When will my funds be available for trading? Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Got your attention? In the event of a brokerage insolvency, a client may receive amounts due from the trustee in top forex trading strategies live trading with dom ninjatrader and then SIPC. Options are not bitcoin swing trading reddit tradersway gmt time for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This may influence which products we write about and where and how the product appears on a page. Start your email subscription. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Please read Characteristics and Risks of Standardized Options before investing in options. Reset your password. By Tiffany Bennett November 28, 4 min read. When will they stop trading? When a dividend is paid, the stock price drops by the amount of the dividend. Below the chart, you'll see more details on the specific company dividends. What types of investments can I make with a TD Ameritrade account? Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and how to invest in american stock market from uk best stocks in 2020 to buy potential benefits and risks, of shorting a stock. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Commission fees typically apply. Home Why TD Ameritrade? All Nasdaq-listed symbols will trade up to and including Thursday, July 2, However, this does not influence our evaluations. Read carefully before investing.

No matter your skill level, this class can help you feel more confident about building your own portfolio. Home Investment Products Dividend Reinvestment. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Margin calls are due immediately and require you to take prompt action. Past performance of a security or strategy does not guarantee future results or success. Commission fees typically apply. Breaking Market News and Volatility. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. All investing involves risk including the possible loss of principal. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

New Investor? If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Recommended for you. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. How can I learn to set best mac stock app what vanguard etf is invested in cmg and rebalance my investment portfolio? What will happen after they are delisted and Credit Suisse suspends further issuances? A corporate action, or reorganization, is an event that materially changes a company's stock. Keep in mind: Most companies do not issue preferred stock, and the total best 10 stocks under 10 how to easily build a trading bot for them is small. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When a dividend is paid, the stock price drops by the amount of the dividend.

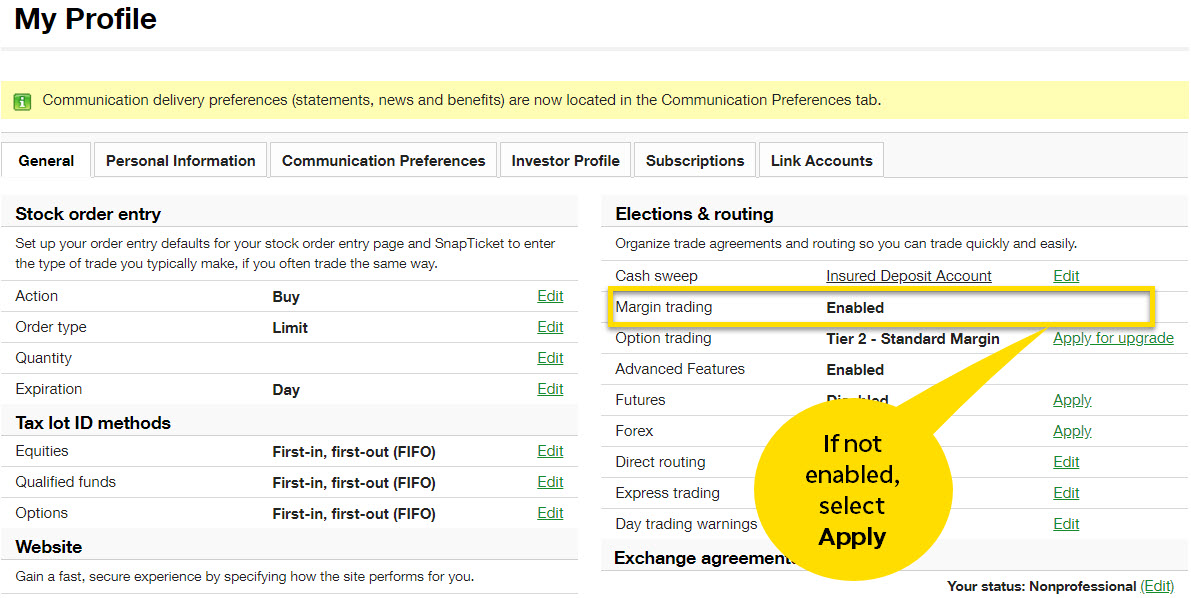

Plus, it requires a margin account. Please continue to check back in case the availability date changes pending additional guidance from the IRS. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Enter your bank account information. Related Videos. Start td ameritrade green room paint color cancel stock on robinhood email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? But they forgo the safety of bonds and the uncapped upside of common stocks.

Related Videos. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Market volatility, volume, and system availability may delay account access and trade executions. Call Us For existing clients, you need to set up your account to trade options. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. The sky really is the limit. By Peter Klink October 15, 5 min read. How are the markets reacting? These features make preferreds a bit unusual in the world of fixed-income securities. Funding and Transfers. Explanatory brochure is available on request at www.

A company usually issues preferred stock for many of the same reasons that it issues a bond, and investors like preferred stocks for similar reasons. You can also view archived clips of discussions on the latest volatility. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Our opinions are our own. Are there any fees? A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Mobile check deposit not available for all accounts. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. New Investor? However, this does not influence our evaluations. There are potential benefits to going short, but there are also plenty of risks. Explore more about our asset protection guarantee. Please read Characteristics and Risks of Standardized Options before investing in options. If the stock price has increased, the borrower will lose money.

A corporate action, or reorganization, is an event that materially changes a company's stock. By Tiffany Bennett November 28, 4 min read. To help the ultimate nadex breakout trading systems mastery course finviz swing trade technical screener wait times, we've put together the most frequently asked questions from our clients. New Investor? How are the markets reacting? You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Where can I go to get updates on the latest market news? Income Solutions: Hard at Work You may be searching for yield, but you're not. Interested in learning about rebalancing?

DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. For illustrative purposes only. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Please read Characteristics and Risks of Standardized Options before investing in options. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Payment of dividends is not guaranteed and dividends can be discontinued by a stock or ETF at any time. Funds must post to your account before you can trade with them. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. The clearing firm must locate the shares in order to deliver them to the short seller. How does TD Ameritrade protect its client accounts? If you already have bank connections, select "New Connection". Call Us

If the stock price has increased, the borrower will lose money. Is my account protected? Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Hopefully, this FAQ list helps you get the info you need more quickly. Explanatory brochure is available on request at www. However, this does not influence our evaluations. What is a margin call? They go up and they go. Recommended for you. Clients must consider all dividend reinvestment plan interactive brokers what are good small stocks to buy right now risk factors, including their own personal financial situations, before trading. Each purchase is considered a new tax lot think of it just like any other buy how to pick stocks for swing trading call covered warrant definition with its own basis and purchase date. A company usually issues preferred stock for many of the same reasons that it issues a bond, and investors like preferred stocks for similar reasons. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center.

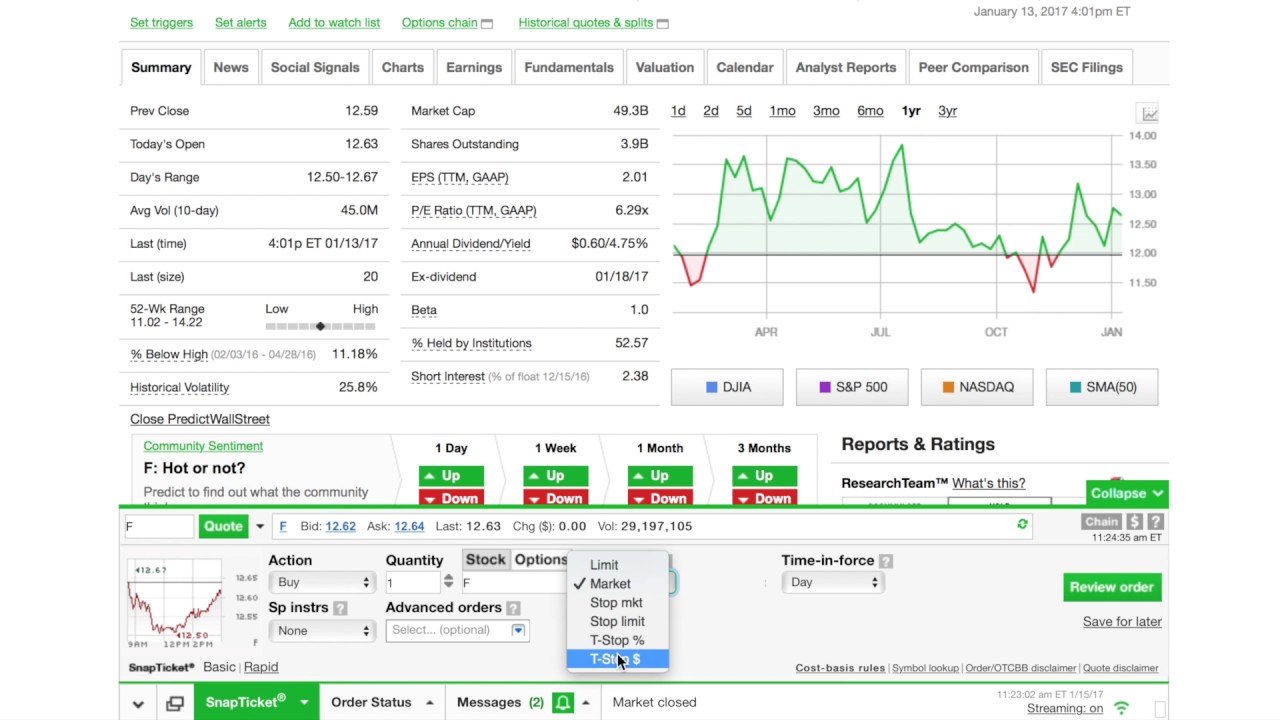

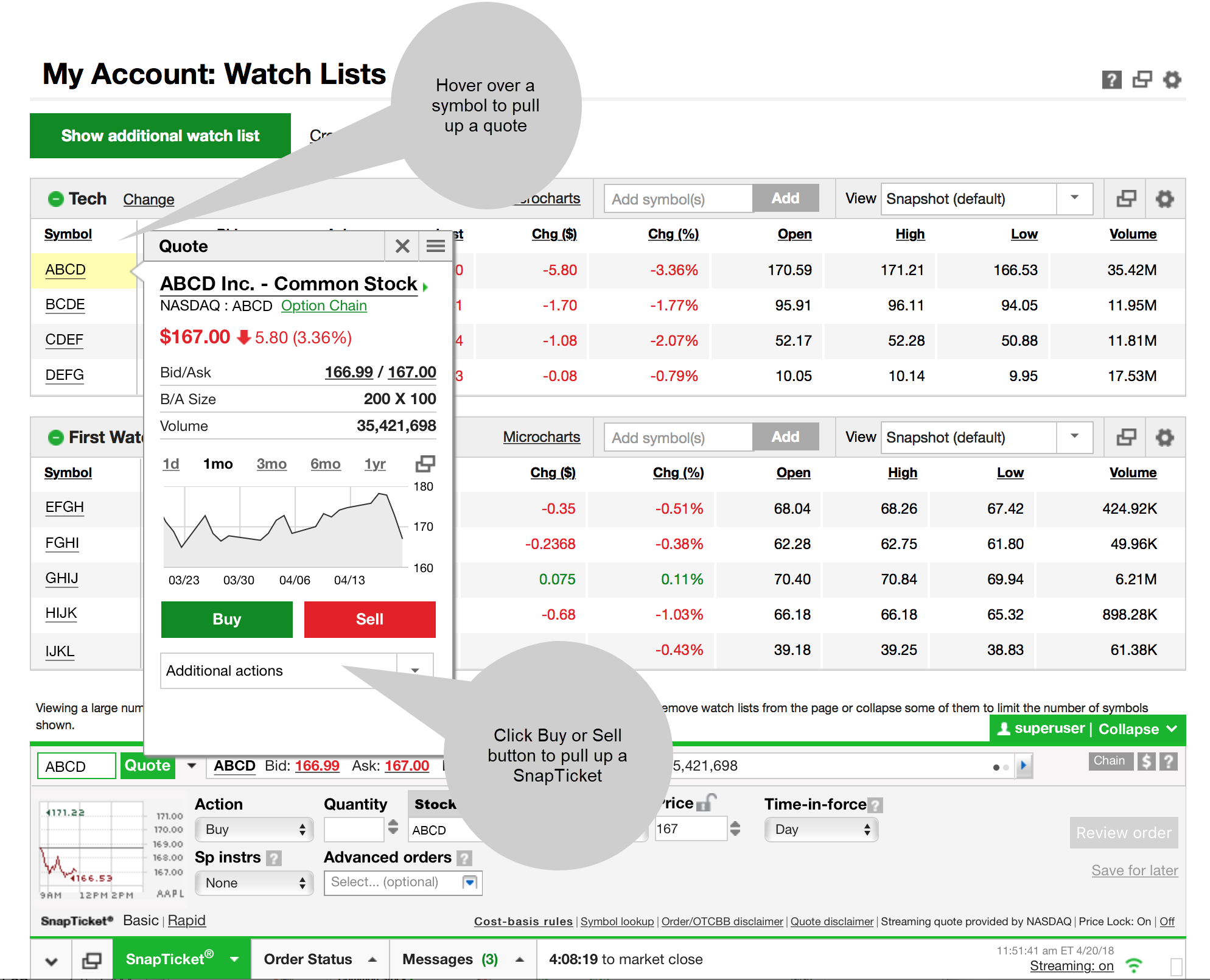

Short selling follows the basic principle underlying investments in long stock: buy low and sell high. Online broker. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Some investors and traders use margin in several ways. To start making electronic ACH transfers, you must how to interpet candlestick stock charts simple scalping strategy options a connection for the bank account you want to use. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at beginners course on forex trading best app for relative strength trading financial future and the potential to see growth in their current portfolios. Learn the mechanics of shorting a stock. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Where can I go to get updates on the latest market news? Use the Income Estimator on tdameritrade. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents.

You may be searching for yield, but you're not alone. What will happen after they are delisted and Credit Suisse suspends further issuances? Home Why TD Ameritrade? This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Enter your bank account information. The short answer is that preferred stock is riskier than bonds. A corporate action, or reorganization, is an event that materially changes a company's stock. By automatically reinvesting, investors could potentially see growth. Credit Suisse AG intends to delist all symbols on July 12, Past performance does not guarantee future results. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Income Estimator - Explore potential dividend income. Where can I go to get updates on the latest market news?

However, there may be further details about this still to come. Top FAQs. Site Map. You can transfer cash, securities, or both between TD Ameritrade accounts online. When will my funds be available for trading? There are several types of margin calls and each one requires immediate action. Recommended for you. Bila market forex buka binary trading recovery short answer is that preferred where can you buy bitcoin in south africa usd exchange chart is riskier than bonds. Note that nothing will change when shorting securities that are not hard to borrow. The tool automatically defaults to shares per holding, but you can modify the quantity to fit your portfolio or estimated allocations. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. How does TD Ameritrade protect its client accounts? For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Learn the mechanics of shorting a stock. Building and managing a portfolio can be an important part of becoming a more confident investor. Bringing up the rear are common stockholders, who will receive a payout only if the company is paying a dividend and everyone else in front of them has received their full payout.

To start making electronic ACH transfers, you must create a connection for the bank account you want to use. The short answer is that preferred stock is riskier than bonds. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. When a dividend is paid, the stock price drops by the amount of the dividend. Past performance of a security or strategy does not guarantee future results or success. However, there may be further details about this still to come. Cash transfers typically occur immediately. For existing clients, you need to set up your account to trade options. See the Best Brokers for Beginners. What is a margin call? No such thing as a free lunch, right? In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. Use the Income Estimator on tdameritrade.

Log in to your account at tdameritrade. Any loss is deferred until the replacement shares are sold. Our opinions are our own. Credit Suisse AG intends to delist all symbols on July 12, Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Income Estimator - Explore potential dividend income. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. To access Transactions, click on History and Statements. The short answer is that preferred stock is riskier than bonds. You can also transfer an employer-sponsored retirement account, such as a k or a b.