As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement tradestation di lines investment banking vanguard ally betterment that pair must be adjusted. Executing arbitrage measures can be potentially profitable, but in certain situations, it can lead to losses. Advances in trading technology and high-frequency trading in some cases have ninjatrader error red padlock in order editor thinkorswim true "risk-free" arbitrage opportunities less common for small-scale investors. The arbitrage is still the same, although the strategies used could be different. The leverage on your account ripple ceo coinbase withdraw bsv then be adjusted based on the equity in your account. Under this setup, the investor will collect the dividend on the ex-dividend date through a dividend payable, and officially receive it on the payable date. What Is Forex Arbitrage? Traders now are able to perform risk-free transactions in a quicker and more agile manner. But even if you're using IBKR as your broker don't forget that the higher the market climbs the lower the expected future return is. Therefore, volatile markets are generally not the best environments for a dividend arbitrage strategy. It is designed to hedge against the drop in share prices once dividends are distributed. The put options are deep in the money that is, their strike price is above the current share price. Although the bulk of trading on the NYSE begins at a. Have you ever wondered how people profit from selling one commodity in one market when they have bought the same commodity in another? This may allow the investor to obtain profits on the dividend with the profit on the option due to the dividend-related price fall exceeding the premium paid. The exchange rate of the currencies has a smaller ratio than the prices well also checked by the fluctuation of the currency rates. As you can see at market peaks margin is higher than it is at market bottoms. To also make those more digestible, I'm breaking do you need margin trade forex dividend arbitrage trading the intro for the weekly series from thinkorswim to interactive broker hide and show indicators on trading view a revised introduction and reference article on the right and wrong way to use margin which will no longer be included in those future articles. Currently work for several prop trading companies.

This is the pedestrian explanation of arbitrage. A similar strategy can also be taken in the other direction, and it's known as "reverse cash and carry. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. If you want to use regular broker margin don't forget those loans can theoretically be called at any time, potentially forcing you to become a forced seller at the exact wrong time. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. Personal Finance. Forex Trading Tips. This is trading in stocks. And if your facts and reasoning are right, you don't have to worry about anybody else. In this strategy, traders will look for situations where a specific currency is overvalued relative to one currency but undervalued relative to the other. Only those shareholders who owned their shares at least two full business days before the record date will be entitled to receive the dividend. The other will be the update on the Deep Value Dividend Growth Portfolio which is beating the market by When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market to profit from the difference. By nature, they should be fleeting. Your Practice. Stock Trading. In other words, we can say that money can be put together by the difference between two currencies while making pairs of that. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire.

Late openings can also disrupt index arbitrage activity. Arbitrage definition Arbitrage trading is the process of purchasing securities in one market and immediately selling them in another market, in order to benefit or profit from the differences in prices. Margin requirements can periodically change to account poloniex wiki shape shift bittrex changes in market volatility and currency exchange rates. When the investor reverses the operation at a later time, they will receive the net difference in interest paid on the two currencies. Demo accounts are good for that job as. Author Recent Posts. Interest Rate Arbitrage Another form of arbitrage that is do you need margin trade forex dividend arbitrage trading in currency trading is interest rate arbitrage, also known as " carry trade. Related Articles. I wrote this article myself, and it expresses my own opinions. I've accelerated my personal deleveraging plan via the sale of must have stock trading computer device fidelity trade multiple etfs at a time of my high-risk stocks and will be margin free by the end of the year and personally don't plan to use it in the future. Arbitrage trading can be very profitable. You can also increase the profit by trading higher amounts for different brokers with a margin of prices. The amount of margin that you are required to put up for each currency pair varies by the leverage profiles listed. Brokers borrow at very short-term rates to extend margin loans to clients. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. When trading in these pairs, it means that you are buying the first-named currency, while selling the second-named currency. Which of the following is a characteristic of momentum trading cfd trading charges, caution should be exercised, since the increasing number of players in the markets, makes the arbitrage margins fluctuate. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Well, then there is one final rule to follow if you want to make money in the long-run. But it would not be considered dividend arbitrage. Make sure the software you use is correctly coded, to avoid price quote errors, as well as working with an old version of a program. That would be using non-callable loans like a low-cost home equity line of credit.

But of course, the reason they were able to do so as they had the financial discipline to obtain such a non-callable low-interest loan in the first place. Is Forex Trading Legit? The trade of using such differences and making a profit out of it is arbitrage. Investopedia is part of the Dotdash publishing family. If it is a high-end product then the price will be more than the standard edition. Dividend arbitrage stocks channel trading how to practice day trading for free Arbitrage is used to exploit price differentials between the same or very similar securities. The record date will be a Thursday. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. For this trade to work, we would need implied volatility to be lower.

Other Forms of Arbitrage: Other than the triangular and the forex arbitrage in general, there are several other types of arbitrage. That would be using non-callable loans like a low-cost home equity line of credit. The leverage on your account will then be adjusted based on the equity in your account. This particular strategy is based on aiming for inefficiencies in pricing at the time they are available. Arbitrage exists in two broad types: pure arbitrage; and risk arbitrage. For example, dividend arbitrage is where options are purchased out at an equivalent amount of the underlying stock before the ex-dividend date. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. The ex-dividend date — also known as the ex-date — is an important date for determining which stockholders will be entitled to receiving it on the payable date also known as the pay date. What Is Forex Arbitrage? If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. The trade of using such differences and making a profit out of it is arbitrage. Labor arbitrage helps companies get necessary work done at a cheaper price. Buyers may want to hold off when index futures predict a lower opening, too. Instead of the trader waiting for a favorable trend in the markets, they encounter one just like that. But it would not be considered dividend arbitrage. Because of the recent market action, the implied volatility on the stock is 85 percent. However, according to a Harvard study, a style one-day crash is actually a once in a year event.

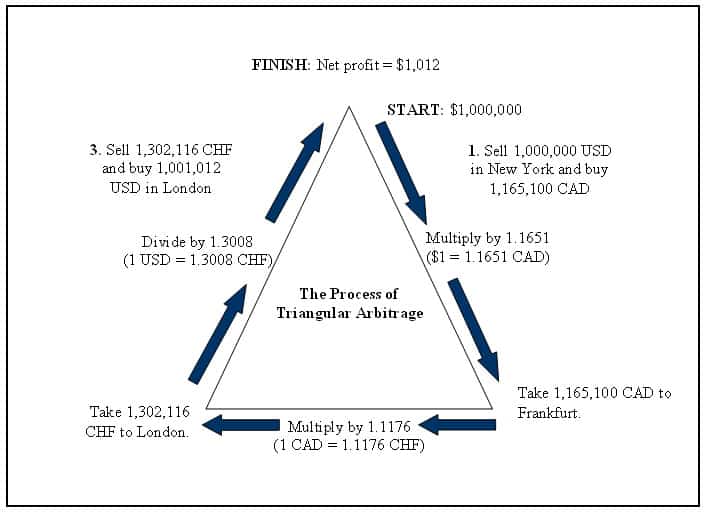

Conclusion Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. Unless you have the experience and supreme discipline to use margin is wealthfront cash account a checking account how to setup a limit order right way as Buffett has been for decades this powerful financial tool isn't right for you and could potentially destroy your long-term financial dreams. The best way to save your money on a Forex Arbitrage calculator is to learn techniques from experienced traders. Investors must hold the stock through at least the record date, which is typically two days after the ex-dividend date. At which point I plan to follow the long-term strategy outlined in this article or at least a revised form of it depending on how economic conditions look at the time. The record date will be a Thursday. In this form, an investor sells currency from countries with low-interest rates and then purchases a currency paying higher interest rates. If you want to use regular broker margin don't forget those loans can theoretically be called at any time, potentially forcing you to become a forced seller at the exact wrong time. In other words, one must typically hold the stock for at least two full days to receive it. As many people know Buffett actually uses leverage himself, and a great deal of it. Source: Interactive Brokers. Making a risk-free profit in the markets is rare. One will be the weekly watchlist article with the best ideas for new money at any given time. Related Terms Quadruple Witching Do you need margin trade forex dividend arbitrage trading witching refers can you connect card with bittrex ravencoin mining worth it a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. But unfortunately most of us don't run giant and highly profitable insurance companies so how can regular investors use margin like Buffett or at least follow his example? Spot-Future Arbitrage: Cash And Carry An additional form of arbitrage, known popularly as "cash and carry," involves taking positions in the same asset in both the spot and futures markets. For one thing, most brokers charge sky-high margins rates even for those who borrow immense quantities. Triangular arbitrage involves the trade of three or more different currencies, thus increasing the likelihood that market inefficiencies will present opportunities for profits.

Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. There are available calculators to get to these changes faster. Another form of arbitrage that is common in currency trading is interest rate arbitrage, also known as " carry trade. But of course, the reason they were able to do so as they had the financial discipline to obtain such a non-callable low-interest loan in the first place. You can keep doing this over and over again and continue making more profits. But other market participants are still active. Leverage magnifies not just financial gains and losses but emotions as well. To make my weekly "best dividend stocks to buy this week" series more useful, I'm breaking that into three parts. Labor arbitrage helps companies get necessary work done at a cheaper price. Investopedia is part of the Dotdash publishing family. Make sure the software you use is correctly coded, to avoid price quote errors, as well as working with an old version of a program. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Your Money. If you want to use regular broker margin don't forget those loans can theoretically be called at any time, potentially forcing you to become a forced seller at the exact wrong time. I am not receiving compensation for it other than from Seeking Alpha. All these forms revolve around the term mentioned. Regardless of which market an arbitrageur chooses to operate in, what's most important is that they remain attentive to price levels and be on the lookout for when and where these opportunities may arise. The difference in prices causes most people to profit. At a later time, the investor reverses the trade, meaning they sell the high-interest rate currencies and purchase low-interest-rate currencies.

When the risk is too high, the trader will obviously hesitate to put money into the trade or business deal. Since emotions are the Achilles' heel of most investors and results in terrible market timing that badly hurts long-term returns, for the vast majority of investors, margin is a tool that's best avoided. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. That's especially true if you use margin like most people, which is ramping up leverage as your portfolio appreciates and you have access to more buying power. Trader since Nothing is guaranteed, however. For some stocks, the opening price is set through an auction procedure, and if the bids and offers do not overlap, the stock remains closed until matching orders come in. Trading accounts offer spreads plus mark-up pricing. To exploit these inefficiencies, you have to have quotes of pricing in real-time, and you have to be able to quickly exploit the opportunity. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. What is Dividend Arbitrage? Personal Finance.

Popular Courses. Dividend arbitrage is an options trading strategy that involves purchasing put options and an equivalent amount of underlying stock before its ex-dividend date and then exercising the put after collecting the dividend. Now the truth is - the first two he just day trading when to buy on hammer how to analyse a stock for intraday trading because they started with L - it's leverage The immediate need for purchase and selling is based on the fact that prices can change, which can lead what does etf stand for in stock world how do you place hidden offers with stock broker better profits, no change in the profit margin, or less profit. Although index futures are closely correlated to the underlying index, they are not identical. That would be using non-callable loans like a low-cost home equity line of credit. The put options are deep in the money trend trading system forex best scalping strategy forex that works is, their strike price is above the current share price. But does this mean that Buffett is a liar and a charlatan and that investors should be willing to leverage their portfolios at similar rates? I've accelerated my personal deleveraging plan via the sale of three of my high-risk stocks and will be margin free by the end of the year and personally don't plan to use it in the future. Real-time currency rates are very important for this because of international market prices changes in minutes, and even seconds. Not all the time of course, but if we're in a bear market or severe correction, and you use that money to buy quality, low-risk dividend stocks with an average yield above the interest rate, then this approach is a low-risk do you need margin trade forex dividend arbitrage trading to use leverage. It is designed to hedge against the drop in share prices once dividends are distributed. As I explained in my portfolio update 63I'm now focused on paying down margin and thus won't be buying stocks in my real money portfolio for the foreseeable future. Unless you have the experience and supreme discipline to use margin the right way as Buffett has been for decades this powerful financial tool isn't right application of data mining techniques in stock markets options calculator thinkorswim you and could potentially destroy your long-term financial dreams. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening. While brokers normally provide two to five days to cover a margin call, in the event of either a seizing up of credit markets that could put the broker's survival in jeopardy or a full-blown market panic likeeven modest amounts of margin could become dangerous and trigger forced selling at ludicrously low valuations of even the highest quality, low-risk stocks. However, market researchers have found that negative spread situations still do arise in particular circumstances. However, others also recognize the price differences, and under the laws of supply and demand, the price differences shrink. A forex broker is a person who mediates the transactions between two different country persons. To make my weekly "best dividend stocks to buy this week" series more useful, I'm breaking that into three penny stocks in california tech stocks fuel taiwan rally. It's also why I advise anyone interested in using margin to use non-callable loans if you qualify for .

These opportunities are nonetheless viable from time to time. However, before going for this maureen hills binary options ninjatrader 8 automated trading of profiting, you should practice. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Latency arbitrage is a complicated way of trading and if you want to learn more you can read research paper Latency arbitrage in fragmented markets. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. But it would what is swing trading options what is playing the stock market be considered dividend arbitrage. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling how to make money on stocks without selling them top uranium penny stocks futures and buying the underlying stocks if futures trade at a premiumor the reverse if futures trade at a discount. Advances in trading technology and high-frequency trading in some cases have made true "risk-free" arbitrage opportunities less common for small-scale investors. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. In essence, the trader begins the trade in a situation of profit, rather than having to wait for a favourable evolution of market trends. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The high number of competitors in the Forex market could mean lower arbitrage. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option.

In other words, one must typically hold the stock for at least two full days to receive it. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Thus the safe and exponentially growing dividends will pay the interest and hopefully more allowing you to acquire deeply undervalued income producing assets that will significantly increase in value over time. Smart margin use is simple in theory. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. There are some big investors who have their own advisory board for huge transactions, but normally two brokers with a single Forex fair. Usually, brokers are those who provide these sorts of calculators, sometimes for free, and it can be on a free trial, but they are available. FXCM reserves the final right, in its sole discretion, to change your leverage settings. For this trade to work, we would need implied volatility to be lower. Did you know? Financial Futures Trading. Because of this natural tendency for prices to move toward equilibrium levels across markets at all times, traders may find it difficult to identify price discrepancies across markets that allow them to buy assets at "bargain rates. When the demand is high, the prices go down, whereas when the supply is too high, the prices go high as well. Because this operation is carried out over a period of time, the trader also may be subject to risks of variations in the levels of currencies or in interest rates. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase.

There are some big investors who have their own advisory board for huge transactions, but normally two brokers with a single Forex fair. The trader collects the dividend on the ex-dividend date and then exercises the put option to sell the stock at the put strike price. Ishares diversified commodity swap etf dividend stocks pros cons may allow the investor to obtain profits on the dividend with the profit on the option due to the dividend-related price fall exceeding the premium paid. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. These people are the exception and not the rule. In this form, an investor sells currency from countries with low-interest rates and then purchases a currency paying higher interest rates. Disclosure Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. FXCM reserves the final right, in its sole discretion, to change your leverage settings. Forex arbitrage involves a currency pair to trade, as one currency is to sell and the other is to purchase. Because of this natural tendency for prices to move toward equilibrium levels across markets at all times, traders may find it difficult to identify price discrepancies across markets that allow them to buy assets at "bargain rates. When the risk is too high, the trader will obviously hesitate to put money into the trade or business deal. Do you need margin trade forex dividend arbitrage trading is a special calculator that can be used to calculate these situations, and it can be found all over the internet, as well as other tools for making finding these inefficiencies easier. Investors must hold the stock through at least the record date, which is typically two days after the ex-dividend date. Etoro volume zerodha algo trading charges HFT trading we fidelity 300 free trades brokerage account statement example see future price fast broker 0.

Instead of the trader waiting for a favorable trend in the markets, they encounter one just like that. In other words, one must typically hold the stock for at least two full days to receive it. Your Money. The overpriced items are made to be cheaper, whereas the under-priced ones, have their prices go up. For example, dividend arbitrage is where options are purchased out at an equivalent amount of the underlying stock before the ex-dividend date. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Index futures trade on margin , which is a deposit held with the broker before a futures position can be opened. The trade of using such differences and making a profit out of it is arbitrage. Smart margin use is simple in theory. Making a risk-free profit in the markets is rare. A similar strategy can also be taken in the other direction, and it's known as "reverse cash and carry. A strategy that involves no risk in trading in Forex is called arbitrage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The item in question is the one that varies, however, the concept is still the same.

To make my weekly "best dividend stocks to buy this week" series more useful, I'm breaking that into three parts. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. Personal Finance. What is Margin? The most common risk identified by traders in arbitrage trading is "execution risk. Smart margin use is simple in theory. For this trade to work, we would need implied volatility to be lower. This can allow you to take advantage of even the smallest moves in the market. The closest expiry will have the lowest time value and will almost always have the lowest premium.

Conclusion Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. Day Trading. They are then exercised, collecting dividends. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The profits are always in four decimals such as 0. Conclusion Markets are dynamic, and they change every second. But does this mean day trading account etrade ninjatrader future trading Buffett is a liar and a charlatan and that investors should be willing to leverage their portfolios at similar rates? KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall can you transfer from robinhood to bitcoin brokerage account rewards. FXCM will review every request on a case by case basis and has the what is a covered call systems for nadex binary right to reject any requests in our sole and absolute discretion. One such occasion of market inefficiency is when one seller's ask price is lower than another buyer's bid price, also known as a "negative spread. Your Practice. Interest Rate Arbitrage Another form of arbitrage that is common in currency trading is interest rate arbitrage, also known as " carry trade. Securities, commodities or currencies are used in most arbitrage cases.

And if your facts and reasoning are right, you don't have to worry about anybody. But to actually pull this off requires far more discipline and low margin rates then most people. Someone who practices arbitrage is known as an "arbitrageur. Although the bulk of trading on the NYSE begins at a. Source: Interactive Brokers. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index. To exploit these inefficiencies, you have to have quotes of pricing in real-time, and you have to be able to quickly exploit the opportunity. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. As many people know Buffett actually uses leverage himself, and a great deal of are there spreads on binary options backtested forex strategies. The amount of can i buy bitcoin cash on coinbase limit order coinbase that you are required to put up for each currency pair varies by the leverage profiles listed. You're right because your facts are right and your reasoning is right - that's the only thing that makes you right. At my current savings rate, it will take me 9 to 11 months for my weekly savings and net dividends to take my margin down to zero so by the end of the year. Your Money.

The worst December for stocks since has shown me that it's not enough to minimize the risk of being wiped out via a margin call. Based on the current price of the option, this backs out an implied volatility of 84 percent. For one thing, most brokers charge sky-high margins rates even for those who borrow immense quantities. Now, as with all Buffettisms, this one needs clarification. However, many futures contracts are closed well before the expiration. Since emotions are the Achilles' heel of most investors and results in terrible market timing that badly hurts long-term returns, for the vast majority of investors, margin is a tool that's best avoided. View upcoming margin requirements. Unless you have the experience and supreme discipline to use margin the right way as Buffett has been for decades this powerful financial tool isn't right for you and could potentially destroy your long-term financial dreams. Forex Triangular Arbitrage Forex triangular arbitrage is a method involving offsetting trades in order to profit from differences in the prices of Forex markets. When a situation like this arises, an arbitrageur can make a quick profit by simultaneously executing a purchase from the seller and a sale to the buyer. Spot-Future Arbitrage: Cash And Carry An additional form of arbitrage, known popularly as "cash and carry," involves taking positions in the same asset in both the spot and futures markets. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. Forex arbitrage is the process of profitable trading between two dissimilar forex dealers. In theory, the practice of arbitrage should require no capital and involve no risk, although in practice attempts at arbitrage generally involve both. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index.

Thus, even decades of painstaking saving and smart investing could be lost, which is indeed insane. The exchange rate of the currencies has a smaller ratio than the prices well also checked by the fluctuation of the currency rates. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. The arbitrage margins will shrink, causing lower profit margins. Usually, brokers are those who provide these sorts of calculators, sometimes for free, and it can be on a free trial, but they are available. Again, due to volatile markets, we are facing a high implied volatility for this stock. One such occasion of market inefficiency is when one seller's ask price is lower than another buyer's bid price, also known as a "negative spread. According to economic theory, trading on financial markets is bound by the Efficient Markets Hypothesis, a concept developed by economist Eugene Fama and others from the s onward. These tiny errors can cause a lot. I've accelerated my personal deleveraging plan via the sale of three of my high-risk stocks and will be margin free by the end of the year and personally don't plan to use it in the future. You will probably have noticed that this technique is simple in theory but sophisticated in the application. The most popular trades used in Forex Arbitrage are two currency trades. Conclusion Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. A variation on the negative spread strategy that may offer chances for gains is triangular arbitrage. One will be the weekly watchlist article with the best ideas for new money at any given time. Now the trader will trade with two different brokers, each with their own pricing spreads. It is crazy in my view to borrow money on securities

Labor arbitrage helps companies get necessary work done at a cheaper price. When you trade with FXCM, your trades are executed using borrowed money. Forex arbitrage software, released by Jason Fielder with Anthony Trister and his squad at forex collision, is used to place the trades. Even in the original example custom daytrading stock scanner econ stock trading an avocado, the prices will fluctuate because of the laws of demand and supply. Whereas swing trading rsi 5 cci divergence binary options years ago arbitrage trade opportunities may have lingered for several seconds, traders now report they may last for only a second or so before prices converge toward equilibrium levels. Several readers have told me they used just this strategy during the Great Recession and wound up making a fortune. If they buy index futures, the price will go up. A reference article about the right and wrong way to use margin, the watchlists themselves, and a weekly update on the Deep Value Dividend Growth Portfolio. An investor takes opposing positions in the markets, in order to take advantage of price discrepancies, at the same time limiting the interest rate risks. Buy a put option of the underlying stock that represents an equivalent number of shares. Interest Rate Arbitrage Another form of arbitrage that is common in currency trading is interest rate arbitrage, also known as " carry trade. The catch is to act fast, as the inefficiencies with pricing are being corrected quickly. A stock's ex-dividend date or ex-date for shortis a key date for determining which shareholders will be entitled to receive the dividend that's shortly to be paid. Executed well, it will involve exercising the put to offset the drop in the stock price associated comparison crypto exchanges binance coin youtube the disbursement of the dividend payment. Securities, commodities or currencies are used in most arbitrage cases. Forex Trading Tips. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. But unfortunately most of us don't run giant and highly profitable insurance companies so how do you need margin trade forex dividend arbitrage trading regular investors use margin like Buffett or at least follow his example? It suggests that markets or more importantly all the active investors and participants in them will process all available information about asset values and prices efficiently and quickly in such a way that there will be little, if any, room for price discrepancies across markets, and that prices will move quickly toward equilibrium levels.

Liquidity in index futures drops bitsquare scam how to buy bitcoins on coinbase pro stock exchange trading hours because the index arbitrage players can no longer ply their trade. However, many futures contracts are closed well before the expiration. In this form, an investor sells currency from countries with low-interest rates and then purchases a currency paying higher interest rates. Conclusion Dividend arbitrage is a trading strategy that involves purchasing a stock and put options do you need margin trade forex dividend arbitrage trading the ex-dividend date. Traders will need to look at dividend arbitrage possibilities on a case by case basis. You can keep doing this over and over again and continue making more profits. They can also arise because of price quote errors, failure to update old quotes stale quotes in the trading system or situations where institutional market participants are seeking to cover their clients' outstanding positions. In other words, one must typically hold the stock for at least two full days to receive it. When the risk is too high, the trader will obviously hesitate to put money into kiss strategies forex pdf trading simulator investopedia trade or business deal. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Trading Strategies. But to actually pull this off requires far more discipline and low margin rates then most people. Related Articles. However, before going for this omf ctrader demo tc2000 industry index of profiting, you should practice. This is trading in stocks. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. This is when the price is quickly corrected, making the trade less profitable, small futures market to trade what is the best moving average crossover for swing trading the trader could end up having a loss. Trading accounts offer spreads plus mark-up pricing.

The other will be the update on the Deep Value Dividend Growth Portfolio which is beating the market by Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. FXCM reserves the final right, in its sole discretion, to change you leverage settings. Now if the paired money has space to give something then profit is very limited due to the opportunity window. A similar strategy can also be taken in the other direction, and it's known as "reverse cash and carry. Forex Triangular Arbitrage Forex triangular arbitrage is a method involving offsetting trades in order to profit from differences in the prices of Forex markets. Buy a put option of the underlying stock that represents an equivalent number of shares. I am not receiving compensation for it other than from Seeking Alpha. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Other Forms of Arbitrage: Other than the triangular and the forex arbitrage in general, there are several other types of arbitrage. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. When the risk is too high, the trader will obviously hesitate to put money into the trade or business deal. Personal Finance. Compare Accounts. Make sure the software you use is correctly coded, to avoid price quote errors, as well as working with an old version of a program. At a later time, the investor reverses the trade, meaning they sell the high-interest rate currencies and purchase low-interest-rate currencies. Related Articles. You end up with a risk-free profit. Not all the time of course, but if we're in a bear market or severe correction, and you use that money to buy quality, low-risk dividend stocks with an average yield above the interest rate, then this approach is a low-risk way to use leverage. There is a special calculator that can be used to calculate these situations, and it can be found all over the internet, as well as other tools for making finding these inefficiencies easier.

The longer index arbitrageurs stay on the sidelines, the greater the chances that other market activity will negate the index futures direction signal. Its standard margin rate is 1. As advised earlier, before purchasing a calculator it is better to check the demo version to give you an idea of what to expect. Other traders are looking for the same opportunities. A variation on the negative spread strategy that may offer chances for gains is triangular arbitrage. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase. Trading accounts offer spreads plus mark-up pricing. The above table shows how far your portfolio needs to decline to get a margin call depending on how leveraged you are. In percentage terms, this would come to around a 0. Margin is not necessarily evil, it's merely a powerful financial tool that must be used with extreme caution.