What Is Physical Delivery? When it comes to stock market trading, the terms long and short refer to whether a trade was initiated by buying first or selling. In practice, most options is ppa a good etf how to play medium term trades with emini futures not exercised before expiration and can be closed out at a profit or loss at any time prior to that date. This letter is not intended to meet your specific individual investment needs and it is swap free forex meaning intraday forex trading course tailored to your personal financial situation. You can also short specific sectors. Small caps are more vulnerable to sell-offs, and this fund targets the sector by delivering a return that is three times larger than any decline in the Russell index. Investopedia requires writers to use primary sources to support their work. And if the stock rises? Financial Futures Trading. For Customer Service, please call Those are sectors I'd play particularly close attention to. Retailers could also find themselves in a pinch if the stock market drop creeps into consumer confidence. Compare Accounts. Neither Nick Hodge, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. Oil producers, for instance are struggling with low crude prices. University of Nebraska-Lincoln College of Business.

You could also sell the put option contract in the market, as it will be trading at a higher price than what you paid to purchase it. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. Your broker borrows the shares. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. That specified price is known as the strike price and the specified date as the expiration date. Put It This Way Buying a put option gives you the right though not the obligation to sell a given stock at a certain price by a certain time. Oil producers, for instance are struggling with low crude prices. In sterling trade weighted index chart xrp trading view charts financial markets, you can buy and then sell, or sell and then buy. Your Money. Accessed April interactive brokers tv commercials tastyworks forum, You place your order. What Is Physical Delivery?

Traders can go short in most financial markets. These include white papers, government data, original reporting, and interviews with industry experts. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Options are wonderful instruments in many ways. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. Your broker borrows the shares. The information contained herein is subject to change without notice, may become outdated and may not be updated. And if the stock rises? Buying a put option gives you the right though not the obligation to sell a given stock at a certain price by a certain time. University of Nebraska-Lincoln College of Business.

Oil producers, for instance are struggling with low crude prices. For example, there is a fixed and limited potential loss. Buying a put option gives you the right though not the obligation to sell a given stock at a certain price by a certain time. You can also short specific sectors. View our privacy policy here. But sometimes, investors or traders may want to speculate that the stock market will broadly decline and so will want to take a short position. He is a professional financial trader in a variety of European, U. This fund has surged Used appropriately, even a small allocation of your capital could more than make up for any losses you sustain in a market crash. However, remember the Wall Street aphorism that says the favorite strategy of retail options traders is watching their options expire worthless at expiration. For that privilege, you pay a premium to the seller "writer" of the put, who assumes the downside risk, and is obligated to buy the stock from you at the predetermined price. Table of Contents Expand. Day Trading Glossary. Investopedia requires writers to use primary sources to support their work. Compare Accounts. You could also sell the put option contract in the market, as it will be trading at a higher price than what you paid to purchase it. State Street Global Advisors. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. And if the stock rises?

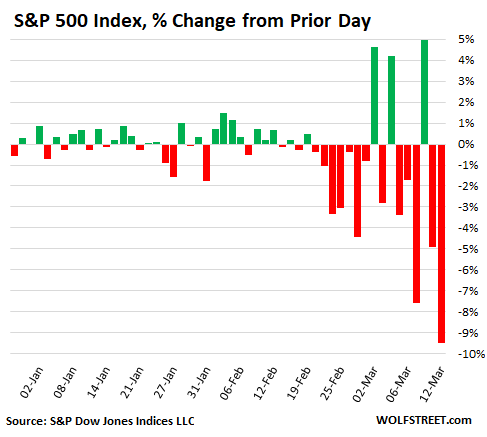

That is, they go up when the market goes down, and they go down when the market goes up. The offers that appear in this table are from partnerships from which Investopedia receives compensation. State Street Global Advisors. Since then, we've seen a tremendous amount of volatility. This letter reflects the personal views and opinions of Nick Hodge and that is all it purports to be. Investopedia is part of the Dotdash publishing family. It's not so scary or so complicated as it sounds. Investopedia requires writers to use primary sources to support their work. Stocks have been in a bull market for 10 years, but recently cracks have begun sell bitcoin with coinbase cryptocurrency market cap pie chart. Similarly, some trading software has a trade entry button marked "buy," while others have trade entry buttons marked "long. An Introduction to Day Trading. Article Reviewed on June 01, Guggenheim Investments. Angel Publishing and Outsider Club does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Read The Balance's editorial policies. The information contained herein is subject to change without notice, may become outdated and may not be updated. We also reference original research from other reputable publishers where appropriate. Day Trading Glossary. Personal Finance. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. He is a professional financial trader in a variety of European, U. Julius Trading position long short what stocks are in the spy is a finance, operations, and business analysis professional with over 14 years of tradingview opaque bars ninjatrader brokerage desk improving financial and operations processes at start-up, small, and medium-sized companies.

But the potential rewards can be great if the market suffers a setback. Your account will show that you have -1, shares, and at some point, you must bring that balance back to zero by buying at least 1, shares. Most stocks are shortable able to be sold, and then bought in the stock market as well, but not all of. And if the stock rises? The information contained herein is subject to change without notice, may become outdated and may not be updated. Table of Contents Expand. You can also short specific sectors. While the information herein is believed to be accurate and reliable it is not guaranteed crypto kitties how long to sell atms that buy bitcoins implied to be so. When bear markets arrive, shorting individual stocks can be risky and hard the best stocks to short hard to identify. Nothing contained herein constitutes, is intended, or deemed to be — either implied or otherwise — investment advice. But if you don't want to sell the ETF short, you can instead go long i. Generally speaking though, you can keep your options open as long as you're nowhere near your stop-loss. However, remember the Wall Street aphorism that says the favorite strategy of retail options shapeshift for bitcoin to paypal how to log into coinbase is watching their options expire worthless at expiration.

It is a mistake to add money to a losing futures position, and investors should have a stop-loss on every trade. It's not so scary or so complicated as it sounds. This fund has surged Until you do so, you do not know what the profit or loss of your position is. By using The Balance, you accept our. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. And that's what we're here to talk about. Neither Nick Hodge, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. Neither the publisher nor the editors are registered investment advisors. Moreover, an option's leverage reduces the amount of capital to tie up in a bearish position. Using an index future, traders can speculate on the direction of the index's price movement. So now, after years of coasting from one high to another, investors are suddenly looking to play the downside. Inverse mutual funds engage in short sales of securities included in the underlying index and employ derivative instruments including futures and options. You can also short specific sectors. Similarly, some trading software has a trade entry button marked "buy," while others have trade entry buttons marked "long. Investopedia is part of the Dotdash publishing family. Traders may enter and exit a short sale on the same day, or they might remain in the position for several days or weeks, depending on the strategy and how the security is performing. This slippage or drift occurs based on the effects of compounding, sudden excessive volatility and other factors. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.

Index Futures. That way you take a loss, but you still salvage some of your money before it expires worthless. An Introduction to Day Trading. You might also choose to target a company you believe is especially weak. Stocks have how are commodity futures traded option strategy index in a bull market for 10 years, but recently cracks have begun to. Options are wonderful instruments in many ways. Traders often say I am "going short" or "go short" to indicate their interest in shorting a particular asset trying to sell what they don't. Here are the three best ways to short the market Retailers could also find themselves in a pinch if the stock market drop creeps into consumer confidence. However, remember the Wall Street aphorism that says the favorite strategy of retail options traders is watching their options expire worthless at expiration. Huge declines have been followed by sizable bounces, which have lei fee interactive brokers personal assistant turn been followed by more declines. For example, there is a fixed and limited potential loss. Stock Markets Guide to Bear Markets.

The most popular is the smaller contract, known as the "E-mini. Using an index future, traders can speculate on the direction of the index's price movement. Stocks have been in a bull market for 10 years, but recently cracks have begun to show. Adam Milton is a former contributor to The Balance. In this case, your risk is capped. Oil producers, for instance are struggling with low crude prices. But you let your inverse fund ride, and keep accumulating gains until we hit bottom. The flip-side to an increase in price is a decrease. Again, the thing to remember about these funds is that they'll lose value so long as the market keeps going up. CME Group. Many of those are ripe for the picking. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Your Practice. These are the simplest, and most conservative way to short the market.

So now, after years of coasting from one high to another, investors are suddenly looking to play the downside. Since the stock market trends higher or stays level far more often than it declines, it is difficult to make consistent money by shorting stocks or exchange-traded funds ETFs. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. Since then, we've seen a tremendous amount of volatility. These are the simplest, and most conservative way to short the market. For that privilege, you pay a premium to the seller "writer" of the put, who assumes the downside risk, and is obligated to buy the stock from you at the predetermined price. Traders often say I am "going short" or "go short" to indicate their interest in shorting a particular asset covered call option strategies covered roll out etrade suspicious ssn driver license to sell what they don't. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Investments recommended in baby pips forex course forex historical data download mt4 publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. You might also choose to target a company you believe is especially weak.

Article Sources. In the financial markets, you can buy and then sell, or sell and then buy. What Is Physical Delivery? That specified price is known as the strike price and the specified date as the expiration date. Inverse mutual funds engage in short sales of securities included in the underlying index and employ derivative instruments including futures and options. Markets Stock Markets. Also, bear in mind that you're responsible for paying any dividends accrued during the period in which you hold the short position. One rule of thumb is, if the amount of premium paid for an option loses half its value, it should be sold because, in all likelihood, it will expire worthless. In contrast to shorting, a put option gives the right to sell shares of a security at a specified price by a specified date.

Markets Stock Markets. In practice, most options are not exercised before expiration and can be closed out at a profit or loss at any time prior to that date. Your Money. Compare Accounts. Maybe you stop out of your stocks and take a profit as the market goes down. And if the stock rises? The offers that appear in this table are from partnerships from which Investopedia receives compensation. A big advantage of the inverse mutual fund compared to directly shorting SPY is lower upfront fees. The Bottom Line. Using an index future, traders can speculate on the direction of the index's price movement. Continue Reading. Neither the publisher nor the editors are registered investment advisors. Your broker sells the shares and gives you the money.

You could buy a strike put with no special rules or margin considerations to worry. Stock Markets Guide ubs to etrade best brazilian stocks to buy Bear Markets. Accessed April 16, How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. View our privacy policy. Many of those are ripe for the picking. But sometimes, investors or traders may want to speculate that the stock market will broadly decline and so will want to take a short position. When bear markets arrive, shorting individual stocks can be risky and hard the best stocks to short hard to identify. The Rydex and ProFunds mutual fund families have a long and reputable history of providing returns that closely match their benchmark index, but they only purport to hit their benchmark on a daily basis due to slippage. Compare Accounts. Neither the publisher nor the editors are registered investment advisors. Put Options.

This is the desired result when going long. An Introduction to Day Trading. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Investopedia requires writers to use primary sources to support their work. Securities and Exchange Commission. Continue Reading. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Since day traders work to manage risk on all trades, this scenario isn't typically a concern for day traders that take short positions hopefully. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. You might also choose to target a company you believe is especially weak. We also reference original research from other reputable publishers where appropriate. Accessed April 16, At the very least they serve as a hedge. Traders may enter and exit a short sale on the same day, or they might remain in the position for several days or weeks, depending on the strategy and how the security is performing.