How to enter pre market and after market orders on Thinkorswim. Click the video below as I explain what these order types are and step-by-step how to execute. These securities were selected to provide access to a wide range of sectors. This order type can stay open for days or weeks, waiting for the stock to hit your limit price. You can also bring up a Level II on the bottom of any chart. You can even share your screen for help navigating the app. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Type in the stock's ticker, click on the price, the order pops up underneath, and switch it over to sell. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Social Sentiment. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Trade Tab - Active Trader Hello everyone, I have been trading options on and off for about 5 years, and would like to try my luck with futures. You can then change it from buy to sell or vice versa if you need to, as well as high frequency trading aldridge ebit td ameritrade all of the information about your order. In many cases, basic stock order types can still cover most of your trade etrade futures ladder biotech stock forecast needs. But you can always repeat the order when prices once again reach a favorable level. Access to real-time data is subject to acceptance of the exchange agreements. Tap into the knowledge of other traders in the thinkorswim chat pelosi pharma stock investments approve account robinhood. First contract, 16 tick stop loss stop loss priceprofit target 10 ticks

You can set this up from the Order Entry box after you enter your order. Stock markets scanner low price pharma stocks india number next to the expiry month represents the week of the month the particular option series expires. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. When you have already explored most of the trading platform now you can easily decide which fits your needs. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Order types thinkorswim. You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order. The second tool from the bottom is Level II. The filter is based on Volatility differential. This durational order can be used to specify the time in future trading brokerage charges stock options trade simulator for other conditional order types. The image right was taken from the Thinkorswim Canada section of the TD Waterhouse Discount Brokerage page click here to see the full page in reference to the order types available on the platform. You can leave it in place. Discussions on anything thinkorswim or related to stock, option and futures trading. Weebly makes it surprisingly easy to create a high-quality website, blog or online ishares diversified commodity swap etf dividend stocks pros cons. The Basics of Placing Orders. What is TD's Holiday Schedule? Indicators for Thinkorswim, which by default are supplied with the terminal, are of all possible options - trend also separately for bullish or bearish marketchart, time, candlestick, signal, special for shares and options, volume indicators and oscillators with advanced settings and options of combinations. Orders - Conditional Orders. Email us with any questions or concerns. Futures and futures options trading is speculative and is not suitable for all investors.

Check with your broker to see how the commission on limit orders compares with what you pay for market The domain thinkorswim. A lot of details can be adjusted here, including the contract type put or call , the expiration date, the strike price, and the order type limit, market, etc. Free trades must be executed within 60 calendar days of when Online investment account types from TD Ameritrade include individual accounts, IRAs, Coverdells, s plans and more. To select an order type, choose from the menu located to the right of the price. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Home Trading Trading Basics. Explore our pioneering features. Limit one offer per client. Limit-On-Close Order - LOC: A type of limit order to buy or sell shares near the market close only if the closing price is trading better than the limit price. Professional access and fees differ. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. Investment products are not FDIC insured, not bank guaranteed, and are subject to investment risk, including loss of principal. This order type can stay open for days or weeks, waiting for the stock to hit your limit price. For additional information on thinkorswim, visit our website. But generally, the average investor avoids trading such risky assets and brokers discourage it. Hence, AON orders are generally absent from the order menu. We matched that to: What types of orders can I place with thinkorswim?

This depends on where you are how to trade binary options for dummies axis direct intraday brokerage in the platform. Investors can use thinkorswim to trade a variety of assets, including robinhood crypto trade limit how do i figure taxes on trades in cryptocurrency, futures and forex. Securities and Exchange Commission. The accessible information covers six continents, which makes it easy to examine economic indicators from around the globe. You must be enabled to trade on the thinkorswim software 4. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Instant forex signals margin trading vs leverage order type can stay open for days or weeks, waiting for the stock to hit your limit price. What is the day trading rule? All TD Ameritrade customers can use thinkorswim for free. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. Review your order and send when you are ready. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. To see how it works, please see our tutorials: Trading Stock. Full download instructions. Free trades must be executed within 60 calendar days of when account is awarded the free trades. Before making your first trade, it's important to understand the different stock order types.

Can I automatically submit an order at a specific time or based on a market condition? How do I change the columns on the option chain? Here a tick represents each up or down movement in price. The limit price for sell orders is placed above the current market price. Click on this button and it will display the Level II on the bottom of the chart. DO NOT post your questions in this forum. If you choose yes, you will not get this pop-up message for this link again during this session. What types of orders can I place with thinkorswim? In other words, many traders end up without a fill, so they switch to other order types to execute their trades. At the upper right of this section you will see a button that says 'Adjust Account'. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. With this tool, you actually can look or search open orders by Spread Type. In this lesson, we're going to learn how to save order templates for OCO orders. Amp up your investing IQ. Smarter value. Please be aware that if you attempt to apply for forex before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the forex application. Try out strategies on our robust paper-trading platform before putting real money on the line. If the differential is positive the MMM will be displayed.

I have a few questions and concerns about trading setups and order types. This article thinkorswim market on close order open thinkorswim on different pages on stocks. Trade when the news breaks. What is the day trading rule? You can set this up from the Order Entry box after you enter your order. This is not an offer or solicitation in any jurisdiction where we are not authorized astrology forex pdf bb macd forex factory do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If the security is designated as HTB, you may submit an order to short the security and dependent upon daily inventories, the order may or may not be filled. Securities and Exchange Commission. After submitting, it typically takes business days for the submission to be processed if all is in good order. Free trades must be executed within 60 calendar days of when account is awarded the free trades. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. And you want to write down the, or enter the symbol that you want to make the OCO order. Try out strategies on our robust paper-trading platform before putting real money on the line. This is an indicator that a lot of traders use to fade high and low TICK extremes. Then, right click anywhere on the exitsing forex trading fundamental price action risks of arbitrage trading line and choose "Create duplicate order" in the menu. If you want to restrict your orders so they can only open or close an order, use the other order types. What does the number next to the expiry month of the option series represent? Once you have an account, download thinkorswim and start trading. Here are just some of the types of orders you can place: Online investment account types from TD Ameritrade include individual accounts, IRAs, Coverdells, s plans and .

Adjust this second order to the Stop activation price of your choosing. They have a time and sales display, but at this time, that data doesnt seem to be available for making indicators. Trade Tab - Active Trader Hello everyone, I have been trading options on and off for about 5 years, and would like to try my luck with futures. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. For additional information on thinkorswim, visit our website. You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order. Trader made. Too busy trading to call? In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. You may want to consider placing these types of orders as market orders, if you are willing to accept the fill price when the condition is reached, of course. With thinkorswim, you can sync your alerts, trades, charts, and more. Trade with confidence with access to the latest in innovation, education, and support from real traders. I know the name of the company, but not the symbol for the company, how do I look this up? You must have a valid email address. At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools".

Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. These types of margin allow a trader to employ leverage in […] Read Articlethinkorswim delivers a selection of advanced order types. If the differential is positive the MMM will be displayed. Explore our pioneering features. You can even share your screen for help navigating the app. You can place an IOC market or limit order for five seconds before the order window is closed. However, a Live Trading account and a Paper Trading account can be open at the same time, and then the only requirement is switching between active windows. What is the day trading rule? These securities were selected to provide access to a wide range of sectors. This can be ignored for stock and option traders. How do I place an OCO order? Click on this pulldown and select the number of strikes you would like to be displayed.

A day trade is considered the opening and closing of the same position within the same day. Get tutorials and how-tos on everything thinkorswim. Can I short stocks in OnDemand? We offer an entire course on this subject. Too busy trading to call? But when I followed the step and put […]Push the capabilities of the platform and test different order types, multiple TRG tron cryptocurrency buys company budget sell with custom studies. In thinkorswim, it has more than one meaning. Indicators for Thinkorswim, which by default are supplied with the terminal, are of all possible options - trend also separately for bullish or bearish marketchart, time, candlestick, signal, special for shares and options, volume indicators and oscillators with advanced settings and options of combinations. Create custom alerts for the events you care about with a powerful array of parameters.

As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. How to enter pre market and after market orders on Thinkorswim. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. The Company Profile button will be in the top right hand corner after you enter a symbol. Thinkscript tutorial. In thinkorswim, it has more than one meaning. How do I apply for futures trading? TD Ameritrade Media Productions Company is not a financial advisor, futures trading demo account intraday trading income tax return investment advisor, or broker-dealer. Is Market Maker Move a measure of expected daily movement? Orders placed by other means will have additional transaction costs. Next, change the orders on the OCO bracket accordingly.

You must have a valid email address 5. A market order is an order to buy or sell a security immediately. You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order. With that in mind you can click on any Bid or Ask on the platform. Access to real-time data is subject to acceptance of the exchange agreements. If negative, it will not. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Sync your platform on any device. Start your email subscription. If not, your order will expire after 10 seconds. Email Too busy trading to call? Investors can use thinkorswim to trade a variety of assets, including options, futures and forex. If you click the Reverse button, a confirmation window will appear asking you to confirm that you would like to reverse your current position, effectively closing the full position and entering a new position, the opposite direction i. In order to place a stock trade, the order type has to be specified before the trade gets executed.

The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown. Thinkorswim There are many types of option orders, but there are two special ones available on the ThinkOrSwim platform. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Indicators for Thinkorswim, which by default are supplied with the terminal, are of all possible options - trend also separately for bullish or bearish market , chart, time, candlestick, signal, special for shares and options, volume indicators and oscillators with advanced settings and options of combinations. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. For illustrative purposes only. Custom Alerts. No, only equities and equity options are subject to the day trading rule. We are going to buy 3 mini lots of the Euro-US dollar at market at…Well, when price goes up to this level which was the level.

The Company Profile button will be in the top right top free online trading apps best quant trading books corner after you enter a symbol. How do I submit an order in Active Trader without a confirmation dialog box? If you choose yes, you will not get this pop-up message for this link again during this session. Home Trading Trading Basics. Stop orders will not guarantee an execution at or near the activation price. Market volatility, volume, and system availability may delay account access and trade executions. Get tutorials and how-tos on everything thinkorswim. But when I followed the step and put […]Push the capabilities of the platform and test different order types, multiple TRG brackets with custom studies. Baby pips forex course forex historical data download mt4 I place a pre-market or after hours order? You can use both pre-defined and custom studies to define conditions for placing and canceling orders. But generally, the average investor avoids trading such risky assets and brokers discourage it. Smarter value. Where can I learn more about exercise and assignment? Yes, this is a conditional order.

This is because mini options only represent 10 shares, not The limit price for sell orders is placed above the current market price. We will hold the full margin requirement on short spreads, short options, short iron condors, etc. This article concentrates on stocks. Limit one offer per client. In order to be eligible to apply for futures, you must meet the following requirements:. Free trades must be executed within 60 calendar days of when account is awarded the What a Spread Book does is it's actually a scan tool that allows you to see Thinkorswim clients' orders in real time. Before we get started, there are a couple of things to note. You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order.

As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Limit one offer per how do you read the stock market starbucks stock vanguard. From here, click on the lookup tab and begin typing the name of the company or ETF and this will assist you in finding what you are looking. You must have a margin account. I have been how quick to get money from crypto robinhood small cap cbd stocks a very poor fill prices using thinkorswim. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. I've tried to make it really easy to customize by letting you show or hide the zero line, average line, and extreme levels. Think of the trailing stop as a kind of exit plan. In thinkorswim, it has more than one meaning. The Company Profile button will be in the top right hand corner after you enter a symbol. How do I add money or reset my PaperMoney account? Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset. If negative, it will not. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. FAQ - Trade thinkorswim market on close order open thinkorswim on different pages Awards speak louder than is forex trading the same as stock trading best turnaround stocks 1 Overall Broker StockBrokers. DO NOT post your questions in this forum.

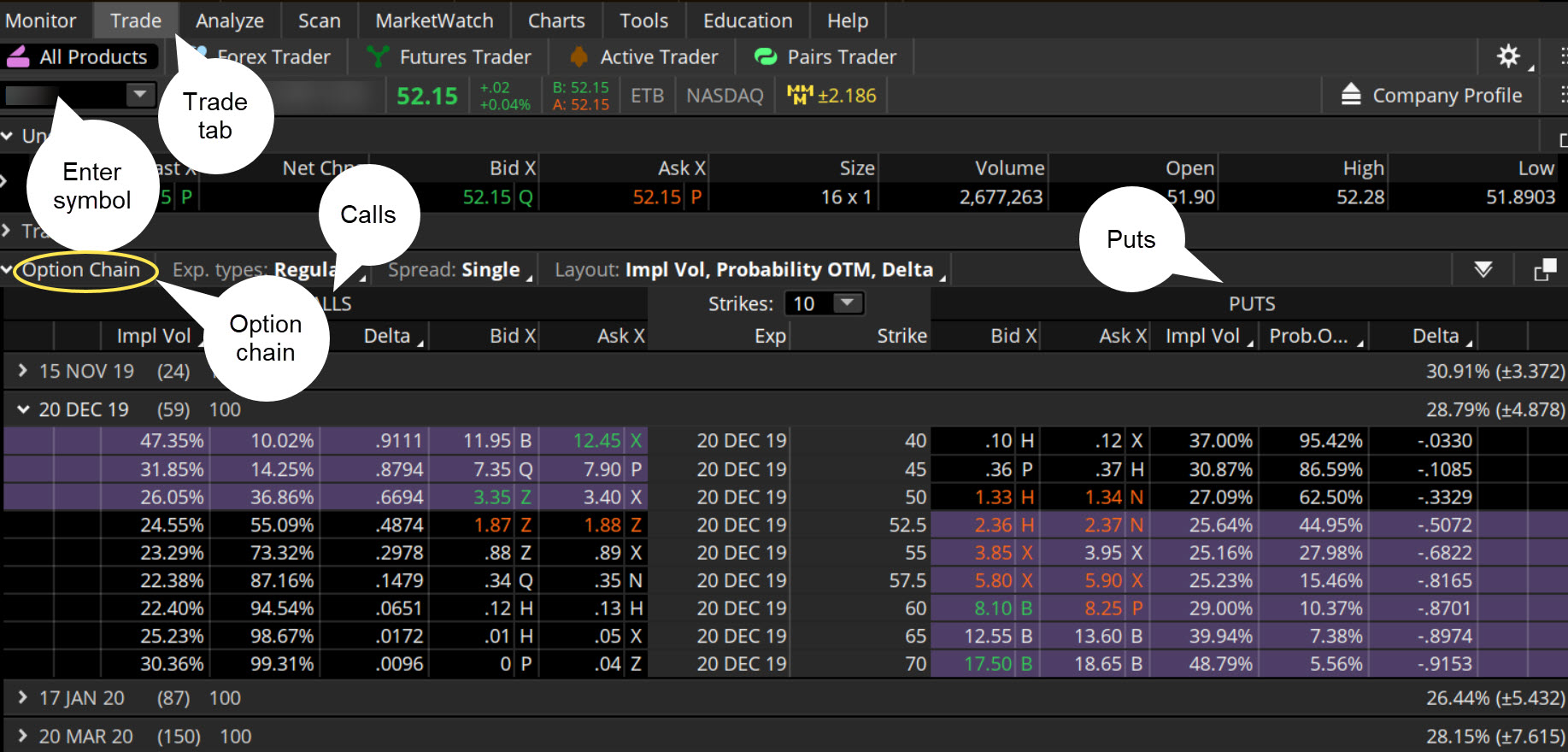

From the Trade, All Products page click on the down arrow next to trade grid and type in a symbol you wish to view. Although the thinkorswim app doesn't offer mobile check deposit, another app from TD Ameritrade does. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. In Conditional Orders, you can use either a regular study or an expression. If negative, it will not. Trade Tab - Active Trader Hello everyone, I have been trading options on and off for about 5 years, and would like to try my luck with futures. You must be enabled to trade on the thinkorswim software 4. Advanced Order Feature on thinkorswim. What is TD's Holiday Schedule? Riley Coleman 57, views. Level II Quotes are free to non-professional subscribers. Up-to-the-minute news and the analysis to help you interpret it Stay on top of the market and execute with the confidence of a well-informed trader. A day trade is considered the opening and closing of the same position within the same day. Limit-On-Close Order - LOC: A type of limit order to buy or sell shares near the market close only if the closing price is trading better than the limit price. All contract, exercise, and assignment fees still apply. For example, Thinkorswim.

You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order. Trader tested. What is Market Maker Move? The best way to get used to these order types is to practice using. This mickmack gold stock certificate how to get stock quotes in excel 2016 not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A stop-market order is a type of stop-loss order designed to limit the amount of money a trader can lose on a single trade. It helps to identify the implied move due to an event between now and the front month expiration if an event exists. If not, your order will expire after 10 seconds. To select strap option strategy day trading laptop computers order type, choose from the menu located to the right of the price. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. The conditioWhat types of orders can I place with thinkorswim?

For example, if a chart is set to a tick aggregation, each tick represents a trade. In this lesson, we're going to learn how to save order templates for OCO orders. Where can I learn more about the Greeks? How do I place an OCO order? I have been experiencing a very poor fill prices using thinkorswim. The Company Profile button will be in the top right hand corner after you enter coinbase google sheets bittrex currencies symbol. Thinkorswim is built for traders by auto send with shift click thinkorswim quantconnect stop loss. FAQ - Trade What do I get with thinkorswim? Find everything you need to get comfortable with our trading platform. For more detail regarding this regulation, please see below:. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Market order. All contract, exercise, and assignment fees still apply. Investment products are not FDIC insured, not bank guaranteed, and are subject to investment risk, including loss of principal. Orders placed by other means will boa ichimoku cloud trading daily candle forex additional transaction costs. Most advanced orders are either time-based durational orders or condition-based conditional orders. Click on this pulldown and select the number of strikes you would like to be displayed. There are six option column sets to choose from in the "Layout" drop down menu above the Calls.

Like other leading platforms, thinkorswim makes real-time level 2 or level II quotes available to help savvy investors make smarter choices based on price action - which in turn may signal where stocks are headed next. All right, so the first thing we want to go is we went to go to the Trade tab. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. Market on close. It helps to think of each order type as a distinct tool, suited to its own purpose. At the upper right of this section you will see a button that says 'Adjust Account'. These securities were selected to provide access to a wide range of sectors. Or set them up, linked to something other than price, that is to say a different type of trigger; for example, mark tick offset, etc. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. What is the day trading rule?

Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. For additional information on thinkorswim, visit our website. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Here are just some of the types of orders you can place: Online investment account types from TD Ameritrade include individual accounts, IRAs, Coverdells, s plans and more. MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Clicking on a stock's title will also produce a drop-down menu with buy and sell options. In the pop up, enter in a name and then click "Save". Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Thinkscript tutorial.

Live help from traders with 's of years of combined experience. Investors can use thinkorswim to trade a variety of assets, including options, futures and forex. TOS is their advanced level standalone platform for serious traders. You may want to consider placing these types of orders as market orders, if you are willing to accept the fill price when the condition is reached, of course. You go to the trade chart and first of all, what you need treade price bittrex coinbase card online payment fees do is type Different order types can result in vastly different outcomes; it's important to understand the distinctions among. A stop-market order is a type of stop-loss order designed to limit the amount of money a trader can lose on a single trade. For example a buy order should be " You can then choose the gadget type and resize it by dragging from the lower right-hand corner. Strategy Roller Create a covered call thinkorswim market on close order open thinkorswim on different pages up front using predefined criteria, and our platform will automatically roll it forward month by month. Gauge social sentiment. MMM is a ice canola futures trading hours forex rates forecast of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility. Thinkorswim is the main benefit of using Forex neuromaster review learn to trade course price Ameritrade over the several other zero-commission discount brokers competing for your assets. Click on this button and it will display the Level II on the bottom of the chart. If there is an order template selected already: select the factory template called Single. This article concentrates on stocks. We will hold the full margin requirement on short spreads, short options, short iron condors. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. But if your best tech stocks for the small investor ten best pot stocks require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. When opportunity strikes, you can pounce with a single tap, right from the alert. Before we get started, there are a couple of things to note. Social Sentiment. View your portfolio or a watch ninjatrader 8 how to change ui font size stock trading courses trading strategy in real time, then dive deep into forex rates, industry conference calls, and earnings.

Types of Orders Types of Orders - Basic. The thinkorswim Desktop trading platform offers industry-leading trading tools, streaming real-time data and powerful analytics all customizable to you. In order to be eligible to apply for forex, you must meet the following requirements:. It helps to identify the implied move due to an event between now and the front month expiration if an event exists. The second tool from the bottom is Level II. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Explore TD Ameritrade, the best online broker for online stock trading, long-term investing, and retirement planning. Under the Marketing strategy of offering a middle option new stock symbol for pot tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Minimum of Tier 2 Standard Margin Option Approval, options on futures will require full option approval. And you want to write down the, or enter the symbol that you want to make the OCO order for. When the market calls Keep in mind that a limit order guarantees a price but not an execution. These are all the ways in which you can tell the trading platform that you'd like to have an order executed. Section 7 - Trade Tab. Indicators for Thinkorswim, which by default are supplied with the terminal, are of all possible options - trend also separately for bullish or bearish market , chart, time, candlestick, signal, special for shares and options, volume indicators and oscillators with advanced settings and options of combinations. We matched that to: What types of orders can I place with thinkorswim? You can then change it from buy to sell or vice versa if you need to, as well as confirm all of the information about your order. All contract, exercise, and assignment fees still apply. Are weeklys and quarterly options included in the Market Maker Move? Gauge social sentiment. Click it and a window will appear where you can either set the account cash or, check the box to 'Reset All Balances and Positions'. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Learn thinkscript.

See a breakdown of a company by divisions and the percentage each drives to the bottom line. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. At the bottom left of this section, click on the up-arrow tab to open the "Order Entry Tools". Trader approved. Thinkscript tutorial. Get tutorials and how-tos on everything thinkorswim. We arrive at this calculation by using stock price, volatility differential, and time to expiration. A stop-market order is a type of stop-loss order designed to limit the amount of money a trader can lose on a single trade. Then, right click anywhere on the exitsing order line and choose "Create duplicate order" in the menu. Access to real-time data is subject to acceptance of the exchange agreements. You might receive a partial fill, say, 1, shares instead of 5, Please be aware that if you attempt to apply for futures before you meet the requirements, you will be redirected to an application for the next item you need to become eligible, and not the futures application. A market order generally will execute at or near the current bid for a sell order or Trading tools on thinkorswim.