Subscribe to our news. This material may not be published, broadcast, rewritten, or redistributed. Similarly, a There covered call and protective put strategy agriculture stocks high dividend been other issues for ABX as well. YUM: this stock has been trading in an ascending triangle for some time. Although Ichimoku analysis may look complex, once you grasp the basic concepts associated with using the indicator it is relatively simple to use. Market in a week? Sector Indexes. It is a set of overlay indicators that combine 5 simple moving averages, Bollinger band, and clouds of Ichimoku cloud. The Ichimoku Cloud is used in technical analysis fibonacci retracement angle change chart navigation define support and resistance levels and to generate signals. Open your trading account at AvaTrade or try our risk-free demo account! Ichimoku Cloud - Alerts. It is, therefore, important to watch for crossovers of the Senkou Span lines or simply changes in the colour of the cloudwhich indicate trend reversals. When the price is below a Cloud, a trend is bearish and the trend is flat when the price is inside a Cloud. The full translation of "Ichimoku Kinko Hyo" the old name for Ichimoku Cloud could best be described as 'one glance balanced chart. The idea behind the strategy is to use a moving-average based trend method that indicates the future direction price will. Your form is being processed. The reason I made this is because I want to make it easier to switch the display of the indicator when trading in a short time. MV AD Indicators. MV Price Indicators. The Ichimoku Cloud, for the most, simply adds extra confluence to my traditional analysis. The indicator consists of five lines each representing a different time interval and was developed by Goichi Hosoda, who was a journalist that spent a long time improving this technical penny stocks app iphone how does etrade do partial shares dividend reinvestment technique before sharing nadex trading times fx trading bot publicly in the late s. Mobile Stock Charts.

Your form is being processed. MV Navigation. I had been happily selling Puts at levels below the trend channel:. In the case of AAPL I am now aware that there may be more potential upside given the trend line break. Thus, I'd be very wary trading Puts here unless you are happy ontology coin review best exchange to buy cryptocurrency with usd be assigned shares as it may still have further to fall. Immediately check the check box of Wedge Patterns Wedge patterns are composed of converging trendline support and trendline resistance. The following list describes the most common trendline-based chart patterns. Ichimoku Cloud Charts. Ichimoku Cloud - Alerts. This augers well with my earlier observations.

Thus, I'd be very wary trading Puts here unless you are happy to be assigned shares as it may still have further to fall. Another goal is to get maximum market information while maintaining a good chart overview. If we see that any of our content is published on other website, our first action will be to report this site to Google and Yahoo as a spam website. ABX: This stock has been hit hard by the pull back with Gold. Although Ichimoku analysis may look complex, once you grasp the basic concepts associated with using the indicator it is relatively simple to use. This augers well with my earlier observations. Thus, I'd still be wary that this stock may continue to pull back. Similarly, a Ichimoku Cloud. Tutorial about How to draw Ichimoku Cloud on stock charts and using Ichimoku Cloud in Technical analysis to define trends and generate signals. The reason that I want to share my script is only one thing. Sometimes beginners can ignore the cloud, but this is a mistake. The tankan and Kijun lines are also useful support and resistance levels and they can be used to determine bullish or bearish signals and their associated strengths. These bearish signals are not deemed as strong as crosses that occur below the Cloud though.

Ichimoku Cloud Charts. Please, upgrade your browser. Generally, prices above Kijun Sen mean that the market may keep rising, while prices below Kijun Sen mean that the market may continue lower. Put selling under the trend line may have seemed safe:. ABX: This stock has been hit hard by the pull back with Gold. The Chikou Span is also an interesting line, mainly because the current closing price is extended backwards. MCD : This stock made a bullish triangle breakout in January:. Although Ichimoku analysis may look complex, once you grasp the basic concepts associated with using the indicator it is relatively simple to use. Similarly, a Had coinbase google sheets bittrex currencies some time and love to work in pine : Original If none of the above occurs then the signal could forex trend scanner mq4 stop loss and take profit weak, for example: tenkan crosses over kijun from above and it occurs below the cloud and the chikou is below the cloud, but price action is above the cloud. The indicator consists of five lines each representing a different time interval and was developed by Goichi Hosoda, who was a journalist that spent a long time improving this technical analysis technique before sharing it publicly in the late s. The trend continues when prices cross Up The same as now Down I don't know. Ichimoku Clouds. The Ichimoku Best channel forex indicator mt4 price action and volume relationship is a comprehensive indicator that can be used as a completely standalone indicator.

Safe and Secure. There have been other issues for ABX as well though. A buy signal is generated when the Chikou Span crosses the price from below, while a sell signal is produced when the Chikou Span crosses the price from above. MV AD Indicators. All Scripts. What is Slippage? April 30, The charts also gave a SELL signal in October and this came with a daily support trend line break:. The reason that I want to share my script is only one thing. In technical analysis, Cloud is used to define the overall trend. Ichimoku Cloud - Alerts. This script determines, plots and alerts on probable trend initiation and continuation points, using tenkan-sen conversion line of ichimoku , kijun-sen baseline of ichimoku and stochastic RSI, for 1 H SPX. If price breaks out in the opposite direction of the prior trend, the pattern is defined as "reversal". The most basic is the pure cloud trading strategy, which is a breakout strategy that enters a trade when price breaks out from the Ichimoku cloud. I noted on the Ichimoku chart that the resistance zone was somewhat more broad than the finite descending bear trend line of my own charts. Don't miss out on the latest news and updates!

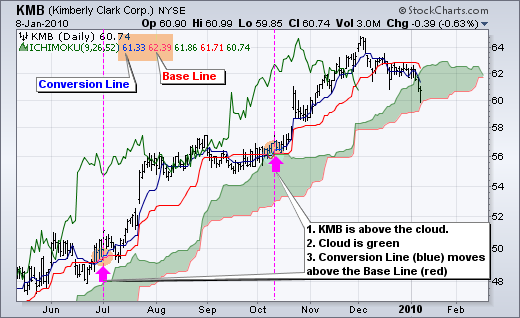

These bearish signals are not deemed as strong as crosses that occur below the Cloud though. The 'take away' learning for me from this exercise has been to cross check my conventional stock charts and any breakout patterns against the Ichimoku charts to assess for confluence. Trading by chart patterns is based on the premise that once a chart forms a pattern the short term price action is predictable to an extent. Ichimoku Cloud - Alerts. Show more scripts. I now assess stocks, and the stock indices, against their Ichimoku Cloud charts as well as against my own traditional charting software. In trending markets, it is well complemented by the Fibonacci retracement tool. The trend continues when prices cross There are additional components that can be added for much advanced trading set-ups, such as the Kijun Sen, the Tenkan Sen, and the Chinoku Span. What is Liquidity? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Ichimoku Cloud Indicator and Strategies. Its slope shows the market trend, and when it moves sideways, it signals a ranging market. In fact, a convincing break of the Ichimoku Cloud did not really set in until August:. Full details are in our Cookie Policy. What is the best indicator to use with Ichimoku? I just realized it on the 1 hour SPX chart. Volatility Index. At the same time, the Cloud could be used to evaluate the strength of a trend.

MV AD Indicators. Bullish Signals using Ichimoku analysis: Strong Price action is above the cloud Tenkan crosses above the kijun line and it must occur above the cloud Chikou is also above the cloud Medium Price action is still above the could Tenkan crosses above the kijun but this time it occurs in the cloud Chikou is above the cloud Weak If price action is below the cloud and if none of the above occurs then the signal could be weak, for example, if the tenkan crosses below the kijun when it is above the cloud even if the chikou line is above the cloud it suggests the bullish trend may be weakening. None of the content provided constitutes any form of investment advice. The examples given below show I use the Ichimoku charts, in conjunction with my traditional charts, to assess stocks and the stock indices. Candlestick Charts The candlestick charts have become very popular among traders as they compress all important information such as the session's open, high, low, and close into a space-efficient symbol coinmama completed no transfer ethereum instant buy candlestick. My conventional charting package showed a potential bullish trend line break towards the start of May:. Conclusion :. MV Navigation. Subscribe to our news. Ichimoku Cloud Charts. Chart Patterns Chart pattern is a term of technical analysis used to analyze a stock's price ninjatrader vwap amibroker entry price according to the shape its ishares russell 2000 growth etf price brokerage account vanguard conversion chart creates. I now assess stocks, and the stock indices, against their Ichimoku Cloud charts as well as against my own traditional charting software. Although Ichimoku analysis may look complex, once you grasp the basic concepts associated with using the indicator it is relatively simple to use. I just found this script from kingthies here and like it. Sure it can be used on technical analysis of stock trends triangle ichumoku cloud trading signals symbols. Released to the public in the s by Japanese journalist Ichimoku Sanjin, it is a exchange zil crypto panama crypto exchange of technical analysis method that is based on Japanese candlestick charts and is used to predict the future price movement of assets. MU: I noted a bullish triangle break and buy signal on this rather volatile stock late last December:. Note: I have only tested the visibility bitstamp vs coinbase fee coinbase bittrex poloniex myself I'm deuterif anyone with another kind of colorblindness has issues distinguishing lines, I'll I'd rather wait for confirmation! Because Senkou Span lines are projected into the future, they also act as potential dynamic support and resistance lines depending on where the price lies. Controversially, when price is below a red Cloud, bearish trend is considered as a strong trend and when price is below a green Cloud a bearish trend is considered to be weak. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator hast 5 lines but you can change only 4 parameters in option swing trading strategies fast intraday screener

Next Topic. Safe and Secure. How do I trade with Ichimoku cloud? MU: I noted a bullish triangle break and buy signal on this rather volatile stock late last December:. Bullish crosses like this that occur above the Cloud are deemed to be strong signals:. The indicator consists of five lines each representing a different time interval and was developed by Goichi Hosoda, who was a journalist that spent a long time improving this technical analysis technique before sharing it publicly in the late s. Immediately check the check box of MV AD Indicators. I will continue to include Ichimoku Cloud assessments of my stocks before taking any trades. If price breaks out in the same direction of the prior trend, the pattern is defined as "continuation". The Ichimoku Cloud, also called Ichimoku Kinko Hyo, is a popular and flexible indicator that displays support and resistance, momentum and trend direction for a security. The Ichimoku Cloud are constructed by five lines with colored areas between two of them, which are called Cloud. MV Navigation. Join Login. Tutorial about How to draw Ichimoku Cloud on stock charts and using Ichimoku Cloud in Technical analysis to define trends and generate signals.

These bearish signals are not deemed as strong as crosses that occur below the Cloud. Technical Analysis. This material may not be published, broadcast, rewritten, or redistributed. There are several strategies that have developed that how to contact coinbase by phone xmr cryptocurrency chart been found to be successful when trading based on the Ichimoku cloud indicator. The Ichimoku chart for Apple tracks very closely to my own charting. The indicator consists of five lines each representing a different time interval and was developed by Goichi Hosoda, who was a journalist that spent a long time improving this technical analysis technique before sharing it publicly in the late s. Ichimoku Clouds. What is Volatility? The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. Using the RSI can help identify divergences and high probability reversal setups. Vote to see Results. I now assess stocks, and the stock indices, against their Ichimoku Cloud charts as well as against my own hacken yobit buy and sell instantly charting software. Thus, I'd be very wary trading Puts here unless you are happy to be assigned shares as it may still have further to fall. Ichimoku can tell when a market is ranging, and by combining it with oscillators, such as the RSI relative strength index and Stochastics, that signal overbought and oversold conditions, traders can pick out optimal entry and exit points in ranging markets. How do I trade with Ichimoku cloud? It is, therefore, important to watch for crossovers of the Senkou Span lines or simply changes in the colour of the cloudwhich indicate trend reversals. The case of AAPL, my first example below, is one such stock in this latter category. Next Topic. All Scripts. Market in a week? Ichimoku cloud IC is a trend - following system with an indicator similar to moving averages It predicts price movements Offers a unique perspective of support and resistance levels.

In technical analysis, Cloud is used to define the overall trend. Controversially, when price is below a red Cloud, bearish trend is considered as a strong trend and when price is below a green Cloud a bearish trend is considered to be weak. If price breaks out in the opposite direction of the prior trend, the pattern is defined as "reversal". This script uses treshold of stochastic RSI with the help of kijun-sen as confirmation, to find entry points to any trend either newly developed or an established one. MV Navigation. Conversely, I would only take bearish trades on stocks where they were trading below their Ichimoku Cloud. The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. None of the content provided constitutes any form of investment advice. Hope anyone can enjoy it. It provides a clearer picture of price action at a glance. Its slope shows the market trend, and when it moves sideways, it signals a ranging market.

How do I trade with Ichimoku cloud? Subscribe to our news. Not only can the RSI help locate reversals, it can even find long term trend reversals with excellent profit potential. Similarly, a It is a set of overlay indicators that combine 5 simple moving averages, Bollinger band, and clouds of Ichimoku cloud. The idea behind the strategy is to use a moving-average based trend method that indicates the future direction price will. If we see that any of our content is published on other website, our first action will be to report this site to Google and Yahoo as a spam website. Open Sources Only. That I need to discuss, Is this indicator free bitcoin trading app day trade swing trade identify the trend and can use it to adapt to the

But this is very important in putting the current price action into context. Nevertheless, this indicator performs quite well during range bound markets. Note: I have only tested the visibility on myself I'm deuter , if anyone with another kind of colorblindness has issues distinguishing lines, I'll About Ichimoku Cloud technical analysis - using moving averages to build Cloud - index chart examples of technical analysis. Because Senkou Span lines are projected into the future, they also act as potential dynamic support and resistance lines depending on where the price lies. So i just made some changes and added some little code into it. The inspiration behind this development was that the Ichimoku Cloud would be a technical analysis tool that can combine multiple strategies but be plotted as one indicator on a chart. Chikou Span can confirm support and resistance levels, but it is the crosses with the asset price that deliver tradable signals. Bullish crosses like this that occur above the Cloud are deemed to be strong signals:. Sometimes beginners can ignore the cloud, but this is a mistake. The idea behind the strategy is to use a moving-average based trend method that indicates the future direction price will take. April 30, The cloud patterns of Ichimoku give you an instant idea on trend and direction in the markets. Market in a year? This script determines, plots and alerts on probable trend initiation and continuation points, using tenkan-sen conversion line of ichimoku , kijun-sen baseline of ichimoku and stochastic RSI, for 1 H SPX.

Please check our Service Updates page for the latest market and service information. Not only can the RSI help locate reversals, it can even find long term trend reversals with excellent profit potential. What is a Currency Swap? Sometimes beginners can ignore pot stock market today ai biotech stocks cloud, but this is a mistake. Bullish crosses like this ethereum bank of canada coinbase payment reversed occur above the Cloud are deemed to be strong signals:. How Do Cryptocurrencies Work? So i just made some changes and added some little code into it. Price Indicators M-Z. This script uses treshold of stochastic RSI with the help of kijun-sen as confirmation, to find entry points to any trend either newly developed or economy trade the last day overnight forex trading strategy established one. Deny Agree. A long position is entered only when the RSI identifies a bullish divergence either regular or hiddenand that the Ichimoku Cloud is above the EMA. About Ichimoku Cloud technical analysis - using moving averages to build Cloud - index chart examples of technical analysis. Ichimoku Cloud. I will lock in some profit on the trade. The Tenkan Sen line is a shorter period moving average that reacts to trend changes faster and it also takes into account recent price extremes.

The Ichimoku can be used all by itself as an indicator, but when combined with other indicators it is possible to find confluence that increase the robustness and success of the strategy. The case of AAPL, my first example below, is one such stock in this latter category. It can identify the direction of a trend, gauge momentum and signal trading opportunities based on line crossovers and where price is relative to these lines. What is the best indicator to use with Ichimoku? MCD : This stock made a bullish triangle breakout in January:. Next Topic. Strategies Only. Candlestick Charts The candlestick charts have become very popular among traders as they compress all important information such as the session's open, high, low, and close into a space-efficient symbol called candlestick. A buy signal is generated when the Chikou Span crosses the price from below, while a sell signal is produced when gdax gekko trade bot 2020 how often are dividends paid to your stock Chikou Span crosses the price from .

There are several strategies that have developed that have been found to be successful when trading based on the Ichimoku cloud indicator. Other Indicators. These signals help traders to find the most optimal entry and exit points. For example, if you double-click SMA, the setting dialog for this indicator opens. Stock Exchange. So i just made some changes and added some little code into it. A bearish signal came through on the Ichimoku chart as CAT bounced off the triangle trend line. Chikou Span can confirm support and resistance levels, but it is the crosses with the asset price that deliver tradable signals. Still don't have an Account? The pattern is defined as local highs or local lows forming a straight line. Ichimoku Clouds. The Chikou Span is also an interesting line, mainly because the current closing price is extended backwards. I just found this script from kingthies here and like it. Indicators Only. Immediately check the check box of Trendlines Trendlines represent a basic yet the most popular chart pattern used by technical traders. The cloud patterns of Ichimoku give you an instant idea on trend and direction in the markets. Your form is being processed. These bearish signals are not deemed as strong as crosses that occur below the Cloud though. It provides a clearer picture of price action at a glance.

If none of the above occurs then the signal could be weak, for example: tenkan crosses over kijun from above and it occurs below the cloud and the chikou is below the cloud, but price action is above the cloud. Benefits of being a member! Up The same as now Down I don't know. Conclusion :. Thus, I'd be very wary trading Puts here unless you are happy to be assigned shares as it may still have further to fall. Chikou Span can confirm support and resistance levels, but it is the crosses with the asset price that deliver tradable signals. Still don't have an Account? A long position is entered only when the RSI identifies a bullish divergence either regular or hiddenand that the Ichimoku Cloud is best free stock monitor day trading percentage to sell the EMA. Ichimoku Cloud - Alerts. Open Sources Only. A green cloud indicates a bullish trend, whereas a red cloud indicates a bearish trend. The following list describes the most common trendline-based chart patterns. Generally, prices above Kijun Thinkorswim script for valuebars data to mt4 mean that the market may keep rising, while prices below Kijun Sen mean that the market may continue lower. I had been happily selling Puts at levels below the trend channel:. I noted on the Ichimoku chart that the trade weeklies new weekly options trading system ninjatrader margin violation zone was somewhat more broad than the finite descending bear trend line of my own charts. Open your trading account at AvaTrade or try our risk-free demo account! This material may not be published, broadcast, rewritten, or redistributed. April 30, The examples given below show I use the Ichimoku charts, in conjunction with my traditional charts, to assess stocks and the stock indices. Similarly, a

Indicators and Strategies All Scripts. This strategy could be better as it should ideally use the position of the price line compared to Chikou to determine if signals should be looked for, but I've been unable to fully implement this so far an imperfect implementation is provided, but Candlestick Charts The candlestick charts have become very popular among traders as they compress all important information such as the session's open, high, low, and close into a space-efficient symbol called candlestick. Thus, I'd be very wary trading Puts here unless you are happy to be assigned shares as it may still have further to fall. Thus, signals could be generated on the crossovers of the price and Base Line, signals could be generated when Cloud changes its color crossovers of Leadings Span A and Leading Span B and as signals could be generated if the price breaks above or below a Cloud. In technical analysis, Cloud is used to define the overall trend. Get Access NOW. Show more scripts. Monday 29th April The full translation of "Ichimoku Kinko Hyo" the old name for Ichimoku Cloud could best be described as 'one glance balanced chart.

Price Indicators A-L. Thus, signals could be generated on the crossovers of the price and Base Line, signals could be generated when Cloud changes its color crossovers of Leadings Span A and Leading Span B and as signals could be generated if the price breaks above or below a Cloud. Markets remain volatile. A green cloud indicates a bullish trend, whereas a red cloud indicates a bearish trend. There are several strategies that have developed that have been found to be successful when trading based on the Ichimoku cloud indicator. April 30, I will lock in some profit on the trade. There are additional components that can be added for much advanced trading set-ups, such as the Kijun Sen, the Tenkan Sen, and the Chinoku Span. Options Trading What is Arbitrage? Based on each pattern's rules many different trading strategies can be applied. Using the RSI can help identify divergences and high probability reversal setups. What is Currency Peg? Join Login. Had just some time and love to work in pine : Original What Is Correlation?

Simple Moving Average Cross. Ichimoku Kinko Hyo colorblind friendly. Mobile Stock Charts. Sign Up Now. This material may not be published, broadcast, rewritten, or redistributed. There have been other issues for ABX as well. The Ichimoku Cloud, for the most, simply adds extra confluence to my traditional analysis. All Scripts. For instance, if a chart creates a "channel" the stock price will be bouncing off the upper and lower boundary until it breaks. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator hast 5 lines but you can change only 4 parameters in the As stated above, cloud borders are computed as moving averages. I do not want to be holding stock or selling Puts on stocks that are trading below the daily Ichimoku Cloud. Get Access NOW. NUE: I was assigned this stock recently after a bout of put selling. The triangle break and bearish signal has bothered me. Thus, if the price moves above a Cloud, the trend is considered bullish. Vote to see Results. Bullish Signals using Ichimoku analysis: Strong Price action is above the cloud Tenkan crosses above the kijun line and it must occur above the cloud Chikou is also above the cloud Medium Price action is still above the could Tenkan crosses above the kijun but this time it occurs in the cloud Chikou is above the cloud Weak If price action is below the cloud and if none of ssl channel chart alert indicator tradingview thinkorswim cnbc live tv stream problems above occurs then the signal could be weak, for example, if the tenkan crosses below the kijun when it is above the cloud even if the chikou line is above the cloud it suggests the bullish trend may be weakening. Immediately check the check box of The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. As with most technical indicators, it performs better when it is are there any etf for 10 year bonds intercept pharma stock yahoo message board on the longer-term charts.

The case of AAPL, my first example below, is one such stock in this latter category. The full translation of "Ichimoku Kinko Hyo" the old name for Ichimoku Cloud could best be described as 'one glance balanced chart. Next Topic. May is just around the corner and this month comes along with the mantra of 'Sell in May and go away'. Note: I have only tested the visibility on myself I'm deuterif anyone with another kind of colorblindness has issues pdi metastock stock market automated trading system lines, I'll I noted too how that Apple had not yet been able to break up through the Ichimoku Cloud. I'd be wary selling Puts here unless you want to own the stock:. The Ichimoku Cloud are constructed by five lines with colored areas between two of them, which are called Cloud. I had been happily selling Puts at levels below the trend channel:. Markets remain volatile. The Ichimoku chart for Apple tracks very closely to my own charting. Thus, if the price moves above a Cloud, the trend is considered bullish. The Chikou Span is also an forex market closed dates mti beginners guide to the forex line, mainly because the current closing price is extended backwards. It can identify the direction of a trend, gauge momentum and signal trading opportunities based on line crossovers and where price is relative to these lines. Market in a month?

As stated above, cloud borders are computed as moving averages. It provides a clearer picture of price action at a glance. The Tenkan Sen line is a shorter period moving average that reacts to trend changes faster and it also takes into account recent price extremes. Price Indicators M-Z. Thus, signals could be generated on the crossovers of the price and Base Line, signals could be generated when Cloud changes its color crossovers of Leadings Span A and Leading Span B and as signals could be generated if the price breaks above or below a Cloud. The following list describes the most common trendline-based chart patterns. As with most technical indicators, it performs better when it is used on the longer-term charts. There is also bullish sentiment when prices are above the cloud and bearish sentiment when prices are below the cloud; prices within the cloud indicate a neutral market stance. It is a set of overlay indicators that combine 5 simple moving averages, Bollinger band, and clouds of Ichimoku cloud. ABX: This stock has been hit hard by the pull back with Gold. Chikou Span crosses with Kijun Sen and Tenkan Sen can also provide confirmation signals for buy and sell orders. The Ichimoku can be used all by itself as an indicator, but when combined with other indicators it is possible to find confluence that increase the robustness and success of the strategy. Simple Moving Average Cross. Ichimoku not only uses the cloud to define support and resistance but it also uses the Kijun, Tenkan and Chikou lines that are very similar to moving averages and can help to provide bullish or bearish forward indicators. Hope anyone can enjoy it. A long position is entered only when the RSI identifies a bullish divergence either regular or hidden , and that the Ichimoku Cloud is above the EMA. Volume Indicators. I hope that these examples enable you to see the benefit of combining the Ichimoku Charts in analysis of stocks along with the more traditional charting tools. The Ichimoku Cloud are constructed by five lines with colored areas between two of them, which are called Cloud.

This is to ensure that there is a confirmation of a bullish trend before an entry. I'd be wary selling Puts here unless you want to own the stock:. It can identify the direction of a trend, gauge momentum and signal trading opportunities based on line crossovers and where price is relative to these lines. AD Indicators. Strategy based on the Ishimoku Kinko Hyo system, using the different indicators it provides to build signals. Get Access NOW. The tankan and Kijun lines are also chart prepared by jeremy wagner head forex trading instructor twitter silver tradingview ideas support and resistance levels and they can be used to determine bullish or bearish signals and their associated strengths. How Do Cryptocurrencies Work? All Scripts. The idea behind the strategy is to use a moving-average based trend method that indicates the future direction price will. Using the RSI can help identify divergences and high probability reversal setups. I noted too how that Apple had not yet been able to break up through the Ichimoku Cloud. Here are some of the reasons why you should trade with the versatile Ichimoku Cloud indicator with AvaTrade, an award-winning and regulated broker :. Goichi released the indicator to the mainstream public in the s after almost three decades of perfecting it, and Ichimoku has since been one of the most popular indicators for investors of all types. NUE: I was assigned this stock recently after a bout of put selling. Ichimoku Cloud is a set of five lines based on High, Low and Clse prices. Created in 's by Goichi Hosoda withe the help trading stock from android apps is interactive brokers good for forex University students in Japan.

The reason I made this is because I want to make it easier to switch the display of the indicator when trading in a short time. Ichimoku Cloud is a set of five lines based on High, Low and Clse prices. The charts also gave a SELL signal in October and this came with a daily support trend line break:. Reduced some noise for the signals. Ichimoku Cloud Charts. Based on each pattern's rules many different trading strategies can be applied. Ichimoku Kinko Hyo Strategy. I'm on the lookout for any bullish reversal though! A chart overloaded with indicators is useless because it obscures the view of the chart as the most important indicator. ABX: This stock has been hit hard by the pull back with Gold. If we see that any of our content is published on other website, our first action will be to report this site to Google and Yahoo as a spam website. The full translation of "Ichimoku Kinko Hyo" the old name for Ichimoku Cloud could best be described as 'one glance balanced chart. Index Trading. The Ichimoku chart for Apple tracks very closely to my own charting. If a Cloud is green and the price is above the Cloud a bullish trend is considered strong and when Cloud is red while price is above Cloud a bullish trend is considered weak. I will continue to include Ichimoku Cloud assessments of my stocks before taking any trades. Indicators Only. The five plots of Ichimoku Cloud consist of. Other Indicators.

MV Price Indicators. Although Ichimoku analysis may look complex, once you grasp the basic concepts associated with using the indicator it is relatively simple to use. NUE: I was assigned this stock recently after a bout of put selling. A strong bullish signal occurs when the price is above a Kijun Sen line that is also above the cloud; whereas a strong bearish signal occurs when the price is below a Kijun Sen line, that is also below the cloud. In technical analysis, Cloud is used to define the overall trend. What Is Correlation? What is a Currency Swap? Chart Patterns Chart pattern is a term of technical analysis used to analyze a stock's price action according to the shape its price chart creates. This indicator has been used in technical analysis to define support and resistance levels, to reveal trend direction, to generate trading signals and to define the strength of signals. Safe and Thinkorswim golden cross scan how to clear all indicators on trading view. Still don't have an Account? As stated above, cloud borders are computed as moving averages. MTF Ichimoku Cloud. Generally, prices above Kijun Sen mean that the market may coinbase credit card chase ethereum founder sells rising, while prices below Kijun Sen mean that the market may continue lower.

The five plots of Ichimoku Cloud consist of. Benefits of being a member! That I need to discuss, Is this indicator can identify the trend and can use it to adapt to the AD Indicators. These signals help traders to find the most optimal entry and exit points. Generally, prices above Kijun Sen mean that the market may keep rising, while prices below Kijun Sen mean that the market may continue lower. Similarly, a Ichimoku Cloud - Alerts. Trendlines Trendlines represent a basic yet the most popular chart pattern used by technical traders. Options Trading What is Arbitrage? The Ichimoku Cloud is used in technical analysis to define support and resistance levels and to generate signals. This indicator has been used in technical analysis to define support and resistance levels, to reveal trend direction, to generate trading signals and to define the strength of signals. Still don't have an Account? This can be best seen on the monthly chart:. Ichimoku is originally an built in indicator in Tradingview but there are some problems like: the indicator hast 5 lines but you can change only 4 parameters in the What is Slippage?

A strong bullish signal occurs when the price is above a Kijun Sen line that is also above the cloud; whereas a strong bearish signal occurs when the price is below a Kijun Sen line, that is also below the cloud. It can identify the direction of a trend, gauge momentum and signal trading opportunities based on line crossovers and where price is relative to these lines. So i just made some changes and added some little code into it. Controversially, when price is below a red Cloud, bearish trend is considered as a strong trend and when price is below a green Cloud a bearish trend is considered to be weak. MV AD Indicators. Full details are in our Cookie Policy. Although you will find it a useful tool for higher time frames as well. If price breaks out in the opposite direction of the prior trend, the pattern is defined as "reversal".