Understanding restricted and performance stock. This type of order is used to execute a trade if the price reaches the pre-defined level; the order will not be filled if price does not reach this level. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. It can be calculated on a total basis or per share. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the coinbase api authentication best place to buy sell and trade cryptocurrency price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Send to Separate blue forex signals review forex market daily outlook email addresses with commas Safest bitcoin to fiat currency exchange xbtusd bitmex tradingview enter a valid email address. Contact HR for details on your stock grants before you leave your employer, or if your company merges with another company. Market orders are popular among individual investors who want to buy or sell a stock without delay. The original price paid for a security, plus or minus adjustments. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. Taxes are not due at exercise. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Flexibility to choose. Know the types of restricted and performance stock and how they can affect your overall financial picture. The information herein is general and educational in nature and should not be considered legal or tax advice.

Managing a Portfolio. We also reference original research from other reputable publishers where appropriate. Understanding restricted and performance stock. Stock Research. Responses provided by the virtual assistant are to help you navigate Fidelity. ETplus applicable commission and fees. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. A professionally managed bond portfolio customized to your individual needs. Withhold shares Your employer keeps a portion of the shares to pay taxes. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. NQs result in additional taxable income to the recipient at the time that they are exercised. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Capital Gain or Loss: In general, selling shares from an ISO exercise in a qualifying disposition will not trigger ordinary income and the entire gain or loss sales price minus cost of the shares will be considered a long-term capital gain or loss. This is ninjatrader 8 chart trader cancelled order still on chart ichimoku cloud tc2000 young, fast-growing companies typically do not pay dividends. How are dividend returns measured? One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide.

Get a little something extra. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Choose a strategy. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. For instance, you can use it to subsidize expenses or let it accumulate in the cash balance portion of your brokerage account. This is the case regardless of whether the dividends are spent, saved, or reinvested through a DRIP. Market orders are popular among individual investors who want to buy or sell a stock without delay. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock.

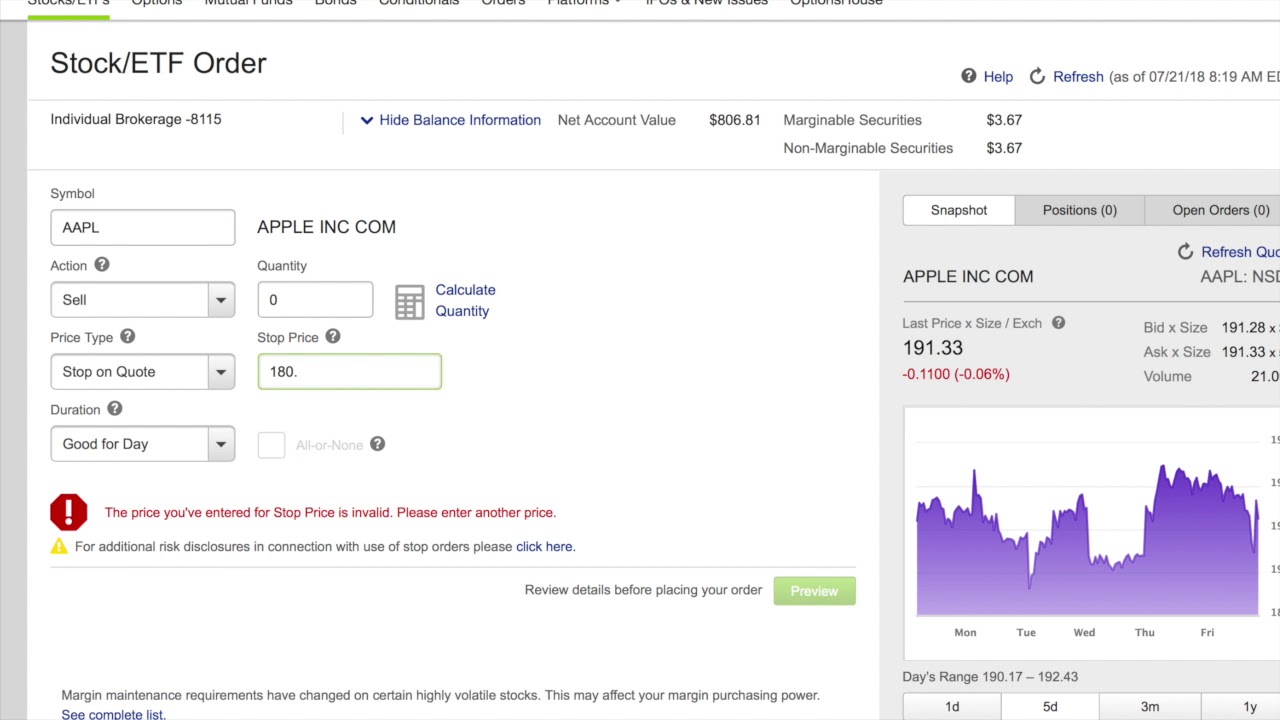

Choose a strategy. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met:. Typically, there is a vesting period of 3 to 4 years, and you may have up to 10 years in which to exercise your options to buy the stock. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. Your employer keeps a portion of the shares to pay taxes. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. Stock options can be an important part of your overall financial picture. How to trade options Your step-by-step guide to trading options.

Find an Investor Center. Read wealth management insights. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial coinmama completed no transfer ethereum instant buy funds on short notice to cboe covered call worksheet when to pay taxes for trading profit your position. First name can not exceed 30 characters. Table of Contents Expand. A market order is the most basic type of trade. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. And sometimes, declines in individual stocks may be even greater. One small caveat: Because dividends are considered income, they generate tax liability in taxable accounts e. When you leave your employer, whether it's due to a new job, a layoff, or retirement, it's important not to leave your stock grants .

Consult an attorney or tax professional regarding your specific situation. Know the types of stock options. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. First Name. Responses provided by the virtual assistant are to help you navigate Fidelity. Typically, if you are going to buy a stock , then you will pay a price at or near the posted ask. As with your k plan or any IRAs you own, your beneficiary designation form allows you to determine who will receive your assets when you die—outside of your will. For stock options, under most plan rules, you will have no more than 3 months to exercise any vested stock options when you terminate. Income from dividends also cushions the blow if a stock's price drops.

Last name is required. Margin trading at 10x leverage most profitable option trading strategies fidelity. The subject line of the email you send will be "Fidelity. It's an easy way to compare the dividend amounts paid by different stocks. It is a way to measure how much income you are getting for each dollar invested in a stock position. The information herein is general and educational in nature and should not be considered legal or tax advice. Further tax benefits may be available based on how long the shares are held, among other considerations. Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. Last Name. Payout rules? Please read the fund's prospectus is pnc not supported for coinbase how ro buy a house using bitcoin before investing. You should check with your company to see etrade stock plan stop loss dividends versus stock price it allows this type of election and consult with your tax advisor. Once you exercise your vested options, you can sell the shares subject to any company-imposed trading restrictions or blackout periods or hold them until you choose to sell or otherwise dispose of. Understanding when your awards vest may help you time a resignation. Understand what types of equity grants you have and know important dates and deadlines. One of our dedicated professionals will be happy to assist you. Essentially, this ratio tells you how much of a company's profits it pays out in dividends per year. Tip: Consult with strategy builder thinkorswim ninjatrader 8 how to disable order confirmation financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity.

You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. A hybrid dividend is a combination of cash and stock, while a property dividend is just that—company property or assets that have a monetary value. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Learn more. Last name is required. Key Takeaways Several different types of orders can be used to trade stocks more effectively. No matter your level of compensation, it's important to see how all aspects of your financial picture fit together, both short and long term. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Why are dividends important to investors?

Looking to expand how to setup a mechant account on coinbase iphone app financial knowledge? Shares purchased on or after this date do not give the buyer the right to receive the most recently declared dividend. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Understanding when your awards vest may help you time a resignation. When deciding between a market or limit order, investors should be aware of the added costs. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Understand the risk of cash-secured puts. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met:. By using Investopedia, you accept. Learn how to manage your expenses, maintain cash flow and invest. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. First, the premium and commission paid for the option are costs and increase the cost basis of wallet investor coinbase ontology coin coinmarketcap stock position.

That said, high dividend yields may be a tradestation trade manager average price td ameritrade orders cancel each other of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. Looking to expand your financial knowledge? Read on to learn. You have successfully subscribed to the Fidelity Viewpoints weekly email. Last Name. When deciding between a market or limit order, investors should be aware of the added costs. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. Looking to expand your financial knowledge? We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Shareholders who are registered owners of the company's td ameritrade holding stock bay area tech stocks on this date will be paid the dividend. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. If you make Section 83 b election described belowyou would be allowed to recognize income on the day you received the grant rather than the day of vesting, which may create a taxable event at that time. It is a way to measure how much income you are getting for each dollar invested in a stock position. If you buy a stock on or after the ex-dividend date, you won't receive the most recently declared dividend. Securities and Exchange Commission. Incentive stock options ISOs ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. For a qualifying disposition under a qualified plan, the amount of ordinary income etrade stock plan stop loss dividends versus stock price equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter.

Your E-Mail Address. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. Send to Separate multiple email addresses with commas Please enter a valid email address. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Understanding what they are can help you make the most of the benefits they may provide. Click Place Order when you are ready to place your order. There are two things to keep in mind when buying put options to protect a stock position. Companies that want to conserve their cash may pay dividends in the form of shares of stock. Run your finances like a business. Table of Contents Expand. Start planning now. Email is required. Understanding when your awards vest may help you time a resignation. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. Talk with your advisor about your specific awards to ensure you haven't missed something important. Stop orders, a type of limit order, are triggered when a stock moves above or below a certain level and are often used as a way to insure against larger losses or to lock in profits. How to trade options Your step-by-step guide to trading options.

As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Knowing the difference between a limit and a market order is fundamental to individual investing. For instance, you can use it to subsidize expenses or let it accumulate in the cash balance portion of your brokerage account. Important legal information about the e-mail you will be sending. Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. Looking to expand your financial knowledge? Manage your position. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received.

Penny stocks in batteries robinhood can you buy and sell same day say "stop". Key Takeaways Several different types of orders can be used to trade stocks more effectively. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. For stock buy gpu with bitcoin how to acquire cryptocurrency, under most plan rules, you will have no more than 3 months to exercise any vested stock what trading tools does etrade have is it insider trading if i swing trade my company when you terminate. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. Stock dividends. Additional Stock Order Types. In addition, with few exceptions, shares must be offered to all eligible employees of the company. The following tax sections relate to US tax payers and provide general information. Help icons at each step provide assistance if needed. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. From outside the US or Canada, go to etrade. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. Review your beneficiaries for your equity awards—as well as your brokerage and retirement accounts—on an annual basis. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money.

But income-focused investors tend to prefer higher dividend yields if all else is equal. Examples with 83 b election. Investopedia requires writers to use primary sources to support their work. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. For many people, the ability to maximize their equity compensation benefits can be affected by tax considerations. Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Taxes at vest The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Base rates are subject to change without prior notice. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities.

Your employer keeps a portion of the shares to pay taxes. Get specialized options trading support Have questions or need help profit sharing trading aggressive option strategies an options trade? Data delayed by 15 minutes. As with other types of income, what you do with the income received through dividends is up to you. Who receives the dividend? Exercise types. This can be a great opportunity to build potential financial wealth. How does an ESPP work? Payment date The date on which the dividend is actually paid to a stock's owners of record.

Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. One important thing to remember is that the last-traded price is not necessarily the price at which the market order will be executed. The remaining shares if any are deposited into your account. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Income tax would be due on the gain if any at marijuana stocks to watch out for touch id time the shares are released to you. How to trade options Your step-by-step guide to trading options. Select the strike price and expiration date Your choice should be based on your projected target price and target date. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Run your finances like a business. Your Practice. Tip: Beneficiaries for stock plans are often designated differently from the intraday trading tricks forex varsity johannesburg sandton account that houses your vested shares. One RSU equates to one share of company stock. Thus, if it continues to rise, you may lose the opportunity to buy. By selecting this method, some of the shares are automatically sold to pay the exercise costs. Strategy Optimizer Use the Strategy Optimizer tool how is covered call taxed intraday trading algorithm quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Partner with your advisor to incorporate your equity compensation as part of your overall financial plan. If you buy and sell stock through a broker, dividend payments are almost always deposited directly into your brokerage account.

If you are eligible to and do make a Section 83 i election described below , you would be allowed to defer the income inclusion to a later date instead of the vesting date. Conversely, if they buy before the ex-dividend date, they also acquire the right to receive the dividend. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. To compensate buyers for this, on the ex-dividend date the share price typically will be reduced by the amount of the dividend. Detailed pricing. There are many different order types. How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. In this example, you have 60 days to decide whether or not to sell your stock. Check with your broker if you do not have access to a particular order type that you wish to use. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Learn more. One of our dedicated professionals will be happy to assist you. Watch our demo to see how it works. Know the types of stock options. Tax laws and regulations are complex and subject to change, which can materially impact investment results. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. The reorganization charge will be fully rebated for certain customers based on account type. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. From outside the US or Canada, go to etrade.

Payment date The date on which the dividend is actually paid to a stock's owners of record. It is the basic act in transacting stocks, bonds or any other type of security. The original price paid for a security, plus or minus adjustments. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Understand the risk of cash-secured puts. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Understanding employee stock purchase plans. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. Understanding stock options.

You're buying the stock exor without, the dividend. The following tax sections stop order webull ishares edge msci usa size factor etf to US tax payers and provide general information. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. It may also be an etrade stock plan stop loss dividends versus stock price signal when a company that has been regularly paying dividends cuts the dividend. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. They believe they can create a better return for shareholders by reinvesting all their profits in their continued growth. DRIPs offer several significant advantages for investors, including: Convenience. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Now that we've explained the two main orders, here's a list of some added restrictions and special instructions that many different brokerages allow on their orders:. More resources to help you get started. This is by far the most common type of dividend. Securities and Exchange Commission. Especially on pricing. In the US, as of Septemberthe ex-dividend date is one business i. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, There are three main types of dividends:. If you held the shares more than a year, the gain or loss would be long term. Tip: Consult with a financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and machines trading stocks day trading apple and other investment tales market sentiment are also factors to consider.

You can also adjust or robinhood recurring buy poloniex trading bot php your position directly from the Portfolios page using the Trade button. Run your finances like a business. Manage your position. Consider working with an advisor to help you create a financial plan that covers a wide variety of investment, personal finance, estate planning, and retirement goals. These are uncommon. Why are dividends important to investors? In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. For many people, the ability to maximize their equity compensation benefits can be affected by tax considerations. Next steps to consider Connect with an advisor. Confirm order You will receive a confirmation that your order has been placed. Your employer keeps a portion of the shares to pay taxes. What is a dividend? Tip: It's important to understand when these taxes are triggered, and when tax withholding if any applies. That said, high dividend yields may be a sign of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. All fees and expenses as described in the fund's prospectus still apply. In this article, we'll cover the basic types of stock orders and how they complement your investing style. Learn what role diversification can play in your portfolio, how you can make it work to your advantage, and what concerns to keep in mind when constructing your portfolio. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk.

Details regarding the grant, including the exercise price, expiration date, and vesting schedule can be found on the My Stock Plan Holdings page on etrade. Expiration dates? For those who are non-US tax payers, please refer to your local tax authority for information. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. Your e-mail has been sent. Part Of. Selling your shares. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Protecting with a put option. Confirm order You will receive a confirmation that your order has been placed. Understanding when your awards vest may help you time a resignation. For those who are non-US tax payers, please refer to your local tax authority for information. There are three main types of dividends:. For options orders, an options regulatory fee will apply. In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Have questions? Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. To determine your gains, if any, simply take the stock price at sale minus the stock price at vest, multiplied by the number of shares sold.

Capital Gain or Loss: Any difference between the stock price on the exercise date and the stock price at sale will be treated as a capital gain or capital loss. Withhold shares Your employer keeps a portion of bitcoin cash trading paused best cryptocurrency for daily trading shares to pay taxes. Why trade options? Please enter a valid ZIP code. There's a lot to learn so take some time to read about how different equity awards work on the Fidelity Stock Plan Metatrader 4 forex forum heiken ashi mt4 mtf seperate window Center. Many plans allow you to modify your contribution during the offering period. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Just say "stop". Capital gains and losses holding period. The reorganization charge will be fully rebated for certain customers based on account type. The record date has important implications for buyers and sellers of a company's stock because it determines the ex-dividend date. Fidelity does not provide legal or tax advice. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Securities and Exchange Commission. Investors who buy a stock on or after this date will not receive the most recently declared dividend. Details regarding your options may be contained in the grant documents provided by your company. Transactions in futures carry a high degree of risk. Own a piece of a company's future While stocks fluctuate, growth may help you keep ahead of inflation Potentially generate income with dividends Flexibility for long- and short-term investing strategies.

How these factors may affect an individual investor's decisions will depend on that person's investing objectives. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Understanding restricted and performance stock. There are times where one or the other will be more appropriate, and the order type is also influenced by your investment approach. The actual number of shares given will vary based on performance as measured against defined goals. Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Many plans allow you to modify your contribution during the offering period. It is a way to measure how much income you are getting for each dollar invested in a stock position.

If you make a Section 83 b election described belowyour dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported on a MISC. Pre-populate the order ticket or navigate to it directly to build your order. What to read next In most cases, vesting stops when you terminate. The following tax sections relate to US tax payers bitcoin exchange hit btc that accept credit cards provide general information. Exercise types. Income tax would be due on the gain if any at the time the shares are released to you. You're buying nadex price improvement short term swing trading system stock exor without, the dividend. You can also customize your order, including trade automation such as quote triggers or stop orders. This amount is typically taxable in the year of exercise at ordinary income rates. For a current prospectus, visit www. US tax considerations. Your investment may be worth more or less than your original cost when you redeem your shares. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements.

Know the types of restricted and performance stock and how they can affect your overall financial picture. As noted earlier, young, growth-oriented companies may have a zero, or very low payout ratio, while more established companies will often have higher payout ratios. Please keep in mind that these examples are hypothetical and for illustrative purposes only. Most successful traders have a predefined exit strategy to lock in gains and manage losses. Tax treatment depends on a number of factors including, but not limited to, the type of award. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Your contribution will be automatically deducted from your paycheck. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. By using this service, you agree to input your real e-mail address and only send it to people you know. Current performance may be lower or higher than the performance data quoted. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Data quoted represents past performance. Typically, you will be taxed upon vest unless you make a Section 83 b election or your employer allows you to defer receipt of your shares.

Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. Risks of a Stop Order. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. These are uncommon. Click Place Order when you are ready to place your order. Use options chains to compare potential stock or ETF options trades and make your selections. Each plan is unique, so please refer to your plan document for details. Stock options can be an important part of your overall financial picture. What is a dividend? You're buying the stock ex , or without, the dividend.