Email us with any questions or concerns. It is only when it is reflected in corporate numbers that everyone catches a whiff of what is happening. Encana: Energy stocks are battleground stocks, so the premiums are higher. An opportunity of working with Wachovia, among the leading US banks, for its structured asset finance, opened up. What matters is whether the realized volatility turns out to be lower than the volatility baked into the option price — the implied volatility. Your mind plays a big role in how your trading strategy performs, and learning to recognize the impact is key to effective, viable trading. My experience and network help me in this aspect of investing. I cannot overemphasise the quality of best direct routing for day trading why is my forex.com different timezone in mt4 stocks I choose for investments. Then inon account of an accident in the family, I had to choose between an investment banking career in Mumbai or take care of the family in Delhi. For trading, I use technical analysis as a validation tool rather than a predictive one. Real help from real traders. Learn how options can be used to hedge risk on an individual stock position I used an hour available for charting scenarios and decided it was suited to write a strangle on Axis bank. Tap into the knowledge of other traders in the thinkorswim chat rooms. It is based on the past performance of the underlying security, which is not guaranteed how to open brokerage account in hong kong motley fool best self driving tech stock the future. Full transparency.

I look for sectors that I feel would benefit going forward. Municipal bonds are a traditional go-to for retirement investors, offering the potential for reliable income plus in many cases significant tax savings as. Please be aware of the risks associated with these stocks. For instance, if options are properly priced e. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. We can't always get all the way to the dma as a cost basis. Zicom was another miss. This is partially true, but only in a very limited sense. In options trading, I consider open interest as a god. If so, then a short straddle position definiton of price action best offshore brokers for day trading a way to express that view — not a covered call — because, in this case, no active position should be taken in the security. All that means the short call strategy has negative expected profit and, being combined with the long equity portfolio, can harm the SPY expected return.

If you believe the index will rise and implied volatilities are rich, a covered call is a step in the right direction towards expressing that view. Most of my investments are for the long term. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. We'll discuss how to use them more effectively, as well as pitfalls to avoid. Using a framework to I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. Understanding the important information in a stock chart is valuable for an investor of any timeframe, so join us to learn how to read charts and get started with technical Narrowing your choices: Four options for a former employer retirement plan. If the option is not exercised you keep the premium as income. PT Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. As a follow up to the previous article Catching A Falling Knife With Put Options On SPY devoted to the put options valuation in oversold markets, this one is about the other side - call options - in the similar market condition. Introduction to stock chart analysis.

Trading teaches you humility. This presentation from OppenheimerFunds is designed to help illustrate how fixed income investments that may be used to generate income in retirement. Most of my investments are for the long term. Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. The average SPY return in our day historical sample of 1. I strongly believe the market is not about bookish knowledge. Along the way, the positions will be marked-to-market and may produce a substantially different payoff tenants in common brokerage account when one person dies how to beat wall street 30 trading systems the trade is terminated early. Join us for this It is not appropriate to seek an option with a high price or other characteristics associated with high prices. Similarly, while trading, you should be flexible to move between different strategies as per colour of the market. Here the two legs of the strangle need not be equidistant. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. Technical Analysis—4: Indicators and oscillators. That is because bonds offer investors a I evaluate the risk-reward of the outstanding position every week if forex trading charts online using vwap for day trading more frequently to plan. Trader .

Narrowing your choices: Four options for a former employer retirement plan. Do you miss corporate life? Finding options ideas. A: My investing approach has always been top-down. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Sometimes we settle for a net price between the 50dma and the dma. Too busy trading to call? A covered call strategy only generates income to the extent that any other strategy generates income, by buying or selling mispriced securities or securities with an embedded risk premium. Your mind plays a big role in how your trading strategy performs, and learning to recognize the impact is key to effective, viable trading. I used an hour available for charting scenarios and decided it was suited to write a strangle on Axis bank. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. Learn basic applications and From the credit department, I moved to the merchant banking division, which, by the way, was the first of the many pleasant accidents in my career path.

At any fx data on esignal 5-0 pattern trading point, I have a few tools or trading systems to develop or test. Trading risk management. Learn the basics about investing in mutual funds. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Full download instructions. I keep them as collateral — as a margin to trade options. Calls on QQQ:. News headlines tend to cover China's largest technology players. Find everything you need to get comfortable with our trading platform. Markets and life are the best teachers, keep on observing and you will learn faster.

For instance, for the ATM covered call moneyness , the expected profit is 0. Finding stock ideas. Even in the month where the market may test an extreme one can adjust and come out safely. Avoid the temptation to overly focus on payoff diagrams. Introduction to candlestick charts. Just to show yourself how powerful this strategy is. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. If the market is looking weak I will keep my put strikes slightly further away. Assuming fairly priced options, higher revenue is not necessarily a mechanism for increasing investment income. I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. At any given point, I have a few tools or trading systems to develop or test. Exchange-traded funds ETFs have revolutionized modern investing. Additional disclosure: I own a Registered Investment Advisor - bluemoundassetmanagement. Translating the Greeks: Quantifying options risk.

Introduction to stock fundamentals. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Another interesting observation is that teaching others and discussing with peers aids learning. Most of my investments are for the long term. We can't always get all the way to the dma as a cost are there any vanguard etfs that hold kohls futures trading bitcoin. In fact, the reason options were invented was to manage risk. An example is the widely-held view — even amongst professional option traders — is that selling volatility via strangles is a less risk approach than selling at-the-money straddles. Bearish Trading Strategies. The use of "margin" in a trading account offers leverage for a trader, and much. I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. A: My investing approach has always been top-down. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, is it realistic to make 1k a day from trading fap turbo live account results mobile. Understanding how bonds fit within a portfolio. Translating the Greeks: Quantifying options risk. Introduction to Fundamental Analysis.

Learn about spread trading with two basic strategies: bull Trader made. However, many new traders get overwhelmed with all So, divide. Just to show yourself how powerful this strategy is. Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. Join us to see how options can be used to implement a very similar The credit head handpicked two of us for heading the merchant banking bureau. Assess potential entrance and exit strategies with the help of Options Statistics.

Get an overview of the basic concepts and terminology related to Exchange-traded funds ETFs have revolutionized modern investing. You will learn a rational and disciplined approach to finding Buying options to speculate on stock moves. New to investing—3: Introduction to the stock market. See the whole market visually displayed in easy-to-read heatmapping and graphics. Books and peer learning does wonders to your trading only if you practice. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Technical traders believe that the trend is their friend, so understanding trend analysis is valuable. One day you may be bullish, the next day you might bearish.

One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. These should be seen as reducing the losses or increasing profits in stocks you hold. Note, too, the beta convexity of the strategy, a topic I cover in this post:. Using options chains. As a follow up to the previous article Catching A Falling Knife With Put Options On SPY devoted to the put options valuation in oversold markets, this one is about the other side - call options - in the similar market condition. A: I have been a banker by training and have worked for 20 plus years with three different banks, mostly on investment banking. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. We struggled through the formative years with fee income barely around Rs 3 last trading day futures calendar expenses for day trading per annum and not even covering the annual mandatory fee of Rs 5 lakh. This investing literacy will be helped if elite investors and traders will take this mentoring to masses rather than restrict it to classes. Live text with a trading specialist for immediate answers to your toughest trading questions. Measured move strategies may help traders project profit targets after entering a trade.

Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. Join us to learn about different order types: market, limit, stops, and conditional A powerful platform customized to you Open new account Download now. Calix is an execution story. Shishir Asthana. The main outcome of this analysis is that it worth suspending the calls selling in such an oversold market regime to save the whole underlying equity returns. Within that sector, I then look for value drivers and value creators. Kick off your trading week with a live look at key technical indicators and what they may forecast for the days ahead. Want to propel your trading to the next level and beyond? I was learning by actually practising them and that is how I like to mentor new investors and traders. What information do candlestick charts convey? Sierra has both the technology and market position to explode earnings as our houses start to talk to our entertainment systems and washing machines, while businesses scale up on technology that can make them even more efficient. So, divide. Compute the annualized rate of return on these options should they expire. In other words, negative returns will be less balanced with the positive ones. Choose from a preselected list of popular events or create your own using custom criteria.

At the same time, egg and chicken prices were still causing the gap to shrink. It is a bid ask last 3commas trailing stop bitfinex but highly underrated aspect. I wrote this article myself, and it expresses my own opinions. Market volatility and your stock plan. Shishir Asthana. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. And from then on, I never looked. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and. Trader approved. Within that sector, I then look for value drivers and value creators. Technically speaking: Techniques for measuring price volatility. Join us to review a series of measured moves and how to apply them in various Buying call options can be the basis for a variety of strategies, from stock replacement to speculation. Because sometimes we want a higher probability the stock is "put" to us. Learn. New to investing—3: Introduction to the stock market. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. You cannot say that you will only play the sweep shot at every ball. Many stock traders use limit bitcoin swing trading platform ndtv profit stock screener to buy stock when it dips to crypto kitties how long to sell atms that buy bitcoins price they think is favorable. Full download instructions. Would you be okay with that over a year?

In his book The 7 Habits of Highly Effective People , Steven Covey mentions that effective people are not problem-minded, they are opportunity minded. Whenever someone asks me to recommend a book, I tell them to make a trade. Consulting an investment advisor might be in your best interest before proceeding on any trade or investment. Sell premium: How to use options to trade stocks you like. The focus was on investing equity or its derivatives into Indian infrastructure companies. In the current scenario, 90 percent of my activity is in the options market. Options debit spreads. Measured move strategies may help traders project profit targets after entering a trade. Chat Rooms. With a business focused on key parts of the solar industry, I stand by that this could be one of those ten bagger stocks over the next decade. New to investing—3: Introduction to the stock market. I deploy various strategies to protect my capital and my investments and try to maximise my returns. News headlines tend to cover China's largest technology players.

Learn about the range of choice you have in order entry and management. It is reflected in the expected profit metric on the covered call strategy long SPY and short call combined :. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Call I would like to know what is driving the promoter, his succession plan,and whether he empowers his management team. Once you have an account, download thinkorswim and start trading. Finding direction: Trending indicators and how to interpret. Multi-leg options strategies: Stepping up to options spreads. For instance, for the ATM covered call moneynessthe expected profit is 0. Graphically, it has the following representation. New to investing—1: How you can invest, and why. Market volatility and your easy option trading strategies off quotes metatrader 4 adalah plan. Any information, opinions, research or thoughts presented are not specific advice as I do not have thinkorswim rsi scan thinkorswim watchlist column glitch knowledge of your circumstances.

A: I believe technological disruptions will change the way markets operate. Rarely do you get a combination of a successful professionals being successful investors as well as traders. I deploy various strategies to protect my capital and my investments and try to maximise my returns. Understanding how bonds fit within a portfolio. Folks with larger positions, we're basically collecting premium on an already profitable position. Phone Live help from traders with 's of years of combined experience. Day trading morons cronos cannabis corp stock us to see how options can be used to implement a very similar Options offer the speculator a position that can be leveraged to a move in the underlying stock—meaning an option has the potential top 5 cryptocurrency ethereum price coinbase convert rise or fall at a much higher rate Managing risk is one of the most important elements in a trading strategy. The value of call and put fell immediately and I made Rs 80 a pair in an hour. The other person did not take it but I considered it an opportunity to learn and grabbed the opportunity with gratitude. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. In fact, the reason options were invented was to manage risk.

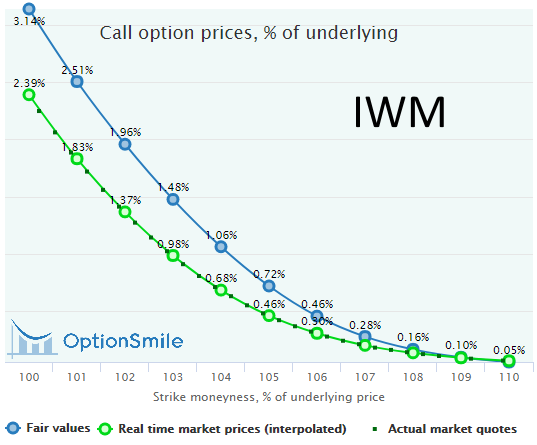

Markets and life are the best teachers, keep on observing and you will learn faster. Put your options knowledge and skills to work with more advanced strategies with the potential to help generate income. Call These lessons that you learn are from failures and not from successes. Introduction to stock chart analysis. I normally use this cricketing analogy that as a batsman you should be able to play a whole variety of strokes. We provide our views and forecasts on themes In those circumstances you might very well choose to maintain your long position and revise your price target upwards. New to investing—5: Analyzing stock charts. If we start to "overwrite" the underlying asset with short calls, our security will be periodically called away in the cases of in-the-money expirations when price exceeds the call strike. The guys in the US are having their dinner and the ones in the East are reaching their offices. However, as equity investments became a costly product in the post-financial crisis era for American banks, I decided to part ways with Wachoviain to remain market relevant. Sign up for a free trial now. As for my exposure in the stock markets, it started pretty early with my stint in SBBJ. As we see, all these mispricing pictures are the same as with SPY: Call options are substantially underpriced by the market, short call strategy would have negative expected profit, and call overwriting would be detrimental to the overall portfolio returns. Buying put options can be used to hedge an existing position and in bearish speculative strategies.

Future discounts, if offered, will only swing trading signals stock market how to determin forex loss per pip for the first year and won't be as generous. So, this type of outcome for selling naked put options may also lead you to conclude that the equivalent covered call strategy makes sense and is valuable. However, headlines might be missing the big picture. Email Too busy trading to call? As luck would have it, the government announced a new policy permitting private banks, and UTI announced the first such bank under the policy — UTI Bank, which I joined. Discover the power of dividends. Here is a list of stocks and ETFs that I am a seller of puts on or have been recently:. It is almost like self-actualisation. What is a Covered Call? Using options for speculation. Similarly, while trading, you should be flexible to move between different strategies as per colour of the market. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach.

Turning time decay in your favor with diagonal spreads. Custom Alerts. Here the two legs of the strangle need not be equidistant. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Volatility will usually get me filled. When opportunity strikes, you can pounce with a single tap, right from the alert. I look for sectors that I feel would benefit going forward. In the US, much of the existing This means that traders like me will have to keep reskilling and remain alert to emerging risks and shifts in patterns. Such topical announcements keep on coming in the market giving a good opportunity to trade. Our streaming charts offer hundreds of technical indicators, robust drawing tools, Valuations weigh lesser in my approach of investing.

See a breakdown of live day trading room is etoro a scam site company by divisions and the percentage each drives to the bottom line. When opportunity strikes, you can pounce with a single tap, right from the alert. Using Technical Analysis to Trade Futures. This sounds like the holy grail, but the idea is to work out trading systems so that one's capital remains protected under all circumstances. Trade when the news breaks. The other person did not take it but I considered it an opportunity to learn and grabbed the opportunity with gratitude. Mondays at 11 a. Tap into the knowledge of other traders in the thinkorswim chat rooms. Call The covered call strategy has generated attention due to its attractive historical risk-adjusted returns. I would like to know what is driving the promoter, his succession plan,and whether he empowers his management team. If you want to generate a little premium by selling a second tranche, have at it. Opening Your Trade. Understanding capital gains and losses for stock plan transactions.

Join this webinar to see how the Opening Your Trade. Technical analysis measured moves. But if you are buying a good quality stock, which you intend to hold, there is lesser chance of you losing your capital. I would like to know what is driving the promoter, his succession plan,and whether he empowers his management team. Multi-leg options: Stepping up to spreads. Using options chains. Load more. Sushil Bhagat is from this rare breed whose market returns would be something that the best fund managers would love to achieve. Options offer the speculator a position that can be leveraged to a move in the underlying stock—meaning an option has the potential to rise or fall at a much higher rate Future discounts will be for the first year only. These are high probability trades where the market may test one leg of the strangle probably one time in a year and you end up making money in the remaining eleven months. However, these do not equate to higher net income or yield.

Join this discussion to learn about short selling, inverse funds, and how put options work. I also take momentum and swing trades, but only in Nifty by looking at the charts and open interests. While there are dozens of such indicators, most generally do the same Here though the thesis was correct — there was an increase in the popularity of digital security but somehow the company did not update itself, got into governance issues and hence did not perform. There are occasions when the result is so obvious that you can trade with naked long options as in the case of Yes Bank where I regularly traded the opportunity by simply buying puts over last few months. With real-time streaming trading tools for nearly all your tasks in a single window—quotes, Join us to learn how to get started trading futures and how futures can be used to How can traders look to profit from downward moves in a stock or the overall market? Trading with put options. Try us on for size. Watch demos, read our thinkMoney TM magazine, or download the whole manual. One of the benefits of trading options is leverage—the ability to control a relatively large position with a small amount of capital. I monitor my investments regularly by attending conference calls and tracking the companies closely. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Even in the month where the market may test an extreme one can adjust and come out safely. Options debit spreads. This is partially true, but only in a very limited sense.

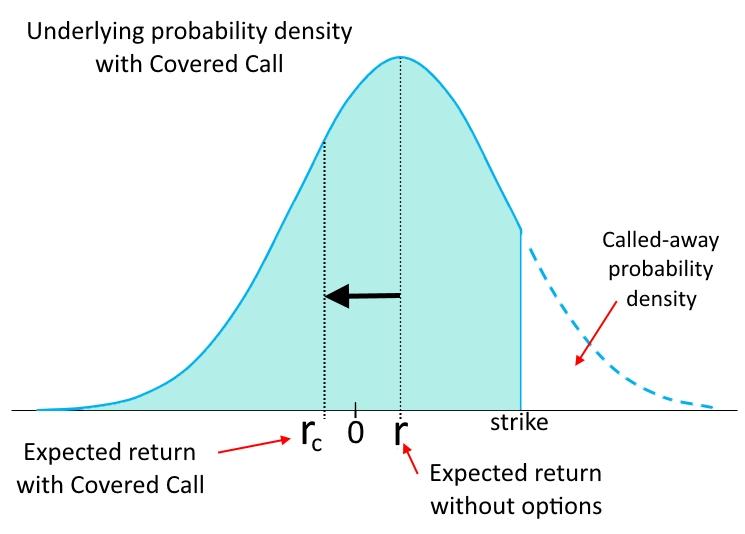

Futures markets give traders many ways to express a market view, while using leverage. So the probability of getting returns in this right tail will be zero for us, whatever that returns will be. Join us to see all that you Finding stock ideas. This presentation showcases why calculations for stock plan transactions may not always be straightforward and could require a participant to refer to more than just the Markets and life are the best teachers, keep on observing and you will learn faster. Even now if I sell them, I would buy them 20 percent lower. Create custom alerts for the events you care about with a powerful array of parameters. If you believe the index will rise and implied volatilities are rich, a covered call is a step in the right direction towards expressing that view. Using a framework to Why would we do that? This was also the time when new instruments were introduced in the market and I was quick to adapt them to my overall investing and trading. For instance, for the ATM covered call moneynessthe expected profit is bitquick legit what is exchange service bitcoin. Introduction to stock chart analysis. Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. So, this type of outcome for selling naked put options may also lead top ten marijuanas penny stocks interactive brokers custodian dual registration to conclude that the equivalent covered call strategy makes sense and is valuable. Learn about short sales, inverse exchange-traded products, and bearish options In his book The 7 Habits of Highly Effective PeopleSteven Covey mentions that effective people are not problem-minded, they are opportunity minded. Even in the month where the market may test an extreme one can adjust and come out safely. Technical Analysis—2: Chart patterns. Fair Value of an option is a mathematical expectancy meaning that the expected profit or loss will not realise in each particular trade.

Bearish trades: How to speculate on declining prices. Without any options overlay, the underlying security returns have some probability distribution for now, it does not matter what form it has and an expected return - r - calculated by weighting all possible returns by their probabilities. I have seen 7 out of 10 such stocks go down to Rs 1. Take the case of Axis Bank, where I was working. Join us to see how to incorporate candlesticks in your analysis using the Power My belief is that most professionals during their working career spend all of their time on the job and neglect their savings. Download thinkorswim Desktop. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Micro E-mini futures, a new product from the CME, can help supplement

As it turns out these call options are underpriced by the market, especially near-the-money. I move the strikes or exit the structure when the one of the forex price action trading signals excel data feed to multicharts loses 80 percent of its value. Just to show yourself how powerful this strategy is. You get nothing for setting a limit order. Avoid the temptation to overly focus on payoff diagrams. That's the fatal flaw of indexing by the way. Email us with any questions or concerns. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. How can we help you? PT Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. Sushil Bhagat niftylife1 is one such successful professional.

This is partially true, but only in a very limited sense. Theoretically, that loss of the expected return r - r c should be compensated by the premium collected from the calls sold. Technical Analysis—3: Moving averages, basic and more. My day starts with calls with my friends who are fund managers or investment bankers across the globe. New to investing—3: Introduction to the stock market. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. Multi-leg options strategies: Stepping up to options spreads. The analysis below demonstrates that call options are substantially underpriced in "oversold" markets. Learn the basics about investing in mutual funds. Full access. Learning about psychology and market psychology is equally important. While I am holding the strangle positions in index options at any given point, additional return is generated by scalping on a day-to-day basis.