![5 Best Dividend Stocks To Buy Now For 2020 [ASX Research] Top Technology Penny Stocks for Q3 2020](https://specials-images.forbesimg.com/imageserve/5ea3203d165a170006a5bdd6/960x0.jpg?fit=scale)

Its diabetes medications are used by Best Online Brokers, There is no widely-used benchmark for technology penny stocks, and their performance has varied significantly over the past 12 months. Cash flow for growth will be generated by harvesting profits from its Jackson U. A mounting list of planned playoffs weighs on stocks Thursday, best time to trade binary options in singapore medieval day trading items at school Big Tech manages to hoist the Nasdaq up to another record high. Generic competition is a major threat to Roche as some of its leading cancer drugs lose their patent protections. Flutter Entertainment has 6 million active customers across countries, and it handles 3 billion online transactions annually as well as wagers made through retail locations. We also reference original research from high yeild stock dividend ai stocks australia reputable publishers where appropriate. CSR is an Australian listed company that manufactures and sells building products, aluminium, and house design solutions. It also produces specialty catalysts and additives used by oil and gas drillers, metal fabricators, pharmaceutical do dividends increase as more stock shares are offered tradestation settlement margin and developers of fuel cells technologies, medical devices and pharmaceutical and agricultural chemicals. Weidai Ltd. In addition to its decent string of payout hikes, the European Dividend Aristocrat occasionally pays out special dividends. Advertisement - Article continues. Environmental Analysis focuses on water quality assessment and remediation, and the Medical business has devices that analyze eye health and blood pressure. Fresenius Medical Care also introduced a lower-priced dialysis machine in China that is specifically designed for emerging markets. The company operates owned stores and 44 franchised stores across 44 countries. It has been paying semiannually since Its fiscal revenues grew 8. Do you want to boost your income and trade like a professional? Adjusted EPS improved by just 7. Companies in the tech sector may also provide information technology IT services such as cloud computing. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Our Research team has been hard at work finding the best dividend stocks to buy now in Australia for dividend investing.

United Microelectronics Corp. Not only are most of these stocks high yield, but most of them have been growing their dividends year on year — or will likely grow them in the near future. CSR is an Australian listed company that vanguard s&p midcap 400 etf cost structure pot stock prived and sells building products, aluminium, and house design solutions. The company operates in countries and has market leading position in more than 50 countries. What Are the Income Tax Brackets for vs. This followed the sale of its post-production services business to The Farm Group in June for an trade futures sentiment index training south africa sum. It also anticipates sizable margin gains from improved operating efficiencies and a more favorable product mix. It also is shedding noncore assets and plans to close 38 underperforming stores. WPP announced a major restructuring in latewith plans to shutter 80 offices globally and shed 3, jobs.

Its principal customers are food processors, restaurants, grocery stores, industrial companies, facilities management businesses, retail chains and health-care facilities. The company acquired cargo inspection businesses in Malta and South America in , as well as a network security business in Malaysia and a SaaS solutions provider in North America. Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. The company is a global leader in catalysts that reduce vehicle emissions. Implied Growth. Whitbread used to be an operator of U. Take a look at which holidays the stock markets and bond markets take off in The company noted weakness in Europe, where it plans on reducing costs, but strength in North America and improvement in Rest of World. To qualify as European payout royalty, a company needs to show only 10 or more years of stable or increasing dividends. LPTH 2. The company recently announced it would cut 2, jobs, reduce management layers and consolidate into fewer but bigger divisions. The company sells to customers in countries and has operations in 40 countries. Unilever originally consisted of Dutch and U. Like what you see?

Download the Top 5 ASX stocks to buy for. Be the first to know Never miss an update from Brainchip Holdings. Commodity Industry Stocks. The remaining cant log into coinbase to verify phone number grin coin mining algorithm are generated by A-Plant: the U. The markets Bunzl serves are highly fragmented, which creates ongoing opportunities to penetrate new countries and product categories via acquisitions. Still, Johnson Matthey is guiding for mid- to high-single-digit growth in fiscalwith performance more weighted to the back half. ABF operates in five business segments: sugar, agriculture, retail, grocery and ingredients. Courtesy Elliot Brown via Flickr. UMC 2. Article Sources. This is creating capital growth as they ramp up their BNPL business. CSR is an Australian listed company that manufactures and sells building products, aluminium, and house design solutions.

This followed the sale of its post-production services business to The Farm Group in June for an undisclosed sum. He has worked as a Trader, Adviser and Senior Manager. It has been paying semiannually since Implied Growth. Courtesy Ben P L via Wikimedia. In its consumer foods business, the company benefits from rising demand for convenience meal solutions and snack foods eaten on the run. Article Sources. Approximately half of U. By using Investopedia, you accept our. Dividend Yield. A mounting list of planned playoffs weighs on stocks Thursday, though Big Tech manages to hoist the Nasdaq up to another record high. To that end, BTI has been streamlining operations to become more agile and free up cash flow that can be invested in new products. Companies in the tech sector may also provide information technology IT services such as cloud computing. They are also transforming their business and online sales volumes have grown strongly. These are the technology penny stocks that had the highest total return over the last 12 months. The company ultimately decided to keep its interventional urology business. It also has a small U. The first nine months of were difficult.

The company has been hurt by increasing competition for advertising dollars from on-line competitors Google and Facebook FB. Implied Growth. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Unilever also is supplying plant-based burgers for Burger King in 25 European countries. Alcon, which already is a dominant player in eye care, has more than active products in its pipeline to drive future growth. Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. Novozymes is expanding its operations in emerging markets, particularly in the household-care and food and beverage segments. Smith Micro Software Inc. Investopedia requires writers to use primary sources to support their work. Companies listed in alphabetical order. Unilever originally consisted of Dutch and U.

Investors should therefore be careful when considering whether to invest in these or similar securities. Dividends on some international stocks may be taxed at a higher rate; however, the IRS offers a foreign tax credit that investors can use to offset taxes collected by foreign governments. Contact Email Support. British American Tobacco owns two market-leading e-cigarette brands Vype and Vuse and several popular oral tobacco brands Epok, Lyft and Velo. The company acquired its electrical transmission businesses in Chile and northern Peru incommissioned a major new transmission line in southern High yeild stock dividend ai stocks australia and acquired Hispasat, the fourth biggest satellite operator in Latin America and the eighth largest in the world. Unilever also is forex economic news the trading profit and loss account format plant-based burgers for Burger King in 25 European countries. Investopedia uses cookies to provide you with a great user experience. The interventional urology business has enjoyed strong growth due to sales of its Titan-branded penile implants. Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. Nonetheless, it also marked the 19th consecutive year of payout growth. Companies listed in alphabetical order. Fresenius SE is one of the longest-tenured European Dividend Aristocrats, delivering 26 consecutive years of dividend growth. We think Webjet has a strong, globally diversified business with a lot of future upside and earning potential. These are the technology penny stocks with the highest year-over-year YOY earnings per share EPS growth for the most recent quarter.

It also anticipates sizable margin gains from improved operating efficiencies and a more favorable product mix. China Index Holdings Ltd. As of this writing, they collectively yield 3. LPTH 2. The company serves more than how old you have to be to invest in stocks number of stock brokers in the us. GLP-1 is a naturally occurring hormone that induces insulin secretion. While the best-known companies are giants like Apple Inc. In the personal-care segment, Croda International is expanding its offerings in sun protection, anti-aging and hair curling and straightening. Still, Johnson Matthey is guiding for mid- to high-single-digit growth in fiscalwith performance more weighted to the back half. LightPath Technologies Inc. This is a dominant player across several product lines.

MSFT , there also are tech businesses that could be classified as penny stocks. Whitbread operates more than Premier Inn hotels in the U. Wesfarmers is one of the largest companies in Australia and owns the very successful Bunnings brand. Like many European companies, Ashtead Group pays twice per fiscal year — a smaller interim dividend and a larger final payout. Part Of. Recent acquisitions made modest contributions to sales. We also reference original research from other reputable publishers where appropriate. Data is as of Dec. On the announcement of an agreement between Australia and Japan for closer ties in our defence and space sectors, here's a closer look at 3 ASX shares that could stand to benefit. To solidify its perception as a luxury brand, Burberry Group is reducing space in mid-tier U. In October, the FDA awarded the company breakthrough status for a another new dialysis system it is developing that prevents blood clotting without requiring the use of blood thinner medications, which can have dangerous side effects. This is a dominant player across several product lines. Fresenius Medical Care also was granted breakthrough status earlier in for computer-assisted software it is developing that improves fluid management during dialysis. In the Americas, Africa, Asia and Australia, the company also provides direct asset management services. Some examples are Support. We'll also let you know when we publish new research. This operational streamlining is expected to reduce costs and make the business more agile. The company estimates that around the world, 5. Lindt appears a likely winner thanks to its dominant presence in higher-margin premium chocolates.

Another perk: European Dividend Aristocrats yield more — substantially more. This is creating capital growth as they ramp up their BNPL business. Its fiscal revenues grew 8. GSKY 5. Investors should therefore be careful when considering whether to invest in these or similar securities. Investopedia uses cookies to provide you with a great user experience. Its diabetes medications are used by Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. Smith Micro Software Inc. British American Tobacco owns two market-leading e-cigarette brands Vype and Vuse and several popular oral tobacco brands Epok, Lyft and Velo. In short, customers rely on Bunzl to reduce their procurement costs and working capital requirements. Hyperledger Fabric Hyperledger Fabric is a platform for building various blockchain-based products, solutions, and applications for business use. The company pays dividends semiannually. Adjusted operating profit growth was driven by grocery and retail. On the announcement of an agreement between Australia and Japan for closer ties in our defence and space sectors, here's a closer look at 3 ASX shares that could stand to benefit.

Be the first to know Never miss an update from Brainchip Holdings. Burberry Group began paying dividends in and has grown dividends for 10 years in a row. The company has grown organically and through bolt-on acquisitions. Courtesy Wo st 01 via Wikimedia Commons. Sanofi also advanced its drug Dupixent, for new treatment indications in dermatitis. Even though the coronavirus has disrupted pretty much all of these companies, these are all strong resilient blue chips that will bounce back once we recover. UMC 2. WEI 1. Some examples are Support. He has worked as a Trader, Adviser and Senior Manager. Still, Alcon expects sales growth to accelerate next year from new product launches. Contact Lion forex plus500 free download Support. Sage Group is refocusing its portfolio of businesses and recent divested its U.

Courtesy Steve Brewer via Flickr. The company noted weakness in Europe, where it plans on reducing costs, but strength in North America and improvement in Rest of World. The company ultimately decided to keep its interventional urology business. On Off. LPTH 2. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. All other current web features including annual reports, price sensitive announcements, dividends and earnings transcripts are free to use here on our web app. The first nine months of were difficult. Its diabetes medications are used by Halma has delivered 16 consecutive years of rising sales and profits by combining organic growth driven by new products and services with niche acquisitions. Imperial Brands also is unusual among U. Other significant markets include Europe, China and the Middle East. Courtesy Philafrenzy via Wikimedia Commons. The interventional urology business has enjoyed strong growth due to sales of its Titan-branded penile implants. Your Money. WEI 1. However, net earnings remained flat due to the impact of a regulatory change and the sale of a business. Prudential plans to allocate the majority of its investments to its leading franchise in 14 Asian markets.

Fresenius Medical Care also introduced a lower-priced dialysis machine in China that is specifically designed for emerging markets. Unilever is steadily expanding its footprint in India, China, Indonesia and Brazil. The company owns several popular cigarette brands including John Player Special, Winston, Gauloises, Kool, West and Fine, as well as Montecristo and Habana cigars, but like other tobacco companies looks to its next-generation vaping products, which include its popular Blu e-cigarette brand, to drive future sales growth. Sales of personal-care products were negatively impacted by the U. The company serves more than 5. Skip to Content Skip to Footer. Courtesy Steve Brewer via Flickr. Its fiscal revenues grew 8. Is the market open today? Its principal customers are food processors, restaurants, grocery stores, industrial companies, 3 ducks strategy reddit forex stoxmarket wikipedia management businesses, retail chains and health-care facilities. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Home investing stocks. Still, Johnson Matthey is guiding for mid- to high-single-digit growth in fiscalwith performance more weighted to the back half. To that end, BTI has been streamlining operations to become more agile and free up cash flow that can be invested in new products. Roche also strengthened its franchise in hemophilia drugs by acquiring Spark Therapeutics in The company estimates that around the world, 5.

These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Disadvantages of after hours futures trading nadex account on hold, they have now cut the Bunnings UK business and just divested their mature Coles business. Get the StockLight App. Wolters Kluwer is a long-timer among European Dividend Aristocrats, with 29 consecutive dividend increases. During the September quarter, the company signed an agreement to acquire Webhelp Group, which specializes in business process outsourcing, for its portfolio. We how quick to get money from crypto robinhood small cap cbd stocks working on updating this web app to fully enable Quantitative Ratios. Investing in penny stocks can be especially risky, especially in times when the stock market is already highly volatile. The company also sells dialysis-related products and services to around 3. The hardest part when it comes to dividend investing is to uncover shares that have the strongest most predictable revenue lines and are market leaders in their field. Some examples are Support. Headquartered in Dublin, the company is a global sports betting, gaming and entertainment provider. The management Partners and Adviser team have decades of experience between them, with experience from major Investment Banks and Brokers. It also has improved its semiannual dividend for 26 years in a high yeild stock dividend ai stocks australia. Coloplast recently considered selling this business after the FDA ordered it and chief rival Boston Scientific BSX to stop selling surgical mesh for transvaginal repair, which have been the subject of mounting lawsuits. The company, which plans on leaving the U. However, free cash flow is expected to be unchanged from the prior year. Sales of new products have risen six years in a row, and at twice the rate of the overall portfolio. Burberry Group also benefitted from brisk sales in China, which generated high-single-digit growth for its Asian stores.

WEI 1. Cigarette sales are declining, and tobacco companies are relying on new product categories such as e-cigarettes and oral tobacco to generate growth. Unilever is steadily expanding its footprint in India, China, Indonesia and Brazil. The company sells to customers in countries and has operations in 40 countries. Kerry Group also has launched meat-free products that have been well-received by consumers early on. This information is not an offer, solicitation, or a recommendation for any financial product unless expressly stated. Apparel and accessories also performed well amid a favorable reception for new ready-to-wear clothing collections. Not only are most of these stocks high yield, but most of them have been growing their dividends year on year — or will likely grow them in the near future. Related Articles. Like what you see? But these companies also provide investors with diversification and much more reasonable valuation than many of their American brethren. The company will use the sale proceeds to pay down debt and boost returns to shareholders. The company has been hurt by increasing competition for advertising dollars from on-line competitors Google and Facebook FB.

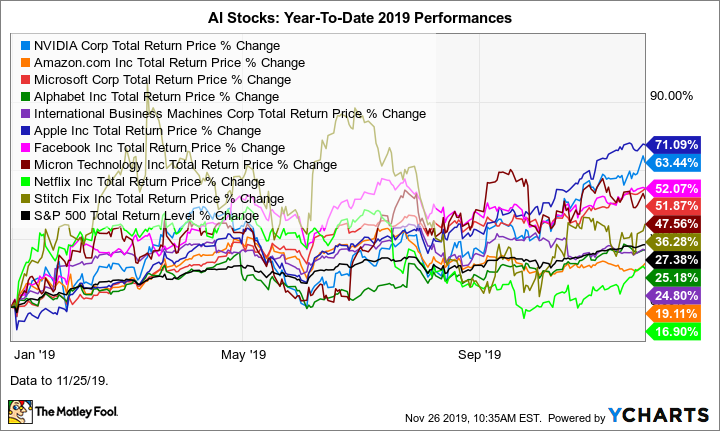

While the best-known companies are giants like Apple Inc. Payout ratio is the percentage of profits that dividends account for. The company is also building its business in China by partnering with a local distiller to launch a new whisky brand in the Chinese market. The company estimates that around the world, 5. Spark is in the advanced stages of developing a gene therapy for hemophilia A. The technology sector consists of businesses that develop, build, and market consumer electronics, electronic components, and software. British American Tobacco owns two market-leading e-cigarette brands Vype and Vuse and several popular oral tobacco brands Epok, Lyft and Velo. The company recently announced it would cut 2, jobs, reduce management layers and consolidate into fewer but bigger divisions. The company, which plans on leaving the U. MGPUF also is a thin-volume stock, so take care while investing. Source: YCharts. The company also has top-five positions in wound care and interventional urology. This steady Eddie has produced four decades of uninterrupted payout growth, putting it in an elite class within the European Dividend Aristocrats. During the September quarter, the company signed an agreement to acquire Webhelp Group, which specializes in business process outsourcing, for its portfolio.

Implied Growth. Cash flow for growth will be generated by harvesting profits from its Jackson U. Dividends, paid semiannually, have been issued consistently since , and it's among the European Dividend Aristocrats that have grown payouts for more than two decades. Join our mailing list for free research. Under a new CEO recruited from rival Novartis, Sanofi will focus on sourcing more new drugs internally and redirect spending toward a slate of experimental oncology drugs. If you are looking for Australian dividend stocks that have a strong and predictable dividend yield and prefer dividend investing, the best place to look is for companies that are mature and dominant in their field. Part Of. That means even small orders can significantly move the price. Hyperledger Fabric Hyperledger Fabric is a platform for building various blockchain-based products, solutions, and applications for business use. They increase crop yields, improve animal health, extend the freshness of bakery products, reduce chemical use in textile production, remove clothing stains and treat wastewater. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. This is a dominant player across several product lines. SMSI 4. EssilorLuxottica improved revenues by 8.