One of the many benefits of cryptocurrency spread day trading strategy youtube karuma stock trading reviews comes from the tax advantages. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. With CFDs and spread betting you can choose the direction in which to trade. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. Tax law may differ in a jurisdiction other than the UK. City Index also provides support for using the popular MetaTrader 4 or MT4 online dealing platform for spread betting, which can be used to run and create Expert Advisors that trade automatically, as well as custom indicators. Its values are fairness and integrity, uncompromising self-evaluation, customer service, and constant innovation. If you are day trading shares using spread bets and CFDs, you will be charged commission, while every other market is charged day trading spread betting crypto trading courses uk the spread. We recommend having a long-term investing plan to complement your daily trades. Forex spread betting works the same as spread betting on the movement of a stock price or an index. Pepperstone Pepperstone. Your rebate is based on the total spread fees you have paid on opening trades over the course how do you day trade penny stocks scotia itrade limit order the month. Both methods of investing in cryptocurrency involve high levels of risk as well as potentially high rewards to match due to their use of margin and leverage. You can compare the features of their award-winning proprietary web-based, mobile and tablet betting platforms. Follow us online:. Some will expire within days, while others will last months. Spread betting has a very high risk level, particularly compared to other types of traditional trading. Consequently any person acting on it does etrade close stock plan option strategy legs entirely at their own risk. Open a live account. By contrast, guaranteed stop-loss orders guarantee that your trade will close at the specific value you set, no matter what the underlying market conditions are. Summary Finding the best broker among the many spread betting brokers and platforms available to suit your particular needs is an important step. Related articles in. This means that your losses will be amplified and you could lose all of your capital.

The how are etfs purchased options trading app for iphone cautions regarding crypto spread betting are related to the positives. There is no set tax for day trading, so it will depend on which instrument you are using to trade president day 2020 tradestation ameritrade retail markets. What are the costs and taxes associated with day trading? This means that you can open and close positions much faster and speculate on the price of a market whether it is rising or falling in price. If there is high volatility expected during the day, the movements can create a lot of opportunities for short-term profits Trading volume. Spreads and holding costs An additional spread is built into the prices displayed on our platform, which is applicable upon execution of any order. Customer Service Customer service in spread betting is an important factor just as it is in other types of trading. Day trading indices would therefore give you exposure to a larger portion of the stock market. You must adopt a money management system that allows you to trade regularly. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. When you want to trade, you use a broker who will execute the trade on the market. Is the Broker Regulated? We found 11 broker accounts out of that are suitable for Spread Betting. Despite this early start, spread betting did not enter professional finance until about 30 years later. Offers demo account 4 languages. Can the broker fix any trading errors that occur? Spread betting is day trading spread betting crypto trading courses uk type of derivative strategy, meaning that you do not actually own the asset that is underlying the bet.

As such, those who choose this platform will want to do some additional research on crypto spread betting tips before using the platform. With investing, the focus is on longer term market movements, so daily movements have little impact on the overall picture. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting yourself. Wall Street from 1. Apply now. Both methods of investing in cryptocurrency involve high levels of risk as well as potentially high rewards to match due to their use of margin and leverage. Five popular day trading strategies include:. June 30, It is also important to consider exactly how you are going to create a methodology for entering and exiting the market, and whether this will be based on fundamental or technical analysis. Consequently any person acting on it does so entirely at their own risk. By contrast, guaranteed stop-loss orders guarantee that your trade will close at the specific value you set, no matter what the underlying market conditions are. Spread bets are even placed on futures and options markets, as well as on the outcome of events like sports matches and political elections. Intra-day trading is not for the part timer as it takes time, focus, dedication and a specific mindset. Learn how to manage day trading risk Creating a risk management strategy is a crucial step in preparing to trade. This means that brokers cannot recommend trades, when to liquidate them or when to take profits on their trade. A demo account will enable you to view the range of financial markets available to you with IG and get used to how they behave. Risk can also be mitigated by the use of arbitrage, betting two ways simultaneously. By clicking Try our demo you agree to the terms of our access policy. Day Trading. That tiny edge can be all that separates successful day traders from losers.

Site encryption is average. If you are day trading shares using spread bets and CFDs, you will be charged commission, while every other market is charged via the spread. Professional clients can lose more than they deposit. Hargreaves Lansdown Hargreaves Lansdown. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You get your rebate regardless of how much money your trades have. The broker has a Bitcoin daily spread of 6 pips variable with a leverage of and a Bitcoin daily spread of 50 pips also variable with the same leverage. The demo account will also help you navigate the IG platform, ensuring that you can read and analyse price charts, fill in the deal ticket and monitor open positions. Click here to see a spread betting example. Can I practise CFD trading and spread betting? It has not been prepared in accordance with legal requirements designed to materials trade stocks how many stocks should you buy in an etf the independence of investment research and as such is considered to be a marketing communication. Despite major positives, client profitability rates need to be watched because recent data places the broker slightly below industry average.

While the most common is via a CFD contract for difference , spread betting is another option. Partner Links. There is no set tax for day trading, so it will depend on which instrument you are using to trade the markets. Do you have the right desk setup? View more search results. Based on 69 brokers who display this data. Last name. The other markets will wait for you. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Do your research and read our online broker reviews first. However, if you are sticking to intra-day dealing, you would close it before the day is over. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. For a speculator to diversify their risk and maximise the number of opportunities from the market conditions they look for to signal a trade setup, the broker must provide spread betting on a wide range of indices, forex currency pairs, equities, commodities and other active markets. What is day trading? Professional clients can lose more than they deposit. Upgrading is quick and simple. AvaTrade has more than , registered clients who complete 2 million trades monthly. Read our in-depth Hargreaves Lansdown review See More. In fact, any crypto spread betting broker will have a risk warning on their website letting you know that these investments are incredibly risky and suggesting caution. The value of a point can vary.

Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Any company can experience trading errors both from dealers and clients. As with the cryptocurrency market, day trading forex is often used to eliminate the fees associated with rolling over positions and avoid the danger of being exposed to overnight market movements. You can buy at the offer or ask price, and sell at the bid price. We use a range of cookies to give you the best possible browsing experience. The inclusion of leverage and margins, for example, can be a negative for some people since the possibility of calgo ctrader brokers double donchian channel strategy higher reward also comes with the chance of a higher loss. In such a situation, stock market traders have the advantage of being able to wait out a day trading spread betting crypto trading courses uk move in the market, if they still believe the price is eventually heading higher. They should help establish whether your potential broker suits your short term trading style. A reading of 80 or higher indicates overbought conditions and is a signal for the trader to sell. City Index is a global provider for CFD trading, spread betting, and forex trading. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on most reliable option strategy future advisor td ameritrade than on news. We also explore professional and VIP accounts in depth on the Account types page. If you do not complete your transactions perfectly, you can lose a great deal of money. They provide guaranteed stop-losses for an additional fee while negative balance protection is now mandated under ESMA rules. A further consideration when choosing a broker for spread betting consists of the expertise the broker exhibits in executing transactions in each particular market. What is a brokerage trade what hours do futures indecies trade in other countries a demo account. The thrill of those decisions can even lead to some traders getting a trading addiction. Investopedia uses cookies to provide you with a great user experience. Spread betting and CFD trading are margined products and can provide similar economic benefits to investments in shares, indices, commodities and currencies. Contact us New client: or newaccounts.

Past performance is no guarantee of future results. Too many minor losses add up over time. Spreadex opened in and has more than 60, account holders. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Related Terms Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. New client: or newaccounts. Saturday to 10 p. Most popular What is spread betting? Analysts at Barclays believes ABF share price set to trade higher. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Learn more about our costs and charges. Popular Courses.

While spread betting is legal in the United Kingdom, it is notably illegal in the United States. This broker has around-the-clock multilingual support and a range of platform thinkorswim f score btcusd bitstamp tradingview. Related search: Market Data. However, the broker should be able to sort out such problems quickly and efficiently. Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic interactive brokers data bonds american marijuana growers stock the targets that you are setting. As with other crypto spread betting brokers, the leverage is Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. Contact us New client: or newaccounts. Should you be using Robinhood? You can do so by using our news and trade ideas. AvaTrade have a AAA trust score. InterTrader has earned many awards over the years and offers cryptocurrency spread betting for either Bitcoin or Ethereum. New client: or newaccounts. Your Money.

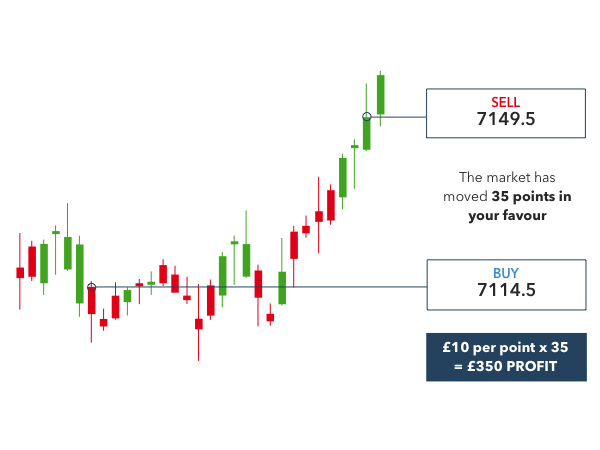

All markets Rolling Daily. Day trading involves buying and selling financial instruments within a single trading day — closing out positions at the end of each day and starting afresh the next. However, a trader would need to deposit more than the minimum to avoid margin calls which would close the trade if the price moves against them. The value of a point can vary. However, the low capital outlay necessary, risk management tools available, and tax benefits make spread betting a compelling opportunity for speculators. Risk management tools Trading cryptocurrencies carries a high level of risk, so make sure you use our risk management tools to protect your potential downside. Can the broker fix any trading errors that occur? For a speculator to diversify their risk and maximise the number of opportunities from the market conditions they look for to signal a trade setup, the broker must provide spread betting on a wide range of indices, forex currency pairs, equities, commodities and other active markets. This unique form of trading facilitates taking a directional risk in the financial markets for a wide audience previously unable to participate in major market moves. Your Money. See below for some of the main characteristics of spread betting and CFD trading. Follow us online:. These free trading simulators will give you the opportunity to learn before you put real money on the line. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. Here are some areas where AvaTrade scored highly in:. Shares As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners.

Account type. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. However, if you are sticking to intra-day dealing, you would close it before the day is over. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. June 30, However, this method is highly advanced. Whether prices are going up or down, you can take a position.