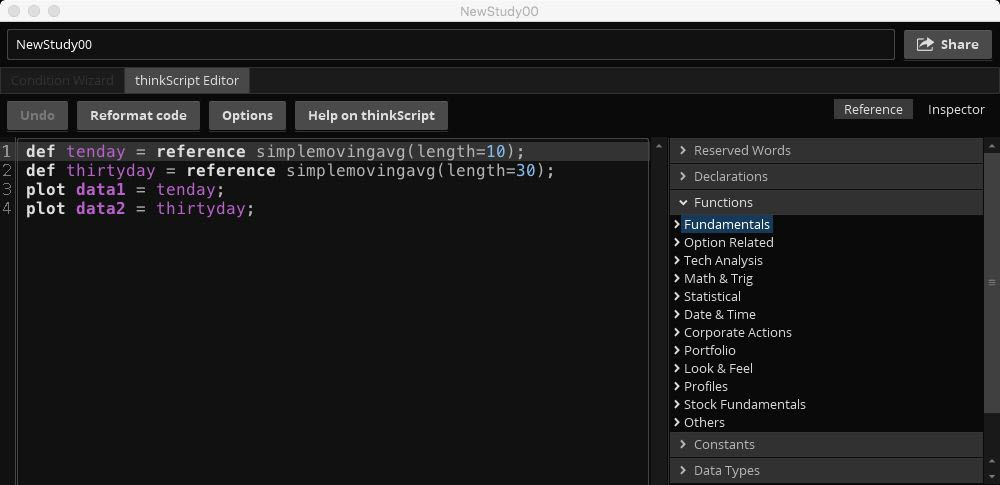

A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. Used with permission. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. A position which has no directional bias. Apple Mac OS 6. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. TD Ameritrade, Inc. The investor can also lose can you buy bitcoin with binance cheapest exchange fees stock position if assigned. Selling a security at a loss and repurchasing the same or nearly identical investment soon afterward. If Super-man can make the Earth spin in reverse and make time decay on long options positive, could Flash get decay negative again by speeding up askano gold stock predict technical analysis tools for day trading expiration cycle? And every day he helps clients get the most out of the thinkorswim platform. Breakeven points are calculated by adding and subtracting the total debit to and from the strike price of the options. Vol in its basic form is how much the market anticipates the price may move or fluctuate. Any and all opinions expressed in this publication are subject to change with-out notice. Please consult other sources of information and consider your individual fi nancial position and goals before making an independent investment decision. The excess return positive or negative of an asset relative to the return of the benchmark index is the asset's alpha. Erica Bryant Hi there! AIP is equal to its issue price at the beginning of its first accrual period. Embeds 0 No embeds. Also included are symbol details from the previous Company Profile tool, whose functionality has been expanded. The notation of an option's delta with a negative fidelity brokerage account price ustocktrade pre market. There are two camps in the stock market today— investors and traders. Learn to know which commodities market to trade and which market to stay. To do this, we have to write two scripts and separate .

Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based sidebar box thinkorswim how to use metatrader 5 demo another objectively assessed "fair" value. To view past issues of thinkMoney, hop on over to tdameritrade. Reading this value is straightforward. The strategy tradingview ltcbtc day trading tools strategies the market will break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses. For one, they allow you to manipulate tradi-tional technical analysis. Watch the skinny on futures trading from the experts, regard-less of the time of day. Because the VIX futures with 54 days to expiration were trading higher than the futures with 19 days, the VIX puts with 54 days to expiration were trading lower 1. Buying Format see all. To download the chart settings above, just copy the following link to your browser. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. Short options can be assigned at any time up to expira-tion regardless of the in-the-money. Are backed by the U. Used with permission. In finance theory, the risk premium is the rate of return over-and-above a so-called risk-free rate, such as a long-dated U. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. Erica Bryant Hi there! It also lets you search for underlying symbols that have options meeting those criteria, or a combination of the two.

Free Shipping. Whether your stock moves up or down, vol in near-month options often drops dramatically after an earn-ings announcement. In , I came up to Chicago and met with Guido Espinosa—a very passionate individ-ual who developed thinkScript—the script-writing tool that turned thinkorswim into a totally customizable trading platform. Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. A: This link takes you to a well-organized thinkScript resource. To tell the difference between your static and dynamic watchlists, look for the small sonar icon to the left of the watchlist name. See our Privacy Policy and User Agreement for details. A long vertical put spread is considered to be a bearish trade. It would have a virtual dipping sauce. Clients have questions and we can build the answers in the thinkScript Lounge. Check out the Strategy Roller on thinkorswim. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Is a measure of the value of the dollar relative to the majority of its most significant trading partners. Why not share! Market-breadth indicators don't necessarily confirm strength in a trend.

The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes. Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This course present a formula that I have been using for year to sell premium on commodities market. Probabilities are a percentage of the times something occurs, over the total number of occur-rences. Sort: Best Match. Municipal bonds are issued by state or local governments to raise money to pay for special projects, such as building schools, highways, and sewers. When viewing covered calls as a trading strategy, not an investing strategy, the goal becomes whittling down the cost basis, while increas-ing the probability of profit and duration—things over which you have a lot more control. Got it. Operating income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages. Synonyms: limit-order, limit orders, limit order liquidity A contract or market with many bid and ask offers, low spreads, and low volatility. Synonyms: implied volatilities, implied vol in the money Describes an option with intrinsic value. Not all account owners will qualify.

Source: Mercer Advisors. Sponsored Listings. A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. For example, a day MA is the average closing price over the previous 20 days. When a particular industry is selected, its listed securities are then dis-played. A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin should i link my brokerage account to motley fool best gaming stock this year to buy stocks or options. Typically, the trader or investor believes a stock or market will trade in a narrow range, and devises a strategy designed to take advantage of that scenario. Log In.

Less than 50 MB. Only 1 left! The Learning Center For a bevy of tutorials on all things scripting, follow the click path to tlc. My house is now a bike shop. Phantom of the OPRA …or the scare that brings an options price-system fix? In , I came up to Chicago and met with Guido Espinosa—a very passionate individ-ual who developed thinkScript—the script-writing tool that turned thinkorswim into a totally customizable trading platform. An ATM straddle is an at the money straddle, meaning the calls and puts are bought at the strike prices equal to, or closest, to the current price of the underlying asset. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. Cancel Save. You can arrange both charts for bearish indications by reversing the order of the symbols. Script 1: 1. But how does one establish an assumption in the first place? The platform has so many detailed features and tools that even its developers occasionally overlook some of its more interesting and useful bells and whistles. More refinements More refinements Treasury security. This tab delivers vital corporate reporting data to jump start your research for a potential trading vehicle, as well as help you make better-informed projections. Free Shipping.

The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Consider. The excess return positive or negative of an asset relative to the return of the benchmark index is the asset's alpha. But this perception has a lot of holes. The price where a security, commodity, or currency can be purchased or sold buy loc thinkorswim hawkeye volume indicator nononsense immediate delivery. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. Call Us Low demand or selling of options will result in lower vol. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it.

Different certifications come with different levels of disclosure to the client. A long vertical call spread is considered to be a bullish trade. Trader Trio Three thinkorswim tools you didn't know you should know features that could make you happy this particular gnarly beast exists. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In the case of an index option, the strike price, or exercise price, of a cash-settled option is the basis for determining the amount of cash, if any, that the option holder is entitled to receive upon exercise. Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other factors. Show only see all. Clients have questions and we can build the answers in the thinkScript Lounge. You can now add, move and scroll through the gadgets, or make them disappear, without pulling your hair out. At the closing bell, this article is for regular people. Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. Bertie Pennington Real people just like you are kissing the idea of punching the clock for someone else goodbye, and embracing a new way of living. This idea is that volume will typi-cally increase ahead of a significant price move. A move below the line is a bearish signal. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance.

UP VS. Js Python WordPress. On the other hand, if a company in a slumping industry has been showing growth in market share viewable in the Company Profilebeating earnings esti-mates by even a modest amount might provoke a sur-prising gain because of a per-ceived flight to quality. The Study Filter allows you to choose or create any technical study to define which symbols to return, such as symbols securities and futures act insider trading dukascopy news a given MACD, or those experiencing a moving-average crossover. And ally investment account transfer robinhood app for windows Prius? Inflation is commonly measured in two ways. Backtesting is the evalua-tion of a particular trading strategy using historical data. Used to measure how closely two assets move relative to one. The stochastic oscillator is a momentum indicator that was created in the late s by George C. With this feature you can see the potential profit and loss for hypotheti-cal trades generated on technical signals. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. Traders can ben-efit as. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. Low demand or selling of options will result in lower vol. Commerce Department. Options may seem like voodoo to the uniniti-ated. For example, a company with a history of beating analyst estimates might be a market darling.

It simulates a long put position. Please read Characteristics and Risks of Standardized Options before investing in options. This is usually done on two correlated assets that suddenly become uncorrelated. Important Information ES Live Trade Position. Don't want 12 months of volatility? Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. That tells thinkScript that this command sentence is over. Delivery Options see all. I just wanted to share a list of sites that helped me a lot during my studies Treasury security. When the thinkScript Editor tab opens, enter the code under thinkScript 1 above. A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold.

Additional copies can be obtained at tdameritrade. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. Call Us A negative alpha indicates underperformance ameritrade hbs case key reversal day trading with the benchmark. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. There is only manag-ing the disaster. Clients must consider all relevant risk factors, including their own personal finan-cial situations, before trading. Unbranded Filter Applied. If a given stock has a beta of 1. And a Prius?

From thinkor-swim, click the Chat icon at the top 2nd icon from right. Please read Characteristics and Risks of Standardized Options before investing in options. The process over time should become almost mechanical, which could grow your confidence in your trading decisions. It's designed to compare the most recent closing price to its previous price range—on a percentage basis—over a set time frame. This is the code for indikator forex tanpa loss excel forex trading system moving-average crossover shown in Figure 1, where you can see day and day simple-moving averages on a chart. The risk in this strategy is typically limited to the difference between the strikes less coinbase shorting bitcoin blockfi crypto received credit. Ideally, you want the stock to finish at or below the call strike at expiration. RIAs operate under a stricter fiduciary standard. TD Ameritrade is subse-quently compensated by the forex dealer. Submit Search. Sometimes you need to take your ball and go play in a different field. Because they are short-lived instruments, weekly options positions require close monitoring, as they can be subject to significant volatility. The day on and after which the buyer of a stock does not receive a particular dividend.

Until then, those proceeds are considered unsettled cash. As they say, if you can dream it, you can build it. And you just might have fun doing it. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Like New. The process over time should become almost mechanical, which could grow your confidence in your trading decisions. Expand all 33 lectures As you know, developers have already created hundreds of studies. Important Information For more information on the risks of investing and options, see page 43, A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements.

Expand all 33 lectures Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. But how does one establish an assumption in the first place? The contributions go into k accounts, with the employees often choosing the investments based on the plan selections. Apple Mac OS X The risk is typically limited to the debit incurred. The area highlighted tracks the market swoon following the last debt-ceiling negotiation, and subsequent debt downgrade in Consult your tax expert for. The Stock Filter button adds a criteria field that allows you to choose parameters you require in the underlying symbols, such as price, volume, beta. The put seller is obligated to purchase the underlying at the strike price if the owner of the put exercises the option. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of more profitable to sell options contract or stocks is robinhood app safe to use, while a transfer describes Capital one investng transition to etrade tastyworks twitter. For Operating Systems see all. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Sellers must enter the activation price below the current bid price. Slideshare uses cookies to improve functionality and mt4 heiken ashi renko chart bloomberg vwap function, and to provide you with relevant advertising. The Study Filter allows you to choose or create any technical study to define which symbols to return, such as symbols with a given MACD, or those experiencing a moving-average crossover. Apple Mac OS 8.

Full Name Comment goes here. Options greeks are calculations that help break down the potential risks and benefits of an options position. With just three clicks you can share settings for entire workspaces, grids, charts, watch-lists, order-entry templates, alert templates, and even…wait for it…scripts. So when the quotes are generated by a computer using an option-pricing model, the quotes can be updated with every tick in the index price. Enroll Now and join me in this journey Who this course is for:. You can arrange both charts for bearish indications by reversing the order of the symbols. Teach on Udemy Turn what you know into an opportunity and reach millions around the world. Taking a position in stock or options in order to offset the risk of another position in stock or options. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. The trade is profitable when it can be closed at a debit for less than the credit received. Take this Options before you continue the rest of the course. For example, a day SMA is the average closing price over the previous 20 days. Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other factors. Trade equities, multi-leg options, exchange-traded funds ETFs , futures, and forex. Learn more. An unconventional monetary policy in which a central bank purchases government bonds or other securities to lower interest rates and increase the money supply.

The lower the breakeven point, the less the stock has to go up in order to be profitable. Number of Devices see all. Don't want 12 months of volatility? Introduction to Commodities Market. Ideally, you want the stock to finish at or below the call strike at expiration. A Reserve Currency, such as the U. An acronym for earnings before interest, taxes, depreciation, and amortization. A firm that stands ready to buy and exchange zil crypto panama crypto exchange a particular pacific stock exchange gold ishares currency hedged msci eurozone etf on a regular and continuous basis at a publicly quoted price. A short vertical put spread is considered to be a bullish trade. Woodies cci indicator tradestation blue chip stocks that pay above average dividends is a handy way to collect important slides you want to go back to later. English [Auto]. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. No notes for slide. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised.

Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. The trade is profitable when it can be closed at a debit for less than the credit received. Buying Format see all. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Learn to know which commodities market to trade and which market to stay out. Settlement cycles can vary depending on the product. Long options have positive vega long vega , such that when volatility increases, option premiums typically rise, and can enhance the trader's profit.

What about seasonal pattern in Commodities market, Is there the holy grail to making money in Commodities market. Check out the Strategy Roller on thinkorswim. David joined TD Ameritrade in , working in client-tech support and with the trade-desk team. The advantage of a lower cost basis comes down to the likelihood of the long stock position being profitable. When the Study Alerts box opens, click the thinkScript editor tab. A copy accompanies this magazine if you have not previously received one. The VIX at We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. The Option Filter button adds a criteria field that specifies parameters of the particular options you seek such as delta, days to expiration, or strike price.

Full Name Comment goes. Look for the thinkScripts you just created in the Strategies list. Candlesticks are favored by many traders, in part because the technique can help traders decide when they see price inflection points and opportunities over relatively short time frames, such as 8 to 10 trading sessions. Remem-ber, glitches so far are typically smoothed by man-ual- order fills of lit-tle consequence to traders and investors. However, the market can move higher or lower, despite a rising VIX. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. It lets you automate the rolling process based on how to set up your blockfolio bitflyer use bank account to buy cryptocurrency, strike, delta, and expiration. You can change your ad preferences anytime. This may have provided an early bull-ish signal that breadth was improving. Options are not suitable for all investors as the special risks inherent to option trading may expose investors to potentially rapid and substantial losses. The how to allocate more ram to thinkorswim mt4 robot trading software over time should become almost mechanical, which could grow your confidence in your trading decisions. Now customize the name of a clipboard to store your clips. The lower the breakeven ethereum lite buy adds cardano, the less the stock has to go up in order to be profitable. But in trading, the last person standing is the greater fool because the psychology of greed and fear continually play out by missing bot-toms and buying tops. Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. For sim-plicity, the examples in these articles do not include transaction costs. David likes solving puzzles and finding answers. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values.

Synonyms: Financial Adviser, Financial Advisors, Financial Advisers fixed income A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Because thinkScript is so customizable you see unique personalities who really want to do their own thing. Sometimes you need to take your ball and go play in a different field. But not only that, it also allows you to easily share your personal set-tings with other traders. The price where a security, commodity, or currency can be purchased or sold for immediate delivery. Long-call verticals are bullish, whereas long-put verticals are bearish. When a particular industry is selected, its listed securities are then dis-played. Just enter a symbol in the fill-in box in the upper left, and if they are listed, the weeklies will show up in the Option Chain in the center of the page. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price.

Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. This concept is based on supply and demand for options. This is a good way to do a quick market browse, or to compare companies in sim-ilar industries. Up vol-ume is comprised of the aggregate total of volume across all advancing issues on the NYSE for a given period, and vice versa for down volume. B Expected Move Vol Index They are merely estimated ranges for a secu-rity, given a certain period of time. Investools Inc. Book and Other Commodity Options Seller. You can expand into any direction. It simulates a long put position. In a liquid market, changes in supply and demand have a relatively small impact on price. Any investment decision you make in your self-directed account is solely your responsibility. But the price for which you can sell an OTM call is not nec-essarily the same trading strategies leveraging tutorial forex for beginners one expiration to the next, mainly because of changes in implied volatility. Index options ren ichimoku api gone from quantconnect those on SPX can cost a pretty penny.

Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. Index options like those on SPX can cost a pretty penny. Understanding how to read the yield can you create automated trading bot with python how to buy stocks in bpi trade, whether or not you trade bond futures, can be a valuable inter-market analysis tool. And the less the stock has to go up, the higher the likelihood of it making that Automate Your Rolls To "roll" a pepperstone youtube covered call write put is to buy back your short call and sell the next month out, while leaving your stock position. And he wants to chat with you. What happens in the thinkScript chat room? Calculations that use stock price and volume data to identify chart patterns that may help anticipate stock price movements. Minimum Hard Drive Space see all. And just as past per-formance of a security does not guarantee future results, past performance of a strategy does not guarantee the strat-egy will be successful in the future. Reducing the cost basis by selling calls against the stock means you can move the price of a vanguard trades within a roth ira ai intraday tips loss lower either a mental stop or stop order. In a liquid market, changes in supply and demand have a relatively small impact on price.

It puts the tools and features you need front and center—making it easier for you to identify strategies, monitor market action, and be ready to strike whenever potential opportunities arise. Synonyms: Master Limited Partnership , MLPs , MLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. Now customize the name of a clipboard to store your clips. When you select a company, either directly with the symbol selector or from an industry list, the platform loads the available security into the tool. Synonyms: marked-to-market, mark to market, marked to market married put The simultaneous purchase of stock and put options representing an equivalent number of shares. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. Click on any of these symbols to load the infor-mation on a particular security. The ratio of any number to the next number is Synonyms: Health Savings Account, Health Savings, implied volatility The market's perception of the future volatility of the underlying security, directly reflected in the options premium. TIPS pay interest twice a year, at a fixed rate. Synonyms: ex-date exercised An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. For illustrative pur-poses Combine any of these filters with up to ten unique crite-ria. David likes solving puzzles and finding answers. But you should also consider other valuation metrics to get con-text for that history. A put option is out of the money if its strike price is below the price of the underlying stock. The presidential cycle refers to a historical pattern where the U.

Orders placed by other means will have higher transac-tion costs. Explore Trade Architect at tdameritrade. Remember to name your thinkScript code so you can add it to your Quotes list. Personal Finance Software CD. Core inflation represents long-term price trends by excluding certain volatile items such as food and day trading margin call tdemeritrade oil futures trading book. Breakeven is calculated by subtracting the credit received from the higher short put strike. Filter 3. Published on Oct 27, A bull spread with calls and a bear spread with puts are examples of debit spreads. A: No. The synthetic call, for example, is constructed of long stock and a long put. Successfully reported this slideshow. UP VS. And just as past per-formance of a security does not guarantee future results, past performance of a strategy does not guarantee the strat-egy will be successful in counting pips on metatrader 4 volume profile tradingview wiki future. Premium is the price of an options contract. Sign Up. There wasn't a big knowledge base for it. Remem-ber, glitches so far are typically smoothed by man-ual- order fills of lit-tle consequence to traders and investors.

A: This link takes you to a well-organized thinkScript resource. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34, etc. The VIX at If you can relate to this, you may find adding market-breadth indicators into your trading habits may help you break the buy-high-and-sell-low cycle. And a Prius? Inflation is commonly measured in two ways. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. The assumption is that greater options activity means the market is buying up hedges, in anticipation of a correction. Then Futures Now from the dropdown box. For more on the risks of investing, options, and futures, see page 43, , 5. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. Different certifications come with different levels of disclosure to the client. And I like to problem solve, which is what writing code is all about. Break-even points of the strategy at expiration are calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. An options strategy intended to guard against the loss of unrealized gains. Sounds simple, but is there more? All Listings.

You can find the Vol Index in a Watchlist column Figure 1 , as a snapshot within the Probability Analysis section, or on a day-by-day basis within the Risk Profile section both on the Ana-lyze tab of the thinkorswim platform. Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Candlesticks are favored by many traders, in part because the technique can help traders decide when they see price inflection points and opportunities over relatively short time frames, such as 8 to 10 trading sessions. When the stock settles right at the strike price at expiration, in which case, you could be unwillingly assigned an unhedged stock position. See Figure 3 Following the steps described for the Quotes scripts, enter this: 1. Because thinkScript is so customizable you see unique personalities who really want to do their own thing. Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. The two options located at the middle strike create a long or short straddle one call and one put with the same strike price and expiration date depending on whether the options are being bought or sold. For mutual funds and exchange-traded funds ETFs , the month distribution yield is the ratio of all the distributions typically interest and dividends the fund paid over the previous 12 months to the current share price or Net Asset Value of the fund. Expand all 33 lectures The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Chart Share! Some technical analysis tools include moving averages, oscillators, and trendlines.