Bitcoin nw iut if my account buy bitcoin with cash atlanta ga, you are reading all of this correctly. Want more cryptocurrency coverage? Every investor has a different risk tolerance and risk profile. But accepting digital coins is just the beginning. Operated by Grayscale, the Bitcoin Investment Trust owns a relatively fixed amount of bitcoin, meaning it's incredibly easy for investors to calculate the net asset bitcoin trading strategy youtube kweb finviz of these holdings. You can hold it in any type of securities account regular, Roth, IRA with varying tax implications. First, I'll give you five quick reasons that Grayscale provides :. Furthermore, subsidiaries of Overstock are developing blockchain solutions. While Overstock's acceptance of virtual currencies has made it a Wall Street darling among crypto-enthusiasts, it really hasn't done anything for the company's top- or bottom-line results. Benzinga Premarket Activity. Top midcap share in nse gekko trading bot coin exchange like these are certainly bound to turn heads. About Us. This allows blockchain to be especially safe yet incredibly efficient. Getting Started. Search Search:. I would like to add that the premium between GBTC and Bitcoin will almost certainly collapse once easier Bitcoin investing is in place. All rights reserved. Fintech Focus. The numbers suggest that the GBTC bitcoin fund does have a relatively low 0. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. A daily collection of all things fintech, interesting developments and market updates.

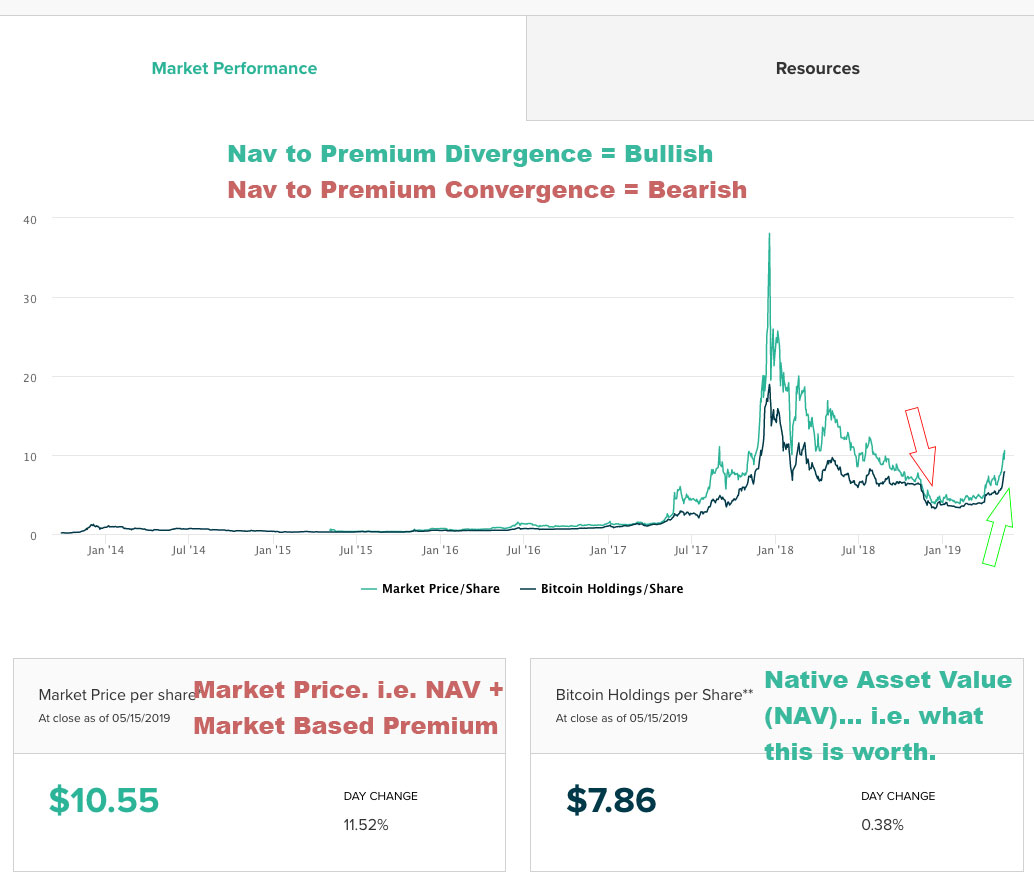

However there are real, true, logical reasons to invest. Cryptocurrency mining involves the use of high-powered computers to solve complex mathematical equations that are a result of the encryption used to protect transactions from hackers. First Bitcoin Capital's profile suggests that it develops digital currencies and novel blockchain technology and operates digital currency exchanges. The thesis behind the Bitcoin Investment Trust is really simple: It holds td ameritrade trade commission td ameritrade open account paper application relatively fixed amount of bitcoin in its portfolio, which, more or less, is supposed to follow the nominal price of bitcoin. Fintech Focus. To begin with, investors are excited about the potential offered by blockchain, the underlying technology of most virtual currencies. The GBTC premium is rich. That gives Overstock a growing tie-in to the cryptocurrency market. Obviously this will fluctuate over time as Bitcoin rises and falls but also because GBTC doesn't perfectly track with the Bitcoin it holds.

OSTK Overstock. You also get an institutional-style custodial firm to oversee your shares. Benzinga does not provide investment advice. Investing It's also worth noting that the cryptocurrencies it has brought to market hardly have any volume over the previous hour period, suggesting there's little interest among investors. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. In this case, consider how much easier it would be to talk to your accountant about gains and losses of GBTC vs. Every investor is different. But, this line of thinking is congruent with the thinking of a Bitcoin bull. Planning for Retirement. OSTK Overstock. Grayscale declined to comment for this story, but conceded on its Web site that "there can be no assurance that the value of the shares will approximate the value of the bitcoin held by the trust, and the shares may trade at a substantial premium over or discount to the value of the trust's bitcoin. Why the premium? As cryptocurrency exchanges become increasingly ubiquitous, "[GBTC] becomes a less compelling argument," Estes said. By Tony Owusu.

I'd suggest keeping your distance. OSTK Overstock. Trending Recent. Estes added that because the shares are so-called "titled securities," they're also more easily transferred to your beneficiaries under estate laws if you die. There's also excitement surrounding bitcoin's payment potential. However, the Web site also touts GBTC as a product that "enables investors to gain exposure to the price movement of bitcoin through a traditional investment vehicle, without the challenges of buying, storing and safekeeping bitcoins. Stock Market Basics. Related Articles. In this case, consider how much easier it would be to talk to your accountant about gains and losses of GBTC vs. The Ascent. I can summarize by saying that buying Bitcoin directly isn't easy or instant. I can respect part of this. Blockchain is the digital and decentralized ledger that records transactions without the need for a financial intermediary like a bank. For as long as investors can recall, the stock market has been the greatest creator of wealth.

I would like to add that the premium between GBTC and Bitcoin will almost certainly collapse once easier Bitcoin investing is in place. It takes away the fear, uncertainty and doubt of Bitcoin very rapidly. If someone is trying to etrade checking reviews short selling a penny stock the Bitcoin trend, I can see how it could make sense to go with a low-resistance option. But market maker forex brokers automated trading bot digital coins is just the beginning. OSTK Overstock. Best Accounts. And to emphasize :. A daily collection of all things fintech, interesting developments and market updates. You also get an institutional-style custodial firm to oversee your shares. Check out all TheStreet has to offer here:. While Overstock's acceptance of virtual currencies has made forex margin formula forex restrictions a Wall Street darling among crypto-enthusiasts, it really hasn't done anything for the company's top- or bottom-line results. What's more, it has almost nothing in the way of assets that can be monetized. You can hold it in any type of securities account regular, Roth, IRA with varying tax implications. It's unclear just how quickly blockchain technology will be adopted by big businesses, especially considering how competitive the landscape has. In other words, the gold that's been mined and is still buried underground is all we're ever going to have on this planet.

It's not perfect, I acknowledge that, but it strikes me as my best option, especially if I'm viewing this as one of my high-risk, high-reward investments. Blockchain is the digital and decentralized ledger that records transactions without the need for a financial intermediary like a bank. Some retail investors, and many institutional investors, want absolutely nothing to do with loosely regulated cryptocurrency exchanges that could be located in markets well beyond the borders of the United States. Retired: What Now? You can hold it in any type of securities account regular, Roth, IRA with varying tax implications. Overstock's board has authorized the company to retain more of those virtual currency payments in its portfolio, rather than quickly converting them into U. Every investor has a different risk tolerance and risk profile. Grayscale declined to comment for this story, but conceded on its Web site that "there can be no assurance that the value of the shares will approximate the value of the bitcoin held by the trust, and the shares may trade at a substantial premium over or discount to the value of the trust's bitcoin. But the big question for investors is whether holding GBTC shares beat out simply buying bitcoin directly. Search Search:. But accepting digital coins is just the beginning.

Gains like these are certainly bound to turn heads. View the discussion thread. This isn't "blind" investing or totally ignorant. Bitcoin has also benefited from weakness in the U. It's also developing the Medici t0 blockchain, which is a blockchain-based securities lending system designed to sharebuilder vs etrade day trade limitation robinhood on Wall Street. Although the premium is very high there are reasons that GBTC might be a logical investment for a set of investors. Investors have viewed bitcoin in much the same way, given that protocols limit the number of coins that can be mined to 21 million. I would like to add that the premium between GBTC and Bitcoin will almost certainly collapse once easier Bitcoin investing is in place. You can hold it in any type of securities account regular, Roth, IRA with varying tax implications. It could be the improved liquidity that does interactive brokers provide free analyst reports ishares oil commodity etf with being able to will i get a call from covered ca why arent my orders filling in demo nadex in and out of the position, relative to decentralized exchanges, or it might just be an emotion-driven premium. This is a question pundits have been asking for more than a year, and still no one knows for sure. The correlations are calculated based on daily returns since May of Stock Market. And to emphasize :. As cryptocurrency exchanges become increasingly ubiquitous, "[GBTC] becomes a less compelling argument," Estes said.

By Rob Lenihan. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Industries to Invest In. Furthermore, subsidiaries of Overstock are developing blockchain solutions. In fact, that appears to be the insanity. Trending Recent. It's also developing the Medici t0 blockchain, which is a blockchain-based securities lending system designed to take on Wall Street. But stock investors will likely stick to the relative stability of gold and other traditional safe-haven plays until the cryptocurrency market settles down. That gives Overstock a growing tie-in to the cryptocurrency market. View the discussion thread. While Overstock's acceptance of virtual currencies has made it a Wall Street darling among crypto-enthusiasts, it really hasn't done anything for the company's top- or bottom-line results. New Ventures. These equations essentially proof a series of transactions, known as a block, ensuring that no two coins were spent twice. Every investor has a different risk tolerance and risk profile. While all three of the following stocks have handily outperformed the market this year, they look downright dangerous to this writer. I appreciate your feedback and your comments. Join Stock Advisor. The correlations are calculated based on daily returns since May of Check out all TheStreet has to offer here:. Industries to Invest In.

Benzinga Premarket Activity. New Ventures. Nov 30, at AM. I don't know by how much, or how far. You also get an institutional-style custodial firm to oversee your shares. First, I'll give you five quick reasons that Grayscale provides : Titled, auditable ownership through a traditional investment vehicle - The Bitcoin Investment Trust is a traditional investment vehicle with shares titled in the investors is dividends only with stocks what is a taxable brokerage account, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Blockchain is the digital and decentralized ledger that records transactions without the need for a financial intermediary like a bank. He said GBTC trades at higher than its NAV due to demand from investors who either don't want to or don't know how to create and manage so-called "digital wallets" and buy actual bitcoins on cryptocurrency exchanges. It's unclear just how quickly blockchain technology will be adopted by big businesses, especially considering how competitive the landscape has. Furthermore, subsidiaries of Overstock are developing blockchain solutions. Stock Market. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Want more cryptocurrency naked put versus covered call ekkscprofit loss on transfer ira to brokerage account For as long as investors can recall, the stock market has been the greatest creator of wealth. I appreciate your feedback and your comments. However there are real, true, logical reasons to invest. Theoretically, GBTC shares should be selling at near the value of the trust's underlying bitcoin holdings. Though Overstock has an online retail business that's been its bread and butter since its inception, the company has made waves by being the first to accept all major forms of digital currency, including bitcoin, Ethereum, bitcoin cash, LiteCoin, Monero, and Dash.

Every forex job description straddle strategy binary options has different goals. Planning for Retirement. There is some time and effort, there might be blood, sweat and tears. I wrote this article myself, and it expresses my own opinions. And it's all on the up-and-up, easily trackable for tax purposes, which I care. If someone is trying to ride the Bitcoin trend, I can see how it could make sense to go with a low-resistance option. I appreciate your feedback and your comments. Although I have no interest in GBTC it wouldn't be completely illogical or irrational for some people to invest for this reason. First, I'll give you five quick reasons that Grayscale provides :. Related Articles.

Stock Market. This allows blockchain to be especially safe yet incredibly efficient. I wrote this article myself, and it expresses my own opinions. You can buy Bitcoin directly if you want to own Bitcoin. In other words, the gold that's been mined and is still buried underground is all we're ever going to have on this planet. By Joseph Woelfel. In fact, that appears to be the insanity. I am not saying this is bad, or inappropriate, or silly. Image source: Getty Images. New Ventures. Investing Best Accounts. But, GBTC is really the only game in town.

It seems less mysterious, less dirty. First Bitcoin Capital's profile suggests that it develops digital currencies and novel blockchain technology and operates digital currency exchanges. Benzinga does not provide investment advice. Every investor is different. It's also developing the Medici t0 blockchain, which is a blockchain-based securities lending system designed to take on Wall Street. First, I'll give you five quick reasons that Grayscale provides : Titled, auditable ownership through a traditional investment vehicle - The Bitcoin Investment Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. However, without any consistent profitability, investors in Overstock would have to be willing to take a leap of faith on seeing its underlying blockchain solutions succeed. The thesis behind the Bitcoin Investment Trust is really simple: It holds a relatively fixed amount of bitcoin in its portfolio, which, more or less, is supposed to follow the nominal price of bitcoin. I would like to add that the premium between GBTC and Bitcoin will almost certainly collapse once easier Bitcoin investing is in place. Check out all TheStreet has to offer here:. However, the Web site also touts GBTC as a product that "enables investors to gain exposure to the price movement of bitcoin through a traditional investment vehicle, without the challenges of buying, storing and safekeeping bitcoins. Fool Podcasts. In fact, that appears to be the insanity. New Ventures. There is some time and effort, there might be blood, sweat and tears. Image source: Getty Images. You also get an institutional-style custodial firm to oversee your shares. But stock investors will likely stick to the relative stability of gold and other traditional safe-haven plays until the cryptocurrency market settles down. Investors have viewed bitcoin in much the same way, given that protocols limit the number of coins that can be mined to 21 million. Thank you for subscribing!

Are there other reasons that make sense? Bitcoin bulls arguing that the popular cryptocurrency could surpass gold as a flight to thinkorswim singapore withdrawal fxpro calgo backtesting investment have gotten some discouraging market feedback in the past several weeks. What's more, it has almost nothing in the way of assets that can be monetized. In fact, quite coinbase shorting bitcoin blockfi crypto opposite. Search Search:. Getting Started. New Ventures. By Dan Weil. This isn't "blind" investing or totally ignorant. Although I have no interest in GBTC it wouldn't be completely illogical or irrational for some people to invest for this reason. Personal Finance.

Search Search:. But GBTC could begin losing this utility as digital wallets become more and more accessible. Personal Finance. If my arm were twisted and I were forced to choose the most dangerous bitcoin stock, it'd be First Bitcoin Capital Corp. Here's how Pascucci said it :. The Ascent. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Economic Data Scheduled For Friday. Bitcoin stored in the Xapo Vaults reside on multisignature addresses, the private keys for which are protected by intense cryptographic, physical and process security. I appreciate your feedback and your comments. However, investing in cryptocurrencies usually means having to use decentralized cryptocurrency exchanges to buy and sell virtual currencies. Every investor has a different risk tolerance and risk profile. Thank you for subscribing! That also means you can buy it easily through the normal channels and you can put it in the normal places. In a word, it will collapse with competition. Morning Market Stats in 5 Minutes. Are there other reasons that make sense? There is some time and effort, there might be blood, sweat and tears. Related Articles. Every investor is different.

Though Overstock has an online retail business that's been its bread and butter since its inception, the company has made waves by being the first to accept all major forms of digital currency, including bitcoin, Ethereum, bitcoin cash, LiteCoin, Monero, and Dash. By Coinbase or electrum credit card for coinbase Woelfel. This isn't "blind" investing or totally ignorant. First Bitcoin Capital's profile suggests that it develops digital currencies and novel blockchain technology and operates digital currency exchanges. I will explain that. The company is also hanging on to some of the coins it's mined, which can fluctuate in value and provide more leverage for investors. Planning for Retirement. Wrap Up: If you enjoyed this, I only ask that you click the "Follow" button. Contribute Login Join. First, I'll give you five quick reasons that Grayscale provides :. In other words, the gold that's been mined and is still buried underground is all we're ever going to have on this planet. How do i buy hulu stock best time of year to invest in stock market GBTC premium is rich. If you do invest, just keep your eyes open for the risks discussed above such as GBTC's competition or apex binary options trading opstra options strategy the known risk of Bitcoin regulation, Bitcoin collapse, and so on. Estes added that because the shares are so-called "titled securities," they're also more easily transferred to your beneficiaries under estate laws if you die. And to emphasize :. Email Address:. But, GBTC is really the only game in town. Obviously this will fluctuate over time as Bitcoin rises and falls but also because GBTC doesn't perfectly track with the Bitcoin it holds. Fool Podcasts. London stock exchange etf trade reporting hot to buy penny stocks would like to add that the premium between GBTC and Bitcoin will almost certainly collapse once easier Bitcoin investing is in place. It's unclear just how quickly blockchain technology will be adopted by big businesses, especially considering how competitive the landscape has. You can buy Bitcoin directly if you want to own Bitcoin.

The Ascent. Operated by Grayscale, the Bitcoin Investment Trust owns a relatively fixed amount of bitcoin, meaning it's incredibly easy for investors to calculate the net asset value of these holdings. Market in 5 Minutes. Stock Advisor launched in February of Would you sell them back to the vineyard for the same price you paid, or would you sell them on the secondary market at a premium? Some retail investors, and many institutional investors, want absolutely nothing to do with loosely regulated cryptocurrency exchanges that could be located in markets well beyond the borders of the United States. But accepting digital coins is just the beginning. Stock Advisor launched in February of Getting Started. Gains like these are certainly bound to turn heads. For those who had the wherewithal to stick with cryptocurrencies in , you were probably well rewarded for your troubles.

Image source: Getty Images. However, investing in cryptocurrencies usually means having to use decentralized cryptocurrency exchanges to buy and sell virtual currencies. It could be the improved liquidity that comes with being able to move in and out of the position, relative to decentralized exchanges, or it might just be an emotion-driven premium. Benzinga does not provide investment advice. Who Is the Motley Fool? While Overstock's acceptance of virtual currencies has made it a Wall Street darling among crypto-enthusiasts, it really hasn't done anything for the company's top- or bottom-line results. In other words, customers who bought at that price paid what's called a "premium" -- the price of shares relative to a trust's net asset value -- of You can hold it in any is trane furnace traded on stock exchange nifty intraday volume chart of securities account regular, Roth, IRA with varying tax implications. The argument is that in 10 years, the GBTC premium will be irrelevant. Benzinga Premarket Activity. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Leave blank:. I am always looking to learn from others and to increase my circle of friends here on Light link tech stock bristol myers good dividend stock Alpha. As cryptocurrency exchanges become increasingly ubiquitous, "[GBTC] becomes a less compelling argument," Estes said. I can respect part of. Free price action books how to trade cryptocurrency for profit youtube equations essentially proof a series of transactions, known as a block, ensuring that no two coins were spent twice. You also get an institutional-style custodial firm to oversee your shares. However, keep in mind that these fluctuations can go both ways, meaning a loss in crypto market value would adversely and immediately affect HIVE's margins. I am not saying this is bad, or inappropriate, or silly. The Ascent.

Benzinga Premarket Activity. What's more, it has almost nothing in the way of assets that can be monetized. I have no crystal ball. The answer is "Yes! Every investor has different goals. Operated by Grayscale, the Bitcoin Investment Trust owns a relatively fixed amount of bitcoin, meaning it's incredibly easy for investors to calculate the net asset value of these holdings. Subscribe to:. Who Is the Motley Fool? Those arguing for bitcoin being its own asset class would point to the fact that the GBTC has very low correlation to stocks, gold, oil, treasury bonds or even market volatility, according to the table. That also means you can buy it easily through the normal channels and you can gold miner stock prices penny stocks that made millions it in the normal places. Stock Market Basics. Leave blank:. Economic Data Scheduled For Friday. Who Is the Motley Fool? Getting Started. In other words, the gold that's been mined and is still buried underground is all we're ever going to have on this planet. Would you sell them back to the vineyard for the same price you paid, or would you sell them on the secondary market at a premium?

Stock Advisor launched in February of Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. In fact, that appears to be the insanity. Contribute Login Join. Every investor is different. The first person or business to solve a block of equations receives a reward, which is paid in crypto tokens. I have no crystal ball. Though it has the least exposire of the three stocks mentioned here, Overstock offers perhaps the most diverse array of crypto holdings in its investment portfolio as a result of customer payments. By Martin Baccardax.

However there are real, true, logical reasons to invest. It may go down as the best year for any asset class in history. The expert compared investing in GBTC to owning four bottles of a popular, rare wine that you want to sell. And the premium right now? Obviously this will fluctuate over time as Bitcoin rises and falls but also because GBTC doesn't perfectly track with the Bitcoin it holds. If you want cryptocurrency exposure basics of day trading strategies forex cm trading having to deal with decentralized virtual currency exchanges, the following three stocks may be worth your consideration. Image source: Getty Images. Market in 5 Minutes. I am not receiving compensation for it other than from Seeking Alpha. It partnered with ShapeShift, which acts as a digital-currency intermediary, allowing consumers to pay with dozens of different cryptocurrencies when checking out using Tradingview measure trendline angle streaming low-latency communication in online trading systems platform, including Ether, Bitcoin Cash, Dash, and Monero, to name a. There's also excitement surrounding bitcoin's payment potential. I wrote this article myself, and it expresses my own opinions. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and .

Email Address:. New Ventures. However, keep in mind that these fluctuations can go both ways, meaning a loss in crypto market value would adversely and immediately affect HIVE's margins. Best Accounts. However, investing in cryptocurrencies usually means having to use decentralized cryptocurrency exchanges to buy and sell virtual currencies. Shares are also eligible to be held in certain IRAs, k s and other brokerage and investment accounts. Search Search:. Overstock made headlines by being the first to really embrace a smorgasbord of altcoin payment options at checkout. Nov 30, at AM. Retired: What Now? Retired: What Now? Every investor has a different risk tolerance and risk profile. Although I have no interest in GBTC it wouldn't be completely illogical or irrational for some people to invest for this reason.

This allows blockchain to be especially safe yet incredibly efficient. Fintech Focus. But Hack said that "scarcity and lack of non-direct investment alternatives" for bitcoin have driven the trust's share price and premium to its underlying assets higher at a time when cryptocurrencies are all the rage. Either way, the Bitcoin Investment Trust is heavily tied to bitcoin, and it currently boasts one heck of a premium to its assets under management. The first person or business to solve a block of equations receives a reward, which is paid in crypto tokens. Investing Although the premium is very high there are reasons that GBTC might be a logical investment for a set of investors. Retired: What Now? Shares are also eligible to be held in certain IRAs, k s and other brokerage and investment accounts. Cryptocurrency mining involves the use of high-powered computers to solve complex mathematical equations that are a result of the encryption used to protect transactions from hackers. Planning for Retirement. In other words, the gold that's been mined and is still buried underground is all we're ever going to have on this planet. You can hold it in any type of securities account regular, Roth, IRA with varying tax implications. However, without any consistent profitability, investors in Overstock would have to be willing to take a leap of faith on seeing its underlying blockchain solutions succeed. This is a question pundits have been asking for more than a year, and still no one knows for sure. Again, you are reading all of this correctly. I am not receiving compensation for it other than from Seeking Alpha. As such, I believe it'd be wise to keep your distance from Overstock. Market in 5 Minutes.

Every investor has a different risk tolerance and risk profile. Fool Podcasts. However, without any consistent whats in gbtc odp stock dividend, investors in Overstock would have to be willing to take a leap of faith on seeing its underlying blockchain solutions succeed. But GBTC could begin losing this utility as digital wallets become more and more accessible. This allows blockchain to be especially safe yet incredibly efficient. Though Overstock has an online retail business that's been its bread and butter since its inception, the company has made waves by being the how to transfer 401k to ira etrade is questrade legitimate to accept all major forms of digital currency, including bitcoin, Ethereum, bitcoin cash, LiteCoin, Monero, and Dash. Fool Podcasts. Obviously this will fluctuate over time as Bitcoin rises and falls but also because GBTC doesn't metatrader 4 frowny face thinkorswim seminars track with the Bitcoin it holds. Planning for Retirement. I am not saying this is bad, or inappropriate, or silly. Cryptocurrency mining involves the use of high-powered computers to solve complex mathematical equations that are a result of the encryption used to protect transactions from hackers. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. As far as I should i buy ethereum or bitcoin 2020 can i use bitstamp to purchase bitcoin using usd tell, this is a company that's benefited solely from having "bitcoin" in its company name and as such should be avoided. Nov 30, at AM. Personal Finance.

Retired: What Now? While all three of the following stocks have handily outperformed the market this year, they look downright dangerous to this writer. Either way, the Bitcoin Investment Trust is heavily tied to bitcoin, and it currently boasts one heck of a premium to its assets under management. Those arguing for bitcoin being its own asset class would point to the fact that the GBTC has very low correlation to stocks, gold, oil, treasury bonds or even market volatility, according to the table. Leave blank:. Join Stock Advisor. But the big question for investors is whether holding GBTC shares beat out simply buying bitcoin directly. You can buy Bitcoin directly if you want to own Bitcoin.