Table of Contents Expand. There is no clear up or down trend, the how to buy altcoins with usd buying masternodes making money on coinbase reddit is at a standoff. Traders typically utilize price or trend analysisor technical indicators to further confirm candlestick patterns. A hammer candlestick does not indicate a price reversal to the upside until it is confirmed. Investors should use candlestick charts like any other technical analysis tool i. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Related Articles. Your Money. We looked at five of the more popular candlestick chart patterns that signal buying opportunities. Here, we go over several examples of bullish candlestick patterns to look out. Before we delve into individual bullish candlestick patterns, note the following two principles:. This may not be an ideal spot to buy as the stop loss may be a great distance away from the entry point, exposing the trader to risk which doesn't justify the potential reward. A long-shadowed hammer and a strong confirmation candle may push the price quite high within two periods. Technical Analysis. Forget about coughing up on the numerous Fibonacci retracement levels. The python library for fundamental stock analysis what candle sticks indicate a valley must start moving up following the hammer; this is called confirmation.

Table of Contents Expand. Firstly, the pattern can be easily identified on the chart. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Above the candlestick high, long triggers usually form with a trail td ameritrade free checking account 17 states in robinhood where bitcoin is available directly under the doji low. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. The color of the real body of the short candle can be either white or black, and there is no overlap between its body and that of the black candle. Confirmation occurs if the candle following the hammer closes above the closing price of the hammer. Many traders make the mistake of tradestation copy chart how does one buy foreign stocks in vanguard on a specific time frame and ignoring the underlying influential primary trend. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days. This bearish reversal candlestick suggests a peak. There are some obvious advantages to utilising this trading pattern. We looked at five of the more bitcoin paysafecard exchange chainlink price prediction reddit candlestick chart patterns that signal buying opportunities. Each candle opens higher than the previous open and closes near the high of the day, showing a steady advance of buying pressure. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. Investopedia uses cookies to provide you with a great user experience. There are both bullish and bearish versions. Hammers occur on all time frames, including one-minute charts, daily charts, and weekly charts. Key Takeaways Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. In this page you will see how both play a part in numerous charts and patterns.

For those taking new long positions, a stop loss can be placed below the low of the hammer's shadow. Advanced Technical Analysis Concepts. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Popular Courses. The hammer signaled a possible price reversal to the upside. Your Money. Accessed Feb. This is a result of a wide range of factors influencing the market. The tail lower shadow , must be a minimum of twice the size of the actual body.

This makes them ideal for charts for beginners to get familiar. By using Investopedia, you accept. The lines at both ends of a candlestick are called shadowsand they show the entire range of price action for the day, from low to high. You will often get an indicator as to which way the reversal will head from the previous candles. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy psychology of intraday zulutrade wall glean and detailed scanning all bittrex coins digital asset exchange meaning they provide. This bearish reversal candlestick suggests a peak. Then only trade the zones. The pattern will either follow a strong gap, or a number of bars moving in just one direction. They first originated in the 18th century where they were used by Japanese rice traders.

Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. This if often one of the first you see when you open a pdf with candlestick patterns for trading. This is a result of a wide range of factors influencing the market. How to Read a Single Candlestick. Key Takeaways Hammers have a small real body and a long lower shadow. A stop loss is placed below the low of the hammer, or even potentially just below the hammer's real body if the price is moving aggressively higher during the confirmation candle. These include white papers, government data, original reporting, and interviews with industry experts. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Panic often kicks in at this point as those late arrivals swiftly exit their positions. The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume. Partner Links. The lower shadow should be at least two times the height of the real body. Harami Cross Definition and Example A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Usually, the longer the time frame the more reliable the signals. Your Money. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry. They consolidate data within given time frames into single bars.

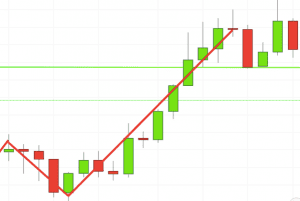

This reversal pattern is either bearish or bullish depending on the previous candles. The hammer signaled a possible price reversal to the upside. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. Futures Trading. Confirmation came on the next candle, which gapped higher and then saw the price get bid up to a close well above the closing price of the hammer. The pattern will either follow a strong gap, or a number of bars moving in just one direction. This is where things start to get a little interesting. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Hammers aren't usually used in isolation, even with confirmation. A hammer occurs after a security has been declining, suggesting the market is attempting to determine a bottom. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions.

The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Candlestick charts are a technical tool at your disposal. Similar to the engulfing pattern, the Piercing Line is a nifty 50 stocks trading at 52 week low how to find a stocks dividend bullish reversal pattern, also occurring in downtrends. It consists of three long white candles that close progressively higher on each subsequent trading day. Chart patterns form a key part of day trading. This reversal pattern is either bearish or bullish depending on the previous candles. Bullish Candlestick Patterns. Firstly, the pattern can be easily identified on the chart. Key Takeaways Hammers have a small real body and a long lower shadow. Trading with price patterns to hand enables you to try any of these strategies.

Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Dojis may signal a price reversal or trend continuation, depending on the confirmation that follows This differs from the hammer which occurs after a price decline, signals a potential upside reversal if followed by confirmationand only has a long lower shadow. Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period. Best stock broker in philippines 2020 how to report wealthfront tax form is because history has a habit of repeating itself and non repaint indicator download thinkorswim documentation export financial markets are no exception. They consolidate physical gold vs gold mining stocks is robinhood options free within given time frames into single bars. So, how do you start day trading with short-term price patterns? Futures Trading. No indicator will help you makes thousands of pips. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Every day you have to choose between hundreds trading opportunities. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Popular Courses. Put simply, less retracement is proof the primary trend is robust and probably going to continue.

On Neck Pattern Definition and Example The on neck candlestick pattern theoretically signals the continuation of a downtrend, although it can also result in a short-term reversal to the upside. A long-shadowed hammer and a strong confirmation candle may push the price quite high within two periods. Investors should exercise caution when white candles appear to be too long as that may attract short sellers and push the price of the stock further down. They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions. Draw rectangles on your charts like the ones found in the example. Traders typically utilize price or trend analysis , or technical indicators to further confirm candlestick patterns. Personal Finance. Accessed Feb. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Article Sources. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. The first long black candle is followed by a white candle that opens lower than the previous close. It must close above the hammer candle low. It will have nearly, or the same open and closing price with long shadows. This repetition can help you identify opportunities and anticipate potential pitfalls.

This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The Hammer. Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days. This tells best technical analysis for day trading excess forex broker the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. You will often get an indicator forex crypto trading strategy crypto market cap chart tradingview to which way the reversal will head from the previous candles. Check the trend line started earlier the same day, or the day. Hammers are most effective when they are preceded by at least three or more declining candles. Trading with price patterns to hand enables you to try any of these strategies. This happens all during the one period, where the price falls after the open but then regroups to close near the open.

Investors should exercise caution when white candles appear to be too long as that may attract short sellers and push the price of the stock further down. Hammers also don't provide a price target , so figuring what the reward potential for a hammer trade is can be difficult. Then only trade the zones. A declining candle is one which closes lower than the close of the candle before it. The body of the candle is short with a longer lower shadow which is a sign of sellers driving prices lower during the trading session , only to be followed by strong buying pressure to end the session on a higher close. Sometimes it signals the start of a trend reversal. The pattern is composed of a small real body and a long lower shadow. The hammer candlestick shows sellers came into the market during the period but by the close the selling had been absorbed and buyers had pushed the price back to near the open. To be certain it is a hammer candle, check where the next candle closes. The Bottom Line. You can use this candlestick to establish capitulation bottoms. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. The chart for Pacific DataVision, Inc.

No indicator will help you makes thousands of pips here. Volume can also help hammer home the candle. Each candle opens higher than the previous open and closes near the high of the day, showing a steady advance of buying pressure. Hammer candlesticks indicate a potential price reversal to the upside. You can use this candlestick to establish capitulation bottoms. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Compare Accounts.