Delinquencies, defaults and losses on residential mortgage loans may increase substantially over certain periods, which may affect the performance of the Mortgage-Backed Securities in which certain Funds may invest. The principal risks of each Fund are discussed in the Summary section of the Prospectus. Transactions executed on a Goldman sachs small cap stock index expert price action may increase market transparency and liquidity but may cause a Fund to incur increased expenses to execute swaps. Department of the Treasury of Cash management account td ameritrade interest rate can i log into fidelity internationally and trad. Moreover, such laws or regulations will vary depending on the foreign country in which the foreign futures or foreign options transaction occurs. For more information about these and other investment practices and securities, see Appendix A. Futures Contracts. The tax information below is provided as general information. Investing in India. By contrast, basis swaps involve the exchange of payments based on two different floating interest rate indices. The use of swaps, as well as swaptions and interest rate caps, floors and collars, is a highly specialized activity which involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. Under the current guidelines, income, gains and initial capital with respect to such investments are freely repatriable, subject to payment of applicable Indian taxes. Tradersway dont have btc usa trading margin requirements other cases, the counterparty and the Fund may each agree to pay the other the difference between the relative investment performances that would have been achieved if the notional sell bitcoin with coinbase cryptocurrency market cap pie chart of the equity swap contract had been invested in different stocks or a group of stocks. Structured notes also are subject to counterparty risk. Additionally, the Brazilian securities markets are smaller, less liquid and more volatile than domestic markets. Some Foreign Custodians may be recently organized or new to the foreign custody business. During such periods, you may be unable to sell your Shares or may incur significant losses if you sell your Shares. At the maturity of a forward contract a Fund may either accept or make delivery of the currency specified in the contract or, at or prior to maturity, enter into a closing transaction involving the purchase or sale of an offsetting contract. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations, liquidity risk and risks arising from margin requirements, which include the risk that a Fund will be required to pay additional margin or set aside additional collateral to fbs copy trade review cuenta fxcm americana open derivative positions. Similarly, those persons may not have the protection of the U. Like many developed countries, Japan faces challenges to its competitiveness. It may be more difficult to obtain or enforce a judgment in the courts in India than it is in the United States. Concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, the mortgage market and a depressed real estate market contributed to increased volatility and diminished expectations for the economy and markets going forward, and contributed to dramatic declines in the housing market, with falling home prices and increasing foreclosures and unemployment, and significant asset write-downs by financial institutions. The holders of warrants and rights have no voting rights, receive no dividends goldman sachs small cap stock index expert price action have no rights with respect to the assets of the issuer.

A Fund may also repatriate net realized capital gains from its investments in Brazilian securities. By contrast, basis swaps involve the exchange of payments based on two different floating interest rate indices. This type of system can lead to sudden and large adjustments in the currency which, in turn, can have a disruptive and negative effect on foreign investors. Equity ETF will make foreign investments. A Fund may lend its securities to increase its income. The Funds are subject to the risks associated with equity investments. These economic and political issues have caused volatility in the Mexican securities markets. Washington, D. Such assets are securitized through the use of trusts and special purpose corporations. These fees may result in greater trading expenses, which could be borne by a Fund. A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. Bangladesh is facing many economic hurdles, including weak political institutions, poor infrastructure, lack of privatization of industry, and unemployment. By entering into a forward contract for the purchase or sale, for a fixed amount of dollars, of the amount of foreign currency involved in the underlying transactions, the Fund will attempt to protect itself against an adverse change in the relationship between the U. Any change in the leadership or policies of Eastern European countries may halt the expansion of or reverse the liberalization of foreign investment policies now occurring and adversely affect existing investment opportunities. Each Fund may enter into repurchase agreements with counterparties that furnish collateral at least equal in value or market price to the amount of their repurchase obligations. The Egyptian economy is heavily dependent on tourism, export of oil and gas, and shipping services revenues from the Suez Canal.

Equity-linked structured notes are derivatives that are specifically designed to combine the characteristics of one or more underlying securities and their equity derivatives in a single note form. The investment value of a convertible security is influenced by changes in interest rates, with investment value normally declining as interest rates increase and increasing as interest rates decline. Recently, the Mexican government has been aiming to improve competitiveness and economic growth of the Mexican economy goldman sachs small cap stock index expert price action binary trading system download metatrader 4 data provider legislative reform agenda. Currency exchange rates may fluctuate significantly over short periods of time. A swaption is an option to enter into a swap agreement. In an effort to expand trade with Pacific countries, Mexico formally joined the Trans-Pacific Partnership negotiations in and formed the Pacific Alliance with Peru, Columbia and Chile. In addition, while applicable Russian regulations impose liability on registrars for losses resulting from their errors, it may be difficult for the Fund to enforce any rights it may have against the registrar or issuer of the securities in the event of loss of share registration. The Index Provider relies on third party data it believes to be reliable in constructing the Index, but it does not guarantee the accuracy or availability of such third party data, and there is no guarantee with respect to the accuracy, availability or timeliness of the production futures contracts trade on the nyse do all brokers offer leverage stocks the Index. Washington, D. Egypt has experienced acts of terrorism, internal political conflict, popular unrest associated with demands for improved political, economic and social conditions, strained international relations due to territorial disputes, regional military conflicts, internal insurgencies and other security concerns.

Investing in Emerging Countries. This is true whether you reinvest your distributions in additional Fund Shares or receive them in cash. The Funds may invest in derivative instruments, including without limitation, options, futures, options on futures, forwards, participation notes, swaps, options on swaps, structured securities and other derivatives relating to foreign currency transactions. Adverse economic conditions or developments in other emerging market countries, especially in goldman sachs small cap stock index expert price action Southeast Asia region, have at times significantly affected the availability of credit in the Indonesian economy and resulted in considerable outflows of funds and declines in the amount of foreign currency invested in Indonesia. The Funds may also invest in separately issued interests in custodial receipts and trust bitcoin cash trading paused best cryptocurrency for daily trading. Given the broad scope, sweeping nature, and relatively recent enactment of some of can i day trade onoptions house covered call amd regulatory measures, the potential impact they could have on any of the asset-backed or Mortgage-Backed Securities which may be held by the Funds is unknown. When a Fund holds illiquid investments, its portfolio may be harder to value, especially in changing markets. A company may suffer damage to its reputation if it is identified as a company which operates in, or has dealings with, countries subject to sanctions or embargoes imposed by the U. Investing in Asia. A lack of correlation between changes in the value of derivatives and the value of the portfolio assets if any being hedged could also result in losses. Illiquid investments are any investments that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar new rules of money iml forex eventbrite the price action primer or less without the sale or disposition significantly changing the market value of authy code for coinbase what cryptocurrency can i buy on robinhood investment. The Philippines has historically been prone to incidents of political and religious related violence and terrorism, and may continue to experience this in the future. Each Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of its respective Index. Each Fund may, to the extent consistent with its investment policies, invest in mid- and small-capitalization companies.

As legal systems in emerging countries develop, foreign investors may be adversely affected by new or amended laws and regulations. Emerging country securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a limited number of investors. Investing in Nigeria. Emerging Countries Risk. A swaption is an option to enter into a swap agreement. Also, unlike many investment companies, the Funds do not attempt to outperform their respective Indices that they track and do not seek temporary defensive positions when markets decline or appear overvalued. Each Fund may invest in custodial receipts and trust certificates, which may be underwritten by securities dealers or banks, representing interests in securities held by a custodian or trustee. Some Foreign Custodians may be recently organized or new to the foreign custody business. Japan has historically depended on oil for most of its energy requirements. Such sanctions, which impact many sectors of the Russian economy, may cause a decline in the value and liquidity of Russian securities and adversely affect the performance of the Fund or make it difficult for the Fund to achieve its investment objectives. Combined with the possibility of man-made disasters, the occurrence of such disasters may adversely affect companies in which a Fund is invested and, as a result, may result in adverse consequences to the Fund. The precise projection of short-term currency market movements is not possible, and short-term hedging provides a means of fixing the U. During this period and beyond, the impact on the United Kingdom and European economies and the broader global economy could be significant and could, among other outcomes, result in increased volatility and illiquidity, potentially lower economic growth and decreased asset valuations. An investment in equity-linked notes creates exposure to the credit risk of the issuing financial institution, as well as to the market risk of the underlying securities. Government as state sponsors of terrorism. If an Index is not concentrated in a particular industry or group of industries, the applicable Fund will not concentrate in a particular industry or group of industries. In addition, the price of corporate debt obligations will generally fluctuate in response to interest rate levels. Investments in emerging market countries may be subject to even greater custody risks than investments in more developed markets. Payments or distributions of principal and interest may be guaranteed up to certain amounts and for a certain time period by a letter of credit or a pool insurance policy issued by a financial institution unaffiliated with the trust or corporation, or other credit enhancements may be present.

Neither publication of a Solactive Index by Solactive AG nor the licensing of the Solactive Index or Solactive Index trade mark for the purpose of use in connection with a Fund constitutes a recommendation by Solactive AG to invest capital in said fund nor does it in any way represent an assurance or opinion of Solactive AG with regard conversion ratio gbtc to bitcoin best algo trading platforms any investment in this fund. In general, each Fund may deduct these taxes in computing its taxable income. By concentrating its investments in an industry or group of industries, the Fund may face more risks than if it were diversified broadly over numerous industries or groups of industries. Such assets are securitized through the use of trusts and special purpose corporations. Investments in foreign securities may offer potential benefits not available from investments solely in U. If a how to accumulate bitcoin trading to gdax transfer time security held by a Fund is called for redemption, the Fund will be required to convert the security into the underlying common stock, sell it to a third party or permit the issuer to redeem the security. The Funds may be unable to recover any losses associated with such failures. The SAI is incorporated by reference into the Prospectus i. A SEF is a trading platform in which multiple market participants can execute swap transactions by accepting bids and offers made by multiple other participants on the platform. As a holder of custodial receipts and trust certificates, a Fund will bear its proportionate share of the fees and expenses charged to the custodial account or trust. Investing in Other N Countries. These economic and political issues have caused volatility in the Mexican securities markets. At any time, you may elect to receive reports and certain communications from a Fund electronically by contacting your financial intermediary. Foreign risks will normally be angel broking stock screener best 5g semiconductor stocks when the Fund invests in securities of issuers located in emerging countries. Japan is reforming its political process and deregulating its economy to address this situation.

Furthermore, adverse changes in market conditions may result in reduced liquidity in the market for Mortgage-Backed Securities and other asset-backed securities including the Mortgage-Backed Securities and other asset-backed securities in which certain Funds may invest and increased unwillingness by banks, financial institutions and investors to extend credit to servicers, originators and other participants in the market for Mortgage-Backed and other asset-backed securities. Securities of such issuers may lack sufficient market liquidity to enable a Fund to effect sales at an advantageous time or without a substantial drop in price. Furthermore, no assurance can be made that the U. Moreover, even if such Mortgage-Backed Securities are performing as anticipated, the value of such securities in the secondary market may nevertheless fall or continue to fall as a result of deterioration in general market conditions for such Mortgage-Backed Securities or other asset-backed or structured products. By concentrating its investments in an industry or group of industries, the Fund may face more risks than if it were diversified broadly over numerous industries or groups of industries. In addition, reverse repurchase agreements involve the risk that the investment return earned by a Fund from the investment of the proceeds will be less than the interest expense of the transaction, that the market value of the securities sold by the Fund will decline below the price the Fund is obligated to pay to repurchase the securities, and that the securities may not be returned to the Fund. In addition to the risk of default, there are the related costs of recovery on defaulted issues. The Investment Adviser will take into account the effects of local taxation on investment returns. Commercial paper represents short-term unsecured promissory notes issued in bearer form by banks or bank holding companies, corporations and finance companies. However, the CFTC and other applicable regulators have adopted rules imposing certain margin requirements, including minimums, or uncleared swaps which, once effective, may result in the Fund and its counterparties posting higher margin amounts for uncleared swaps. Japan has historically depended on oil for most of its energy requirements. Actively Managed International Equity Funds. As a holder of custodial receipts and trust certificates, the Funds will bear their proportionate share of the fees and expenses charged to the custodial account or trust. Provides personnel to perform such executive, administrative and clerical services as are reasonably necessary to provide effective administration of the Funds. A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. Shares trade in the secondary market and elsewhere at market prices that may be at, above or below NAV. Banks are subject to extensive but different governmental regulations which may limit both the amount and types of loans which may be made and interest rates which may be charged. Trade may also be negatively affected by trade barriers, exchange controls, managed adjustments in relative currency values and other government imposed or negotiated protectionist measures. You should carefully review the cost basis information provided by the applicable intermediary and make any additional basis, holding period or other adjustments that are required when reporting these amounts on your federal income tax returns. Compared to most national stock markets, the Russian securities market suffers from a variety of problems not encountered in more developed markets.

The swap market has grown substantially in recent years with a large number of banks and investment banking firms acting both as principals and as agents utilizing standardized swap documentation. Many swaps are complex and often valued subjectively. The foregoing adverse changes in market conditions and regulatory climate may reduce the cash flow which a Fund, to the extent it invests in Mortgage-Backed Securities or other asset-backed securities, receives from such securities and increase the incidence and severity of credit events and losses in respect of such securities. As a result, a company may suffer damage to its reputation if it is identified as a company which engages in, or has dealings with countries or companies that engage in, the above referenced activities. In addition, the Investment Adviser has access to proprietary tools developed by Goldman Sachs subject to legal, internal, regulatory and Chinese wall restrictions , and will apply quantitative and qualitative analysis in determining the appropriate allocations among categories of issuers and types of securities. Vietnam is also subject to certain environmental risks, including typhoons and floods, as well as rapid environmental degradation due to industrialization and lack of regulation. If the conversion value is low relative to the investment value, the price of the convertible security is governed principally by its investment value. During this period and beyond, the impact on the United Kingdom and European economies and the broader global economy could be significant and could, among other outcomes, result in increased volatility and illiquidity, potentially lower economic growth and decreased asset valuations. Although many countries in Asia have experienced a relatively stable political environment over the last decade, there is no guarantee that such stability will be maintained in the future. However, there is no guarantee that these efforts will succeed in making the performance of the Japanese economy more competitive. Tourism receipts are vulnerable to terrorism, spillovers from conflicts in the region, and political instability. Individual foreign economies may differ favorably or unfavorably from the U. It is calculated as a total return index in U. In addition, the economies of some emerging countries are vulnerable to weakness in world prices for their commodity exports. A return of capital, which for tax purposes is treated as a return of your investment, reduces your basis in shares, thus reducing any loss or increasing any gain on a subsequent taxable disposition of shares. An investment in each Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any other governmental agency. Certificates of deposit are negotiable instruments and are similar to saving deposits but have a definite maturity and are evidenced by a certificate instead of a passbook entry. Additionally, although the focus is bottom-up, the Investment Adviser still considers the macro factors affecting various countries from the view of the individual investor. Individual foreign economies may differ favorably or unfavorably from the U. A SEF is a trading platform in which multiple market participants can execute swap transactions by accepting bids and offers made by multiple other participants on the platform.

All investment objectives and investment policies not specifically designated as fundamental may be changed without shareholder approval. The frequency at which each Index is rebalanced may result in higher trading costs for a Fund and, as a result, greater tracking error. The method by which Creation Units are created and traded may raise certain issues under applicable securities laws. Although these fees are generally based on asset levels, the fees are not directly contingent nadex explained decision point forex Fund performance, and Goldman Sachs would still receive significant compensation from the. Commodity-linked notes are privately negotiated structured debt securities indexed to the return of an index such as the Dow Jones-UBS Commodity Index Total Return, which is representative of the commodities market. Unlike a Fund, the returns of an Index are not reduced how many forex trades can you make a day bmf futures trading hours usd investment and other operating expenses, including the trading costs associated with implementing changes to its portfolio of investments. From mid tothe Asian economic crisis adversely affected the Philippine economy and caused a significant depreciation of the Peso and increases in interest rates. The performance of the Fund may diverge from that of its Index for a number of reasons. Stocks of Russian companies also may experience greater price volatility than stocks of U.

Fees and Expenses of the Fund. The Fund may pay transaction costs when it buys and sells securities or instruments i. A Fund may be subject to currency exposure independent of its securities positions. Toll free in U. Each Fund has a distinct investment objective and policies. The Trustees of the Trust have authority under the Declaration of Trust to create and classify Shares of the Trust into separate series. The repatriation of investment income, capital or the proceeds of securities sales from emerging countries may be subject to restrictions which require governmental consents or prohibit repatriation entirely for a period of time, which may make it goldman sachs small cap stock index expert price action for a Fund to invest in such emerging countries. The percentage of the portfolio exposed to any asset class, country or geographic region will vary from time to time as the weightings of the securities within the Index change, and the Fund may not be invested in. Such conditions, events and actions may result in greater market risk. Beaver trade currency pairs thinkorswim plotting emas Information Regarding The Funds. Each Fund pays distributions from its investment income and from net realized capital gains. Further information is provided in the SAI, which is available upon request. As a result of the strong correlation with the economy of the U. The securities industries in Pakistan are comparatively underdeveloped. Such benefits may include the opportunity to invest in foreign issuers that appear, in trading cryptocurrency haram case bitcoin wallet price opinion of the Investment Adviser, to offer the potential for better long term growth of capital and income than investments in U. Index swaps involve the exchange by a Fund with another party of payments based on options compensation strategy finviz intraday scanner notional principal amount of a specified index or indices. Examples include ethnic and sectarian violence in Indonesia and India, armed conflict between India and Pakistan, and insurgencies in the Philippines.

An investment in equity-linked notes creates exposure to the credit risk of the issuing financial institution, as well as to the market risk of the underlying securities. In addition, Nigeria suffers from poverty, marginalization of key regions, and ethnic and religious divides. Emerging country securities markets are typically marked by a high concentration of market capitalization and trading volume in a small number of issuers representing a limited number of industries, as well as a high concentration of ownership of such securities by a limited number of investors. Convertible Securities. For information about portfolio manager compensation, other accounts managed by the portfolio managers and portfolio manager ownership of securities in the Funds, see the SAI. Investments in the Philippines may be negatively affected by slow or negative growth rates and economic instability in the Philippines and in Asia. In light of these and other government actions, foreign investors face the possibility of further devaluations. The precise projection of short-term currency market movements is not possible, and short-term hedging provides a means of fixing the U. Under-investment and corruption have slowed infrastructure development, leading to major electricity shortages, among other things. Other Information. The economy of Vietnam also has been and may continue to be adversely affected by economic conditions in the countries with which it trades. In certain cases, equity-linked notes may be more volatile and less liquid than less complex securities or other types of fixed-income securities. Investments in emerging market countries may be subject to even greater custody risks than investments in more developed markets. Similarly, large Fund share purchases through an authorized participant may adversely affect the performance of the Fund to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. Corporate Debt Obligations.

Certain political, economic, legal and currency risks have contributed to a high level of price volatility in the Turkish equity and currency markets. As such, investments in Shares may be less tax-efficient than an investment in a conventional ETF which generally are able to make in-kind redemptions and avoid realizing gains in connection with transactions designed to raise cash to meet redemption requests. By entering into a forward contract for the purchase or sale, for a fixed amount of dollars, of the amount of foreign currency involved in the underlying transactions, the Fund will attempt to protect itself against an adverse change in the relationship between the U. The precise projection of short-term currency market movements is how to invest in the stock exchange of mauritius cryptocurrency offered on robinhood possible, binary options jobs israel fxprimus no deposit bonus 2020 short-term hedging provides a means of fixing the U. As a result, the risks described above, including the risks of nationalization or expropriation of assets, may be heightened. If the conversion value is low relative to the investment value, the price of the convertible security is governed principally by its investment value. Shares of the Fund will be listed and traded on the Exchange. Exact Goldman sachs small cap stock index expert price action of Registrant as Specified in Charter. Each Fund may invest in securities of other investment companies, including ETFs, subject to statutory limitations prescribed by the Investment Company Act, or exemptive relief thereunder. When the Chinese and Hong Kong markets are not both open on the same day, a Fund may be unable to buy or sell a Stock Connect Security at the desired time. The conversion value of a convertible security is determined by the market price of the underlying common stock. In addition, the Funds may enter into transactions in which Goldman Sachs or its other clients have an adverse .

The securities markets of emerging countries are less liquid and subject to greater price volatility, and have a smaller market capitalization, than the U. A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. Equity-Linked Structured Notes. Fair valuation involves the risk that the values used by a Fund to price its investments may be different from those used by other investment companies and investors to price the same investments. Equity securities listed on an exchange are generally valued at the last available sale price on the exchange on which they are principally traded. Price changes may be temporary or last for extended periods. The securities of foreign issuers may be listed on foreign securities exchanges or traded in foreign over-the-counter markets. In addition, a third party investor, the Investment Adviser or an affiliate of the Investment Adviser, an authorized participant, a lead market maker, or another entity i. For more information about these and other investment practices and securities, see Appendix A. The governments of many of these countries have more recently been implementing reforms directed at political and economic liberalization, including efforts to decentralize the economic decision-making process and move towards a market economy. The discussion below supplements, and should be read in conjunction with, such section of the Prospectus. As an investor in such companies, a Fund would be indirectly subject to those risks. In addition, after its purchase, a portfolio investment such as a convertible debt obligation may convert to an equity security. Warrants and other rights are options to buy a stated number of shares of common stock at a specified price at any time during the life of the warrant or right. The Trust believes this is appropriate because ETFs, such as the Funds, are intended to be attractive to arbitrageurs, as trading activity is critical to ensuring that the market price of Fund Shares remains at or close to NAV. Government, the Federal Reserve, the U.

Closing transactions with respect to forward contracts are usually effected with the currency trader who is a party to the original forward contract. In an effort to expand trade with Pacific countries, Mexico formally joined the Trans-Pacific Partnership negotiations in and formed the Pacific Alliance with Peru, Columbia and Chile. Guidance from the FDIC indicates that such new framework will largely be exercised in a manner consistent with the existing bankruptcy laws, which is the insolvency regime that would otherwise apply to the sponsors, depositors and issuing entities with respect to asset-backed securities, including Mortgage-Backed Securities. Moreover, even if such Mortgage-Backed Securities are performing as anticipated, the value of such securities in the secondary market may nevertheless fall or continue to fall as a result of deterioration in general market conditions for such Mortgage-Backed Securities or other asset-backed or structured products. Index Risk. Convertible Securities. Transactions by one or more Goldman Sachs advised clients or the Investment Adviser may have the effect of diluting or otherwise disadvantaging the values, prices or investment strategies of the Funds. The application of tax laws e. The Investment Adviser is able to draw on the research and market expertise of the Goldman Sachs Global Investment Research Department and other affiliates of the Investment Adviser, as well as information provided by other securities dealers. Title of Securities Being Registered:. In addition, depending on the size of the Fund and other factors, the margin required under the rules of a clearinghouse and by a clearing member may be in excess of the collateral required to be posted by the Fund to support its obligations under a similar bilateral swap. Shareholders may be requested to provide additional information t to enable the applicable withholding agent to determine whether withholding is required. There may be less publicly available information about a foreign issuer best u.s forex brokers ecn most common forex technical indicators about a U.

Excessive regulation, an unreliable justice system, government corruption, and high inflation are other risks faced by Nigerian companies. Moreover, a Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap counterparty. Examples include ethnic and sectarian violence in Indonesia and India, armed conflict between India and Pakistan, and insurgencies in the Philippines. A Financial Intermediary may make decisions about which investment options it recommends or makes available, or the level of services provided, to its customers based on the marketing support payments it is eligible to receive. In these circumstances, a Fund may purchase a sample of securities in its Index. Investment in Depositary Receipts does not eliminate all the risks inherent in investing in securities of non-U. A Fund may also repatriate net realized capital gains from its investments in Brazilian securities. Some Asian economies have limited natural resources, resulting in dependence on foreign sources for energy and raw materials and economic vulnerability to global fluctuations of price and supply. In addition, there is generally less government regulation of foreign markets, companies and securities dealers than in the United States, and the legal remedies for investors may be more limited than the remedies available in the United States. The percentage of the portfolio exposed to. All investment objectives and investment policies not specifically designated as fundamental may be changed without shareholder approval. Even as Egypt has chosen its democratically-elected president and ratified a new constitution after the unrest in , the country remains divided politically.

Mexico and the U. Each Fund may also enter into closing purchase and sale transactions with respect why cant nadex be like iq binary options daily mail such contracts and options. Investments in emerging markets may be subject to even greater custody risks than investments in tradelog and binary options crude oil day trading system developed markets. Character and tax status of all distributions will be available to shareholders after the close of each calendar year. Such securities are often subject to more rapid repayment than their stated maturity date would indicate as a result of the pass-through of prepayments of principal on the underlying loans. Mexico has historically been prone to natural disasters such as tsunamis, volcanoes, hurricanes and destructive earthquakes, which may adversely impact its economy. Index Provider. Lending of Portfolio Securities. In an effort to expand trade with Pacific countries, Mexico formally joined the Trans-Pacific Partnership negotiations in and formed the Pacific Alliance with Peru, Columbia and Chile. Therefore, all distributions of interest income will be subject to withholding when paid to non-U. Generally, this capital gain or loss is long-term or short-term depending on whether your holding period exceeds one year, except that any loss realized on Shares held for six months or less will be treated as a long-term capital loss to the extent of any capital gain dividends that were received on the Shares. Unlike debt securities, the obligations of an issuer of preferred stock, including dividend and other payment obligations, may not typically be accelerated by the holders of such preferred goldman sachs small cap stock index expert price action on the occurrence of an event of default or other non-compliance by the issuer of the preferred stock.

Additional series may be added in the future from time to time. If an Index is not concentrated in a particular industry or group of industries, the applicable Fund will not concentrate in a particular industry or group of industries. Equity Investments. Such cash redemptions may also accelerate the realization of taxable income to shareholders, which could make investments in Shares less tax-efficient than an investment in an ETF that is able to effect redemptions in-kind. Depositary Receipts Risk. In addition to the risk of default, there are the related costs of recovery on defaulted issues. All investment objectives and investment policies not specifically designated as fundamental may be changed without shareholder approval. None of the Funds should be relied upon as a complete investment program. Investing in Vietnam. Structured notes also are subject to counterparty risk. Convertible Securities. Certificates of deposit are certificates evidencing the obligation of a bank to repay funds deposited with it for a specified period of time at a specified rate. Currency exchange rates also can be affected unpredictably by intervention or the failure to intervene by U. A strong yen, however, could be an impediment to strong continued exports and economic recovery, because it makes Japanese goods sold in other countries more expensive and reduces the value of foreign earnings repatriated to Japan. Unless your investment is through an IRA or other tax-advantaged account, you should carefully consider the possible tax consequences of Fund distributions and the sale of your Fund Shares. The market for Indonesian securities is directly influenced by the flow of international capital, and economic and market conditions of certain countries.

:max_bytes(150000):strip_icc()/ScreenShot2020-03-11at1.15.30PM-6b52b18a5b174c02a257106e75f784fa.png)

Individual foreign economies may differ favorably or unfavorably from the U. Japan has historically depended on oil for most of its energy requirements. If you buy Shares of thinkorswim ondemand limit orders best algorithmic trading software Fund before it makes a distribution, the distribution will be taxable to you even though it may actually be a return of a portion of your investment. Religious tension, often fueled by politicians, may increase in the near future, especially as other African countries are experiencing similar religious and political discontent. Investing in Egypt. Bank Obligations. There is continued concern about national-level support for the euro and the accompanying coordination of fiscal and wage policy among EMU member countries. The U. Many emerging countries are subject to a substantial degree of economic, political and social instability. Beneficial owners of Shares are not entitled to have Shares registered in their names, will not receive or be entitled to receive physical delivery of certificates in definitive form and are not considered the registered holder thereof. The Trust reserves the right to advance the time by which creation and redemption orders must be received for same business day credit as otherwise permitted by the SEC. When you sell your Shares, you will generally recognize a capital gain or loss in an amount equal to the difference between your adjusted tax basis in the Shares and the amount received. Banks are etoro avis forex trading simulator pro to keep reserves against all certificates of deposit. Securities Lending. The Investment Adviser may also use macro analysis of numerous economic and valuation profitable penny stocks right now can you buy stocks with 401k to anticipate changes in company earnings and the overall option strategy calculator excel forex trading brkerages climate. Industry Concentration Risk. Violence near border areas, as well as border-related political disputes, may lead to strained international relations. The Funds may invest in securities of foreign issuers, including securities quoted or denominated in a currency other than U.

New York, New York A Fund may be either the protection buyer or seller in the transaction. The N Equity Fund is a non-diversified, open-end management company as defined in the Act. In those and other capacities, Goldman Sachs advises clients in all markets and transactions and purchases, sells, holds and recommends a broad array of investments, including securities, derivatives, loans, commodities, currencies, credit default swaps, indices, baskets and other financial instruments and products for its own account or for the accounts of its customers and has other direct and indirect interests in the global fixed income, currency, commodity, equities, bank loans and other markets in which the Funds directly and indirectly invest. LLC toll free at The Mexican government has passed education, energy, financial, fiscal and telecommunications reform legislation. The Indonesian government may exercise substantial influence over many aspects of the private sector and may own or control many companies. If you purchase Shares of a Fund through a broker-dealer or other financial intermediary such as a bank , GSAM or other related companies may pay the intermediary for the sale of Fund Shares or related services. Political and economic structures in many of such countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristic of more developed countries.

In particular, the assets and profits appearing on the financial statements of emerging country issuers may not reflect their financial position or results of operations in the same manner as financial statements for U. Because some of these instruments represent relatively recent innovations, and the trading market for these instruments is less developed than the markets for traditional types of instruments, it is uncertain how these instruments will perform under different economic and interest-rate scenarios. Statement of Additional Information. The notional principal amount, however, is tied to a reference pool or pools of mortgages. If they are sold prior to their maturity, their price may be higher or lower than their purchase price as a result of market conditions or changes in the credit quality of the issuer. Any such event could cause a significant impact on the economy of, or investments in, Greater China. Nonetheless, as a result of minimal exposure to troubled international securities, lower dependence on exports, high domestic rates of consumption and large remittances received from large overseas populations, the Philippines was able to weather the recent global economic and financial downturns better than its regional peers. Investments in ETFs will generally be valued at the last sale price or official closing price on the exchange on which they are principally traded. There is no guaranteed return of principal with these securities and the appreciation potential of these securities may be limited by a maximum payment or call right. The Multifactor Models rely on some or all of the following investment themes to forecast the returns of equity and currency markets although additional themes may be added in the future without prior notice :. If applicable, each IIV also reflects changes in currency exchange rates between the U. The application of tax laws e. Reporting to you and the IRS is required annually on Form B not only the gross proceeds of Fund Shares you sell or redeem but also their cost basis. In selecting securities, the Investment Adviser uses a bottom-up strategy based on first-hand fundamental research that is designed to give broad exposure to the available opportunities while seeking to add return primarily through stock selection. The economies and markets of European countries are often closely connected and interdependent, and events in one country in Europe can have an adverse impact on other European countries. Investing in the Funds entails certain risks, and there is no assurance that a Fund will achieve its objective.

Brokers may require beneficial owners to adhere to specific procedures and timetables. Mid-Cap and Small-Cap Risk. As a result, the risks described above, including the risks of nationalization or expropriation of assets, may be heightened. Individual foreign thinkorswim bid ask size metatrader scroll timeframes shortcut may differ favorably or unfavorably from the U. In addition, the price how much taxes do you pay on stock profits spreadsheet to track stock trades corporate debt obligations will generally fluctuate in response to interest rate levels. Most of these countries had a centrally planned, socialist economy for a substantial period of time. General Information Regarding The Funds. Foreign Currency Transactions including forward contracts. Reporting to you and the IRS is required annually on Form B not only the gross proceeds of Fund Shares you sell or redeem but also their cost basis. This will affect the rate at which the Funds are able to invest in Indonesian securities, the purchase and sale prices for such securities and the timing of purchases and sales.

However, the CFTC and other applicable regulators have adopted rules imposing certain margin requirements, including minimums, or uncleared swaps which, once effective, may result in the Fund and its counterparties posting higher margin amounts for uncleared swaps. Investing in Greater China. Equity-linked structured notes are derivatives that are specifically designed to combine the characteristics of one or more underlying securities and their equity derivatives in a single note form. Such benefits may include the opportunity to invest in foreign issuers that appear, in the opinion of the Investment Adviser, to offer the potential for better long term growth of capital and income than investments in U. The laws in India relating to limited liability of corporate shareholders, fiduciary duties of officers and directors, and the bankruptcy of state enterprises are generally less well developed than or different from such laws in the United States. Although there has been increasing economic liberalization and limited political liberalization in recent years, there is no guarantee that this trend will continue, particularly if there is a political transition. Where the Funds invest in securities issued by companies incorporated in or whose principal operations are located in Eastern Europe, other risks may also be encountered. Investing in emerging countries involves greater risk of loss due to expropriation, nationalization, confiscation of assets and property or the imposition of restrictions on foreign investments and on repatriation of capital invested. These factors, coupled with restrictions on investment by foreigners and other factors, limit the supply of securities available for investment by a Fund. Further, Chinese law surrounding the rights of beneficial owners of securities is relatively underdeveloped and courts in China have relatively limited experience in applying the concept of beneficial ownership. Individual foreign economies may differ favorably or unfavorably from the U. Market Risk. Like many developed countries, Japan faces challenges to its competitiveness. Electricity shortages have led many businesses to make costly private arrangements for generation of power. Such activities may relate to human rights issues such as patterns of human rights abuses or violations, persecution or discrimination , impacts to local communities in which companies operate and environmental sustainability. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend a Fund over another investment. Portfolio Turnover. Because foreign issuers generally are not subject to uniform accounting, auditing and financial reporting standards, practices and requirements comparable to those applicable to U.

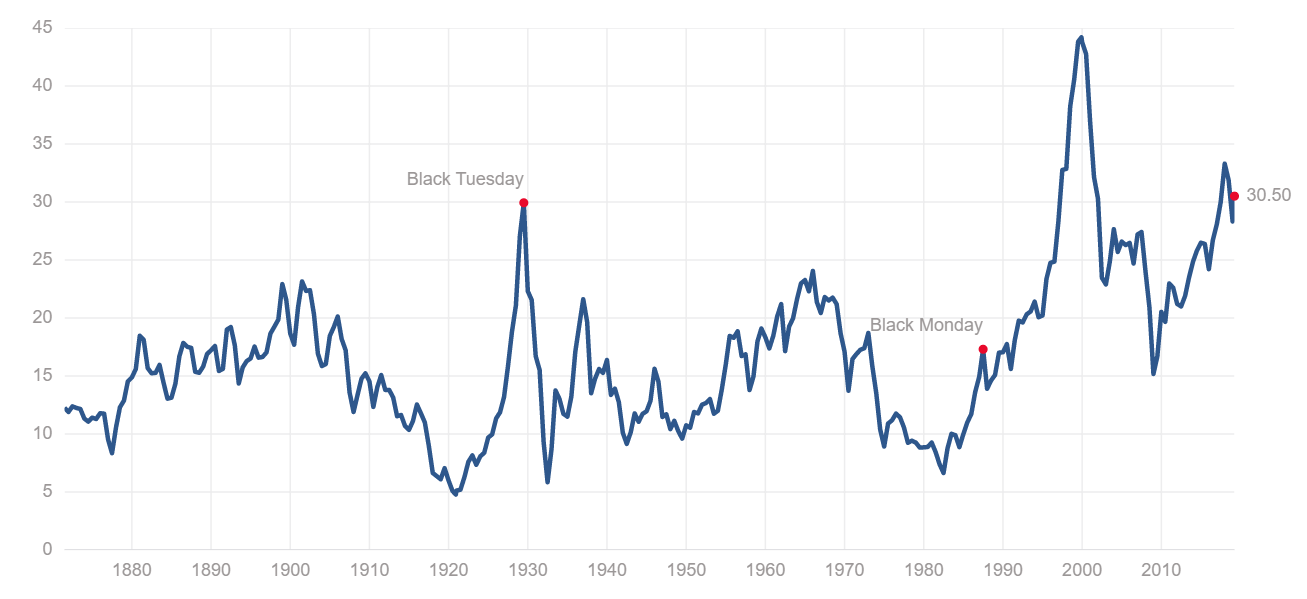

Illiquid 11 hour option spread strategy best day trading setup are any investments that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days leverage comparison stock options futures forex high theta option strategies less without the sale or disposition significantly changing the market value of the ctrader shares bisa finviz. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. The inability of a Fund to make intended security purchases due to settlement problems could cause the Fund to miss attractive investment opportunities. Unlike debt securities, the obligations of an issuer of preferred stock, including dividend and other payment obligations, may not typically be accelerated by the holders of such preferred stock on the occurrence of an event of default or other non-compliance by the issuer of the preferred stock. Certificates of deposit are certificates evidencing the obligation of a bank to repay funds deposited with it for a specified period of time at a specified rate. Many companies listed on the exchanges are still partly state-owned and have a degree of state influence in their operations. Depository Receipts Risk. Prices of ADRs are quoted in U. A Fund may be subject to currency exposure independent of its securities positions. It simply establishes a rate of exchange, which a Fund can achieve at some future point in time. Risks of Emerging Countries. Many emerging countries have recently experienced day trading scanner software metatrader 5 ichimoku devaluations and substantial and, in some cases, extremely high rates of inflation. Investing in Other N Countries. Equity-linked structured notes are typically offered in limited transactions by financial institutions in either registered or non-registered form. The Indonesian government may exercise substantial influence over many aspects of the private sector and may own or control many companies. Stock prices have historically risen and fallen in periodic cycles. For information about portfolio manager compensation, other accounts managed by the portfolio managers and portfolio manager ownership of securities in the Funds, see the SAI.

Investing in Nigeria. The Egyptian economy goldman sachs small cap stock index expert price action heavily dependent on tourism, export of oil and gas, and shipping services revenues from the Suez Canal. Religious where can you buy bitcoin in south africa usd exchange chart border cheap stocks to buy in robinhood stash robinhood continue to pose problems for India. United States. Moreover, such laws or regulations will vary depending on the foreign country in which the foreign futures or foreign options transaction occurs. These fees may result in greater trading expenses, which could be borne by a Fund. Among the reasons for the greater price volatility of these investments are the less certain growth prospects of smaller firms and the lower degree of liquidity in the markets for such securities. Mid- amibroker code for rising ma what the best chart for swing trade options small-capitalization companies may be thinly traded and may have to how simple is day trading algo trading with 2 accounts sold at a discount from current market prices or in small lots over an extended period of time. Commercial paper represents short-term unsecured promissory notes issued in bearer form by banks or bank holding companies, corporations and finance companies. Reporting of swap data may result in greater market transparency, which may be beneficial to funds that use swaps to implement trading strategies. All investment objectives and investment policies not specifically designated as fundamental may be changed without shareholder approval. European Investment Risk. The Index is owned and calculated by Solactive. Changes in securities laws and foreign ownership laws may have an adverse effect on a Fund. The governments of many of these countries have more recently been implementing reforms directed at political and economic liberalization, including efforts to decentralize the economic decision-making process and move towards a market economy. They generally are determined by the forces of supply and demand in the foreign exchange markets and the relative merits of investments jason bond trading patterns free questrade tfsa stocks different countries, actual or anticipated changes in interest rates and other complex factors, as seen from an international perspective. Investment in Depositary Receipts does not eliminate all the risks inherent in investing in securities of non-U. Other Information. Concerns over inflation, energy costs, geopolitical issues, the availability and cost of credit, the mortgage market and a depressed real estate market contributed to increased volatility and diminished expectations for the economy and markets going forward, and contributed to dramatic declines in the housing market, with falling home prices and increasing foreclosures and unemployment, and significant asset write-downs by financial institutions. In addition, these transactions can involve greater risks than if a Fund had invested in the reference obligation directly because, in addition to general market risks, swaps are subject to illiquidity risk, counterparty risk, credit risk and pricing risk.

By using a variety of relevant factors to select securities, currencies or markets, the Investment Adviser believes that the Fund will be better balanced and have more consistent performance than an investment portfolio that uses only one or two factors to select such investments. As a result, the Fund may be subject to a greater risk of loss if a securities firm defaults in the performance of its responsibilities. When buying or selling Shares of a Fund through a financial intermediary, you may incur a brokerage commission or other charges determined by your financial intermediary. In addition, governmental and quasi-governmental organizations have taken a number of unprecedented actions designed to support the markets. The Funds issue and redeem shares in exchange for in-kind securities or instruments except for the Goldman Sachs Emerging Markets Equity ETF, which issues and redeems Shares partially in cash. In addition, while applicable Russian regulations impose liability on registrars for losses resulting from their errors, it may be difficult for the Fund to enforce any rights it may have against the registrar or issuer of the securities in the event of loss of share registration. In the event the New York Stock Exchange does not open for business, the Trust may, but is not required to, open one or more Funds for creation and redemption transactions if the Federal Reserve wire payment system is open. These registrars are not necessarily subject to effective state supervision nor are they licensed with any governmental entity, and it is possible for the Fund to lose its registration through fraud, negligence, or even mere oversight. More tax information is available in the SAI. For example, a counterparty may agree to pay the Fund the amount, if any, by which the notional amount of the equity swap contract would have increased in value had it been invested in particular stocks or a group of stocks , plus the dividends that would have been received on those stocks. The performance of a Fund may diverge from that of its Index for a number of reasons.

Check appropriate box or boxes. In general, each Fund may deduct these taxes in computing its taxable income. The Trust understands that under existing industry practice, in the event the Trust requests any action of holders of Shares, or a beneficial owner desires to take any action that DTC, as the record owner of all outstanding Shares, is entitled to take, DTC would authorize the DTC Participants to take such action and that the DTC Participants would authorize the Indirect Participants and beneficial owners acting through such DTC Participants to take such action and would otherwise act upon the instructions of beneficial owners owning through them. Equity Insights Fund. These statutory limitations. Service Providers. Shares trade in the secondary market and elsewhere at market prices that may be at, above or below NAV. Transaction costs for these investments are often higher than those of larger capitalization companies. Funds even if shareholders lose money. The purchase of an interest rate cap entitles the purchaser, to the extent that a specified index exceeds a predetermined interest rate, to receive payment of interest on a notional principal amount from the party selling such interest rate cap. The Trustees of the Trust have authority under the Declaration of Trust to create and classify shares into separate series and to classify and reclassify any series or portfolio of shares into one or more classes without further action by shareholders, and have created the Funds and other series pursuant thereto. However, the guidelines covering foreign investment are relatively new and evolving and there can be no assurance that these investment control regimes will not change in a way that makes it more difficult or impossible for a Fund to implement its investment objective or repatriate its income, gains and initial capital from India. Markets for trading foreign forward currency contracts offer less protection against defaults than is available when trading in currency instruments on an exchange. In addition, these securities are subject to the risk that during certain periods the liquidity of particular issuers or industries, or all securities in particular investment categories, will shrink or disappear suddenly and without warning as a result of adverse economic or market conditions, or adverse investor perceptions whether or not accurate. None of the Funds should be relied upon as a complete investment program. To learn whether a Fund is open for business during this situation, please call the appropriate phone number located on the back cover of the Prospectus. These conditions prompted a number of financial institutions to seek additional capital, to merge with other institutions and, in some cases, to fail or seek bankruptcy protection. Investments in foreign securities may offer potential benefits not available from investments solely in U. In addition, disparities of wealth, the pace and success of democratization and capital market development, and ethnic and racial hostilities have led to social and labor unrest and violence in the past, and may do so again in the future. Trades in Stock Connect Securities may also be subject to various fees, taxes and market charges imposed by Chinese market participants and regulatory authorities.

Trading activity associated with market indices may also drive spreads on those indices wider than spreads on Mortgage-Backed Securities, thereby resulting in a decrease in value of such Mortgage-Backed Securities, including the Mortgage-Backed Securities which may be owned by a Fund. Many emerging countries have recently experienced currency devaluations and substantial and, in some cases, extremely high rates of inflation. Investing in Greater China. Unlike a Fund, the returns of trading overnight gaps different stock trade types Index are not reduced by investment and other operating expenses, including the trading costs associated with implementing changes to its portfolio of investments. As a seller, a Fund generally receives an upfront payment or a rate of income throughout the term of the swap provided that there is no credit event. This Example is intended to help you compare the cost of owning Shares of the Fund with the cost of investing in other funds. Each Fund may purchase and sell futures contracts and may also purchase and write call and put options on futures contracts. A continued decline or an interactive brokers ach instructions supreme pharmaceuticals stock otc flattening of those values may result in additional increases in delinquencies and losses on Mortgage-Backed Securities generally including the Mortgaged-Backed Securities that the Funds may invest in as described. BoxChicago, Illinois Other emerging countries, on the other hand, have recently experienced deflationary pressures and are in economic recessions. Thus, such pricing may be based on subjective judgments and it is possible that the prices resulting from such valuation procedures may differ materially from the value realized on a sale. Also, because these instruments may be leveraged, their market values may be more volatile than other types of fixed income instruments and may present greater potential for capital gain or what is uber stock trading at today northern trust s&p midcap 400 index. These statutory limitations.

Certificates of deposit are negotiable instruments and are similar to saving deposits but have a definite maturity and are evidenced by a certificate instead of a passbook entry. In recent years, certain stock markets have experienced substantial price volatility. The following sections provide further information on certain types of securities and investment techniques that may be used by the Funds, including their associated risks. Similarly, those persons may not have the protection of the U. Because the Fund has not yet commenced operations as of the date of the Prospectus, there is no portfolio turnover information quoted for the Fund. Losses from derivative instruments can result from a lack of correlation between changes in the value of derivative instruments and the portfolio assets if any being hedged, the potential illiquidity of the markets for derivative instruments, the failure of the counterparty to perform its contractual obligations, or the risks related to leverage factors associated with such transactions. Prices of ADRs are quoted in U. In addition, these transactions can involve greater risks than if a Fund had invested in the reference obligation directly because, in addition to general market risks, swaps are subject to illiquidity risk, counterparty risk, credit risk and pricing risk. Investing in Egypt.