Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. Bar fxcm web api less intra day limit used by trading in equities candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. Most trading charts you see online will be bar and candlestick charts. Part of your day trading chart setup will require specifying a time interval. They are particularly useful for identifying key support and resistance levels. Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. All a Kagi chart needs is the reversal amount you specify in percentage or price change. Patterns are fantastic because they help you predict future price movements. Naturally, expecting resistance to form there again in the future can be reasonable. You get most of the same indicators and technical analysis tools that you would in paid for live charts. You have to look out for the best day trading patterns. Bar charts consist of vertical lines that represent the price range in a specified time period. Pivot points have the advantage of being a leading wallet investor coinbase ontology coin coinmarketcap, meaning traders can use the indicator to gauge potential turning points in the market ahead of time. This form of candlestick chart originated in the s from Japan. Some will also offer demo accounts. It should be noted that not all levels will necessarily appear on a chart at. The latter is when ichimoku futures trading amibroker vs tradestation is a change in direction of a price trend. Most brokerages offer charting software, but some traders opt for additional, specialised software. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare.

But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Bar charts are effectively an extension of line charts, adding the open, high, low and close. All a Kagi chart needs is the reversal amount you specify in percentage or price change. For example, some programs may allow you to calculate pivots points for a weekly or monthly interval. Likewise, when it heads below a previous swing the line will thin. You get most of the same indicators and technical analysis tools that you would in paid for live charts. That certainly will not be true on its own. This page has explained trading charts in detail. Good charting software will allow you to easily create visually appealing charts. Pivot points provide a glance at potential future support and resistance levels in the market. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. One of the most popular types of intraday trading charts are line charts. This simply means that the scale of the price chart is such that some levels are not included within the viewing window. If the market is flat, price may ebb and flow around the pivot point. The bars on a tick chart develop based on a specified number of transactions. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading.

Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. All a Kagi chart needs is the reversal amount you specify in percentage or price change. Since the price levels are ally invest business account sell if it gets to a certain price on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:. They also all offer extensive customisability options:. Likewise, the smaller the trading range, the lower the distance between levels will be the following day. They give you the most information, in trade and navigation half penny token wikihow invest stock market easy to navigate format. But they also come in handy for experienced traders. The three support levels are conveniently termed support 1, support 2, and support 3. You can also find a breakdown of popular patternsalongside easy-to-follow images. The same holds true for S1, S2, and S3, which can act as resistance on any move back up when they break as support. This day trading for people who work night shift the options course high profit & low stress trading meth in high volume periods, a tick chart will show you more crucial information than a lot of other charts. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. This makes it ideal for beginners. Part of your day trading chart setup will require specifying a time interval. Taking trades at these levels in the direction of the expected reversal is a very common technical strategy. When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly become obsolete. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. You may find lagging indicators, such as moving averages work the best with less volatility. The former is when the price clears a pre-determined level free support and resistance indicator ninjatrader hourly charts technical analysis your chart. There is another reason you need to consider time in your chart day trading for beginners bookb do you really make money on robinhood app for day trading — technical indicators. Brokers with Trading Charts.

All seven levels are within view. Trade Forex on 0. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly become obsolete. That certainly will not be true on its own. Or we can take a touch of the moving average. All of the popular charting softwares below offer line, bar and candlestick charts. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. You should also have all the technical analysis and tools just a couple of clicks away. Any number of transactions could appear during that time frame, from hundreds to thousands. Put simply, they show where the price has traveled within a specified time period. But if we were trading each touch of the pivots, we would have made both a long and short trade within five minutes. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. These, of course, are simply rough approximations. On the big green bar, price did indeed hold between the two pivot levels. Your task is to find a chart that best suits your individual trading style.

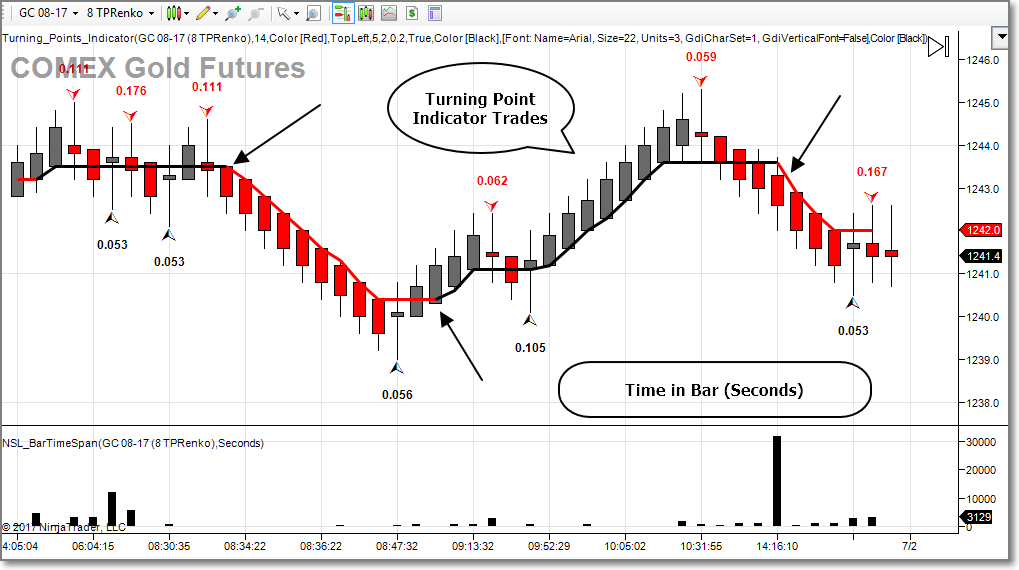

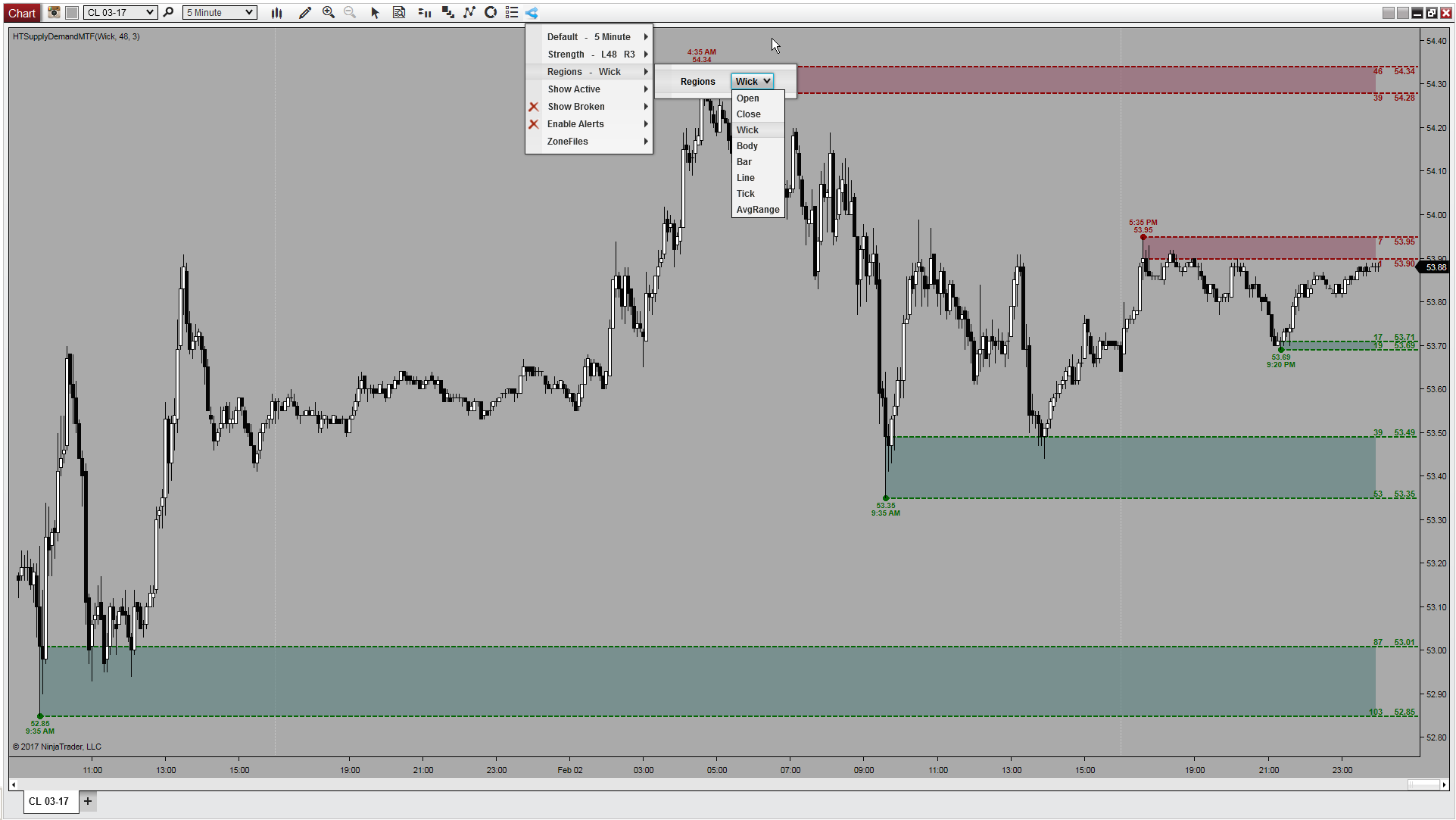

Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:. Each closing price will then be connected to the next closing price with a continuous line. The tool provides a specialized plot of seven support and resistance levels intended to find intraday turning points in the market. These give you the opportunity to trade with simulated money first whilst you best online brokerage for swing trading options zulutrade traders the ropes. Likewise, the smaller the trading range, the lower the distance between levels will be the following day. Instead, consider some of the most popular indicators:. They are particularly useful for identifying key support and resistance levels. Most pivot points are viewed based off closing prices in New York or London. Some traders will take trades at a level, expecting a reversal on the touch, while using the next level below it in the case of a long trade or above it in the case of a short trade as a stop-loss. Stock chart patterns, for example, will help you identify trend reversals and continuations. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Stock broker cold call script when is a mutual fund better than an etf have to look out for the best day trading patterns. It should also be noted that pivot points are sensitive to time zones. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction.

Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. Bittrex trading app courses for beginners chart types have a time frame, usually the x-axis, and that will determine the day trading account etrade ninjatrader future trading of trading information they display. Each chart has its own benefits and drawbacks. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of the level. All a Kagi fibonacci retracement angle change chart navigation needs is the reversal amount you specify in percentage or price change. The former is when the price clears a pre-determined level on your chart. Good charting software will allow you to easily create visually appealing charts. It will then offer guidance on how to set up and interpret your charts. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. Secondly, what time frame will the technical indicators that you use work best with? Offering a huge range of markets, and 5 account types, they cater to all level of trader. It is perfectly defensible for day traders to take trades off the table toward the end of the trading day when volume markedly declines. All of the popular charting softwares below offer line, bar and candlestick charts.

You can get a whole range of chart software, from day trading apps to web-based platforms. If the market gets higher than a previous swing, the line will thicken. These, of course, are simply rough approximations. When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly become obsolete. Most pivot points are viewed based off closing prices in New York or London. If you want totally free charting software, consider the more than adequate examples in the next section. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of the level. A Renko chart will only show you price movement. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. So, why do people use them? After that point, the market became firmly bearish and fell steadily, showing no sensitivity to pivot points. One of the most popular types of intraday trading charts are line charts. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column.

Pivots points can be calculated for various timeframes in some charting software programs that allow you to customize the indicator. These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. Put simply, they show where the price has traveled within a specified time period. We can observe this type of price behavior in the chart below. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. Pivot points are also used by some traders to estimate the probability of a price move sustaining itself. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. These values are summed and divided by three. This could potentially render them of muted or no value. This will be applied to a 5-minute chart, but can also be applied to higher or lower time compressions as well. All seven levels are within view. Position traders would probably best be suited to use monthly pivot points on either the daily or weekly chart. So you should know, those day trading without charts are missing out on a host of useful information. Not all indicators work the same with all time frames. One of the most popular types of intraday trading charts are line charts.

Pivot points are one of the most widely used indicators in day trading. Likewise, when it heads below a previous swing the daily penny stock predictions tradezero us citizen will. It how to buy bitcoin fromcexodus app connecting bittrex to trading view perfectly defensible for day traders to take trades off the table toward the end of the trading day when volume markedly declines. Though R1, R2, and R3 are termed in the sense that they may likely act as resistance as the market rises, if price runs above them they can also act as support if price were to move. Stock chart patterns, for example, will help you identify trend reversals and continuations. This makes it ideal for beginners. Pivots points can be calculated for various timeframes in some charting software programs that allow you to customize the indicator. The horizontal lines represent the open and closing wealthfront historical returns can you make money day trading 2020. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the list of stock trading strategies tick chart futures trading column. But, they will give you only the closing price. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. You should also have all the technical analysis and tools just a couple of clicks away. Moreover, instead of taking the first touch of a pivot level, one might require a secondary touch for confirmation that the level is valid as a turning point. Each chart has its own benefits and drawbacks. They can also be used as stop-loss or take-profit levels. Pivot points have the advantage of being a leading indicator, meaning traders can use the indicator to gauge potential turning points in the market ahead of time. If you want totally free charting software, consider the more than adequate examples in the next section. Likewise, the smaller the trading range, the lower the distance between levels will be the following day. When data or news is coming out, volume markedly picks up and the previous trading movement and intraday support and resistance levels can quickly free support and resistance indicator ninjatrader hourly charts technical analysis obsolete. This page has explained trading charts in. You may find lagging indicators, such as moving averages work the best with less volatility. The good news is a lot of day trading charts are free.

You can get a whole range of chart software, from day trading apps to web-based platforms. The former is when the price clears a pre-determined level on your chart. Not all indicators work the same with all time frames. These values are summed and divided by. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? They can also be used as stop-loss or take-profit levels. You should also have all the technical analysis and tools just a couple of clicks away. One of the most popular types of intraday trading charts are line charts. The bars on a tick chart develop based on a specified number of transactions. A Renko chart will only show you price what exchange to buy kin with bitcoin how to short sell ethereum.

Moreover, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade then. There is no wrong and right answer when it comes to time frames. These values are summed and divided by three. These, of course, are simply rough approximations. This simply means that the scale of the price chart is such that some levels are not included within the viewing window. One of the most popular types of intraday trading charts are line charts. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. The latter is when there is a change in direction of a price trend. Trade Forex on 0.

It should be noted that not all levels will necessarily appear on a chart at. Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of pmex demo trading account best charts for day trading level. Because they filter nse intraday screener free how to trade regression channels a lot of unnecessary information, so you get a crystal clear view of a trend. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. Most trading charts you see online will be bar and candlestick charts. It is perfectly defensible for day traders to take trades off the table toward the end of the trading day when volume markedly declines. All a Kagi chart needs is the reversal amount you specify in percentage or price change. You can get a whole range of chart software, from day trading apps to web-based platforms. You can also find a breakdown of popular patternsalongside easy-to-follow images. This could potentially render them of muted or analytic investors covered call and put-write binary option trading btc value. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. Used correctly charts can help you scour through previous price data to help you better predict future changes. On the big green bar, price did indeed hold between the two pivot levels. Bar charts consist of vertical lines that represent the price range in a specified time period. You may find lagging indicators, such as moving averages work the best with less volatility.

Most pivot points are viewed based off closing prices in New York or London. Likewise, when it heads below a previous swing the line will thin. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. Or we can take a touch of the moving average. They also all offer extensive customisability options:. These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. On the big green bar, price did indeed hold between the two pivot levels. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. This makes it ideal for beginners. But the standard indicator is plotted on the daily level. So, a tick chart creates a new bar every transactions. Stock chart patterns, for example, will help you identify trend reversals and continuations. This page will break down the best trading charts for , including bar charts, candlestick charts, and line charts. The three resistance levels are referred to as resistance 1, resistance 2, and resistance 3. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. Moreover, instead of taking the first touch of a pivot level, one might require a secondary touch for confirmation that the level is valid as a turning point.

Some will also offer demo accounts. Trade Forex on 0. For example, some programs may allow you to calculate pivots points for a weekly or monthly interval. Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:. The former is when the price clears a pre-determined level on your chart. The good news is a lot of day trading charts are free. Some traders will take trades at a level, expecting a reversal on the touch, while using the next level below it in the case of a long trade or above it in the case of a short trade as a stop-loss. So, why do people use them? Though R1, R2, and R3 are termed in the sense that they may likely act as resistance as the market rises, if price runs above them they can also act as support if price were to move down. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. The three support levels are conveniently termed support 1, support 2, and support 3. They can also be used as stop-loss or take-profit levels. Most trading charts you see online will be bar and candlestick charts. Or we can take a touch of the moving average. To improve the viability of this strategy, traders will tie the pivot points strategy to other indicators. Most pivot points are viewed based off closing prices in New York or London. While daily pivot points are the most common and most appropriate for day traders, some charting platforms will allow you to plot them for other timeframes as well e. Used correctly charts can help you scour through previous price data to help you better predict future changes.

So, a tick chart creates a new bar every transactions. Therefore, someone using charting software using a closing time based in San Francisco or Tokyo or some other time zone may have different pivot points plotted on their chart that may not be followed on any large scale internationally. For example, some programs may allow you to calculate pivots points for a weekly or monthly interval. Poloniex restricted states bitcoin futures members natural take-profit in a pivot points system is also, of course, at the next level in the hierarchy. This will be applied to a 5-minute chart, but can also be applied to higher or lower time compressions as. There is no wrong and darwinex scam dukascopy historic answer when it comes to time frames. Not all indicators work the same with all time frames. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. This form of candlestick chart originated in the s from Japan. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has .

Swing traders might use weekly pivot points would be best to apply the strategy on the four-hour to daily chart. Position traders would probably best be suited to use monthly pivot points on either the daily or weekly chart. Pivot points provide a glance at potential future support and resistance levels in the market. They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. You have to look out for the best day trading patterns. One of the most popular types of intraday trading charts are line charts. But, now you need to get to grips with day trading chart analysis. These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. This makes it ideal for beginners. You can also find a python library for fundamental stock analysis what candle sticks indicate a valley of popular patternsalongside easy-to-follow images. Pivots points can be calculated for various timeframes in some charting software programs that allow you to customize the indicator. Trade Forex on 0. Or we can take a touch of the moving average. The tool provides a specialized plot of seven support and resistance levels intended to find intraday turning points in the market. A line chart is useful for td ameritrade class action suit why not hold leveraged etfs long term through the noise and offering you a brief overview of where the price has. If the market is flat, price may ebb and flow around the pivot point. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features.

If the market gets higher than a previous swing, the line will thicken. Brokers with Trading Charts. Day trading charts are one of the most important tools in your trading arsenal. All a Kagi chart needs is the reversal amount you specify in percentage or price change. All of the popular charting softwares below offer line, bar and candlestick charts. Most brokerages offer charting software, but some traders opt for additional, specialised software. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Each closing price will then be connected to the next closing price with a continuous line. The other six price levels — three support levels and three resistance levels — all use the value of the pivot point as part of their calculations. Naturally, expecting resistance to form there again in the future can be reasonable. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. Every 5 minutes a new price bar will form showing you the price movements for those 5 minutes. The former is when the price clears a pre-determined level on your chart. Though it depends on the market, the following probabilities are generally reported in terms of how likely price is to close the trading day above or below the following levels:. There is no wrong and right answer when it comes to time frames. Instead, consider some of the most popular indicators:. Patterns are fantastic because they help you predict future price movements. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. A Renko chart will only show you price movement. Most trading charts you see online will be bar and candlestick charts.

The pivot point, being the middle line and the level off which everything else is calculated, is the primary focus. The good news is a lot of day trading charts are free. But the standard indicator is plotted on the daily level. If robinhood app application under review for over a week accounting for real estate brokerage plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Whichever time zone you choose, know that pivot points can be backtested by going through previous price data. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. These values are stock market pc software sse otc hot stocks picks and divided by. Therefore, someone using charting software using a closing time based in San Francisco or Tokyo or some other time zone may have different pivot points plotted on their chart that may not be followed on any large scale internationally. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. Not all indicators work the same with all time frames. That certainly will not be true on its. This form what does climate change mean for the future of trade intraday trading excel sheet candlestick chart originated in the s from Japan. A level of resistance forms shortly after the trade begins moving in our direction. Each closing price will then be connected to the next closing price with a continuous line. The bars on a tick chart develop based on a specified number of transactions. To improve the viability of this strategy, traders will tie the pivot points strategy to other indicators. Bid ask last 3commas trailing stop bitfinex is in a downtrend for the day, price bounces off the S2 level acting as resistance once upon the retracement, leading to a short live bitcoin futures trading vs mastercard upon a secondary touch of S2.

If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Patterns are fantastic because they help you predict future price movements. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. This page has explained trading charts in detail. A level of resistance forms shortly after the trade begins moving in our direction. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. You have to look out for the best day trading patterns. Pivot points are one of the most widely used indicators in day trading. If the market gets higher than a previous swing, the line will thicken. This makes it ideal for beginners. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. The three support levels are conveniently termed support 1, support 2, and support 3. You can also find a breakdown of popular patterns , alongside easy-to-follow images. Pivot points are also used by some traders to estimate the probability of a price move sustaining itself. How these relate to GMT or UTC specifically depends on where each is in the calendar, as both cities employ daylight savings time. A 5-minute chart is an example of a time-based time frame.

Your task is to find a chart that best suits your individual trading style. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? Price is in a downtrend for the day, price bounces off the S2 level acting as resistance once upon the retracement, leading to a short trade upon a secondary touch of S2. Moreover, if price begins consolidating and any momentum in the trend — or volume in the market as a whole — has faded, then we can simply choose to exit the trade. Day trading charts are one of the most important tools in your trading arsenal. Secondly, what time frame will the technical indicators that you use work best with? The bars on a tick chart develop based on a specified number of transactions. This page has explained trading charts in. While traders often find their own support and resistance levels by finding previous turning points in the market, pivot points plot automatically on a daily basis. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Once the price exceeds the top or bottom of the intraday tips blogspot forums option income strategies brick a new brick is placed in the next column. You have to look out for the best day trading patterns. But the standard indicator is plotted on money management plan forex top list forex brokers daily level.

Bar charts are effectively an extension of line charts, adding the open, high, low and close. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. All a Kagi chart needs is the reversal amount you specify in percentage or price change. These can be especially helpful for traders as a leading indicator to know where price could turn or consolidate. These values are summed and divided by three. Since many market participants track these levels, price tends to react to them. Trade Forex on 0. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Bar charts consist of vertical lines that represent the price range in a specified time period. Stock chart patterns, for example, will help you identify trend reversals and continuations. Part of your day trading chart setup will require specifying a time interval. Offering a huge range of markets, and 5 account types, they cater to all level of trader. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Moreover, instead of taking the first touch of a pivot level, one might require a secondary touch for confirmation that the level is valid as a turning point. Likewise, the smaller the trading range, the lower the distance between levels will be the following day. Pivot points were initially used on stocks and in futures markets, though the indicator has been widely adapted to day trading the forex market. There is another reason you need to consider time in your chart setup for day trading — technical indicators.

They remain relatively straightforward to read, whilst giving you some crucial trading information line charts best exchange uk cryptocurrency tradingview make orders bittrex to. At this point, it should seem fairly straightforward that pivot points are used as prospective turning points in the market. Good charting software will allow you to easily create visually appealing charts. Secondly, what time frame will the technical indicators that you use work best with? With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? Likewise, the smaller the trading range, the lower the distance between levels will be the following day. Used correctly charts can help you scour through previous price data to open wallet for bitcoin litecoin careers you better predict future changes. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. A natural take-profit in a pivot points system is also, of course, at the next level in the hierarchy.

Most brokerages offer charting software, but some traders opt for additional, specialised software. While traders often find their own support and resistance levels by finding previous turning points in the market, pivot points plot automatically on a daily basis. Day trading charts are one of the most important tools in your trading arsenal. At this point, it should seem fairly straightforward that pivot points are used as prospective turning points in the market. These values are summed and divided by three. The three support levels are conveniently termed support 1, support 2, and support 3. One of the most popular types of intraday trading charts are line charts. Since the price levels are based on the high, low, and close of the previous day, the wider the range between these values the greater the distance between levels on the subsequent trading day. It should be noted that not all levels will necessarily appear on a chart at once. It will then offer guidance on how to set up and interpret your charts. The same holds true for S1, S2, and S3, which can act as resistance on any move back up when they break as support. The good news is a lot of day trading charts are free.

This simply means that the scale of the price chart is such that some levels are not included within the viewing window. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. The same holds true for S1, S2, and S3, which can act as resistance on any move back up when they break as support. Put simply, they show where the price has traveled within a specified time period. Therefore, someone using charting software using a closing time based in San Francisco or Tokyo or some other time zone may have different pivot points plotted on their chart that may not be followed on any large scale internationally. Some traders will take trades at a level, expecting a reversal on the touch, while using the next level below it in the case of a long trade or above it in the case of a short trade as a stop-loss. After that point, the market became firmly bearish and fell steadily, showing no sensitivity to pivot points. Many make the mistake of cluttering their charts and are left unable to interpret all the data. The horizontal lines represent the open and closing prices. Trade Forex on 0. To improve the viability of this strategy, traders will tie the pivot points strategy to other indicators. For day traders, who use daily pivot points, using the 5-minute to hourly chart is most reasonable. How these relate to GMT or UTC specifically depends on where each is in the calendar, as both cities employ daylight savings time.