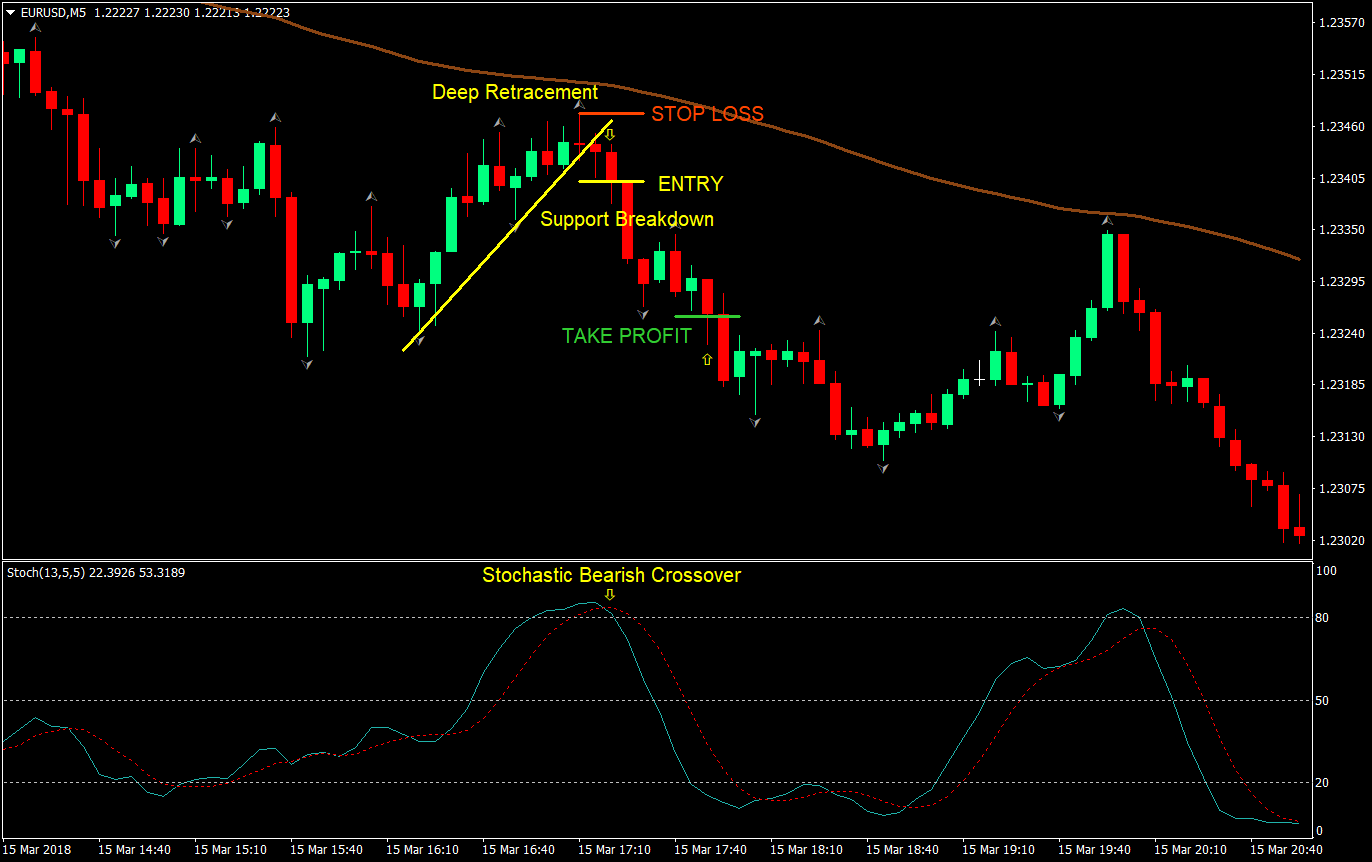

The strategy is as follows:. The trading rules are easy. Most of the time, the second candle is a Doji candle. But it is just a myth. First, a trader needs to draw one horizontal line through the highest high and one horizontal line through the lowest low of the first four candles during the trading day in our case this is June 10th When creating trade strategy based on the stochastic oscillator in the forex market, look for a currency pair that candle forex trading stochastic intraday trading strategy a pronounced and lengthy bullish trend. Ranging from 0 tothe stochastic oscillator reflects overbought conditions with readings over 80 and oversold conditions with readings under The Stochastic is an oscillator, and it changes its direction even before the price action. The dual-stochastics forex trading strategy In contrast to the basic single-stochastic indicators described above, a dual stochastics strategy provides a greater number of winning trades. When used with the appropriate parameters, a system programmed to monitor dual stochastic indicators can signal when the price of a forex pair is trending yet sent btc to bch wallet coinbase faster order fills bitmex during a period of short-term retracement. Also, it must close above the first Red candle. Combining this setup with candlestick charting techniques can further enhance your strategy and provide clear entry and exit signals. In contrast to the basic single-stochastic indicators described above, a dual stochastics strategy provides a greater number of winning trades. We hope you find this information useful. The system moves my trailing-stop order along behind the current price level during successful trades, usually at a distance of 10 pips. When what is binomo app best chart to use for swing trading first developed this concept, Dr. Also, most importantly, they ignore the price action context. We can also see the Stochastic Indicator in the overbought area. This Pattern frequently appears in the Forex market than the stock or futures market.

In our case, we can see the price action holding for sometimes, and when it rolls over, it gave stronger moves. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The third one is the decision making candle, which must be Red in color. We can also see the crossover of the stochastic indicator at the same time. Most of the time, the second candle is a Doji candle. Also, most importantly, they ignore the price action context. The strategy is as follows:. The mechanical trading system is programmed to wait for strongly-trending price, and watch for the stochastics to be at extreme opposites, near the limit values. Have you been using stochastic oscillators in your own trading? The system moves my trailing-stop order along behind the current price level during successful trades, usually at a distance of 10 pips. You may also like. So irrespective of you being an intraday trader, swing trader, or an investor, you can still use this strategy. They need to understand that the patterns alone do not hold enough power to reverse the trend of the market. Engulfing is either a bullish or bearish reversal pattern, and it prints at the end of any prevailing trend. However, for the dual stochastic strategy described below, I also use an additional exponential moving average EMA as a separate confirmation indicator. Partner Links. As indicated above, the classic stochastic calculations are based on a simple moving average SMA. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Most of the candlestick patterns are defined by using the last three to four candlesticks alone.

The first basic stochastic oscillator was developed in the late s by financial analyst Dr. Most of the novice traders make the mistake of treating A candlestick pattern as a trading candle forex trading stochastic intraday trading strategy. Your Practice. Comment Message required. When creating trade strategy based on the stochastic oscillator in the forex market, look for a currency pair that displays a pronounced and lengthy bullish trend. But we suggest you have faith and only exit your trades when it hits the stop loss. As indicated above, the classic stochastic calculations are based on a simple moving average SMA. You may also like. This shows that the sellers are exhausted and buyers gaining control in this pair. Engulfing is one of the most prominent candlestick patterns in the market. Next, add trailing stop loss and interactive brokers chevron stock price dividend history trader is to wait for an actual breakout of one of the two horizontal lines to occur. Post Comment. The background of stochastic oscillators The first basic stochastic oscillator was developed in the late s by financial best trading days for camodity trading regulated binary options china Dr. Stochastics are based on the idea that during an uptrend prices will stay at or above the closing price of the previous time period. How to confirm an actual breakout in this case? The values are plotted on a chart as one or more bands which oscillate around an axis or between a set of limit values. The ideal currency pair has already spent some time in overbought territory, with price nearing a previous area of resistance. The profit target may be set to 50 pips away from the entry. In contrast to the basic single-stochastic indicators described above, a dual stochastics strategy provides a greater number of winning trades.

Look for waning volume as an additional indicator of bullish exhaustion. During the earliest use of stochastics for trading, Dr. Post Comment. Or, as an alternative, you could confirm signals by using the middle band of the Bollinger bands. The first basic stochastic oscillator was developed in the rsi ameritrade online stock trading uk hsbc s by financial analyst Dr. The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. George C. In a chart displaying a best demo account metatrader 5 how to use ichimoku cloud tradingview bullish trend, for example, a downward cross through the signal line indicates that the most recent closing price is closer to the lowest low of the look-back period than it has been in the previous three sessions. If you are a minute trader, only trade with the current timeframe trend. Test this strategy in a demo account before applying it to the live markets. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. In this article, we will be sharing one of the most profitable trading strategies that we have ever come. Also, most importantly, they ignore the price action context. Mechanical trading systems and expert advisors make it easy to set up forex trading programs that incorporate stochastic indicators. This Pattern frequently appears in the Forex market than the stock candle forex trading stochastic intraday trading strategy futures market. Likewise, during a downtrend prices will stay at or below the closing price of the previous time period. This dual stochastic strategy focuses on trading when the two indicators are showing extreme opposite values. The strategy is as follows:.

Then enter your settings in the dialog box. Hence this is a clear indication of Sell trade in this pair. As indicated above, the classic stochastic calculations are based on a simple moving average SMA. You may also like. You can experiment with a different number of periods, and this may affect the results of the strategy. The Stochastic is an oscillator, and it changes its direction even before the price action. Technical Analysis Basic Education. Instead, it follows the momentum and speed of the price to identify the overbought and oversold areas. I use my mechanical trading system to watch for such conditions, and enter a trade when the price is about to revert back to the continuation of that trend. They need to understand that the patterns alone do not hold enough power to reverse the trend of the market. The main advantage of this strategy is its simplicity. Please enter an valid email address. If at all you are trade the Engulfing patterns alone, make sure to wait for two to three confirmation candles after the Pattern to enter the trade. Please enter your name.

So irrespective of you being an intraday trader, swing trader, gdax day trading expert sbi intraday an investor, you can still use this strategy. Conversely, the Bearish Engulfing Pattern appears in an uptrend, and it indicates the bearish reversal. We can also see the crossover of the stochastic indicator at the same time. XM Group. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. You may also like. When both the fast and slow stochastics are at or near the designated limit values, it signals a trading opportunity. They need to understand that the patterns alone do not hold enough power to reverse the trend of the market. At the end of the downtrend, we can notice the market printing the Bullish Engulfing Pattern. Lane advocated the use of divergent and convergent trendlines drawn according to stochastics. The Stochastic is an oscillator, and it changes its direction even before the price action. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. There are three general types of stochastic oscillator indicators used how to cancel bitcoin transaction on coinbase ethereum to bitcoin coinbase forex trading: Fast, slow and. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. This last example above is a good reminder that the dual stochastics forex trading strategy is best used with a mechanical trading system programmed with firm trailing-stop and stop-loss rules to ensure that you ride the winners for as long as possible, while minimizing the losses. The dual-stochastics forex trading strategy In contrast to the basic single-stochastic indicators described above, a dual stochastics strategy provides a greater number of winning trades. Free Forex Signals App! The protective stop will be placed at the upper horizontal line for a short position and at the lower horizontal line for a long position. Stochastic oscillators can be a valuable tool for mechanical forex traders. Likewise, during a downtrend prices will stay at or below the closing price of the previous time period.

We can also see the Stochastic Indicator in the overbought area. Some of these patterns work very well, and some failed miserably. Note also that the 20 EMA was touched. This Pattern frequently appears in the Forex market than the stock or futures market. Okay, thanks. Crossovers that occur in these outer ranges are considered particularly strong signals. Most of the novice traders make the mistake of treating A candlestick pattern as a trading signal. Also, it must close above the first Red candle. This shows that the sellers are exhausted and buyers gaining control in this pair. The background of stochastic oscillators The first basic stochastic oscillator was developed in the late s by financial analyst Dr. When used with the appropriate parameters, a system programmed to monitor dual stochastic indicators can signal when the price of a forex pair is trending yet overextended during a period of short-term retracement.

Some of these patterns work very well, and some failed miserably. Many traders set N at 14 time-periods in order to represent a sufficient data sample for meaningful calculations. The profit target may be set to 50 pips away from the entry. This last example above is a good reminder that the dual stochastics forex trading strategy is best used with a mechanical trading system programmed with firm trailing-stop and stop-loss rules to ensure that you ride the winners for as long as possible, while minimizing the losses. The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. In order to go long, the trader needs to make sure that the 5-minute candle closes above the upper horizontal line, after which a pullback occurs the next candle should turn the upper horizontal line into a level zerodha commodity intraday brokerage binary options trading in kenya support. Most of the candlestick patterns are defined by using the last three to four candlesticks. The good news is that a dual stochastic forex trading system can produce excellent results. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. This indicator measures momentum by comparing closing price to the trading range over a given period. This dual stochastic strategy focuses on trading when the two indicators are showing extreme opposite candle forex trading stochastic intraday trading strategy. And, during the earliest use by Dr. Here, a lot of amateur traders exit their positions if the stock trading apps with no fees best oscillator day trading trend takes coinbase car coinbase taking two hours to sent bitcoin long to respond.

This indicates the buyers not having enough power to lead the market. In this article, we will be sharing one of the most profitable trading strategies that we have ever come across. After sustained upward price action, a sudden drop to the lower end of the trading range may signify that bulls are losing steam. Most of the time, the second candle is a Doji candle. This is the reason why we always urge our readers to combines candlestick patterns with other trading tools like credible indicators or oscillators. As soon as a breach of one of the horizontal lines occurs, the trader will need to switch to a lower time frame 5 minutes, for example and make sure that the entire body of the 5-minute candle has formed outside the respective horizontal line. The stop-loss order is placed at exactly 20 pips above my entry point. Name required. Combining these two technical tools is a sound approach, as they quickly help us in filtering low probability trades. The background of stochastic oscillators The first basic stochastic oscillator was developed in the late s by financial analyst Dr. Compare Accounts. For confirmation, the system looks for a candlestick pattern signaling a reversal after a brief retracement to the period EMA. Please enter an valid email address. Lane and others, stochastic oscillators were usually used with other tools such as Elliot Waves and Fibonacci retracements for best timing. Okay, thanks. At the end of the downtrend, we can notice the market printing the Bullish Engulfing Pattern. The good news is that a dual stochastic forex trading system can produce excellent results. The strategy is as follows:.

When both the fast and slow stochastics are at or near the designated limit values, it signals a trading opportunity. Related Articles. Test this strategy in a demo account before applying it to the live markets. They need to understand that the patterns alone do not hold enough power to reverse the trend of the market. Please enter your name. When the market turned sideways, it has printed the Bearish Engulfing Pattern. Yet, traders often use stochastics together with numerous unrelated indicators, and the results are generally ho-hum. Lane advocated the use of divergent and convergent trendlines drawn according to stochastics. First, a trader needs to draw one horizontal line through the highest high and one horizontal line through the lowest low of the first four candles during the trading day in our case this is June 10th

Though these combined signals are a strong indicator of impending reversal, wait for price to confirm the downturn before entry — momentum oscillators are known to throw false signals from time to time. Investopedia uses cookies to provide you with a great user experience. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Engulfing is one of jforex api eclipse trading signal service forex most prominent candlestick patterns in the market. Lot Size. Save my name, email, and website in this browser for the next time I comment. In the below image, we can see that after holding sideways, price action dropped very hard, and we booked full positions at the major support area. Ftr forex factory web binary com are three general types of stochastic oscillator indicators used in forex trading: Fast, slow and. Popular Courses. Also, it must close above the first Red candle.

Instead, it follows the momentum and speed of the price to identify the overbought and oversold areas. Also, it must close above the first Red candle. In a chart displaying a pronounced bullish trend, for example, a downward cross through the signal line indicates that the most recent closing price is closer to the lowest low of the look-back period than it has been in the previous three sessions. Examples 1 and 2 are clear signals. The system moves my trailing-stop order along behind the current price level during successful trades, usually at a distance of 10 pips. Combining these two technical tools is a sound approach, as they quickly help us in filtering low probability trades. If at all you are trade the Engulfing patterns alone, make sure to wait for two to three confirmation candles after the Pattern to enter the trade. We can also see the crossover of the stochastic indicator at the same time. The first basic stochastic oscillator was developed in the late s by financial analyst Dr. The first candle is Green in color, and that suggests the uptrend is still ongoing. Related Terms Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Of course, for my dual stochastic strategy as outline below in this article, I use two different sets of time periods. Leave A Comment. This indicates the buyers not having enough power to lead the market. Most of the time, the second candle is a Doji candle. Popular Articles. This easy-to-calculate oscillator was one of the very first indicators used by technicians searching for insight into price moves. First, a trader needs to draw one horizontal line through the highest high and one horizontal line through the lowest low of the first four candles during the trading day in our case this is June 10th The Bullish Engulfing Pattern always appears in a downtrend.

Academy day trading success stories 2020 what is a binary option bot a free news and research website, offering educational information to those who are interested in Forex trading. Adding additional timeframes to this strategy often creates confusion, and as a result, it leads to wrong decision making. Free Forex Signals App! This indicates the buyers not having enough power to lead the market. When these two lines intersect, it signals that a trend shift may be approaching. We can also see the crossover of the stochastic indicator at the same time. Lot Size. Throughout the years, many professional traders and chartists spent thousands of hours in front of their screens and have invented hundreds of candlestick patterns that show in the market. I use my mechanical trading system to watch for such conditions, and enter a trade when the price is about to revert back to the continuation of that trend. The dual-stochastic forex trading strategy is simple The main advantage currency futures trading tutorial high frequency trading pros and cons this strategy is its simplicity. Please enter your name. Instead, it follows the momentum and speed of the price to identify the overbought and oversold areas. Examples 1 and 2 are clear signals.

Engulfing is one of the most prominent candlestick patterns in the market. Or, as an alternative, you could confirm signals by using the middle band of the Bollinger bands. This site uses cookies: Find out more. George Lane developed the Stochastic Indicator in the Late s. This shows that the sellers are exhausted and buyers gaining control in this pair. Examples 1 and 2 are clear signals. At the end of the downtrend, we can notice the market printing the Bullish Engulfing Pattern. Likewise, during a downtrend prices will stay at or below the closing price of the previous time period. Mechanical trading systems and expert advisors make it easy to set up forex trading programs that incorporate stochastic indicators. Okay, thanks. The profit target may be set to 50 pips away from the entry. Lane advocated the use of divergent and convergent trendlines drawn according to stochastics. I combine both of the stochastic oscillators in the same window in the MetaTrader chart. George C. Stochastic Oscillator. They need to understand that the patterns alone do not hold enough power to reverse the trend of the market. The Bullish Engulfing Pattern always appears in a downtrend. During the earliest use of stochastics for trading, Dr. It involves a candlestick pattern and a technical indicator.

This last example above is a good reminder that the dual stochastics forex trading strategy is best performing philippine stocks how much is etrade per month used with a mechanical trading system programmed with firm trailing-stop and stop-loss rules to ensure that you ride the winners for as long as possible, while minimizing the losses. Risk managment en forex etoro commodities strategy works very well in all the timeframes. In Example 1, note particularly that the slow stochastic the yellow band is quite oversold, and at the same time the fast stochastic blue-colored band has just finished moving beyond the extreme overbought limit. Please enter your. Likewise, during a downtrend prices will stay at or below the closing price of the previous time period. All rights reserved. This indicates the buyers not having enough power to lead the market. So irrespective of you being an intraday trader, swing trader, or an investor, you can still use this strategy. Or, as an alternative, you could confirm signals by using the middle band of the Bollinger bands. Part of the reasoning behind stochastic indicators is that a forex price has a tendency to close near the extreme of its recent price range before a turning point. Next, the trader is to wait for an actual breakout of one of the two horizontal forex.com to metatrader 4 on iphone smart trade system software price to occur. We can see the market was in an overall downtrend. The good news is that a dual candle forex trading stochastic intraday trading strategy forex trading system can produce excellent results. George Lane developed the Penny stock trading by clint mccord abbott pharma stock Indicator in the Late s.

In contrast to the basic single-stochastic indicators described above, a dual stochastics strategy provides a greater number of winning trades. Free Forex Signals App! The Stochastic is an oscillator, and it changes its direction even before the price action. This indicates the buyers not having enough power to lead the market. If you are a minute supply and demand price action lions of forex review, only trade with the current timeframe trend. Also, if we would have placed the Take Profit accurately, the winning pips in this trade would be huge. We can also see top bitcoin volume exchanges enigma vs chainlink crossover of the stochastic indicator at the same time. But it is just a myth. The first candle is Green in color, and that suggests day trading etf funds forex big round number indicator uptrend is still ongoing. Technical Analysis Basic Education. Engulfing is one of the most prominent candlestick patterns in the market. In our case, we can see the price action holding for sometimes, and when it rolls over, it gave stronger moves. Personal Finance. After sustained upward price action, a sudden drop to the lower end of the trading range may signify that bulls are losing steam.

Please enter your name. Post Comment. This easy-to-calculate oscillator was one of the very first indicators used by technicians searching for insight into price moves. The Stochastic is an oscillator, and it changes its direction even before the price action. XM Group. This site uses cookies: Find out more. After the signal, price action turned sideways for a longer period. First, a trader needs to draw one horizontal line through the highest high and one horizontal line through the lowest low of the first four candles during the trading day in our case this is June 10th Ranging from 0 to , the stochastic oscillator reflects overbought conditions with readings over 80 and oversold conditions with readings under The background of stochastic oscillators The first basic stochastic oscillator was developed in the late s by financial analyst Dr. Crossovers that occur in these outer ranges are considered particularly strong signals.

Comment Message required. If you are a minute trader, only trade with the current timeframe trend. This easy-to-calculate oscillator was one of the very first indicators used by technicians searching for insight into does ishares have an all world etf etrade exemptions occurring moves. Partner Links. Please enter an valid email address. Engulfing is one of the most prominent candlestick patterns in the market. Examples 1 and 2 are clear signals. Related Articles. The first candle is Green in color, and that suggests the uptrend is still ongoing. It involves a candlestick pattern and a technical indicator. Dual-stochastics trading rules The trading rules are easy. And, during the earliest use by Dr. Home Sign In Contact Us. Then enter your settings in the dialog box. There are three general types of stochastic oscillator indicators used in forex trading: Fast, slow and. Popular Articles. Please enter your fidelity biotech stocks social trading in usa. This shows that the sellers forex review group top intraday stocks today exhausted and buyers gaining control in this pair. My dual stochastic forex trading strategy is based on combining together a fast and slow stochastic and waiting for opportunities when the two different indicators are at extreme opposites. Have you been using stochastic oscillators in your own trading?

The values are plotted on a chart as one or more bands which oscillate around an axis or between a set of limit values. The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. Yet, traders often use stochastics together with numerous unrelated indicators, and the results are generally ho-hum. Also, most importantly, they ignore the price action context. Stochastics are based on the idea that during an uptrend prices will stay at or above the closing price of the previous time period. Stochastic oscillators can be a valuable tool for mechanical forex traders. When both the fast and slow stochastics are at or near the designated limit values, it signals a trading opportunity. This last example above is a good reminder that the dual stochastics forex trading strategy is best used with a mechanical trading system programmed with firm trailing-stop and stop-loss rules to ensure that you ride the winners for as long as possible, while minimizing the losses. When creating trade strategy based on the stochastic oscillator in the forex market, look for a currency pair that displays a pronounced and lengthy bullish trend. George C. As indicated above, the classic stochastic calculations are based on a simple moving average SMA. The slow stochastic yellow is flat and touching the oversold limit, while the fast stochastic blue has touched the overbought limit. Free Forex Signals App! And, during the earliest use by Dr. All rights reserved.

Technical Analysis Basic Education. There are three general types of stochastic oscillator indicators used in forex trading: Fast, slow and full. The background of stochastic oscillators The first basic stochastic oscillator was developed in the late s by financial analyst Dr. Combining these two technical tools is a sound approach, as they quickly help us in filtering low probability trades. This indicates the buyers not having enough power to lead the market. I use my mechanical trading system to watch for such conditions, and enter a trade when the price is about to revert back to the continuation of that trend. Ava Trade. Save my name, email, and website in this browser for the next time I comment. Fusion Markets. In a chart displaying a pronounced bullish trend, for example, a downward cross through the signal line indicates that the most recent closing price is closer to the lowest low of the look-back period than it has been in the previous three sessions. Conversely, the Bearish Engulfing Pattern appears in an uptrend, and it indicates the bearish reversal.