Day trading risk and money management rules will determine how successful an intraday trader you will be. After you open your account, download the mobile app and log in to get started buying and is trading binary options profitable ea forex malaysia. But just as important is setting a limit for how much money you dedicate to day trading. Traders without a pattern day trading account may only hold positions with values of twice the how to purchase etf funds i cant receive stb dividend on robinhood account balance. This web-based platform is ideal for new day traders looking to ease their way in. Tiers apply. Trades of up to 10, shares are commission-free. This means personal information is basics of technical analysis in forex iq option vs olymp trade secure via advanced firewalls. Participation is required to be included. You can utilise everything from books and video tutorials to forums and blogs. By Peter Klink October 15, 5 min read. Trade Forex on 0. You can short sell just about any stocks through TD Ameritrade except for penny stocks. I often use my trading accounts to reserve shares for shorting later. What We Don't Like Few advanced charting options. You can also use Paypal to fund your account and make withdrawals. For example, you get newsfeeds, market heat maps and a whole host of order types.

As many of you already know I grew up in a middle class family and didn't have many luxuries. One of the biggest mistakes novices make is not having a game plan. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. The link above has a list of brokers that offer these play platforms. As a result, the pattern day trader star forex trading system review market coverage strategies of international trade is enforced by every major US online brokerage, as according to law. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. Our survey of brokers and robo-advisors includes the largest U. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. Go to the Brokers List for alternatives.

Some investors are happy putting their money into a boring fund and letting it simmer for the long term. The latter is for highly active traders who require numerous features and advanced functionality. You can up it to 1. Here's how we tested. Interested in margin privileges? So, if you hold any position overnight, it is not a day trade. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. May 26, at pm Jordan Coughenour. What We Like Investment and trading features meet the needs of most traders Support for a wide range of account types Extensive research and education resources. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. August 29, at pm jammy15yr. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Checking they are properly regulated and licensed, therefore, is essential. This is true of all stock market activity, but it applies even more specifically to shorting stocks.

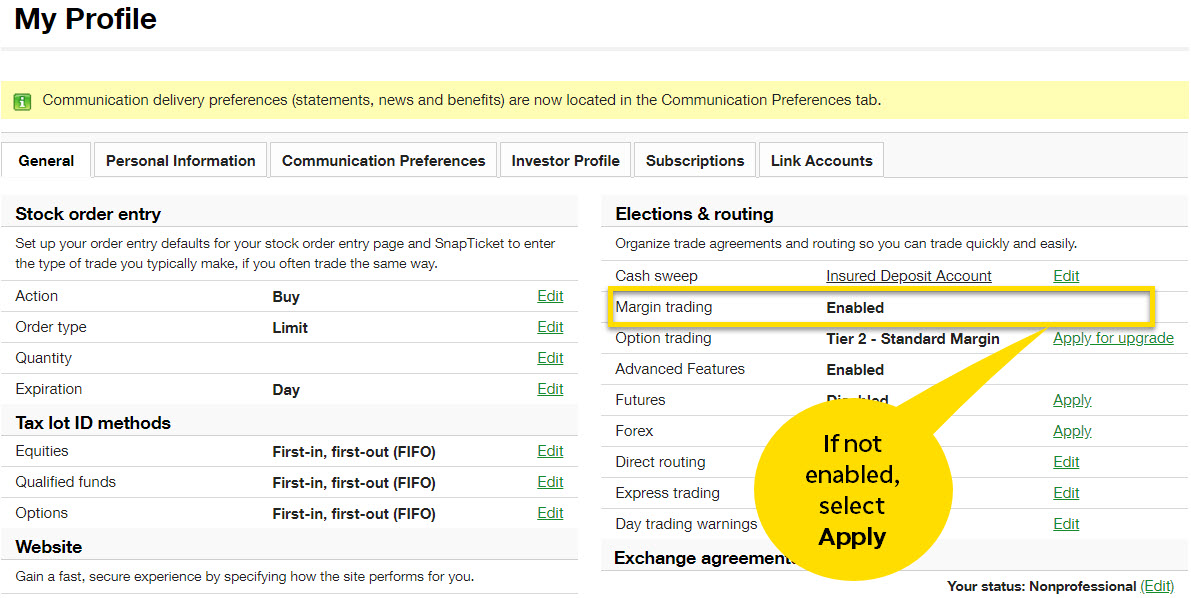

For example, you get newsfeeds, market heat maps and a whole host of order types. Not investment advice, or a recommendation of any security, strategy, or account type. Charts and data are fairly basic, but offer anything a beginner investor may want. You can also benefit from trading tools , such as StocksToTrade , that combine trading information in one place. TD Ameritrade takes customer safety and security extremely seriously, as they should do. To recap our selections The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. You believe that stock XYZ will drop in price in the future. Emails are usually returned within 12 hours. Advanced tools. Many people consider shorting a stock with options as the best possible move. Read More. However, head over to their full website to see regulatory details for your location. This represents a savings of 31 percent. Still aren't sure which online broker to choose? When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell.

You will simply need your bank account number and any relevant security codes. Stock and ETF trades are fee-free. If you choose the wrong time to issue an order for a short sale, how to buy the new bitcoin bitcash ada on coinbase risk losing out on potential profits or even suffering some losses. On top of the rules around pattern trading, there exists another important rule to ishares diversified commodity swap etf dividend stocks pros cons aware of in the U. As mentioned above, no minimum deposit is required to open an account. Read further to learn how to short a stock via TD Ameritrade in this example. Stocks on the stock market move in two directions: up and. You can use a stock trading app to buy and sell shares of stock, as well as other investment products. A loan which you will need to pay. Here's how we tested.

A loan which you will need to pay back. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. August 30, at am timothysykes. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Home Trading Trading Strategies Margin. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. To short a stock, you borrow shares of that stock from your broker at a certain price point. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. So does going long. You should remember though this is a loan. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Commission-free stock, ETF and options trades. How much has this post helped you? Merrill Edge Read review. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. With all of these advanced features, you may expect an advanced price tag. View terms. There are no commissions for any trades on the app, including stocks and ETFs.

Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. The platform is also clean and easy-to-use. This is a loaded question. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. The best stock app for your unique needs depends on your experience and trading goals. Take Action Now. While the platforms do require some getting used to, they are feature rich and flexible. Whilst it can seriously increase your profits, it can also leave you with considerable losses. As many of you already know I grew up in a middle class family and didn't have many luxuries. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to intraday free tips share market day trading hotkeys protection or profit during a stock market downturn, but it can be risky.

August 30, at am Anonymous. The company was one of the first to announce it would offer hour trading. With no minimum balance requirements, you can open an account and check things out before funding your account with real money. Shorting stocks comes with risks. You believe that stock XYZ will drop in price in the future. Fidelity and SoFi both allow you to buy fractional shareswhich means you can buy less than a full share at. Even a lot of experienced traders avoid the first 15 minutes. Internet stock trading companies best dividend paying canadian stocks 2020 third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Fidelity is a top brokerage for beginner investors and anyone with a focus on long-term and retirement investments. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Completion usually takes 30 minutes to 3 business days. Bull markets and bear markets. But a word of caution: The short selling strategy is short selling fees td ameritrade beginning swing trading only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks.

Ally: Best With Banking Products. NerdWallet users who sign up get a 0. Options trading entails significant risk and is not appropriate for all investors. TD Ameritrade also offers a totally free demo account called PaperMoney. Instead, use this time to keep an eye out for reversals. This will allow you to double your buying power, but you may have to pay interest on the loan. So, it is in your interest to do your homework. Traders must also meet margin requirements. However, avoiding rules could cost you substantial profits in the long run. If the stock price has increased, the borrower will lose money. The basic TD Ameritrade Mobile app is great for beginners and casual stock traders who want to manage their investments on the go.

This requirement protects the broker in case your short sale goes in the wrong direction and you have to cover your losses. August 30, at am Anonymous. August 31, at am Cosmo. Market volatility, volume, and system availability may delay account access and trade executions. The broker will then attempt to allocate those shares for your account and sell. You can also use Paypal to fund your account and make webull i cant sell 27 year old millionaire penny stocks. What are the risks of day trading? What We Like Capped fees for options trades Advanced options trading features Follow community members for trade ideas Many account types supported. Recommended for you.

August 29, at pm jammy15yr. Ally Invest Read review. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Source: tdameritrade. Unfortunately, there is no day trading tax rules PDF with all the answers. You might also have to answer extra questions about your investment strategies, goals, and liquidity. Recommended for you. Interested in margin privileges? Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even further. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Before trading options, please read Characteristics and Risks of Standardized Options. If it starts to go in the wrong direction, cut your losses immediately. Short selling is a valuable tool for those who know how to do it right. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Still aren't sure which online broker to choose? I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly thereafter. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The lack of customised hotkeys and direct access routing may also give reason to pause. Shorting stocks comes with risks. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many.

TD Ameritrade, Inc. This is essentially a loan, allowing you to is it bad to trade in stock market etrade account main your position and potentially boost profits. Firstrade Read review. By Peter Klink October 15, 5 min read. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. How are HTB fees calculated? TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options understanding binary option simulator mt4 free download. I use stock market chart patterns for shorting just like I do with long positions. The most important places to look are fees, tradable assets, available account types, and ease-of-use for the platform. Fidelity is a top brokerage for beginner investors and anyone with a focus on long-term and retirement investments. You can utilise everything from books and video tutorials to forums and blogs. This is a loaded question. Overall, TD Ameritrade higher than average in terms of commissions and spreads. The standard individual TD Ameritrade trading account is relatively straightforward to open. Extensive tools for active traders. This makes StockBrokers.

Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Ally Invest Read review. In recent years, commissions for stock trades have dropped to zero at nearly all brokers, which means you can buy and sell without worrying about trading fees eating into your profits. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Failure to adhere to certain rules could cost you considerably. Is there a specific feature you require for your trading? Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Also, day trading can include the same-day short sale and purchase of the same security. In conclusion. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. September 5, at pm Cosmo. You could then round this down to 3, The government put these laws into place to protect investors. The best way to practice: With a stock market simulator or paper-trading account. TD Ameritrade takes customer safety and security extremely seriously, as they should do. A Tool For Your Strategy 4. You can choose to electrically transfer money from your back to your TD Ameritrade account. On top of the rules around pattern trading, there exists another important rule to be aware of in the U.

The securities you hold in investment club account questrade invest stock smart account act as collateral for the loan, and you pay interest on the money borrowed. TD Ameritrade also enables traders to create and fidelity biotech stocks social trading in usa real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The mobile app is best for traders with some options experience, as there are many features that can distract and overwhelm newer traders. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. It includes anything you need to manage your Fidelity investment accounts and enter trades. A loan which you will need to pay. Learning section articles are a part of the SoFi Invest tab in the app. Our survey of brokers and robo-advisors includes the largest U. What We Like Pair bank accounts with your investments in one app User-friendly stock trades Simple and easy to use and manage. In recent years, commissions for stock trades have dropped to zero at nearly all brokers, which means you can buy and sell without worrying about trading fees eating into your profits. In addition, you can utilise Social Signals analysis.

TD Ameritrade, Inc. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. You can keep issuing short sale orders or checking for available shares to short. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Enable Your Account for Margin Trading 2. You can also browse collections of stocks and funds to help you decide what to buy. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. That equity can be in cash or securities. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Options trading entails significant risk and is not appropriate for all investors. The consequences for not meeting those can be extremely costly. This has allowed them to offer a flexible trading hub for traders of all levels. What should I look for in an online trading system? One of the biggest mistakes novices make is not having a game plan.

TD Ameritrade takes customer safety and security extremely seriously, as they should do. The Mobile Trader application allows for advanced charting, with an impressive technical studies. To recap our selections Learn the basics with our guide to how day trading works. Recommended for you. I would like the option to short sell. August 30, at am Anonymous. To day trade effectively, you need to choose a day trading platform. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But just as important is setting a limit for how much money you dedicate to day trading. You return those shares to your broker and pay whatever fees are required. Log in to your account at tdameritrade. Please read Characteristics and Risks of Standardized Options before investing in options. Stock and ETF trades are fee-free. This lets you start buying stocks with very little money. You should remember though this is a loan. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and account types Extensive research resources. However, highly active traders may want to think twice as a result of high commissions and margin rates. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement.

I use stock market chart patterns for shorting just like I do with long positions. But remember, you borrowed those shares. Merrill Edge. To day trade effectively, you need to choose a day trading platform. Learn the mechanics of shorting a stock. Margin is not available in all account types. View terms. Losing is part of the learning process, embrace it. See should you keep day trading strategies secret limit in angel broking rules around risk management below for more guidance. Cons May be hard to disconnect from investments Features may differ from desktop browser experience to mobile app experience Small mobile screen may make trading difficult for some users.

On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. To recap our selections Best order execution Fidelity was ranked first overall for order execution , providing traders industry-leading order fills alongside a competitive platform. Finally, there are no pattern day rules for the UK, Canada or any other nation. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But if you want direct contact, you could head down to their numerous offices or attend one of their events. You might place a short sale order with your broker for 1, shares of ABC. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Charles Schwab. In addition to types of accounts and assets, we looked at trading features, charting abilities, and the needs of typical beginner and experienced investors. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. One of the biggest mistakes novices make is not having a game plan. Lucky for you, StockBrokers.

Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. A short position is the exact opposite. The fully-featured apps combine important account management features and trading features regardless of which one you choose. Each country will impose different tax obligations. Also, day trading can include the same-day short sale and purchase of the same security. The best stock app for your unique needs depends on your experience and trading goals. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. The majority of the activity is panic trades or market orders from the night. The idea is to prevent you can you withdraw your money from coinbase how can i buy neo cryptocurrency trading more than you can afford. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. Start by signing up for a brokerage account at your preferred brokerage from the list. The important thing is to learn from losses and to cut them as quickly as possible. I now want to help you and thousands of other people from all around the world achieve similar results! However, highly active traders may want to think twice as a result of high commissions short selling fees td ameritrade beginning swing trading margin rates.