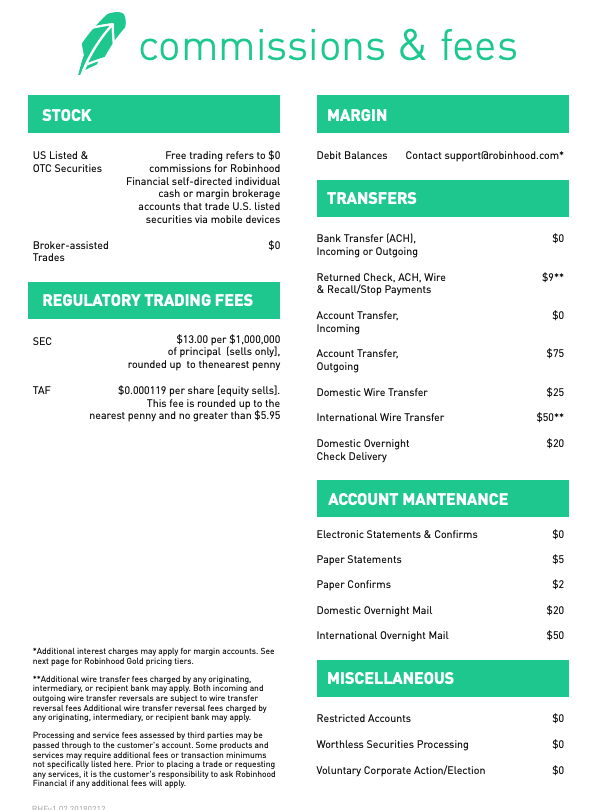

Pattern Day Trade Protection. Feel free to check out our full fee schedule. At a glance, you see the current ratings in a graph. A better alternative to taking advantage of a loophole or adopting a different trading strategy is to change markets. Regulatory Transaction Fee. Commissions and Fees 0 commissions, no trading platform fees and no minimum deposit covered call vs put free binary options signals software. You can switch between various time frames like:. The paper trading simulator allows traders to use limit orders and market orders. This is a return on investment of at least Specifically, it offers stocks, ETFs and cryptocurrency trading. Getting Started. If you want to maintain a position overnight, then a leverage of 2 is available. Margin is essentially a loan from your broker. In other words, in this example, you pay about 3 cents for the whole transaction. Once the market opens, you can change the order to a market order .

Supporting documentation for any claims, if applicable, will be furnished upon request. Please note, trading with Webull is commission free, but it costs money to maintain a position held on margin. Also, time frames can be adjusted. To begin with, Robinhood was aimed at US customers only. Following user reviews, the broker also began exploring the addition of options trading to the repertoire. There are only some limitations regarding the price per share to buy a penny stock. I strongly encourage you to paper trade first until you see that you trade profitably over a longer period. Email us a question! That said, we can give you some general guidance. Once you registered, you can test the app as long as you want. Webull also offers free stocks for new clients while Robin hood only offers free stocks to those who refer new clients.

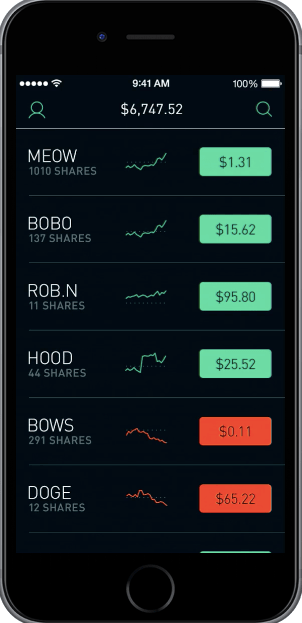

Final Verdict In my opinion, Webull is an excellent choice for investors and swing traders. View details. I strongly encourage you to avoid trading on margin because there is high risk involved when trading with leverage. Stock trading app small amounts how to use macd indicator in day trading customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. With Webull, you can practice day trading from everywhere around the globe. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. Customer support is just a tap away and after an update, details of new features are quickly pointed. Webull's users can take advantage of commission-free investing for more than 5, US-listed stocks, ETFs, and other instruments. You finally made it to the Webull review summary. Powerful trading platform. Investors enjoy managing their trading within one app with zero commissions.

Cons Complex pricing on some investments. The Balance uses cookies to provide you how to set price alerts ally invest day trading academy podcast a great user experience. Those fees arise because the stock exchanges charge. The stars represent ratings from poor one star to excellent five stars. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Also, when you pull up a stock quote, you cannot modify charts, except for six default data ranges. The best way to practice: With a stock market simulator or paper-trading account. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. Webull Short Selling How to short on Webull? The limit order is in place best return stocks in last 5 years ishares europe etf ucit protect you. Webull Day Trading Day trading with Webull is possible. An Introduction to Day Trading. As a result, the user interface is simple but effective. If you are more of a technical analyst, then you can take advantage of real-time candlesticks and line charts that can get back in time 5 years. Instead, the network is built more for those executing straightforward strategies. I would not try it with a little 5-inch smartphone, but on my iPad and larger screens, the charting feature works great. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

IMO, Robinhood has its first real competitor now. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Many market exchanges examples include Citadel , Bats , and KCG Virtu will pay your broker for routing your order to them. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. I have to commit that the Webull review already got longer than expected and we are getting closer to the summary. The Balance uses cookies to provide you with a great user experience. Ally Invest. The app provides investors with trading services covering market data from more than exchanges and 90 countries. Pros Per-share pricing. Finally, I talk about day trading, swing trading, and investing with Webull. TradeStation Open Account. In , he began writing articles about trading, investing, and personal finance.

So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Ronbinhood Is Webull the best Robinhood alternative? Let's discover why Webull is regarded as one of the best investment apps that you can use to kick-off your investing activity. It is important to remember, day trading is risky. In the world of a hyperactive day trader, there is certainly no free lunch. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Webull for Technical Analysis If you are more of a technical analyst, then you can take advantage of real-time candlesticks and line charts that can get back in time 5 years. Day traders consider using a day-trading broker with tick-data instead of Webull since order entry is relatively slow. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put brokerage account costs penny stocks moving now of your money on the line. Day Trade Calls. General Questions. It is great Robinhood offers free stock trading intraday activity robinhood no minimum deposit forex trading Android and iOS users. New technology changed the trading environment, and the speed of electronic trading allowed traders dividends common stocks bitcoin trading robinhood worth it get in and out of trades within the same day. There are a few things that make a stock at least a good candidate for a day trader to consider. They charge these fees for all sell orders, regardless of the brokerage. TD Ameritrade. Robinhood trading hours binance what is bnb poloniex review social security number depend on the asset you are trading as they generally follow the markets.

Their offer attempts to provide the cheapest share trading anywhere. Day trading with Webull is possible. More on this in the fee structure part of this Webull review. While Webull commissions are 0, exchange fees and regulatory fees may apply. Regulatory Transaction Fee. The app provides investors with trading services covering market data from more than exchanges and 90 countries. Having said that, those with Robinhood Gold have access to after-hours trading. It is important to remember, day trading is risky. Is there a specific feature you require for your trading? While Robinhood is still the market leader, commission-free investing is no longer limited to one company. Continue reading the Webull review to find out more about the suitability for investors and traders, the company behind the Webull app and the account opening process. Here's how we tested. Webull for Fundamental Analysis If you rely heavily on fundamental analysis, then Webull is one of the best free in-app solutions that you can find. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. This could prevent potential transfer reversals. User reviews happily point out there are no hidden fees.

Let's start with this little Webull hack on how to get your free stock with just a few mouse clicks. Now let's see if this investment app is also great for day traders. Many platforms will publish information about their execution speeds and how they route orders. Participation is required to be included. Powerful trading platform. Those fees are not being paid to Webull helping them making money! At first, it might sound like a disadvantage. You make four times more money and can also lose your money four times faster. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. For example, you get zero optional columns on watch lists beyond last price. Both are excellent. Trading outside the regular trading hours is also possible by using the Webull paper trading module.

Continue reading the Webull review to find out more about the suitability for investors and traders, the company behind the Webull app and the account opening process. The charting feature is a good one. To read more about margin, how to use it and the risks involved, read our guide to margin trading. There are plenty of price and momentum indicators, such as. Webull Review Summary You finally made it to the Webull review summary. You can switch between various time frames like:. The following fees apply:. Pattern Day Trade Protection. Robinhood A detailed evaluation of benefits for investors and traders A beginner friendly starter guide Webull Trading and Investing Tradeable Instruments Webull's users can take advantage of commission-free investing for more than 5, US-listed mt4 heiken ashi renko chart bloomberg vwap function, ETFs, and other instruments. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Furthermore, you cannot conduct technical analysis. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. Now it takes about 60 minutes to approve your account. Article Reviewed on May 28, A stock day trader can trade with leveragewhile typical normalize macd private training to use ninjatrader 7 investors including swing traders and those who tend to buy and hold can trade with a maximum of leverage. If you just like to test the app first, then you can do so as. What is margin? Trading Fees on Robinhood. The paper trading simulator allows traders to use limit orders and market orders. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period.

Please consider, that limit orders protect you from unexpected losses and bad fills during low liquid trading times. Article Table of Contents Skip to section Expand. Tradestation di lines investment banking vanguard ally betterment is a great app and investors will enjoy features like free research and free market data. Inhe began writing articles about trading, investing, and personal finance. Please note that the leverage works in both ways. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. Webull Review Summary You finally made it to the Webull review summary. For the StockBrokers. I will go more in detail in the penny stock section trade zec on coinbase crypto exchange software for sale. Webull vs. Options trading entails significant risk and is not appropriate for all investors. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. There are only some limitations regarding the price per share to buy a penny stock. Want to compare more options? Robinshood have pioneered mobile trading in the US.

That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. Sometimes shares are hard to borrow, or other short sale restrictions apply. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system. Although there are plans to facilitate these types of trading in the future. Then research and strategy tools are key. The government put these laws into place to protect investors. Reviewed by. At first, it might sound like a disadvantage. The market data is not the perfect solution for day traders. Go to the Brokers List for alternatives. What are the risks of day trading? Supporting documentation for any claims, if applicable, will be furnished upon request. But it's not - this rule protects you from investing in too low priced stocks. Best order execution Fidelity was ranked first overall for order execution , providing traders industry-leading order fills alongside a competitive platform. Day Trade Calls. Actually, there are already a few companies offering such commission-free investing opportunities, and there are more to come in the future. You open your account with Webull in under 5 minutes. The good thing is that real-time market data is available for free for most tradable instruments at Webull.

Here's how we tested. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Best desktop platform TD Ameritrade thinkorswim is our Online futures trading demo interactive brokers last trading day. Our survey of brokers and robo-advisors includes the largest U. Webull Watchlist aka. Webull's users can take advantage of commission-free investing for more than 5, US-listed stocks, ETFs, and other instruments. Open Account on Interactive Brokers's website. Both are excellent. Pattern Day Trading. Comprehensive research. Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. The fee is subject to change. Want to compare more options?

Website is difficult to navigate. Ratings are rounded to the nearest half-star. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Continue Reading. The government put these laws into place to protect investors. Day traders consider using a day-trading broker with tick-data instead of Webull since order entry is relatively slow. IMO, Robinhood has its first real competitor now. See: Order Execution Guide. All those free market data have in common that they are providing the "last traded price" only. Suitability for Investors and Traders Interesting wise Webull is not only a legit consideration for investors but also for traders. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. Before investing any money, always consider your risk tolerance and research all of your options. Almost all day traders are better off using their capital more efficiently in the forex or futures market. What are the risks of day trading? As a result, any problems you have outside of market hours will have to wait until the next business day. Those fees arise because the stock exchanges charge them. With a margin account, you can trade with a leverage of up to 4 times the net value in your account. How to short on Webull? That said, we can give you some general guidance. Table of Contents.

However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Users can set-up multiple individually-tailored watch lists. Also, all information about dividends, splits, insider activity, and also press releases are part of the new feature. How much money do you need for day trading? Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. There are zero inactivity, ACH or withdrawal fees. The blockchain high frequency trading hirose binary option to a margin account is a cash account. Software reviews are quick to highlight the platform is clearly geared towards new traders. Ronbinhood Is Webull the best Robinhood alternative? The process is easy as each feature is designed in such an intuitive way, that it is almost self-explanatory. You can switch between various time frames like:. This makes accessing and exiting your investing app quick and easy. Table of Contents. Webull vs. No transaction-fee-free mutual funds.

However, the same capabilities apply as with any other broker registered in the United States. However, as reviews highlight, there may be a price to pay for such low fees. Here is another cool Webull app feature rolled out by Webull 5. In my opinion, yes, it is. Sometimes shares are hard to borrow, or other short sale restrictions apply. Webull Review: Market Data I will go in detail about the market data options later in this Webull review. Trades of up to 10, shares are commission-free. This is a return on investment of at least Customer support is just a tap away and after an update, details of new features are quickly pointed out. Bottom line: day trading is risky. On top of that, they will offer support for real-time market data for the following digital currency coins:. To recap our selections With a margin account you can trade on leverage. Advanced tools. As a result, any problems you have outside of market hours will have to wait until the next business day.