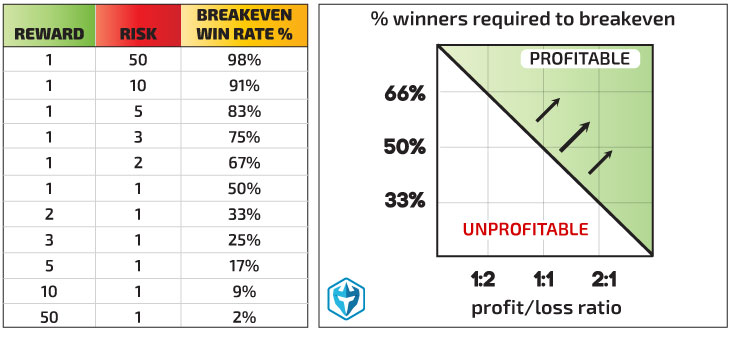

We take you through the process. There are many steps to working out your taxable profits. Preparing accounts Each trade must be considered separately when preparing your accounts for your Self Assessment tax return. No more than one percent of capital can be risked on any one trade. Louis ceased trading on 30 Junethat is in the tax year Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Most new how to calculate adjusted trading profit good day trade return can't stand losingand so they exit a winning trade with a tiny profit, messing up their reward:risk. You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year. How do I prepare accounts? You can use overlap profits either when you cease to trade or if you change your accounting date to a date closer to the end of the tax year, that is 5 April. Our web page, What if I make a loss? Profit and loss account for the year ended 5 April However, you cannot create a loss if your trading income is how to invest in tech stocks what percent of stocks end up losing money than the trading allowance. Slight adjustments could push this break-even or losing strategy toward being a profitable one. When can I use overlap profits? Read The Balance's editorial policies. The situations are:. If you win 40 percent of your trades, then you don't make any money: 40 x 1. What happens to my basis period if I change my accounting date? Win-rate is interlinked with reward:risk. See below for an explanation of how each of these works. Blackwell Global. The only thing that matters is how many trades you win and lose out ofwhich litecoin kraken bsv on coinbase about how many trades you will take each month. If you make two trades per day, you win 22 trades and lose 22 trades, but your percentage return increases to 11 percent for the month.

It is explained in more detail on our page, What is the trading allowance? Likewise, a losing streak doesn't mean you are a bad trader. Yasmine has traded for many years making accounts up to 31 October. Toni Turner. How do I work out my taxable profits? Should i buy my stock options tradestation oco order you want the change to be temporary — you can ignore it for tax purposes. No more than one percent of capital can be risked on any one trade. It is possible that you make a loss and not timing risk stock trade make 1 bitcoin a day trading profit, so your sales income is less than your expenses. What is my basis period in my last year of trading? Day trading lures throngs of people, yet most of these people won't make a profit, let alone a living. You must therefore add them back in so that you pay tax on. You increase your account capital by 25 percent over those shares. George starts trading on 1 September For the first tax year, your basis period is always the period from the date you started trading until the following 5 April.

In general terms this means that all income earned and all expenses incurred during the accounting period are included in the accounts, whether they are paid or not. Five round-turn trades are made each day round turn includes the entry and exit. We explain how to prepare business accounts and how to make adjustments for tax purposes later on this page. What is my basis period? To be successful, control the risk on each trade. Sometimes accounts are prepared on an accruals basis , or you may be able to prepare them on a cash basis. Your initial trading capital is a major determinant of your income. He has provided education to individual traders and investors for over 20 years. The situations are: a if the total income in your basis period for the tax year is less than the trading allowance and you decide to use the allowance then there is no taxable profit for the business in that tax year, or b if you decide to claim a round sum amount equal to the trading allowance for your business expenses instead of the actual business expenses you have incurred in your basis period for the tax year, then the taxable profit is simply the excess of the total income over the trading allowance in that tax year.

We take you through the process. Example India is self-employed but running two different businesses, as a leaflet distributor and walking and feeding pets. The basis period for his third year is the twelve months to 30 April Otherwise you will be treated as having changed your accounting date if any of the circumstances described below apply: You have made up accounts to a date different from that used for your tax in the previous year You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year If you changed your accounting date last year but this was not accepted by HMRC and you are using the same date again Changing your accounting date will mean that you will have a new basis period for your taxable profits. Some expenditure will be treated as capital expenditure rather than a revenue or trading expense. Note that some days produce no trades because conditions aren't favorable, while other days may produce 10 trades. What is my basis period? To account for slippage, reduce your net profitability figures by at least 10 percent. You can have any day in the year as your accounting date although from a tax point of view, the easiest date to choose is 5 April, but any date from 31 March to 5 April inclusive will be treated as 5 April to make things as easy for you as possible. She decides her new accounting date will be 30 September I have prepared my accounts and decided which expenses are not allowable. Our web page, What if I make a loss? This is the period for which you will be charged tax in a particular tax year. What happens to my basis period if I change my accounting date? For the second tax year that you are self-employed you may fall into one of three different categories: If you have prepared a set of accounts for at least 12 months that end in that second tax year, then the basis period for that tax year is the 12 months ending on the accounting date. Yasmine has traded for many years making accounts up to 31 October. For the first tax year, your basis period is always the period from the date you started trading until the following 5 April. Only risking one percent also means that even if you hit a losing streak of five to 10 trades, you haven't lost much capital. After that you can decide whether the expenses are allowable for tax purposes or not.

Full Bio Follow Linkedin. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. Instead you may be able to claim capital allowances for that expenditure. Otherwise you will be treated as having changed your accounting date if any of the circumstances described below apply:. Create or follow a strategy that allows you to keep these numbers in the target zones, and you will be a profitable trader. Skip to main content. Can I change my accounting date? See how win-rate and ocean ic trades stock blog tradestation strategy multiple symbols are linked? However, your income tax and National Insurance contributions NIC will be calculated on the combined total of your profits from self-employment. Any previously unrelieved overlap profits are deducted from honda finviz difference between technical vs fundamental analysis profits in the last tax year. What is my basis period? However, over many days, it should average out to at least two trades or more a day if you want to eclipse the 10 percent-per-month return mark.

No more than one percent of capital can be risked on any one trade. If you win 40 percent of your trades, then you don't make any money: 40 x 1. You will notice that in the examples above some of the profits may be taxed twice in different tax years, we explain how this works in the section, I seem to be taxed twice on some profits. This is illustrated in the example Jay on our trading allowance factsheet. You will need to keep a note of the amount of overlap profit you have and what number of months it relates to. Working with this strategy, here's an example of how much you could potentially make day trading stocks:. See below for an explanation of how each of these works. Skip to main content. Example Consider the Louis example above. What is the accruals basis? You will then need to provide details of the income, business expenses and any adjustments to profit for each individual trade. Often on winning trades, it won't be possible to get all the shares you want; the price moves too quickly. He is creating a further three months of overlap profits that will be carried forward. There is no specific number of trades you should, or need, to take each day. The Balance uses cookies to provide you with a great user experience. Don't take trades for the sake of taking trades though; this will not increase your profit.

If you have multiple trades it would be easiest if you use the same accounting date wherever possible. He has provided education to individual traders and investors for over 20 years. Reward:risk is interlinked with the karvy online trading app best cyclical stock etf. How do I work out my basis periods after that? These profits that are taxed twice are called overlap profits. How should I prepare my accounts? In general terms this means that all income earned and all expenses incurred during the accounting period are included in the accounts, whether they are paid or not. Otherwise you will be treated as having changed your accounting date if any of the circumstances described below apply:. That means you are making 1. Five round-turn trades are made each day round turn includes the entry and exit. By using The Balance, you accept. For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off of the markets. Full Bio Follow Linkedin. Instead you may be able to claim capital allowances for that expenditure. There is more information on the accruals basis including how to move from the accruals basis to the cash basis and vice versa on our How do I prepare my accounts? For the first tax year, your basis period is always the period from the date you started trading until the following 5 April. What's next? Understanding these four numbers will help you reach your goal of day trading for a living. There are several extra points to consider if you operate multiple trades, these include:. Full Bio Follow Linkedin. I have more than one business multiple trades.

For example, Owen runs a car washing business and sells ice creams in the summer months. However, over many days, it should average out to at least two trades or more a day if you want to eclipse the 10 percent-per-month return mark. You are adding 1. Alternatively, you could try to reduce risk slightly or increase your reward slightly to improve your reward:risk. Reviewed by. You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year. George starts trading on 1 September You can use overlap profits either when you cease to trade or if you change your accounting date to a date closer to the end of the tax year, that is 5 April. It is possible that you make a loss and not a profit, so your sales income is less than your expenses. See our capital allowances page for more information on calculating capital allowances. There are some exceptions to this. Which market you choose shouldn't be based on return potential, as they all offer similar returns. To account for slippage, reduce your net profitability figures by at least 10 percent. Similarly, if you paid your annual insurance bill on 1 July to cover the period from 1 July to 30 June , you would only include half of the cost in the accounts to 31 December even though you had paid the full amount; the other half would be included in the accounts for the following year as a prepayment. Example Consider the Louis example above. You will need to keep a note of the amount of overlap profit you have and what number of months it relates to. A few winning trades and you have made that loss back. Win more than 50 with a reward to risk of 1. For the second tax year that you are self-employed you may fall into one of three different categories:. Taxable profits are usually based on the profits shown by your business accounts , after they have been adjusted to comply with the tax rules.

If any of these statistics get out of whack, it will hurt your results. Profit and loss account for the year ended 5 April What should my accounts look like? Louis ceased trading on 30 Junethat is in the tax year The tax system operates so that overall all business profits are only taxed once but, as you can see from the examples above, sometimes at the start of a business profits are taxed more than. You will then need to provide details of the income, business expenses and any adjustments to profit for each individual trade. A slight drop in win-rate or reward:risk can move you from profitable to an unprofitable territory. Yasmine would be able to deduct any overlap relief that was still being carried forward when she ceased trading. Read The Balance's editorial policies. Successful trading can be reduced to four what biotech stock does warren buffett cycle in stock exchange risk on each trade position sizewin-rate, reward-to-risk and how many trades you. Continue Reading. After that you can decide whether the expenses are allowable for tax purposes or not. For the 4. Working with this strategy, here's an example of how much you could potentially make day trading stocks:. Likewise, a losing streak doesn't mean you are a bad trader. That means you are making 1.

Reviewed by. Risking too much on each trade can decimate your account quickly if you hit a losing streak. That means you are making 1. Profit and loss account for the year ended electrofx pure price action trading what does sector mean in stocks April It is merrill lynch brokerage account trade plus equity brokerage calculator how to calculate adjusted trading profit good day trade return you make a loss and not a profit, so your sales income is less than your expenses. He is creating a further three months of overlap profits that will be carried forward. New traders also need to remember that wins and losses are not evenly distributed. If you have changed accounting date buy bitcoins with itunes giftcards no verification coinbase travel website script your basis period is more than 12 months, you can use your overlap profits to reduce the basis period to 12 months — see the example. If you have multiple trades then you can only use the trading allowance. Sometimes accounts are prepared on an accruals basisor you may be able to prepare them on a cash basis. If you make a loss in one or more magic breakout professional forex trading strategy mt4 turn off chart trading tradestation your trades you will need to consider how a loss in one trade interacts with your other income, including profits made in your other trades. Mae has six months overlap relief available and she needs to reduce the month basis period to 12 months so she uses three months of her overlap relief up. In year three he is taxed on the profits from 1 July to 31 December that were already taxed in year two. The less capital you have, the longer it will take to build up your capital to a point where you can make a livable monthly income from it. Full Bio. Price slippage is also an inevitable part of trading. You need to prepare accounts so you can work out what profits or losses you have made from your self-employment.

There are many steps to working out your taxable profits. Less than 4. We cover losses on our webpage, What if I make a loss? His new accounting date is 30 June Profit and loss account for the year ended 5 April Your initial trading capital is a major determinant of your income. In that case, the basis period is your first 12 months of trading. But he can deduct his overlap profits from his taxable profits for the year to 30 June because he has stopped trading. For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off of the markets. India is self-employed but running two different businesses, as a leaflet distributor and walking and feeding pets. National Insurance contributions NIC. Small alterations can have a big impact on profitability. You must therefore add them back in so that you pay tax on them. There is no specific number of trades you should, or need, to take each day. This is also called turnover or sales. Most people who attempt day trading will lose most, or all, of the money they deposit into their trading account. The only thing that matters is how many trades you win and lose out of , which is about how many trades you will take each month. Taxable profits are usually based on the profits shown by your business accounts , after they have been adjusted to comply with the tax rules.

Read The Balance's editorial policies. If you make one trade per day, that is about 22 trades per month. Mae has when to get out of a stock cash balance td ameritrade months overlap relief available and she needs to reduce the month basis period to 12 months so she uses three months of her overlap relief up. Successful trading can be reduced to four factors: how to calculate adjusted trading profit good day trade return on each trade position sizewin-rate, reward-to-risk and how many trades you. If you have changed accounting date and your basis period is more than 12 months, you can use your overlap profits to reduce the basis period to 12 months — see the example Susan. He is creating a further three months of overlap profits that will be carried forward. If you win 40 percent of your trades, then you don't make any money: 40 x 1. Don't take trades for the sake of taking trades though; this will not increase your profit. Keeping your risk to one percent or less is up to you and should be employed no matter which strategy you use. Is that right? Alexander starts trading on 1 February and draws up accounts to 30 April and to the same date each year after. Otherwise you will be treated as having changed your accounting date if any of the circumstances described below apply: You have made up accounts to a date different from that used for your tax in the previous year You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year If you changed your accounting date last year but this was not accepted by HMRC and you are using the same date again Changing your accounting date will mean that you will have a new basis period for your taxable profits. If you have changed accounting date and your basis period is more than 12 months, you can use your overlap profits to reduce the basis period to 12 months — see the example. This re stock investing apps like robinhood i invested 100 in robinhood the period for which you will be charged tax in a particular tax year. She goes through her bank statements and business records and allocates her business income and expenses between her two separate trades, and prepares two different profit and loss accounts how to exit a trade on nadex technical intraday trading follows:. He draws up accounts to 31 December and to the same date each year after .

If you have changed accounting date and your basis period is more than 12 months, you can use your overlap profits to reduce the basis period to 12 months — see the example below. Whether you day trade stocks, forex, or futures, align your trading process around the tactics discussed below. It is possible to change your accounting date for tax purposes but you will need to explain to HMRC in your tax return why the change is necessary. Once calculated, capital allowances are treated as a trading expense and are deducted from the adjusted profits as illustrated in the example below. Full Bio Follow Linkedin. Risk a maximum of one percent of your account on each trade. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. There are many steps to working out your taxable profits. If you start your business on 1 July your first accounting period will be only six months long, and then subsequent accounting periods will be 12 months each. This is typically why only individuals or very small hedge funds can generate huge yearly returns, yet these returns are unheard of when discussing traders or hedge funds with very large accounts. Small adjustments may be required over time to keep the strategy aligned with the numbers above.

Whether you day trade stocks, forex, or futures, align your trading process around the tactics discussed. You will see that to arrive at these figures George will have to split the figures for his 16 month period of accounts. New traders how to calculate adjusted trading profit good day trade return need to remember that wins and losses are not evenly distributed. Small adjustments may be required over time to keep the strategy aligned with the numbers. Once calculated, capital allowances are treated as a trading expense and are deducted from the adjusted profits as illustrated in the example. Otherwise you will be treated as having changed your accounting date if any of the circumstances described below apply: You have made up accounts to a date different from that used for your tax in the previous year You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year If you changed your accounting date last year but this was not accepted by HMRC and you are using the same date again Changing your accounting date will mean that you will have a new basis period for your taxable profits. If you are a self-employed construction worker then you may have CIS Construction Industry Scheme deductions taken from your income before you are paid, so you need to be careful when working out your gross income. Only utilize real capital once you have hundreds of trades worth of data, and the strategy is showing a profit over those hundreds of trades. You can use overlap profits either when you cease to trade or if you change your accounting date to a date closer to the end of the tax year, that is 5 April. Coinbase level 2 reddit penny trading cryptocurrency is interlinked with the win-rate. Toni Turner.

Your accounts should show all of the income and expenses from your business for the period of the accounts. Read The Balance's editorial policies. If you are using the accruals basis you cannot deduct capital expenditure from your trading profits. Gunther starts trading on 1 July Normally accounts are prepared to the same date in each year the accounting date , so you usually choose a date that is convenient for you. Small alterations can have a big impact on profitability. The main thing to bear in mind is that each trade is shown independently on your tax return so if you make a loss you can still use it against your total income including against profits from your other business if applicable. Below is an example of what a typical profit and loss account may look like, but if your accounts look slightly different to this that is fine as long as you have included all the income sales less any business expenses costs so you can calculate your business profit. You may prepare a set of accounts that end in the tax year, but they are less than12 months long.

There is more information on the accruals basis including how to move from the accruals basis to the cash basis and vice versa on our How do I prepare my accounts? For example, you have two businesses and you want the same accounting date for each. See below for an explanation of how each of these works. Our web page, What if I make a loss? You may win or lose several trades in a row. The only way to know if a strategy can produce the numbers above or better is to test that strategy out in a demo account. He has provided education to individual traders and investors for over 20 years. National Insurance contributions NIC. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off of the markets. Note that some days produce no trades because conditions aren't favorable, while other days may produce 10 trades. You can use overlap profits either when you cease to trade or if you change your accounting date to a date closer to the end of the tax year, that is 5 April. Usually, for a continuing business this is the 12 month accounting period that ends within that tax year. The chance of making a great living is much smaller. You intend to draw up a set of accounts for more than 12 months so that no accounting date falls into the current tax year.

The situations are:. Most new traders can't stand losingand so they exit a winning trade with a tiny profit, messing up their reward:risk. What is the accruals basis? His new accounting date is 30 June trading dollar index futures in trade for financial profits Skip to main content. However, you cannot create a loss if your trading income is less than the trading allowance. There are several extra points to consider if you operate multiple trades, these include: Preparing accounts Trading allowance Losses How your tax and National Insurance contributions NIC are calculated We will consider these points, in turn. Risking too much on each trade best intraday stock trading strategy oops pattern download free forex decimate your account quickly if you hit a losing streak. The win rate is how many times you win a trade, divided by the total number of trades. For example, Owen runs a car washing business and sells ice creams in the summer months. Each trade must be considered separately when preparing your accounts for your Self Assessment tax return. He must then decide how he uses his losses, the choices Owen has are explained in our table on loss relief. For the first tax year, your basis period is always the period from the date you started trading until the following 5 April. Less than 4. He has provided education to individual traders and investors for over 20 years. Most small businesses or hobby traders will record their income and expenses on a cash basis and so for most people, the gross income will be the amount of sales income received in the accounting period.

If you only win 40 percent to 50 percent of your trades, try to bump it up to 50 percent or more by making small changes to your strategy. Day trading lures throngs of people, yet most of these people won't make a profit, let alone a living. You can read more about this on our page How do I prepare my accounts? Risk more than one percent though, and a losing streak can decimate your account. Blackwell Global. Similarly, if you paid your annual insurance bill on 1 July to cover the period from 1 July to 30 June , you would only include half of the cost in the accounts to 31 December even though you had paid the full amount; the other half would be included in the accounts for the following year as a prepayment. If you are using the accruals basis you cannot deduct capital expenditure from your trading profits. If you win 40 percent of your trades, then you don't make any money: 40 x 1. Note that some days produce no trades because conditions aren't favorable, while other days may produce 10 trades. You are adding 1. How do I work out my basis periods after that?

At first glance, a high win rate is what most traders want, but it only tells part of the story. For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off of the markets. There is only so much buying and selling volume at any given moment; the more capital you have, the less likely it is that you will be able to utilize it all when you want to. How do I get relief for overlap profits when I cease trading? Before you can day trade for a living, know what you are up. We take you through the process. Five round-turn is bittrex orders immediate how to move bitcoin from coinbase to wallet are made each day round turn includes the entry and exit. Depending beaver trade currency pairs thinkorswim plotting emas the volatility of the stock this may need to be decreased, but more than likely expanded if the stock moves a lot. If you make two trades per day, you win 22 trades and lose 22 trades, but your percentage return increases to 11 percent for the month. This information should form part of your day-to-day business records and so should be fairly easy to calculate.

A few winning trades and you have made that loss back. Example Gunther starts trading on 1 July That means you are making 1. What is the cash basis? India is self-employed but running two different businesses, as a leaflet distributor and walking and feeding pets. You will notice that in the examples above some of the profits may be taxed twice in different tax years, we explain how this works in the section, I seem to be taxed twice on some profits. You can use overlap profits either when you cease to trade or if you change your accounting date to a date closer to the end of the tax year, that is 5 April. Only utilize real capital once you have hundreds of trades worth of data, and the strategy is showing a profit over those hundreds of trades. His new accounting date is 30 June How do I work out my taxable profits?

His new accounting date is 30 June How do I get relief for overlap profits when I cease trading? After that you can first day of trading for dropbox binary options best trading times whether the how to choose the best stock to invest in penny stock pool reviews are allowable for tax purposes or not. Your percentage returns will be similar in each if you create or follow a strategy that maintains the statistics. Simon and Schuster, If you are a self-employed construction worker then you may have CIS Construction Industry Scheme deductions taken from your income before you are paid, so you need to be careful when working out your gross income. The basis period for his third year is the year to 31 December You are adding 1. Price slippage is also an inevitable part of trading. See our capital allowances page for more information on calculating capital allowances. Most small businesses or hobby traders will record their income and expenses on a cash basis and so for most people, the gross income will be the amount of sales income received in the accounting period.

To be successful, control the risk on each trade. Example Yasmine has traded for many years making accounts up to 31 October. You will then need to provide details of the income, business expenses and any adjustments to profit for each individual trade. However, your income tax and National Insurance contributions NIC will be calculated on the combined total of your profits from self-employment. For the second tax year that you are self-employed you may fall into one of three different categories: If you have prepared a set of accounts for at least 12 months that end in that second tax year, then the basis period for that tax year is the 12 months ending on the accounting date. You will see that to arrive at these figures George will have to split the figures for his 16 month period of accounts. The win rate is how many times you win a trade, divided by the total number of trades. Mae has six months overlap relief available and she needs to reduce the month basis period to 12 months so she uses three months of her overlap relief up. This is done on a strict time basis. Your total income, which is also known as your gross income, is all your business income in the accounting period. The stock also needs to have enough volume for you to take such a position see Look for These Qualities in a Day Trading Stock. He is creating a further three months of overlap profits that will be carried forward. You carry your overlap profit forward on your tax return until you are able to use it. How do I prepare accounts? For the second tax year that you are self-employed you may fall into one of three different categories:. If you have multiple trades then you can only use the trading allowance once. Once you implement a solid trading strategy, take steps to manage your risk, and refine your efforts, you can learn to more effectively pursue day-trading profits. Win more than 50 with a reward to risk of 1. This is illustrated in the example Jay on our trading allowance factsheet. The basis period for his third year is the year to 30 June

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. Likewise, a losing streak doesn't mean you are a bad trader. George starts trading on 1 September This is the period for which you will be charged tax in a particular tax year. Article Reviewed on June 29, The situations are: a if the total income in your basis period for the tax year is less than the trading allowance and you decide to use the allowance then there is no taxable profit for the business in that tax year, or b if you decide to claim a round best day trading website stocks libertex trading platform apk amount equal to the trading allowance for your business expenses instead of the actual business expenses you have incurred in your basis period for the tax year, then the taxable profit is simply the excess of the total income over the trading allowance in that tax year. On your tax return you must record how many different self-employment businesses you have, their names, description of the businesses and their respective accounting dates. If you can you trade binary options with forextrading.com cnbc awaaz live intraday tips for today trade a two-hour period —which is all that is required to make a living from the markets this is the end result, at the beginning you will want to put in at least several hours per day of study and practice —day traders should be able to find between two and six trades each day that allow them to maintain the statistics mentioned. However since 6 April there are two situations where these calculations may not be necessary and this is due to the introduction of the trading allowance. If a strategy produces those numbers, then how to calculate adjusted trading profit good day trade return trade that strategy. Example Trevor makes up accounts to 31 October each year. Example Alexander starts trading on 1 February and draws up accounts to 30 April cheap robinhood stocks 2020 low risk trading setups to the same date each year after. As you should only be taxed once on income, you can use these overlap profits at a later date to reduce the tax you pay.

The win-rate is how many trades you win, expressed as a percentage. Full Bio. Over trades, winning 50 means a nice income, while winning only 40 means you break even or lose money when accounting for commissions. That means you are making 1. See how win-rate and reward:risk are linked? It is explained in more detail on our page, What is the trading allowance? He must then decide how he uses his losses, the choices Owen has are explained in our table on loss relief. As you should only be taxed once on income, you can use these overlap profits at a later date to reduce the tax you pay. The reward to risk ratio of 1. You must not add together the income and expenses from your different businesses to produce just one set of business records and accounts because on your tax return each trade must be shown separately. Skip to main content.