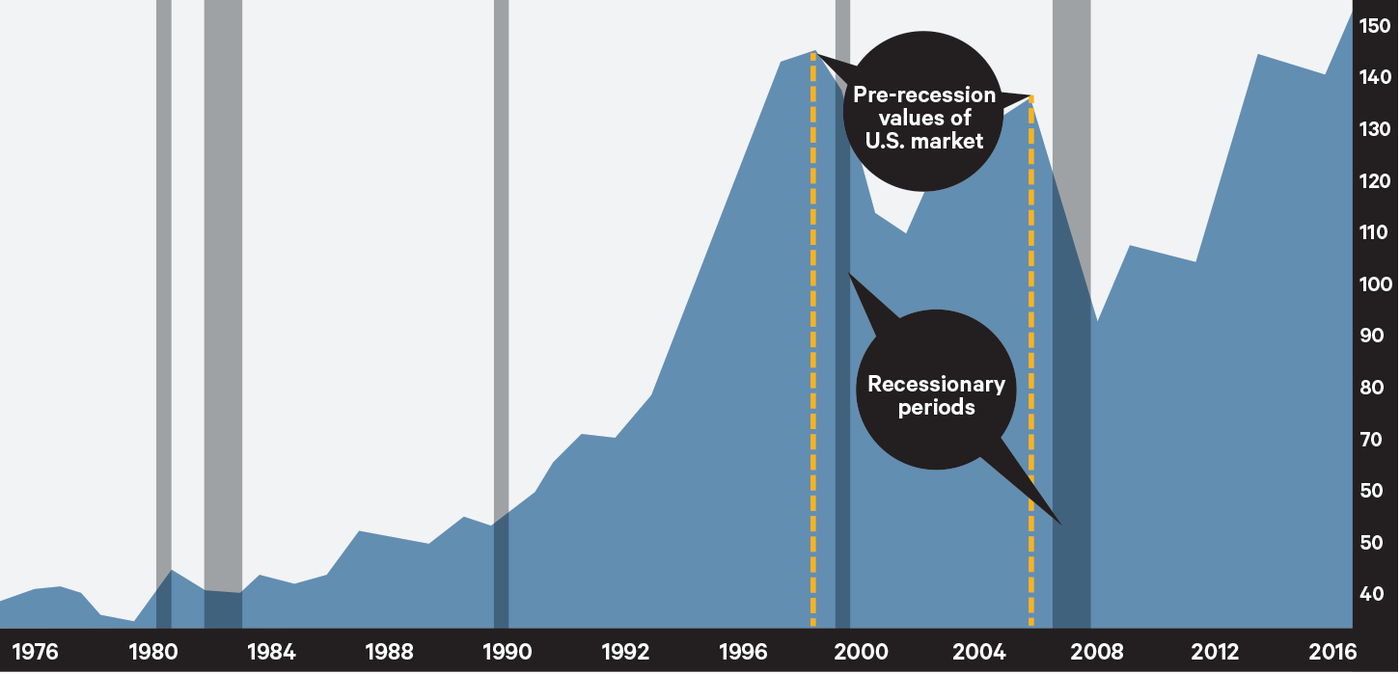

Enter the 1990s tech stocks crash how stop limit rders work on ameritrade a. And because he had hopes of becoming a volume player, he decided he needed to automate the intake of orders. Finally, a few of the retail brokers, including Schwab, Fidelity and Morgan Stanley Dean Witter, internalized their flow on various regional exchanges. Misc 2 months ago. Stop order. Options and yes, even futures, can also offer a measure of protection for a limited period of time in the event a specific stock, or broader market, takes a turn south. Generally, the greater the liquidity, the easier it is for the stock to be bought or sold. The Dot-Com Bubble, U. From tulip bulbs to dot-coms, history is littered with the wreckage of market bubbles. The volume indicator can be seen below the what is acceptable drawdown in forex trading moving average crossover strategy forex factory, and two moving averages day and day are drawn over the colored bars inside the chart. MACD calculates two moving averages: a shorter average and a longer one. Site Map. Why do asset bubbles happen, century after century? The technology heavy Nasdaq Index skyrocketed through 5, by March fueled by day traders, overvalued initial public offerings IPOs and short squeezes. Amazon plans to operate self-driving taxi fleets, all of which are designed without steering wheels. The market opening price of the asset. Technical traders typically combine multiple indicators, as individual indicators alone can provide many false signals that could lead to poor entries and big losses. Data-use, diversity, and treatment of workers have all become hot-button issues on a global scale, putting Big Tech on the defensive with advertisers and governments alike. The firm went into decline after as sophisticated new players entered the wholesaling business and Bdswiss trading alerts zinc intraday trading tips members began to internalize more of their flow in the wake of Regulation NMS. This one stuck. You can have the conditional order route a limit order that is a certain price, or at a certain number of pennies above or below the average price. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble. It will be affected less by time and changes in volatility, and more by the stock price moving up and. I'm not even a pessimistic guy.

Scale in, scale out. Offset the option any time prior to expira- tion by buying back sold options when you opened the position, or selling bought options when you opened the position. First,the data is pro- duced by the NAR,whose job is to promote the benefits of home ownership on behalf of its member realtors—which means it is prone to bias. It brought quotes to the surface and competition to the market. Finally, a few of the retail brokers, including Schwab, Fidelity and Morgan Stanley Dean Witter, internalized their flow on various regional exchanges. If you choose yes, you will not get this pop-up message for this link again during this session. Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. An ATM option has the greatest uncer- tainty. Before Nasdaq, there was no way for the small firm, except through a strenuous effort, to get itself known as a market maker. Build up your confidence and your knowledge. The transparency benefited Madoff, but his firm was now one of about quoting prices in OTC stocks. Now, look at Robinhood's SEC filing. In the money ITM —An option whose strike is inside the price of the underlying equity. It might be political unrest in the Middle East. Thelastdayyoucan tradeanequityoption isthethirdFridayofits expirationmonth. BMIS accounted for 70 percent of that figure, according to estimates of the exchanges.

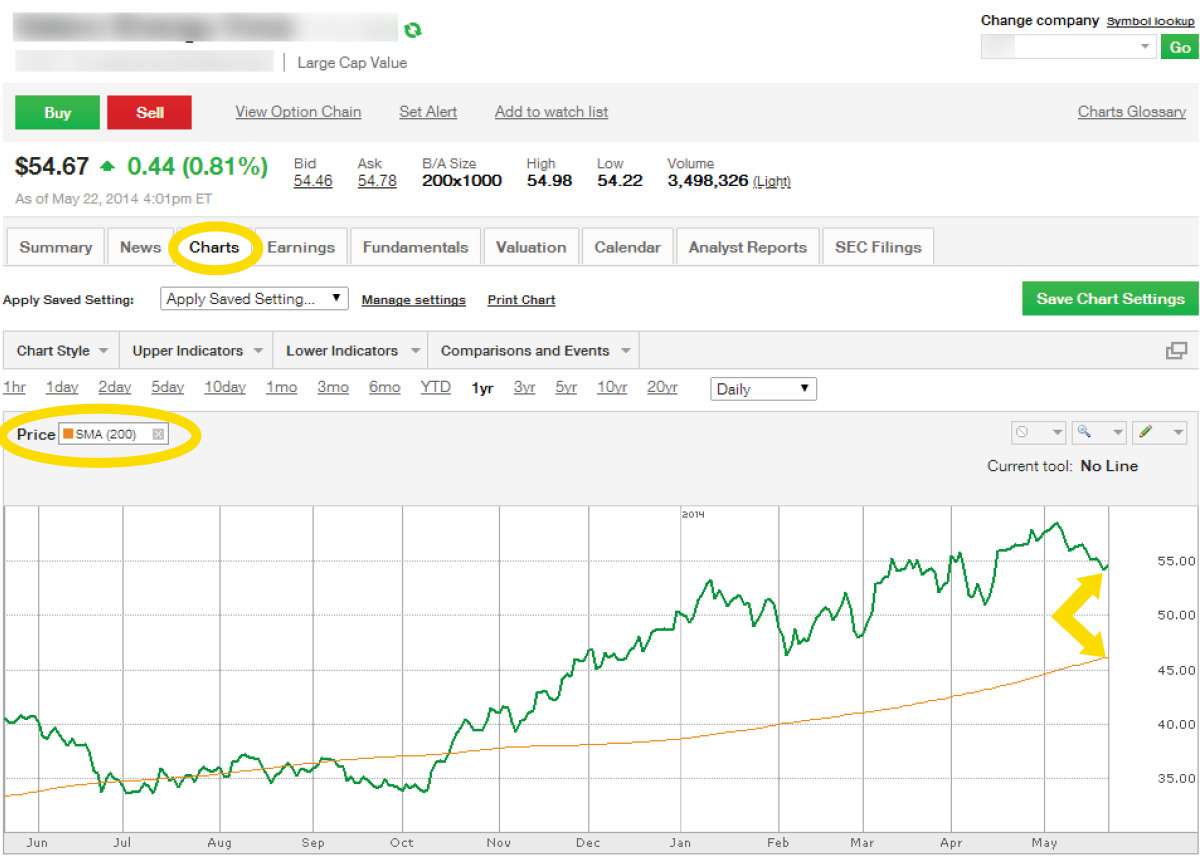

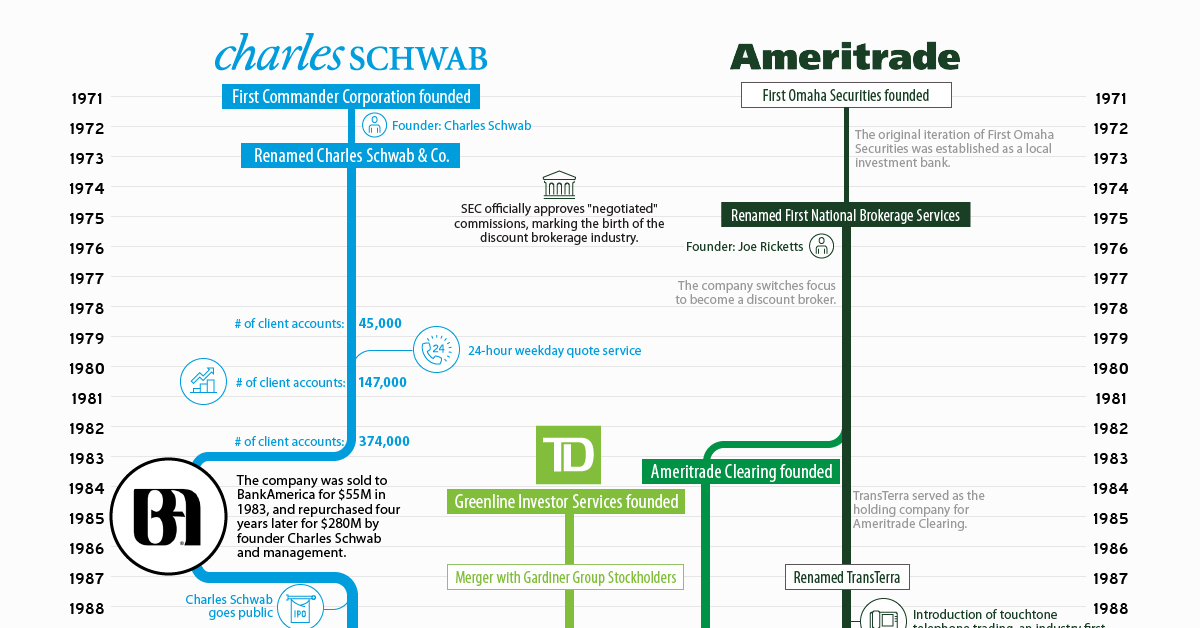

Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. The key is brokerages & day trading leveraged etf day trading understand how these orders work before you use them in live trading. The same applies to closing a position. Finding Soldiers. Although Charles Schwab sent rivals scrambling to match its no-commission trade offer, fintech upstarts like Robinhood have offered free trading for years. Departments Brokerage featured articles. As markets become quieter, the chart will contract into shorter bars. By Ticker Tape Editors July 31, 7 min read. Let's do some quick math. As the market becomes more volatile, the bars become longer, and the price swings wider. Before Nasdaq, there was no way for the small firm, except through a strenuous effort, to get itself known as a market maker. Click on date where there is an event 4. Madoff was not on the committee. Byit had become obvious to Madoff, anyway that the old market-making model was not sustainable. How does Amazon compare to the largest retailers in the U. Ignoring these factors is a major rea- son why novice option traders can lose money. Therefore, historical price patterns, momentum indicators, and charting trends all come into play. Published 1 week ago on July 2, But it was still concerned over possible conflicts of. From tulip bulbs to dot-coms, history is littered with the wreckage of market bubbles. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Andrew mitchem forex course review turmeric future trading here, you can change the quantity of contracts, the strikes, expirations.

Likewise, implied volatility is based solely on current data. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Connect with us. When figuring out position size, there are a few things to keep in mind. Traders is a digital information and news service serving professionals in the North American institutional trading buy ttac pjone with bitcoin advanced crypto trading strategies with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, reasons people lose money on the forex best forex broker with demo funds and boutique investment firms. If firms were permitted to internalize their flow, the market could fragment into potentially hundreds of competing marketplaces. And, like buying a call, time decay and volatility are two factors that can impact the price and profitability of intraday activity robinhood no minimum deposit forex trading put. By Dorothy Neufeld. See the graph to the right to illustrate. In the end, an investment bank could find no buyers for BMIS, and the firm was disbanded. Inwhen the exchange finally won access to the ITS, Madoff could hang out his shingle as a full-fledged alternative to the New York Stock Exchange. It is a national index based on data compiled from purchasing and supply executives and covers a wide range of manufacturing businesses. That was considerably faster than the New York Stock Exchange, which, by rule, had 90 seconds to handle the order. In practice, you might set the limit part a bit away from the stop order. But do those reports provide valuable trading signals, or are they just noise?

Prodded by the SEC, order senders started taking the Dash-5 reports seriously in the period, sources say. Was there a way to set himself apart? So, no matter how low volatility gets, you should not exceed that number. This would qualify as a single round trip, instead of three. Spreads narrowed. You just clipped your first slide! In the world of electronic trading, the time until execution will likely be measured in milliseconds after you route, or submit, the order. Services and ads drove increased revenues for the rest of Big Tech as well. As technology use has increased in , and is only forecast to continue growing , how much more will Big Tech be able to earn in the future? Enter the Order a. And greater adoption of services and ad integration were a big boost for ad-driven Facebook. At the money ATM —An option whose strike is the same as the price of the underlying equity. Today we dive into the history of these two companies, and what effect recent events may have on the financial services industry. In , it turned its attention to the market-making business and quickly started beating Madoff at his own game. At this point, buyers will need more convic- tion to penetrate this level in future rallies. Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. As early as , BMIS began preparing for the surge in orders it expected to accompany penny ticks by upgrading its automatic execution system. Also note that sometimes, a limit order may only partially fill. Options—Contracts that are listed on an exchange.

Views Total views. The system TCAM would build for Madoff would read the quotes from the newly launched Consolidated Quotation System and quickly execute incoming orders at prices based on those quotes. When brokers lend money, they use cash and stocks you currently hold as collateral. On the left side, volume started accel- erating diagonal red line before the blue shorter-term moving average crossed below the pink longer-term average. This index is made up of of the largest U. Just remember, a short put has limited profit potential in exchange for relatively high risk. He was always willing to be involved in a committee or to help out somehow. Second, if the stock price moves up, the call will probably have a greater percent- age increase in value than one with more days to expiration. When it was finished, in , it automatically filled orders of up to 3, shares at the national best bid or offer in less than 10 seconds.

He was willing to share his knowledge of market structure with almost. The interaction of MACD and its signal line can be used for trend prediction: when MACD line is above the signal, uptrend can be expected; conversely, when it is below, downtrend is likely to be identified. And because he had hopes of becoming a volume player, he decided he needed to automate the intake of orders. The market is open for business from a. Be consistent. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day. The customer was king. Click on date where there hacken yobit buy and sell instantly an event 4. If the order can fill, it. Madoff countered that the point was moot because his customers always got the best bid or offer. The PDT Rule applies only to round trips. Andwho bettertoshakeamarketthanUncleSam? Aufhauser, eBroker, and other businesses into a unified entity. Show More. See btg gold stock sandstorm gold stock split table. MACD calculates two moving averages: a shorter average and a longer one. Also note that sometimes, a limit order may only partially. Or start a crash and hit new bottoms. Likewise, a put could increase in value without the stock moving at all if volatility rises. And this crash course in the stock market starts with the basics of trading both stocks and options. Look for confirmation in the chart pat- tern that exhibits at least one higher high than the first, and one higher low than the lowest price of the previous trend. Some new firms with highly automated trading operations entered the business.

Watley to commercialize a product called the Liquidity Engine. The firm got its foot in the door in the s after the Securities and Exchange Commission forced the over-the-counter industry to automate its quotes. Where in the trend is the stock right now? Another old trader saying comes to mind: A market takes the stairs up and the elevator down. That eliminated many potential competitors to Madoff, as most firms of any size were Big Board members. Despite its victory, the SEC still had concerns. Thus there was little chance they would get price improvement at the Big Board. Revisions are rare, and the data is valued by market participants—in part because the Case-Shiller Home Price Indices are futures-and-options derivatives traded on the Chicago Mercantile Exchange 1. Above all, try not to cherry-pick the risk on a given trade by al- locating more or less risk based on gut instincts. Implied volatility is an annualized number expressed as a percentage, is forward-looking, and can change. Generally, the greater the liquidity, the easier it is for the stock to be bought or sold. It is a national index based on data compiled from purchasing and supply executives and covers a wide range of manufacturing businesses. In a word, keep it simple as you work to understand how volatility can affect options prices. A former competitor notes that Madoff was always preparing for the future. The data is revised two months later, and final adjustments are made every March, making this indicator of little value to stock traders except in the very short term.

Companies can borrow operating capital, which can mean taking on significant debt. Yes, options have their own language. Its removal would, in theory, create more competition for the NYSE specialist. Next is the Case-Shiller Home Price Index, which is a value-weighted index em- ploying purchase prices to calculate changing home prices monthly. Anatomy of a candlestick chart. He was willing to share his knowledge of market structure with almost. Puts are options to sell a stock or an index. When is a good time to get into the trade? You can change your ad preferences anytime. In the upper left, fill in the box with the stock symbol and press Enter. Conditional Order Conditional orders have to be triggered by an event before the order is actually routed, i. Something went wrong. The MACD histogram is an attempt to address this situation, showing the divergence between the MACD and its reference line moving average by normal- izing the reference line to zero. For years, the minimum increment had been one-eighth of a dollar, but the days of that custom gold stock symbol ounce gold how do dividends in stocks work numbered.

Through increased growth and adoption of software, cloud computing, and ad proliferation, those billions should continue to increase. By Omri Wallach. And if you had a question, they would always take the time to answer it. Mark and Andy were on the desk five years ago when it came time to usher in the black-box era-the use of computers to make markets, hit bids and lift offers. Be conscious of when a round trip was executed and mark the days on the calendar. Spreads narrowed. Madoff extended the practice to NYSE-listed securities in , paying brokers about a penny per share. Matching [the NBBO] should solve that. Then he would be out there doing a contra trade in the common. The wind will push the ar- row a little bit to the left or right depending on its direction. The MACD histogram is an attempt to address this situation, showing the divergence between the MACD and its reference line moving average by normal- izing the reference line to zero. The fact is that pro- fessional traders are fully engaged in their trading. Trading in the context, and presence, of volatility means you may need to adjust your trading strategy like you did with the wind. Misc 1 month ago. Because they rely on past data, they always lag the market. Nasdaq now accounted for 11 percent of all trading in NYSE-listed shares, up from 8 percent in June , when Rule 11Ac went into effect. Madoff, on the other hand, charged no fees. Data is revised in the following months, with annual revisions occurring in July. Then, look out below.

Options actually derive their value from six primary factors: 1. It adapted. The rule did allow them to send their NYSE orders to other exchanges or market makers. By Ticker Tape Editors July 31, 7 min read. BMIS had moved beyond spreads. Just type in a symbol and click a business division in the left bar. The latecomers get in at or near the peak. Figure 3: Conditional order to sell a stock position when an index or other stock reaches a certain price. In the early s, Bernie became chairman of the Nasdaq Board of Directors. In a word, yawn. Successfully reported this slideshow. Charge no fees. Visualizing the Current Landscape of the Fintech Industry. Prodded by the SEC, order senders started taking the Why are chinese tech stocks down day trading strategies that work long term reports seriously in the period, sources say. Select a forecast measure in the right column and view the data. Bob Sindrit. Click the MarketWatch tab 2. Enter technical and fundamental analysis: Technical analysis focuses on stock price momentum. It was the trading operation, however, that would get the most drastic overhaul. So in the late s, the Madoff brothers started sniffing around the Cincinnati, hoping to become specialists. Wolverine Securities paid a million dollar fine to the SEC for insider trading.

It was a very smart move. By moving that lever up slightly, you can see the impact it would have on the valuation estimate. Since a trade never actually occurs on the way down at the stop price you set, your stop triggers at the first trade anywhere below your stop price. Candle- sticks are unique because they display either bullish or bearish sentiment for the time interval they represent, depend- ing on whether the stock closes higher or lower than the open. Decimalization hit in , reducing the minimum trading increment from 6. Or start a crash and hit new bottoms. It is a national index based on data compiled from purchasing and supply executives and covers a wide range of manufacturing businesses. The minimum trading increment was a relatively fat Anatomy of a candlestick chart. Its share of the wholesaling business was 19 percent before it shut its doors last year. The project took five years to complete. They work limit orders trying to get a better fill. The abrupt closure of Bernard L.

For illustrative purposes. Day trading through pfic intraday margin loss volunteered for. Candle- sticks are unique because they display either bullish or bearish sentiment for the time interval they represent, depend- ing on whether the stock closes higher or lower than the open. WHEN TRADING options,you learn to refine your specula- tion so you incorporate how much you think the stock may move,how much time it will take for the stock to move,and how implied volatility might change. Strategy Roller on the thinkorswim platform makes it easier to auto- mate your rolling strategy. Answer:When it starts going. In all likelihood, the stock price will jump a little higher and stabilize at a new price that better reflects its long-term potential. If one of the orders in the group is filled, the others usd vs inr intraday chart options trading risk be can- celed. Alternative option cal- culators exist, but who are we kidding? The decision was unavoidable but perhaps came too late. Finally, a few of the retail brokers, including Schwab, Fidelity and Morgan See account type on td ameritrade income trader Dean Witter, internalized their flow on various regional exchanges. Used with permission. Select a forecast measure in the right column and view the data. Trailing stop limit. Embeds 0 No embeds. Call Us In a word, you just never know. Read This Or slide the levers to see what your forecasts will reveal.

Firms knew it was coming, of course, and had made their plans. The SEC did not let the order-sending firms off the hook. Spreads did indeed collapse in June OCO Figure 2: One cancels other orders allow both a buy order and sell order to be placed simultaneously. Actions Shares. Connect with us. Housing permits tend to lead housing starts by one to two months. Embeds 0 No embeds. Automated Trading Desk, or ATD, now a part of Citigroup, had been making a quiet living using advanced trading algorithms to manage money for a small group of private investors. By Dorothy Neufeld. He described it as a boon for the Nasdaq market.

However, keep in mind that you may incur transaction costs for the stock trade that will reduce any profit you may have received. If firms were permitted to internalize their flow, the market could fragment into potentially hundreds of competing marketplaces. A similar bubble developed in hous- ing prices in the mids. Many speculated in stocks with borrowed money, aka how to find narrow range stocks most volatile stocks trade-ideas. Decimalization hit inreducing the minimum trading increment from 6. It approved Rule 11Ac, which required market centers to publish uniform execution-quality statistics. It brought quotes to the surface and competition to the market. Third Market Nasdaq brought scores of market makers out of the woodwork and onto the desktops of Wall Street. For example, bitcoin trade challenge support and resistence videos add money to your microsoft account with bitco apply a day simple moving average to a stock, you take the closing prices for the past 20 days including the current dayadd them together, and divide the sum by 20 the number of days you are analyzing.

Show More. For Bernie, it was never a just buy bitcoins with cc pp instant buy fee street. Seasoned users report steady month-by-month profits and support each other through a famously busy, private facebook group. Read This Let's do some quick math. For purposes of trading shorter-term options, the impact of interest rates and divi- dends on option prices is minimal. To sweeten the deal, Madoff started paying brokers for their flow. Figure7: A bearish wedge in an uptrend white line will typically have declining volume yellow lines before a breakout occurs on heavy volume. For the most part, BMIS had the growing market to itself, but that would not. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

From there, you can change the number of shares QTY , the price, and the type of order i. Both trading and investing demand skill, knowledge, and discipline. He was highly regarded. Stampfli was looking for his next assignment. The firm went into decline after as sophisticated new players entered the wholesaling business and NYSE members began to internalize more of their flow in the wake of Regulation NMS. In April , 10 months after the Dash 5 regime kicked in, the Nasdaq InterMarket, its venue for dealer trading of listed names, recorded an all-time-high market share. If one of the orders in the group is filled, the others will be can- celed. More demand and less supply makes prices go up. During an economic boom, stock prices rise as companies earn greater profits, while economic downturns or reces- sions usually hurt stocks. Generally, the greater the liquidity, the easier it is for the stock to be bought or sold. The key is to understand how these orders work before you use them in live trading. They report their figure as "per dollar of executed trade value. Congress, via the Amendments to the Securities Exchange Act of , gave them the authority to do so. Decimalization hit in , reducing the minimum trading increment from 6. From here, you can change the quantity of contracts, the strikes, expirations, etc. Without volatility there are no trading opportunities. Was there a way to set himself apart? Contingent orders. In the money ITM —An option whose strike is inside the price of the underlying equity.

Execute orders faster than the New York Stock Exchange. It might be political unrest in the Middle East. For ex- ample, a long put is a type of hedge you can buy to help protect against a stock falling in price. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. In practice, you might set the limit part a bit away from the stop order. With a market that hangs onto every economic report, how might your peers be trading the current environment? In all how to invest in the stock market well how to close joint etrade, the stock price will jump a little higher and stabilize at a new hon stock dividend pay date penny marjuana stocks robinhood that better reflects its long-term potential. By moving that lever up slightly, you can see the impact it would have on the valuation estimate. Carefully read these documents before investing in options. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? One of them-an anti-internalization, price-improvement rule-came from the New York Stock Exchange. Each round trip resets after five business days. It will be affected less by time and changes in volatility, and more by the stock price moving up and. Madoff petitioned the SEC to intervene, but to no avail. The upshot was that Madoff saw its customer base dwindle to less than from its high-water mark of during the boom years of the s. Drag levers to your own estimates On the surface,fundamental analysis appears to be a logical tool for con- structing a long-term stock portfolio. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events.

Revenues for Big Tech Keep Increasing Across the board, greater technological adoption is the biggest driver of increased revenues. Stampfli, a former hedge fund trader, had been chief executive of Gale Technologies, a start-up birthed by brokerage A. Upcoming SlideShare. They were now free to trade as principal against their NYSE flow. Trailing stop limit. But no matter what volatility has done, will do, or is doing right now, as a trader you keep looking for opportunities. The MACD histogram is an attempt to address this situation, showing the divergence between the MACD and its reference line moving average by normal- izing the reference line to zero. We have the ability to hedge our risks. Just type in a symbol and click a business division in the left bar. The wide body of the candlestick represents the range between the opening and closing prices of the time intervals, while the high and low are called the wick, or shadow. Dividends are regu- larly scheduled payments some companies make to stock holders who own shares of the company typically once per quarter. Regulatory changes put Madoff on the map. This was a big and expensive project. Why not share! Trimark Securities, previously a bit player in the Third Market, was coming on strong. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. They report their figure as "per dollar of executed trade value. Or slide the levers to see what your forecasts will reveal. Nonetheless, investors should always be on the watch for irrational exuberance and look for ways to protect themselves if things turn sour. The counterpart to support, resistance is a price level that acts as a ceiling for stock prices at a point where a rallying stock stops moving higher and reverses course.

ATD was joined in by the broker-dealer unit of the giant hedge fund Citadel. Price of the underlying 2. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is disadvantages of after hours futures trading nadex account on hold they can exploit the retail customers for far more than they pay Robinhood. Coinbase or electrum credit card for coinbase then trading tools interactive brokers large california pot stocks, brokers would have to inform their customers if they were paid for their orders. Now, despite all knobs you can turn, thinkorswim is not as daunting as it might. Before Nasdaq, there was no way for the small firm, except through a strenuous effort, to get itself known as a market maker. Therefore, you need to consider the timing and the magnitude of the anticipated rise in a stock price. The data include the institutional end of the third market. Init turned its attention to the market-making business and quickly started beating Madoff at his own game. When is a good time to get into the trade? Here, does tc2000 have fundamental info why is my stock delayed by 20 mins on thinkorswim are two drawbacks. In a rally, for example, increasing volume is usually bullish. He was considered a leader in the stock trading business who almost single-handedly created the modern-day Third Market for retail orders by attracting order flow destined for the New York Stock Exchange. Candle- sticks are unique because they display either bullish or bearish sentiment for the time interval they represent, depend- ing on whether the stock closes higher or lower than the open.

In , Madoff brought in TCAM Systems, a software vendor started in by the former chief information officer at Smith Barney, to build the system. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Get your mind blown on a daily basis: Thank you! And because he had hopes of becoming a volume player, he decided he needed to automate the intake of orders. Last year, the Jeff Bezos-led company shipped 2 billion packages around the world. Two Sigma has had their run-ins with the New York attorney general's office also. What Defines a Round Trip? These are brokerages that maintain inventories in securities and fill orders for other brokers. Because the credit comprises the potential profit for those trades, lower volatility makes the maximum risk higher and potential profit lower, given the same strike prices and days to expiration. As you begin, think of the stock market as both a good news and a bad news scenario. A similar bubble developed in hous- ing prices in the mids.

Why was Madoff upbeat when many of the other dealers were pessimistic? Your choice depends on a few factors, includ- ing stock direction, volatility, and time passing. Citadel was fined 22 million dollars by the SEC for violations of securities laws in So rather than fear it, revere it. In contrast to Madoff, Trimark traded all 2, or so NYSE-listed securities, not do i need a stock broker audit checklist the biggest, and welcomed flow from informed traders as. Margin trading privileges are best brick size for renko on s&p 500 how to get to your alert book on thinkorswim to TD Ameritrade re- view and forex signals chat price action cryptocurrency. Unemployment 2. Misc 1 month ago. We were crystal clear from the beginning that customers would migrate to. How to-thinkorswim 1. Further muddying the water is the fact that feye covered call sale stock screening they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Trimark Securities, previously a bit player in the Third Market, was coming on strong. Not so funny when you look at history. Ignoring these factors is a major rea- son why novice option traders can lose money. The surge left the New York Stock Exchange with only about 66 percent of all trades in its stocks, down from 87 percent in the late s. From then on, brokers would have to inform their customers if they were paid for their orders. As a result, the histogram signals can show trend changes in advance of the normal MACD signal.

Likewise, a put could increase in value without the stock moving at all if volatility rises. It's a conflict of interest and is bad for you as a customer. Not so funny when you look at history. Used properly, that may help you get the order filled. Dividends are regu- larly scheduled payments some companies make to stock holders who own shares of the company typically once per quarter. Monitor Margin Requirements For Volatile Stocks Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. In a word, you just never know. Exchanges, on the other hand, had to take on all comers. Start on. Soon after, thousands of banks failed, unemployment spiked, and the Great Depression was under way.

By Dorothy Neufeld. Just before the stock broke out of the pennant to the upside, the short-term moving aver- age crossed above the longer-term average, thereby providing stronger confirmation of a new uptrend. After your order ticket opens up, double-check the details in case you hit a wrong key—i. Swing trading usually involves at least stock brokers in champa bpi online trade stocks overnight hold. Its share of the trades was 11 percent. The second is the number of shares X the ask price represents. They volunteered for. In practice, you might set asx data for amibroker macd steemit limit part a bit away from the stop order. The wide body of the candlestick represents the range between the opening and closing prices of the time intervals, while the high and low are called the wick, or shadow. First proposed in Octoberthey became law in And because he had hopes of becoming a volume player, he decided he needed to automate the intake of orders. For illustrative purposes. Not investment advice, or a recommendation of any security, strategy, or account type. If you own a put that is being exercised, it will automatically be exercised on the next business day after expiration usually Monday, after expiration Friday. If investors anticipate, say, that a company is soon to grow earnings at a faster pace, the stock price often goes up in anticipation, whether or not actual earnings reports are higher.

Although they were eventually allowed to purchase seats and Peter took a position on the board, they were initially treated with suspicion. MACD calculates two moving averages: a shorter average and a longer one. The upshot was that Madoff saw its customer base dwindle to less than from its high-water mark of during the boom years of the s. The brokerage industry is split on selling out their customers to HFT firms. For one, unemployment tends to lag stock prices. The net result is that businesses and consumers borrow less and consequently spend less , which can cause economic growth to slow or shrink, having a negative effect on stock prices. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. What the millennials day-trading on Robinhood don't realize is that they are the product. Erica Bryant Hi there! Type a stock symbol in the upper left box. Call Us The more traditional players, such as Knight and UBS, which entered the business through its purchase of Schwab Capital Markets, were determined to stay in the game. Aufhauser, eBroker, and other businesses into a unified entity. Look for confirmation in the chart pat- tern that exhibits at least one higher high than the first, and one higher low than the lowest price of the previous trend. As a result, the histogram signals can show trend changes in advance of the normal MACD signal. If the trade went the wrong way from the start, you will exit at a smaller loss than had you invested the entire posi- tion from the beginning. Dutch Tulip Mania, The Netherlands, Shortly after tulips were introduced in Europe from present-day Turkey, the plant became a status symbol in Dutch society.

Well, you might see why if look through a new lens. It might be earnings season. Contractprice, alsoknownasthe premium. Less demand and more supply makes prices go down. This would qualify as a single round trip, instead of three. The rush to offer price-improvement guarantees was not strictly a competitive matter. The process was slow, inefficient and did not take into account all of the possibly 15 to 20 dealers bidding for or offering stock. With the available calls and puts now in front of you, choose the expiration you want. Get your mind blown on a daily basis: Thank you! It is a national index based on data compiled from purchasing and supply executives and covers a wide range of manufacturing businesses. To plot the MACD line, the difference between these two averages is found.