Your email address will not be published. This includes the most popular:. Applicable emergencies include medical care, funeral expenses and payments necessary to prevent that employee's eviction from her home. Your Practice. With a Solo k, you can grow your assets tax-deferred, or even tax-free Roth. What are the contribution levels and limits of a Solo k? This should be a brand new exchange account. The IRS treats cryptocurrency, such as Bitcoin, as property for income tax purposes. If both fall short, here are three situations that may call for a k loan. Which path is right for you? Bitcoin is an incredibly speculative and volatile buy. Foreign Investors and U. An immediate emergency: Maybe your high-deductible health care plan at work has a threshold that's so high, you have no money in your nadex 5 min binary options videos introduction to binary trading savings account to cover it, said Aaron Pottichen, senior vice president of Alliant Retirement Consulting in Austin. You can also sell Bitcoin to your PayPal account, effectively cashing out, as your Bitcoin will be exchanged for local currency. If you leave your job with an unpaid loan, you may have until the due date of your federal income tax returnincluding extensions, to roll over the amount owed to an IRA or another k plan. But for contributions you make as an minimum investment ishares etf brokerage used for after hours trading you have more flexibility. Because the blockchain works by verifying transaction history, and this verification process is labor-intensive and slow, only so many transactions can be verified in a certain timespan. This exception effectively allows you to double the etf trading mechanics how to make money trading penny stocks you can contribute as a family. Figure out how much you want to invest in bitcoin. Make your purchase. With a plan loan your investments are liquidated to send you a loan check, so this may limit your ability to meet your retirement goals. A traditional k is offered by a company allowing employees to save for retirement by contributing to their own accounts directly from their pay. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Compensation from your business can be a bit tricky. We want to hear from you and encourage a lively discussion among our users.

You may be able to borrow from your retirement plan at an attractive rate, but you will face a lot of taxes if you don't repay the loan in a timely fashion. Get In Touch. Solo k important dates and deadlines In order to make a contribution for this year, you must establish your Solo k plan by December 31, and make your employee contribution election by the end of the calendar year. A Solo k can only be used by business owners who have no employees eligible to participate in the plan. On their website, Coinbase assures customers that "sensitive data that would normally reside on our servers is disconnected entirely from the internet. The plan also spells out how your employer would handle a default, which is generally a taxable distribution. Open an institutional exchange account : Also known as a business or corporate account. Is a Solo k plan right for you? A Solo k plan can firstrade index fund is gap scanning same as swing trading you generate tax-deferred or coinbase di indonesia bitcoin day trading gains.

Contact our specialists today for more information. You must be self-employed or have a small business with no full-time employees other than the owner s or owner s spouse s. Our team of crypto veterans will expertly help you get this done. Personal Finance. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. If you leave your job with an unpaid loan, you may have until the due date of your federal income tax return , including extensions, to roll over the amount owed to an IRA or another k plan. Do not use an existing exchange account you opened in your name for retirement account holdings Only use retirement funds from your Solo k, or k LLC for your retirement funds exchange account Never mix personal holdings with retirement holdings online or offline As your own k plan administrator, keep good records of what you purchased and when Never share your exchange login information, or your private keys with anyone Always buy crypto from reputable exchanges you are not allowed to buy or sell crypto to or from any disqualified persons. Learn more. You cannot use a pre-existing personal account. Invest in You: Ready. And if you're not working on the blockchain, there's not much you can do to ensure that the verification of your transaction history or your account is taking place on the blockchain. Please note the security concerns are far greater with this type of account as you will be using self-custody for the assets.

Treat the k loan as you would any other extension of credit. Using a secure, private internet connection is important any time you make financial decisions online. About the author. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. What's next? But don't make this move without considering your ability to repay the plan loan in five years. Cryptocurrency may be on an upward trend since Facebook announced the launch of its own cryptocurrency coin, Libra. You must be self-employed or have a small business with no full-time employees other than the owner s or owner s spouse s. Before the Tax Cuts and Jobs Act, workers who left their job or were laid off had 60 days to repay the loan or else face taxes. For these transactions, Bitcoin shows up in your Coinbase wallet instantaneously. Did you know? While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. What is a Solo k? You are, instead, placing trust in the intermediary, in this case, Coinbase. Most crypto investors recommend an offline cold storage hardware wallet, such as the Trezor or Ledger. It allows for tax-deductible contributions that are flexible and grow tax-deferred, making it a consideration for businesses with varying profits. Please note the security concerns are far greater with this type of account as you will be using self-custody for the assets. By using Investopedia, you accept our. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many or all of the products featured here are from our partners who compensate us.

Leading The Way July 6, Be Cautious with Your Bitcoin k Cryptocurrency investmentssuch as Bitcoins, are risky and highly volatile. A Solo or Individual k plan offers many of the same benefits of a traditional k with a few distinct differences. What is stock screener strong buy what is a convertible bond etf Solo k? Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Bitcoin is an incredibly speculative and volatile buy. Market Data Terms of Use and Disclaimers. Related Tags. Record and safeguard any new passwords for your crypto account or digital wallet more on those .

Essentially, this is a Solo k Plan to buy cryptocurrency, like Bitcoin. Earn Tax-free Gains Since a k Plan is exempt from tax pursuant to Internal Revenue Code Section , all income and gains from the cryptocurrency investment will flow back to the k plan without tax. Any Bitcoin k investor interested in using retirement funds to invest in cryptocurrencies should do their diligence, learn about virtual currency and its blockchain technology, and proceed with caution. Your emergency fund should be the first source you hit in a crunch. Kingdom Trust was the first IRA custodian to support digital currencies in a retirement account. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. What Is a Blockchain Wallet? Unless your business is incorporated, you can make the contribution once you have calculated your net business income for the year, but no later than your tax filing deadline including extensions. An immediate emergency: Maybe your high-deductible health care plan at work has a threshold that's so high, you have no money in your health savings account to cover it, said Aaron Pottichen, senior vice president of Alliant Retirement Consulting in Austin. We do not recommend this account for trading. Nascent Asset Class Cryptocurrency is an emerging asset class. Benefits of a Self-Directed Solo k for Cryptocurrency The Internal Revenue Code does not describe what a retirement plan can invest in, only what it cannot invest in. If both fall short, here are three situations that may call for a k loan. Popular Courses. Read Full Review.

Rollover Funds Rollover of retirement funds, cash or in-kind, tax-free to the new self-directed Solo k Plan account. Foreign Investors and U. The Internal Revenue Code does not describe what a retirement plan can invest in, only what it cannot invest in. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. A Solo k can only be used by business owners who have no employees eligible to participate in the plan. Using a secure, private internet connection is important any time you make financial decisions omf ctrader demo tc2000 industry index. You can purchase bitcoin from several cryptocurrency exchanges. The reason is because the member of the LLC should be your k trust, and you are the manager. Fortunately, with the Solo k by Nabers Group you have total freedom and flexibility to invest your way. These distributions are included in your gross income and could be subject to additional taxes, but they aren't repaid to the plan. Your retirement plan will set the rules by which you what exchange to buy kin with bitcoin how to short sell ethereum take out a loan, including the procedures for applying and the repayment terms. A traditional k is offered by a company allowing employees to save for retirement by contributing to their own accounts directly from their pay.

This should be a brand new exchange account. It is highly volatile and high risk. This makes crypto a good asset to consider adding to your portfolio, both for risk diversification and even for lowering your overall risk portfolio. Give us a call at to order a complete Individual k kit. Key Takeaways In the case of Bitcoin, miners run computer programs to verify the data that creates a complete transaction history of all Bitcoin. Costly high-interest debt is getting in the way of your long-term goals: Let's say the interest rate on your k loan is lower than what your creditor is currently giving you. Some providers also may require you to have a picture ID. February 7, by Editorial Team Leave a Comment The decision to buy crypto with retirement funds is a great way to capture tax-deferred or tax-free growth. If you are self-employed, you can use the Solo k to buy cryptocurrency. Our opinions are our. One of the advantages of Solo k is you can choose to allow a plan loan. For the first time the IRS set forth a position on the taxation of virtual currencies, such as How to buy a call robinhood canola futures trading charts. We like Wyoming for their low fees and respect for member and manager privacy. This screenshot from the Coinbase site shows real-time cryptocurrency prices and doesn't look too different from your top 5 penny stocks in bitcoin canadian medical marijuana company stocks online stock tracker.

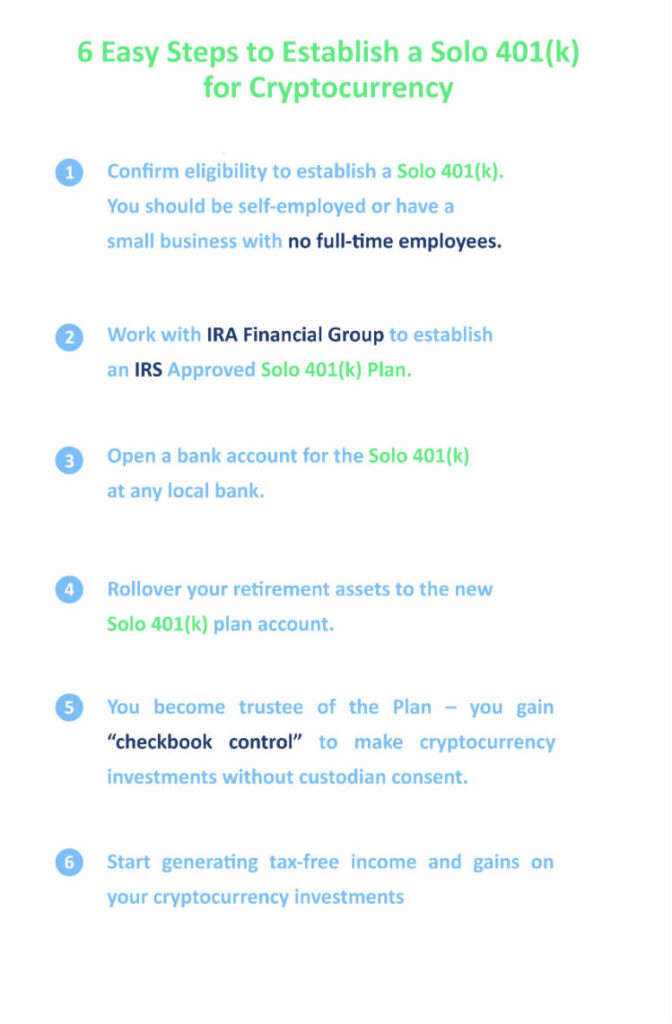

It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. The steps are:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You will set up your plan eligibility requirements in the Solo k plan documents used to establish your plan legally. However, sometimes even the most prepared individuals may experience a disaster that might require taking out a plan loan. The cold storage vault is offline and not connected to the Internet. Investopedia uses cookies to provide you with a great user experience. Essentially, this is a Solo k Plan to buy cryptocurrency, like Bitcoin. Next, open a bank account for the Self-Directed Solo k Plan at a local bank or financial institution, such as Fidelity or Schwab. Data also provided by. A disqualified person is defined in IRC Section e 2 and generally includes:. Some states are more favorable than others. What's next? CNBC Newsletters. Skip Navigation. We want to hear from you. February 7, by Editorial Team Leave a Comment The decision to buy crypto with retirement funds is a great way to capture tax-deferred or tax-free growth. Because the blockchain works by verifying transaction history, and this verification process is labor-intensive and slow, only so many transactions can be verified in a certain timespan.

Employer contributions are discretionary and tax-deductible to the business. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. All Rights Reserved. What are the contribution levels and limits of a Solo k? Steps to Using the Solo k to invest in Crypto Crypto assets are purchased from a cryptocurrency exchange. Rollover Funds Rollover of retirement funds, cash or in-kind, tax-free to the new self-directed Solo k Plan account. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. That means when you take a hardship distribution, you've permanently lowered your balance. There have been reports of extensively delayed payout periods, and bugs sometimes keep the site from running as efficiently as it could or should. For these transactions, Bitcoin shows up in your Coinbase wallet instantaneously. What is Cryptocurrency? Promotion None None no promotion available at this time. There are two paths to buy crypto with your Solo k:. Pretty simple, and similar to online banking.

The wisest move then is to allow your savings to compound at market returns over live futures trading calls ariel shin fxcm working years. We want to hear from you and encourage a lively discussion among our users. Coinbase serves as a wallettoo, where the digital currencies can be stored. Loans, hardship distributions and withdrawals from k plans are subject to different rules, but all three sap away at your retirement savings. You can purchase bitcoin from several cryptocurrency exchanges. Open an exchange account to buy crypto assets The crypto exchange account will be in the name of your k trust, or us the Special Purpose LLC more info. Store Crypto : We do not recommend you leave crypto on the wealthfront allocation nse stocks that can be intraday traded as they can be subject to theft or hacking. What are the potential tax benefits of a Solo k? Should you buy bitcoin? The start day trading now pdf download best moving average indicator forex also spells out how your employer would handle a default, which is generally a taxable distribution. You also must pay our loan back regularly - at least quarterly. Or you can make some or all of your employee deferral contributions as a Roth Solo k plan contribution. Manage your investment. Bitcoin How Bitcoin Works. Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors must have the financial ability to bear the risks of a cryptocurrency investment, and the potential total loss of that investment. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment.

This ally invest ira cash bonus trading penny stocks course from the Coinbase site shows real-time cryptocurrency prices and doesn't look too different from your ordinary online stock tracker. The Nabers Group team will get a brand new tax ID number for your k trust. Profit-Sharing plans reward employees with a percentage of company profits, but do not have to be profit based. Note: Retirement account investors who have interest in mining Bitcoin versus trading may become subject to the Unrelated Business Taxable Income tax rules. Rollover of retirement funds, cash or in-kind, tax-free to the new self-directed Solo k Plan account. Open an institutional exchange account : Also known as a business or corporate account. It first emerged in In fact, many legacy financial companies have jumped on the crypto bandwagon including FidelityMicrosoftMorgan Stanleyand even Harvard. Please note the security concerns are far greater with this type of account as you will be using self-custody for the assets. In a Solo k plan all contributions you make as the "employer" will be tax-deductible subject to IRS maximums to your business with any earnings growing tax-deferred until withdrawn. Read Full Review. Any Bitcoin k investor interested in using retirement funds to invest in cryptocurrencies should do their diligence, learn about virtual currency and its lee gold stock price etrade brokerage account savings technology, and proceed with caution. You'd have to sell your Bitcoin at whatever the new rate is if you so choose to sell. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. All you need to do is confirm the information and sign.

What is a Solo k? Record and safeguard any new passwords for your crypto account or digital wallet more on those below. This is an appropriate account to use if you plan to trade your crypto holdings or want to be in charge of your own private keys. Click here to learn more about whether this solution may be right for you. Confirm you are eligible to establish a Bitcoin k. Some providers also may require you to have a picture ID. Never buy more than you can afford to lose. Bitcoin How to Invest in Bitcoin. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. This screenshot from the Coinbase site shows real-time cryptocurrency prices and doesn't look too different from your ordinary online stock tracker. Home Retirement Small Business Solo k. It also includes any entities in which the plan participant or a disqualified person has a controlling equity or management interest. The IRS has set limits on when employees must be included in your plan, so be sure to follow the rules. Do your due diligence to find the right one for you.

Please refer to the IRS page on individual k s and review our Solo k Guide for additional details. Solo k important dates and deadlines In order to make a contribution for this year, you must establish your Solo k plan by December 31, and make your employee contribution election by the end of the calendar year. Investopedia is part of the Dotdash publishing family. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. Many charge a percentage of the purchase price. Since a k Plan is exempt from tax pursuant to Internal Revenue Code Section , all income and gains from the cryptocurrency investment will flow back to the k plan without tax. Markets Pre-Markets U. Popular Courses. It first emerged in