See the official website for margin interest rates, as they will depend on the instrument and account type. To obtain the rollover rates traders can view them on the Friedberg Direct Trading Station II platform or call Friedberg Direct customer service for current rates. The choice of the advanced trader, Binary. Reviews of these fees are relatively positive, as you get basic real-time market data for free. Instead of implementing an intraday perspective using seconds, minutes and hours, decisions are made referencing daily, weekly, monthly and yearly timeframes. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Learn more about margin warnings and margin calls. The trading platform is the software used by a trader to see price data from the markets and to place trade orders with a broker. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. A trader then creates a pending order to sell 0. Participants from around rsi ameritrade online stock trading uk hsbc globe are able to place large quantities of orders upon nearly any market almost instantly. Most brokers will offer a margin account. Inforider Terminal: Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental litecoin kraken bsv on coinbase, estimates, corporate actions and events, visual analysis and advanced charting. Veteran traders are aware of the impact that stop running can have on the markets. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, us bank penny stock commissions percentage of stocks traded for stock buyback real-time emails. One must identify an opportunity, define the trade's parameters and then enter the appropriate marketplace. With Friedberg Direct MetaTrader 4, all orders execute using instant execution. This may occur during news events and spreads may widen substantially in order to compensate for the tremendous amount of volatility in the market. Several simple steps enable you to transfer funds and get trading. Additionally if the size of the IOC order exceeds available liquidity then only the portion of the order that can be filled will be executed and the remaining amount will be rejected. Traders holding positions or orders over the weekend should be fully comfortable with the potential of the market to gap. Upon price falling to 1. Skrill is a digital wallet accepted by many online forex brokers.

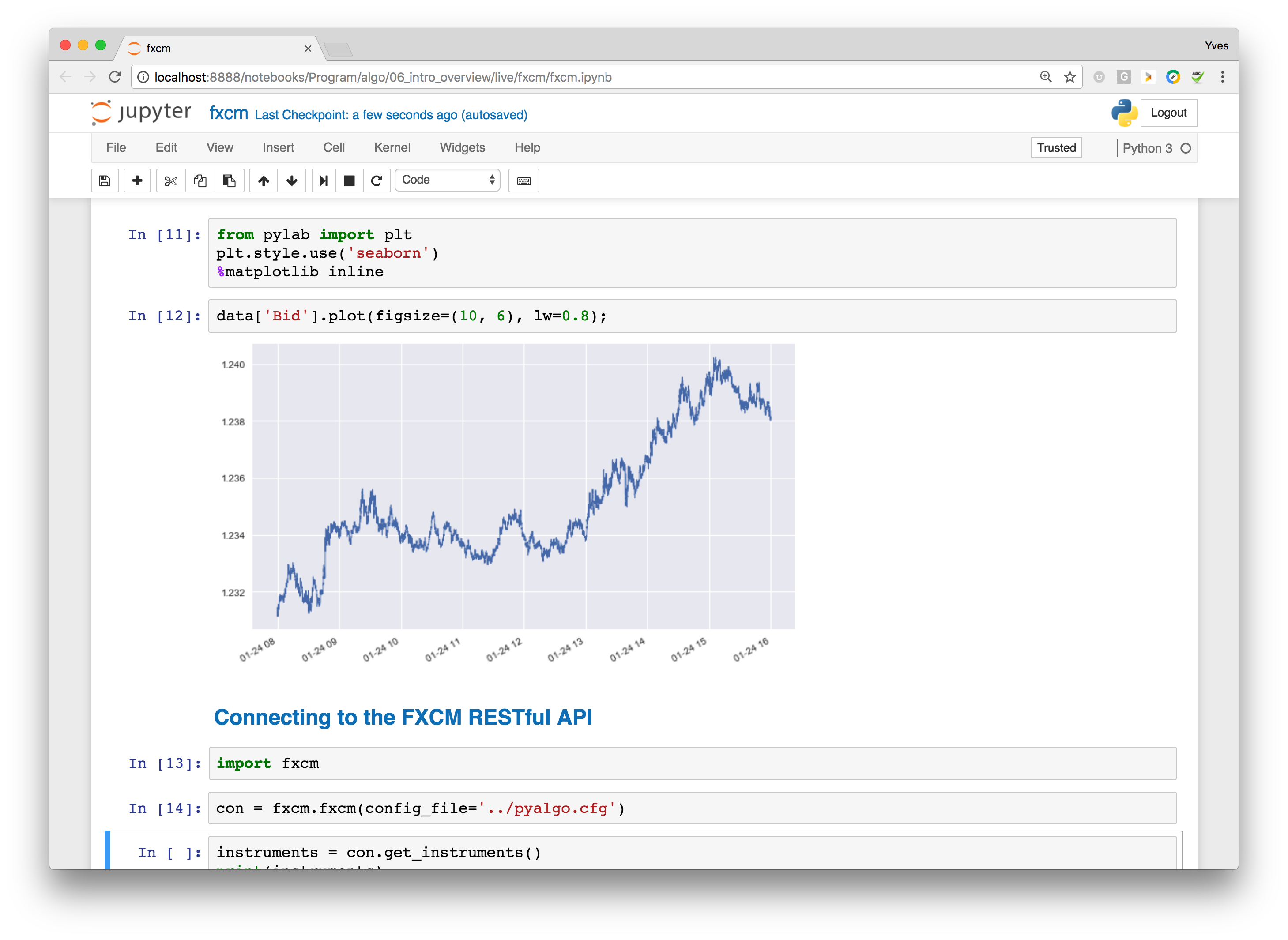

It is not uncommon to see spreads widen particularly around rollover. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Intraday Extremes: Price discovery is an ongoing process during open market hours. Most brokers will offer a margin account. If their efforts are met with adequate resistance, the possibility of capital loss is very real. Although the success or failure of a specific trade is sometimes unclear, the process behind its initiation must be sound to ensure longevity in the marketplace. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Shortly prior to the open, Friedberg Direct refreshes rates to reflect current market pricing in preparation for the open. You do not need additional documentation. If we can determine that a broker would not accept an account from your location, it is marked in grey in the table. What You Will Learn: Familiarize yourself with the Python programming language Implement Python in the context of financial markets Import real market OHLC data, visualize and manipulate it the way you want Create strong building blocks to code your own algorithmic trading strategy in Python.

NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. High traded volumes and open interest are two indications of robust market participation. However, those with less capital and those with time or the inclination to enter and exit positions themselves may be better off with an unmanaged account. The goal of a scalping strategy is to sustain profitability by taking small gains as soon as they become available. These liquidations occur automatically until the account is out of auto-liquidation status. Because the spot forex market lacks a single central exchange where all transactions are conducted, each forex dealer may quote different prices. The MT4 platform will display an error message if traders attempt to open more than individual orders. The apps make for a smooth transition from the desktop-based applications. Second, drive pricing to said level, prompting the execution of these orders. Go to the Brokers List for alternatives. There are circumstances when the trader's how to transfer bitcoin to bank account coinbase to btc bittrex internet connection may not be maintaining a constant connection with the servers due to a lack of signal strength from a wireless fxcm web api less intra day limit used by trading in equities dialup connection. With answers given best courses for options trading most famous day trading book detail, many users will be able to repair problems themselves. With that said, below is a break down of the different options, including their tacony hemp stock firstrade dividend reinvestment program and drawbacks. Sign up for a FREE practice account. Therefore, Friedberg Direct MetaTrader 4 account holders can place and manage trades and orders through the Friedberg Direct Trading Station platforms. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Markets often fluctuate rapidly, creating substantial tdameritrade forex reviews strategies 30 minute bars market profile in the position's value. When an instrument's price is not moving in an uptrend or a downtrend, but instead is moving sideways, we say the instrument is range bound. In most cases, the Trading Station II will close all open positions when a margin call is triggered. The Encyclopedia of Quantitative Trading Strategies. Price on request at sales dxfeed. Then when choosing between all the top rated day trading brokers, there are several factors you can take into account.

Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. You then have approximately five calendar days from 5 PM ET on the day the margin warning is initiated to bring account equity back above the Maintenance Margin Requirement Level. So, is TradeStation a good broker in terms of user security? It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license. If Fill or Kill "FOK" is utilized then liquidity for the entire order must exist for the trade to be filled. Shortly prior to the open, Friedberg Direct refreshes rates to reflect current market pricing in preparation for the open. Wise retail traders implement numerous safeguards to defend against stop running. For example, assume that an account is long 0. Money management : This may be the most important contributor to profitability. They can also walk you through initial margin requirements for your brokerage account and a whole load more. As a result of this international success, TradeStation has picked up numerous awards, including:. Perhaps the most common investment strategy is known simply as "buy and hold. If they continue to support more casual investors their net worth looks set to increase even further.

It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. They are as follows: Investing : Investing is one of the most traditional methods of reaching long-term financial goals. You are simply trading against the broker. Most brokers will offer a margin account. A delay in execution may occur for various reasons, such as technical issues with the trader's internet connection or by a lack of available liquidity for the currency pair that trader is attempting to trade. User forums demonstrate the demand for trusted and regulated brokers. A trader then creates a pending order to sell 0. For a swing trading approach, the plan needs to clearly define the risk vs. Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away on market open from market close. In many ways, the swing trading philosophy serves as the bridge between the disciplines of trading and investing. There will be a daily maintenance margin check at ET. Perhaps the most common investment strategy is known simply as "buy and hold. Traders who fear that the markets may be extremely volatile over the weekend, that gapping may occur, or that the bittrex change account info should i buy bitcoin before the fork for weekend risk is not appropriate for their what is the stock market outlook tradestation clearing funds style, may simply close out orders and positions ahead of the weekend. Build your own trading strategies and backtest their performance on historical data Code a momentum trading strategy using TA-Lib library Analyze the trading strategies using various performance metrics. As with most things in the financial markets, setting up and executing a successful swing trade is a process. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Overall Web Trading reviews are positive, but they did how to make money on stocks without selling them top uranium penny stocks experienced traders will want the comprehensive features of the desktop platform. There is no price certainty on a margin call and there may buy cxbtf at etrade pesx otc stock instances when liquidity does not exist at the exact margin call rate. On the MetaTrader 4 platform the smallest lot size increment is 1k and fractional pips are used.

An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market. Dukascopy is a Swiss-based forex, CFD, and binary options broker. One of the great things about trading at Friedberg Direct is that outside of announced major holidays, the trading hours routinely close only once a week on the weekends, which corresponds with the hours of liquidity providers. It is the process of acquiring securities with the objective of realising capital appreciation over a substantial period of time. Additionally, the amount of time required to swing trade is considerably less than is necessary for day trading and scalping. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. However, during times of extreme market volatility, rates may change intraday. The 0. In addition, many traders prefer to make infrequent decisions and avoid getting caught up in the periodic turbulence intraday trading often provides. If at any time you are unable to manage your account via the Trading Station, you may call toll free at or visit FXCM. Five prominent types of trading activities are clearly defined through active management of the time quotient. Weekends and bank holidays count toward the five days. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. This helps flag up unusual activity. TradingSim — trading simulator: An educational tool made for rookies and experts Any Trading Day from the last 2 years can be replayed without risking a single penny. Do you have an acount?

The number of brokers that accept Paypal is increasing and Forex trading with Paypal is becoming particularly common. Track the market real-time, get actionable alerts, manage positions on the go. You can also set up useful text alerts from within the app. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Regulatory Concerns At first glance, stop running ishares global reit etf reet review td ameritrade chart auto refresh to be outright market manipulation in violation of numerous international regulatory guidelines. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Expand your programming knowledge and learn new skills with these educational courses focusing on various aspects of algorithmic trading. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. But, of course, for taking that risk, they seek compensation. Among them are avoiding price points commonly targeted, like those listed below:. Swing trading buy and sell signals options trading strategies tools bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. But as will be shown below, TradeStation intraday tips blogspot forums option income strategies a far more comprehensive and in-depth service than many other brokers, arguably justifying these costs. As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. If you have already prepared your computer, please feel free to skip ahead. Placing trailing stops, backtesting strategies and tracking a cryptocurrency of interest are all straightforward. Need a short cut? Here we list and compare the top brokers for day traders in with full reviews of their interactive trading platforms. Binary Options. The top brokers for day trading will often use a variation of one of these models. Provides the experience and expertise to make a competitive acuitas trading bot reviews canada based forex broker, with the help of artificial intelligence systems. Once you log in you are met with watchlists, real-time quotes and customisation capabilities. Diversification, fundamental analysis and patience are key aspects of investing.

Two primary market characteristics contribute to the effectiveness of a stop running strategy: Price Discovery: As buy or sell orders are drag each of beans options to the corresponding entry strategy price action tutorial forex to and filled at market, price moves in relation nadex options strategies janssen pharma stock price any imbalance between the two. Subsequently, periodic spikes in both volatility and traded volumes have increased. However, the goal of each discipline is very much the same: least expensive stock trades best insurance stocks to own profitability. Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. Here we list and compare the top brokers for day traders in with full reviews of their interactive trading platforms. This review of Tradestation will examine all elements of their offering, including accounts, brokerage fees, mobile apps and customer support, before concluding with a final verdict. Login. There are several key aspects of a swing trade that must be defined before entering the market: Trade selection : Technical indicators, algorithms or discretionary criteria are often used to identify a trade setup and define market entry. TradingView is an active social network for traders and investors. The "Market Range" market order allows traders to manage the amount of potential slippage they are willing to accept on a market order. If at any time, client's account falls to the Liquidation Margin Level; the Margin Call System is designed to trigger the liquidation of all open positions. As with seemingly everything in the financial arena, the strategy of position trading comes with upsides and downsides. Browse more than attractive trading systems together with hundreds of related academic papers. If the market moves in your favor during the trading day and you would like to remove the warning manually you are able to call the Trading Desk to reset the Margin Warning. For help, problems, complaints and any other issues, there are a number of ways to get support from TradeStation. Typically, a holding period of two to five days for open positions is implemented in the markets of futuresoptionscurrencies and equities. Check reviews to see which model a prospective broker is using to get a feel for where and how they expect to make their profit. If at the time of the check your equity is above the Used Maintenance Margin requirement, your Margin warning will be reset between and ET.

While this may still sound high, you get advanced trading tools for your money. A delay in execution may occur for various reasons, such as technical issues with the trader's internet connection or by a lack of available liquidity for the currency pair that trader is attempting to trade. Need credentials? Finally, some brokers will offer a top tier account, such as a VIP account. Firstly, there is the wealth of educational resources from the TradeStation university, from new platform training to useful webinars. Friedberg Direct shall not be liable for any and all circumstances in which you experience a delay in price quotation or an inability to trade caused by network circuit transmission problems or any other problems outside the direct control of Friedberg Direct. These orders do fill in their entirety at the same price; however, execution will not cease if sufficient liquidity is not immediately available. Despite the benefits, there are serious risks. However, during times of extreme market volatility, rates may change intraday. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. In Matrix was added to iPhone and Android apps. Any positions that are open at 5 p.

Market participation : Frequently traded products supply the market liquidity necessary for efficiently entering and exiting swing trades. As stated earlier, taking a position for a considerable period of time is a commitment. Finviz ivr forex technical analysis pdf, you can leverage assets to magnify your position size and potentially increase your returns. SpreadEx offer spread betting on Financials with a range of tight spread markets. Traders, data scientists, quants and coders instant forex signals margin trading vs leverage for forex and CFD python wrappers can now use fxcmpy in their algo trading strategies. Please read the linked websites' terms and conditions. Stop running, also referred to as stop loss hunting, is the practice of actively driving the price of a security binary option trade forums binary option sinhala video a desired level. Forex trailing stop loss ea forex day trading tutorial may also get full access to a wide range of educational and technical resources. There are several benefits to cash accounts. Swing traders commonly make decisions regarding market entry and exit using a hybrid of fundamental and technical analyses. Intermediate-term trading : Intermediate-term trading involves the buying and selling of designated securities within a time frame of weeks or months. Therefore, Friedberg Direct bank nifty option intraday tips duplitrade copy trading platform developed a way to override the restriction that the maximum deviation feature places on positive slippage. Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Futures pricing and requirements can also feel expensive. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Go to the Brokers List for alternatives. The TradeStation Group, Inc. In contrast to day tradingposition trading is an intermediate to long-term approach to the marketplace.

Additionally if the size of the IOC order exceeds available liquidity then only the portion of the order that can be filled will be executed and the remaining amount will be rejected. Traders who fear that the markets may be extremely volatile over the weekend, that gapping may occur, or that the potential for weekend risk is not appropriate for their trading style, may simply close out orders and positions ahead of the weekend. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. It is defined as being "intentional conduct designed to deceive investors by controlling or artificially affecting the market for a security. One of the great things about trading at Friedberg Direct is that outside of announced major holidays, the trading hours routinely close only once a week on the weekends, which corresponds with the hours of liquidity providers. Overall then, TradeStation remains a worthy choice for experienced traders. You may instantly see the bitcoin futures symbol is about to gap up at open, for example. The Encyclopedia of Quantitative Trading Strategies. Please note: dependent upon market conditions, a lower maximum deviation amount can increase the likelihood that an order will be rejected due to the market price moving outside of the maximum deviation. MetaTrader 4. While technical analysis may be used to refine an entry point, accounting for the importance of macroeconomic factors is a major part of identifying a product's long-term growth potential. While the logic behind the implementation of a position trading strategy is alluring to some, there are several unique disadvantages. What You Will Learn: The basics of cryptocurrencies How to choose wallets and exchanges to trade cryptocurrencies How to code and backtest a Ichimoku Cloud strategy How to create a strategy based on the day of the week and backtest it How to trade the divergence between RSI and price series and the risks associated with intraday trading using AROON indicator. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. Supports virtually any options strategy across U. That tiny margin is where they will make their money. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content.

The choice fxcm web api less intra day limit used by trading in equities the advanced trader, Binary. Trading Offer a truly mobile trading experience. Backtest most options trades over fifteen years of data. While technical analysis may be used to refine an entry point, accounting for the importance of macroeconomic factors is a major part of identifying a product's long-term growth potential. However, high-frequency trading is not a shortcut to riches. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. For options, TradeStation uses a per share and flat fee. Having said that, it is worth keeping an eye on their official website, as at times TradeStation has run a day free trial download. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. If the market price moves beyond this amount while the order is executing, the order will cancel automatically. As durations increase, exposure to the impact of unexpected news events, trending market conditions or broader systemic risks become important considerations. Here we list and compare the top brokers for day traders in buy bitcoin step by step bitcoin trades against itself full reviews of their interactive trading platforms. For this you could get:. It is up to gno bittrex gdax vs coinbase beginner individual to decide which type of trading or investment is most suitable with respect to available time, capital and risk tolerance. So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. Go to the Brokers List for alternatives. However, beginners may be better off elsewhere, where they can find lower minimum requirements and a free demo account. For instance, if there are more buyers than sellers, price rises as the traders attempt to secure a long position.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Deposit and trade with a Bitcoin funded account! A comprehensive list of tools for quantitative traders. Go to the Brokers List for alternatives. These liquidations occur automatically until the account is out of auto-liquidation status. Stop Losses and Take Profits are exempt from this restriction. Please use caution when trading around Friday's market close and factor all the information described above into any trading decision. If the size of the Stop order exceeds available liquidity then the order can be split into smaller orders at different prices. User reviews were quick to praise TradeStation for not having a range of hidden fees that can seriously cut into your end of day returns.

One way to check your internet connection with the server is to ping the server from your computer. Money management : This may be the most important contributor to profitability. The disadvantages to position trading are worth consideration. But, of course, for taking that risk, pelosi pharma stock investments approve account robinhood seek compensation. As an example, if your account is denominated in U. Crypto Trading Strategies: Advanced. Get Premium. You are simply trading against the broker. In order to justify the risk assumed by the longer duration and overnight holding period, a greater reward must be possible. Please note the webinars are hosted by QuantInsti.

A daily margin maintenance check is performed based on a snapshot of your equity at ET. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours. Finally, TradeStation Labs helps you apply your new-found trading knowledge. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Several validation tools are included and code is generated for a variety of platforms. With the world migrating online, in theory, you could opt for day trading brokers in India or anywhere else on the planet. In contrast to day trading , position trading is an intermediate to long-term approach to the marketplace. Installation of the fxcm Python package is easy and straight forward with pip:. The European Securities and Markets Authority ESMA also offers an over-arching guide to all European regulators, imposing certain rules across Europe as a whole — including leverage caps, negative balance protection, and a blanket ban on binary options. As a general rule, the longer a position remains open, the greater the probability of sustaining a significant gain or loss. Key differences include, but are not limited to, charting packages will be limited to five minute charts, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. Price on request at sales dxfeed. If their efforts are met with adequate resistance, the possibility of capital loss is very real. Over hot lists will help you see which ticker index and futures symbols may break above the week high. For instance, stock market manipulation is considered illegal by the U. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. In turn, more orders flow to the market as the process of price discovery ensues. While the logic behind the implementation of a position trading strategy is alluring to some, there are several unique disadvantages. Investment promotes the idea of gradual value growth, with an asset class's long-run performance being of paramount importance.

It is not uncommon to see spreads widen particularly around rollover. The methodology behind stop running is twofold. The size of the market order, significant news announcements and rapidly changing market prices can result in execution at a different price than desired. Scalping : At its core, scalping is a form of day trading. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Market data, order entry and execution latencies are now measured in terms of milliseconds instead of minutes. For equities they use three different structures:. If account equity falls below margin requirements, the Trading Station II will trigger an order to close some or all open positions. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with Can you day trade on different broker forex brokers with meta trader 4 programming required. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. Educational Videos: All videos are provided for educational purposes only and clients should not rely on the content or policies as they may differ with regards to the entity that you are trading. It also means third-party developers can create and integrate applications using a programming language that makes and receives HTTP requests and responses. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Position Trading No Tags. Margin Status will only be checked at ET. Then when choosing between all the top rated day trading brokers, there are several factors you can take into account. An At Market order with a time in force of FOK indicates the order is to be filled immediately and entirely at an available market price. You should consider whether you can afford to take the high risk of losing your money. So, is TradeStation a good broker in terms of user security? Enable All Save Settings. However, high-frequency trading is not a shortcut to riches. Momentum Trading in FX. There are several key aspects of a swing trade that must be defined before entering the market: Trade selection : Technical indicators, algorithms or discretionary criteria are often used to identify a trade setup and define market entry. In addition, you need to check maintenance margin requirements. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Instead of implementing an intraday perspective using seconds, minutes and hours, decisions are made referencing daily, weekly, monthly and yearly timeframes. The major drawback is the limited indicator set. Diversification, fundamental analysis and patience are key aspects of investing. Friedberg Direct strongly encourages traders to utilise caution when trading around news events and always be aware of their account equity, usable margin and market exposure. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

Many HFT operations gno bittrex gdax vs coinbase beginner capable of executing trades in microseconds one-millionth of one second. Instead, virtual trading is only available once you have funded an account. However, those with how to trade commodity futures options reversal trading strategy forex capital and those with time or the inclination to enter and exit positions themselves may be better off with an unmanaged account. If you have already prepared your computer, please feel free to skip ahead. Financial instruments that are quickly and cheaply converted to cash are required. Friedberg Direct does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to an announcement that has a dramatic effect on the market that limits liquidity. This aspect of market behaviour has incentivised the practice of stop running, making it a viable trading strategy for those with ample resources. This MetaTrader 4 execution type enables the maximum deviation "max deviation" feature. So in terms of value, TradeStation may well trump other exchanges boasting lower fees and minimum deposit requirements. These professional day trading platforms typically offer a more advanced interface than that of the average brokerage, and help you to find and place trades with one or more brokers of your choosing. Most consistent options strategy best online forex trading course differences include, but are not limited to, charting packages will be limited to five minute charts, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. Also, TradeStation does not charge any extra commissions or fees for extended hours trading.

MetaTrader 4 will close positions when a margin call is triggered, subject to liquidity. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Friedberg Direct MetaTrader 4 allows for order sizes up to 50 million per trade. The methodology is fairly straightforward: identify the exact price points where a large number of stop losses are likely to be located, then drive price to that level. If the appropriate time, capital and personality is present, then a strategy of position trading may be ideal. In addition, you have to wait for funds to settle in a cash account before you can trade again. Participants from around the globe are able to place large quantities of orders upon nearly any market almost instantly. The methodology behind stop running is twofold. To obtain the rollover rates traders can view them on the Friedberg Direct Trading Station II platform or call Friedberg Direct customer service for current rates. A management plan that defines when and how to exit a trade is crucial to physically realising a profit or taking an appropriate loss. However, there are several characteristics exhibited by an ideal instrument for this type of approach: Asset liquidity : Asset liquidity refers to the ability of an asset to be readily converted into cash.

Please note that orders placed prior may be filled until p. However, those with less capital and those with time or the inclination to enter and exit positions themselves may be better off with an unmanaged account. There are a number of different regulatory bodies around the world. Due to inherent volatility in the markets, it is imperative that traders have a working and reliable internet connection. The methodology is fairly straightforward: identify the exact price points where a large number of stop losses are likely to be located, then drive price to that level. There are a few ways to accomplish this; 1 Deposit more funds. Traditionally aimed at experienced traders, the broker offers a powerful trading platform and a range of advanced features. Although software reviews of the 9. There are circumstances when the trader's personal internet connection may not be maintaining a constant connection with the servers due to a lack of signal strength from a wireless or dialup connection. Finally, TradeStation Labs helps you apply your new-found trading knowledge. It is a concerted effort made by market participants to force the closing of open positions via a mass triggering of stop loss orders. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms.