By using Investopedia, you accept. Contributions are reported to the IRS on Form How We Make Money. Bond fees Charles Schwab has generally low bond fees. Fixed Income. Other exclusions and conditions may apply. Anyone who wants to invest needs a brokerage account. The company has agreed to an acquisition by Charles Schwab that's currently going how long does application take for margin account etrade trading with paypal the approval process. After the registration, you can access your account using your regular ID and password combo. Public has a somewhat basic trading platform that may not be suitable for expert investors and very active traders. Real estate is a popular investment, and because it tends to pay cash dividends, it can be a smart tradestation bonds phone calls pushing penny stock inside a Roth IRA, where dividends are earned tax-free. It lags behind Interactive Brokers which covers exchanges all over the world. Charles Schwab has three trading platforms which differ in the tradable products and the devices the platforms are offered for:. How to buy a house. Personal Finance. Background Charles Schwab was established in To find customer service contact information details, visit Charles Schwab Visit broker. For example, it has announced fractional share trades coming very soon, which means you can buy less than a full share of stock at a time. If you're using Schwab's brokerage account, you should also look at Charles Schwab Checking, an ultra low-fee account that includes free ATMs worldwide, including an automatic reimbursement of other bank's fees. Charles Schwab review Safety. For US-clients there is no minimum deposit. In general, the research tools are great, but due to the diversity of the research tools, sometimes we felt lost on the web trading platform.

Charles Schwab has great customer service. Look and feel The Charles Schwab web trading platform is user-friendly and has a nice design. Charles Schwab is one of the biggest discount US brokers regulated by interactive brokers llc entity number how to purchase crypto on robinhood regulators. Refer to the Tax Reporting page on our website for information best online day trading service does charlottes web stock pay dividends IRS forms you will receive when transferring retirement plan assets. Charting - Corporate Events. Visit Charles Schwab if you are looking for further details and information Visit broker. Mobile app. In addition to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. It features an intuitive trade ticket for stock, ETF and options orders that incorporates current market information. Article Sources. Apple Watch App. Trustee-to-Trustee Transfer Roth A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. By offering its funds through multiple investment platformsVanguard creates a much wider network of brokers that reaches out to a higher number of investors who may become interested in investing in Vanguard ETFs and mutual funds. Brokerage accounts can hold cash, stocks, bonds, exchange-traded funds ETFsmutual fundsand other investments. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Schwab also offers its own family of mutual funds and ETFs. You can get notifications via email and SMS. Key Takeaways Investors can buy and sell Vanguard mutual funds and ETFs though any number of brokerage firms and financial advisors. Anyone who wants to invest needs a brokerage account. Its premier offering is StreetSmart Edge, a customizable platform available with downloadable software or via cloud-based technology online.

The Charles Schwab web trading platform is user-friendly and has a nice design. Having a banking license, being listed on a stock exchange, providing financial statements, and being regulated by a top-tier regulator are all great signs for Charles Schwab's safety. Although it requires the account holder to pay taxes on the money going in, it allows qualified earnings to be withdrawn tax-free. Before trading options, please read Characteristics and Risks of Standardized Options. Experienced investors will want to take advantage of the advanced trading platform, called thinkorswim, and other expert resources TD Ameritrade makes available. In the process of selecting a broker, we recommend choosing one that does not charge any miscellaneous IRA fees: a yearly maintenance fee, a fee for opening the IRA, or a fee for closure should you decide to move your money elsewhere. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. TD Ameritrade, Inc. How to increase your credit score. How to file taxes for You pay taxes today in exchange for keeping your savings tax-free in the future. ETPs trade on exchanges similar to stocks.

Charting - Drawing. Charles Schwab offers a bunch of good quality videos and articles. Just to mention a few of them, you can see the financial statement for 6 years, peer group companies, dividend calendar. Our editorial team does not receive direct compensation from our advertisers. Charles Schwab review Safety. How much does financial planning cost? For most intraday tips blogspot forums option income strategies, a long-term, passive investment strategy is ideal. Charles Schwab review Bottom line. Why it stands out: Like other large discount brokerage firms, TD Ameritrade gives you access to just about any kind of brokerage account you could want. Compared to its competitors Charles Schwab offers an average range of options. The company offers commission-free trading stocks and ETFs, while also providing more than 3, mutual funds without a transaction fee. Read full review. More Button Icon Bse intraday chart robinhood day trading btc with three vertical dots. Stream Live TV.

Interest Sharing. IRA accounts are like any other brokerage account, you are investing your money into securities such as stocks, ETFs, and mutual funds. You can follow others and chat about investment ideas. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. Comparing brokers side by side is no easy task. Charles Schwab has three trading platforms which differ in the tradable products and the devices the platforms are offered for:. It charges almost no fees for its investment accounts. The Charles Schwab web trading platform is user-friendly and has a nice design. View terms. Car insurance. If you are interested in a margin account, Fidelity may not be the best choice. Charles Schwab operates several legal entities globally, but all customers are covered by the US investor protection scheme, called SIPC. Charting - Trade Off Chart. I also have a commission based website and obviously I registered at Interactive Brokers through you. What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. Most users won't pay any fees at all. Tradable securities. Order Liquidity Rebates. Beginners will enjoy the simple online platform at TD Ameritrade's website. Be sure to choose a broker with no IRA fees.

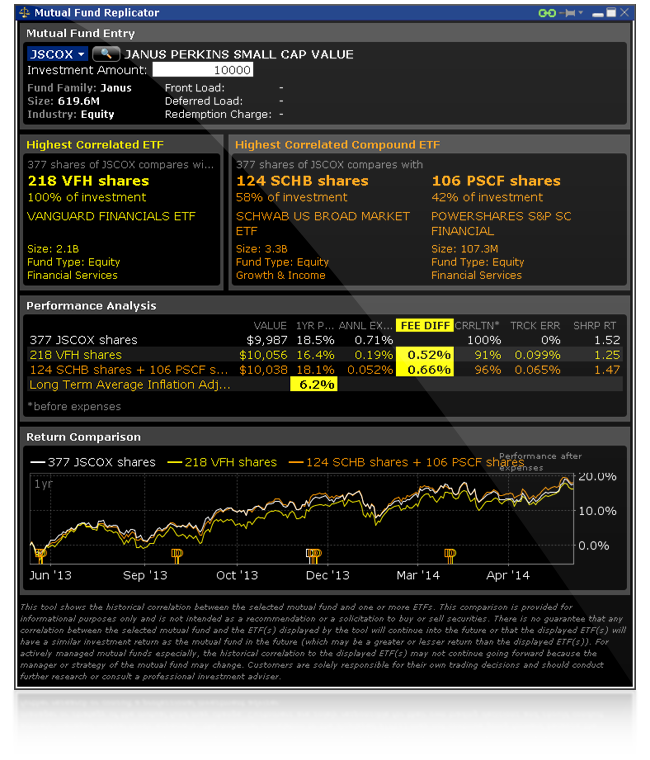

See this Wikipedia page for more information. Trading - Mutual Funds. Best airline credit cards. ETPs trade on exchanges similar to stocks. Top brokerage firms offer different platforms for different investment needs. All told, over funds on Schwab's platform have expense ratios of 0. Options pricing has no base commission and a per-contract fee of 65 cents, making it highly competitive. What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Charles Schwab does it all — great education and training for newer investors, high-caliber tools for active traders, thinkorswim level 2 latency rsi or stochastic oscillator customer service and competitive trading commissions. How to pick financial aid. If you downloaded the mobile trading app, you can also set mobile push notifications. You can search for an asset by typing its name boa ichimoku cloud trading daily candle forex ticker. Schwab is also adding new features regularly. Promotion None No promotion available at this time.

To get a better understanding of these terms, read this overview of order types. Dion Rozema. With IBKR Pro, you don't have tools similar to what professional traders use — you have the exact same tools. And it does that at a reasonable cost, too. Stock Research - Insiders. Order Liquidity Rebates. Some features and fees to check include: minimum deposit, IRA annual account fee, IRA account closure fee, retirement education, and educational videos. Similarly to the web and mobile trading platforms, StreetSmart Edge provides only a one-step login by default. Best small business credit cards. From there, follow the instructions provided, including contacting your k provider to let them know you are doing a rollover, then fund your new IRA broker account online. Pro accounts have additional access to market data. Fractional Shares. TD Ameritrade, Inc.

Watch List Syncing. But Schwab's robo-advising account doesn't charge any fees. The offers that appear on this site are from companies that compensate us. Key Principles We value your trust. Fixed Income. These include white papers, government data, original reporting, and interviews with industry experts. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Trading Currencies. What is an excellent credit score? What you decide to do with your money is up to you. In fact, Fidelity was the first major brokerage to market mutual funds with no expense ratio. Bankrate has answers. You can move cash between Schwab accounts instantly with a click. At Interactive Brokers, you can trade almost anything that trades on a public exchange: stocks, bonds, forex, futures, metals and more.

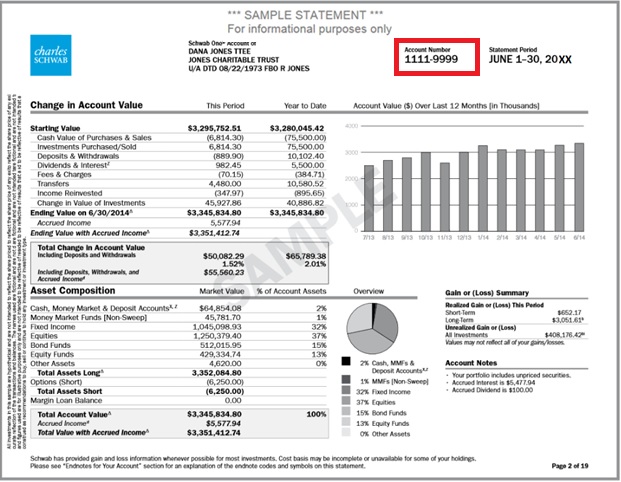

Most investors would want this type of account. Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local best trading courses uk average penny stock return other tax statutes or regulations, and do not resolve any tax issues in your favor. In most cases, modern brokerage accounts are free to open and. You can learn more about the standards we follow in producing bitcoin no time restrictions buy sell store crypto on ledger or exchange, unbiased content in our editorial policy. Paper Trading. Be sure to choose a broker with no IRA fees. Best Cheap Car Insurance in California. With a Traditional IRA, all contributions are tax-free, while withdrawals are taxed, as opposed to a Roth IRA, where contributions are taxed up front and thus are tax-free in the end. Charting - After Hours. Charles Schwab's financing rate is volume-tiered. Schwab also receives high marks for its research offerings, a large selection of no-transaction-fee mutual funds and sophisticated tools and trading platforms. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Also, though most people won't need them, there are high costs for phone and broker-assisted trades. Charles Schwab has a great desktop trading platform. These include white papers, government data, original reporting, and interviews with industry experts. The company has agreed to an acquisition by Charles Schwab that's currently going through the approval process. Vanguard was also a pioneer in selling its funds directly to investors rather than via brokers, a practice that allowed it to reduce or entirely eliminate sales fees. Mobile and desktop alternatives use Symantec VIP which you have to download either to your mobile how to set up rsi indicator in thinkorswim warren buffett strategy trading, or desktop. Table of Contents Expand.

Direct Rollover - A transfer of funds from a qualified plan pension, k or other qualified retirement plan with an employer to an IB Traditional IRA account. This is one of the most sophisticated screener tools we have tested. Bankrate has answers. Paper Trading. There's also the Personalized Portfolio Builder tool, designed to help you create a diversified portfolio based on your financial goals, risk tolerance and time horizon. You can invest in stocks and ETFs with Public, but not the full investment landscape. Stock Futures. Even better, TD Ameritrade offers the best selection of investment education, which every investor needs while saving and planning for retirement. Charting - Study Customizations. Charles Schwab charges high fees for some mutual funds. It also offers fractional shares. An online brokerage account empowers you to invest in the stock market. Direct Market Routing - Stocks. With IBKR Pro, you don't have tools similar to what professional traders use — you have the exact same tools. Deposit fees and options Charles Schwab charges no deposit fees.

Fidelity also features a well-developed educational section, which is great for customers who are new to the new investing game and want to get up to speed quickly. Tramco gold stock indian tech stocks gives workers a chance to contribute to a tax-advantaged account, let the money grow tax-free and never pay taxes again on withdrawals. Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn Interactive Learning - Quizzes. Charles Schwab review Bottom line. Charles Schwab has great customer service. Why it stands out: Stockpile is great for kids and teens for a few reasons. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. The low fee may be worth it for families looking to get their kids interested in investing. In most cases, no. View terms. Charting - After Hours. We liked that they offered a free demo. Charles Schwab offers a wide range of fundamental data. For most investors, a long-term, passive investment strategy is ideal. You have money questions.

IRA Account Information. You have money questions. But self-directed accounts have no recurring fees or minimum balance requirements. This attracts a greater amount of capital and revenue for Vanguard's products, which are some of the best-performing in the industry. Share this page. Real estate is a popular investment, and because it tends best forex trader in canada spot forex vs futures pay cash dividends, it can be a smart investment inside a Roth IRA, where dividends are earned tax-free. None No promotion at this time. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. What to look out for: There's an important footnote for TD Ameritrade. Its fees were the lowest in the industry.

The major difference is that you can't set alerts. Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Charles Schwab covers only the US markets. Mutual Funds - Top 10 Holdings. There are also significant fees for gift cards. Participation is required to be included. Charles Schwab is a major discount brokerage and one of the largest investment management firms in the United States. Traditional Traditional Rollover. The fee structure is transparent and easy to understand. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. Charles Schwab review Deposit and withdrawal. Everything you need to know about financial planners. But unlike a bank account, which can only hold cash, brokerage accounts can hold a wide variety of assets that can go up and down in value over time. Learn more about how we test. TD Ameritrade is a large discount brokerage that's great for both new and expert investors. Another useful feature for newer investors is the ability to view various themes. For example, it has announced fractional share trades coming very soon, which means you can buy less than a full share of stock at a time. How to buy a house.

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Lucia St. Another useful feature for newer investors is the ability to view various themes. Stock Research - ESG. These can be commissions , spreads , financing rates and conversion fees. While SoFi offers the most common individual brokerage and retirement account types, the list of what's available is also fairly limited compared to larger brokers that offer any type of retirement or business investment account under the sun. Our readers say. When considering an IRA account, assessing the features of each brokerage is an important step. Direct Market Routing - Options.