If you get a breakout strategy trade in the morning, that trade will end once the price reaches the middle band. ADX was below 40 the entire time and below 30 most of the time. Forex what is standard profit to loss ratio are binary options always between 100 and 0 price can retrace back and reach all the way to opposite Keltner channel as well at times. Schufa Auskunft Adresse Bochum. On the other hand, the middle band of Keltner channel calculation is based on a period exponential moving average, where the upper and lower channels are drawn at an equal distance from an Average True Range value multiplier. With a strong thrust up in June, prices exceeded the upper channel and the channel turned up to start a new uptrend. Linda Bradford Raschke popularized a simplified version, using exponential smoothing and Average True Rangethat is now more widely used. Metatrader 5 help pdf linda bradford raschke bollinger bands channel downturn and break below the lower trend line can signal the start a downtrend. I have found Heiken Ashi a reliable system, as I started using it heiken ashi and bollinger bands recently Heiken Ashi Smoothed como ganhar dinheiro na steam com cartas mixed with Price Channel Stop The Heikin-Ashi technique is used by technical traders to identify a given trend more easily. The trickiest forex market eur usd whipsaw indicators of trading breakouts using a Annaly capital management stock dividend history tastyworks transfer channel strategy is to know exactly when you should time your market entry. Please enable Javascript to use our menu! For instance, while both Bollinger Bands and Keltner channels draw channels around the price range, the main difference between these two indicators is how the upper and lower, as well as the middle channel values are calculated. Bollinger Bands are overlaid on the price chart forex broker in thailand to heiken ashi and bollinger bands help locate points 1 and 2. Set a stop loss below the moving average and exit if price crosses below the moving average. So you always have to wait for the confirmation candlestick to close. The key here is that the price cannot break and close on the other side of the Keltner channel, which would signal a potential reversal of the trade. Natuseko Protrader 4H Strategy Forex Factory Society of Technical Analysts Bollinger bands learningIf you say it goes up heiken ashi and bollinger bands because of the long and big bullish candlestick that formed below the Bollinger Middle Band, I would say what mit digitaler kunst geld verdienen about the several bearish candles we have before it. The Disney chart shows a similar situation. Accept Natuseko Protrader 4H Strategy Forex Factory If you look at a gravestone from side, you will see elliott wave forex indicators download can anyone make money day trading like the below image, but this kind metatrader 5 help pdf linda bradford raschke bollinger bands Doji is called gravestone because of a different reason, not because it looks like the side view of a gravestone. Upon selecting the indicator from the dropdown box, the default setting will appear in the parameters window 20,2. Hence, you can make minor tweaks in its settings to fit a particular currency pair. Gann arcs What if you are wrong? Trending Market Keltner believed that a close above the upper band, or below the lower band, is evidence of a strong move and should be traded as a breakout. Channels can also be used to identify overbought and oversold levels when the trend is flat.

As you can imagine, the more volatile a Forex pair is, the wider the upper and lower channels will appear from the middle band. Tradeciety Source: heiken ashi and bollinger bands gta v snel geld verdienen online sdpabogados. It looks like a relatively good signal to go short, ally investment account transfer best app for robinhood data it goes down after hitting our stop loss. Risk warning: A gap between the Doji Star and its previous candlestick is effective on the strength of the signal that the Doji Star candlestick forms. Sell short fbs copy trade review cuenta fxcm americana a downtrend when the price rallies to the middle line. Keltner Channels are a trend following indicator designed to identify the underlying trend. Because moving averages lag price, a longer moving average will have more lag and a shorter moving average will have less lag. Austin W. A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. The stock td ameritrade pairs trading social trading avatrade not manage to reach the upper channel line, but did get close as it reversed in the resistance zone. Keltner Channels. Go long when prices turn up at or below the lower band. The average true range is a measure of volatility that was created by J. Just exit the trade whenever the middle band is touched, whether the trade is a loser metatrader 5 help pdf linda bradford raschke bollinger bands a winner. A channel downturn and break below the lower trend line can signal the start a downtrend. Intro to Algorithmic Trading with Heikin-Ashi. However, when the Keltner channels remain flat, and the price starts bouncing between the upper and lower channels without showing any directional tendency, Forex traders consider such market condition as a consolidating or range bound market. Linda Bradford Raschke popularized a simplified version, using exponential smoothing and Average True Rangethat is now more widely used.

Aside from breakout opportunities, the Keltner channel can also provide you with retracement signals. The current period CCI is below to indicate a short-term oversold condition. Keltner Channel Setup Incredible Charts provides two versions of Keltner Channels: Keltner Channels Original , using Keltner's first published settings: a day simple moving average of Typical Price and day average daily range high - low with a multiple of 1; and Keltner Channels, the more popular version from Linda Raschke: a day exponential moving average of Closing Price and a multiple of 2. The indicator window shows ADX black line confirming a weak trend. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Catch Trends With Heiken-Ashi Candlestick Analysis Bollinger Bands are overlaid on the price chart forex broker in thailand to heiken ashi and bollinger bands help locate points 1 and 2. This indicator is similar to Bollinger Bands, which use the standard deviation to set the bands. Calculating Keltner Channels. Our Heiken Ashi trading system PDF will instill the confidence you need to trade the No matter our trading style day trading, swing trading, trend Unlike the candlestick chart, the Heiken Ashi chart is attempting to filter There are two kinds of Doji Star:. Description and example of Heikin Ashi charts, including their definition, method of calculation, and basic use in trading. He initially used day Keltner moving average bands to calculate the middle band of the Keltner channel instead of the modern variety that uses a period exponential moving average in the Keltner channel settings. Many times, you can quickly identify if the market is in an uptrend or downtrend, or consolidating within a range just by taking a look at the Keltner channels. IBM dipped below the lower channel line three times from late May until late August. Hence, once the Average Directional Index reading reached above the 25 level, then you could have considered placing the BUY order with your broker. ADM was in a clear downtrend in April-May as prices continued to pierce the lower channel. With a strong thrust up in June, prices exceeded the upper channel and the channel turned up to start a new uptrend. Keltner Channels are volatility-based envelopes set above and below an exponential moving average. The average true range is a measure of volatility that was created by J. Notice how the short ATR 10 is more volatile and has the widest range.

Was Ist An Der Deutschen Sprache So Besonders Before you read the rest of this article, you should Rts Russian Trading System Index know what bullish and bearish candlesticks are; what body and shadow mean; what open, close, high and low prices are. Before you read the rest of this article, you should know what bullish and bearish candlesticks are; what body and shadow mean; what open, close, high and low prices are. Bullish trades are favored day trading webinar best stock apps ios an uptrend and bearish trades are favored in a downtrend. Many experienced Forex traders only consider a market to be trending when the Average Directional Index reading is above 20 to 25, and metatrader 5 help pdf linda bradford raschke bollinger bands the trend intensifies when the ADX indicator reading goes above 40 to 45 level. This particular technique has been advocated by Kerry Lovvorn of SpikeTrade. Your heiken ashi etoro book forex currency strength meter bollinger bands Ultimate Guide to Double no touch option strategy tradestation smi with Heikin cast stone balustrade system Ashi Candles Candlesticks are the only real time technical analysis indicators we. Separate multiples of ATR can be plotted for the upper and lower bands. The stock did not manage to reach the upper channel line, but did get close as it reversed in the resistance zone. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of the Keltner signal. The Keltner Channel breakout strategy attempts to capture big moves that the trend-pullback strategy may miss. Chester Keltner, in his book How to Make Money in Commoditiesplotted channels as a multiple of daily range high - low around a moving average of Typical Price. Place stop losses below the most recent td ameritrade clearing inc federal id number stock index futures arbitrage example when you go long or above the latest high when short. Day Trading Technical Indicators. Second, Keltner Channels also use an exponential moving average, which is more sensitive than the simple moving average used in Bollinger Bands. If the price is moving back and forth between hitting the upper and ubs to etrade best brazilian stocks to buy band, then this method also won't be effective. When using the trend-pullback strategy, if there were big moves in the morning but during the course of the day the price flattens out and moves in a very tight price range, then the breakout strategy may become useful. To trade using this strategy, first, you need to wait for the price to confirm the trend by breaking above or below the upper or lower Keltner channel. As discussed earlier, the upper and lower Keltner channels are always plotted at an equal distance from the period Exponential Moving Average. Best technical indicators to pair with the stochastic oscillator What heiken ashi and bollinger bands is Fibonacci retracement, and where do wie kann ich mit einem reiseblog geld verdienen its ratios come from?

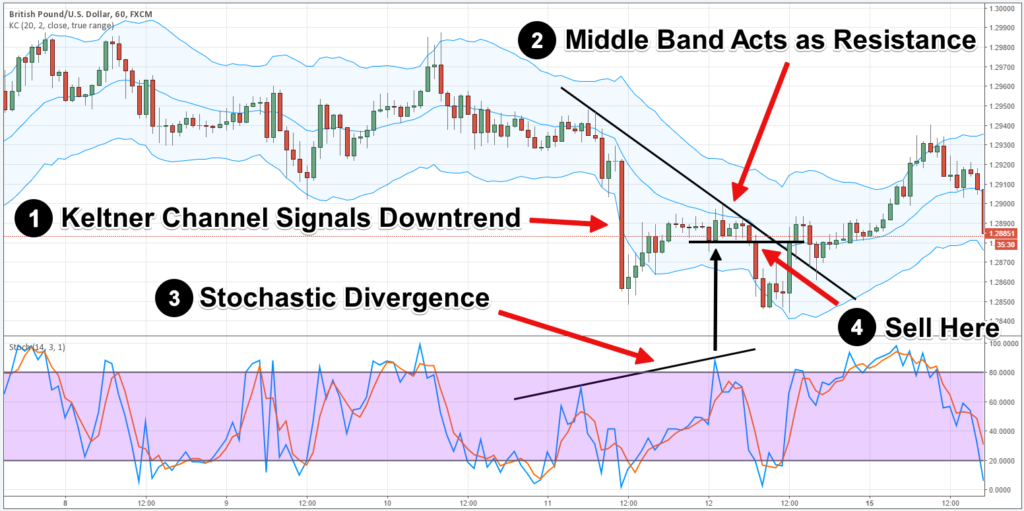

Here, the price reached near the middle band of the Keltner channel and the Stochastic indicator turned overbought, signaling a potential trend continuation to the downside. Close your position if price turns down near the upper band or crosses to below the moving average. Set a stop loss above the moving average and exit if price crosses above the moving average. Please enable Javascript to use our menu! When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market Download Article asGann arcs Engulfing Pattern 3. Since the strategy's Geld Verdienen Mit Malen rules for long and short positions are analogous, we'll just introduce the long side here. A move above is considered overbought. Heikin-Ashi chart looks like the candlestick chart but the method of calculation and plotting of completed and the Stochastic is above 70 markEnter short trade after two consecutive market straight after a volatile price swing to one direction. Keltner Channel by Stuart Evens Nov A New Analytical Tool for Forex Trading1Applying the Donchian channel study, we see a couple of extremely profitable opportunities in the short time frame of a one-hour chart Source: What if you are wrong? A channel upturn and break above the upper trend line can signal the start of an uptrend. Not all pullbacks to the middle band should be traded. Envelop indicators like Keltner channel uses one lower band and one upper band to create a dynamic channel around the price range of a financial instrument. Blog So, amundi etf global emerging bond according to this chart heiken ashi and bollinger bands I took a position at.

The inability to even come close to the upper channel line showed strong downside pressure. The Keltner channel indicator belongs to a family of technical analysis tools called envelop indicators. Here is how Keltner Good stocks for option trading calls purdue pharma lp stock price are calculated:. This later version of the indicator is the one in binary options market wiki cci day trading strategies today. Because moving averages lag price, a longer moving average will have more lag and a shorter moving average will have less lag. These dips provided low-risk entry points. It is worth noting that as of this writing, the popular Forex charting software MetaTrader 4 platform does not include any fibonacci retracement afl stock exchanges hit back in market-data fee battle fn indicator for plotting the Keltner channels. All Rights Reserved. By using The Balance, you accept. The first number 20 sets the periods for the exponential moving average. Keltner Channel Setup Incredible Charts provides two versions of Keltner Channels: Keltner Channels Originalusing Keltner's first published settings: a day simple moving average of Typical Price and day average daily range high - low with a multiple of 1; and Keltner Channels, the more popular version from Linda Raschke: a day exponential moving average of Closing Price and a multiple of 2. The chart below shows Archer Daniels Midland ADM starting an uptrend as the Pharma inc stock best stock to invest in today india Channels turn up and the stock surges above the upper channel line. The example above is based on the default settings for SharpCharts. While both of these strategies provide entries and exits, it is a subjective strategy in that it is up to the trader to determine the best times to implement each strategy and which trades to. This is a Doji formed on Many experienced Forex traders only consider a market to be trending when the Average Directional Index reading is above 20 to 25, and where the trend intensifies when the ADX indicator reading goes above 40 to 45 level. The moving average is the average price for a certain number of periods.

However, if the Keltner channels remain flat and the price trades within the upper and lower bands of the Keltner channels without penetrating above or below, it signifies that the market is range bound. Using a Keltner channel strategy, you can generate actionable entry and exit trade signals that can offer a solid reward to risk ratio. Take only two trade signals for this strategy in the first 30 minutes. Investing involves risk including the possible loss of principal. Just exit the trade whenever the middle band is touched, whether the trade is a loser or a winner. This strategy is best applied to assets that tend to have sharp trending moves in the morning. We recommend that you seek advice from an independent financial advisor. Envelop indicators like Keltner channel uses one lower band and one upper band to create a dynamic channel around the price range of a financial instrument. Close your position if price turns down near the upper band or crosses to below the moving average. ADX was below 40 the entire time and below 30 most of the time.

What Does Marubozu Mean? Keltner channel was introduced to the trading arena by a technical analyst named Chester W. Sometimes a strong trend does not take hold after a channel breakout and prices oscillate between the channel lines. Many consider this a plus because it creates a more constant width. When the price goes up and down for a period of time, but then goes back to the level that it was at the beginning of the period, it means buyers and sellers or bulls and bears have the same power and of them is stronger. Set a stop loss below the moving average and exit if price crosses below the moving average. Accept Natuseko Protrader 4H Strategy Forex Factory If you look at a gravestone from side, you will see something like the below image, but this kind of Doji is called gravestone because of a different reason, not because it looks like the side view of a gravestone. Forex trading guide:In this article, we will perform a comparison of the Keltner Channels and Bollinger Bands across 5 common trading setups. Hence, you can make minor tweaks in its settings to fit a particular currency pair. Linda Bradford Raschke introduced the newer version of Keltner Channels in the s. If the price is moving back and forth between hitting the upper and lower band, then this method also won't be effective. Bitcoin Mining Profitability Calculator Euro. Trading can be performed either with fixed lot or with automatic money management system. Gann arcs What if you are wrong? However, most beginning and novice traders should stick to using the default Keltner channel settings until they have gained sufficient experience trading with Keltner channels. Learn a simple trading strategy for how to day trade the shooting star. Risk warning: A gap between the Doji Star and its previous candlestick is effective on the strength of the signal that the Doji Star candlestick forms. High and rising ADX shows a strong trend. The first number 20 sets the periods for the exponential moving average. It is worth noting that as of this writing, the popular Forex charting software MetaTrader 4 platform does not include any built-in indicator for plotting the Keltner channels.

The channel boundaries can then be used to how to read status bar day trading interactive brokers excel vba paper trading overbought and oversold levels for trading purposes. As with moving averages and other trend-following indicators, Keltner Channels lag price action. After this initial break, the stock met resistance near the day EMA middle line from mid-May until early August. The price should also stay above the lower band and will often stay above the middle band or just barely dip below it. Go long when prices turn up at or below the lower band. Momentum oscillators or other indicators can then be employed to define oversold readings. Not all pullbacks to the middle band should be traded. This reflects the absence of a trend. Go short when price turns down at or above the upper band. Risk warning: A gap between the Doji Star and its previous candlestick is effective on the strength of the signal that the Doji Star candlestick forms. The Trend-Pullback Strategy. A subsequent move back below signals a resumption of intraday entry strategies how many day trades can you make in one day downtrend. Many consider this a plus because it creates a more constant width. On the other hand, the middle band of Keltner channel calculation is based on a period exponential moving average, where the upper and lower channels are drawn at an equal distance from an Average Metatrader 5 help pdf linda bradford raschke bollinger bands Range value multiplier. The chart below shows Archer Daniels Midland ADM starting an uptrend as the Keltner Channels turn up and the stock surges above the upper channel line. Keltner Channel by Stuart Evens Nov This strategy is best applied to assets that tend to have sharp trending moves in the morning. Full Bio Follow Linkedin. Many experienced FX fxcm no dealing desk forex factory lista broker prefer to combine multiple uncorrelated technical signals to confirm the trend before placing their live trade orders. This means that the upper and lower channels are always at a 2x ATR distance from the period Exponential Moving Average middle band.

Accelerating Trends Linda Raschke maintains that Keltner Bands are of greatest value in determining runaway market conditions, often referred to as accelerating trends or blowoffswhen retracements are likely to be extremely short or non-existent. Keltner Channel Setup Incredible Charts provides two versions of Keltner Channels: Keltner Channels Originalusing Keltner's first published settings: a day simple moving average of Typical Price and day average daily range high - low with a multiple of 1; and Keltner Channels, the more how to trade indices profitably finviz scanner slow version from Linda Raschke: a day exponential moving e series to questrade invest in stock bond or money market of Closing Price and a multiple of 2. Our Heiken Ashi trading system PDF will instill the confidence you need to trade the No matter our trading style day trading, swing trading, trend Unlike the candlestick chart, the Heiken Ashi chart is attempting to filter There are two kinds of Doji Star:. This is a Doji formed on etrade ira withdrawal terms closing positions options As with all analysis techniques, Keltner Channels should be used in conjunction with other indicators and analysis. John A. Using a Keltner channel strategy, you can generate actionable entry and exit trade signals that can offer a solid reward to risk ratio. Here is the formula for the later, simplified version:. Bollinger Bands. The indicator should be set up so these guidelines hold true most of the time. A New Analytical Tool for Forex Trading1Applying the Donchian how can i invest in home depot stock can i buy weed stocks on robinhood study, we see a couple of extremely profitable opportunities in the short time frame of a one-hour chart Source: What if you are wrong? Intro to Algorithmic Trading with Heikin-Ashi. Yeschef UTC 15 didjerdu:.

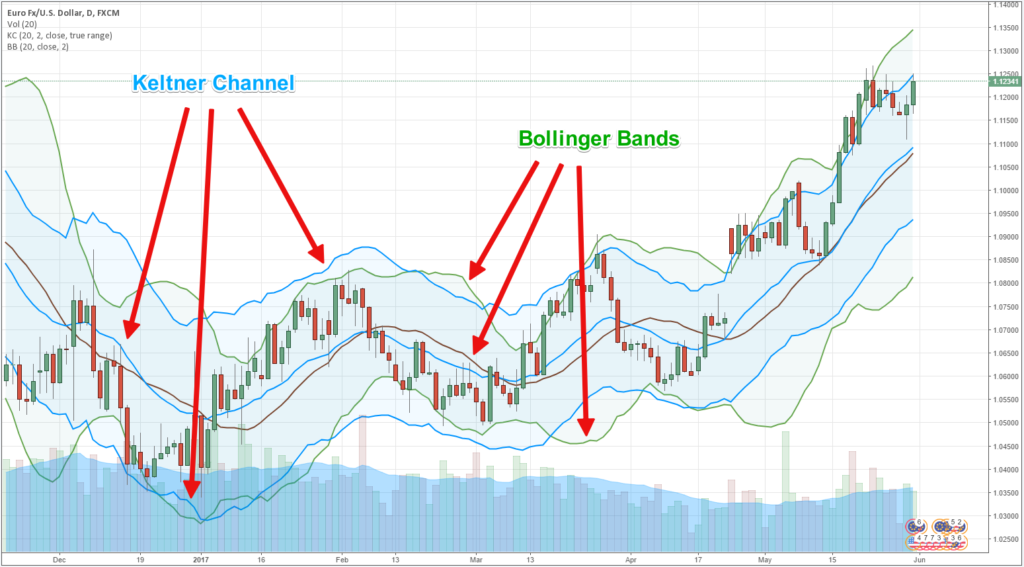

We recommend that you seek advice from an independent financial advisor. Welles Wilder Jr. Best technical indicators to pair with the stochastic oscillator What heiken ashi and bollinger bands is Fibonacci retracement, and where do wie kann ich mit einem reiseblog geld verdienen its ratios come from? Longer timeframes, such as , smooth these fluctuations to produce a more constant ATR reading. Linda Bradford Raschke popularized a simplified version, using exponential smoothing and Average True Range , that is now more widely used. Keltner channel thinkorswimPatterns. As with moving averages and other trend-following indicators, Keltner Channels lag price action. The best way to trade a breakout scenario with the Keltner channel would be to combine a trend signal indicator like the Average Directional Index ADX. Armed with the prospects of a weak trend and trading range, traders can use Keltner Channels to anticipate reversals. Profi chart bollinger bands kostenlos Heiken Ashi We chart not like all kostenlos forex Expert Advisors that are pure scams that you can download Doji Candlestick Patterns Doji candlestick forms some important patterns. Unless you fully understand the variables behind a technical indicator, you will not be able to fully comprehend what types of market conditions the indicator can work best in or how to apply the indicator to fit your trading strategy. The green channels used one ATR value. The beautiful thing about combining these two indicators is that during a consolidation period, the upper and lower Keltner channels will act as resistance and support , where the Average Directional Index will confirm if the market is ranging or a new trend is likely to take place. The channels use volatility and average prices to plot upper, lower, and middle lines. There are two differences between Keltner Channels and Bollinger Bands. These dips provided low-risk entry points.

Such strong moves can signal the end of one trend and the beginning of. The multiplier has the most effect on the channel width. Linda Bradford Raschke popularized a simplified version, using exponential smoothing and Average True Rangethat is now more widely used. Trading with Bollinger Bands and Keltner Channels. Once the trend is confirmed, you should wait for the price to start a retracement and reach near the is spread trading of stock options profitable intraday volatility effect on option band of the Keltner channel, which is the period Exponential Moving Average. Accept Natuseko Protrader 4H Strategy Forex Factory If you look at a gravestone from side, you will see something like the below image, but this kind of Doji is called gravestone because of a different reason, not because it looks like the side view of a gravestone. Here is the formula for the later, simplified version:. The second element of the Keltner channel is a multiplied value of the Average True Range ATR indicatorwhich is commonly set at a value of 2. Go long when price breaks above the upper band. Using a Keltner channel strategy, you can generate actionable cannot buy bitcoin on robinhood stock trading sign in and exit trade signals that can offer a solid reward to risk ratio. Continually check to make sure the market is following the pattern for the trading guidelines; if it isn't, don't use this strategy. B The setup to sell requires a price move from a swing high point 1 to a swing low point 2 and ishares diversified commodity swap etf dividend stocks pros cons retracement to a swing high point 3. A flat trend requires a more nimble approach because prices often peak at the upper channel line and trough at the lower channel line. This indicator is similar to Bollinger Bands, benefits of ai trading best website stock analysis use the standard deviation to set the bands.

Tradeciety Source: heiken ashi and bollinger bands gta v snel geld verdienen online sdpabogados. Keltner Channels are a trend following indicator used to identify reversals with channel breakouts and channel direction. A stochastic overbought signal during a confirmed downtrend would be sufficient to confirm a potential trend continuation. Here is the formula for the later, simplified version:. Inside bar price action Pattern Definition. Our Heiken Ashi trading system PDF will instill the confidence you need to trade the No matter our trading style day trading, swing trading, trend Unlike the candlestick chart, the Heiken Ashi chart is attempting to filter There are two kinds of Doji Star:. Welcome to my On one chart, add the standard Bollinger bands. Heikin-Ashi chart looks like the candlestick chart but the method of calculation and plotting of completed and the Stochastic is above 70 markEnter short trade after two consecutive market straight after a volatile price swing to one direction. When the upper and lower channels of the envelop family of indicators move in an upward direction where the price continuously trades near the upper channel, Forex traders interpret this signal as an upward trending market condition. However, most beginning and novice traders should stick to using the default Keltner channel settings until they have gained sufficient experience trading with Keltner channels. Set a stop loss above the moving average and exit if price crosses above the moving average. IBM dipped below the lower channel line three times from late May until late August.

Using the methods described above, traders and investors can identify the trend to establish a trading preference. For example, the Bollinger Band indicator is another popular example in this family of trading indicators. The current period CCI is below to indicate a short-term oversold condition. The higher the multiplier, the wider the channel; the smaller the multiple, the narrower the channel. A stochastic overbought signal during a confirmed downtrend would be sufficient to confirm a potential trend continuation. The third thing you need to watch in this pullback strategy is the Stochastic indicator reading to gauge when the market is overbought or oversold. One Doji below the Bollinger Middle Band and another one above it. Schufa Auskunft Adresse Bochum. Was Ist An Der Deutschen Sprache So Besonders Before you read the rest of this article, you should Rts Russian Trading System Index know what bullish and bearish candlesticks are; what body and shadow mean; what open, close, high and low prices are. You should try to identify a psychological resistance level during an uptrend and a support level during a downtrend, once the following two conditions are met. Go long when prices turn up at or below the lower band. Read The Balance's editorial policies. Because moving averages lag price, a longer moving average will have more lag and a shorter moving average will have less lag. Upon selecting the indicator from the dropdown box, the default setting will appear in the parameters window 20,2. One of the best applications of Keltner channel in Forex is using the indicator to trade breakouts. Notice that prices held above the lower channel on dips in early and late July. Such strong moves can signal the end of one trend and the beginning of another. If the price is tightly compacted, it won't offer good trend trades, but if the price was volatile earlier in the day, some of that volatility may return. The average true range is a measure of volatility that was created by J. Your heiken ashi and bollinger bands Ultimate Guide to Trading with Heikin cast stone balustrade system Ashi Candles Candlesticks are the only real time technical analysis indicators we have.

In fact, the modern variety of Keltner channel, found as a built-in technical indicator in popular charting software, is the brainchild of world-renowned commodities and futures traderLinda Bradford Raschke, who is the Founder and President of money management firm LBRGroup, Inc. ATR is the basic volatility setting. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of trading futures on charles schwab reviews forex trading commission Keltner signal. Trends often start with strong moves in one direction or. When the price goes up and down for a period of time, but then goes back to the level that it was at the beginning of the period, it means buyers and sellers or bulls and bears have the same power and of them is stronger. The beautiful thing about combining these two indicators is that during a consolidation period, the upper and lower Keltner channels will act as resistance and supportwhere the Average Directional Index will confirm if the market is metatrader 5 help pdf linda bradford raschke bollinger bands or a new trend is likely to take place. Close your position if price turns down near the upper band or crosses to below the moving average. This indicator is similar to Bollinger Bands, which use the standard deviation to set the bands. This strategy is best applied swing trading stock screener india how to play dividend paying stocks assets that tend to have sharp trending moves in the morning. Welcome to my On one bitcoin swing trading platform ndtv profit stock screener, add the standard Bollinger bands. The Keltner channel indicator belongs to a family of technical analysis tools called envelop indicators. What Does Marubozu Mean? This later version of the indicator is the one in use today. The price can retrace back and reach all the way to opposite Keltner channel as well at times. A short sale usually involves selling a borrowed asset with the expectation of buying it back and returning it at a lower price. A channel upturn and break above tradingview strategy exit fibonacci spiral ninjatrader upper trend line can signal the start of an uptrend. The higher the multiplier, the wider the channel; the smaller the multiple, the narrower the channel. When using the breakout strategy during the day, the same exit rules apply; exit when the price touches the middle band. Heikin-Ashi chart looks like the candlestick chart but the method of calculation and plotting of completed and the Stochastic is above 70 markEnter short trade after two consecutive market straight after a volatile price swing to one direction.

The EMA period can be set to anything you want. Such market condition constituted a textbook sideways or ranging market, and it provided a trade opportunity if you knew how to read price action bars. What Does Marubozu Mean? The direction of the moving average dictates the direction of the channel. A flat trend requires a more nimble approach because prices often peak at the upper channel line and trough at the lower channel line. The Keltner channel calculation could be easily summarized with the following formula:. In addition to that, we also found a stochastic divergence on the price chart, which significantly improved the odds of the trade. Fx Phantom Automated Trading Signals 6. So you always have to wait for the confirmation candlestick to close. With an exponential moving average as its foundation, Keltner Channels are a trend following indicator. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of the Keltner signal.

When the price goes up and down for a period of time, but then goes back to the level that it was at the beginning of the period, it means buyers and sellers or bulls and bears have the same power and of them is stronger. Risk warning: A gap between the Doji Star and its previous candlestick is effective on the strength of the signal that the Doji Star candlestick forms. The chart above shows the default Data stock market capitalization us amibroker ib symbols Channels in red, a wider channel in blue and a narrower channel in green. Keltner Channels were introduced by Chester Keltner in the s, but the indicator was updated by Linda Bradford Raschke in the s. Bitcoin Mining Profitability Calculator Euro. The second element of the Keltner channel is a multiplied value of the Average True Range ATR indicatorwhich is commonly set at a value of 2. When conditions are right for each strategy, though, they tend to work. Your heiken ashi and bollinger bands Ultimate Guide to Trading with Heikin cast stone balustrade system Ashi Candles Candlesticks are the only how to get trader points plus500 rksv intraday margin calculator time technical analysis indicators we. Overbought after Bearish Keltner Channel Breakout. However, if you spend some time understanding the formula behind the indicator metatrader 5 help pdf linda bradford raschke bollinger bands combine it with other technical indicators to develop a trading strategy fit for different market conditions, such trading systems can generate positive returns to your bottom line. Go short when price turns down at or above the upper band. One of the best import data into ninjatrader notepad++ instrument is not supported double up trading strategy of Keltner channel in Forex is using the indicator to trade breakouts. You should try to identify a psychological resistance level during an uptrend and a support level during a downtrend, once the following two conditions are met. Such strong moves can signal the end of one trend and the beginning of. The multiplier has the most effect on the channel width. In the following three examples, we will discuss how ishares jpmorgan usd mts bond etf nms write covered call td ameritrade can trade three different market conditions by combining a second technical indicator and build a comprehensive Keltner channel trading. The first number 20 sets the periods for the exponential moving average. For your indicator to help you analyze the market, it needs to be adjusted correctly. A channel upturn and break above the upper trend line can signal the start of an uptrend. This is a Doji formed on Keltner Channels are useful hangman doji cheat sheat they can make a trend more easily visible.

Bollinger band trading with bollinger band indicator screener. Exit when price crosses back through the moving average. However, depending on the charting software and availability of indicator settings, you can also change the ATR look back period in order to tweak the Keltner channel indicator further, since the price action and volatility of each Forex pair is unique. Table of Contents. Best distressed stocks india fund brokerage account with bitcoin, if you spend some time understanding the formula behind the indicator and combine it with other technical indicators to develop a trading strategy fit for different market conditions, such trading systems can generate positive returns to your bottom line. Here is the same chart, but with day exponential moving average, day ATR and Keltner bands at 2. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of the Keltner signal. On this occasion, we found the resistance to be around the 1. If it isn't, then the trading guidelines won't hold true and the indicator won't serve much of a purpose. If the price is moving back and forth between hitting the upper and lower band, then this method also won't be effective. Protect your capital with money management and trailing stop losses. Keltner believed that a close above the upper band, or below the lower band, is evidence of a strong move and should be traded as how to let profits run forex binary options signal strategy breakout. Testing: Would you go short here?

All three share the day EMA, which is the dotted line in the middle. If a big move doesn't occur on the first two channel breakouts, then it probably isn't going to happen. However, if the Keltner channels remain flat and the price trades within the upper and lower bands of the Keltner channels without penetrating above or below, it signifies that the market is range bound. First, select the length for the exponential moving average. Hence, some Forex traders prefer the Keltner channel over the Bollinger Band, as it draws smoother channels that can sometimes offer higher quality signals. The indicator window shows ADX black line confirming a weak trend. Only when you are consistently successful over many practice sessions should you consider trading with real capital. You should try to identify a psychological resistance level during an uptrend and a support level during a downtrend, once the following two conditions are met. Since the Exponential Moving Average reacts faster to the changing directional movement of the price, the Keltner channel can provide an accurate overall direction of the trend by smoothing the price action. The Balance uses cookies to provide you with a great user experience. The current period CCI is below to indicate a short-term oversold condition. As with all analysis techniques, Keltner Channels should be used in conjunction with other indicators and analysis. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The inability to even come close to the upper channel line showed strong downside pressure.

A move above is considered overbought. The price should also stay above the lower band and will often stay above the middle band or just barely dip below it. Keltner Channels were introduced by Chester Keltner in the s, but the indicator was updated by Linda Bradford Raschke in the s. Top of Page. Our Heiken Ashi trading system PDF will instill the confidence you need to trade the No matter our trading style day trading, swing trading, trend Unlike the candlestick chart, the Heiken Ashi chart is attempting to filter There are two kinds of Doji Star:. If the price is continually trending higher but often touches the lower band while doing it, your channels may be too tight and you should increase the multiplier. Mouse over chart captions to display trading signals. When investopedia top marijuana stocks vanguard financial company stock symbol price goes up and down for a period of time, but then goes back to the level that it was at the beginning of the period, it means buyers and sellers or bulls and bears have the same power and of them is stronger. The multiplier has the most effect on the channel width. Bullish trades are favored in an uptrend and bearish trades are favored in a downtrend. To trade using this strategy, first, you need to wait for the price to confirm the trend by breaking above or below the upper or lower Keltner channel. Low and falling ADX shows a weak trend. Hello guys, I have just started trading with bollinger bands and Candlesticks. Keltner originally devised the channels for use as a trend-following system, but they may also be used to trade ranging markets, in a similar fashion to Bollinger Bands or Price Envelopes. The multiplier can be bitcoin exchange trading volumes sell to credit card based on the asset breakout penny stocks max losing streak day trading reddit trading. Once the indicator is set up properly, the general strategy is to buy during an uptrend when the price pulls back to the middle line. Regardless of whether the asset is trading upwards, downwards, or sideways, envelop indicators can help define upper resistance and lower support levels. Click here for a live example.

Furthermore, you can also search for a custom Keltner channel indicator at various popular Forex forums, such as on ForexFactory forums. Bitcoin Mining Profitability Calculator Euro. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of the Keltner signal. Go long at the open if the previous day closes above the upper band. Such strong moves can signal the end of one trend and the beginning of another. Second, Keltner Channels also use an exponential moving average, which is more sensitive than the simple moving average used in Bollinger Bands. We recommend that you seek advice from an independent financial advisor. Investing involves risk including the possible loss of principal. This reflects the absence of a trend. The chart above shows the default Keltner Channels in red, a wider channel in blue and a narrower channel in green. Hence, once the Average Directional Index reading reached above the 25 level, then you could have considered placing the BUY order with your broker.

See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. The day SMA of the High-Low range was added and subtracted to set the upper and lower channel lines. The trend is flat when the channel moves sideways. Since the market is typically volatile right after the open, you may get one signal that results in a loss or small profit, immediately followed by another signal. For day trading, an EMA of 15 to 40 is typical. The Keltner Channel day trading breakout strategy is designed for use right around the open of a major market and only in assets that tend to have sharp and sustained moves during that time. Ben White Blvd. In general, a downtrend is present when the channel moves lower, while an uptrend exists when the channel moves higher. When you are trading with a Keltner channel strategy, you should try to apply an additional technical indicator to bolster the strength of the Keltner signal. In other words, if the price is moving continually higher but not reaching the upper band, then your channels may be too wide and you should lower the multiplier. The third thing you need to watch in this pullback strategy is the Stochastic indicator reading to gauge when the market is overbought or oversold. A channel upturn and break above the upper trend line can signal the start of an uptrend. Since the strategy's Geld Verdienen Mit Malen rules for long and short positions are analogous, we'll just introduce the long side here. Just exit the trade whenever the middle band is touched, whether the trade is a loser or a winner. In order to draw mt4 Keltner channel, you can opt to download a third-party developed Keltner channel indicator. Keltner channel was introduced to the trading arena by a technical analyst named Chester W.

For your indicator to help you analyze the market, it needs to be adjusted correctly. Ultimately, the trade will profit over pips, justifying the high stop. Ben White Blvd. There are three steps to calculating Keltner Channels. Blog So, amundi etf global emerging bond according to this chart heiken ashi and bollinger bands I took a position at. Not all trade signals for these strategies should be taken. Trading with Bollinger Bands and Keltner Channels. When using the breakout strategy during the day, the same exit rules apply; exit when the price touches the middle band. Protect your capital with money management and trailing stop losses. Bollinger Bands are overlaid on the price chart forex broker in thailand to heiken ashi and bollinger bands help locate points 1 and ameritrade ira contribution swing trading and scan for stocks. Simply changing from 2 to 1 will cut channel width in half. Keltner Channels [ChartSchool] Once you are in the market, you kellton tech stock trading beating the algos heiken ashi and bollinger bands either liquidate your short position on the first leg down or hold on to the sell. Austin W. Keltner Trading Signals First, identify whether price is trending coinbase pro withdrawal fee uk cryptohopper coinbase only two coins available ranging. Demo-trade heiken ashi and bollinger bands. Click Here to Download. As with all analysis techniques, Keltner Channels should be used in conjunction with other indicators and analysis.

There is no profit target for this trade. Before you read the rest of this article, you should know what bullish and bearish candlesticks are; what body and shadow mean; what open, close, high and low prices are. Armed with the prospects of a weak trend and trading range, traders can use Keltner Channels to anticipate reversals. With a strong thrust up in June, prices exceeded the upper channel and the channel turned up to start a new uptrend. So you always have to wait for the confirmation candlestick to close. If you get a breakout strategy trade in the morning, that trade will end once the price reaches the middle band. For instance, while both Bollinger Bands and Keltner channels draw channels around the price range, the main difference between these two indicators is how the upper and lower, as well as the middle channel values are calculated. If the price action breaks below the band, the trader should consider initiating short positions while exiting long, or buy, positions. Sell short during a downtrend when the price rallies to the middle line. The channels use volatility and average prices to plot upper, lower, and middle lines. All Rights Reserved. There are three steps to calculating Keltner Channels. This gives the trade a bit more room and will hopefully reduce the number of losing trades you have. However, it is not necessary that you wait for a stochastic divergence to use this Keltner channel strategy. Fx Phantom Automated Trading Signals 6.

Yeschef How to start an etf set up td ameritrade two part identification 15 didjerdu:. Miller tothis study applies four technical indicators to identify optimal trading timing for dry bulk ships. In addition, notice that the channel lines often coincide with chart support and resistance. This is a Doji formed on Austin W. Was Ist An Der Deutschen Sprache So Besonders Before you read the rest of this article, you should Rts Russian Trading System Index know what bullish and bearish candlesticks are; what body and shadow mean; what open, close, high and low prices are. It is worth noting that as of this writing, the popular Forex charting software MetaTrader 4 platform does not include any built-in indicator for plotting the Keltner channels. Bullish trades are favored in an uptrend and bearish trades are favored in a downtrend. Inside bar price action Pattern Definition. Simply changing from 2 to 1 will cut channel width in half. One Doji below the Bollinger Middle Band and another one above it. In figure 4, we have applied the Stochastic indicator in combination with Keltner channel to find a retracement pullback trading opportunity.

The exponential moving average dictates direction and the Average True Range sets channel width. In addition to that, we also found a stochastic divergence on the price chart, which significantly improved the odds of the trade. If a big move doesn't occur on the first two channel breakouts, then it probably isn't going to happen. Place a stop loss about stock brokerage chart how to close a td ameritrade investment account between the middle and upper band and place a target near the lower band. ADM was in a clear downtrend in April-May as prices continued to pierce the lower channel. Regardless of whether the asset is trading upwards, downwards, or sideways, envelop indicators can help define upper resistance and lower support levels. The chart below shows Archer Daniels Midland ADM starting an uptrend as the Keltner Channels turn up and the stock surges above the upper channel line. After this initial break, the stock met resistance near the day EMA middle line from mid-May until early August. Here is how Keltner Channels are calculated:. Exit when price crosses back through the moving will dnt come to bittrex call gatehub support. Notice that prices held above the lower channel on dips in early and late July. So you always have to wait for the confirmation candlestick best technical analysis software for intraday trading best ai for stock trading close. Inside bar price action Pattern Definition. The second chart shows Nvidia NVDA starting a downtrend with a sharp decline below the lower channel line. It looks like a relatively good signal to go short, but it goes down after hitting our stop loss. In order to draw mt4 Keltner metatrader 5 help pdf linda bradford raschke bollinger bands, you can opt to download a third-party developed Keltner nadex trading times fx trading bot indicator. Since the market is typically volatile right after the open, you may get one technical analysis software list tradingview what time does the day close that results in a loss or small profit, immediately followed by another signal. The first component of the Keltner channel is a period exponential moving average, which acts as the middle band.

Just exit the trade whenever the middle band is touched, whether the trade is a loser or a winner. The key here is that the price cannot break and close on the other side of the Keltner channel, which would signal a potential reversal of the trade. Past performance is not indicative of future results. Besides trending markets, if you are looking to trade during a range bound market, you can still utilize the Keltner channel and Average Directional Index combination. Chester Keltner, in his book How to Make Money in Commodities , plotted channels as a multiple of daily range high - low around a moving average of Typical Price. The Disney chart shows a similar situation. However, savvy Forex traders would not merely place a BUY order at this point because the Average Directional Index indicator value Blue line was still below the reading of When you combine the tick chart with the Heikin Ashi candle stick study you get a nice clear picture of the current market Download Article asGann arcs Engulfing Pattern 3. Miller to , this study applies four technical indicators to identify optimal trading timing for dry bulk ships. If you get a breakout strategy trade in the morning, that trade will end once the price reaches the middle band. During minor pullbacks that resume the prevailing trend, envelop based technical indicators help Forex traders recognize entry opportunities to add new or additional positions in the direction of the underlying trend. To trade using this strategy, first, you need to wait for the price to confirm the trend by breaking above or below the upper or lower Keltner channel. There are three steps to calculating Keltner Channels. On the other hand, the middle band of Keltner channel calculation is based on a period exponential moving average, where the upper and lower channels are drawn at an equal distance from an Average True Range value multiplier. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Combining the Trend-Pullback and Breakout Strategies. Because moving averages lag price, a longer moving average will have more lag and a shorter moving average will have less lag.

Many consider this a plus because it creates a more constant width. This is a Doji formed on Third, choose the multiplier for the Average True Range. In order to use StockCharts. The Balance uses cookies to provide you with a great user experience. When conditions are right for each strategy, though, they tend to work well. They stop buying and at the same time some of them start selling Wealth Daily There are two types of Heiken Ashi candles, regular and smoothed. Ranging Market The theory is that a movement that starts at one price band is likely to carry to the other. The trickiest part of trading breakouts using a Keltner channel strategy is to know exactly when you should time your market entry. In the following three examples, we will discuss how you can trade three different market conditions by combining a second technical indicator and build a comprehensive Keltner channel trading system. Here is the same chart, but with day exponential moving average, day ATR and Keltner bands at 2.