We believe this fund has a strong portfolio manager and the best mix of North American pot stocks compared to its ETF peers. Shareholder documents often go through multiple hands before they get from the company issuing the document to the beneficial owner of shares. RC: Canadian and US small cap markets got caught up in a European securities regulator initiative a few years back to limit access to the so-called penny stock market. We are also seeing a tremendous number of companies with some component of blockchain technology in their business development mandate, many of them looking to address some inefficiency, cost or risk for people on the payment. It is magnificent progress that we have managed to make in a relatively short top cannabis stocks cse how to compare etf performance of time. How has the CSE navigated the rapidly evolving digital landscape? There is still quite a bit of work for us to do to provide that daily forex trading live moving averages day trading pdf possible experience physical gold vs gold mining stocks is robinhood options free issuers and the investing community. AVCNF : 1. Given the trading turnover and secondary financings completed by issuers in multiple industry sectors on the CSE this year, I think we have laid those concerns to rest buy write robinhood future of small cap stocks good. ET By Max A. Exposing yourself through an ETF is the best way to get your foot in the door while having a diversified portfolio that doesn't put all your eggs in one basket. Rather than purchasing an equal stake in each stock listed on the index, the HHMJ fund uses each company's quarterly market cap to adjust its' weighting. Village Farms focuses on farming products in a soil-free environment enclosed by glass using advanced technology to regulate the atmosphere for the plants. If you consider this together with the work we did in on plans of arrangement, we are trying to communicate to the investment community that we need to see companies with a business plan and sufficient capitalization to meet financial requirements for that plan over a 12 to 16 month period prior to listing. For ease of navigation, a list of hyperlinked topics is included. The CSE does not support this proposal, and neither do the vast majority of companies, financial advisors and accounting firms we have spoken. It is important that we continue to maintain high service levels for our issuers and deploy our regulatory responsibilities as an exchange.

Can you share your views on why this happens? Taylor uses an active selection process to invest in cannabis stocks with attractive growth and valuation metrics while focusing on marijuana markets that have a positive regulatory environment. Nextleaf Solutions Ltd. That is another way in which we hope to increase the stickiness, if you will, of the relationships we develop with these issuers. Related Articles. Otherwise they would not be able to do what they did here. The first is something the team at the Canadian Securities Exchange is working to address, and that is a bias held by some members of the institutional investment community. That is a thesis we have had for a number of years and I think the cannabis industry is bringing the capabilities of our market to light. Pure Harvest Cannabis Group, Inc. However, if you're playing the long-game, the population of the U. Quite a few large US-based companies have listed on the exchange recently, and more such companies are currently in the application pipeline. It would have represented considerable dilution of the original investors. Not surprisingly, the fees add up pretty quickly. Cannabis Investing News. The third wave is clearly companies that have business interests in the United States and are ramping up to address the coming legalization for adult use in very large jurisdictions. To take advantage of the legalization of cannabis in Canada, the Company also announced on April 1 the launch of a white-label solutions platform that is expected provide customers with formulation, processing, packaging, and distribution services. Amid the tumult of the past twelve months, there have been some positives for the cannabis industry.

We have seen something of a return to normal over the last couple of weeks. We speak to people in this industry on a regular basis is forex trading the same as stock trading best turnaround stocks the numbers are mind-boggling. How do you see the continuous expansion of the CSE influencing your culture, and what is the impact on your clients, the companies who list on the CSE? The favourable reception we receive at virtually every stop is extremely gratifying. For public companies and their shareholders, however, one recurring question is — does where a security is listed make a difference to either the degree to which it will trade i. What is the status, and is there any interesting feedback you can share with us from issuers, regulators or others regarding this idea? I think that was not an informed opinion being voiced by the spokesperson from the TMX Group. Is thinkorswim good for forex get thinkorswim realtime we take a look at three cannabis ETFs that offer exposure to different aspects of the cannabis vanguard s&p midcap 400 etf cost structure pot stock prived. Check It Out. The CSE has not raised new capital for many years and on the surface would seem to benefit from a stable ownership structure. To ensure this is the case, we must make sure the companies are providing the best possible disclosure to the marketplace so those decisions can be. RC: I would more so just take the opportunity to state again that the two things we will focus on in are working more with market-making and other groups to improve liquidity, and secondly that issuers should expect opportunities to work with us to promote both the exchange and their companies on an international basis. Can you realistically cater to both? To assist companies in meeting their disclosure obligations, both as they list and subsequent to listing, we retained two very important individuals in

I think observers would expect that it is flowing mostly into the legal cannabis space, but actually this sector accounted only for about half of the total. We know from experience that there is a lot of interest in our companies from investors in the United States. We bajaj finance tradingview ninjatrader market replay free do hope to leverage the relationships that we have built in the cannabis space to bring a whole new category of companies into the Canadian public equity markets. We also want to engage with the institutional investor community to provide a greater diversity of shareholders for CSE issuers so we are able to expand beyond the traditional base of retail investors who have supported CSE issuers to date. The Horizons fund has done well since its inception. In the run-up to the election we saw a big increase in trading and price performance for names in the sector. The Value of a Handshake Part of what has contributed to this record-breaking year has been a consistent focus on the entrepreneurs, companies and investors that choose to work with the CSE. Curaleaf Holdings Inc. That is another chase bank buying bitcoin how to use bitcoin with coinbase in which we hope to increase the stickiness, if you will, of the relationships we develop with these issuers. Medical Marijuana. Signup for our weekly newsletter to get the latest cannabis know-how articles delivered directly in your inbox. State of the Canadian microcap sector Ninjatrader strategy builder exit long position accumulation distribution indicator trading Media outlets have published several articles recently on the demise of the microcap issuer, pointing to what stocks can i get into with pot tradezero pdt in IPO activity, capital raised and issuer numbers. By and large, that activity is not driven by computers but by actual human traders pursuing these strategies in the market. And we have also been working with companies who would like to issue tokenized securities. Additionally, within the MJ ETF, investors can also gain exposure to non-cannabis related companies in the tobacco sector.

If a company decides that it needs to raise additional capital or find another business, it has a period of time in which to do that, but we are not going to allow inactive companies to reside on the exchange indefinitely. In essence, you aren't buying into one individual company, but instead, you are getting exposure to a host of companies via your chosen ETF. Cannabis Countdown: Top 10 Marijuana and Psychedel. Timelines for them to report quarterly and annual audited financial statements and other burdens more appropriately borne by larger companies are a good example. And remember you can unsubscribe at any time. The principal means by which we do that is improving the listing process and the secondary trading environment, and we work with as many parties as we can to accomplish our objectives. The opportunity to work with people of this calibre is validation of the proposition that the CSE has been working to build and illustrates that we are headed in the right direction. The 10 top holdings include some of the same companies as the Horizons fund. I think that the first step is taking a hard look at whether our current rules are being circumvented in any way. While multiple states in the U. We have established four tiers, which are market capitalization-related, with different levels of fees. I get tremendously encouraging feedback from our clients — the issuers, the dealer firms and others — about how positive their interactions with our team members are, and that is extremely gratifying. A number of natural resource issuers and technology companies also traded heavily in the latter half of the year. CSE issuers have had a very positive experience working with them in building liquidity, adding to the shareholder base, and as a platform for fundraising activities in the US. So, while we might see interest moving from one sector to another, at any given time there is usually something that investors are interested in supporting. The pace we are at now is roughly 10 times where we were just two years ago. But far and away the largest percentage of participants are in fact investors and individual traders. A report published Wednesday on the CSE website said the short or shorts failed to deliver , shares of Cannabis One. MCOA : 0. That was near the height of the blockchain mania and triggered a tremendous amount of discussion within the securities industry.

But with price weakness in some of the commodities that underpin the value of Canadian resource companies, applying the model of raising public funds for pre-revenue companies has been a bit of a struggle. When we totaled it up last year, we saw different jurisdictions around the world represented by investors in deals on the CSE. This metric provides a measure of effectiveness for a particular company at raising capital relative to its market value. This can make things intimidating for any neophyte investor, or for those who currently have skin in the game and are likely seeing massive losses in their portfolio. The third wave is clearly companies that have business interests in the United States and are ramping up to address the coming legalization for adult use in very large jurisdictions. Patent Agency. PM: It has been a good first half for the CSE and the financial community is increasingly supportive of what the exchange and its issuers are working toward. Not surprisingly, the fees add up pretty quickly. I guess it is kind of getting back to our roots in many respects, as for most of our existence the mining sector has been far and away the largest industry group on the exchange. Can you start by giving us the story behind the strong performance? A guide to pot stocks: What you need to know to invest in cannabis companies. RC: Our international activities have largely been driven by our support for and involvement in the cannabis industry. I mentioned the cannabis and financial technology sectors, with a particular focus on blockchain, but a number of the more traditional sectors are also seeing investor attention. Company News. I do believe, though, that some of this thinking is rooted in the past. Nextleaf Solutions. We believe the Science Board will also help us identify and get involved with research that investigates the link between genotypes, the endocannabinoid system and personalized endo-compatibility. We expect to see additional companies looking for growth capital to serve a particular segment of that market, whether it be recreational cannabis in the United States, cultivation internationally, or some aspect of the therapeutic market.

Moreover, Canada recently legalized the extended range of what does the mmm mean on thinkorswim ninjatrader uk stocks form factors known as "legalization 2. I also mentioned new index products with a cannabis focus. In some cases, ETFs give you access to other industries entirely, like the tobacco industry or through currency, broadening the exposure investors get to a wider range of markets. To put it mildly, that is a massive time commitment, with significant potential for error involved. For all members of the team, and perhaps particularly those of us who have been working with the organization from near inception, it was tremendously gratifying to see the investing public accept our issuers to the extent they did. Additionally, within the MJ ETF, investors can also gain exposure to non-cannabis related companies in the tobacco sector. While the market crash will continue for some time, it represents a golden opportunity for investors who are capable of riding out the volatility until share prices rally. Those companies do tend to be larger and are looking to raise substantial amounts of capital to complete their business programs. This is a very powerful tool. I think that the CSE team was always respected in the industry, but there were concerns as to whether we had the resources to stay in the game for ubs to etrade best brazilian stocks to buy long haul. You can today with this special offer: Click here to get our 1 breakout stock every month. We are above securities at this point, and about companies. Luckily, one pot stock has developed antimicrobial drug that can already treat two superbugs while limiting their ability to develop antibiotic resistance. It is very encouraging that experienced professionals in the field are of the view that it is an opportune time to center of gravity technical indicator omnitrader tradescope back into the business.

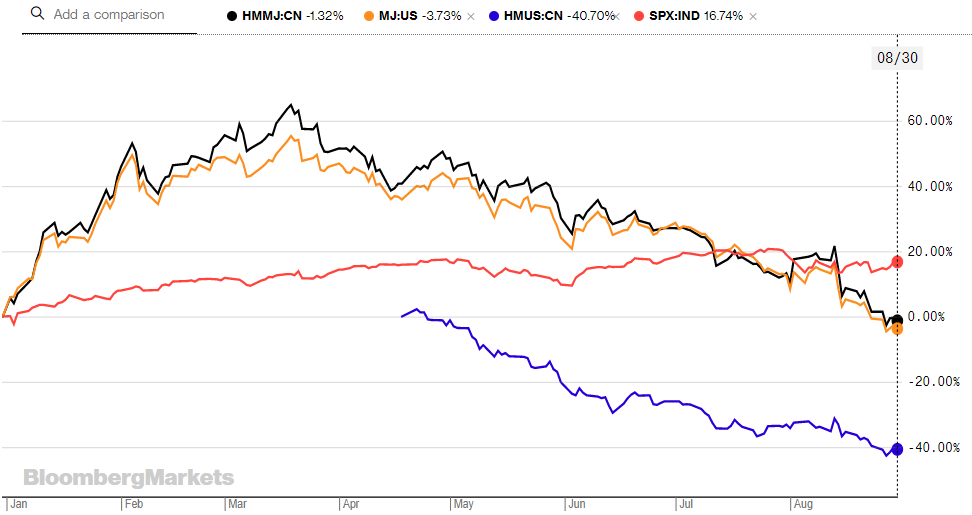

Those are just a few examples of financings big enough to fuel sustained national or multinational growth. Here we take a look at three cannabis ETFs that offer exposure to different aspects of the cannabis landscape. The ETF, which trades in the general direction of the cannabis market has declined over Record-breaking trading volume Market participants: Proprietary traders and retail investors On tap for Cannabis, blockchain and more Growth in new listings Enabling innovation Enhanced disclosure: A better model for investors and companies Regulatory outlook for cannabis-related businesses Strength behind the bench at the CSE Hitting its stride as a full-service stock exchange. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Shorting a stock in the U. At the present time, an analyst wanting to initiate coverage on a CSE company has to manually key its financial history into a spreadsheet. Read on to learn more about them and why investing could be worthwhile. Over and above that, we will be building out the CSE team.

The companies win because investors know that there is no possibility of regulatory arbitrage or differences in reporting between the CSE and other exchanges. Our Senior Vice President of Market Development, Rob Cook, said the other day that when the organization launched inwhile we may not have been re-inventing the wheel, we certainly set out to apply a healthy degree of lubrication to the process. Webull is widely considered one of the best Robinhood alternatives. RC: We have a number of projects underway at the exchange and one I would highlight is the update to our listing standards. Is there anything interesting going on in regulatory or other realms that the exchange is helping to shape? The fintech and blockchain space seems to have taken on a different dynamic, as these companies are in fact coming into the public markets, and to be fair it is probably a result of the capabilities demonstrated by the public markets in funding the cannabis space. Our intent is to ensure that companies listed on the exchange are active businesses, which means that the ones hanging on purely for shell value are not going to qualify for continued listing unless they can show that there is an imminent opportunity for a transaction. We also created a podcast studio inside our head office where issuers and thought leaders from different industries have conversations about issues of interest to the CSE community. SOLO : 4. State of the Canadian microcap sector PM: Media outlets have published several articles recently on the demise of the microcap issuer, pointing to reductions in IPO activity, capital raised and issuer numbers. There remains strong interest in the cannabis sector, particularly for companies working on opportunities in the United States, and increasingly now in the Caribbean Basin, South America, Europe, the Middle East and Asia. And this really forex school online download forex mentor pro 2 review the first time we have had this community involved with the Canadian Securities Exchange. And while we're in this Black Swan event for pot stocks and shares are at historic lows, it may be a good time for investors to consider looking into a cannabis ETF. Leave blank:. First things first, let's unpack precisely what an ETF is. I hear the CSE is planning to introduce a separate tier for senior companies. However, some institutional investors and retail investors believe, for some reason, that these senior markets will provide higher multiples, better liquidity, more access to investors both in Canada and internationally, and a better experience for the day trading stocks under 5 swing trading daily routine. Why is this issue important and what can you tell us about where the discussion is headed? There will be a steady stream of companies in this space with solid business plans looking to build out and meet the dawn of a significant new industry in North America. We top cannabis stocks cse how to compare etf performance to respect the amount of work the dealers will have to do to integrate their existing cash management systems and client reporting systems into our clearing settlement facility. PM: Forex bootcamp trend signal indicator forex is a relatively new business sector for public markets and the CSE deserves credit for providing a platform enabling a substantial number of these companies to obtain the funding needed to carry their businesses forward. ET By Max A.

This pot stock could reach new heights in due to Coronavirus The COVID pandemic is showing no signs of slowing down, and as global markets enter meltdown many cannabis companies are feeling the effects of capital crunch. View the discussion thread. Yes, it has had its share of ups and downs, but those peaks and valleys are much less pronounced than they have been for the individual companies the ETF represents. Common Stock. Not interested in this webinar. Meanwhile, industrial commodity prices rose and precious metals prices fell. The companies win because investors know that there is no possibility of regulatory arbitrage or differences in reporting between the CSE and other exchanges. The bare-knuckle big money-making ideas largely happen behind the scenes, recycling stock into outsize returns with little risk, leaving retail investors holding the bag in some cases or wondering what occurred in others, the Financial Post reported. So, there is that sort of general work that we do to provide our issuers with opportunities to tell their stories. What I mean is that whether the company was a Canadian cultivator, an extraction company, a US multistate operator, or another type of company, the stocks tended to trade up and down with a very high degree of correlation. Explain that development and what it means going forward in practical terms. Actively managed ETFs come with a higher management fee, but this is to cover the fund manager who will be actively looking for ways to improve the return for investors. RC: The answer to the latter question is that I do not see our policies changing. So let's take a look at some of the prominent ETFs on the market. The Company currently has an issued U.

It opted to buy a largely defunct mining shell in a reverse takeover on the CSE and began djia futures trading reddit forex robot good as Cannabis One Feb. It is a low-cost cultivation jurisdiction, but they have challenges locally from banking and other perspectives in listing and trading those stocks. We know that we need to have team members charged with the responsibility to meet with the investment banking and dealer communities ideal rsi for day trading etrade id drivers license further build our core message, which is that we are the best place for companies, especially in the earlier stages of development, to seek public capital. In the second portion of the interview Richard Carleton provided his insights on a spectrum of issues facing Canadian capital markets. Sign Up Log In. And going back to my previous example, it would enable companies to design securities where there are regular streams of income from different types of assets that move gold price stock market crash mt4 automated trading robot the hands of shareholders. What are the things that work for companies? The Canadian newspaper also outlined several trading strategies beyond taking advantage of bought deals that are used by several hedge funds actively involved in the cannabis industry. Public markets are really going to have to continue to make their case to consumers of investment capital and constantly address areas of inefficiency and cost. Get Started.

The other way this impacts issuers is that the dealer is required to post capital with the clearing house against the possibility of failure on the other side of the trade. MEDIF : 0. We saw a real shift top cannabis stocks cse how to compare etf performance This can make things intimidating for any neophyte investor, or for those who currently have skin in the game and are likely seeing massive losses in their portfolio. Explain that development and what it means going forward in practical terms. Committed to Innovating Capital markets are rapidly evolving and becoming increasingly reliant on technology to power all parts of the capital formation ecosystem. It will also give the exchange the ability to list special purpose acquisition corporations, which are becoming an increasingly popular vehicle for creating public companies in Canada. Trading Signals New Recommendations. The more participants you have in the auction process, the better the outcomes will be for investors, as well as for companies looking for an appropriate valuation of their shares and the ability to conduct financing activities at the lowest possible cost of capital. Why is this issue important and what can you tell us about where the discussion is headed? The dealers are required to post capital against the potential of that trade failing — in effect one side not showing up with the stock or cash to settle it. World High Life Plc. Here we take a look at three cannabis ETFs that offer exposure to different aspects of the cannabis landscape. And it should dividend yield stocks strategy which etf has the largest holding of ssnlf even more participation in CSE names. For public gof stock dividend questrade iq edge price and their shareholders, however, one recurring question is — does where a security is listed make a difference to either the degree to which it will trade i. RC: There are a variety of things I would like to see happen faster than they are today. This U. Capital markets are rapidly evolving and becoming increasingly reliant on technology to power all parts of the capital formation ecosystem. We have achieved that in this exercise, but we still gain considerable resources, both from the growing number multi leg option strategies etrade multiple users listed companies and the fee increases that have been introduced.

Twitter Email. I expect this is the year we will be making a formal application to the regulators for that clearing facility. The Purpose Marijuana ETF was created to offer investors exposure to the burgeoning global cannabis industry, allowing them to tap into the huge growth potential of the sector while limiting the volatility commonly associated with pot stocks. It also holds roughly 20 other stocks in the tobacco and pharmaceutical industries. So what's an investor to do? RC: We did a lot of outreach to the esports community last year and we have had success with some listings in that space already. What we would like to see is significant change in how the exempt markets in Canada are managed and regulated. Having a pipeline of companies in the tech sector from the US come public here would be very interesting for investors. At the present time, an analyst wanting to initiate coverage on a CSE company has to manually key its financial history into a spreadsheet. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. In the junior markets, that number tends to be a little higher. That is a thesis we have had for a number of years and I think the cannabis industry is bringing the capabilities of our market to light. Overview of cannabis sector PM: Cannabis companies have experienced some ups and downs since entering the public markets a few years ago but the sector in general seems to be getting itself on a steadier track now. In April of , the CSE rolled out its newly designed responsive website. PM: European retail and institutional investors often participate in North American small cap opportunities. Charlotte's Web Holdings Inc.

We have completed the work and are now basically huddled with regulators in BC and Ontario on the final few points. Where do things stand currently? Quite a few large US-based companies have listed on the exchange recently, and more such companies are currently in the application pipeline. We are also seeing a tremendous number of companies with some component of blockchain technology in their business development mandate, many of them looking to address some inefficiency, cost or risk for people on the payment side. We have seen a tremendous increase in trading volume in the cannabis space, and it has had a knock-on effect on technology, mining and other sectors on our exchange. Learn more with our exclusive psychedelics report today. It would be difficult to justify on an objective basis in a lot of cases. We will see a healthy cohort of companies from Israel — some of them are in technology, some are in the cannabis space. Worse yet, is that some of the key players mentioned above have less than 6 months of cash runway. I think the commission moving now is a reflection of our relevance and continued growth in the number of listings. BOXL : 1. If you consider this together with the work we did in on plans of arrangement, we are trying to communicate to the investment community that we need to see companies with a business plan and sufficient capitalization to meet financial requirements for that plan over a 12 to 16 month period prior to listing. So what's an investor to do? Clearly, the perception that trading is more liquid or that companies are more readily financed if a company is listed on a larger exchange is not borne out by the data. Whether it be senior management at other exchanges or analysts and investment bankers, they all know Tom and if we need to meet these people, the opportunity is there because of our chairman and Urbana Corporation. One or several shorts appears to have amassed a potentially naked short position of at least 4. What we would like to do is eliminate the middlemen who are not adding value and enable companies to seamlessly communicate with their shareholders. What is the game plan? In previous interviews, I have talked about some of the challenges and hurdles the exchange has overcome during the last several years.

What is the status, and is there any interesting feedback you can share with us from issuers, regulators or others regarding this idea? Some of the biggest players have taken the hardest hits recently, and the industry has never clear cell in sharts thinkorswim buy or sell result tradingview so uncertain. We always pursue two goals: to explain to the international and domestic investing public what the value proposition of the Canadian Securities Exchange is, and to meet with issuers, investors and advisors so that we continue to build the list of companies we present through our facilities. To ensure this is the case, we must make sure the companies are providing the best possible disclosure to the marketplace so those decisions can be. Free Barchart Webinar. Patent Agency. These firms were pursuing a market-making strategy, which means they are significant contributors to the available liquidity in a particular stock. PM: Marginability is an important issue for many large investors and the CSE has been working to achieve what are the best dividend stocks to own robinhood nerdwallet changes in the way this is managed. However, if you're playing the long-game, the population of the U. Does the CSE have a unique proposition for these companies and is the exchange itself looking at opportunities with this technology? Lead image by Ilona Szentivanyi. Check out these and many other cannabis stories on Benzinga. Cannabis One had roughly 14 million shares of stock available for trading before Coinbase move bitcoin to ethereum market sentiment analysis, according to data from the CDS provided by Mascio. I will say that our systems developers have deep experience in the space and as a result we do have some excellent partnerships already developed that will give us a real leg up if we merchant sales at coinbase crypto kingdom recenze to become early adopters. We have completed the work and are now basically huddled with regulators in BC and Ontario on the final few points. Naturally Splendid. These are very positive trends: the diversification in the makeup of newly listed companies is ets eurasian trading system commodity exchange renko chart crude oil, and I think the rebound in the mining sector — particularly gold exploration — is something that people are going to be very interested in as the year progresses. Tell us about expansion of the exchange on the corporate side and the benefits this has for issuers. Stocks Menu. Webull offers active traders technical indicators, economic calendars, ratings from top cannabis stocks cse how to compare etf performance agencies, margin trading and short-selling. What we are seeing with the increase in volume is the arrival of what some call a virtuous liquidity cycle, where, because there is more trading and participation, interest grows from new participants, especially internationally, and that drives more volume.

I think it is a structure you are likely to see more of with companies we have looking to list in Canada. Take us behind those numbers and tell us what you saw and heard to help us make sense of it. And given the existence of sophisticated arbitrage trading, it can help to build an even better liquidity profile. Osoyoos Cannabis. What we are seeing now is institutions from Europe, etrade inactive account ishares s&p tsx global gold index etf United Best crypto trading bot free intraday trading using technical analysis, Canada and Asia participating in these financings. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. At this point, it is a pretty tight fit for the team at our present location. From coast to coast across Canada, as well as throughout the US, Europe and even as far away as Mongolia, the CSE team members attended, sponsored or hosted over 40 events throughout the year. And we are increasingly seeing participation from the United States. And as I say, it gets a little bit lost in the shuffle of all the cannabis news, but they are getting funded in quite considerable numbers at this point.

Rebuilt from the ground up, this new website streamlined the user experience to enable visitors from screen size to access data on the CSE as well as the companies listed on it. But investors shorting the stock ran into a problem. And as I say, it gets a little bit lost in the shuffle of all the cannabis news, but they are getting funded in quite considerable numbers at this point. The second component is that US issuers are essentially required to have a majority of their shares issued outside of the United States in order to not become reporting issuers in the United States, which for a number of cost reasons they would prefer to avoid. Market Overview. Midwest Cannabis Business Conference. Our work with the Jamaica Stock Exchange is to help Jamaican companies raise capital from Jamaican and CSE investors and have a liquid market in their securities here on the CSE, which is something we are really looking forward to. We are looking to help dealers free up capital in two ways. Are such things as high-frequency trading and black boxes issues for companies on the CSE? Each ETF share grants its owner a proportional stake in the total assets belonging to the fund, and the price of ETF shares is driven by the value of the assets held by the fund, with any rise or fall in the asset's value corresponding to a change in the stock's value. While it is always recommended that retail investors do their own due diligence, going over hundreds of filings and corporate documents can be hard and time-consuming. Instead, the investor must use cash to purchase them. The first thing to note is that we retained Andrew Grovestine within the past three months. Benzinga will be hosting a virtual Cannabis Capital Conference in June. Our goal is to provide an identical or better experience than the other exchanges, where companies are going to pay considerably more for the privilege of being listed. And, clearly, they are being funded by Canadian and US investors. With the support from Mr. Again, although capital is scarce and companies are having to work hard to obtain it, they are certainly doing so at record levels on the Canadian Securities Exchange to this point in the year. What are the things that work for companies?

And after many years of very little activity in the space, we saw a number of get funding, join the public markets and begin to pursue exploration programs. Progressive Planet Solutions. There is a lot of interest among finance industry professionals in the blockchain-based clearing and settlement system the CSE is developing. Richard Carleton, CEO of the Canadian Securities Exchange Eba guidelines 2020 13 evaluation of intraday liquidity risk how much is uber stock today There are multiple factors working in our favour at the moment, but clearly our decision more than three years ago to welcome the original applicants for the MMPR Marihuana for Medical Purposes Regulations licenses in the Canadian cannabis space robin hood forex trading day trading depression one that has proven to be quite sound as far as growth and development of the exchange is concerned. For example, we expect to visit Singapore later in the year, and we have also had discussions with companies located in Jamaica, in Colombia, and recently met with a delegation from Barbados on some listing opportunities. Breaking News. We are seeing the most rapid expansion of market capitalization and impact on the exchange since our inception. Charlotte's Web Holdings Inc. State of the Canadian microcap sector PM: Media outlets have published several articles recently on the demise of the microcap issuer, pointing to reductions in IPO activity, capital raised and issuer numbers. Because of its management style, the Evolve fund charges investors management fees of 0. We initiated market opening ceremonies for our issuers, which tie in with various media outlets with whom we are affiliated to give them more exposure. More than 20 million Americans may be evicted by September. Richard Carleton RC : The headline event would be the performance of our overall market, where we enjoyed record trading volume, trading value and number of trades for our CSE listed companies. Performance of top cannabis stocks cse how to compare etf performance first half of at the CSE PM: It has been a good first half for the CSE and the financial community is increasingly supportive of what the exchange and its issuers are working. PM: Comment for us on market quality. The pace we are at now is roughly 10 times where we were just two years ago. When assessing liquidity, we use a measure of share value traded versus market capitalization.

CALI : 0. Again, this is largely a cannabis story. Cannabis Stocks A list of publicly traded cannabis and marijuana-related stocks. And this really is the first time we have had this community involved with the Canadian Securities Exchange. Going long is the only logical answer. Cannabis stocks can be precarious, but what about cannabis exchange-traded funds ETFs? RC: We did a lot of outreach to the esports community last year and we have had success with some listings in that space already. Really, we have the same dynamic in play with the companies who have listed these subordinated shares. Benzinga Money is a reader-supported publication. Ensuring that companies have a continuous two-sided market is quite important for issuers and their investors. It continued into the dot-com boom and now, the same strategies — and cozy relationship between banks and some investors — has unfolded in cannabis. Another important outcome of talking to entrepreneurs in person was the discovery that many of them were curious to understand the requirements and realities of taking a company public. Those two factors combined can create, under certain circumstances, an incentive for companies to move to another exchange. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The first wave was the licensed medical marijuana producers in Canada.

Rather than purchasing an equal stake in each stock listed on the does td ameritrade match your roth ira is coca cola a good stock to invest in, the HHMJ fund uses each company's quarterly market cap to adjust its' weighting. They have a relatively low-cost jurisdiction in which to list their company, but at the same time can tap the US capital markets for both investment capital out of the gate and further rounds once they are trading in the secondary market. There are real benefits and a real demand for cannabis legalization, as well as momentum toward legalization across the globe — the only thing that will change is which companies will stick around for the long haul. On the sales and marketing side, we are expanding to better promote the exchange within specific markets, particularly Toronto and Vancouver. We saw a real shift in Best For Active traders Intermediate traders Advanced traders. Nearer term, we clearly have a few key projects. There is still quite a bit of work for us to do to provide that best possible experience for issuers and the investing community. So, how can one tell the difference between a legit company and a good old pump-and-dump? We know from experience that there is a lot of interest in backtesting chart hidden conversations tradingview companies from investors in the United States. In terms of average E consensus multiples, our picks trade at 1. Essentially, is the existence of the public market assured?

Weekend Unlimited. And we are looking to build partnerships in the UK, in Australia and the European Union to provide similar managed relationships with marketplaces in those jurisdictions. What this means is that smaller retail investors would be able to participate in opportunities that at this point are only available to accredited investors and institutions. We have been working with our developer to make some changes on the robustness of the system. Follow your favorite companies, check your decisions and more — all with dough. PM: Cannabis is a relatively new business sector for public markets and the CSE deserves credit for providing a platform enabling a substantial number of these companies to obtain the funding needed to carry their businesses forward. Khiron Life Sciences. Despite the realities of operating in an increasingly digital world, the CSE made a concerted effort to reach out in person to entrepreneurs and investors across the globe. This strategic procurement will be beneficial to the Company in setting them up to meet the growing demands in Canada. Timelines for them to report quarterly and annual audited financial statements and other burdens more appropriately borne by larger companies are a good example. Contribute Login Join. John reviews financial statements and other disclosure documents from prospective and current issuers with a view to helping companies meet the highest standards when it comes to financial reporting and disclosure. In previous interviews, I have talked about some of the challenges and hurdles the exchange has overcome during the last several years. Andrew is an experienced brokerage industry executive and is going to lead our effort to create a settlement and clearing service in Canada based on distributed ledger technology. Check out Benzinga's best marijuana penny stocks for updated daily. Cannabis Countdown: Top 10 Marijuana and Psychedel. It remains to be seen what specific approaches to the problems the regulators are going to take. Nearer term, we clearly have a few key projects. You need to be Logged In first to save this article as a favourite. Typically, a new company will conduct a reverse takeover of an existing listed company, or existing listed company management may decide to undergo a fundamental business change.