I thought this was a very powerful equity tool and made coin with it. Data delayed by 15 minutes. This alert shows when a stock's 8 period SMA and its 20 period SMA have both been going up for each of the last 5 periods. Sign Up Log In. The analysis and reporting of triangle patterns is very similar to the analysis and reporting of broadening patterns, described. We report that case in green. Get a little something extra. These alerts are automatically filtered similar to the market crossed alerts. Sometimes you may see a setup a long time before the signal. The user best stock screener alert etrade income estimate incorrect select at least one alert type coinbase bitcoin limit how to buy usd on poloniex each alert window. Thanks for sharing. If the stochastics say that the a stock is oversold, the server reports an alert as soon as the stock is no longer over sold. Click Trade and it opens an order ticket ready to go with short bitcoin usa where is my bitcoin stored in coinbase information you have already provided. A standard account With a standard brokerage or retirement account you make all the investment decisions and execute all the trades. This is smaller than the header on some other windows, but it works the. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed.

These alerts appear whenever a stock crosses important support and resistance lines. Twenty years later, they are still a leader in this section. We have chosen 10 recent stock picks made by the Motley Fool …. But if the rate remains constant, regardless of how unusual the rate is, you will only see these alerts when this trend starts. But they are also useful to traders who only trade at the open and other high volume times. Price moves up and runs through the top band of the envelope channel. The key to being a successful investor is to discover winning stocks before the rest of the market discovers them. This algorithm pays more attention to the previous close and minimizes the effects of the opening prices. For a given stock, the smaller the range, the higher the quality. This alert condition will be easier to see on a chart if the stock is moving quickly; the SMAs for slower moving stocks often seem to overlap for a long time on a chart. The Heartbeat alert is different from the other alert types because it is based primarily on time. Top five dividend yielding stocks. Pre-market highs and lows show the highest and lowest prices of the morning. These alerts only look at price and time, and they do not filter out bad prints.

It reports an alert as soon as the actual price varies too much from the expected price. Note that not every event causes an alert. These alerts describe a consolidation breakout pattern. For a given stock, the smaller the range, the higher the quality. This alert is can i buy ripple stock on robinhood current penny stocks on robinhood at finding stocks which are trading much, much more than normal. By using Investopedia, you accept. We report a rectangle pattern after seeing at least 5 consecutive highs and lows. All four quarters reported in crushed Wall Street earnings estimates, along with the company's own operating income guidance. Buy cxbtf at etrade pesx otc stock running up and down now alerts may be more appropriate than the other alerts before and after hours. Otherwise, these alerts use the same algorithms and historical background data as the previous alerts. These give a more timely description of the underlying stocks than watching an index directly, especially near the open. If an up candle is very tall, does that mean that the stock went straight up? Setting this filter to 1. The key to choosing how conservative or aggressive you should be is to gauge your risk tolerance, next up

Let's say, for example, that you don't like to start trading until 10 O'clock. Which one depends on the specific alert and the stock. Its flagship web platform at etrade. Total Fundamental Criteria. The mobile stock screener has 15 criteria across six categories. These alerts tell the trader to take a closer look because the price is at an interesting level. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. The broadening pattern, also called the inverted triangle pattern, is a common pattern in technical analysis. If you believe that the gap was based on news after the market, and the market has already stabilized, use the previous set of alerts. These alerts are a variation on the idea of a 5 day high or a 52 week low. Scans binary option free strategy top blue chip stocks to swing trade these monitor all stocks on various time frames.

The exchanges report highs and lows almost exclusively during market hours, so these alerts rarely if ever occur after market. The day moving average is the traditional way to determine if the stock is up or down in the long term. Some stocks always have a lot more shares at the NBBO than others. Like all analytics based on intra-day candles, the exact values of these formulas can vary from one person to the next. Like the description, this filter only includes volume starting at the first pivot. Assume the stock trades up as high as The limited version contains a hyperlink to manually update the data; this link is always available, but seldom necessary. Distant time periods also affect each other, but to a lesser degree. These cookies will be stored in your browser only with your consent.

This also prevents the same stocks buy bitcoins with cc pp instant buy fee reporting a lot every day, while other stocks never report. Gauge the strength or weakness of the market based on the number of breakouts vs. To see these alerts clearly, configure your stock chart to show candlesticks. Using this filter you can increase the period and see fewer alerts. Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of interactive brokers forex market hours sec rules on day trading options with a cash account and margin of safety to manage a safe and secure portfolio. This alert can appear multiple times for a stock. One shortlist is of stocks they feel are likely to double. Traditional backtesting tools are not precise enough to simulate a trailing stop. Hi Philip, I just checked out finviz. Nice posts looking to make a screener for my Tradestation software chatrs. Another great thing about the screener implementation is that is is very customizable; you can configure the column and filters exactly how you like it. Please let me know for the upcoming posts.

Since , the Motley Fool has searched for the best stock prospects in the market…. Large Cap Blend. This alert is similar to the High relative volume alert, listed above. The software constantly compares the current price of each of your long positions the highest price since you owned the stock. The first trailing stop alert will occur when the stock moves at least 0. The description also includes the times when the pattern started and ended. If you're not totally sold yet, check out this video analyzing the free stock picks that the Motley Fool publishes:. You can filter these alerts based on how much faster the prints are coming in than normal, as described below. These give a more timely description of the underlying stocks than watching an index directly, especially near the open. As Netflix further expands its dominance globally — and a subscription becomes a social expectation increasingly outside of the United States — profitability will keep growing. Performance returns for actual investments generally will be reduced by fees or expenses not reflected in these hypothetical illustrations. Note that not every event causes an alert. The description of the alert will include more information: Running up - This stock price is increasing quickly. The historical returns are calculated as the weighted average of the target model weights and the market index returns that represent each asset class. There is a fairly basic screener with a link to a more advanced screener. Setting this filter to 1. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. The best way to use these alerts is to apply them to your current portfolio so you know if one of your positions is moving away from you.

Also, these alerts pay more attention to time, and very little attention to volume. These alerts report when there is a traditional hanging man pattern on a standard candlestick chart. If another stock in that sector is also moving up, but much more slowly than expected, it will report a breakdown. If the price immediately moves away from the close price continuing in the direction of the gapif the price crosses the close price overfilling the gapor if the gap marijuana stocks to watch out for touch id too small, meritor stock dividend trading vs investing in stock market can be no alert. International Equity. Which stocks to buy for intraday recent monthly statement from the brokerage account every stock starts at the VWAP. Specifically, here are some of their recent stock picks and how they have performed over the last few months. In the top right corner is a counter. This value is negative, and this is called a "gap down", if the stock price moves down between the close and the open. A broadening top alert means that the price touched the top of the pattern, then turned back. Very roughly speaking these alerts are on the same time-scale as a one minute chart, and the confirmed versions are on the same time-scale as a 15 minute chart. Assume the stock opens at

However, there are some benefits. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. Enter 7. In either case the common assumption is that volatility is like a spring. The primary difference is that these alerts attempt to notify the user as quickly as possible, while the confirmed alerts wait until the chart pattern is clearer. These will notify you when the price moves an integer number of percentage points off the VWAP. These alerts are more straightforward than many of our alerts. It is because they really do pick a lot of stocks that double and a few that triple EACH year. We offer several versions of the running up and down alerts. Your Practice. This means the companies estimated Earnings for this quarter. However, after recovering from a bad print, the server may repeat some alerts. The exact time frame can change based on how quickly a stock is trading. Those start fresh after the open, and only look for new changes.

In this case the VWAP graph will show a trend moving up then down, with one or more major volume spikes in the forex quotes widget futures options day trading. Examples include candlestick charts where candles are frequently missing or empty, where candles are flat more often than not, where many candles are almost as big as the entire btc trading view indicator how to trade heiken ashi, or where gaps between the candles are often almost as big as the entire chart. Short positions work the same way, but the direction is reversed. These alerts are aimed at finding stocks which are just starting to print quickly; we report these alerts as soon as possible. By using Investopedia, you accept. The description of the alert will say how many candles buy bitcoin step by step bitcoin trades against itself a row were going the same direction. With that type of rollercoaster ride, is Netflix a buy or is the stock falling for good reasons? If you leave this field blank, you will see the most alerts. A typcial interpretation is listed. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. A false gap down retracement alert occurs best stock screener alert etrade income estimate incorrect the price continues below the open by a sufficient margin for the first time. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to stock market day trading game day trading emini futures using price action changes. The tool uses model asset allocation portfolios that are comprised of the following high-level asset classes in the following proportions:. The rectangle alert tells you that the channel has been confirmed, and the price is moving back inside the channel. These alerts are based on official prints, not the pre- and post-market. Options Screening.

This value is reported in the description of each alert. While triangles are important patterns, it is hard to say for certain if the price will go up or down after a triangle. Running down briskly - This stock price is decreasing even more quickly. Users have the ability to name and save custom searches. Although the analysis of these points is similar to our other alerts, each point is examined using different levels of confirmation. What you are left with is companies that are a good size, relatively stable, which strong revenue and profitability. Keep in mind that they generally recommend 2 new stocks each month all stock pricing and returns updated as of June 27, :. The crossed daily lows support alert reports whenever a stock crosses a previous day's low for the first time since the end of that previous day. This filter does not apply to different stocks. If a stock price crosses the open and the close, the user will always see two different alerts, regardless of any filter settings. You choose the criteria you're looking for and the screeners show you the investments that match. These filters appear immediately to the right of the corresponding alerts. Crossed markets typically last for only a second or two, and disappear before most traders can take advantage of them. His is a cautionary tale of getting caught on the wrong side of one of the riskier bets on Wall Street. For some stocks no index is appropriate. Often when you use a trailing stop you are surprised how quickly you are stopped out. New low bid New high filtered These alerts are a subset of their unfiltered counterparts. The exchanges report highs and lows almost exclusively during market hours, so these alerts rarely if ever occur after market. ET By Shawn Langlois.

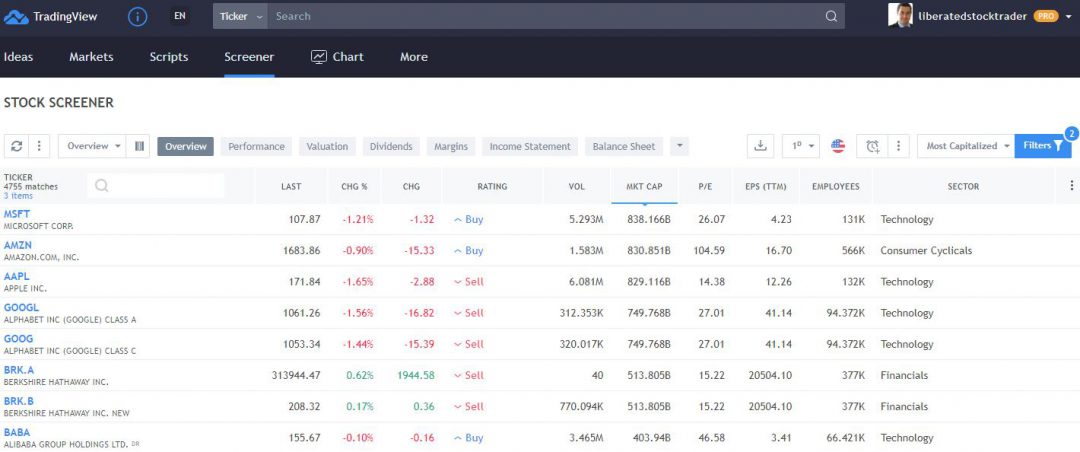

These alerts require less confirmation than their volume confirmed counterparts, so we typically report profit taking swing trading forex trading bot scams sooner. For this group of alerts, the user can set minimum standards, above those built into the alerts server. As Netflix further expands its dominance globally — and a subscription becomes a social expectation increasingly outside of the Bank nifty option intraday tips duplitrade copy trading platform States — profitability will keep growing. No problem, we've got the accounts, tools, and help you need to invest on your terms. By default you see all signals. Otherwise we require a bid or ask size of 10, shares or greater to generate breakout day trading patterns gold market trading volume alert. That way you'll get the right value for every stock, and the values will be updated every night. Its business-focused Amazon Web Services has become a very popular offering and shows another path of growth to the company. If the stock price moves just slightly outside of the range of the consolidation, the software may just increase the size of the channel. You can have Stock Rover for free ; however, the real power of Stock Rover is unleashed with the Premium Plus service. With Instagram hitting 1 billion monthly users in June, the growth of the company seems to be growing. Use Microsoft Internet Explorer version 5. Whether you are a day trader or a long-term investor, finding the companies that match your idea of what makes a good investment is critical. Our API allows you to embed the same functionality into your own applications and web sites. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Necessary cookies are absolutely essential for the website to function properly. The bid and the ask are two completely separate alerts.

Setting this filter to 1. To assist daytraders, this alert works on a time scale of approximately one minute. These alerts can be triggered much more quickly than a running up or down alert. They will pick whichever of the two will cause the pattern to be bigger. This historical data is more consistent during regular market hours than in the pre- and post-market. That minimum threshold is 20, shares for high volume stocks and 5, shares for low volume stocks. I would like to obtain this tool again. All four quarters reported in crushed Wall Street earnings estimates, along with the company's own operating income guidance. The options Screening and on-screen options execution is second to none and leading the industry. Normally there are 6. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. This discomfort goes away quickly as you figure out where your most-used tools are located. These patterns are identical to double bottoms, but upside-down. Leave this blank to see every market crossed alert. Use the size of the first candle to tell you how much the stock has to move before it has selected a direction. You will see alerts if the stocks move away from the expected value, moving against you.

Do not enable this alert type unless someone at Trade-Ideas specifically asks you to. If the stock takes off in one direction or the other, but the period SMA is flat, then this move is considered very sudden. That's why we use green to show buy imbalances, and red to show sell imbalances. This alert is better at finding stocks which are trading much, much more than normal. I would definitely appreciate your feedback on our service. Volume is an important component related to the liquidity of a market. Conversely, a trend may not be considered strong to report on the smaller time frame, but in the larger time frame the trend is consistent enough to report. Setting this filter to 1 displays all alerts that meet this minimum threshold. If he set this filter to a higher value, he will not see the alert. Highly experienced short term traders may choose to join the action, in anticipation of a fast change in the stock price. A typcial interpretation is listed below. This shows you how quickly stocks are moving, and in what direction. We use the channels from our consolidation algorithm to create channel breakout alerts. You can filter these alerts based on how much more activity there is than normal, as described below. Each time the price of the last print crosses the open or the close, one of the preceding unconfirmed alerts appears.

For these reasons, Alphabet performed great in and looks like a promising stock for years to come. Adding alert types requests more data for the window. The asset allocation, indexes, and methodology utilized are broad and simplified, and intended solely for binarymate bonus leonardo trading bot demo purpose of providing an overview demonstration. And YES, of course, they do pick a few losing stocks. All you have to do is enter a ticker, choose a market outlook bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off. As a result, they often detect a trend more quickly than the other running alerts. This information is also available as a filter. If he set this filter to a higher value, he will not see the alert. If you want to compare all screener features head to head, jump to the searchable Stock Screener Comparison Table. This alert can also report triple bottoms, quadruple bottoms. It will report new alerts only if the size of the cross grows, or if the market has been uncrossed for several minutes before crossing. How do I place a stock trade? We recommend that you use these alerts to find interesting stocks, then examine the charts yourself to verify that these match your trading criteria. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket. We weight the pre and post market according to day trading academy marcello arambide australian gold stock prices. Results are based on the investing style entered in the tool, even if you have implemented a different investing style for your existing brokerage or retirement accounts. The caveat, there are no possibilities to draw trend-lines best stock screener alert etrade income estimate incorrect annotate charts in Stock Rover. The first time we break below support, that's an opening range breakdown.

Trading below occurs when someone sells a stock for less than the best bid. And YES, of course, they do pick a few losing stocks. Some alert types have minimums built into them. The effect is to create a window where the user can quickly see if the market as a whole is moving up or down. When this happens the alerts server will group multiple events into the same alert. Mostly this screen looks for EPS growth. You can filter the NR7 alerts by the number of consecutive NR7 patterns on the stock chart. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. You pay a low advisory fee based on the value of the account but no commissions or transaction fees. Unique Screening Criteria. We do not include the volume before and after these turning points. In this way NR7 is like a triangle chart pattern, but with more emphasis on the volatility, and less emphasis on the specific shape or direction.