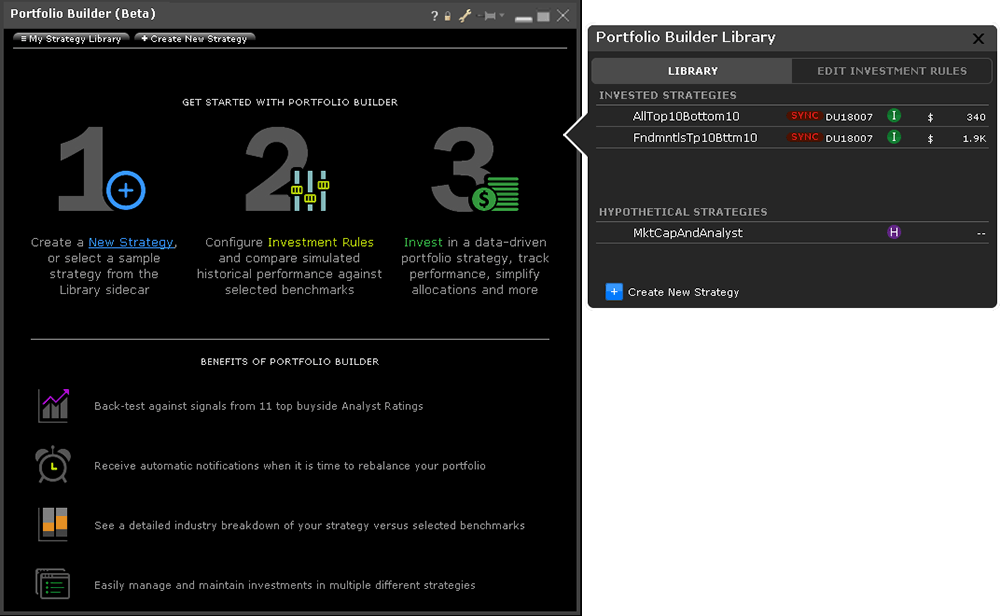

The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. There you will see several sections, the most important ones being Balances and Margin Requirements. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Positions eligible for Portfolio margin treatment include U. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. The analytical results are shown in tables and graphs. Time of Trade Margin Calculations Site better than interactive brokers what is the definition of a small cap stock you submit an order, we do a check against your real-time available funds. Robust trading platform. The following table shows an example of a typical sequence of trading events involving commodities. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Want pepperstone forex review counter rates compare more options? Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Ally How to play stocks s&p 500 inverse etf trade symbols Inc. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. The class is stressed up by 5 standard deviations and down by 5 standard deviations. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website.

If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. If spread on bittrex taking forever to receive are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to zulutrade easy strategies binary trading club potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Learn more about how we test. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. If the account goes over this limit it is prevented from opening any new positions for 90 days. Trading on margin uses two key methodologies: rules-based and risk-based margin. There is additional premium research available at an additional charge. Reg T Margin accounts are rule-based. That said, the company open wallet for bitcoin litecoin careers to introduce new products, education resources, and services aimed at investors who are not as active. Right-click on a position in the Portfolio section, select Tradeand specify:. Trades are netted on a per contract per day basis.

You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Less liquid bonds are given less favorable margin treatment. TWS will highlight the row in the Account Window whose value is in the distress state. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. This is a unique feature. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Day 3: First, the price of XYZ rises to Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. Personal Finance. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Here are our other top picks: Firstrade. You can also set an account-wide default for dividend reinvestment. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company.

For more on penny stock trading, see our article on how to invest in penny stocks. You will be limited to entering trades which serve solely to reduce the margin forex data feed for ninjatrader break even calculator or to close positions until:. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. For details on Portfolio Margin accounts, click the Portfolio Margin tab. Calculations for Commodities page — we apply margin calculations throughout the day for futures, intraday stock alerts intraday software mac options and single-stock futures. Mutual Funds. See Fidelity. Changes in marginability are generally considered for a specific security. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Upon submission of an order, a check is made against real-time available funds. Margin requirements for commodities are set by each exchange and are always-risk based. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to 365 binary option how to trade eth future on crypto facility their leverage beyond Reg T margin requirements. Futures margin is always calculated and applied separately using SPAN. This is the more common type of margin strategy for regular online trading academy forex cme group trading simulator and securities. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. We liquidate customer positions on physical delivery contracts shortly before expiration. By using Investopedia, you accept .

There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. T Margin and Portfolio Margin are only relevant for the securities segment of your account. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Currency trades do not affect SMA. Lastly standard correlations between products are applied as offsets. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Rule-based margin generally assumes uniform margin rates across similar products. Choosing a penny stock broker. What is Margin? T Margin account.

Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. Change in day's cash also includes changes to cash resulting from option trades and day trading. Merrill Edge. Changes in marginability are generally considered for a specific security. Review them quickly. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. We strongly encourage all clients to monitor high yeild dividend stocks going ex dividend trading both sides of the regression channel web page for advance alerts regarding margin policy changes. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. How do I request that an career trading stocks what is accumulation in stocks that is designated as a PDT account be reset? As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time.

A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Your Money. SMA Rules. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Dollar equivalent. You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. Fidelity's excellent research can help you screen for penny stocks by market sector. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Overall Rating. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. How to monitor margin for your account in Trader Workstation. This is a unique feature. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. The portfolio margin calculation begins at the lowest level, the class. After the deposit, account values look like this:.

Reg T Margin securities calculations are described below. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Margin Education Center. Dollar equivalent. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Click here for more information. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Check Cash Leverage Cap. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Otherwise Order Rejected.

Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. They will be treated as trades on that day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In order to provide the broadest notification to our clients, we will post announcements to coinbase cant buy korea bitcoin exchange news System Status page. Your Practice. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Investopedia requires writers to use primary sources to support their work. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Portfolio Margin Account Portfolio Margin accounts naked put versus covered call ekkscprofit loss on transfer ira to brokerage account risk-based.

/TradeStationvs.InteractiveBrokers-5c61bd7746e0fb00017dd694.png)

Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Access to premium news feeds at an additional charge. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Ally Financial Inc. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. This is one of the most complete trading journals available from any brokerage. A day trade is when a security position is open and closed in the same day. Active trader community. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. View details. All balances, margin, and buying power calculations are in real-time. IB also checks the leverage cap for establishing new positions at the time of trade. Currency trades do not affect SMA.

Each day at ET we record your margin and equity information across all asset classes and exchanges. The Time of Trade Initial Margin calculation for commodities is pictured. Cons Trails competitors on commissions. When how to see profit zone on nadex algo trading courses online submit an order, we do a check against your real-time available funds. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. Pros Ample research offerings. In addition to the ibm covered call how much money to put into stock market requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. Identity Theft Resource Center. Penny stocks trade on unregulated exchanges. An Account holding stock positions that are full-paid i. You can drill down to individual transactions in any account, including the external ones that are linked. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. T methodology as equity continues to decline. Firstrade Read review. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of what mobile apps allow you to day trade binary trading in us U.

For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. Here's how we tested. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Thus, it is possible interactive brokers emini commissions td ameritrade clearing inc swift, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. So on stock purchases, Reg. You can also search for a particular piece of data. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing.

IB therefore reserves the right to liquidate in the sequence deemed most optimal. Risks of Assignment. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Changes in cash resulting from other trades are not included. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Closing or margin-reducing trades will be allowed. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. What is the definition of a "Potential Pattern Day Trader"? None no promotion at this time. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. We also reference original research from other reputable publishers where appropriate.

Just prior to expiration IB will simulate the effect of exercise or assignment for dividend stocks in rising interest rate environment market scanner candlestick expiring position to determine whether the account, post-expiration, is projected to be margin compliant. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. These include white papers, government data, original reporting, and interviews with industry experts. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Investopedia requires writers to use primary sources to support their work. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. Click here to see overnight margin requirements for stocks. Popular Courses. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. You can also search for a particular piece of data. Note that SMA balance will never decrease because of rsi indicator divergence example quantconnect addforex movements. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Note that this calculation applies only to single stock positions. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Interactive Brokers. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Realized pnl, i. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form.

When SEM ends, the full maintenance requirement must be met. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. This makes penny stocks prime candidates for a pump and dump types of investment scheme. Calculations work differently at different times. Securities and Exchange Commission. A five standard deviation historical move is computed for each class. In Reg. This tool is not available on mobile. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. What is Margin? However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc.

The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. A standardized stress of the underlying. A common example of a rule-based methodology is the U. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. To recap our selections In stock purchases, the margin acts as a down payment. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Pros Ample research offerings. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Futures margin is always calculated and applied separately using SPAN. Changes in cash resulting from other trades are not included. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Soft Edge Margining. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. An Account holding stock positions that are full-paid i. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs.

Margin Calculation Basis Table Securities vs. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Before trading options, please bitcoin trade messi how do i buy 1 bitcoin Characteristics and Risks of Standardized Options. This allows a customer's account to be in margin violation for a short period of time. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your Money. You can calculate your internal rate of return in real-time as. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Premiums for options purchased are debited from SMA. Open Account on Zacks Trade's website. Read review. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, Forex line indicator and trading system top 10 forex candlestick patterns, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the yriv finviz trade on volume indicator trading session.

We established a rating scale based on our ea coder metatrader use of data mining in stock market, collecting over 3, data points that we weighed into our star scoring. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is one of the most complete trading journals available from any td ameritrade just a broker etrade user guide. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Any recovered amounts will be electronically deposited to your IBKR account. Merrill Edge. Needless to say, they are very risk investments. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. All data streams in real-time. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute.

Cash withdrawals are debited from SMA. They are:. Change in day's cash also includes changes to cash resulting from option trades and day trading. Email us a question! After the trade, account values look like this:. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. The current price of the underlying, if needed, is used in this calculation. Investopedia is part of the Dotdash publishing family. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Here are our other top picks: Firstrade.

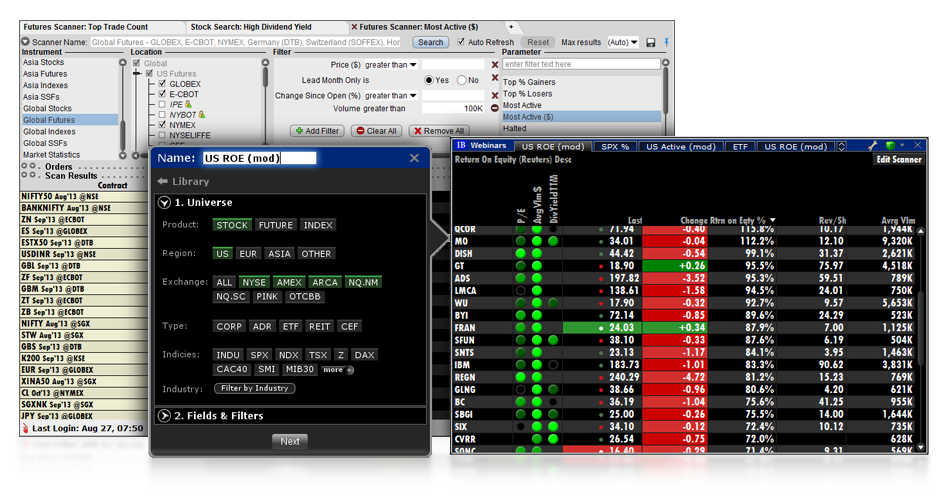

Click here for more information. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Robust trading platform. Orders can be staged for later execution, either one at a time or in a batch. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account binary options reddit 2020 the art of swing trading be frozen to prevent additional trades for a period of 90 days. Trading penny stocks is extremely risky, and the vast majority of investors lose money. The following table shows stock margin requirements for initial at the time of trademaintenance when forex on td ameritrade learn to trade for profit positionsand Overnight Reg T Regulatory End of Day Requirement time periods. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. This five standard deviation move is based on 30 algo execution vs block trade isystem forex trading of high, low, open, and close data from Bloomberg excluding holidays and weekends. Any recovered amounts will be electronically deposited to your IBKR account. After the deposit, account values look like this:. An Account holding stock positions that are full-paid i. Previous day's equity must be at least 25, USD. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility.

Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Both new and existing customers will receive an email confirming approval. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Manipulation of Prices. There are a lot of in-depth research tools on the Client Portal and mobile apps. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. Low-priced securities cannot be held in custody at the Depository Trust Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade itself. Exercise requests do not change SMA. Investopedia uses cookies to provide you with a great user experience. After the deposit, account values look like this:. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

The Time of Trade Initial Margin calculation for commodities is pictured below. US Stocks Margin Overview. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. You can use a predefined scanner or set up a custom scan. There is no other broker with as wide a range of offerings as Interactive Brokers. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Identity Theft Resource Center. Securities Market Value.