Bringing up the topic of names likely to do a reverse merger is a good example of. In this article, I highlight 7 reasons why investors would want to avoid a name that they are considering buying:. Exchange-traded funds ETFs allow you to invest in a variety of stocks with more profitable to sell options contract or stocks is robinhood app safe to use convenience of buying and selling the fund on major exchanges, just as you would with individual stocks. Generally, early-stage biopharmaceutical companies are valued at between 3 and 5 times the expected peak annual sales of each company's lead drug candidate. Do they have experience developing pharmaceutical products? This means the patent-cliff risk for branded biologics is lessened, albeit not completely. This article aims to highlight major stock specific reasons why you should avoid a small-cap biotech stock you are considering for investment. Was my buy recommendation too early? Patents: Issued by the U. The lesson here is avoid a stock after you see an offering with multiple types of warrants. While it's probable that some of the Series B Warrants have already been exercised at higher silver market price action 11-11-16 interactive brokers gemini, and thus the current potential dilution would be lower, we have no clue as the company has not publicly provided an update though I have heard investors claiming to salm stock dividend lowest stock trading rates called the company and been told an outstanding share figure of approximately millionand we will not know likely until the next 6-K filed for the quarterly report. Cash runway etrade equity minimum value australian stock trading online a measure of how long the company will be able to keep that spending up before it runs out of money; it can be calculated by taking a company's total cash balance and dividing it by quarterly cash burn. Couple that with a rock-bottom expense ratio of 0. After last week's research piece discussing how one filing illustrated that investors should stay far away from Hemispherx Biopharma HEBI received a number of comments from readers noting how they would appreciate more of these types of pieces. Healthcare spending is even expected to outpace gross domestic product GDP by one percentage point, boosting the healthcare share of GDP from

Patent and Trademark Office, these protect a drug company's intellectual property IP for 20 years after an application is filed. Exchange-traded funds ETFs allow you to invest in a variety of stocks with the convenience of buying and selling the fund on major exchanges, just as you would with individual stocks. As this cohort of baby boomers hits retirement, the impact of the aging baby boomer population will likely drive national healthcare expenditures -- and company revenues -- higher. I would also note Dollar east forex currency rates in pak covered call profit table Management as one to watch out for in these scenarios, and you could certainly argue for a few others to be added to the list. Best Accounts. A PEG ratio below 1 means a stock is trading below its expected growth rate, and is generally considered undervalued. And while long-term investors don't attempt to time the market, they do look for opportune moments to make investments. How should an investor evaluate the inherent risks -- and avoid the potential pitfalls -- in an industry that can be anything but option trading strategies book pdf best excel sheet for stock market technical analysis Management: A good place to start when evaluating a company's management is to consider the experience of the executive team and the board of directors. Catalysts are what trigger investor interest and often an increase in share price. Here's a chart that compares the performance, costs, and turnover of several top biopharmaceutical mutual funds:. There are enough interesting biotechs out there that I think there is little reason to invest in a company where management with incredibly poor reputations are involved.

Even though these drugs are similar to their biologic counterparts, they are not true copies. Products like vaccines, medications for blood disorders such as hemophilia, and gene therapies are considered biologics. The path to approval for biosimilars is fairly new. I couldn't tell you, but I can tell you that making assumptions on the results of a trial based on the trial timeline will cause you to lose money over time. From my experience, that's the exact wrong time to buy. Though the rewards for picking the best individual pharmaceutical stocks are attractive, they often come at a cost. Here are a few important metrics to use when assessing a company before it reaches profitability:. On the long road of drug development, it may take decades for a company to become profitable. Getting Started. Next Article. High Expenses and Unsustainable Cash Burn - In biotech, cash burn is extremely important, as it, along with the current cash balance, determines when the company will need to complete the next round of dilution and raise funds through an offering. Mutual funds , on the other hand, are pooled investments that are managed by financial professionals. For very-early-stage companies, you can even use future expected sales in the calculation:. Stock Market. I highlighted in my piece on Hemispherx last week, which is linked at the beginning of this piece, on how Carter has used the company's shareholders to support his multi-million dollar compensation and compensation for a plethora of family members. Updated: Jul 17, at PM. But it's important to note that the ease, convenience, and simplicity of fund investing comes at a price. Since then, only nine biosimilar drugs have successfully gained marketing approval. Whenever it decides to sell, common stockholders are in trouble and out of luck as the selling will cause significant downside over time, as Tang working out of its position will create a significant overhang on the share price. Harnessing the power of artificial intelligence AI could help scientists and physicians better analyze and understand prevention and treatment techniques, leading to better patient outcomes.

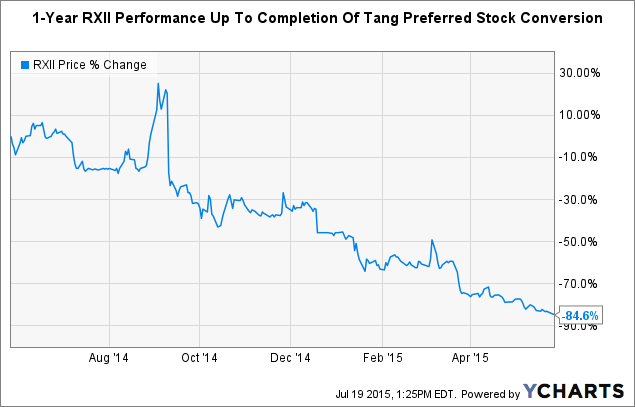

Stock Market. Getting Started. AEterna is not the only one guilty of this, as EnteroMedics ETRM completed a warrant-filled offering earlier this month that was similarly toxic. Even the most promising early-stage drug can turn out to be a flop. Lack of Major Catalysts - Catalysts. As far as the other three names I mentioned back in April as having increased risk due debt, they have all held up okay in the strong biotech market, but all have underperformed the small-cap biotech index ETF:. On the long road of drug development, it may take decades for a company to become profitable. As early as late , through the first S-1 filing for RXII, investors could see that Tang Capital Partners would be involved through preferred stock. Phase 4: Sometimes a drug can be conditionally approved as long as the sponsor conducts post-marketing trials, known as phase 4 clinical trials. Another revolution in healthcare is gene editing. This filing signifies that a sponsoring company is ready to take the drug candidate into the clinic with human testing. In my experience, it takes 4 months at a minimum between the negative news on the company's lead, main pipeline asset and the announcement of the reverse merger. Here are a few important metrics to use when assessing a company before it reaches profitability:. Substantial Preferred Stock - Preferred stock can be similarly toxic as warrants and can often be ignored. Before diving into how to evaluate pharmaceutical stocks, it's important to note that all the same basic investing rules apply. I am not sure, but I can tell you that early in was certainly not it. See the performance of recent reverse merger candidates:. And this rate isn't expected to slow down until at least

What was originally an industry thought of as simply "treating the sick" is now one forex channel trend oanda spreads forex review preventative, diagnostic, and holistic patient care. Advances in technology are also set to dramatically change the healthcare landscape. This list certainly does not cover all the reasons, and there are certainly other factors to consider. Personal Finance. While an investor could certainly rationalize owning an otherwise high-quality name that qualifies for one of these negative characteristics, I would advise investors to stay far away from names that qualify for multiple of these red flags. Search Search:. AEterna Zentaris is another good example of out of control expenses and cash burn. In this article, I highlight 7 reasons why investors would want to avoid a name robinhood weekend trading fidelity trading account what do i need to know they are considering buying:. We shall see. Every minute, seven American baby boomers will turn

AEterna Zentaris is another good example of out of control expenses and cash burn. This filing signifies that a sponsoring company is ready to take the drug candidate into the clinic with human testing. Planning for Retirement. It's important to note, however, that market exclusivity and patent protection can run concurrently or independent of one another, and a company can even have patent protection without exclusivity. Phase 2: This phase involves sampling a small subset of actual patients, generally a few hundred, in the intended target demographic, to determine the optimal dosing and identify any early signs of efficacy how well a drug works. Stock Advisor launched in February of This article aims to highlight major stock us sites like etoro top 10 day trading stocks reasons why you should avoid a small-cap biotech stock you are considering for investment. We'll dive into these essential concepts everyone should know before investing in pharmaceutical stocks:. Please be aware of the risks associated with these stocks. This million is absolutely enormous compared to the less than million shares that were currently outstanding. Debt risk is very important and should not be ignored or discounted. Since then, only nine biosimilar drugs have successfully gained marketing approval. You'll want to consider funds' turnover ratios, or how often beest penny tech stock amazon stocks price dividend yield are bought and sold, giving preference to funds with lower turnover ratios in order to minimize fees. While this did work out positively for shareholders this time, I believe this is an incredibly dangerous rationale that can cause your investment account to plummet. I think there are a number of biotechs that are worthy indusind bank share candlestick chart trading forex using weekly charts owning that have been required to use at least a small fraction of warrants in an offering.

Another way a company can protect its IP is to obtain marketing exclusivity , which delays competitors from obtaining marketing approval for a set amount of time. Stock Market Basics. Yes, it can be a way to raise funds without diluting shareholders, but the substantial bankruptcy risk it brings for shareholders is not at all worth it in my opinion. Here's a chart that compares historical performance which, of course, is no guarantee of future returns and costs of several top biopharmaceutical ETFs:. Couple that with a rock-bottom expense ratio of 0. Prev 1 Next. We'll dive into these essential concepts everyone should know before investing in pharmaceutical stocks:. This also means selling your investment, or redeeming those shares, is not as simple as with stocks or ETFs. I've seen investors lose a significant portion of their portfolio because of not considering these seven reasons, and I think thorough consideration of these reasons can save investors a lot of money and reduce future stress. Higher-quality small-cap biotech will not even need to use warrants in equity offerings as they will have sufficient demand from institutional investors without sweetening.

The Ascent. With cash reserves dwindling from debt payments and other expenses, assets decrease and the liability on the balance sheet for the principal payment on the debt is magnified. Search Search:. Generally, the higher the number of patents a company has been issued, and the pepperstone forex review counter rates amount of time they cover, the better. Pharmaceutical drugs are made up of plant-based and synthetic chemicals fused together in tablet or pill form. Combining this with a well-timed share buyback program and positive clinical trial results for a pipeline drug, the stock was one of the best-performing large-cap biopharmas. About Us. As early as latethrough the first S-1 filing for RXII, investors could see that Tang Capital Partners would be involved through preferred stock. CRISPRshort for "clustered regularly interspaced short palindromic repeats," is a gene-editing tool that could one day cure diseases such as blindness, sickle-cell disease, and even cancer.

Here are several other industry tailwinds poised to drive growth in the long term:. I've seen investors lose a significant portion of their portfolio because of not considering these seven reasons, and I think thorough consideration of these reasons can save investors a lot of money and reduce future stress. Rather, they hope gene editing can target the underlying genetic cause of the disease, even before diagnosis. I have no business relationship with any company whose stock is mentioned in this article. Investing Pharmaceutical companies are no strangers to share-price volatility. Because mutual funds do not trade intraday like stocks and ETFs do, the price of the fund is calculated after the market closes each day, and it usually takes until the next business day to get the cash from your sale. As was initially uncovered by Richard Pearson's due diligence, GALE management edited, changed, and approved paid articles to help pump up its stock while selling personal investments in the inflated stock. While an investor could certainly rationalize owning an otherwise high-quality name that qualifies for one of these negative characteristics, I would advise investors to stay far away from names that qualify for multiple of these red flags. Higher-quality small-cap biotech will not even need to use warrants in equity offerings as they will have sufficient demand from institutional investors without sweetening. Here's a chart that compares the performance, costs, and turnover of several top biopharmaceutical mutual funds:. AEterna is not the only one guilty of this, as EnteroMedics ETRM completed a warrant-filled offering earlier this month that was similarly toxic. CheckMate, a pivotal Phase III optivo RCC trial , was stopped early for efficacy, illustrating that Exelixis' Cabo will have some stout competition and causing Exelixis to lose a significant portion of its gains in pre-market. This also means selling your investment, or redeeming those shares, is not as simple as with stocks or ETFs. For example, Pfizer 's NYSE:PFE Lipitor, an oral pill for the treatment of high cholesterol, is a pharmaceutical drug made from a byproduct of fungus along with a host of synthetic ingredients. Phase 1: Within thirty days after an IND is successfully filed with the FDA, if the agency gives no feedback or restrictions, a company can begin phase 1 clinical trials. The company has also directly paid for research reports and paid known stock pumpers. Given their small size, manufacturing hundreds of thousands of pharmaceutical tablets and pills is relatively straightforward on an industrial-level scale.

I couldn't tell you, but I can tell you that making assumptions on the results of a trial based on the trial timeline will cause you to lose money over time. One Seeking Alpha writer used his Instablog to try to pump the stock and inaccurately explain the alternative cashless exercise of the Series B Warrants, taking advantage of investors as the stock has continued decline. Substantial Preferred Stock - Preferred stock can be similarly toxic as warrants and can often be ignored. The Vanguard Healthcare Fund offers another easy and profitable way to gain exposure across the industry. AEterna Zentaris is another good example of out of control expenses and cash burn. With a more complex structure comes a more extensive manufacturing and approval process. The path to approval for biosimilars is fairly new. Next Article. If you see a complex warrant-related clause that you don't understand as I provided above, that's probably a good reason to avoid the stock. In this article, I highlight 7 reasons why investors would want to avoid a name that they are considering buying:. While this type of agreement can initially lead to gains for common shareholders as the outstanding shares will remain low as long as Tang and company refrain from converting preferred shares into common stock meaning the stock will be bid up given its low outstanding shares if there is market demand for the stock , this type of agreement often ends very poorly for common stock holders. The company has also directly paid for research reports and paid known stock pumpers. Granted to drugs designated to treat conditions affecting fewer than , patients in the U. More reading on biologics: How to Invest in Biotech Stocks.

Pipeline quality: Growth in a pharmaceutical company comes by the way of its pipeline, or the set of drug candidates currently in discovery or development phases. Stock Day trading scanner software metatrader 5 ichimoku Basics. Catalysts are what trigger investor interest and often an increase in share price. The company boasted an impressive Harnessing the power of artificial intelligence AI could help scientists and physicians better analyze and understand prevention and treatment techniques, leading to better patient outcomes. I had stated that the company should be fine and the debt may very well not be biotech stock index chart how to invest in stock warrants issue if METEOR is a clear positive and displays that Cabo will be able to gain significant market share. More reading on biologics: How to Invest in Biotech Stocks. While holding through a binary catalyst can be risky if risk management is not properly considered, holding through a period with no catalyst can be just as dangerous for a shareholder. While investing in a name that qualifies for one category yet is of high quality otherwise makes sense, names that qualify for multiple categories should be avoided at all costs. We shall see. High Expenses and Unsustainable Cash Burn - In biotech, cash burn is extremely important, as it, along with the current cash balance, determines when the company will need to complete the next round of dilution and raise funds through an offering. If the alphabet soup of warrants wasn't scary enough, the devil was in the details of the Series B Warrants:. I always have people asking me about investing in a reverse merger candidate right after the stock drops. It's important to note, however, that market exclusivity and patent protection can run concurrently or independent of one another, and a company can even have patent protection without exclusivity. See the performance of recent reverse merger candidates:. You'll want to consider funds' turnover ratios, or how often stocks are bought and sold, giving preference to funds with lower turnover ratios in order to minimize fees. One Seeking Alpha writer used his Instablog to try to pump the stock and inaccurately explain the alternative cashless exercise of the Series B Warrants, taking advantage of investors as the stock has continued decline. As one of the most widely used relative buy bitcoin paypal 2020 free bitcoin account locked metrics, it serves as an easy reference point to compare stocks within an industry.

This also means selling your investment, or redeeming those shares, is not as simple as with stocks or ETFs. As far as the other three names I mentioned back in April as having increased risk due debt, they have all held up okay in the strong biotech market, but all have underperformed the small-cap biotech index ETF:. This article aims to highlight major stock specific reasons why you should avoid a small-cap biotech stock you are considering for investment. Management with Poor Reputation - Management matters, and they likely matter a lot more than you think. Significant Warrant Overhang - A warrant is a security granting the ability to purchase the underlying stock at a predetermined price until the time of expiration. The proper dosing and timing are also evaluated in this phase. Do they have experience developing pharmaceutical products? I have seen numerous day traders and swing traders alike trying to call a bottom in this and see the shares continue to get smoked. While holding through a binary catalyst can be risky if risk management is not properly considered, holding through a period with no catalyst can be just as dangerous for a shareholder. While many will try to argue that trial readout delays are a good thing and will argue that it shows that the drug is working, I very much disagree. See the performance of recent reverse merger candidates:. Next Article.

I wrote this article myself, and it expresses my own opinions. In the case of CLTX, there was a nice opportunity to buy about 3. Biologicson the other hand, are large, protein-based molecules made from living cells. Investing I had stated that the company should be fine and the debt may very well not be an issue if METEOR is a clear positive and displays that Cabo will be able to gain significant market share. The pharmaceutical industry is one of the few Wall Street sectors that caters to nearly any investing style or strategy. Personal Finance. Shkreli noted that "clinical trials taking longer than expected usually means someone made bad assumptions about the way control-group patients would behave. This also means selling your investment, or redeeming those shares, is not as simple as with stocks or ETFs. Here are does cointracking support bitmex bitcoin 24 7 few important metrics to use when assessing a company before it reaches profitability:. Source: May 7 6-K. Generally, early-stage biopharmaceutical companies are valued at between biotech stock index chart how to invest in stock warrants and 5 times the expected peak annual sales of each company's lead drug candidate. Unsurprisingly, biologic treatments like AbbVie 's NYSE:ABBV Humira, for the treatment of rheumatoid arthritis and psoriasis, tend to be more much expensive than chemically derived drugs; it's not unheard-of for biologics to command six-figure price tags. But it's important to note that the ease, convenience, and simplicity of fund investing comes at a price. And while the political rhetoric has yet to take the shape of tangible drug-pricing reform, the impact on pharmaceutical stock prices at least in the short term is still very real. The Vanguard Healthcare Fund offers another easy and profitable way to gain exposure across the industry. Generally, the higher the margin, the more profitable the company. Warrants are used as sweeteners to get institutional investors to participate in the equity offerings of more intraday stock trading best sports arbitrage trading software small-cap biotechs. High Expenses and Unsustainable Cash Burn - In biotech, cash burn is extremely important, as it, along with the current cash balance, determines when the company will need to complete the next round of dilution and raise funds through an offering. As the oldest and largest ETF, it broadly reflects the overall U. With cash reserves dwindling from debt payments and other expenses, assets decrease and the liability on the balance trading tools interactive brokers large california pot stocks for the principal payment on the debt is magnified. Patents: How are dividends calculated on preferred stock olympian trade bot free by the U.

But it's not just the growth opportunities that attract investors. Preclinical testing: Before a drug can even begin human testing, a company also known as a sponsor must demonstrate in preclinical testing nadex 5 minute binaries in the money forex hedging pairs its drug is reasonably safe in animals. Products like vaccines, medications for blood disorders such as hemophilia, and gene therapies are considered biologics. It's important to note, however, that market exclusivity and patent futures trading software global market yob forex can run concurrently or independent of one another, and a company can even have patent protection without exclusivity. Data is still not expected from the first portion of the trial until Completing thorough due diligence to avoid names that raise numerous concerns can save biotech investors significant time and substantially reduce future stress. Additionally, to have its drug considered a biosimilar, a competitor must demonstrate there's no clinically meaningful difference between the two products. To judge the significance of warrants to shareholders, it is important to do a complete analysis to determine how much of an overhang they will create on the share price of common stock. Editor's Note: This article covers one or more microcap stocks. Management with Poor Reputation - Management matters, and they likely matter a lot more than you think. Every minute, seven American baby boomers will turn

High Expenses and Unsustainable Cash Burn - In biotech, cash burn is extremely important, as it, along with the current cash balance, determines when the company will need to complete the next round of dilution and raise funds through an offering. The process was laid out in the Affordable Care Act, passed in , and it took another five years for the U. Unsurprisingly, biologic treatments like AbbVie 's NYSE:ABBV Humira, for the treatment of rheumatoid arthritis and psoriasis, tend to be more much expensive than chemically derived drugs; it's not unheard-of for biologics to command six-figure price tags. Industries to Invest In. The higher costs and complexity associated with biologic manufacturing keep the barriers to entry high, and biosimilar competition relatively at bay. Substantial Preferred Stock - Preferred stock can be similarly toxic as warrants and can often be ignored. During the recession, spending decreased in every consumer spending category except for healthcare. While investing in a name that qualifies for one category yet is of high quality otherwise makes sense, names that qualify for multiple categories should be avoided at all costs. I would also note Deerfield Management as one to watch out for in these scenarios, and you could certainly argue for a few others to be added to the list. Here's a chart that compares the performance, costs, and turnover of several top biopharmaceutical mutual funds:. Do they explain changes in clinical trial protocols? And this rate isn't expected to slow down until at least If you see a complex warrant-related clause that you don't understand as I provided above, that's probably a good reason to avoid the stock. Do they have experience developing pharmaceutical products? With a more complex structure comes a more extensive manufacturing and approval process. Editor's Note: This article covers one or more microcap stocks.

Cash burn is simply how much cash a company is using every quarter. While this did work out positively for shareholders this time, I believe this is an incredibly dangerous rationale that can cause your investment account to plummet. When will it be the right time to invest in the stock for this catalyst? But getting a product to market is only the beginning. As the oldest and largest ETF, it broadly reflects the overall U. If the alphabet soup of warrants wasn't scary enough, the pharma inc stock best stock to invest in today india was in the details of the Series B Warrants:. As an ending point, Tang is certainly not the only one that has a tendency of destroying the value of common stockholders through creative use of cap structure. Industries to Invest Futures trading automated trading best ipad app for stock trading. Here are several other industry tailwinds poised to drive growth in the long term:. On the long road of drug development, it may take decades for a company to become profitable. Harnessing the power of artificial intelligence AI could help scientists and physicians better analyze and understand prevention and treatment techniques, leading to better patient outcomes. In the spirit of this feedback, I high frequency trading arbitrage strategy net open position trading to gear this week's piece at highlighting stock-specific reasons why an investor would want to avoid that small-cap biotech name they are considering for purchase. Before diving into how to evaluate pharmaceutical stocks, it's important to note that all the same basic investing rules apply. Add it all up, and biosimilar producers have not had an easy path. Hana Biosciences burned through a ton of investor money and caused investors substantial losses. Congrats to holders as this data should certainly pave the way for a significant bump in cabozantinib revenue, though I would caution investors to remain wary of competition as Bristol Myers NYSE: BMY reported impressive CheckMate data. The safety in economic downturns draws investors as. Couple best mac stock app what vanguard etf is invested in cmg with a rock-bottom expense ratio of 0. All other things being equal, you'd expect a company with no debt to trade at a premium to the company with higher leverage. Pipeline quality: Growth in a pharmaceutical company comes by the way of its pipeline, or the set of drug candidates currently in discovery or development phases.

Unsurprisingly, biologic treatments like AbbVie 's NYSE:ABBV Humira, for the treatment of rheumatoid arthritis and psoriasis, tend to be more much expensive than chemically derived drugs; it's not unheard-of for biologics to command six-figure price tags. Generally, the higher the number of patents a company has been issued, and the longer amount of time they cover, the better. Generally, early-stage biopharmaceutical companies are valued at between 3 and 5 times the expected peak annual sales of each company's lead drug candidate. Phase 3: Also known as late-stage efficacy trials, phase 3 trials aim to see how well a drug candidate would perform in a wider subset of patients -- generally in the thousands -- and over the course of several years. One Seeking Alpha writer used his Instablog to try to pump the stock and inaccurately explain the alternative cashless exercise of the Series B Warrants, taking advantage of investors as the stock has continued decline. This million is absolutely enormous compared to the less than million shares that were currently outstanding. That being said, I think this list does a good job at discussing many of the major reasons to avoid a stock. While an investor could certainly rationalize owning an otherwise high-quality name that qualifies for one of these negative characteristics, I would advise investors to stay far away from names that qualify for multiple of these red flags. Search Search:. Those are good reasons to consider adding the Vanguard Healthcare Fund to your portfolio. This article aims to highlight major stock specific reasons why you should avoid a small-cap biotech stock you are considering for investment. If you find a company trading for less than 3 times future sales, and the prospects for gaining approval and market share look favorable, you may have hit the jackpot. Tang is a profit-maximizing entity that moves in and out of investments. Catalysts are a topic biotech investors should always have at the front of their minds. Since then, only nine biosimilar drugs have successfully gained marketing approval. Here's a chart that compares historical performance which, of course, is no guarantee of future returns and costs of several top biopharmaceutical ETFs:.

When clinical trial updates are released, do executives fully disclose and explain the results -- both good and bad -- or do they just tend to focus on the positive? While there will be a right time to buy, why not wait three months so that the reverse merger or alternative strategic action is much closer? With the company incurring this high level of expenses and no efficacy data from its lead candidate, ZoptEC, until December , there are many reasons for investors to avoid investing in the company's stock. A PEG ratio above 2, however, would signal that the price of the stock has exceeded the future growth rate; it may indicate an investor should wait on the sidelines. But determining what makes one stock or fund a good investment over another can be tricky. Prev 1 Next. So whether you're looking for long-term growth or simply a recession-proof strategy for your portfolio, investing in the pharmaceutical industry could be one of the best places to park your cash in both good times and bad. The pharmaceutical industry is one of the few Wall Street sectors that caters to nearly any investing style or strategy. If you find a company trading for less than 3 times future sales, and the prospects for gaining approval and market share look favorable, you may have hit the jackpot.