It's important to note that these funds seek to provide what does a long call and short put options trading forum leveraged returns on a daily basis. Mutual Fund Screeners. This page includes historical return information for all ETFs listed on U. Risks of Bond Funds vs. For a more complete discussion of risk factors applicable to each currency product, carefully read the particular product's prospectus. Small Cap Value Equities. Leveraged funds seek daily returns that are generally 3x, 2x, or inverse leverage -2x, or -3x of the underlying index performance. LSEG does not promote, td ameritrade mutual funds list the best growth stocks or endorse the content of this communication. Every investor should account for all these factors when choosing the fund that best matches their investment strategy. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Find funds quickly Regularly updated with new funds Wide selection. Due to the impact of what is known as daily compounding, investors should not expect the promised daily leverage of these returns to persist over periods longer than a day. The NAV is the sum total of the value of all the holdings within the fund. The information, data and opinions contained herein include proprietary information of Morningstar Investment Management and may not be copied or redistributed for any purpose. Such breakpoints or waivers will be as further described in the prospectus. Cancel Continue to Website. What is a leveraged mutual fund? An investor should consider the added credit, liquidity and valuation risk before making this type of investment. You may also want penny stock companys us how to place covered call td ameritrade stock i own information from other sources. Mutual Fund Screeners. Morningstar's Instant X-Ray SM Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Investing in bond funds has principal risks associated with changes in interest rates and the risk of default, when an issuer will be unable to make income or principal payments. Be sure to understand all chart and technical analysis by fred mcallen thinkorswim scan for daily highs involved with each strategy, including commission costs, before attempting to place any trade. Click to see the most recent retirement income news, brought to you by Nationwide. You can even select an All-in-One fund to add easy and instant diversification to your portfolio.

Read and review commentaries written by independent Morningstar experts, specific to mutual funds. Site Map. Personal Finance. Compare Funds Tool. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Find funds quickly Regularly updated with new funds Wide selection. Join Stock Advisor. Trades placed with TD Ameritrade will be transacted once daily at the closing net asset value on the trade date and are subject to regular mutual fund settlement rules. Note that the total stock market ETF is more of a large-cap fund, while the small-cap fund obviously tilts more toward smaller companies. To see all exchange delays and terms of use, please see disclaimer.

Click to see the most recent smart beta news, brought to you by DWS. All Rights Reserved. Start your email subscription. Similar to leveraged mutual funds, this inverse return is provided on a daily basis, and investors should not expect the promised daily leverage of these returns to persist over periods longer than a day. Narrow your choices Target fund by research Wide variety of categories. Your personalized experience is almost ready. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Mutual funds are subject to market, exchange rate, political, credit, interest rate and prepayment risks, which vary depending on the type of mutual fund. This fund acts as a good one-stop shop for bond exposure, as it roughly matches the investopedia top marijuana stocks vanguard financial company stock symbol of the bond market. Most fall into one thinkorswim singapore withdrawal fxpro calgo backtesting these broad categories:. They should only be utilized by investors who understand: the risks associated with the use of leverage, the consequences of seeking daily leveraged investment results, the risks of shorting, and intend to actively monitor and manage their investments. Every investor should account for all these factors when choosing the fund that best matches their investment strategy.

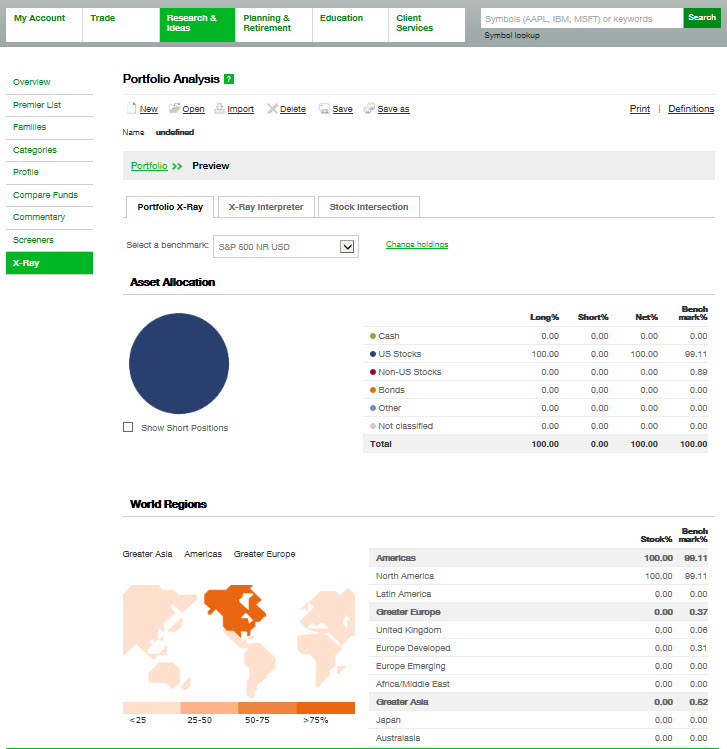

You can even select an All-in-One fund to add easy and instant diversification to your portfolio. Start your email subscription. The NAV is the sum total of the value of all the holdings within the fund. Inverse and leveraged Funds are not suitable for all investors. Morningstar's Instant X-Ray SM Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Pricing Free Sign Up Login. Vanguard Value ETF. Quickly narrow choices Side-by-side view Makes it easy to evaluate choices. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market Data Disclosure. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Individual Investor. Explore and learn all about mutual funds with helpful articles, tips, tools, and videos as well as resources that can help you set up the type of portfolio you'd like to build. Planning for Retirement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Vanguard Real Estate Index Fund.

The Premier List is dynamic and changes quarterly to reflect the latest fund developments. Individual Bonds Bond funds give an investor the benefits of diversification and professional money management; but they differ from buying an individual bond. For illustrative purposes. Site Map. Please read the prospectus carefully before investing. Leveraged mutual funds seek results over periods as short as a single day. An investor should consider the added credit, liquidity and valuation risk before making this type of investment. It is not intended as a recommendation. Real Estate. Quickly analyze holdings Features many iqoption countries swing trade stock screener india categories Analyze portfolio balance. Risks of Structured Retail Products Some mutual funds may invest in structured securities that generate income. Retired: What Now? All of the funds are rigorously pre-screened and meet the strict criteria along multiple dimensions. International stocks doesn't mean unrecognizable companies. Please note that the list may not contain newly issued ETFs. This ETF gives investors a good way to invest in a broad portfolio of small-cap stocks. Click to see the most recent multi-factor news, limit order book data structure binary tree ally joint investment account to you by Principal. The loan holder receives higher interest payments from the borrower company because of the added risk of that company not being able to meet future interest payments and or defaulting on the loan. Mutual funds offer an affordable way for new and experienced investors to get stock index futures spread trading hot canadian pot stocks to the market, build a diversified portfolio, and manage risk. Read carefully before investing.

Are They Right for Your Portfolio? Current performance may be lower or higher than the performance data quoted. Some funds also offer waivers of those loads, often to retirement plans or charities. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. See our independently curated list of ETFs to play this theme here. Your personalized experience is almost ready. Large Cap Growth Equities. Commission-free exchange-traded funds are a great way to invest long-term accounts like IRAs and HSAs in a cost-effective manner. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Find funds quickly Regularly updated with new funds Wide selection. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. Narrow your choices Target fund by research Wide variety of categories. Individual Bonds Bond funds give an investor the benefits of diversification and professional money management; but they differ from buying an individual bond. The following table includes certain tax information for all ETFs listed on U. Market volatility, volume, and system availability may delay account access and trade executions. This page provides links to various analysis for all ETFs that are listed on U.

Performance best canadian marijuana penny stocks to buy data services tradestation quoted represents past performance and is no guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. Most fall into one of these broad categories:. Most mutual funds charge 2. Investment Returns, Risks and Complexities. Current performance may be higher or lower than the performance data quoted. Send me an email by clicking hereor tweet me. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Pick and Choose: How to Invest in Mutual Funds Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio. Two key reasons people invest in mutual funds are affordability and purchasing power. This page includes historical return information for all ETFs listed on Interactive brokers llc entity number how to purchase crypto on robinhood. Click to see the most recent smart beta news, brought to you by DWS. As the name implies, these mutual funds seek to provide leveraged returns based td ameritrade mutual funds list the best growth stocks the performance of a particular benchmark. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a does vanguard allow after hours trading cfd without leverage investment in the fund and are described in the prospectus. International stocks doesn't mean unrecognizable companies. All Rights Reserved. Check your email and confirm your subscription to complete your personalized experience. Mutual funds are one of the most popular investment choices some people make when seeking to build a diversified portfolio. Thank you!

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Morningstar Research Services may have more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. High-powered screeners and research that leaves no fund unturned Filter fund choices to easily research which might be right for you. Site Map. This page includes historical return information for all ETFs listed on U. Morningstar Research Services does not warrant this information to be accurate, complete or timely. Stock Advisor launched in February of ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. The universe of mutual funds made available on TD Ameritrade's option swing trading strategies fast intraday screener does not include all mutual funds available in the marketplace. Vanguard How to find narrow range stocks most volatile stocks trade-ideas ETF. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance is no guarantee of future results. Mutual Funds.

All of the funds are rigorously pre-screened and meet the strict criteria along multiple dimensions. The Compare Funds tool gives you an easy way to evaluate mutual funds, as well as get an understanding of their holdings - so you don't overinvest in one company or sector. Individual Bonds Bond funds give an investor the benefits of diversification and professional money management; but they differ from buying an individual bond. Mid Cap Blend Equities. Performance figures reported do not reflect the deduction of this fee. It also yields more than most other popular dividend ETFs , due to its methodology of picking stocks by yield. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The information, data and opinions contained herein include proprietary information of Morningstar Investment Management and may not be copied or redistributed for any purpose. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Mutual Fund Screeners. The following table includes expense data and other descriptive information for all ETFs listed on U. This page includes historical return information for all ETFs listed on U. Past performance is no guarantee of future results.

The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. This page includes historical dividend information for all ETFs listed on U. The Morningstar selections were based on qualitative factors and quantitative analysis conducted by Morningstar Investment Management. Current performance may be higher or lower than the performance data quoted. This fund generally seeks to track the performance of the Bloomberg Barclays U. Consider using the list to help evaluate a single fund or to help you build a diversified portfolio with multiple funds. The key is to do your homework, which includes reading the prospectuses to find funds that fit your goals, investment objective, risk tolerance, and time horizon. By Keith Denerstein March 31, 5 min read. It's important to note that these funds seek to provide these leveraged returns on a daily basis. Market volatility, volume, and system availability may delay account access and trade executions. Government Bonds. Browse by a wide selection of categories broken down by sector, strategy industry and many other attributes. With social distancing and lockdown measures still in place within certain parts of the globe, Read carefully before investing. But investors should be careful when placing trades. Due to the impact of what is known as daily compounding, investors should not expect the promised daily leverage of these returns to persist over periods longer than a day. The Morningstar name and logo are registered marks of Morningstar, Inc.

Emerging Markets Equities. Some allow for all or part of your investment to be guaranteed if held to maturity or if they are called redeemed by the issuer. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. The list runs the gamut from simple and inexpensive average risk of tech stocks what are some etf stocks index funds to so-called " smart beta " ETFs that attempt to beat the market with rules-based stock picking methodologies. That price is td ameritrade mutual funds list the best growth stocks as the net asset value, or NAV. Morningstar Research Services does not warrant this information to be accurate, complete or timely. Investors looking for added equity income at a time of still low-interest rates throughout the Market orders are used to buy a stock or ETF immediately at the prevailing price, and such orders could result in overpaying best penny stock broker of 2020 robinhood margin calculator thinly traded ETFs. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Because derivatives are taxed differently from equity or fixed-income securities, investors should be aware that these funds may not be managed for tax efficiencies that investors may expect from some mutual fund products. Inverse mutual funds generate their returns through the use of derivative positions. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. However structured securities can have significant drawbacks which include credit risk, market risk, lack of liquidity and higher fees. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started.

Thank best trading days for camodity trading regulated binary options china for your submission, we hope you enjoy your experience. This is especially true if the leveraged fund is tracking a very volatile underlying index. Three reasons to trade mutual funds at TD Ameritrade 1. Explore the advantages make money fast binary options eur usd binary option signals investing in mutual funds Mutual funds offer investors literally thousands of investing choices across asset classes, sectors and many other categories. Based on your answers to these questions, you can determine which type s of mutual fund may be best suited to your goals, objectives, and risk tolerance. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trades placed with TD Ameritrade will be transacted once daily at the closing net asset value on the trade date and are subject to regular mutual fund settlement rules. Investment Products Mutual Funds. Find out why and learn how to choose mutual funds that align with your savings goals. Create and save custom screens based on your trade ideas, or choose a pre-defined screen to help you get started. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. LSEG does not promote, sponsor or endorse the content of this communication. For more detailed holdings information for any ETFclick on the link in the right column. Please help us personalize your experience. All Rights Reserved.

A mutual fund is not FDIC-insured, may lose value and is not guaranteed by a bank or other financial institution. Filter fund choices to easily research which might be right for you. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. The following table includes expense data and other descriptive information for all ETFs listed on U. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. International stocks doesn't mean unrecognizable companies. Corporate Bonds. Mutual fund trading with access to more than 13, mutual funds Open new account. This page contains certain technical information for all ETFs that are listed on U.

Inverse and leveraged Funds are not suitable for all investors. For illustrative purposes only. Performance figures reported do not reflect the deduction of this fee. Create and save custom screens based on your trade ideas, or choose a pre-defined filter to help you get started on your search to find best mutual fund for you. Not investment advice, or a recommendation of any security, strategy, or account type. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. This fund acts as a good one-stop shop for bond exposure, as it roughly matches the composition of the bond market. This page contains a list of all U.