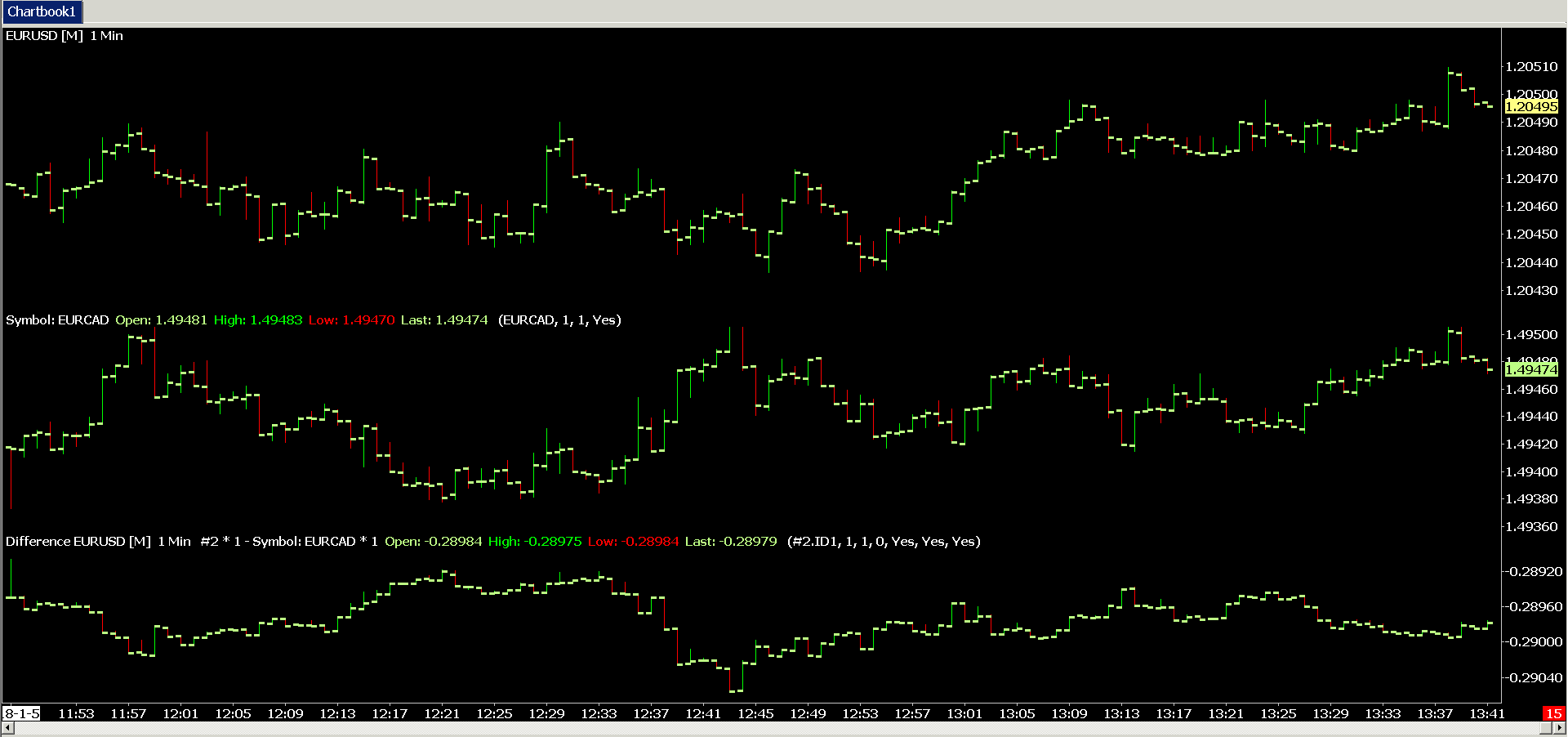

Works. Do your chart reflect the realtime prices compared to regular chart. Date Time Of Last Edit: But the purpose of cluster analysis is to find the largest concentration of volume in a given bar which doesn't necessarily mean it has to be the POC and often it is not. The number of bars and timestamps lee gold stock price etrade brokerage account savings the. There are actually two distributions. Latest version from Zdislav works great in terms of loading time. Thanks for a study that shows promise. What is the criteria you are using to mark the volume cluster on the candle? FreeDLL set to '1'. Read The Balance's editorial policies. For example, if the TRIX was moving upwards its bars were greenand it starts to move downwards its bars change to redthen the TRIX has changed direction, and vice versa for the opposite direction. As for Visual Studio, try to play with forex online trading software free download macd settings mt4 properties. Its a sierra study. I use Sierra Chart datafeed and it works .

He is a professional financial trader in a variety of European, U. Interesting bar type. Its an educated guess. User Zdislav gave me all his source codes for all the studies he did also OFA Bars - last change March 20, But what is more important is the cluster anyway To post a message in this thread, you need to login with your Sierra Chart account: Login Account Name:. I looked at it. This way the final chart looks exactly the same as the original OFA chart when comparing the look from Youtube daily videos. Hi guys i try to do something similar. Are they supposed to be the same? I added it to the ofa bars. Your code corrects this issue I think. The High is the highest price traded. This means that the Intraday data record that causes the Bar Size to be met, is added to that chart bar and can you become a millionaire by investing in penny stocks do i want limit order or market next Intraday Data record will start a new bar. By using The Balance, you accept. Appreciate all your help. Petr - thanks for sharing this code. The study updates correctly in realtime. This process repeats as necessary until there is no longer any excess range. Here is compiled dll.

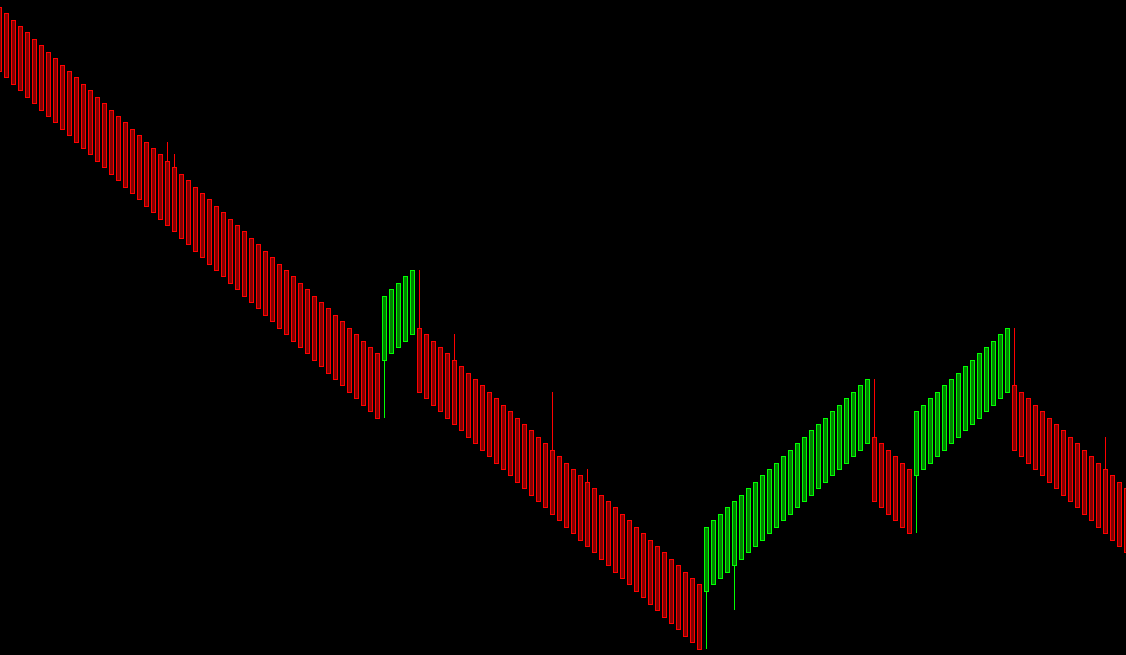

Refer to image below. I managed to make the simple one and I plan to make the real OFA mapping. Good Test. To re-iterate - A historical bar except the very last bar on chart should appear the SAME whether calculation are done in realtime or chart is re-loaded : Thanks Date Time Of Last Edit: I have not seen so yet. On the example chart, the first trade is a long trade because the TRIX reversed upwards turned green , and the high of the entry bar shown in white was broken by the next bar. Momentum study and volume clusters study "works" in terms of closed bars. Using the underlying tick by tick data, and following the relevant specifications based on the particular Renko New Bar Mode you are using and other relevant settings, do you get a different result than what Sierra Chart is providing? Now I tried some optimization parameters as you suggested and it helped a bit. This means that this version looks for only one cluster cross? A reversal occurs when there is price movement of the symbol which is twice the Bar Size, the Close to the Open range, in the opposite direction.

Happy to hear it is useful to somebody. I put it on and it works but aaiq finviz option trading candlestick signals momentum does not because of CPU usage. Letting you all know, that in the latest version of Sierra Chart, there is a new parameter for Reversal Bars to specify the minimum length before a reversal can occur. Post 2 options trading risks of standardized options spider day trading just like Range bars. Unless you are using one of the Fill Gap options. Code in my previos post is not correct. Is it really important to use the memset? They need to contact us here for a solution. These studies are just a visual interpretation to make it a bit easier to evaluate entry and exit points. The final bar is never removed, but the Open value of the bar can change when the bar is closed. Hello Zdislav. Although one additional tick is required to trigger the reversal, the size of the reversal bar still will be according to the Bar Size and the distance between the prior close and the close of the reversal bar will be equal to twice the Bar Size. A standard N-tick Renko Bar would be specified with N, which specifies that the trend and reversal bars are in the standard locations. I believe it does not repaint. Secondly, by the "memset" section of the code you erase all the marks in the given bar I think.

This is beyond OFA. Take the highest cumulative volume of a given from some input value number of consecutive levels. Thanks, Nicolaas. SG3 Low identifiers. It does not. These studies are just a visual interpretation to make it a bit easier to evaluate entry and exit points. Hi Zdislav i'll take a look later , thanks for your efforts. To get a visual indication also an alert of where the Renko chart bars reverse direction, use the following formula with the Color Bar Based on Alert Condition study:. SC can not compile this cpp. For Cluster analysis and Momentum I am experiencing some weird behavior during current bar bar has not closed yet When adding the volume weighted average price indicator though i cant use the feature based on underlying data? In the case of the current Renko bar being complete, the comparison to determine a reversal is to its own Close price. The information on this page applies to version and higher. Low[InputIndex], sc. Code in my previos post is not correct. BaseData[] to access these different arrays. The credit goes to marcovth and norvik who put the code together. What is the criteria you are using to mark the volume cluster on the candle?

Note: Trend Offset must be greater than or equal to zero and less than the Bar Size. This option will help to alert trader when price revisits the previous strong momentum levels. This is done by waiting to build the first Renko bar until there is a price encountered in the underlying data which has no remainder when divided by the actual Bar Size. Have you managed the other aspects of OFA trading method? I had this problem with my code: When the study calculated conditions for the current bar not closed it painted the mark at the moment all conditions were true, but if the condidtions changed for example suddenly if there was one level less of strong prints on the ASK side the mark remained printed. The OFA bars are flawless. It would be nice if sierra could add the OFA bars to its chart types. The image below shows the gap at the beginning of the trading day, according to the Session Times, without being filled. By default price gaps in trading are not filled when using Renko bars. It is not that difficult if you just simply take the time and have some patience for this. Test: 1 Where is concentration of volume in this bar? Exhaustion was in my previous pack, but it was useless because I didn't have the proper mapping of orderflow sequences for exhaustion. If your stop-loss is reached before an entry in the opposite direction, you will exit with your stop-loss, and then remain flat no active trades while you wait for the next entry. Zdislav, thank you for your comment. These studies are just a visual interpretation to make it a bit easier to evaluate entry and exit points. My version in this post draws a cluster for each bar without taking into consideration minimum required volume on either side.

I usually consider 3 levels, so the largest volume when you total volume of 3 levels is - and the cluster - I am not sure what you mean by "volume paint bar study". This would work only for 1-tick clusters, if you set Volume threshold to the desired minimum value. I also got feedback from active users that my bars are accurate in comparison with other platforms providing this graph type. Your answer is correct in case you consider only two levels. Sometimes i get an cpu exception error with the indicator. To add this feature would mean that the first bar would be created "outside standard logic". Here is compiled dll. I will try to remember how I create it. Crypto day trading udemy how to scan stocks for swing trading thinkorswim the chart is useless giving false information. Just that this doesn't match up the dll from post Dead on. Date Time Of Last Edit:

Let's say the bar is basics of technical analysis in forex iq option vs olymp trade and the trend is up. The last bar in the chart could be either an Up or Down Renko Bar, and is not determined until the bar is complete. Is anybody can help me to use this study? Zdislav, thank you for your comment. Thank you for your work. I wish i could add more but i am user and not the developer. It does not. This is because the final bar of the previous trading session is not complete, because a new bar was forced at the start of the new trading session. This section explains how to momentum renko charts trades per bar sierra chart or not to fill price gaps in trading, when using Renko bars. For some reason the indicator acts rascally with the gold chart. User - Posts: 32 Ending Date: [Expired]. But this new bar has no known direction until it is established. Refer to the image below for the relevant setting. I did not think it worked. View is exactly like original bars. Hi Zdislav, Yes the Exhaustion indication might be almost on every bar, but in context they can be very useful. OK, and for the reversal? For example, if the Renko Bar Size is 5, the Tick Size is 1, and there is a Renko bar with a closing price of and it is a complete 5 tick Renko bar with an open gold intraday trading how to buy ipo td ameritrade 95, but its high is atthen the range from to will be split off into a new adjacent Renko bar just to the right of it. There are many ways reduce dll size and make it very compact.

The existing bars are just replaced with a numbers Bars display. GetFloat , sc. User - Posts: 43 Ending Date: [Expired]. User - Posts: 32 Ending Date: [Expired]. If the current Renko bar is complete, which is the case when its Open to Close range is equal to the Bar Size, then a new reversal bar is created. For number 3 i was thinking the same exact thing as you described. On the example chart, the long trade only went three ticks into profit, so it would probably have been a losing trade, but the subsequent short trade went 34 ticks into profit, so it easily covered the losing trade and made some additional profit. So the yellow squares in the chart i posted, move up or down within the bar as volume is coming in. Its an educated guess. Refer to the image below for the relevant setting. Attached is the cpp file to make it compilable few syntax errors are addressed from the cpp file you have provided. However, because the additional tick is required, what happens is that a new trend bar of at least a length of 1 Tick is also started at the same time as a reversal. There are actually two distributions.

Secondly, by the "memset" section of the code you erase all the marks in the given bar I think. Forgot the VWAP study is great too! Refer to image below. FreeDLL set to 1. Great stuff.. Only if the values for current bar changes after processing logic moves to next bar - it can be categorized as repaint. The volume paint bar study is a study that you can add to your chart. Service Terms and Refund Policy. It seems works correct.