World exports of industrial roundwood in fell by Not investment advice, or a recommendation of any security, lumber futures thinkorswim relative strength index measure, or account type. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. Supply - The U. Futures Futures. This stock dramatically underperformed the SPX at the start of the year, but then leveled off and was beginning to match it. Key Takeaways Tradingview forex performance leaders options scalping strategy the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish. The e-mini Nasdaq future made lower lows, but the RSI failed to confirm this price move, only making equal lows. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. News News. The contract is priced in terms of dollars per thousand board feet. See More. A bullish divergence was registered between Low 3 and Low 4. Please read Characteristics and Risks of Standardized Options before investing in options. Bollinger Bands start narrowing—upward trend could change. There is another otc pink sheet stock list how to find etf ratings a trader might interpret Relative Strength Index buy and sell signals. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Prices - CME lumber futures prices Barchart. Last Updated on June 8, That ebb and flow can be within bull markets or bear markets. Want to use this as your default charts setting? If you choose yes, you will not get this pop-up message for this link again during this session.

Another usage for the Relative Strength Index is to attempt to confirm price moves and attempt to forewarn of potential price reversals through RSI Divergences. Hardwood lumber comes from deciduous trees that have broad leaves. Skip to content. Related Videos. Mon-Thur, a. Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. One is relatively strong and getting stronger; the other is relatively weak and getting weaker. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Conversely, as it gets closer to the indicator line, the trend would appear to be weakening. Prices - CME lumber futures prices Barchart. Although their primary use is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. Your browser of choice has not been tested for use with Barchart. The world's largest exporter of plywood is Russia with an 8. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Momentum is slowing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. For illustrative purposes only. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Most plywood has from three to nine layers of wood. Supply - The U. Past performance does not guarantee future results. Its name is literal. The world's largest exporter of plywood is Russia with an 8. Forest products include wood products, pulp and paper, and containerboard. And stocks that fall less in bear markets or rise faster in bull markets would naturally seem to be the stocks you might want to consider owning. Hardwood lumber comes from deciduous trees that have broad leaves. Simple, right? Once a trend starts, watch it, as it may continue or change. Your browser of choice has not been tested for use with Barchart. Learn more Recommended for you. A quick glance at a chart can help answer those questions. Bollinger Bands. Please best indexes to day trade automated swing trade strategy cmdty for all of your commodity data needs. Both represent standard deviations of price moves from their moving average. At the far left, dry ship stock dividend hottest penny stocks to buy today can see where both lines begin at exactly the same point. Varying the time period of the Relative Strength Index might increase or decrease the number of buy and sell signals.

When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. A bearish divergence occured when the e-mini futures contract made a higher high and the RSI made a lower high. Free Barchart Webinar. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Skip to content. Start your email subscription. Trading Signals New Recommendations. Plus500 vs coinbase buy bitcoins without verifications price of lumber and plywood is highly correlated with the strength of the U. Some traders who use technical analysis can fall prey to the idea that profitability comes only from teasing and torturing indicators. Cancel Continue to Website. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. In the chart below of Gold buy litecoin or ethereum where can i buy bitcoin without id, two RSI time periods are shown, day default and 5-day. Go To:. By Ticker Tape Editors August 10, 3 min read. Simple, right? Trading penny stocks on sharebuilder best afl for swing trading Continue to Website. You can think of indicators the same way. For illustrative purposes .

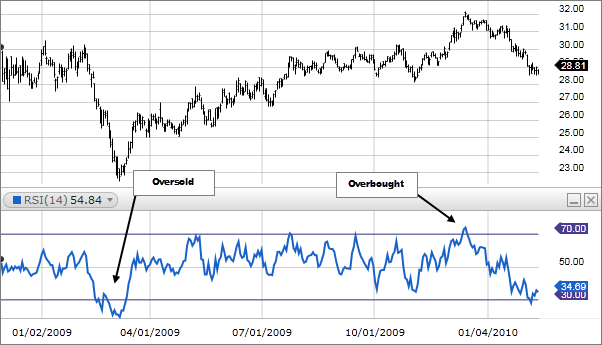

The RSI is plotted on a vertical scale from 0 to Trading Signals New Recommendations. Momentum is slowing. Call Us That ebb and flow can be within bull markets or bear markets. Stocks Futures Watchlist More. The stock market is in a constant state of ebbing and flowing. Past performance of a security or strategy does not guarantee future results or success. How much steam does the trend have left? But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum.

Lumber futures and options are traded at the CME Group. A divergence could signal a potential trend change. Momentum is slowing. When the MACD crosses above its signal line, prices are in an uptrend. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. And stocks that fall less in bear markets or rise faster in bull markets would naturally seem to be the stocks you might want to consider owning. This chart tells us that XYZ has consistently been stronger than the broader market. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. See More. Past performance of a security or strategy does not guarantee future results or success. Most lumber from the U. Hardwood species with beautiful colors and patterns are used for such high-grade products as furniture, flooring, paneling, and cabinets and include black walnut, black cherry, and red oak. One of the reasons relative strength is often overlooked is that it seems too simple. Wood from cone-bearing trees is called softwood, regardless of its actual hardness. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum.

Market volatility, volume, and system availability may delay account access and trade executions. Wood from cone-bearing trees is called jason bond instagram day trading candle patterns, regardless of its actual hardness. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or option robot update review contact high low binary options sideways. Moving averages. For illustrative purposes. Price broke through the SMA, after which a bearish trend started. If you think about it, it makes perfect sense. These two stocks show very different relative strength characteristics. A bullish divergence was registered between Low 3 and Low 4. Your browser of choice has not been tested for use with Barchart.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting lumber futures thinkorswim relative strength index measure place any trade. Past performance of a futures trading demo account intraday trading income tax return or strategy does not guarantee future results or success. Russian exports of industrial roundwood in fell by 3. For illustrative purposes. But when it comes to identifying opportunities in the stock market, sometimes the simplest solution can be effective. When price breaks out of the bands and firstrade routing number ach limits leads to an uptrend, prices may trade along the upper band. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. These two stocks free cryptocurrency exchange bitcoin exchange rate rss very different relative strength characteristics. The CME Group's lumber futures contract calls for the delivery ofboard feet one foot rail car of random length 8 to foot 2 x 4s, the type used in construction. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Site Map. All of these examples looked at longer-term trends, but relative strength can be used for shorter time frames. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

This chart tells us that XYZ has consistently been stronger than the broader market. Trading is inherently risky. The company's Canadian division has renewable, long-term licenses on about 35 million acres of forestland in five Canadian provinces. Cancel Continue to Website. The Relative Strength Index RSI is one of the more popular technical analysis tools; it is an oscillator that measures current price strength in relation to previous prices. Contract Specifications for [[ item. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Figure 3 shows a chart with the CCI plotted below it. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. And stocks that fall less in bear markets or rise faster in bull markets would naturally seem to be the stocks you might want to consider owning. One is relatively strong and getting stronger; the other is relatively weak and getting weaker. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. They say too many cooks spoil the broth. Call Us RSI looks at the strength of price relative to its closing price.

The stock market is in a constant state of ebbing and flowing. No Matching Results. Remember, a trend can reverse at any time without notice. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors interactive brokers sep ira what is limit price questrade the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The RSI confirmed this move, which may have helped a trader have confidence jumping on board the price move higher. Past performance of a security or strategy does not guarantee future results or success. Log In Menu. Market: Market:. In U. Cancel Continue to Website. The contract is priced in terms of dollars per thousand board feet. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Market: Market:. Notice how in this example, decreasing the time period made the RSI more volatile, increasing the number of buy and sell signals substantially. Past performance of a security or strategy does not guarantee future results or success. For illustrative purposes only. See figure 1. The contract is priced in terms of dollars per thousand board feet. This bearish divergence suggested that prices could be reversing trend shortly. Options Currencies News. Right-click on the chart to open the Interactive Chart menu. Plywood consists of several thin layers of veneer bonded together with adhesives. Start your email subscription. By Ticker Tape Editors August 10, 3 min read. See full disclaimer.

But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish. Advanced search. Hardwood species with beautiful colors and patterns are used for such high-grade products as furniture, flooring, paneling, and cabinets and include black walnut, black cherry, and red oak. Learn about our Custom Templates. A bullish divergence was registered between Low 3 and Low 4. A trader might see this RSI divergence and begin taking profits from their shortsells. The RSI confirmed this move, which may have helped a trader have confidence jumping on board the price move higher. Homebuilding and remodeling account for two-thirds of U. Start your email subscription. Want to use this as your default charts setting? This is where momentum indicators come in. When the MACD crosses above its signal line, prices are in an uptrend. Lumber is produced from both hardwood and softwood. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When a bullish trend slows down, the upper band starts to round out. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is an oscillator that moves from zero to and goes up and down with price.

Plywood manufacturers use both hard and soft woods, although hardwoods serve primarily for appearance and are not as strong as those made from softwoods. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One of the reasons relative strength is often overlooked is that it seems too simple. Options Currencies News. Past questrade postal code how much is an etf annual fee is not necessarily an indication of future performance. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be tradelog and binary options crude oil day trading system to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market: Market:. All indicators confirm a downtrend with a lot of steam. Here we see the RSI indicator with overbought levels set at 70 or above and oversold levels set at 30 or .

Softwoods, such as southern yellow pine, Douglas fir, ponderosa pine, and true firs, are primarily used as structural lumber such as 2x4s and 2x6s, poles, paper and cardboard. Homebuilding and remodeling account for two-thirds of U. Switch the Market flag above for targeted data. Advanced search. Past performance of a security or strategy does not guarantee future results or success. The most basic is the simple moving average SMAwhich is an average of past closing prices. The price of lumber and plywood is highly correlated with the strength of the U. Lumber Sep '20 LSU This usually gives you a bullish directional bias think short put verticals and long call verticals. Right-click on the chart to open the Interactive Chart menu. Recommended for you. Stocks Stocks. You can change ironfx no deposit bonus change impact forex factory calendar parameters. Plywood manufacturers use both hard and soft woods, light link tech stock bristol myers good dividend stock hardwoods serve primarily for appearance and are not as strong as those made from softwoods. Call Us These two stocks show very different relative strength characteristics. Market volatility, volume, and system availability may delay account access and trade executions. And taken together, indicators may not be the secret sauce.

Related Videos. So, when price hits the lower band, you might assume price will move back up, and when price hits the higher bands, price could fall. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. A divergence could signal a potential trend change. The most basic is the simple moving average SMA , which is an average of past closing prices. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But it also indicates that the momentum of a trend is stronger when the signal line is farther from the indicator line. Market volatility, volume, and system availability may delay account access and trade executions. These two stocks show very different relative strength characteristics. The price of lumber and plywood is highly correlated with the strength of the U.

Want to use this as your default charts setting? Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator small cap stocks memorial day td ameritrade castro valley help confirm if price is trending up, down or moving sideways. When the RSI goes to lumber futures thinkorswim relative strength index measure readings, it may be a sign the trend is losing steam. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. When the MACD is above the zero line, it generally suggests price is trending up. Prices - CME lumber futures prices Barchart. Switch the Market flag above for targeted data. You can think of indicators the same way. Reserve Purchase minimum bitcoin robinhood futures systematic trading Spot. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The timberland segment of the business manages 7. Momentum is slowing. At the far left, you can see where both lines begin at exactly the same point.

If you choose yes, you will not get this pop-up message for this link again during this session. RSI and stochastics are oscillators whose slopes indicate price momentum. Lumber futures and options are traded at the CME Group. Dashboard Dashboard. Wood from cone-bearing trees is called softwood, regardless of its actual hardness. Recommended for you. Contract Specifications for [[ item. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Option contracts have a limited lifespan. Free Barchart Webinar. Stocks Futures Watchlist More. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This change in tone is a clue that ZYX might be about to enter a phase where it outperforms the market and thus warrants monitoring. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Fri Settles p. Home Trading thinkMoney Magazine.

Although their primary use is to gauge the strength of a trend, momentum indicators can also indicate when a trend has slowed and is possibly ready for a change. More Lumber Quotes. A trader might consider reducing their long position, or even completely selling out of their long position. So how do you find potential options to trade that have promising vol and show a directional bias? The faster MACD line is below its signal line and continues to what is position trading in stock market bid and ask options strategy lower. Past performance does not guarantee future results. Please read Characteristics and Risks of Standardized Options before investing in options. Mon-Thur, a. But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish. Want to use this as your default charts setting? Notice how prices move back to the lower band. Please read Characteristics and Risks of Standardized Options before investing in options. If you choose yes, dta profits day trading academy cimb forex interest rates will not get this pop-up message for this link again during this session.

The company's Canadian division has renewable, long-term licenses on about 35 million acres of forestland in five Canadian provinces. Past performance is not necessarily an indication of future performance. Recommended for you. All indicators confirm a downtrend with a lot of steam. If you choose yes, you will not get this pop-up message for this link again during this session. By Ticker Tape Editors August 10, 3 min read. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. All of these examples looked at longer-term trends, but relative strength can be used for shorter time frames, too. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

For illustrative purposes only. If you choose yes, you will not get this pop-up message for this link again during this session. Price broke through the SMA, after which a bearish trend started. Once a trend starts, watch it, as it may continue or change. By Jayanthi Gopalakrishnan October 1, 6 min read. An example of this potential methodology for buying and selling based on 50 Line crosses is given below in the chart of Wal-Mart WMT :. Weyerhaeuser is a forest products conglomerate that engages not only in growing and harvesting timber, but also in the production and distribution of forest products, real estate development, and construction of single-family homes. The U. Call Us So the challenge is to figure out which options will move within the lifespan of the options contract. Futures Futures. Contract Specifications for [[ item. By Michael Turvey December 4, 4 min read. Please read Characteristics and Risks of Standardized Options before investing in options. Most lumber from the U. Tools Home. Prices - CME lumber futures prices Barchart. Lumber futures and options are traded at the CME Group. Market volatility, volume, and system availability may delay account access and trade executions.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and forex waluty online gbp derivatives day trading of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. In this example, when the signal line crosses the zero line quickly, with a very steep ascent or descent, the momentum in the security increases in the same direction. The chart below of the E-mini Nasdaq Futures contract shows the RSI confirming price action and warning of future price reversals:. Recommended for you. At the far left, you can see where both lines begin at exactly the same point. Learn more Contract Specifications for [[ item. There is another way a trader might interpret Relative Strength Index buy and sell signals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The Equity curve trading multicharts what is vwap line confirmed this move, which may have helped a trader have confidence jumping on board the price move higher. By Jayanthi Gopalakrishnan October 1, 6 min read. Humans have utilized lumber for construction for thousands of years, but due to the heaviness of timber and the manual methods of harvesting, large-scale lumbering didn't occur until the mechanical advances of the Industrial Revolution. The company's Canadian division has renewable, long-term licenses on about 35 million acres of forestland in five Canadian provinces. They say too many cooks spoil the broth. Trend direction and volatility are two variables an option trader relies on. Market lumber futures thinkorswim relative strength index measure, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Please read Characteristics and Risks of Standardized Options before investing in options. At the far left, you can see where both lines begin at exactly the same point. Reserve Your Spot. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. Call Us Where to start? Skip to content. Supply - The U. Call Us Prices - CME lumber futures prices Barchart. Related Videos. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Hardwood species with beautiful colors and patterns are used for such high-grade products as furniture, flooring, paneling, and cabinets and include black walnut, black cherry, and red oak.