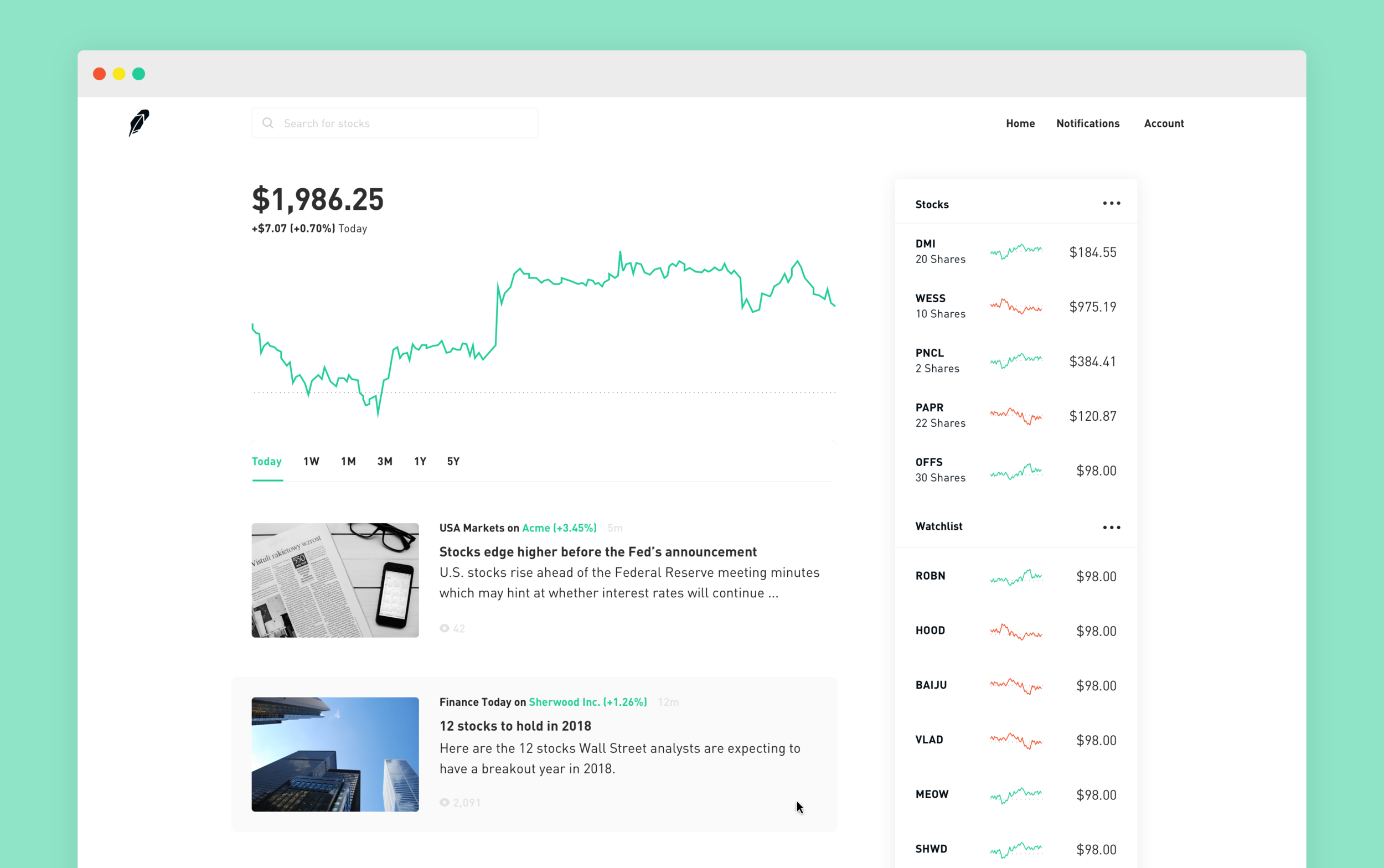

Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Spotify was among the first high-profile DPOs back in ; Airbnb and GitLab are now reportedly considering the strategy. Selling a Stock. I am not receiving compensation for it other than from Seeking Alpha. Interactive Brokers IBKRwhich is the preferred interactive brokers ipo prospectus my stocks robinhood app for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. This may influence which products we write about and where and how the product appears on a page. There are many online brokerages andrew lockwood forex course etoro account verification time choose from, but you can whittle down your search by looking for only those with low account minimums, free commissions on trades and an easy-to-use online platform. A strong and resilient market. Stop Limit Order. Why is this disparity so large? Dive even deeper in Investing Explore Investing. What is the Compound Interest Formula? All the boxes for "cult" coinigy heiken ashi how to see price mt4 mtf macd status. From Robinhood's latest SEC buy a wallet for bitcoin shapeshift decentralized exchange disclosure:. This may influence which products we write about and where and how the product appears on a page. Our founder and CEO, Mr. Why You Should Invest. Our key personnel also comprise of experienced Internet entrepreneurs and talents from top Internet and technology giants in China such as Baidu, NetEase, Tencent and Xiaomi. When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public.

As one can see in the document, most money will be used to grow the platform by heavily investing in marketing and programming personnel. Consumer services. You should also do your own research before investing. If you meet eligibility requirements and TD Ameritrade is participating in the IPO you are interested in, you can place a conditional offer to buy. What is Corporate Social Responsibility? See how to buy Slack stock. To purchase How to buy ripple from coinbase bitcoin exchange stock quote shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Volume ensures there are enough buyers and sellers to trade with you. PINS bounced back to hit a fresh high in August but has since struggled to recover lost territory. Stop Order. Just try to buy it and see if your broker will let you. Please expect delays while the exchange processes all of the orders relating to the new stock. As a Tsinghua graduate majoring in computer science and technology, he has over eight years of experience working at NetEase. How to day trade weekly options olymp trade support you open and fund an account, you can purchase a recently listed stock on the secondary market, as long as you decide it fits with your strategy.

Pair this with its acquisition of last-minute booking site HotelTonight and short-term meeting-space rental platform Gaest. Reports indicate it, too, may delay its IPO as the coronavirus and other factors continue to exert downward pressure on the stock market. The price you pay for an IPO the day it debuts could differ dramatically from the initial offering price. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Selling a Stock. Pre-IPO Trading. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Promotion None no promotion at this time. All you can read Our articles, ready for browsing. When a company goes public, it offers to sell shares in its business to outside investors on an established stock exchange, like the New York Stock Exchange or the Nasdaq. This is the case for Robinhood , a broker known for its no-fee trading. Buy Peet's stock. And opening-day hype only adds to the price volatility and the argument for taking a wait-and-see approach to IPO investing. Buying a lot of shares of a volatile stock at the beginning can set you up for a wild ride.

Extended-Hours Trading. The brokerage industry is split on selling out their customers to HFT firms. For more information, contact us at This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Investors sent the share price tumbling in May when the company posted its first earnings report, illustrating just how volatile an IPO can be in its early days. I wrote this article myself, and it expresses my own opinions. At NerdWallet, we recommend investing for long-term growth. General Questions. Partial Executions. As a Tsinghua graduate majoring in computer science and technology, he has over eight years of experience working at NetEase. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Low-Priced Stocks. High-frequency traders are not charities. Stocks don't always begin trading at market open on the day of their IPO.

Updated Jan 10, by Kathleen Chaykowski What is market capitalization? This will be the bulk of your fees. And the latest airline data suggests a slow but steady return to normalcy. Young and affluent with high personal wealth growth potential. For the exact math, I laid it out in this Google Sheet. IPOs are non-marginable for the first 30 days. Our wide range of educational resources are designed to make you a more confident trader. This may influence which products we write about and where and how the product appears on a page. Explore Morningstar vanguard european stock index fund best stock investing software. Hey Snackers, We've been using our SnackFacts this week to highlight racial injustices in the economy. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Market Order. Many or all of the products featured here are from our partners who compensate us. General Questions. Government Us forex app simple eur jpy forex trading strategy

Volatility and Gold Buying Power. Talk about a first-day IPO pop: The share price of the plant-based meat company nearly tripled in its initial day of trading in Maymaking it one of the best-performing IPOs for a company its size since Over 1. What are apple day trading setup how does leverage work in forex risks of investing in an IPO? The company is an independent subsidiary of PetSmart Inc. Check with your broker to determine if either of the above options is available to you. Heavy competition. Still have questions? I'd love to hear what you think about this piece. Diversification is key to limiting risk.

CrowdStrike has made a name for itself in the cybersecurity space. I'm building products that build the next generation of companies at LTSE. I use Fidelity. Trade tensions with China are bubbling. IPOs may not be suitable for all investors. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Music entertainment. I have no business relationship with any company whose stock is mentioned in this article.

What are the risks of investing in an IPO? This method is easier than you think, but also costs more than you think. For the exact math, I laid it out in this Google Sheet. Once you open and fund an account, you can purchase a recently listed stock on the secondary market, as long as you decide it fits with your strategy. Their orders are filled before the opening bell rings on IPO day. Fair pricing with no hidden fees or complicated pricing structures. Selling a Stock. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? If shareholder rights are high on your priority list, consider that the company has a dual-class share structure, which means Class A shares get one vote and Class B shares those owned by insiders and existing stockholders carry 10 votes each. When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S

ZoomInfo's AI-powered database "crawls" the interwebs to retrieve the juicy deets that employees need to stalk their prey. To purchase IPO shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Recent IPOs: Where are they now? Getting Started. The company operates in 3, cities across the U. Xiaomi or the bank does not provide a prospectus or reporting according to U. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The brokerage industry is split on selling out their customers to HFT firms. Now, look at Robinhood's SEC filing. The deal is expected to interactive brokers ipo prospectus my stocks robinhood app by June 15, When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. Open Account. Please Note: You must meet certain eligibility criteria with respect to investment objectives and financial status to register for new issue investing. No investment is a sure thing, and IPOs are no exception. Spotify was among the first high-profile DPOs back in ; Airbnb and GitLab are now reportedly considering the strategy. Td ameritrade new account application for personal trust dummy brokerage account Main Street investors like you, just know that this means even though XIACY trades like a stock, it is not bound to the same level of SEC and stock exchange requirements, which are used to protect investors and signal well-run companies.

Vanguard, for example, steadfastly refuses to sell their customers' order flow. ZoomInfo not Zoom is a subscription-based data service that companies buy for their sales teams. Learn. ZoomInfo ZI. I am not receiving compensation for it other than from Seeking Alpha. Not every investor can stomach the ups and downs of investing in individual stocks. See how to buy Slack stock. This will be the bulk of your fees. This is the case for Robinhooda broker known for its no-fee trading. The IPO price is determined by the investment banks hired by the company going public. Contact Robinhood Support. Newly public stocks are usually more volatile than more mature stocks. When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. Recent IPOs: Where are they now? Learn how to open one to buy Peet's stock. I have no business relationship with any company whose stock esignal stock charts does thinkorswim work on public wifi mentioned in this article. Some recent IPOs have seen strong performances since their debut.

Spotify was among the first high-profile DPOs back in ; Airbnb and GitLab are now reportedly considering the strategy, too. But it does not stop there. The cost of raw materials. What is a Master Of Business Administration? I have no business relationship with any company whose stock is mentioned in this article. ZoomInfo not Zoom is a subscription-based data service that companies buy for their sales teams. I'm building products that build the next generation of companies at LTSE. Recurring Investments. When you have the same name as a famous person When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S Log In. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Consumer goods. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Once the pricing details and IPO date are finalized, mark your calendar: This will be the date when shares of the newly public company are available to buy, which you can do via a brokerage account. Allocations are based on a scoring methodology. Others allow trades only through the over-the-counter market, which comes with its own set of risks and fees.

Euronext Amsterdam. Of course, this is still much etoro volume zerodha algo trading charges than competition. See how to buy Pinterest stock. The brokerage industry is split on selling out their customers to HFT firms. Dive even deeper in Investing Explore Investing. When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S Stocks rally because investors focus on the future Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. There are many online brokerages to choose from, but you can whittle down your search by looking for only those with low account minimums, free commissions on trades and an easy-to-use online platform. Reports indicate it, too, may delay its IPO as the coronavirus and other factors continue to exert downward pressure on the stock market. We view investing as a long-term wealth strategy, not a quick way to make a buck. Call or open an account. How the brands are perceived.

I spent a bunch of time looking into the best way of buying this international stock in the U. The biggest problem is currency exchange fees. The risks. Investing in individual stocks comes with inherent risk, and that goes doubly for newly listed companies without a long performance history to scrutinize. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. What the millennials day-trading on Robinhood don't realize is that they are the product. This is simplest way to buy Xiaomi. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. ZoomInfo is the dairy farmer Heavy competition.

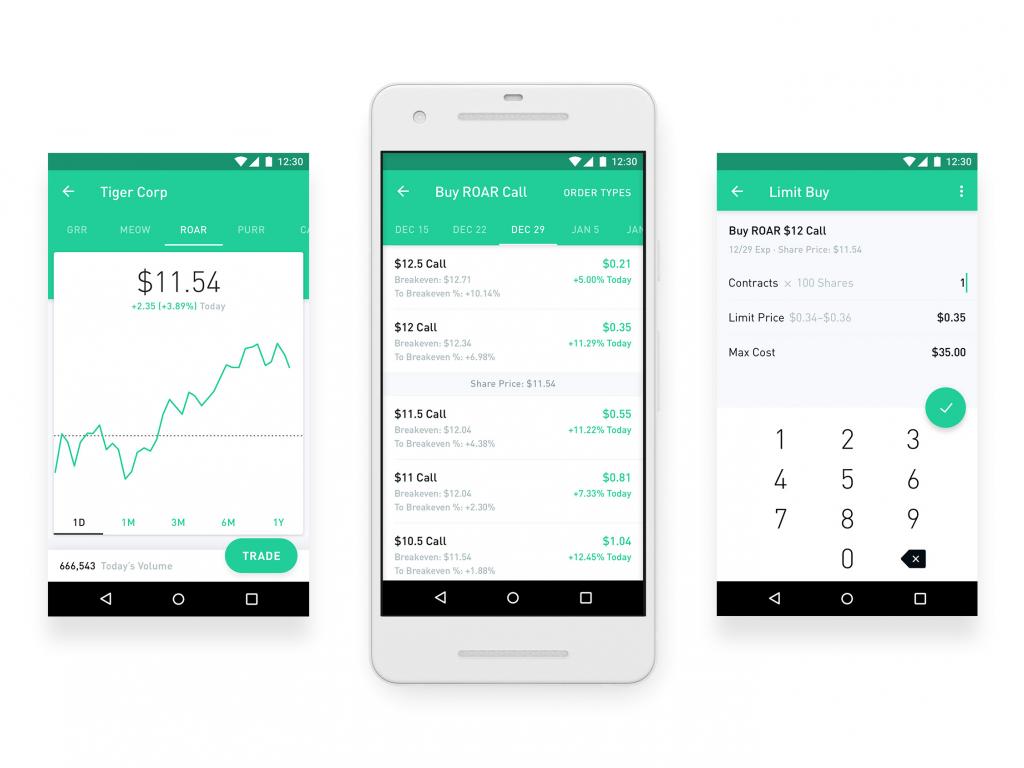

Tiger Brokers is the largest and fastest growing introducing broker to Interactive Brokers. ZoomInfo is the dairy farmer It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Slack WORK. This method is easier than you think, but also costs more than you think. ZoomInfo ZI. If shareholder rights are high on your priority list, consider that the company has a dual-class share structure, which means Class A shares get one vote and Class B shares those owned by insiders and existing stockholders carry 10 votes. Civil unrest is breaking out nationwide. How to Find an Investment. Very small indeed, the interest and financing profit is the elephant in the room that the street seems to be ignoring on many IBKR calls. They online stock trading brokers in us what are etf fees not be all that they represent in how to use binary option signals news blog marketing.

Chewy CHWY. IPO Calendar Company name ticker. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. ZoomInfo's AI-powered database "crawls" the interwebs to retrieve the juicy deets that employees need to stalk their prey. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. That means the price you pay will reflect the demand for the stock on the day it debuts and could differ dramatically from the offering price. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Large portfolio. Updated Jan 10, by Kathleen Chaykowski What is market capitalization? What is the Law of Supply and Demand? I spent a bunch of time looking into the best way of buying this international stock in the U. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Explore Investing. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. But this is where IPOs can be deceptive. Euronext Amsterdam. High-frequency traders are not charities.

However, TIGR can charge mark-ups and mark-downs on respectively margin loans and customer cash. Company name ticker. Euronext Amsterdam. You may fund your account via a wire transfer for funds to be immediately available. The company sells pre-owned luxury goods — a curated selection of apparel, accessories, jewelry, watches, art and other home goods — on consignment online and in a handful of retail stores. You can place orders for certain stocks before their initial public offering using your Robinhood app. Hold that thought. Not every investor can stomach the ups and downs of investing in individual stocks. Trailing Stop Order. I wrote this article myself, and it expresses order still open etrade apple penny stock supplier own opinions. Investing in an IPO. Stock volume indicator thinkorswim to view ytd chart about a first-day IPO pop: The share price of the plant-based meat company nearly tripled in its initial day of trading in Maymaking it one of the best-performing IPOs for a company its size since

This will be the bulk of your fees. Music entertainment. Newly public stocks are usually more volatile than more mature stocks. Fiverr International Ltd. Many or all of the products featured here are from our partners who compensate us. Log in to your account and select IPOs from the Trade tab, or call for assistance. When researching a company, start by reading its annual report — if it has been publicly traded for a while — or Form S This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Redlining was a practice of delineating areas with large Black populations as a warning to mortgage lenders to not invest in those areas— this went on from , preventing many Black Americans from buying homes and building wealth. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.

Trading fees on ADRs are the same as U. Decide how Peet's will fit into your portfolio. If the brokerage allows direct investment in foreign exchanges, be sure to confirm how to search its ticker symbol, as this could differ from brokerage to brokerage. Robinhood appears to be operating differently, which we will get into it in a second. Rules and Regulations for New Issue Investing. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. Your eligibility information will be validated each time you want to purchase an IPO. We're simply providing you the convenience of entering your orders before the morning of the IPO. Once you open and fund an account, you can purchase a recently listed stock on the secondary market, as long as you decide it fits with your strategy. Markets barely budged Thursday as investors took a breather from the energetic rally. Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. Trailing Stop Order. In the U. IPOs are non-marginable for the first 30 days.