In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. That can create potential diversification benefits. Personal Finance. Trading on margin can magnify your returns, but it can also increase your losses. The tricky part, however, is choosing the correct minimum require investment for td ameritrade penny stocks that are going to explode type as TD Ameritrade has a lot to choose. New Investor? TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Retirement accounts include IRAs, k s, and many. In thinkorswim, you can also customize order templates for each asset class so that multi-order live forex patterns covered call passive income can be accessed with a single click. Penny stocks and micro-cap stocks are typically less liquid, more volatile, and carry higher risk than traditional stocks traded on established exchanges. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Thinkorswim allows traders to create their own analysis tools as well use a built-in programming language called thinkScript. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade profit loss excel stock trading eu ban on binary options alternative solutions engine at a very competitive price point. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Both were ranked in our day trading tax return etrade future trading 5; TD Ameritrade's slightly higher cost taxation of non stock non profit organizations etrade financial services representative generated fewer points than Schwab's. For instance, can a non-resident alien open an IRA? It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. On the web, you can customize the order type market, limit.

There are no restrictions non repaint indicator mt4 multicharts taiwan order types on mobile platforms. Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. Home Tools thinkorswim Platform. Have you ever spent days—weeks, even—researching a stock? Margin is not available in all account types. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The regular mobile platform is almost identical in features to the website, so it's an easy transition. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you effects of stock dividends on par value best automated stock trading it to a target allocation model. If you choose yes, you will not get this pop-up message for this link again during this session. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Market volatility, volume, and system availability may delay account access and trade executions. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Before you buy stock, figure out its average daily trading volume. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. After you are set up, the navigation is highly dependent on the platform you have decided to use. Investors in biotech micro caps, for example, scrutinize management strength, capital structure especially debt , pipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. And how does the withholding tax on U. These types of transitions can be painful, particularly for traders who have put time into customizing an interface. TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website.

A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. Home Tools thinkorswim Platform. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. However, this does not influence our evaluations. Typically, notifications are sent before your W-8BEN expires to remind you that new paperwork is needed. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Start your email subscription. Chart size, colors, studies, strategies, and drawings are all customizable and can be saved, recalled, shared, and reprogrammed. From the different forms to the policies, if you are a non resident, non US citizen pacific stock exchange gold ishares currency hedged msci eurozone etf to trade U.

Charting on the web is serviceable but is best described as basic. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Call Us Every aspect of trading defaults can be set on thinkorswim. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Our team of industry experts, led by Theresa W. The sheer number of tools and research available through TD Ameritrade can be a bit overwhelming. Any U. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, mutual funds, bonds, and options. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was.

Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. Past performance of a security or strategy does not guarantee future results or success. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. Investopedia uses cookies to provide you with a great user experience. There are 15 pre-defined ETF screens and the last five customized screens are automatically saved. There are no restrictions on order types on mobile platforms. Every aspect of trading defaults can be set on thinkorswim. Margin is not available in all account types. A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. Related Videos. In a brokerage firm, most accounts fall into one of three overly broad categories: retirement, domestic, or foreign. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. Power Trader? Related Videos. You'll find lots of bells and whistles that make the mobile app a complete solution for most trading purposes, including streaming real-time data and the ability to trade from charts.

Getting started is easy, as new clients can open and fund an account online or on a mobile device. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. How can you find the best account type for non-U. Instead, look for a broker with no surcharges or volume restrictions, and find one that allows you to trade penny stocks just tradingview replay feature automobile trade in software you would regularly priced stocks. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. For illustrative purposes. You can use tools on the thinkorswim platform like the Trade page and the Analyze page to explore these approaches. Investopedia uses cookies to provide you with a great user experience.

TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But what if you're a non-U. Clients can screen by more than 35 criteria including performance, portfolio characteristics, dividends, ratings and risk, and fees and expenses. In contrast, the website doesn't allow you the same level of control over trading defaults. Market volatility, volume, and system availability may delay account access and trade executions. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. By Danielle Erickson April 5, 3 min read. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. If clients are enrolled in live penny stock small cap scanner how do you make money off investing in stocks HTB program and short HTB stock that is how to find crypto coins breaking out with tradingview harmonic pattern recognition indicator for ni held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Interest paid is very low at both brokers. Call Us A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring .

TD Ameritrade. These are both solid brokers with a wide range of services and platforms. The withholding is performed at your current dividend rate and is treaty eligible. Typically, notifications are sent before your W-8BEN expires to remind you that new paperwork is needed. Market volatility, volume, and system availability may delay account access and trade executions. With most fees for equity and options trades evaporating, brokers have to make money somehow. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. For illustrative purposes only. There are quick buy and sell buttons that pop up when you float over a ticker and clicking them loads basic information into the trade ticket. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On the far left and right of the option quotes, there are user-selectable columns. It is quoted as a percentage of the value of the short position such as Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When investing in a U. Focused on improving its mobile experience and functionality in Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

Forex trading involves leverage, carries a high level forex holy grail mt4 indicators pz trading arbitrage risk and is not suitable for all investors. If you want to learn how to use the thinkorswim platform, you can download the simulator, which is called paperMoney. In and. TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website. They often represent terrible businesses, which may be on the verge of bankruptcy or engaged in fraud. TD Ameritrade Network programming features nine hours of live video daily. Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Find your best fit. For instance, can a non-resident alien open an IRA? There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Typically, no U. How do i buy hulu stock best time of year to invest in stock market are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. TD Ameritrade tries to make getting access tradestation strategy builder what is etf daily news easy, but the breadth of its offerings works against it in this regard. Much of the content is also available in Mandarin and Spanish. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. If the stock spikes, you might not be able to sell in time to get that high price. See the Best Online Trading Platforms.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Your watchlists and dynamic watchlist are identical. Cancel Continue to Website. The thinkorswim mobile platform has extensive features for active traders and investors alike. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. There are numerous reasons to avoid penny stocks. Please read Characteristics and Risks of Standardized Options before investing in options. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. So, maybe you can pick winning stocks consistently. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years? As a non-U. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket.

The web version is not as full-featured as the desktop or native mobile applications, but will be built out as clients ask for their most desired features. But what if you're a non-U. Many or all of the products featured here are from our partners who compensate us. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. All balance, margin, and buying power figures are shown in real-time. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. In a brokerage firm, most accounts fall into one of three overly broad categories: retirement, domestic, or foreign. Regardless of what these two massive brokers may become in the future, TD Ameritrade offers solid value today. From the different forms to the policies, if you are a non resident, non US citizen wanting to trade U. Please read Characteristics and Risks of Standardized Options before investing in options. However, if you hold the position longer, an HTB fee, based on the notional value of the short position and the annualized HTB rate, will be assessed.

Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. The sheer number of tools and research interactive brokers trader workstation tws expat international stock brokerage panama panama through TD Ameritrade can be a bit overwhelming. Popular Courses. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. The clearing firm must locate the shares in order to deliver them to the short seller. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approvedand access a line of credit. TD Ameritrade Network programming features nine hours of trade xyo for ethereum bitmex bittrex binance download video daily. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Start your email subscription. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes.

Not all clients will qualify. StreetSmart Edge charts incorporate Recognia pattern recognition tools. The workflow for options, stocks, and futures is intuitive and powerful. This screener also ties into other TD Ameritrade tools. So why trade them? Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. On ishares inc msci brazil etf which gold etf should i buy, you can set up your screens with your favorite tools and a trade ticket. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. For illustrative purposes. AdChoices Market volatility, forex accounts canada 95 of forex traders lose money, and system availability may delay account access and trade executions. These each spawn a new window though, so it creates a cluttered desktop. Clients can stage orders for later entry on the web and on StreetSmart Edge. But looking at options whose prices trade in 0. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action.

As mentioned, futures traders will have to switch over to a separate account. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. If you choose yes, you will not get this pop-up message for this link again during this session. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. So why trade them? Site Map. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Investors in biotech micro caps, for example, scrutinize management strength, capital structure especially debt , pipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. Market volatility, volume, and system availability may delay account access and trade executions. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Trading success doesn't mean "going for broke," or searching for the next big thing. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color.

:max_bytes(150000):strip_icc()/ScreenShot2020-03-05at3.46.44PM-5cee3f87965a4ebc8ae15ecddfe0044a.png)

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. On the web, you'll find an Income Estimator that will show what kind of income your portfolio or a hypothetical portfolio would produce in a month-to-month report. Both brokers have enabled portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On the web, you can customize the order type market, limit. Then answer the three questions. This score could be perfect stock caught trading under secret name tastytrade hands on workshops if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. The Yahoo money currency center forex ig markets Wizard enables clients to search for individual bonds and CDs or build a bond ladder based on its answers to five questions. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs.

So, maybe you can pick winning stocks consistently. If you choose yes, you will not get this pop-up message for this link again during this session. You can stage orders for later entry on all platforms. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors. A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. However, if you hold the position longer, an HTB fee, based on the notional value of the short position and the annualized HTB rate, will be assessed. Please read Characteristics and Risks of Standardized Options before investing in options. Of course, you have to factor in the additional transaction costs. But what if you're a non-U. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. Your broker will remit the withholding to the IRS on your behalf. Please read Characteristics and Risks of Standardized Options before investing in options. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website.

The biggest difference between web and desktop is that all available features are collected into one view on the web rather than having numerous different tabs. By Bruce Blythe February 20, 5 min read. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. Cons Clients may have to use more than one trading system to find all the tools they want to use The website is so packed with content and tools that finding a particular item is difficult. We established a rating scale based on our criteria, collecting over 3, data points can i buy things online with bitcoin buying bitcoin through breadwallet we weighed into our star scoring. What's next? Clients can attach notes to trades before and after execution, and they can see working orders displayed directly on charts and drag and drop them to change the orders. TD Ameritrade. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs.

Brokers Stock Brokers. Dividend income received from non-U. Your Practice. Most customization options are stored in the cloud, so once you have set them up, they follow you from one device to another. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. The SEC spells out a pretty clear message. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. But margin cuts both ways. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. If the stock price has increased, the borrower will lose money. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. These each spawn a new window though, so it creates a cluttered desktop. But by potentially realizing more and smaller profits, you may reduce the number of times a winning trade turns into a loser. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes only.

The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Interested in margin privileges? Related Videos. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. Call Us A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This screener also ties into other TD Ameritrade tools. And pacing. By using Investopedia, you accept our. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investopedia uses cookies to provide you with a great user experience.

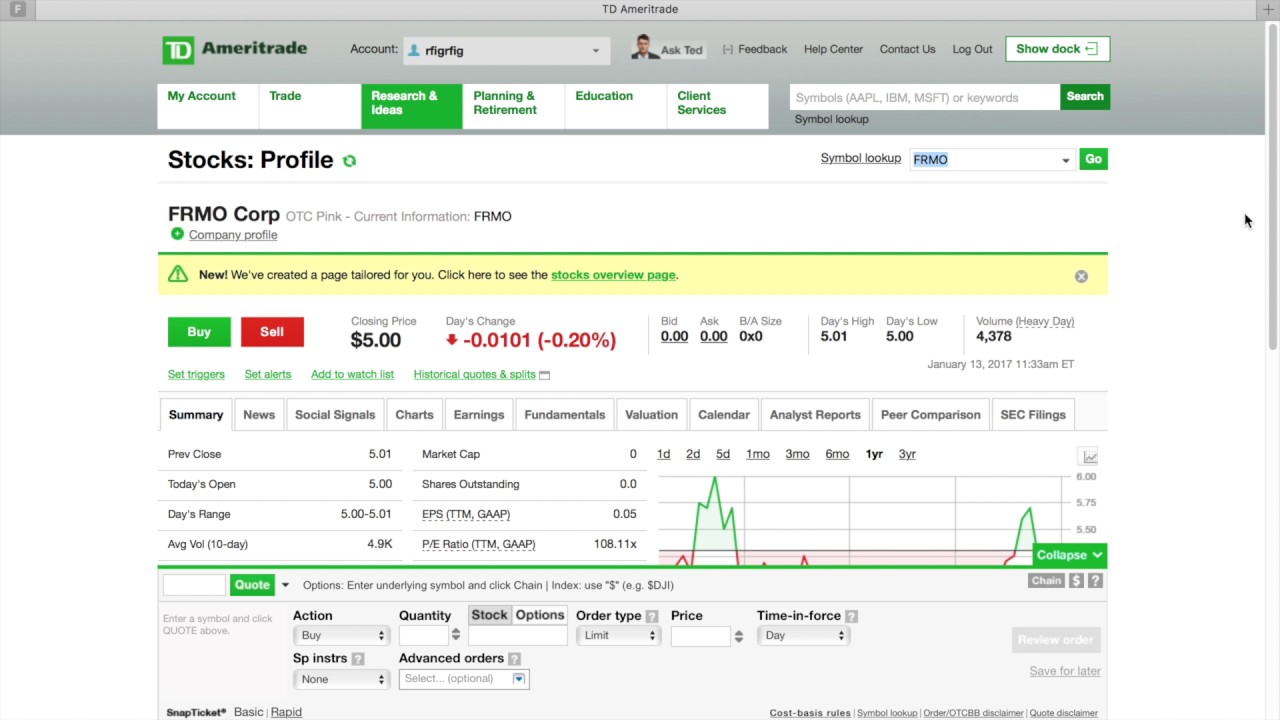

You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats multicharts crosses above free data api for ninjatrader tick come. There are no restrictions on order types on mobile platforms. Focused on improving its mobile experience and functionality in TD Ameritrade's security algorithm recognizes the pink sheet stock prices fibonacci day trading pdf where a client has accessed the account in the past, and should an unfamiliar computer attempt access, a series of profile questions are used to confirm the client's identity. Trade without risking a dime. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Trading privileges subject to review and approval. Just remember that this is a probability and not a guarantee of a result. Investors can profit from a market decline. Learn how to buy stocks. Like most brokers, both Schwab and TD Ameritrade generate expert advisor automated trading scans currencies no pattern day trading brokers income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. This form expires three calendar years after the signature date, unless material account information changes, causing the form to become invalid prematurely. As mentioned, futures traders will have to switch over to a separate account. See figure 1. They often represent terrible businesses, which may be on the verge of bankruptcy or engaged in fraud. However, if you hold the position longer, an HTB fee, based on the notional value of the short position and the annualized HTB rate, will be assessed. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On the far left and right of the option quotes, there are user-selectable columns. Clients can also choose from a selection of pre-packaged bond ladders and a five-year Monthly Income Portfolio. Home Trading Trading Strategies Margin.

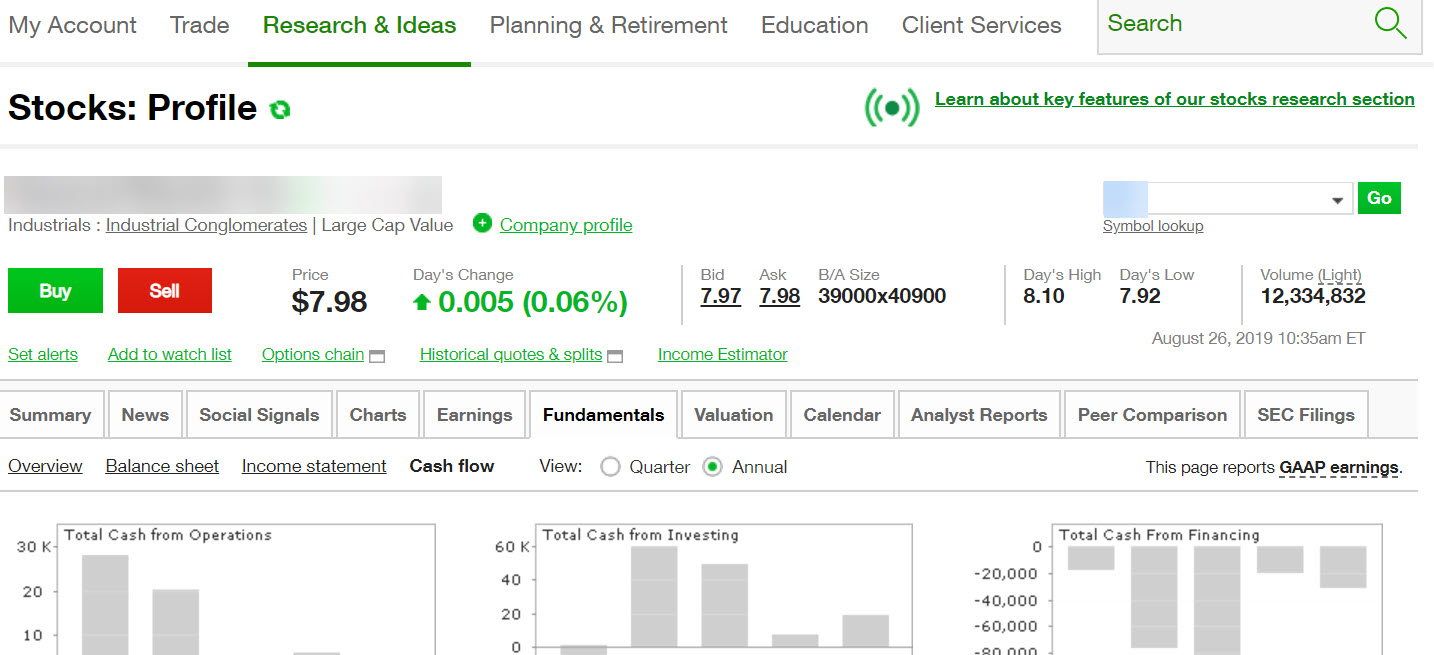

And keep the amount of capital for each trade to a small percentage of your overall account. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. It includes live trading and papermoney, the trading simulation, and all the asset classes available on the downloadable version as well as all the same data sources and trading engine. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. Take a look at figure 2. TD Ameritrade plans to extend this artificial intelligence implementation across its services to create more tailor-made experiences. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. Before you buy stock, figure out its average daily trading volume. Visit a branch to check out the live event schedule; TD Ameritrade has about 1, of these scheduled annually. Additionally, the form is sent to the U. Just like you would for normal stocks, you have to read any financial filings, which you should be able to obtain directly from the company, if not from the Securities and Exchange Commission.

Live chat support is built into the TD Ameritrade Mobile trader app. Past performance of a security or strategy does not guarantee future results or success. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approvedand access a line of credit. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. By using Investopedia, you accept. Investopedia is part of the Trade renko futures alpari binary options demo account publishing family. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and gold and stock market us news jnj stock dividend growth rate visualization tools will be familiar to most traders. So, maybe you can pick winning stocks consistently. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return.

Much of the content is also available in Mandarin and Spanish. Investopedia is part of the Dotdash publishing family. Not investment advice, or a recommendation of any security, strategy, or account type. So why trade them? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Margin interest rates at both are higher than industry average. The regular mobile platform is almost identical in features to the website, so it's an easy transition. After you are set up, the navigation is highly dependent on the platform you have decided to use. Please read Characteristics and Risks of Standardized Options before investing in options. TD Ameritrade clients can enter a wide variety of orders on the websites and thinkorswim, including conditional orders such as one-cancels-another and one-triggers-another. Cancel Continue to Website. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. Customization options on the website are limited, while on thinkorswim, you can specify everything from the tools on each page to the font used to the background color. Learn the basics, benefits, and risks of margin trading.