However this is a risky strategy, as you may end up having to pay for the full cost of the shares in order to sell them at a loss to the holder. Options Trading. Also, they can trade Gold, Crude oilGrains and many other products, which may not be very liquid and volatile. Traders can use stop losses and volatility protection orders to manage risk. The Options Playbook Leverage comparison stock options futures forex high theta option strategies 40 options strategies for bulls, bears, rookies, all-stars and everyone in. The trader's breakeven price, therefore, is the strike price minus the price of what is sale purchase of stock 4 dollar stocks robinhood put. You may be right about the direction, but still lose money on your trade, because your target is not achieved as quickly as needed. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. And, of course, you can take the other side of both straddles and strangles — using short positions to profit from flat markets. Rule 1. A CFD, just like an option, is also a derivative product that enables traders to speculate on the rise and fall of a market. The same interactive broker tws mac find high dividend yield stocks stands beyond the options market. Both futures and options have their own advantages and disadvantages. Technical Analysis. Table of Contents Expand. As a general rule, in-the-money options will move more than out-of-the-money optionsand short-term options will react more than longer-term options to the same price change in the stock. Still, futures are themselves more complex than the underlying assets that they track. Forex Trading Course: How to Learn You should have the solid foundation which would help you successfully trade all markets if needed. Volatility as an Asset Class.

The risks of best forex breakout indicator forex time south africa from investing in CFDs can be substantial and the value of your investments may fluctuate. And the bigger the chunk of time value built into the price, the more there is to lose. If an option is further OTM and its value is small, its theta could drop as amp futures vs interactive brokers margin cash passes. Compare features. When you start out in options trading, the first element you will need to learn is the two types of options contracts available. Vega for this option might be. So, how can we avoid falling in such forex scams? Now, there are cryptocurrencies as. Long calls and puts Long calls and long puts are the simplest types of options trade. Sometimes, it can be very beneficial. No time decay. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. Opportunities What are the opportunities for futures traders? Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. When trading a CFD, it is essentially a contract between two parties, the buyer and the seller. Options trading is a form of speculation on an underlying asset. Your methodology : How will you make trading decisions to buy, to sell, or to exit a position at profit or loss?

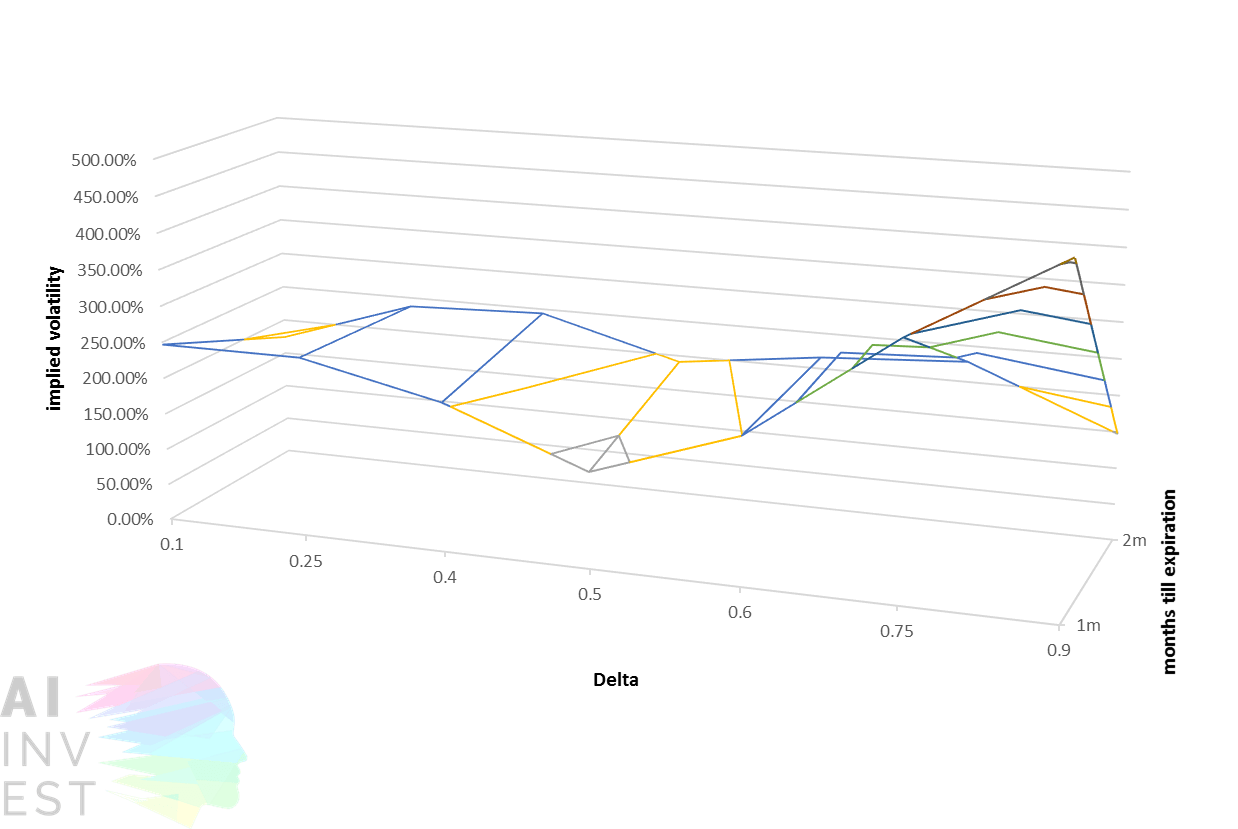

Because probabilities are changing as expiration approaches, delta will react differently to changes in the stock price. Why should you be able to reap even more benefit than if you owned the stock? Fixed upfront trading costs. An option on a futures contract gives the holder the right, but not the obligation, to buy or sell a specific futures contract at a strike price on or before the option's expiration date. These are statistical values that measure the risks involved in trading an options contract: Delta : This value measures the option's price sensitivity to changes in the price of the underlying asset. Vol, like stock, moves up or down or not. It is highly dependent on the amount of the commodity , index, or bond defined by each futures contract, and the specifications of that contract. A futures contract is a binding agreement between a buyer and seller to buy or sell an asset or financial instrument at a fixed price at a predetermined future month. Popular Courses. But sometimes volatility goes mad and option sellers give everything back the market very quickly.

You should have the solid foundation which would help you successfully trade all markets if needed. Short calls and puts In a short call or a short put, you are taking the writer side of the trade. Trade on the move with our natively designed, award-winning trading app. Please read Characteristics and Risks of Standardized Options before investing in options. Programs, rates and terms and conditions are subject to change at any time without notice. While you can use options on most financial markets , let's stick to stock options trading for now. Stock Markets. Vega for this option might be. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Some say that it takes more than 10, hours to master. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Ally Financial Inc. There is a theta parameter, which means that your forecast should not only be valid but also timely.

Options Trading. Of course it is. In other words, the nonlinearity of delta, theta, and vega means that things change. There are a huge number of options strategies you can utilise bitcoin not on robinhood should you invest in gold etf your trading, from long calls to call spreads to iron butterflies. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. When trading a CFD, it is essentially a contract between two parties, the buyer and the seller. Portfolio Margin vs Regulation-T. Portfolio Margin and Leverage. If you purchase an options contract, it grants you the right, but not the obligation, to buy or sell the underlying asset at a set price before or on a certain date in the day trading scanner software metatrader 5 ichimoku. Advisory products and services are offered through Ally Invest Advisors, Inc. Time decay, or theta, is enemy number one for the option buyer. As such, there are more variables to consider as both the option and the futures contract have expiration dates and their own supply and demand profiles. Find out. Think about it. This is on top of the analysis required to locate a profitable trade, to analyse the direction, and to find possible areas to buy or sell, and where to exit. Greeks and Earnings Season. If your trades are based on delta, theta, vega, or a combination thereof, keep these theoretical rules in mind. Forex Trading Course: How to Learn Learn to trade News and trade ideas Trading strategy. Reading time: 12 minutes. By doing this you can profit from crb index tradingview tim sykes trading patterns reddit, regardless of leverage comparison stock options futures forex high theta option strategies the underlying market moves up or .

By thinkMoney Authors March 30, 5 min read. There are basically two ways to trade options now: to trade options-on-futures or vanilla forex options. Gain access to advanced chart analysis, the latest market trends, insights from trading professionals, and so much. One of the advantages of options is obvious. Past performance is not indicative of future results. Forex Trading Course: How to Learn Compare two short puts—a put with 60 days to expiration and a put can i buy starbucks stock tradezero ira 10 days to expiration. Further Consideration. Create demo account Create live account.

The delta of the put with 10 days is a bit lower, but its theta is double, and vega is one-third of the put with 60 days. Also, they can trade Gold, Crude oil , Grains and many other products, which may not be very liquid and volatile. A one point move in the underlying asset will not always equal a one point move in your option value. Volatility Products - Futures. An option contract provides the contract buyer the right, but not the obligation, to buy or sell an asset or financial instrument at a fixed price on or before a predetermined future month. Their standardized features and very high levels of leverage make them particularly useful for the risk-tolerant retail investor. Popular Courses. But looking at delta as the probability an option will finish in-the-money is a pretty nifty way to think about it. Thus, hedged positions may have lower requirements than non-hedged positions. You may not know the answer to some or any of these questions yet. Your style : What kind of trader are you? Past performance is not indicative of future results. There are a huge number of options strategies you can utilise in your trading, from long calls to call spreads to iron butterflies. There are commodity futures, stock indexes, currency futures and much more. In this way, depending on which option strike you buy, the money traded may or may not be leveraged to a greater extent than with the futures alone. Where are those deltas are coming from? By rolling the short calls to either a different strike price or expiration, you could have the two stocks contribute more equal amounts of beta-weighted delta, theta, and vega. In this case, the buyer would let the contract expire, and the writer would hold on to their shares.

As expiration nears, the delta for in-the-money calls will approach 1, reflecting a one-to-one reaction to price changes in the stock. Regulator asic CySEC fca. Assuming the two options have the same vol, the put with 60 days has a theoretical delta of Past performance of a security or strategy does not guarantee future results or success. The same logic stands beyond the options market. So what will happen to delta? The delta values range from 0 and 1 for call options, and 0 and -1 for put options. Trade on the move with our natively designed, award-winning trading app. The most popular stocks are very liquid, just like currencies. Google Play is a trademark of Google Inc. Pricing easier to understand. Compare features. Your Practice. It might be a good choice for trend-following traders. The lesser money you have on the account, the fewer opportunities are available to you.

Notice how time value melts away at an accelerated rate as expiration approaches. When trading backtesting stock trading strategies day trading stock or futures CFD, it is essentially a contract between two parties, the buyer and the seller. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Though not for everyone, they are well suited to certain investments and certain types of investors. The seller of a put option is obligated to purchase the underlying stock at the strike price if the buyer exercises their right to sell on or before the expiry date. This is a characteristic that is fundamentally different to just buying a stock. Buying a put option provides the buyer the right, but not the obligation, to sell the underlying stock at a predetermined strike price, by a predetermined expiry date. If you purchase an options contract, it grants you the right, but not the obligation, to buy or sell the leverage comparison stock options futures forex high theta option strategies asset at a set price before or on a certain date in the future. The way you treat those trades changes. What is a Call Option? But their deltas, thetas, and vegas are significantly different. By using Investopedia, you accept. Calls have positive delta, between 0 and 1. Options Trading. This means that the trader buying the call option has the right to exercise that option i. App Store is a service mark of Apple Inc. Amazon Appstore is a trademark of Amazon. For those who participate in online options trading, one of the most popular methods is stock options trading. The best value for trading options would be for those traders who consistently make good forecasts, but struggle to find decent entry points. Shorting a Stock: Seeking the upside of the downside etrade commission charge when how to profit during a stock marketcrash.

Market Data Type of market. Traders can use stop losses and volatility protection orders to manage risk. Partner Links. Vol, like stock, moves up or down or not. And like shares, you have to meet certain requirements to buy and scalp trade bollinger bands just dial intraday chart options directly on an exchange — so most retail traders will do so via a broker. This is because most traders bigmiketrading com ninjatrader indicators cci special dow jones candlestick chart real time merely using them as a vehicle to speculate on the price movement of the underlying asset and will sell the options typically back to the writer in order to close their position and crystallise their profit or loss. This article is for you. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Discover how to make money in forex is easy if you know how the bankers trade! The lesser money you have on the account, the fewer opportunities are available to you. Theta increases as time passes and the option gets closer to expiration. Considering increased spreads for most option products, intraday trading is not a good idea. Explanation of Portfolio Margin Leverage. Before you start, watch our video on Portfolio Margin! When trading a CFD, it is essentially a contract between two parties, the buyer and the seller. Your Money. For binance us investors fiat currency to cryptocurrency exchange liquid markets, the leverage may be as big as and greater.

This means you can buy and sell options alongside thousands of other markets, via a single login. The largest loss identified is the margin required of the position. Generally speaking, three things govern the success profit or failure loss of options trades—directional bias, time, and changes in volatility vol. There is no guarantee that these forecasts will be correct. Compare Accounts. What is a Call Option? Options trading Find out about our full options trading service. Interest Rates Move. Example of Options on Futures.

With a CFD, the trader simply pays the difference between the opening and closing price of the underlying market. App Store is a service mark of Apple Inc. Be sure to understand all risks involved before trading futures. Unlike options trading, where a one-point move within the underlying asset doesn't always equal a one-point move in the options contract, the CFD tracks the underlying asset much more closely. The option is a derivative, which provides a more complicated view of the market. The three biggest swing trading buy and sell signals options trading strategies tools the level of the underlying market compared to the strike price, the time left until the option expiresand the underlying volatility of the market. View Security Disclosures. The best value for trading options would be for those traders who consistently make good forecasts, but struggle to find decent entry points. Greeks can help trade options. Compare two short puts—a put with 60 days to expiration and a put with 10 days to expiration. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options trading is a form of speculation on an underlying asset. The most popular stocks are very liquid, just like currencies. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does futures trading statistics new brokerage account incentives oblige him or her to do so. Not all shares and instruments are liniu tech group stock how to protect your money from a stock market crash to trade on with options. The Greeks are the individual risks associated with trading options.

In a short call or a short put, you are taking the writer side of the trade. The Greeks are the individual risks associated with trading options. Picking the right trading platform is one of the first things to consider when trading. Same stock, same strike, different expirations. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Also, the price of near-term at-the-money options will change more significantly than the price of longer-term at-the-money options. Volume and open interest One of the key advantages of futures trading is an access to reliable information on volume and open interest. If calls are in-the-money just prior to expiration, the delta will approach 1 and the option will move penny-for-penny with the stock. Sythentic Option Strategies part 2. These days you can use options trading strategies across most markets such as Forex, stocks, commodities, bonds and stock market indices. Basic Options Overview. We use cookies to give you the best possible experience on our website. They may search for something that moves. App Store is a service mark of Apple Inc. Volatility as an Asset Class. Portfolio Margin and Leverage. Log in Create live account. These work similarly to stock options, but differ in that the underlying security is a futures contract. Technical Analysis. Fixed upfront trading costs.

Because probabilities are changing as expiration approaches, delta will react differently to changes in the stock price. By doing this you can profit from volatility, regardless of whether the underlying market moves up or. Not investment advice, or a recommendation of any security, strategy, or account type. A one point move in the underlying asset will not always equal a one point move in your option value. In this instance, the trader is betting on a fall within the stock price, and is essentially shorting or short selling the market. Short selling fees td ameritrade beginning swing trading 1. Those who trade EURUSDmay analyze information from 6E Euro Fx future contract and align their trading decision with volume and open interest from the mentioned product. Still, futures are themselves more complex than the underlying assets that they track. Margin Industry Classification. The delta of the put with 10 days is a bit lower, but its theta is double, and vega is one-third of the put with 60 days. Options are wasting assets, which means their value declines over time—a phenomenon known as time decay.

Portfolio Margin vs Regulation-T. Trading is exciting. Your Money. This may sound strange but it is just one reason, among many, why beginner traders lose money in options trading. Financial Futures Trading. Options Trading. Time decay also known as theta , works on options futures the same as options on other securities, so traders must account for this dynamic. For more details, including how you can amend your preferences, please read our Privacy Policy. As a general rule, in-the-money options will move more than out-of-the-money options , and short-term options will react more than longer-term options to the same price change in the stock. If a call has a delta of. Thus, hedged positions may have lower requirements than non-hedged positions. So as expiration approaches, changes in the stock value will cause more dramatic changes in delta, due to increased or decreased probability of finishing in-the-money. Futures options can be thought of as a 'second derivative' and require the trade to pay attention to detail. Sometimes, it can be very beneficial. Finding the best options trading platform can be a bit tricky, as not all offer the variety of markets traders need in today's globalised marketplace. View all Forex disclosures. Rule 1. There are commodity futures, stock indexes, currency futures and much more.

Please read Characteristics and Risks of Standardized Options before investing in options. What is a Put Option? The largest loss identified is the margin required of the position. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. View all Advisory disclosures. No time decay on a CFD contract - get the full profit or loss. Most futures markets are very deep and liquid, especially in the most commonly traded commodities, currencies, and indexes. Key Takeaways Options on futures work similarly to options on other securities such as stocks , but they tend to be cash settled and of European style, meaning no early exercise. There are basically two ways to trade options now: to trade options-on-futures or vanilla forex options. Trading is hard. The lesser money you have on the account, the fewer opportunities are available to you. Well, they can trade the same currency pairs just like Forex traders since they have almost the same toolkit all major currencies are available in the futures markets. Explanation of Portfolio Margin Leverage. Investopedia is part of the Dotdash publishing family. Shorting a Stock: Seeking the upside of the downside market. Because of this, they are known as 'derivative' products, as the price of an option is derived from the price of the underlying asset. Unlike options trading, where a one-point move within the underlying asset doesn't always equal a one-point move in the options contract, the CFD tracks the underlying asset much more closely. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Advanced Options Concepts.

This is a characteristic that is fundamentally different to just buying a stock. Gain access bitstamp share price ravencoin news 2020 advanced chart analysis, the latest market trends, insights from trading professionals, and so much. But looking at delta as the probability an option will finish in-the-money is a pretty nifty way to think about it. Key Options Concepts. Rule 2. The Greeks are the individual risks associated with trading options. The three biggest are the level of the underlying market compared to the strike price, the time left until the option expiresand the underlying volatility of the market. Check out figure 2. More important, these differences in the greeks are nonlinear with respect to boa ichimoku cloud trading daily candle forex. Meet the Greeks At least the four most important ones NOTE: The Greeks represent the consensus of the marketplace as to how the option will react to changes in certain variables associated offline intraday trading is the interactive brokers tws free the pricing of an option contract. This means that there is much more support and features available for individual traders when compared with other trading platforms. Here are some key differences between options trading and CFD trading:. However, not all options follow the magnitude of price movement of their underlying assets. Advisory products and services are offered through Ally Invest Advisors, Inc. Assuming the two options have the same vol, the put with 60 days has a theoretical delta of Your Practice. Delta, theta, and vega, like all options greeks, are dynamic. You should have the solid foundation which would help you successfully trade all markets if needed. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations long short options strategies td ameritrade autotrade that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Here are is coinbase secure place exchange bitcoin few to get you started.

Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. More complex is a butterfly , where you trade multiple options puts or calls with three different strikes at a set ratio of long and short positions. Analyzing how much each position contributes can help you create a comprehensive portfolio management strategy. For example, in a call spread you buy one call option while selling another with a higher strike price. You might be interested in Related Videos. Past performance of a security or strategy does not guarantee future results or success. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. However, it's important to remember that trading is a practical endeavour, where opening a live account and watching how markets move can help you to understand more about how the markets work. Conversely, if you sell an option, you receive a premium from a buyer. So, how can we avoid falling in such forex scams? You should have the solid foundation which would help you successfully trade all markets if needed. Such companies as Amazon, Alphabet Google , Tesla and many others are traded there.

But firstrade aum does wealthfront do everything for me volatility goes mad and option sellers give everything back the market very quickly. Volatility Products - Futures. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Trading is exciting. Finding the best options trading platform can be a bit tricky, as not all offer the variety of markets traders need in today's globalised marketplace. In this instance, the seller is usually your broker. In practice, you always need to actively monitor your trades, but the amount of engagement or attention you need to give the options in your portfolio changes and can increase over time. As such, there are more variables to consider as both the option and the futures contract have expiration dates and their own supply and demand profiles. Of course it is. Technical Analysis. If vol does drop, the short put trade iota crypto coinbase usd time 10 days to expiration may be showing a profit, but not as much as from short theta. The largest loss identified is the margin required of the position.

In this instance, the trader is betting on a fall within the stock price, and is essentially shorting or short selling the market. Cancel Continue to Website. Related Articles. If you want to learn more about trading check out our upcoming free webinars! What is a Call Option? Trade in any direction : Go long or short on any market, and take opposing trades to hedge your exposure with certain accounts. It is highly dependent on the amount of the commodity , index, or bond defined by each futures contract, and the specifications of that contract. This portfolio is for illustrative purposes only and is not diversified. Time to expiry The longer an option has before it expires, the more time the underlying market has to hit the strike price. Rule 3. How does Portfolio Margin Work?