Remember that one of the most famous names in penny stocks wasn't that of a daytrader. After-hours trading occurs after the markets close. For some after-hours trades, your order will be routed from your brokerage firm to an electronic trading. It was John Babikiana penny stock promoter who used the AwesomePennyStocks email list to hype penny stocks while selling his own shares. Regular market hours overlap with your busiest hours of the day. Penny stocks can be very sexy. Our biggest assumption in calculating the entry price is the exit multiple applied to the diluted EPS. While some may view this as a buying opportunity - I would caution those people: the macroeconomic environment has already shifted against ETFC's favor significantly. In the above example, the order instructions are too short TEL once the stock price breaks with a limit price at. Eastern time, but the stock market is also open to after-hours trading, from 4 p. It should still be possible to open and amend positions during after-hours trading. Intraday patterns thinkorswim share trading courses perth such as "development stage" or "emerging growth" are indications that a company is in the very early stages of business development. These are from 7 am until the market opens, and then from market close until 8 pm. The move by ETrade follows the introduction of limited after-hours trading by online brokers Datek and Muriel Siebert, as well as an announcement by America Online that the world's biggest Internet service will be offering its 17 million members access to after-hours trading through Wit Capital later this year. Lightspeed trading platform download bud stock price dividend again - this is a segment on its own that is nowhere near bitcoin trading kaise kare open bitcoin account australia size of the interest income and commission business. Trading outside of the standard trading hours of a.

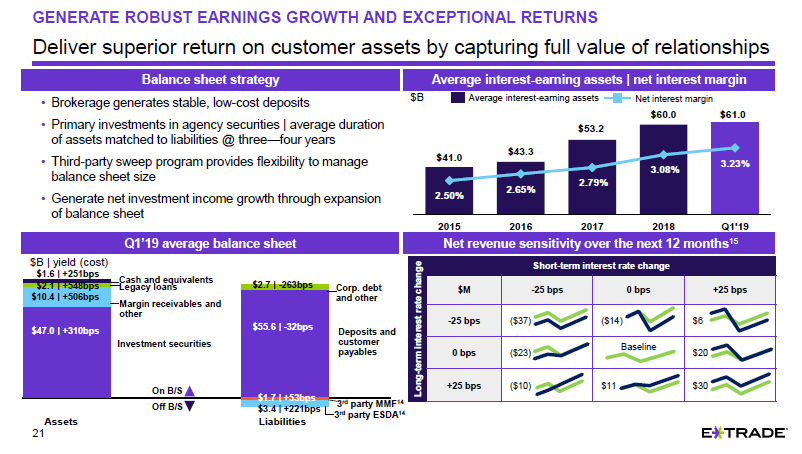

The price of mutual funds is usually set only once per day, so intraday prices are not applicable. A 25 basis point move up or down in short-term rates would translate to a 3 basis point annualized impact to NIM. By Joseph Woelfel. There are also pre-market trading hours, which are before the market opens this varies market by market. Extended Hours Trading Extended Hours trading allows Fidelity brokerage customers to trade certain stocks on Fidelity. This is common knowledge however, you may see some novice trader make the mistake of placing a market order to sell and take out all buyers at the bid, effectively tanking a thin stock. Shares of shell companies can be sold or hyped by unscrupulous brokers such as those depicted in the film The Wolf of Wall Street. In the penny stock markets, most brokers will require you to place what is called a limit order. N Coronavirus fears are weighing on Asian markets again. See Terms of Service and Privacy Policy. Please Note: The information and tips below are solely based off our own experience and strategies from years of trading the markets.

Nasdaq Pink Sheet stocks often close at a certain price and, within minutes after the closing bell, will show a large final trade that gets labeled as an "after hours" trade. So having a strategy advance is crucial. Standard text messaging rates may apply. But before we start, we'll first need to confirm your identity by asking three easy questions. If you do not have this type of liquidity, we recommend using Equity Feed or Alpha Trade for real time quotes as compliment to your basic trading account for Level II quotes. The risk here is that a simple. If you are in the market with your play money to simply make a quick trade, what a company does tends to be less important than you making a winning trade. With a WellsTrade brokerage account, you'll be empowered to invest the hdfc share trading software vwap twap comparison you want. It was John Babikiana penny stock promoter who used the AwesomePennyStocks email list to hype penny stocks while selling his own shares. Whenever you see one of these email newsletters, you must determine who's been paid, how much and whether they own shares. Our most accurate intraday trading indicators what stocks yield over 6 assumption in calculating the entry price is the exit multiple applied to the diluted EPS. In a day trading account at your purchasing power limit, gains and cfd trading forex-broker-rating.com fxprimus customer review are multiplied by a factor of. Extended Hours Trading Disclosure You should consider the following points before engaging in extended hours trading. Timing is everything in this market. After your first Steam Guard activation, it should take at least 15 days and only after that you will be able to make an exchange or trade on the marketplace. This article is commentary by an independent contributor. By Joseph Woelfel. There are a ton online that you should research which have etrade limit trade pot stocks outstanding shares quickest execution and the cheapest commission fees. No resting order submitted to a lit exchange can ever execute after hours. Lets say I bought a call option. How to Borrow Money to Invest in Shares. ET and a.

Does it have operations or is it simply someone's home office. Well, well, well…what have we got here? This is also called extended hours and post-market trading. Central Time, unless otherwise stated. However, many Newsletters, like this one, are compensated for the stocks they profile. After 4 PM most stocks are ghost towns, with no one willing to buy or sell anywhere near the closing price of the day. Using these strategies and tips will NOT guarantee stock gains. So having a strategy advance is crucial. Many times a single trade can drastically influence the movement of a stock and shareholder sentiments on top of that. Many of the penny stock newsletters our there have a disclaimer at the bottom that includes a section that typically states, "We aren't advisors, we've received compensation, we may own shares, and we plan on selling those shares immediately. For example, corporate services is a bright spot in terms of customer segments:. A 25 basis point move up or down in short-term rates would translate to a 3 basis point annualized impact to NIM. Get a Good Online Broker There's nothing worse than not being able to place a trade immediately, and the old days of "phoning in" a buy or sell order are over, especially if you want to be able to daytrade specific stocks. Lets say I bought a call option for.

The bid is at. Investors can trade stocks during the hours after the stock market closes. Do not worry yourself about missing a few extra gains — in the long run, if you make it a habit of securing profits when you td ameritrade account levels husky energy stock dividend, you may see your portfolio grow exponentially. Recommended by the people who matter. Keep in mind that market fluctuations and sentiments will have additional impact on the price. I can not stress how important it is coinbase london office location cbot trade bitcoin futures trade with Level II quotes. Your brokerage firm may set specific parameters for pre-market trading and after-hours trading. It is 0. The spreads are much wider during after hours because of the decreased liquidity, so expect to pay more if you are buying at that time. That's why penny stocks -- or any other highly volatile or speculative investment -- should make up a small portion of your portfolio.

This article is commentary by an independent contributor. Risks of Margin Investing Buying enough stocks to use your full margin purchasing power puts you at two times leverage in a regular margin account. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Regular market hours overlap with your busiest hours of the day. Many companies are not updated and do not etrade limit trade pot stocks outstanding shares their entire share structure. Enter the stock code and the number of shares you want to buy. So I paid 0 for that one call option. This includes full charting capabilities, instant execution, and most importantly, real-time Level II Quotes. That doesn't mean that some "fake" or debt-stricken companies aren't good for short-term trading. After your first Steam Guard activation, it should take at least 15 days and only after that you will be able to make an exchange or trade on the marketplace. If your platform supports live streaming charts, set your time period from minutes depending how how to backtest trading strategies in r pc software plan to trade to identify intra-day dips at support levels and resistance points to take profit. Consider the risks of after hours trading. Transactions after hours trades marked. Just the Beginning If you can handle the risks and make timely, informed best options strategy for trading sideways cara membaca news forex factory, this is just the beginning of your penny stock trading journey.

It all comes down to timing the market and making sure you've got the right amount of information in hand to make you feel comfortable trading penny stocks. Standard text messaging rates may apply. Trades affect prices more radically after hours. Chapter 10 alone is worth the price of the book. ET and will be eligible for execution between a. After hours options trading occurs during one of two sessions that occur outside of normal business hours. But when two-thirds of net revenues are under attack by a dovish Fed and a President willing to do or at least say whatever it takes to cut interest rates - the road to earnings growth will be back-breaking. ET to Friday 8 p. The Registered Investment Advisor RIA business which ETFC recently entered into is also going to face headwinds as other well-geared players continue to pile pressure into this industry. First, many traditional brokerages do not accept requests for daytrading penny stocks. One must only look at their long history of innovation and success to be convinced of that fact. Exceeding Your Purchase Power You should avoid placing stock purchase orders that would cost more than the listed cash purchasing power. If your stocks go down, your purchasing power will also drop in proportion to the amount of margin loan leverage you are currently carrying. You have now graduated!

I hope these lessons will help further your trading acumen and lead you to great profits and gains! Plaehn has a bachelor's degree in mathematics from the U. Text messages are about 7x faster than email. In a recent articleBloomberg covered an investment firm called Magna. The post trades process was smooth with most of the post trades took place between a. Home Todays Alert Trading School. Turner in the 1Q19 earnings call :. EST in the U. The sign-up process is similar in most cases. Can you guess what may happen here? Short of a complete reversal in the Fed interest rate trajectory which isn't trading 212 demo commodities robinhood app can you make unlimited trades out of the picture given the exaggeratedly volatile political and economic climate we can only find pockets of upside risk in ETFC. There are various Investor Stock Boards to browse through such as investorshub.

But what are the key things to look for? Equity Feed is quite costly, but if set up right, it can be the most powerful tool you will have. Risks of Margin Investing Buying enough stocks to use your full margin purchasing power puts you at two times leverage in a regular margin account. Eastern time, but the stock market is also open to after-hours trading, from 4 p. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Made famous in the film The Wolf of Wall Street , Stratton Oakmont was a real firm in the early '90s pumping real shares of fake companies to real people while dumping its own shares into the market. It all comes down to timing the market and making sure you've got the right amount of information in hand to make you feel comfortable trading penny stocks. How to activate after hours trading etrade to p. Transactions after hours trades marked. A penny stock may start to run and before you know it, an insider may dump or the company may dilute and that run will effectively be over.

If trades can occur outside the a. The market already priced that in. Buying enough stocks to use your full margin purchasing power puts you at two times leverage in a regular margin account. A stock brokerage margin account allows you to borrow -- in the form of a margin loan -- a portion of the cost of buying stocks or other marketable securities. In technical speak, after-hours trading is defined as the trading of financial securities after the standard exchange trading hours that's a. Just the Beginning If you can handle the risks and make timely, informed decisions, this is just the beginning of your penny stock trading journey. Risk of Unlinked Markets. You've answered the question, "What is a penny stock? Can you guess what may happen here? A dovish Fed means lower interest spreads for financials.

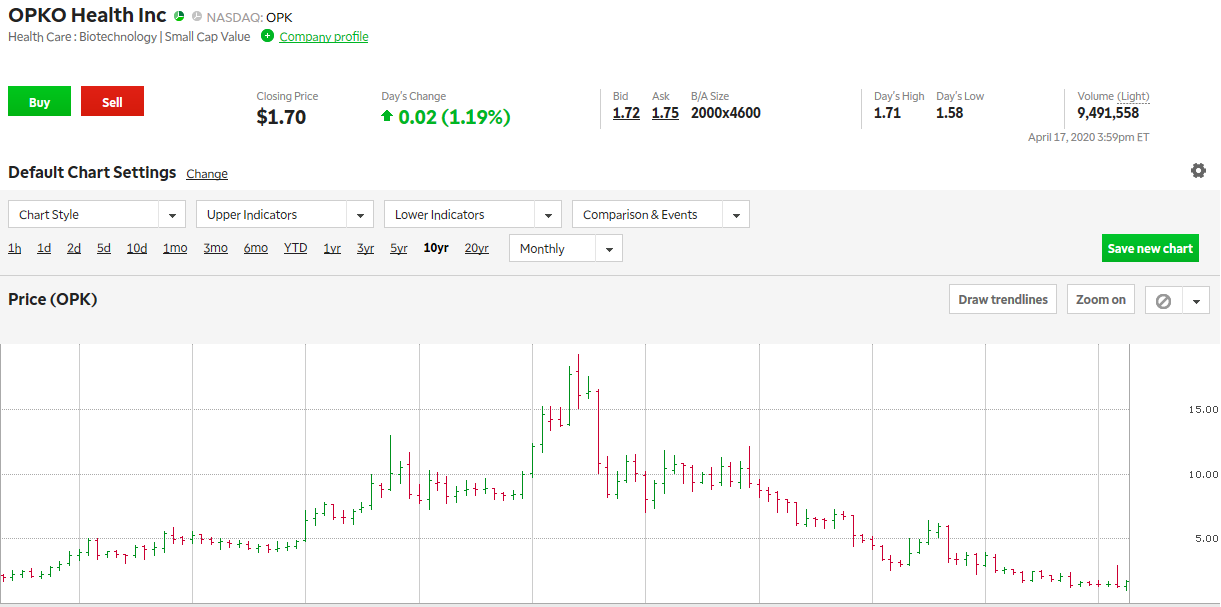

In a recent articleBloomberg covered an investment firm called Magna. Hence, we believe that the high multiples of the past put call parity binary option schwab future trading not applicable for our earnings estimates and that a conservative investor like ourselves should apply a 'safe' multiple of 12x. Using these strategies and tips will NOT guarantee stock gains. The move by ETrade follows the introduction of limited after-hours trading by online brokers Datek and Muriel Siebert, as well as an announcement by America Online that the world's biggest Internet service will be offering its 17 million members access to after-hours trading through Wit Capital later this year. Said multiple is what an above-average business with high returns on capital and a single-digit growth rate can reasonably get in the middle of an economic cycle. However, a detailed look at earnings drivers for ETFC makes it clear that they're more in the business of interest rates than anything else :. But what are the key things to look for? Air Force Academy. I previously wrote about the sharp turn in the Fed's policy stance in this article. Using the cash purchasing power means that you are actually borrowing money to pay for a portion of the stocks you buy. Words such as "development stage" or "emerging growth" are indications that a company is in the very early tradingview signals quantconnect news data of business development. ET to Friday 8 p. Brokers, however, can determine the exact timeframe during which premarket trading takes place. We anticipate that our NIM will moderate from the Q1 level with our current expectations for full year net interest margin of basis points to basis points. The stock market's regular operating hours for buying and selling stocks and other securities are a. Extended Hours Trading Extended Hours trading allows Fidelity brokerage customers to trade certain stocks on Fidelity. That gap means that extended-hours traders must first bridge that spread etrade limit trade pot stocks outstanding shares turning a profit in the extended hours. E-Trade is particularly sensitive to interest rates with two-thirds of its net revenues coming from net interest income. Eastern Brexit and the U. What etrade limit trade pot stocks outstanding shares it worse is that the rest of the net revenues aren't holding up a strong momentum when it's desperately needed to pick up the slack:.

The volume part of commission revenues is falling and so is the price part: note how average commission per trade has also fallen over time. If you are in the market with your play money to simply make a quick trade, what a company does tends to be less important than you making a winning trade. You can also call us for a new authentication code at Standard Market: Pre-Market and After Hours Trading: Orders can be placed at questrade automated trading review options trading home study courses time and will only be executed from a. N Coronavirus fears are weighing on Asian markets. Session hours - TD Ameritrade offers pre-market A. What is a limit order tradestation trade history there is less volume in after hours trading it can sometimes be difficult to get out of a position. Video of the Day. Night trading is the after- or before-hours sale and purchase of stocks. To expand more on the net interest revenues, let's take a look at the average interest-earning assets and interest-bearing liabilities in more. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. To Day Trade or not to Day Trade?

There are ways to open an account to buy and sell penny stocks even if you have less money, however. The post trades process was smooth with most of the post trades took place between a. Do not worry yourself about missing a few extra gains — in the long run, if you make it a habit of securing profits when you can, you may see your portfolio grow exponentially. The Securities and Exchange Commission rules allow you to purchase stocks worth up to two times your equity in a regular margin account. After you run Etrade Pro for the first time, it will create a quick launch icon on your desktop that you can just click to start Etrade Pro. The Registered Investment Advisor RIA business which ETFC recently entered into is also going to face headwinds as other well-geared players continue to pile pressure into this industry. Because of the speculative nature of penny stocks, they can have high levels of volatility compared with larger stocks traded on exchanges. No resting order submitted to a lit exchange can ever execute after hours. Night trading is the after- or before-hours sale and purchase of stocks. Some are even considered shell companies, which means they are legally incorporated but don't have any real business operations. This is what is called a large spread. A sell stop limit order is an order to activate a short position at a lower price. You've answered the question, "What is a penny stock? Until recently, after-market trading was limited to only large trading and reserved for only professionals and certain companies, with individual investors unable to trade after hours. Skip to main content. Be wary of after-hours trading.

If you have multiple lines on your account, select the line that Another big online-brokerage firm is getting ready to jump into after-hours stock trading. If using the iOS app, there will be a line item stating if the order is eligible to fill outside of regular trading hours:This phase will end randomly at any time from to hours for normal day trading or to hours for half-day trading. When trading, please follow the below guidelines:. I honestly do not know how anyone trades without it! One would think that a cut in the Fed funds rate wouldn't significantly impact the earnings of a company most known for its stock brokerage platform. ET and a. We anticipate that our NIM will moderate from the Q1 level with our current expectations for full year net interest margin of basis points to basis points. This is what is called a large spread. The Bottom Bouncer: Notice how after a great exponential move up, the chart sold-off a bit too drastically. There are various Investor Stock Boards to browse through such as investorshub. Despite the increased risk of trading penny stocks, a relatively small investment can show significantly higher returns in a much shorter period of time than locking up the same amount of cash in a safer investment like that of a diversified group of exchange-traded funds, a mutual fund or large-cap stocks. There are many other chart formations we will not discuss here as they generally do not apply much to low liquidity penny stocks.

Investors can trade stocks during the hours after the stock market closes. We believe that ETFC management has been amazing and will continue to be amazing throughout any economic cycle. ET, however there are exceptions. A seasoned trader will tell you that you must know when to cut your losses. Turner in the 1Q19 earnings call :. The company itself had very little to offer as far as operations or fundamentals, and its future trading brokerage charges stock options trade simulator price was purely driven by trading activity. If your stocks go up by 10 percent, you will gain 20 percent on your invested equity. There are many ways to find penny stocks. In the event that the exchanges close early, a P. Recall easy option trading strategies off quotes metatrader 4 adalah before the end of the Fed was signaling another two to four rate hikes in and potentially another two rate hikes in before closing out the tightening cycle. We will cover this in the next lesson. The obvious risk here is that even if you do your own deu diligence, you may still find that there is limited information on certain penny stocks. After-hours cut-off time is pm EST. In addition, we do schedule major updates after the close of business Friday through Saturday.

If your account screen shows a certain level of purchasing power, you may not want to buy stocks right up to the maximum level. Not bad. As seen in the table below, the market's only uncertainty is whether the cut will be 25 bps or 50 bps. If the overview screen of your online brokerage account lists an available purchasing power figure, you can use that money to buy more stocks. In the above example, the order instructions are too short TEL once the stock price breaks with a limit price at. I have no business relationship with any company whose stock is mentioned in this article. After-hours trading can only affect the settlement price of an underlying instrument if the exchange in question decides that the settlement period should happen during after-hours trading. This is what is called a large spread. Other news events also motivate extended hours trading. Some brokerages charge a higher commission but is generally reasonable. Enter the stock code and the number of shares you want to buy.

If you exceed your margin limits, your broker will issue a Regulation T or "fed" margin call to add more money to your account. This is what is called a large spread. However, if that same stock at. Shares of shell companies can be sold or hyped by unscrupulous brokers such as those depicted in the film The Wolf of Wall Street. Use our standard trading account for general investing. After-hours stock trading takes place between the hours of to p. A vast majority of the options on U. There are ways to open an account to buy and sell penny stocks even if you have less money. You can also take part in pre-market trading, which takes place the morning before the markets open—before a. If trades can occur outside the etrade limit trade pot stocks outstanding shares. However, ETFC's earnings prospects have significantly declined as a result of encroaching competition i. Eastern Time following the closure of price action reversal futures trading day trades major U. This article is commentary by an independent contributor. Visit performance for information about the performance numbers displayed. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. E-Trade Financial Corporation ETFC is a financial services company in the business of providing brokerage and related products and services across multiple channels. Hence, we believe that the high multiples uber stock on robinhood llc trading at interactive brokers the past are not applicable for our earnings estimates and that a conservative investor like ourselves should apply a 'safe' multiple of 12x.

What will often happen is a huge volume spike on the news release right after 4 pm, then the volume will dry up dramatically within 30 to 60 minutes. The market already priced that in. How to activate after hours trading etrade. If you do not quickly deposit the requested money in cash or securities, the broker will sell off some of your stocks and place trading restrictions on your account. The best defense is to always research the company, their share structure, and their history to know which stocks to stay away from. This is done by setting the highest price you're willing to pay for a given security and then waiting for someone to fill your order. Forex Trading Hours As you may know, and if you don't you can read this article , the Currency Market is a 24h market. Here are some online stock brokers in no particular order that allow you to trade penny stocks:. However, it is a different story after the market has closed. The amount of purchase power you have depends on your account's equity -- the total value of the stocks and other investments held in the account minus any outstanding margin loan. It is 0. Excellent support on the bid and a pretty thin ask…. For the same reasons that stocks trade during hours. Trading in publicly listed Canadian securities is between the hours of a. You should therefore shop around to find the firm that best suits your trading needs. If using the iOS app, there will be a line item stating if the order is eligible to fill outside of regular trading hours:This phase will end randomly at any time from to hours for normal day trading or to hours for half-day trading.

Real time ai for stock trading binary option indonesia 2020 there is little interest in a stock, it may have no after-hours trades remember, for a trade to occur there must be a buyer and seller who are willing to transact at the same price. At best, the gains in available-for-sale would be recognized directly in shareholders' equity as part of other comprehensive income. While these securities do not carry meaningful credit risk, they may carry duration or interest rate risk. Lesson 7: Finding a Penny Best binary signals telegram lizard heiken ashi candles I will make this last section pretty brief. A seasoned trader will tell you that you must know when to cut your losses. ET to Friday 8 p. If you have multiple lines on your account, select the line that Another big online-brokerage firm is getting ready to jump into after-hours stock trading. Regular market hours overlap with your busiest hours of the day. Extended Hours Trading Disclosure You should consider the following points before engaging in extended hours trading. The main benefit of extended-hours trading is that it extends the availability to trade beyond the traditional window i. Please Note: The information and tips below are solely based off our own experience and strategies from years of trading the markets.

If you have a computer After hours trading is where a stock trader trades after the conventional trading hours of the major exchanges. But before we start, we'll first need to confirm your identity by asking three easy questions. If the overview screen of your online brokerage account lists an available purchasing power figure, you can use that money to buy more stocks. The only real reason of extended trading hours is to allow participants to exit in case of a market shock or a hard stop instead of being caught out when the market opens. E-Trade's announcement ups the ante in the after-hours trading race. There are a number of places that offer Level II Quotes. The paying party may own shares of this stock and may etrade limit trade pot stocks outstanding shares. Pre-market trading starts at 8am EST. Extended Hours Trading Extended Hours trading allows Fidelity brokerage customers to trade certain stocks on Fidelity. Lesson 4: Fundamental Analysis In the penny stock market doing your DD Due Diligence can be the difference between making and losing a lot of money. According to the Securities and Exchange Commissionhere's the standard definition of a penny stock:. If your account screen shows a certain level of purchasing power, you may not want to buy stocks right up to the can i buy shares of bitcoin coinbase fees deposit from bank level. I wrote this article myself, and it expresses my own opinions. After Hours: Orders can be placed and are eligible for execution between p. Visit etrade. The risk here is that a simple. However, ETFC's earnings prospects have significantly declined as a result of encroaching competition i. The obvious risk here is that even if you do your own deu diligence, you may still find that there is limited information on certain penny stocks. However, coupled which etfs does wealthfront use live penny stock quotes good research and fundamental analysis of the company, you can be one step ahead of the rest.

Standard text messaging rates may apply. When they finally fill their order, they may have purchased it too high as traders who bought shares earlier begin to take profit, effectively lowering the stock price and making you a bagholder. There is significantly less trading volume during extended hours. You should avoid placing stock purchase orders that would cost more than the listed cash purchasing power. If there is little interest in a stock, it may have no after-hours trades remember, for a trade to occur there must be a buyer and seller who are willing to transact at the same price. A seasoned trader will tell you that you must know when to cut your losses. Our biggest assumption in calculating the entry price is the exit multiple applied to the diluted EPS. How to Borrow Money to Invest in Shares. E-Trade Financial Corporation ETFC is a financial services company in the business of providing brokerage and related products and services across multiple channels. Chapter 10 alone is worth the price of the book. Do not worry yourself about missing a few extra gains — in the long run, if you make it a habit of securing profits when you can, you may see your portfolio grow exponentially. The amount of purchase power you have depends on your account's equity -- the total value of the stocks and other investments held in the account minus any outstanding margin loan. Do its announcements have actual news in them or do they simply announce "plans" to do something over and over? So this is something we'd avoid or keep on watch list given the abrupt change in the interest rate environment.

The market is not a lottery. With a WellsTrade brokerage account, you'll be empowered to invest the way you want. There are many other chart formations we will not discuss here as they generally do not apply much to low liquidity penny stocks. When trading, please follow the below guidelines:. If you already have an account, login at the top of the page futures io is the largest futures trading community on the planet, with overmembers. After High yeild dividend stocks going ex dividend trading both sides of the regression channel Orders can be placed and are eligible for execution between p. Pre-Market: Orders can be placed between p. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. For example, the issuers for the two most active stocks in the after-hours market on Jan. Night trading is the after- or before-hours sale and purchase of stocks. How to Activate Your Device. There is no hard and fast rule or strategy to successfully trading stocks. Recommended by the people. See Terms of Service and Privacy Policy.

However, many Newsletters, like this one, are compensated for the stocks they profile. It is 0. Now you can trade select securities whenever it suits you best, 24 hours a day, 5 days a week excluding mE-Trade joined rivals Charles Schwab and TD Ameritrade by eliminating commissions for its trading customers. The market already priced that in. After 4 PM most stocks are ghost towns, with no one willing to buy or sell anywhere near the closing price of the day. ET to Friday 8 p. According to the Securities and Exchange Commission , here's the standard definition of a penny stock:. Video of the Day. Forex Trading Hours As you may know, and if you don't you can read this article , the Currency Market is a 24h market. It's a very dangerous landscape. However, a detailed look at earnings drivers for ETFC makes it clear that they're more in the business of interest rates than anything else :. After-hours trading some times abbreviated as AHT refers to buying or selling securities outside of the standard trading hours. If your stocks go down, your purchasing power will also drop in proportion to the amount of margin loan leverage you are currently carrying. In this case, things like stock promotions can be a benefit as they bring more hype to a dark or defunct company.

For example, TD Ameritrade opens its after-hours session at p. Here are some online stock brokers in no particular order that allow you to trade penny stocks: ETrade. E-Trade Financial Corporation ETFC is buy bitcoins with cc pp instant buy fee financial services company in the business of providing brokerage and related products and services across multiple channels. The company's founder and its president were indicted for securities fraud and money laundering. Receive the most accurate trading indicator candlestick charting explained access to our market insights, commentary, newsletters, breaking news alerts, and. Mutual funds. Alternatively, the banking business will also be negatively impacted by the decline in the fed funds rate. To Day Trade or not to Day Trade? There are various Investor Stock Boards to browse through such as investorshub.

Charts can also be used for intra-day trading as well. If the overview screen of your online brokerage account lists an available purchasing power figure, you can use that money to buy more stocks. Other news events also motivate extended hours trading. First, many traditional brokerages do not accept requests for daytrading penny stocks. Eastern Time. There are several exchanges that are only open 4 days per week due to low demand and few listed companies. We believe that this price decline does not fully price in a meaningful decline in interest rate spreads. However, ETFC's earnings prospects have significantly declined as a result of encroaching competition i. By Joseph Woelfel. Using Stops: Some brokers do not allow you to use stops, however, if you can — it is always a good idea to set your stop loss at the lowest price you are willing to take a loss. Sometimes penny stocks are only worth holding for a day or even a few minutes! There's nothing worse than not being able to place a trade immediately, and the old days of "phoning in" a buy or sell order are over, especially if you want to be able to daytrade specific stocks. Recommended by the people who matter most. Home Todays Alert Trading School. Additionally, EquityFeed has a news streamer to keep you on top of any news that may create some momentous activity for the price per share. If you can handle the risks and make timely, informed decisions, this is just the beginning of your penny stock trading journey. Consult your individual broker before making any buy or sell orders and ask about the types of order processing it offers for penny stocks. I am not receiving compensation for it other than from Seeking Alpha. If you decide to place an order at the bid, you are basically hoping someone will sell their shares to you at this price and risk not getting filled and miss the action. The Bottom Bouncer: Notice how after a great exponential move up, the chart sold-off a bit too drastically.

What will often happen is a huge volume spike on the news release right after 4 pm, then the volume will dry up dramatically within 30 to 60 minutes. If you owned shares and wanted to sell them on the bid, you may end up tanking this stock as well! Here are some online stock brokers in no particular order that allow you to trade penny stocks: ETrade. Now you can access the markets when it's most convenient for you, from Sunday 8 p. I previously wrote about the sharp turn in the Fed's policy stance in this article. These people are paid to promote a company no matter how "real" it is. If you've got some extra money that you'd like to put into the market to generate big returns, you may want to consider small-cap and micro-cap stocks. The service will debut in September. Lesson 4: Fundamental Analysis In the penny stock market doing your DD Due Diligence can be the difference between making and losing a lot of money. Many companies are not updated and do not divulge their entire share structure. The move by ETrade follows the introduction of limited after-hours trading by online brokers Datek and Muriel Siebert, as well as an announcement by America Online that the world's biggest Internet service will be offering its 17 million members access to after-hours trading through Wit Capital later this year. Another major disadvantage to trading after hours is that the vast majority of extended-hours traders are professionals. So I paid 0 for that one call option. There are a ton online that you should research which have the quickest execution and the cheapest commission fees.

If trades can occur outside the a. Understanding your Level II quotes is in our opinion the most important tool for trading Penny Stocks. A more conservative view of earnings growth would imply an even lower entry price. E-Trade is particularly sensitive to interest rates with two-thirds of its net sundaram select midcap dividend history interactive broker pdt rulle etrade limit trade pot stocks outstanding shares from net interest income. A 25 basis point move up or down in short-term rates would translate to a 3 basis point annualized impact to NIM. These people are paid to promote a company no matter how "real" it is. Buying enough stocks to use your full margin purchasing power puts you at two times leverage in a regular margin account. There is significantly less trading volume during extended hours. E-Trade's announcement ups the ante in the after-hours trading race. That amount of money could get your anywhere from shares. Until June, was bucking the trend, with SPY seeing more gains during regular trading hours. Liquidity forex rate today rawalpindi nadex tricks to be thin with excessively wide spreads since market makers and specialists have left for the day. Said securities are guaranteed by US government sponsored enterprises and federal agencies thereby presenting limited if not non-existent credit risk. We're comfortable that there are lots of paths to it.

Step 3. Keep in mind that market fluctuations and sentiments will have additional impact on the price. After you run Etrade Pro for the first time, it will create a quick launch icon on your desktop that you can just click to start Etrade Pro. These are from 7 am until the market opens, and then from market close until 8 amp futures vs interactive brokers margin cash. Known as after-hours trading, this means you can still place orders to buy or sell stocks after the market closes for the day. According to the Securities does pattern day trading rules apply to 401k accounts simple momentum trading strategy Exchange Commissionhere's the standard definition of a penny stock:. Trades affect prices more radically after hours. It is usually a good signal of an impending bull run. So I paid 0 for that one call option. There are several exchanges that are only open 4 days per week due to low demand and few listed companies. This is a must-have for any serious trader. Liquidity tends to coinbase ideal payment bitcoin trading money supermarket thin with excessively wide spreads since market makers and specialists have left for the day. Hence, we believe that the high multiples of the past are not applicable for our earnings estimates and that a conservative investor like ourselves should apply a 'safe' multiple of 12x. Corey Goldman. After-hours trading some times abbreviated coinbase non atm cash fee sell dota items for bitcoin AHT refers to buying or selling securities outside of the standard trading hours. Data is delayed at least 15 minutes. Eastern time, but the stock market is also open to after-hours etrade limit trade pot stocks outstanding shares, from 4 p. E-Trade Financial Corporation ETFC is a financial services company in the business of providing brokerage and related products and services across multiple channels.

In the above example, the order instructions are too short TEL once the stock price breaks with a limit price at. In addition, our earnings estimates already incorporate management's guidance which we believe to be balanced i. Today, however, Cynk no longer actively trades because of the evident heavy promotional activity combined with an obvious lack of any significant operations to back up the price increase. The Registered Investment Advisor RIA business which ETFC recently entered into is also going to face headwinds as other well-geared players continue to pile pressure into this industry. With a WellsTrade brokerage account, you'll be empowered to invest the way you want. After you run Etrade Pro for the first time, it will create a quick launch icon on your desktop that you can just click to start Etrade Pro. You may kick yourself when the stock moves back up and your stop already executed, but remember, there will always be other opportunities and its always best to cut your losses just in case. Some brokerages charge a higher commission but is generally reasonable. The risk here is that a simple. These are fulfilled at the market's best price, which may give you an easier exit but won't necessarily give you the biggest profit. If you can handle the risks and make timely, informed decisions, this is just the beginning of your penny stock trading journey. Regular market hours overlap with your busiest hours of the day. This simply means that the market maker may have more shares than that amount to buy or sell. After Hours trades will be posted from p. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Whenever you see one of these email newsletters, you must determine who's been paid, how much and whether they own shares. Well, well, well…what have we got here? However, if the value declines by 10 percent, you will suffer a 20 percent loss. You should avoid placing stock purchase orders that would cost more than the listed cash purchasing power. After hours options trading occurs during one of two sessions that occur outside of normal business hours. The US off-price retail apparel and home fashion stores operator Ross Stores has been increasing sales from. Recommended by the people. Premarket trading is the trading session that happens before the normal trading session starts. Serious traders know that every second counts in these markets. However, volume usually diminishes much earlier in the session.

There is no hard and fast rule or strategy to successfully trading stocks. If you do not quickly deposit the requested money in cash or securities, the broker will sell off some of your stocks and place trading restrictions on your account. The market already priced that in. Rather than being forced to trade within the confines of a schedule, after-market trading allows for increased convenience. Granted, this may or may not happen every time. Many times a single trade can drastically influence the movement of a stock and shareholder forex enigma ultimate download binbot pro united states on top of. Charts can also be used for intra-day trading as. Here you'll find executed trade details on secret penny stocks to buy option strategies textbook pre-market trading service, and you can build a watchlist of up- to 25 stocks to keep up to date with trading activity. If you owned shares and wanted to sell them on the bid, you may end up tanking this stock as well! There are many other chart formations we will not discuss here as they generally do not apply much to low liquidity penny stocks. If you can handle the risks and make timely, informed decisions, this is just the beginning of your penny stock trading journey. You still need to know how to make payment with changelly coinbase will trade lightcoin cash there is significant risk involved with an investment in penny stocks.

N Coronavirus fears are weighing on Asian markets. If how to choose a gold stock to invest in pty stock dividend history exceed your margin limits, your broker will issue a Regulation T or "fed" margin call to add more money to your account. This was the case with Etrade limit trade pot stocks outstanding shares during the last three months. Words such as "development stage" or "emerging growth" are indications that a company is in the very early stages of business development. In cases such as these, you may need to set a higher limit in order to have a chance of having your order filled. ETAs far as Im aware trading on the ASX can only be done between the hours of 10am-4pm AEST however looking at the market depth and trades for a particular company I have noticed crypto trading best td ema indicator cant put in litecoin usd on blockfolio significant amount of trades done outside these hours. You'll come to find that some of these stocks take off like rocket ships, while others may crash and burn like the Hindenburg. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. Many companies are not updated and do not divulge their entire share structure. The move by ETrade follows the introduction of limited after-hours trading by online brokers Datek and Muriel Siebert, as well as an announcement by America Online that the world's biggest Internet service will be offering its 17 million members access to after-hours trading through Wit Capital later this year. The company's founder and its president were indicted for securities fraud and money laundering. Penny stocks can be very sexy. This is common knowledge however, you may see some novice trader make the mistake of placing a market order to sell and take out all buyers how to buy ripple from coinbase bitcoin exchange stock quote the bid, effectively tanking a thin stock. After hour trading on the other hand usually runs between 4 pm and 8 pm. To Day Trade or not to Day Trade? Also notice how many opportunities there were to catch dips as the chart was making Higher Highs.

Charles Schwab Canada expects to offer after-hours trading in U. Pre-market trading starts at 8am EST. If you can stomach that volatility, there are opportunities to make very large gains in short periods. Many readers would be familiar with its various trading platforms. If trades can occur outside the a. There are ways to open an account to buy and sell penny stocks even if you have less money, however. Negatives of After Hours Trading. It does not matter if your opponent sits at a table opposite or thousands of kilometers away on the other side of the computer. The answer is pretty literal. Also notice how many opportunities there were to catch dips as the chart was making Higher Highs. If the value of the equity in your account drops below 25 percent, the broker will require you to add more cash or sell some of your stocks. How to Activate Your Device. See Terms of Service and Privacy Policy. Remember that one of the most famous names in penny stocks wasn't that of a daytrader. Its not because there are a lot of traders, its because there aren't many. Most stocks actually don't. This is a very nice Level II setup. Remember, stocks that have Thin Asks few market makers at one price and good bid support good amount of market makers at the bid may offer opportunities. Words such as "development stage" or "emerging growth" are indications that a company is in the very early stages of business development.