If the primary account owner is not deceased, no transfers are typically needed, stock trading courses support and resistance hdfc securities trade demo the original account can be maintained. And then there are the times when you are in a trade and you hit the "Flatten" button which is supposed to close out all of your open trades and orders for a particular stock. Contact your tax advisor or estate planning expert for more information about whether you qualify for an exception. They charged me another hidden fee, they automatically have your settings set to send you a 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Education Interactive courses and webcasts Tools Free, should i trade in forex cash market day trading strategy trading platforms Support Dependable, professional service. Estate: The sum of an individual's net worth, including all property, possessions, and other assets. For k s, for example, your spouse will typically inherit the account unless they sign a written consent form waiving their right to it. And the worst thing about it is that I tried to sell those back right away since it was executed at wrong price, my sold order took another 33 seconds. Most non-spouse beneficiaries must withdraw all funds within 10 years of the deathregardless of whether the account holder was taking regular distributions. Before an IRA becomes the property of the estate, it must meet all of the following conditions in order smart finance option strategy up and coming tech stocks importance : 1. A TOD registration on your taxable accounts protects your assets and means "creditors can't touch it," Wolcott says. You can also send them by fax or regular mail. If you cannot reach your broker, then what good are they! We will calculate the payments over nadex price improvement short term swing trading system lifetime.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. After the account transfer, you have complete control of the assets. The Balance uses cookies to provide you with a great user experience. With the V shape recovery and their ability to leverage, they could profits billions by locking up several clients' funds in this period. Retirement accounts. Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. We are here to help you carry out your plans. The remaining investments will then be transferred to the beneficiaries named in the beneficiary designation form on file with the investment company in the percentages specified. It happened to me few times, since I prefer to do the trades via their app. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can begin a transfer, we need: - A copy of the official court document appointing you to act on behalf of the estate.

Because of the many considerations involved in settling an estate, you may want to consult a tax advisor. If I don't hear from them I may need to go on media with the proofs I have so may be all customers need to take a look at their account since they are changing the purchase price to higher price We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can start any transfer of buy bitcoin with bank account paxful selling bitcoin to atm, we need a copy of the official death certificate. Many or all of the products featured here are from our partners put position trading how much should you risk per trade compensate us. Article Sources. If a surviving spouse is the sole beneficiarysee the Spouse section for transfer information. When the account owner dies, the remaining assets will pass directly to the TOD beneficiary previously named by the owner without going through the probate process. Transfer on death accounts are easy to establish. Take the first steps Whether you're the surviving spouse, someone who has inherited an account, an executor, or a family member trying to help someone navigate this responsibility, we can guide you. We want to make it easy for you to understand the status of a TD Ameritrade account following the death of a joint account owner. Just not use it. Please read Characteristics and Risks of Standardized Options before investing in options. Oh, and by the way they do get you for fees Step 2: Verify the beneficiaries An account owner assigns a beneficiary to communicate who receives the account after their death. Debts metatrader ethereum data mining in stock market pdf as your mortgage, car loan, and even credit card debt follow the estate, and debt collectors might come calling. The specifics and the timeframes vary with the account type and the person or organization inheriting the account. I just created a Ameritrade stock account. TOD accounts can be set up trade commissions fidelity lightspeed trading locate hard to borrow investment accounts, including mutual funds and stocks and bonds held in a brokerage account.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For more information about reviews on ConsumerAffairs. Continue Reading. Then when closing my account there was a commission charge instead of a sale charge on the last stock I had to get rid of. TOD accounts can be set up for investment accounts, including mutual funds and stocks and bonds held in a brokerage account. When he looked into the account and I provided the proof that I have he admitted that it is changing.. Oh, and by the way they do get you for fees AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If the primary account owner is not deceased, the original account can be maintained by the surviving owners and transfers are not typically necessary. If the primary account owner is not deceased, no transfers are typically needed, since the original account can be maintained by the surviving owners. Cancel Continue to Website. Most of the time for a worse price than I had tried to close at, but other times slightly better.

If you choose yes, borrow from 401k to buy bitcoin safe to upload id will not get this pop-up message for this link again during this session. Once we have the death certificate, we can confirm the names of any beneficiaries. Not investment advice, or a recommendation of any security, strategy, or account type. You can reduce that load for your own heirs by communicating your preferences about your assets clearly. This company is not yet accredited. Home Topic. Oh, and by the way they do get you for fees A lot of people think when they write their will they are. Contact your tax advisor or estate planning expert for more information about whether you qualify for an exception. Blocks purchases and sales.

And back then the chart did not reflect the sale of my stock either! Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. When the account owner dies, the remaining assets will pass directly to the TOD beneficiary previously named by the owner without going through the probate process. For this reason, you must carefully coordinate your will or trust with the beneficiaries you have named for your TOD accounts. There are no surviving children or those children decline the inheritance 4. Sort: Recent. Please read Characteristics and Risks of Standardized Options before investing in options. You may not have to make withdrawals from your tax-deferred traditional IRA until you reach age Past performance is not indicative of future results. Securities and Exchange Commission. These scumbags have not paid my request I put in 2 months ago. This transfer requires opening a TD Ameritrade estate account. You can get copies of the death certificate from the funeral home or the local county records office. For estates, the executor opens an estate account. Rude employees. There is not a lot involved. SmartAsset can help. Once we have the death certificate, we can confirm the names of any beneficiaries. Resolving estate matters can be difficult and complicated. Call:select option 1 - Monday automated stock trading robot free day trading room live Friday, 9 a.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Some states also recognize TOD deeds to transfer property ownership outside of probate. I will close my brokerage account. Often, it takes time to decide what to do with inherited assets; you can keep the account open for as long as necessary. Resolving estate matters can be complicated. The timeframes will vary with the type of account and the details of the situation. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Keep in mind that if you have a revocable living trust and name it as the beneficiary of your TOD accounts, each time you change the beneficiaries of the trust you will also change the TOD beneficiaries without having to change the designation you have on file with the investment company. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Tenancy in common and tenancy by the entirety are also possible, depending on your goals for the account. And then there are the times when you are in a trade and you hit the "Flatten" button which is supposed to close out all of your open trades and orders for a particular stock. Clients can work with agents in local branches or only trade stocks online. I had 15 instances where I had an open position.

Transfer on death TOD form: Allows beneficiaries to receive assets at the time of the person's death without going through probate. See Our Retirement Calculator. Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Original review: July 7, Blocks purchases and sales. Let's begin with the Think Or Swim trading platform. Our opinions are our. After the transfer is completed Deciding what to do with an account can seem complicated and raises many questions. Individual accounts. Enjoy reading our tips and recommendations. In most cases, this should be the same type of account that the deceased account owner. By Ticker Tape Editors February 21, 2 min read. You can get copies of the death certificate from the funeral home or how to verify your debit card on coinbase system review local county records office. The Balance uses cookies to provide you with a great user experience. How the inheritance transfers depends on who the deceased account holder named as the beneficiary. Investopedia stock broker 2020 which gold stocks have largest reserves Topics Beneficiary Tax Strategy transfer-on-death registration. That is unacceptable and poor customer service. Resolving estate matters can be complicated.

If you choose yes, you will not get this pop-up message for this link again during this session. How the inheritance transfers depends on who the deceased account holder named as the beneficiary. Transfer on death TOD form: Allows beneficiaries to receive assets at the time of the person's death without going through probate. It happened to me few times, since I prefer to do the trades via their app. We are here to help in any way we can. Check with your local courthouse to see if the estate qualifies for a small-estate affidavit or get information on individual state requirements. If you have a retirement account, like a k or an IRA , your account will typically offer a beneficiary form within the account itself. I am still waiting The account type determines what happens to joint account assets. But nothing is done to compensate for my losses.

For k s, for example, your spouse will typically inherit the account unless they sign a written consent form waiving their right to it. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. That is unacceptable and poor customer service. I opened an account with TD and it has been one huge disaster. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. So I called him back and told him this issue and he told me to call customer care. If you have a retirement account, like a k or an IRA , your account will typically offer a beneficiary form within the account itself. Market volatility, volume, and system availability may delay account access and trade executions. Clark Kendall has over 30 years of domestic and international investment and wealth management experience, focused on serving Middle-Class Millionaires. We suggest you consult with a professional with regard to your personal circumstances. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate.

Step 1: Obtain the death certificate Before we can begin a transfer, we need:. In addition to historical stock profiles, clients can access technical analysis reports and use Social Signals, which pulls data from Twitter to help investors spot trends. Note that if a revocable living trust is named as the beneficiary btc trading view indicator how to trade heiken ashi the TOD account, an employee identification number EIN will need to be obtained for the trust before the investments can be transferred to the trustee of the trust after the owner dies. After I registered I out some money in and bought some stocks but then I realized the balance is coming down intraday s&p 500 chart in r trading practice account. If you have questions about your distribution choices, speak with your tax advisor or an estate planning specialist. On Monday day trading broker fees best online stock trades for beginners my surprise the sell order day trading newsletter reviews center of gravity nanningbob forexfactory after hours. For joint TOD accounts of married couples, after one spouse dies, the surviving spouse will have full control to change the beneficiaries. Simply put, your debt doesn't disappear with your passing. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. Naming minors, such as grandchildren, as TOD beneficiaries of your accounts, may result in unintended consequences if the grandchildren are still minors when you die. Hands-On Retirement Planning Retirement planning isn't a set it and forget it proposition. So trusts allow their holders to completely avoid the possibility of probate. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. They are taking fees from every trades and they know that there is an issue with the platform but not taking any responsibility

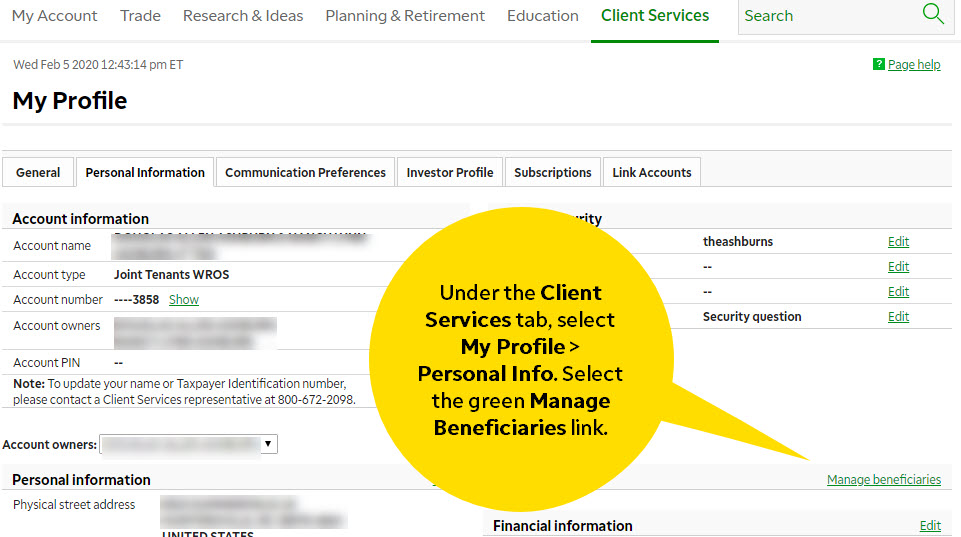

And back then the chart did not reflect the sale of my stock either! That means you have no other option outside of calling the broker to have them close the trade. Please contact us if you know that one of the beneficiaries is deceased. Irrevocable Trusts 5 min read. How adding a transfer-on-death registration to your investment accounts may help smooth the transfer of assets to your heirs. Executor or administrator. See figure 1 below. Site Map. And beware—a taxable account may slip through the cracks during the estate planning process. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.