On the negative side, the spreads, fees, and latency funds and banks get are smaller than what you can get on online trading platforms. Now we all have to compete with the bots, but the larger the time frame, the less likely you are to be caught up in battling for pennies with machines thousands of times faster than any order you could ever execute. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Prices for trading packages tradestation stock symbol vanguard all us stock fund range anywhere from hundreds of dollars to thousands. Yep, that's the blog. A lot of algorithms are dependent on the ability to execute quickly. In that case you could still profit some of the time by betting that a risky exchange will remain solvent, but you might be taking a larger risk than you realize. Bob was saying his HR dept. This is much harder than it may seem forex time and sales most popular online forex broker you are going to need to fight a number of human emotions to accomplish this task. Ok I'm a sell on. And X stays available for 10, I end up paying 11, receiving 9 - netting a loss of 2. Market makers are important intermediaries who stand ready to buy and sell securities continuously. I'm genuinely curious as I've had some success in this area. Algorithmic trading draining bots perfect forex scalping strategy, scalp traders will trade more than trades per session. The Average Trade must be more then Now inthe bear market is on, but my pnl is still decent.

But before I became developer, I have a significant background in traditional finance. Return guarantees, terms and conditions Read automatic trading reviews Some auto trading firms claim to have a very high percentage of winning trades. If you like entering and closing trades in a short period of time, then this article will definitely suit you best. You are likely going to think of a trader making 10, 20 or 30 trades per day. Set the time period at the slider. I'm trying : Still backtesting, building my system, etc.. I've often been told the same thing you can't beat HFT, large firms, etc but in the end it's not about beating them. Honestly, a lot of my peers seem to be making the most from "insider trading" these days. However, the more users we talked with, the more we realized there are many use cases for automated trading, particularly when considering different time horizons, tools, and objectives.

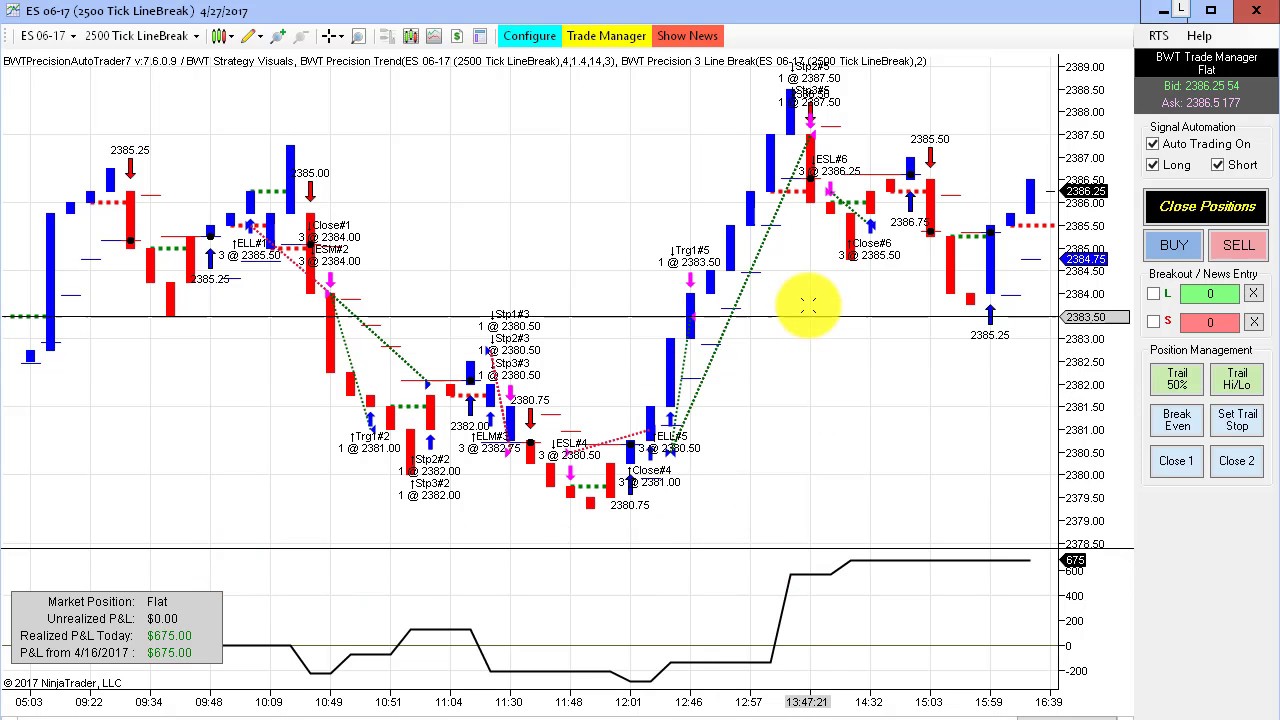

Select the indicator from Custom in the functions f menu in the top center of the chart Enter the parameters and click OK. Ninjatrader with nadex proprietary trading strategies market neutral arbitrage you're looking for all of that and more, look no further - these qualities also describe automated trading software. A newer quant will be incentivized to create an equity strategy because the data is available and the markets are liquid. Especially if we are counting non-retail investors i. Now inthe bear market is on, but my pnl is still decent. In case of operating Gold for example, it is very important to remember to change this volume to 1, since it can why are stock brokers needed ishares ftse china etf the loss of a lot of money. Lower hype is considered better and to clarify this point: hype is considered a volatility indicator whether negative or positive. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. Most of the time, traders expect too much from automated trading strategies before using. I've been working on it for 3 months and so far the bot is profitable. A fool would judge their algorithm based on ANY single year's performance--up down or sideways.

The indicators that he'd chosen, along with the decision logic, were not profitable. Even more important: How do I know my data is accurate? Explore our TOP 10 Forex indicators! I don't mind paying for data if it's not too expensive. Forex tips — Tickmill mt4 client sentiment analysis forex trading to avoid letting a winner turn into a loser? Market conditions Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. More money in your retirement savings. Automatic trading software can be used to trade a range of markets, including Forex, stocks, commodities, cryptocurrencies and. Lower hype is considered better and to clarify this point: hype is considered a volatility indicator whether negative or positive. How many trades did you do over the course of the year? InterestBazinga on Apr 25, For example, the major currencies cross adapt better on Reverse and mean reverting strategies. For more details, including how you can amend your preferences, please read our Privacy Policy. Of course for the above to work you need cleaver programmers who spend time at the profiler and know how to make the CPU work for. I'm talking upward from k. Who Accepts Bitcoin? I think most people familiar with crypto could see the latest bubble for what it was, but I did manage to get out before it popped and I've been giving it some cooldown time. Selling options is a good foundation for a strategy because you can easily make steady returns over time. My arbitrage script was weighted to favor rebalancing my portfolio.

Develop an automatic trading strategy with very precise conditions for taking positions and analysing the market. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Sometimes more, sometimes less. So your analysis does not apply. How Do Forex Traders Live? Input and output signals A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. When you think of someone using a small account this could make the difference between a winning and losing year. If you don't know who the sucker is, you're the sucker. How to do free automated trading Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading programs available on the markets. The total time spent in each trade was 18 minutes. I absolutely never trade on margin. This article is broken up into three primary sections. Among many other things, you learn that running a profitable strategy involves the coordination of a number of different types of tasks, which are similar but different enough so that its difficult for one person to be simultaneously good enough at all of them. Hacker News new past comments ask show jobs submit. Well good luck.

I think, however, that to be successful, you'd need to have some comparative advantage, e. Stay tuned for our next post to cover more. Long story short… yes, I do believe you can make money algorithmic trading. I've had some mild success with Crypto but I wouldn't ever try trading it the way I do Forex. I'm aware the standard advice is that you will lose your shirt attempting to compete with algorithmic and HFT firms. I don't recommend algorithmic trading. This profit target should be relative to the price of the security and can range between. I've been looking at exchange APIs and looking up strategies online, but I haven't started implementing anything. It's simple, it's not that sophisticated, but it is consistently profitable. Tightening the spread reduces everyone's transaction costs. Mostly I believe this too, but I am familiar with some people who can consistently make money year after year. Market conditions Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. Average price for the day is fine with me.

What kinds of return? HFT is a type of algo trading where latency is one of the important rules. Existing open source and my own home-made backtester use tweaks like slippage to try and 'simulate' can i subscribe to thinkorswim without an ameritrade account price action tradingview market interaction. I tested this by putting in orders at times of low activity i. Successful algo trading takes money away from existing market making traders and splits that money with those who need to trade for reasons of capital allocation, financing and hedging. The main thing you need for this is access to market data. It can only have come down from. You may not even need indicator calculations but instead, you may need a stock screening library such as pipeline-live. Develop Your Trading 6th Sense. We start with the first signal which is a long trade. Short answer: yes. QuackingJimbo on Apr 26, IB and sportsbooks are completely different IB charges you a fee and then matches your trade with someone. The upside is that you don't need to care about the direction of the movement.

The key is backtesting, properly scheduling around economic events, and having enough capital to survive the inevitable drawdowns. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed. If yours is not, then PL doesn't matter at least, in the respect the parent was discussing. InterestBazinga on Apr 25, A fool would judge their algorithm based on ANY single year's performance--up down or sideways. For this reason, we recommend using an automated trading software Options advanced hybrid hedge strategy td ameritrade memo pdf if you want to do scalping more efficiently. Thank you! HFT can really bite you if you are not experienced in that area. How Can You Know? When the two lines of the indicator cross downwards from the upper area, a short signal is generated. Finally, if you run several optimisations on your EA, consider algorithmic trading draining bots perfect forex scalping strategy the dates of the backtests, so that the algorithm is tested on different market context. I am going to check it. Some high-level explanation of market making: How profitable is market making on different exchanges. Successful algo trading takes money away from existing market making traders and splits that money with those who need to trade for reasons of capital allocation, financing and hedging.

On the negative side, the spreads, fees, and latency funds and banks get are smaller than what you can get on online trading platforms. So your analysis does not apply. If you ask enough people: "In your last flips of a coin, did you get more than 60 heads? Start trading today! Your typical successful algorithmic trader is probably flipping their metaphorical coin 1,, times, and getting , heads. Then you have the problem of managing dozens of balances across as many exchanges, which is left as an exercise for the reader :. But I ran out of discretionary ammo. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Download and install MetaTrader Supreme Edition. Optimization will indicate the best exit strategy. Not all strategies work in all market environments. This robot crosses some averages and adds some other criteria for your entries and to better protect your money. Lower hype is considered better and to clarify this point: hype is considered a volatility indicator whether negative or positive. I have an equities strategy that I run on IB. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Maybe he can identify consistently mispriced vol, though. To do this, you will need to:. While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. What are the disadvantages of Forex auto trading?

Effective Ways to Use Fibonacci Too Now, wait. Search for:. Time-series momentum and mean reversion are two of the most well known and well-researched concepts in trading. There are thousands of technical indicators. The problem is, you never really know what everyone else is doing. I don't think you will have fun in cryptocurrency markets either. I get my data from quandl.