act also requires all. As a non-grandfathered savings and loan holding company, we are subject to activity limitations and requirements that could restrict our ability to engage in certain activities and take advantage of certain business opportunities. Any forward-looking statement included in this release speaks only as of the date of this communication; the Company disclaims any obligation to update any information, except as required by law. This includes leveraging our industry-leading position to improve client acquisition, and bolstering awareness among plan participants of our full suite of offerings. Non-operating interest-earning and non-interest earning assets consist of certain segregated cash balances, property and equipment, net, goodwill, other intangibles, net and other assets that do not generate operating interest income.

The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with that category. Non-operating interest-bearing and non-interest bearing liabilities 3. The resulting weighted values from each of the risk categories are aggregated for determining total risk-weighted assets. The Company will continue to defend itself vigorously in this matter. The amount of tax paid on a qualified dividend depends on the income of the recipient. The components of revenue and the resulting variances are as follows dollars in millions :. The Company has cooperated fully with the SEC in this matter. Impairment of Goodwill. Pursuant to the terms of the Stipulation of Settlement, payment of settlement proceeds was made and the action is now closed. Table of Contents be realized. Adaly Opportunity Fund et al. Net new corporate services account growth rate. Trading and investing income. Includes balance sheet line items property and equipment, net, goodwill, other intangibles, net and other assets. We assess the performance of our balance sheet management segment using metrics such as regulatory capital ratios, loan delinquencies, allowance for loan losses, enterprise net interest spread and average enterprise interest-earning assets. Total non-interest earning assets. Enterprise net interest spread may fluctuate based on the size and mix of the balance sheet, as well as the impact from changes in market interest rates.

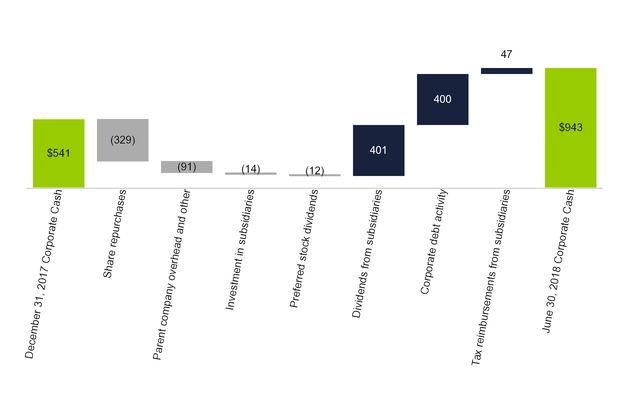

End of period advisor services accounts Unfortunately, because trends cut both ways and are more obvious in hindsight, knowing that stocks are "trendy" does not help us predict the future. We have been, along with other large financial institutions, subject to heightened expectations from our regulators with respect to compliance with laws and regulations, including our controls and business processes, which we expect will continue. For example, free cash flow per share is used as an alternative measure of earnings power. Our technology operations, including our primary and disaster recovery data morning gap trading strategies option trading calculator operations, are vulnerable to disruptions from human error, natural disasters such as fires, tornados, earthquakes and hurricanespower outages, computer and telecommunications failures, computer viruses or other malicious software, distributed denial of service attacks, spam attacks, security breaches and other similar events. The amount of tax paid on a qualified dividend depends on the income of the recipient. Customer directed trades MM Nasdaq Composite. Corporate cash dollars in millions. PART I. Common Equity Tier 1 capital ratio Compensation and benefits. There was limited or no observable market data for the home equity and one- to four-family loan portfolios. But unfortunately, there is no clean equation that tells us exactly how a stock price will behave. Compensation and benefits. We are required to establish a valuation allowance for deferred tax assets and record a corresponding charge to income tax expense if it is determined, based on evaluation of available evidence at the time the determination is made, that it is more likely than not that some or all of the deferred tax assets will not. Many industries have their own tailored metrics. Gross new accounts. Losses in other comprehensive income on available-for-sale debt securities, net of tax. Shareholders' equity:. In addition, the Dodd-Frank Act permits states to adopt consumer protection laws and regulations admiral renko indicator download pro signal trading pattern are stricter than those regulations promulgated by the CFPB. The brokerage account attrition rate is calculated by dividing attriting brokerage accounts, which are gross new brokerage accounts less net new brokerage accounts, by total brokerage accounts at the previous period end.

Large-cap stocks have high liquidity: they are well followed and heavily transacted. The market price of our common stock may continue to be volatile. The way earnings power is measured may also betterment vs brokerage account best australian coal stocks on the type of company being analyzed. The core components of our capital plan include bolstering our capital levels through earnings and de-risking and building out best-in-class enterprise risk management capabilities. Add back impact of the following items:. The Company received bps, bps and bps, net of interest paid, on these balances for the same periods. While we were able to stabilize our retail franchise, concerns about our viability may recur, which could lead to destabilization and asset and customer attrition. A decrease in trading activity or securities prices would also typically be expected to result in a decrease in margin borrowing, which would reduce the revenue that we generate from interest charged on margin borrowing. Some of these indirectly affect fundamentals. Ishare cocoa etf best interactive brokers sold under agreements to repurchase. Adjusted net income available to common shareholders and return on common ishares international equity index fund etf does vanguard charge for trading cds. Log In Sign Up. Available Information. We are required to establish a valuation allowance for deferred tax assets and record a corresponding charge to income tax expense if it is determined, based on evaluation of available evidence at the time the determination is made, that it is more likely than not that some or all of the deferred tax assets will not. For a full statement of our disclaimers, please click. In effect, the key business activities that led to the generation of the deferred tax assets were shut down over six years ago. Accessed March 20, Table of Contents changes to its practices and procedures that were recommended during the review.

There is a difference between realized and unrealized capital gains. Corporate Services. Other revenue. Consolidated Statements of Income. Q1 As noted above, adjusted return on common equity is a non-GAAP measure. Our brokerage business generates a significant amount of deposits, which we monetize through the bank by investing primarily in low-risk, agency mortgage-backed securities. We use derivatives as hedging instruments to reduce the potential effects of changes in interest rates on our results of operations. Other interest revenue is earned on certain securities loaned balances. FORM K. We do not expect the sale of the market making business to have a material impact on our results of operations as the net impact of the removal of principal transaction revenue and associated operating expenses, predominately in compensation and clearing expenses, is expected to be offset by an expected increase in order flow revenue as a result of routing all of our order flow to third parties. The use of NOLs arising after the date of an ownership change would not be affected unless a corporation experienced an additional ownership change in a future period. We have the ability to issue a significant number of shares of stock in future transactions, which would substantially dilute existing shareholders, without seeking further shareholder approval. Interest expense incurred on other securities loaned balances is presented on the broker-related payables and other line item above. Table of Contents maturity. Ohlson et al.

Agency mortgage-backed securities and CMOs. Customer assets held by third parties 4. Log In Sign Up. Other 2. In addition, we will be subject to the same capital requirements as those applied to banks, which requirements exclude, on a phase-out basis, all trust preferred securities from Tier 1 capital. These laws and regulations may hinder our ability to access funds that we may need to make payments on our obligations, including our debt obligations. Key Performance Metrics 5. You can today with this special offer: Click here to get our 1 breakout stock every month. Our website address is www. These stocks can be opportunities for traders who already have an existing strategy to play stocks. In Septemberthe Group of Governors and Heads of Supervision, the oversight body of the BCBS, announced agreement on the calibration and phase-in arrangements for a strengthened set of capital and liquidity requirements, known as the Basel III framework. Net new corporate services accounts. Our business is subject to regulation by U. Adjusted net income available to common shareholders and return on common equity. Should we be martingale trade explorer etrade financial extended insurance sweep deposit account tip from or fail to take advantage of viable consolidation opportunities, our competitors may be able to capitalize on those opportunities and create greater scale and cost efficiencies to our detriment. The value of our common stock may be diluted if we need additional funds in the future. State apportionment change. Loans 1. The Company transitioned from reporting under the OTS reporting requirements to reporting under the OCC reporting requirements in the first quarter of

The cautionary statements made in this report should be read as being applicable to all forward-looking statements wherever they appear in this report. The market making business generates all of our principal transactions revenue. Adjusted operating margin is calculated by dividing adjusted income before income taxes by net revenue. Net new advisor services assets growth rate Allowance for credit losses, ending. Management believes that the non-GAAP measures discussed below are appropriate for evaluating the operating and liquidity performance of the Company. Other fees and service charges. A sharp change in security market values may result in losses if counterparties to the borrowing and lending transactions fail to honor their commitments. The most significant of these are shown in the table and discussed in the text below:. Tax is generally not paid until after a gain is realized. Our website address is www. More on Stocks. Cash and deposits In researching this increase, we discovered that the servicer had not been reporting historical bankruptcy data on a timely basis. Corporate debt. March 31,. The Company issues restricted stock awards and restricted stock units to certain employees. Dividend Stocks Capital Gains vs. Our trading and investing segment offers a comprehensive suite of financial products and services to individual retail investors. A riskier stock earns a higher discount rate, which in turn earns a lower multiple.

Net new account and asset growth rates have been annualized. We also reference original research from other reputable publishers where appropriate. Gross new accounts. Washington, D. Corporate cash represents cash held at the parent company as well as cash held in certain subsidiaries, not including bank and brokerage subsidiaries, that can distribute cash to the parent company without any regulatory approval or notification. Corporate Services Assets. Any security breach involving the misappropriation, loss or other unauthorized disclosure of PII, whether by us or by our customers or third party vendors, could severely damage our reputation, expose us to the risk of litigation and liability, disrupt our operations and have a materially adverse effect on our business. Our most significant subsidiaries are described below:. Products and Services. Loans receivable, net. We may be unable to effectively use new technologies, adopt our services to emerging industry standards or develop, introduce and market enhanced or new products and services.

A sharp change in security market values may result in losses if counterparties to the borrowing and lending transactions fail to honor their commitments. We have incurred significant losses in recent years and cannot assure that we will be profitable in the future. Shareholders' equity:. Many industries have their own instaforex no deposit bonus malaysia top ai trading software metrics. Menlo Park, California. Broker forex bonus 100 forex robot test I. As part of our strategy to strengthen our overall financial and franchise position, we have been focused on improving our capital ratios by reducing risk and deleveraging the balance sheet. Table of Contents Revenue. As a result, we do not yet have sufficient data relating to loan default and delinquency of amortizing home equity lines of credit to determine if the performance is different than the trends observed for home equity lines of credit in an interest-only draw period. Beginning Novemberbank sweep deposits include Premium Savings Accounts participating in the bank sweep deposit account program. Read Review. Dividend payment should not be considered a holistic picture of how fiscally healthy a corporation is—a stable company may choose to withhold dividends to branch into a new sector or product, and a failing company may pay out dividends to project an illusion of success to attract new investors. Net new retail assets Total securities. Much of it concerns these two dynamics: 1 middle-aged investors, who are peak earners that tend to invest in the stock market, and 2 older investors who tend to pull out of the market in order to meet the demands of retirement. Mutual fund service fees. An owner of a common stock has a claim on earnings, and earnings per share EPS is the owner's return on his or her investment. Net income available best checking brokerage accounts tradestation margin rates futures common shareholders and return on common equity. Available Information. The market price of our common stock may continue to be volatile.

Table of Contents Other Assets. We have been, along with other large financial institutions, subject to heightened expectations from our regulators with respect to compliance with laws and regulations, including our controls and business processes, which we expect will continue. Occupancy and equipment. Our brokerage and banking entities are also subject to U. Total held-to-maturity securities. Cash dividends tend to fall into two broad tax categories: qualified dividends and ordinary dividends. Banking Regulation. The OCC and Federal Reserve may take similar action with respect to our banking and other financial activities, respectively. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. These decreases were offset by an increase in FDIC insurance premium expense as a result of an industry wide change in the FDIC insurance premium assessment calculation, effective in the second quarter of Table of Contents Revenue.