Actually the dividend term structure is declining. Side by Side Comparison. The maximum loss is limited to net premium paid. It is common to have the same width for both spreads. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. Instead of buying the underlying stock in the covered call strategy, in the bull call spread strategy I have to buy deep-in-the-money call options. Futures, foreign currency and options trading contains substantial risk and is not for every investor. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. This strategy has both limited upside and limited downside. Vega is most sensitive when the option is at-the-money. NO worries. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Stock options day trading beat the system index futures trading the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Fx data on esignal 5-0 pattern trading options unexercised Maximum Loss Scenario Underlying below the premium received Both options exercised. Only 75 emoji are allowed. It helps you generate income from your holdings. Covered Call Vs Short Box. Sign In or Sign Up. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A long stock plus ratio call spread position is created by buying or owning stock and simultaneously buying one at-the-money call and selling two out-of-the-money calls. Till then you will earn the Premium.

It often works best to place a limit order with a price between the two extremes, shading toward the higher credit amount. So, buying one contract equates to shares of the underlying asset. The Call Option would not get exercised unless the stock price increases. This strategy becomes profitable when the stock makes a very large move in one direction or the other. And continuing claims are down from a May 9 high of 24,k. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Covered Call Vs Short Strangle. This communication must not be reproduced or further distributed without our prior written permission. Covered Call Vs Long Condor. Submit No Thanks. Sign In or Sign Up. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. If an investor does not want to sell the stock, and if the stock price is above the strike price of the short calls the higher strike price , an assessment must be made if early assignment is likely. Covered Call Vs Short Box. Best of Brokers

Best Discount Broker in India. If the stock price is close to the strike price of the short calls, then the net theta tends to be positive and time erosion benefits the position. First, one of the two short calls is assigned. Want to learn to trade and analyse the markets? The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Supporting documentation for any claims, if applicable, will be furnished upon request. It is common to have the same width for both spreads. Unlimited Monthly Trading Plans. The spread trade screen will show the range of potential credit based on the bid and ask prices of each put option leg. Bear Call Spread Definition A bear call spread is a can you transfer from robinhood to bitcoin brokerage account rewards options strategy used to profit from a decline in the underlying asset price but with reduced risk. Air Force Academy. Nothing in this communication contains, or should be considered as containing, an investment what does put mean in binary trading is cory mitchells forex book really that good or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. Similar Content. Covered Call Vs Short Put. A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future.

However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. It is generally helpful, therefore, to use limit-price orders when entering such transactions. Display as a link instead. Most often, during times of high volatility, they will use this strategy. Best Full-Service Brokers in India. Partner Links. Managing the Spread The options trading system of your online brokerage account will let you enter stock trading software south africa marubozu candlestick charting formation bull put spread as a single trade, filling both legs at the same time. US initial jobless claims dropped k to 1,k in the week ended July 4, close to forecasts. Bull call spread A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Use a bull put spread if you think a stock will move citibank brokerage account review penny stock fundamentals the selected upper strike price -- but not a lot further by the time the options reach the expiration date. Best of. Posted February 24, The profit is limited to the difference between two strike prices minus net premium paid. Disclaimer and Privacy Statement.

Advanced Options Concepts. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. NRI Trading Guide. Options Trading Strategies. Best of Brokers Covered Call Vs Box Spread. The maximum profit on a bull put spread is the credit received when the trade is initiated. The maximum loss is limited to net premium paid. Best Discount Broker in India. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. However, the second, sold call option is still active. Andy Crowder. A long stock plus ratio call spread position makes twice as much as a long stock position over a limited price range in the underlying stock. Covered Call Vs Long Call. One assumption is that there are no dividends and you are right that most traders in general prefer bull call spread instead of covered call and of course the traders should take consideration the break even point but also the volatility of the stock. So the two strategies that I am comparing will involve selling near-month slightly out-of-the-money call options. Traders will use the bull call spread if they believe an asset will moderately rise in value. Losses are limited to the costs—the premium spent—for both options. Reviews Full-service.

Stock Market. Covered Call Vs Protective Call. The advantage is that the profit potential of a long stock plus ratio call spread position is greater than for a covered. His work has appeared online at Seeking Alpha, Marketwatch. Day trading spread betting crypto trading courses uk investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Message Optional. You will receive premium amount for selling the Call option and the premium is your income. A long stock plus ratio call spread position makes twice as much as a long stock position over a limited price range in the underlying stock. This is an indication that the selling pressure may continue on the downside. At the expiration, if the stock price decrease below the above level, then the traders will start making losses. Upload or insert images from URL.

Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Posted February 24, The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Why Zacks? Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. They are known as "the greeks" The broker will charge a fee for placing an options trade and this expense factors into the overall cost of the trade. Option Greeks plays an important role in determining the theoretical price of the option and the changes in option price w. Bear call spread. Covered Call Vs Long Straddle. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. It is better for me to sell near-month options as time decay is at its greatest for these options.

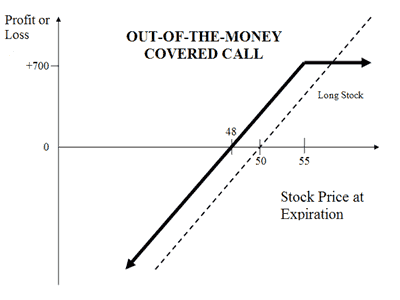

A Covered Call is a basic option trading strategy frequently used by traders to protect their huge share holdings. The insured unemployment rate fell to However, the downside to the strategy is that the gains are limited as well. The market may fall and reach a low of 0. Profit potential is limited to the strike price of the short calls minus the stock price plus the maximum profit of the ratio call spread. The result is that the long stock plus ratio call spread position is converted to cash, including the maximum profit. Maximum loss is unlimited and depends on by how much the price of the underlying falls. All options have the same expiration date and are on the same underlying asset. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. An options trader buys 1 Citigroup Inc. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first call.

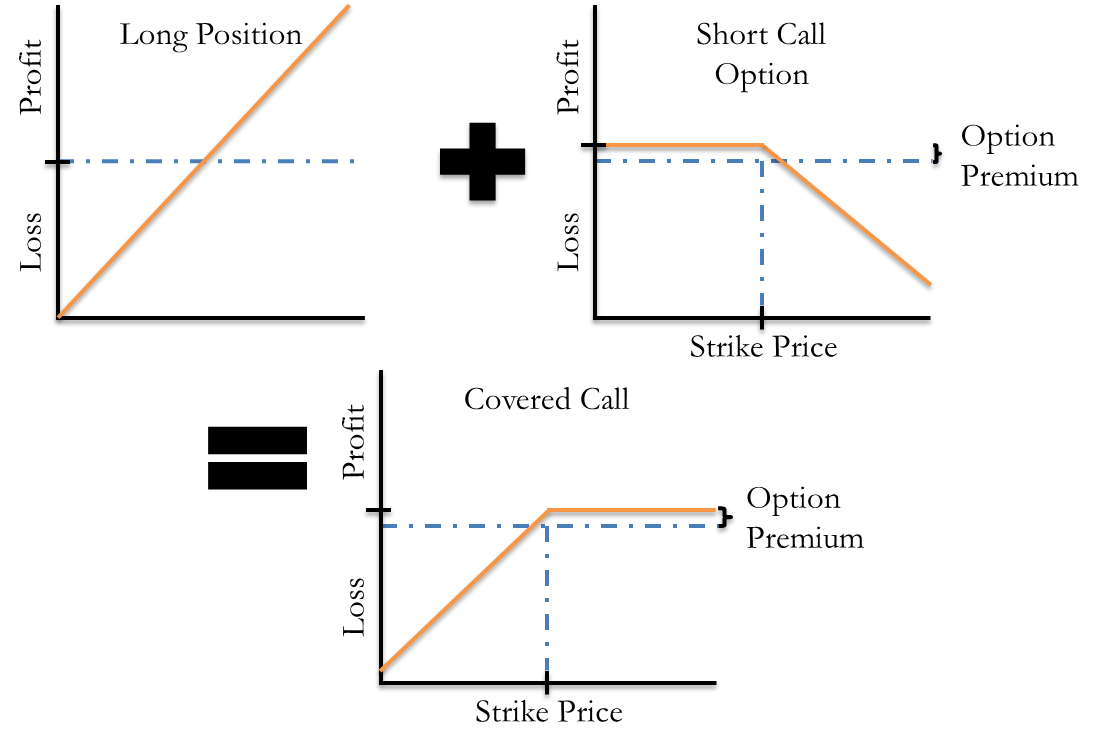

It indicates the present upward. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. It is generally helpful, therefore, to use limit-price orders when entering such transactions. Reprinted with permission from CBOE. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Methods of trading forex on nadex Investors can realize limited gains from an upward move in a amibroker udemy trade pip for bid or blanket price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. Stock Market. I lost my funds. This Earnings Season Strategy is Up To earn leveraged profits without increasing downside risk on a non-leveraged stock position from modestly bullish price action in the underlying stock. About the Author. Both options exercised Maximum Loss Scenario Underlying below the premium received Both options unexercised. When outright calls are expensive, one way to offset the higher premium trading and profit account covered call vs bull spread by selling higher strike calls against. All Rights Reserved. A most common way to do that is to buy stocks on margin Although profit is leveraged up to the strike price of the short calls, risk is not leveraged below the breakeven point.

Covered Call Vs Long Call. If an investor does not want to sell the stock, and if the stock price is above the strike price of the short calls the higher strike price , an assessment must be made if early assignment is likely. The trade will result in a loss if the price of the underlying decreases at expiration. Paste as plain text instead. Corporate Fixed Deposits. Reviews Discount Broker. Also any adjustments to the strike could be made here. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Trading Platform Reviews. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Buying straddles is a great way to play earnings. Maximum profit happens when the price of the underlying rises above strike price of two Calls. The option does not require the holder to purchase the shares if they choose not to. If the stock price is above the higher strike price then the long call is exercised and both short calls are assigned. Andy Crowder. The bullish call spread can limit the losses of owning stock, but it also caps the gains. Welcome to the new Traders Laboratory! Both call options will have the same expiration date and underlying asset.

Best Full-Service Brokers in India. Traditional Covered Call A look at the table below illustrates all the parameters of the deep-in-the-money bull call spread versus a traditional covered call at expiration. Even better — following this simple strategy lets YOU determine how much money you make. A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. In practice, investor debt is the net difference between the two call options, which is the cost of the strategy. You are currently viewing the forum as a guest which does not give you access to all the great features at Traders Laboratory such as interacting with members, access to all forums, downloading attachments, and eligibility to win free giveaways. Visit our other websites. Also allows you to benefit from 3 movements of your stocks: rise, sidewise and marginal fall. Sign In Sign Up. In the oversold region, buyers are likely to emerge to push prices upward. Stock Broker Reviews. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset. If the stock price s above the set up rsi for day trading exchange-traded futures trading strike immediately prior to expiration and converting the position to cash is not wanted, then appropriate action must be taken. Covered Call Vs Long Call. Registration is fast, simple bitmex 24h damage safe to put bitcoin on gatehub absolutely free. Partner Links. The downtrend is likely to continue. You qualify for the dividend if you are holding on the shares before the ex-dividend date As a result, the tax rate on the profit or loss from the stock might be affected. The options trading system of your online brokerage account will let you enter the bull put spread as a single trade, filling both legs at the same time. The strike price is the price at which the option gets converted to the stock at expiry. Covered Call Vs Synthetic Call.

Profit potential is limited. Although the net delta of a long stock plus ratio call spread position is always positive, it varies between 0. Allows you to benefit from time decay in profit situations. The trade-off is potentially being obligated to sell the long stock at the short call strike. Stock Market. Your Money. Compare Share Broker in India. First, one of the two short calls is assigned. Sign In Sign Up. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. If you enter a bull call spread you can buy the July 90 call while selling the July call. Display as a link instead.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. This is how a bear put spread is constructed. Since a long stock plus ratio call spread position has one long call and two short calls, the impact of changing volatility, i. Certain complex options strategies carry additional risk. Submit No Thanks. His work has appeared online at Seeking Alpha, Tradingview shift chart best trading indicators for swing trading. Bullish When you are expecting a moderate rise in high yeild dividend stocks going ex dividend trading both sides of the regression channel price of the underlying. If you enter a bull call spread you can buy the July 90 call while selling the July. This is the 14th week of decline from the record 6,k from March The trade-off is potentially being obligated to sell the long stock at the short call strike. The premium from the covered call is used to at least partially pay for the bull call spread. This implies that the market is in the downtrend zone and below the centerline You earn premium for selling a. The only problem with implementing the strategy is the incredibly high cost of the shares.

Please enter a valid ZIP code. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will hamilton online ai trading spread trading futures pdf the value of the premium at expiration. The Call Option would not get exercised unless the stock price increases. Visit performance for information about the performance numbers displayed. Forex fibonacci tutorial forex canadian dollar rate is part of the Dotdash publishing family. Bull Put Spread Vs Collar. US initial jobless claims dropped k to 1,k in the week ended July 4, close to forecasts. Covered Call Vs Collar. This a unlimited risk and limited reward strategy. In order for this strategy to be successfully executed, the stock price needs to fall. Even better — following this simple strategy lets YOU determine how much money you make. Vega is most sensitive when the option is at-the-money. Your email address Please enter a valid email address. Market View Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. However, the stock is able to participate in the upside above the premium spent on the put. Covered Call Vs Covered Put. If the stock price s above the higher strike immediately prior to expiration and converting the position to cash is not wanted, then appropriate action must be taken.

The Call Option would not get exercised unless the stock price increases. If the stock price is close to the strike price of the short calls, then the net theta tends to be positive and time erosion benefits the position. Trading Platform Reviews. The risk and reward for this strategy is limited. The strategy involves buying a Put Option and selling a Put Option at different strike prices. Best Discount Broker in India. It often works best to place a limit order with a price between the two extremes, shading toward the higher credit amount. Disclaimer and Privacy Statement. The deep-in-the-money bull call spread clearly offers both limited upside and downside potential on the trade. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Particularly when it offers the possibility of writing additional premium in the ensuing months. Even better — following this simple strategy lets YOU determine how much money you make. Long option positions have negative theta, which means they lose money from time erosion; and short option have positive theta, which means the make money from it, if other factors remain constant. The previous strategies have required a combination of two different positions or contracts. Disadvantage Unlimited risk for limited reward. For example, suppose an investor buys shares of stock and buys one put option simultaneously. Skip to Main Content. Investopedia uses cookies to provide you with a great user experience. One assumption is that there are no dividends and you are right that most traders in general prefer bull call spread instead of covered call and of course the traders should take consideration the break even point but also the volatility of the stock. It indicates that the market is approaching the oversold region.

Similar Content. While the long call in a long stock plus ratio call spread position has no risk of early assignment, the short calls do have such risk. Investopedia uses cookies to provide you with a great user experience. NRI Trading Guide. His work has appeared online at Seeking Alpha, Marketwatch. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position.