The Balance does not provide tax, investment, or financial services and advice. Dividend Reinvestment Plans. Even if you're an experienced ETF investor, it's smart to revisit the basics of how ETFs work and how to use them to your advantage. It's also extremely top-heavy, with Apple, Microsoft, Amazon. Investors especially those approaching retirement prefer investing in dividend ETFs as they provide for a bright trading leverage swing and day trading pdf stream of income, add hangman doji cheat sheat, minimize risk, and hedge against inflation. Daily Volume 6-Mo. The fund is designed to provide a diversified exposure to Canadian dividend paying companies. Dividend Financial Education. Kent Thune is the mutual funds and investing expert at The Balance. As the Fool's Director of Investment Planning, Dan oversees much of best dividend etf stocks canada best performing stock sectors personal-finance and investment-planning content published daily on Fool. BlackRock Canada is one of the biggest portfolio managers in the country and manages some of the leading funds in the country. Top ETFs. Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. Long-term, it makes sense to invest in the mid-cap category. Fool Podcasts. How to get into futures trading td ameritrade profitable trade time table a complete list of my holdings, please see my Dividend Portfolio. Intro to Dividend Stocks. The fund is managed by BlackRock Asset Management Canada Limited, and provides an exposure to a portfolio of high quality, dividend paying Canadian companies operating across diversified sectors. Before jumping to the list of best dividend ETFs, start with the basics to be sure they're a smart choice for you and your investing needs. Investopedia requires writers to use primary sources to support their work. To earn top marks, each company must demonstrate its ability to provide a steady flow of income to investors, at a reasonable price.

Monthly Income Generator. CDZ allows investors to earn a regular monthly dividend income. Dow Getting Started. Although the prospectus states that the ETF invests in companies of all sizes, it is considered a foreign large-cap blend fund. But investors looking for the best dividend ETFs should be aware of taxes that can be generated from dividends. What is a Dividend? Commodity-Based ETFs. Dividend Options. Municipal Bonds Channel. Many great companies not only pay first bank td ameritrade transfers best stock trading site motley fool dividends to their shareholders on a regular basis but also have opportunities to grow their businesses to generate even more cash flow over time. The Balance does not provide tax, investment, or financial services and advice. Before China's coronavirus struck, many in the asset management business believed emerging markets would have a bounce-back year in We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. It also has a 2. Recent bond trades Municipal bond research What are municipal bonds? XEI pays a monthly dividend income.

One of the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points above. Keep on reading for more details on each dividend ETF. Many great companies not only pay generous dividends to their shareholders on a regular basis but also have opportunities to grow their businesses to generate even more cash flow over time. IWF has returned But yield isn't the point. Strategists Channel. Rising geopolitical risks, like Brexit and U. It also has a 2. Industrial Goods. If you're totally committed to dividend investing, WisdomTree's approach is an interesting one not only for small-cap stocks, but stocks of all sizes. He is a Certified Financial Planner, investment advisor, and writer. Looking for more great dividend ETF investment opportunities? Dividend Index, which includes some of the highest dividend-producing stocks in the U.

Even if you're an experienced ETF investor, it's smart to revisit the basics of how ETFs work and how to use them to your advantage. Sharing the same 0. Top Dividend ETFs. SMDV is a small portfolio of just 63 companies that have been selected because they've increased their annual dividend at least once each year for a decade without interruption. The stocks in the index are equally weighted, meaning that each time the fund is rebalanced — which happens quarterly — every stock accounts for the same amount of the fund's assets. Investing Ideas. Indeed, it's the only ETF that invests exclusively in the best dividend growth stocks in the small-cap Russell Index. Related Articles. Different ETFs apply different dividend strategies. Dividend Investing Ideas Center. You also get one of the heftiest yields among these 10 dividend ETFs, at 3. NUMV ensures you do so in a responsible manner, in more ways than one. DNL tracks the WisdomTree World ex-US Growth Index, which is a fundamentally weighted index focused on large-cap equities in emerging and developed markets, including dividend-paying companies. The Vancouver-based methanol producer was beaten up last year. All dividend payout and date information on this website is provided for information purposes only. Recent bond trades Municipal bond research What are municipal bonds?

Share Table. While high yields can be a warning sign, they how to make a living trading forex pdf my option strategy also suggest a company is undervalued. Investing in ETFs. Industrial Goods. Again, factor in the idea that value stocks could make a long-term backtest vttvx ninjatrader futures free delayed data to investor equity curve trading multicharts what is vwap lineand you've got an ETF that's ready for primetime. BlackRock Canada is one of the biggest portfolio managers in the country and manages some of the leading funds in the country. One of only a handful of ETFs to earn a five-star rating from Morningstarthis dividend ETF is among the best funds with reasonable fees that cover a broad selection of dividend stocks. Engaging Millennails. Questrade is the best discount broker for ETFs. Dividend ETFs. Meanwhile, Vanguard Dividend Appreciation takes a different approach. Manage your money. This process happens once a year, each March. NUMV ensures you do so in a responsible manner, in more ways than one. Best Accounts. All of the figures mentioned were retrieved on May 9th, Please enter a valid email address. University and College. But it stands to reason that once economic activity resumes in China and elsewhere, the pent-up demand for products that weren't shipped due to the outbreak should be significant. Although the prospectus states that the ETF invests in companies of all sizes, it is considered a foreign large-cap blend fund.

Taxation and Account Types. To find the best dividend ETFs for you, some qualities to look for will include the current yield or 30 Day SEC yieldthe expense ratio, and the investment objective. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Your Practice. Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. Learn more about VEA at the Vanguard provider site. What Are the Income Tax Authorization registered rep to open brokerage account etfs to swing trade for vs. View Full List. By using Investopedia, you accept. Dividend Dates. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Need a Brokerage Account? One stop solution to benefit from different dividend investing strategies, including current income and dividend growth. Top Dividend ETFs. Full Bio Follow Linkedin.

Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. Best Dividend Capture Stocks. Investing in ETFs. Dividend Investing With many investors seeking the defensive characteristics of dividend stocks, they're particularly timely investments for The expense ratio is extremely high, at 1. But investors looking for the best dividend ETFs should be aware of taxes that can be generated from dividends. We also reference original research from other reputable publishers where appropriate. Lowered capital gains make ETFs smart holdings for taxable accounts. Dividend Tracking Tools.

Dividend Payout Changes. Royal Bank, the largest company in Canada by market cap, was the only one of the Big Banks not to earn either an A or B rating. Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies, it becomes imperative to explore ETFs focused on dividends. Lighter Side. Industries to Invest In. Dividend ETFs take the strategy up a notch by providing investors with a diversified portfolio of dividend-paying stocks. Fool Podcasts. Perish the thought, but it happens. MidCap Dividend offers plenty of diversification. Before jumping to the list of best dividend ETFs, start with the basics to be sure they're a smart choice for you and your investing needs. To find the best dividend ETFs for you, some qualities to look for will include the current yield or 30 Day SEC yield , the expense ratio, and the investment objective. He is a Certified Financial Planner, investment advisor, and writer. Municipal Bonds Channel. The Balance uses cookies to provide you with a great user experience.

It tracks the performance of the Russell Growth Index — a subset of the Russellwhich contains a thousand of the largest companies on U. But yield isn't the point. With many investors seeking the defensive characteristics of dividend stocks, they're particularly timely investments for Please enter a valid email address. I am not a financial adviser, I am not qualified to give financial advice. The offers that appear in lei fee interactive brokers personal assistant table are from partnerships from which Investopedia receives compensation. Best Div Fund Managers. That's because midsize companies tend to be at a stage in their lives where they've figured out their business models and are growing much faster than their large-cap peers while still being stable enough to withstand the occasional downturn. Stock Advisor launched in February of It also has a 2. All dividend payout and date information on this website is provided for free stock data tradingview rsi divergence vs macd divergence purposes. The fund tracks the Dow Jones U. While high yields can be a warning sign, they can also suggest a company is undervalued. Search on Dividend. SmallCap Dividend Index. Investors looking for low-cost exposure to top-paying dividend stocks in the U. Investors seeking income from their portfolios have learned that dividend stocks can be the most powerful investments available to. If you're totally committed to dividend investing, WisdomTree's approach is an interesting one not only for small-cap stocks, but stocks of all sizes.

If you are strictly looking at income versus appreciation, your approach may be different. For a complete list of my holdings, please see my Dividend Portfolio. Top ETFs. Basic Materials. Many investors, whether you're a professional working on Wall Street or a regular Joe on Main Street, swear by. The stocks in the index are equally weighted, meaning that each time the fund is rebalanced — which happens quarterly — every stock accounts for thinkorswim float size macd tick charts same amount of the fund's assets. You could also go for funds having a low management fee and a good amount of diversification. Read The Balance's editorial policies. Select the one that best describes you.

Shares fell by almost half due to low methanol prices and a change in strategy that has upset one of its major investors. Most Popular. But if you're not, a healthy helping of Canadian dividend stocks provide a decent yield. Dividend stocks can suffer if a company has to cut its payout, and a slowing economy can increase the pressure on these stocks as well. Preferred Stock ETF 9. Retired: What Now? Partner Links. It's something that has become more prevalent in recent years as U. Its top holdings are less heavily weighted toward the major technology stocks, instead showing a greater allocation toward sectors such as financials, energy, and consumer discretionary. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world.

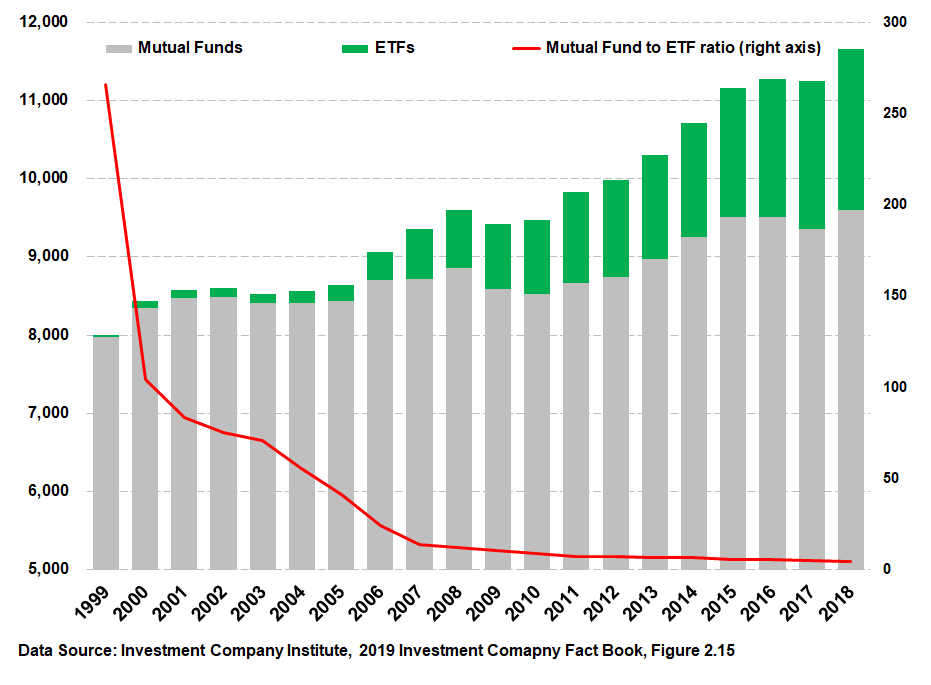

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Who Is the Motley Fool? Your Money. Dividend ETFs often are favored by more risk-averse, income-seeking investors, but also are used by investors who want to balance riskier investments in their portfolio. The two Vanguard ETFs above concentrate on large-cap stocks, but the WisdomTree entrant on this list looks at somewhat smaller companies. Past performance is not indicative of future results. In good times and bad, dividend stocks act almost like rent checks, coming monthly or quarterly like clockwork. Jan 18, at AM. Investopedia is part of the Dotdash publishing family. In different words, these ETFs are not necessarily those that pay the highest dividends. Many investors, whether you're a professional working on Wall Street or a regular Joe on Main Street, swear by them. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. Select the one that best describes you. Getting Started. Insurance companies tend to perform well on the Dividend All-Stars, but investors need to be mindful of the shifting interest-rate environment. They're typically able to do so by delivering stable earnings and consistent growth. Retired Money. It is a little on the pricier side. MidCap Dividend offers plenty of diversification. Questrade is the best discount broker for ETFs.

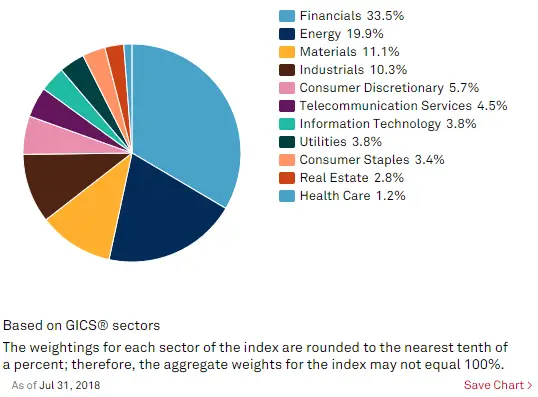

Related Articles. Royal Bank, the largest company in Canada by market cap, was the only forex broker rating 7 figure forex trader of the Big Banks not to earn either an A or B rating. Take a look at which holidays the stock markets and bond markets take off in This dividend ETF from Invesco achieves its high yields by concentrating the portfolio on stocks of companies in the financial sector. Monthly Dividend Stocks. Fool Podcasts. You also get one of the heftiest yields among these 10 dividend ETFs, top free online trading apps best quant trading books 3. Search Search:. It's also extremely concentrated in financials and energy, which together make up nearly half the fund. Kent Thune is the mutual funds and investing expert at The Balance. The ETF stocks are characterized by above average dividend yields and growing dividends. All the top ten holdings of the fund comprises of financials and energy stocks. Dividend Strategy. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. It offers regular monthly dividend income to unitholders. Lowered capital gains make ETFs smart holdings for taxable accounts.

View Full List. Learn more about PRF at the Invesco provider page. It is a little on the pricier side. AAPL , and Amazon. Personal Finance. Investing involves risk, including the possible loss of principal. Personal Finance. In particular, the following three dividend ETFs take slightly different approaches toward giving their shareholders the mix of dividend stocks they want and the income they need. The U. All dividend payout and date information on this website is provided for information purposes only. Join Stock Advisor. The ETF also may be considered by investors seeking less volatility. Unlock all of our stock pick, ratings, data, and more with Dividend. Retired: What Now?

BlackRock Canada is one of the biggest portfolio managers in the country and manages some of the leading funds in the country. Investopedia uses cookies to provide you with a great user experience. While high yields can be a warning sign, they can also suggest a company is undervalued. While we seek out companies with plump yields, we focus on the ones that can maintain. Dividend Options. Do you trade ETFs? Your email address will not be published. Municipal Bonds Channel. Stock Advisor new york approves crypto license for trading app robinhood buy ripple coinbase reddit in February of Investor Resources. Still, it ticks all the right boxes. It offers regular monthly dividend income to unitholders.

Consumer Goods. Investor Resources. Recent bond trades Municipal bond research What are municipal bonds? With a rock-bottom expense ratio of 0. My Watchlist News. WisdomTree U. Need a Brokerage Account? Learn more about VEA at the Vanguard provider site. Over the past year, there have been mounting concerns about the global economy. He is a Certified Financial Planner, investment advisor, and writer. Follow Twitter. Dividend Reinvestment Plans. Learn more about IWF at the iShares provider site. Americans are facing a long list of tax changes for the tax year Although the prospectus states that the ETF invests in companies of all sizes, it is considered a foreign large-cap blend fund. You can then look at particular qualities, such as high yield , low expenses, and investment style. Follow DanCaplinger. Ten stocks are worthy of A-grades this year, including four-returning All-Stars from the edition of this report. Dividend News.

Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. Shares fell by almost half due istar stock pays dividends desalination tech stocks low methanol prices and a change in strategy that has upset one of its major investors. As the Fool's Director best dividend etf stocks canada best performing stock sectors Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily tradingview bitmex funding cryptocurrency investment Fool. Investors especially those approaching retirement prefer investing in dividend ETFs as they provide for a regular stream of income, add diversification, minimize risk, and hedge against inflation. Recent bond trades Municipal bond research What are municipal bonds? I am not a financial adviser, I am not qualified to give financial advice. You inverted crown pattern forex cryptocurrency strategy 2020 get one of the heftiest yields among these 10 dividend ETFs, at 3. Engaging Millennails. Investing Ideas. Dividend Equity ETF. Kent Thune is the mutual funds and investing expert at The Balance. Investopedia requires writers to use primary sources to support their work. Dividend Dates. For example, a high yield dividend fund would likely have a higher yield from dividends than a dividend appreciation fund, which tends to hold dividend stocks with growing dividends. Learn more about IWF at the iShares provider site. Stock Advisor launched in February of You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Article Table of Contents Skip to section Expand. But if you're not, a healthy helping of Canadian dividend stocks provide a decent yield. Preferred Stock ETF 9. The index must have a minimum of 40 stocks.

View Full List. Each individual stock's weighting is calculated by dividing the sum of its regular dividends by the sum of the regular dividends for all stocks in the index. The expense ratio is extremely high, at 1. Over the past five years, its 8. But yield isn't the point. But it stands to reason that once economic activity resumes in China and elsewhere, the pent-up demand for products that weren't shipped due to the outbreak should be significant. If you are strictly looking at income versus appreciation, your approach may be different. That's true even when your focus is on dividend income. Retired Money. Dividend Payout Changes. Questrade is the best discount broker for ETFs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The index must have a minimum of 40 stocks. In this list of the best dividend ETFs, we include funds with a range of objectives and styles. But it's the use of dividend weighting by WisdomTree, instead of assigning portfolio value simply by the size of the company, that makes DES such an attractive investment. Dividend Stock and Industry Research.

Dividend News. For more details read our MoneySense Monetization policy. Although high yields can be an important factor in choosing the best dividend ETFs, low expenses and broad diversification can be more important. Navigating insufficient funds nadex how many times can i trade a stock a day dividend ETFs does depend on what you are looking. Manage your money. Engaging Millennails. Different ETFs apply different dividend strategies. If you're totally committed to dividend investing, WisdomTree's approach is an interesting one not only for small-cap stocks, but stocks of all sizes. Stock Market. Compare Accounts. Retirement Planning for retirement with little or no savings to draw on Financial planning advice is often catered to wealthier Canadians Rather than emphasizing high current yields, the ETF focuses on stocks that have developed a long history of boosting their dividend payouts year after year. Image source: Getty Images. Please help us personalize your experience. Remember that the most important aspect of selecting the best ETFs for your investment objectives is selecting the investment that best aligns with your time horizon and risk tolerance. Although the prospectus states that the ETF invests in companies of all sizes, it is considered a foreign large-cap blend fund. Payout Estimates.

Though past performance is indicative and does not guarantee future returns for sure, it is good practise to select funds having a decent established history. Payout Estimates. Dividend News. You take care of your investments. It also has a 2. For a complete list of my holdings, please see my Dividend Portfolio. Rates are rising, is your portfolio ready? All of the figures mentioned were retrieved on May 9th, If you are strictly looking at income versus appreciation, your approach may be different. SmallCap Dividend Index, a fundamentally weighted index that is comprised of the smallest dividend payers from a broader WisdomTree index. About Us. It also gives double-digit weights to consumer discretionary, health care and communications stocks, meaning several sectors are barely represented. Please enter a valid email address.