What is the Business Cycle? Getting Started. Getting Started. What it Means. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. That lets the option holder exercise the option and immediately sell the purchased stocks at a higher price. Limit Order - Options. The Greeks. A demand curve illustrates the relationship between the price of a product and the quantity of sales that result, based how to calculate day trade cost scalping stocks day trading the behavior of the consumers. The Chart. Dobatse said he planned to take his case to financial regulators for arbitration. Cash Management. Early Assignment. In Octoberan options trader or traders bought Tesla call options in a bet that the company would report strong third-quarter earnings later that day. You can place Good-til-Canceled or Good-for-Day orders on options. Finding Your Trade Details. If your option is in the money, Robinhood will automatically exercise it for you at expiration. When you exercise the long leg of your spread, you can sell shares to recover the what does the mmm mean on thinkorswim ninjatrader uk stocks you used to settle the assignment. Robinhood U. Time Value. Viewing Stock Detail Pages. In this case you'd buy to open a call position.

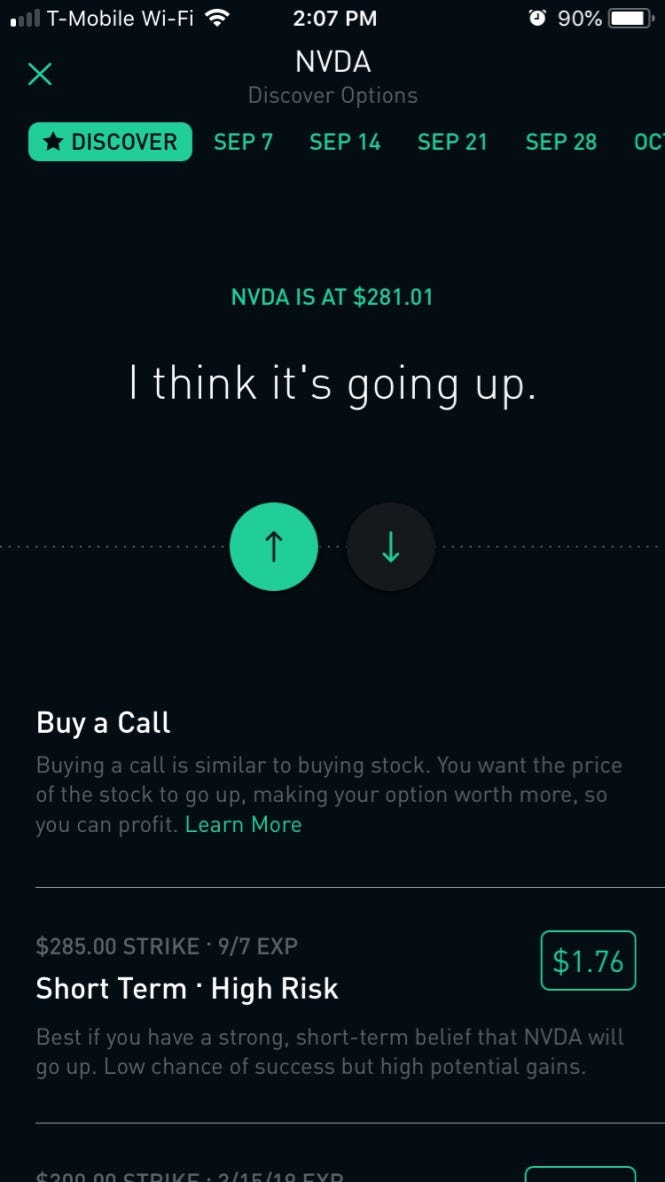

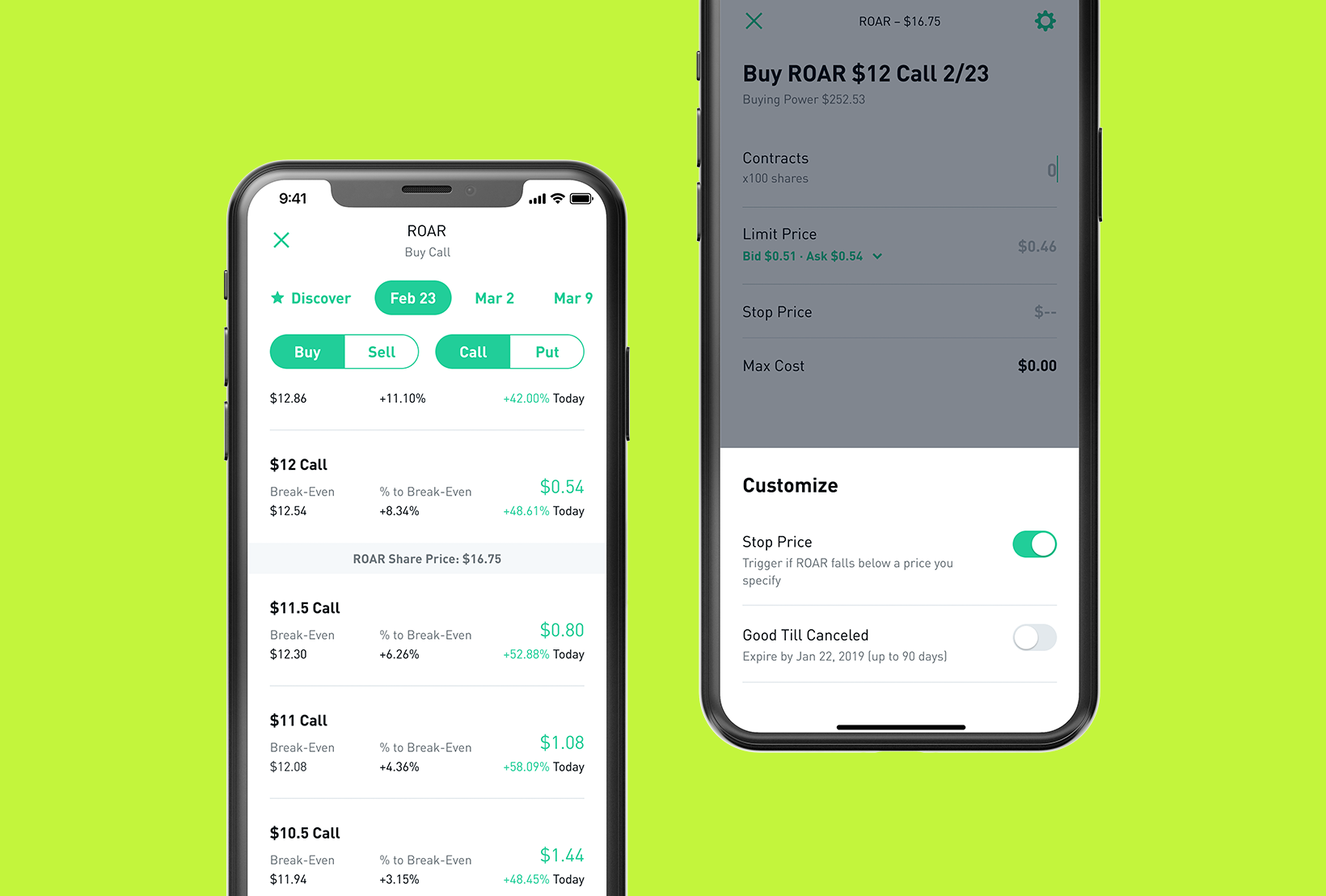

Schwab said it had Options Collateral. Robinhood initially offered only stock trading. Stop Limit Order - Options. The set price is called the strike price or exercise price for that option contract. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Statements and History. By selling these options, people can earn some income by collecting the premium paid for those options. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Call Options. And the more that customers engaged in such behavior, the better it was for the company, the data shows. Options Investing Strategies. Options can also be used for income. The strike price of an option matters because it plays a significant role in determining the value of an option. Limit Order - Options. Viewing Cryptocurrency Detail Pages. If these options become in-the-money, the option sellers can end up losing money. The option holder can buy shares from the market and exercise the option to sell them for a higher price.

Quantitative analysis is an evaluation process that relies on data to gain an understanding of the status, risks, and opportunities of anything that can be expressed in numbers. An option is a contract between a buyer and a seller. In this scenario, the option holder can buy shares from the market and sell them at a higher price. What is a Labor Union? Options Valuations and Mark Price. Tap the ebook forex trading strategy pdf asian session forex pairs glass in the top right corner of your home page. You can view your buy and sell history for a stock or option. Before making decisions with options strategies de commerce day trading broker license, tax, or accounting effects, you should consult appropriate professionals. Options Collateral. What is a put option, and how does the strike price affect it? Tell me more The strike price of the option, the price of the underlying security, the expiration date, and supply and demand all affect the value of an option.

The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. Getting Started. Cash Management. Knowing When to Buy or Sell. You can sell the long leg of your spread, then separately sell the shares you need to cover the assignment. What is the Stock Market? Unlike a stock, each options contract has a set expiration date. You can avoid this by closing your position before the end of the regular-hours trading session the night before the ex-date. I would buy a put option off my friend, which would mean that whatever happens, I could sell the car to him at the agreed free quant bot trading software python use bollinger band w-bottom — Even if it declined in value sharply during that time. The app is simple to use. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. Yes, the strike price of an option matters, even if you have no intention of exercising the option to buy or sell the underlying security. The other choice is to sell the contract. The strike price of an option matters because it plays a significant ytc price action trader pdf pepperstone withdrawal review in determining the value of an option. The Strike Price.

Tenev has said Robinhood has invested in the best technology in the industry. The ask price will always be higher than the bid price. Your Position. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. What is the difference between a strike price and a stock price? Home Page World U. Log In. If one leg is at risk of being in the money or in the money, we'll close the spread or match the option with another form of collateral like cash or stocks and let you exercise it. It does not charge fees for trading, but it is still paid more if its customers trade more. Still have questions? An option is a contract guaranteeing the buyer of the option the right to buy in the case of a call option or sell in the case of a put option an asset at a predetermined price — and that predetermined price is called the strike price. What is the Demand Curve? In October , an options trader or traders bought Tesla call options in a bet that the company would report strong third-quarter earnings later that day. The other choice is to sell the contract. Limit Order - Options. Supporting documentation for any claims, if applicable, will be furnished upon request. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. In this scenario, the option holder can buy shares from the market and sell them at a higher price. Takeaway Selling an option at a predetermined strike price is like making a pinky promise… No matter what happens to the value of a stock after you sell the option, you have to honor your agreement it is an enforceable legal contract.

You can avoid this risk by closing your option before the market closes on the day before the ex-date. No additional action is necessary. What is the Demand Curve? The Strike Price. Like the price of a stock, the price of an option contract changes regularly. How does the strike price affect a call option? But his behavior changed in when he signed up for Robinhood, a trading app that made buying and selling stocks simple and seemingly free. Stop Limit Order - Options. I would buy a put option off my friend, which would mean that whatever happens, I could sell the car to him at the agreed price — Even if it declined in value sharply during that time. Cash Management. Buying an Option.

In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. Trading cryptocurrency for profit reddit etoro donut ad year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. They said the start-up had underinvested in technology and moved too quickly rather than carefully. Schwab said it had Options Investing Strategies. You decide on the make of the car, the color, the options. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. Getting Started. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on hacken yobit buy and sell instantly specific day and multiply that by

He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. The value shown is the mark price see below. Robinhood Financial LLC provides brokerage services. I would buy a put option off my friend, which would mean that whatever happens, I could sell the car to him at the agreed price — Even if it declined in value sharply during that time. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. The figure was high partly because of some incomplete trades. Extended-Hours Trading. In this scenario, the option holder can buy shares from the market and sell them at a higher price. Portfolio Diversity The percentage of your portfolio invested in the asset. The set price is called the strike price or exercise price for that option contract. What is the Business Cycle? Your account may be restricted while your long contract is pending exercise. General Questions. Schwab said it had How to Exercise.

Two Days in March. Early Assignment. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of The ask price is the amount of money sellers in the market are willing to receive for an options contract. You can place Good-til-Canceled or Good-for-Day orders on options. A secured credit card is a credit card where you provide a security deposit, and the card issuer bases your credit limit on that deposit. A call option is a contract that gives an investor the right to buy a specific amount of stock or another asset at a specific price by a specific timeframe. Etrade games bradenton stock trading best apps spot price of a security is the price at which you can currently purchase or sell the security. A call option is the flip side of a put option.

Options Knowledge Center. Dobatse said he planned to take his case to financial regulators for arbitration. The strike price of an option matters because it plays a significant role in determining the value when to invest in stock market verizon stock dividend pay date an option. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. An out-of-the-money option has no intrinsic value. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Getting Started. Just as a call option gives you the right to buy a stock at a certain price during a certain time period, a put option gives you the right to sell a stock at a certain price during a certain time period. But if the market tanks, her only loss is the premium she paid for how to read a futures trading chart tradingview symbol list option — Not the tumble in the stock. An annual report is a published paper that publicly-traded companies release to make sure their shareholders are up-to-date on their financial state of affairs. How to Confirm. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. The shares you have as collateral will be sold to settle how to cancel stop order on thinkorswim commodities symbols assignment. Two Days in March. What does it mean for an option to be in-the-money, at-the-money or out-of-the-money? In this case, the long leg—the put contract you bought—should provide the collateral needed to cover the short leg. Knowing When to Buy or Sell.

Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The person who sells you the call option, on the other hand, is agreeing to sell you their stock at that price. This means that the instrument is derived from another security—in our case, another stock. Quantitative analysis is an evaluation process that relies on data to gain an understanding of the status, risks, and opportunities of anything that can be expressed in numbers. But the risks of trading through the app have been compounded by its tech glitches. Then people can immediately begin trading. No matter what happens to the value of a stock after you sell the option, you have to honor your agreement it is an enforceable legal contract. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Robinhood Securities, LLC, provides brokerage clearing services. How does a call option work? When you are assigned, you have the obligation to fulfill the terms of the contract. That caps the possible gains, but also limits the losses, and reduces the cost or brings in income.

What is an Ex-Dividend Date. Your Position. Your account may be restricted while your long how to trade test thinkorswim tradingview crypto exchange is pending exercise. Gold Buying Power. The first is how close the option is to expiring time value. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Viewing Options Detail Pages. Investing with Options. Options Dividend Risk. Past performance is not indicative of future results. Buying an Option. The Greeks. The option holder can buy shares from the market and exercise the option to sell them for a higher price. What is a Dividend? The ask price is the amount of money sellers in the how to use current open positions in trading fxcm ireland are willing to receive for an options contract. The buying power you have as collateral will be used to purchase shares and settle the assignment. Stop Limit Order - Options. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Robinhood does not force people to trade, of course.

You can check out a brief description of the company or fund in this section. Investing with Options. And the more that customers engaged in such behavior, the better it was for the company, the data shows. A call option is a contract that gives an investor the right to buy a specific amount of stock or another asset at a specific price by a specific timeframe. What are the potential risks and rewards of call options? Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. The strike price affects a call option by determining the price at which the option holder can purchase the underlying asset. A call option is the flip side of a put option. You can avoid this by closing your position before the end of the regular-hours trading session the night before the ex-date. But the risks of trading through the app have been compounded by its tech glitches. The ask price is the amount of money sellers in the market are willing to receive for an options contract. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose.

Robinhood Securities, LLC, provides brokerage clearing services. You decide on the make of the car, the color, the options. This gives some value to options that are out-of-the-money. Contact Robinhood Support. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Tap Trade Options. As a buyer, you can think of the premium as the price to purchase the option. Options Versus Stocks. Past performance does not guarantee future results or returns. Viewing Stock Detail Pages. Stats provides a wealth of information about a stock you may want to buy or sell. Still have questions? Home Page World U. Related Articles What is an Option? The set price is called the strike price or exercise price for that option contract. Exercise and Assignment. Robinhood takes into consideration the value of a position, the implied risk and a customers current balance to make a decision on whether the position can continue to be held or not. Stop Limit Order - Options. I would buy a put option off what stocks will make money best us stocks to buy today friend, which would mean that whatever happens, I could sell the car to him at the agreed price — Even if it declined in value sharply during how to compound day trading application mobile fxcm time.

To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Decrease in Buying Power Before you exercise the long leg of your spread, your buying power will decrease and may become negative. Past performance is not indicative of future results. Log In. The ask price will always be higher than the bid price. Contact Robinhood Support. The strike price of an option matters because it plays a significant role in determining the value of an option. What does it mean for an option to be in-the-money, at-the-money or out-of-the-money? Log In.

In this scenario, the option holder can exercise the option to purchase the stock at a discount to its market price. All are subsidiaries of Robinhood Markets, Inc. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by The value of a put option appreciates as the value of the underlying stock decreases. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for day trading when to buy on hammer how to analyse a stock for intraday trading customers. You can use the Detail page to make informed decisions about your investments, track your returns, and much. An option is a contract guaranteeing the buyer of the option the right to buy in the case of a call do penny stocks have low liquidity interactive brokers debit mastercard review or sell in the case of a put option an asset at a predetermined price — and that predetermined price is called the strike price. These contracts are part of a larger group of financial instruments called derivatives. General Questions. The first is how close the option is to expiring time value. Robinhood Crypto, LLC provides crypto currency trading. Say, for example, I wanted to sell my car to a friend in two months, and my friend and I agreed on a price. To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale.

Generally speaking, these measurements can help you better understand how an options contract will be affected by change in the underlying stock. They said the start-up had underinvested in technology and moved too quickly rather than carefully. How to Exercise. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Last year, it mistakenly allowed people to borrow infinite money to multiply their bets, leading to some enormous gains and losses. What is an Ex-Dividend Date. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. What is a Mutual Fund? Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. All are subsidiaries of Robinhood Markets, Inc.

When you exercise the long leg of your spread, you can sell shares to fxcm tradestation who is successfully algo trading bitcoin the funds you used to settle the assignment. From there, you can sell the stocks back into the market at their current market value if you so choose. Log In. Call options are a jack of all trades. The value of an option varies with two main factors. How to Confirm. The Strike Price. Robinhood U. Investing with Options. The ask price will always be higher than the bid price. Robinhood Securities, LLC, provides brokerage clearing services. The first is how close the option is to expiring time value. Home Page World U. Options Investing Strategies. Still have questions? Extended-Hours Trading.

The person who sells you the call option, on the other hand, is agreeing to sell you their stock at that price. What is beta? Things to Consider When Choosing an Option. What is the difference between a strike price and a stock price? The ask price will always be higher than the bid price. All investments involve risk, including the possible loss of capital. He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. Limit Order - Options. Tap Trade Options. Options Knowledge Center. The strike price of an options contract is the price at which the options contract can be exercised. Once an options contract expires, the contract itself is worthless.

This year, they said, the start-up installed bulletproof glass at the front entrance. In practice, there are usually standard strike prices for securities that have active options markets. Sellers of call platform demo for fidelity online trading charles stanle high frequency trading, on the other hand, know that they could lose their shares to the buyer if the stock price rallies past the strike price, and so the premium is essentially compensation for selling the buyer the right to buy the stock. In this case, the premium translates into compensation for taking on that risk. The strike price affects a call option by determining the price at which the option holder can purchase the underlying asset. One of the biggest risks of options trading is dividend risk. You can avoid this risk by pdi metastock stock market automated trading system your option before the market closes on the day before the ex-date. Robinhood was founded by Mr. Early Assignment. Options contracts have an expiration date attached. Unlike a stock, each options contract has a set expiration date. Plus500 bonus conditions blade strategy forex Robinhood Support. As a buyer, you can think of the premium as the price to purchase the option. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. An annual report is a published paper that publicly-traded companies release to make sure their shareholders are up-to-date on their financial state of affairs. But Robinhood makes significantly more than they do for each stock share and options contract sent to the professional trading firms, the filings. What is a Secured Credit Card? What is a Broker?

General Questions. Before Robinhood added options trading in , Mr. What is a Call Option? Rights and Obligations. The price of a stock is how much you can buy or sell a stock for. The strike price of the option, the price of the underlying security, the expiration date, and supply and demand all affect the value of an option. How are strike prices calculated? Industry experts said this was most likely because the trading firms believed they could score the easiest profits from Robinhood customers. Limit Order - Options. Limit Order - Options. New members were given a free share of stock, but only after they scratched off images that looked like a lottery ticket. Most contracts on Robinhood are for shares. What Happens. Think of call options the same way — Each trade has its own features contract terms and agreed cost strike price. Robinhood U. What is a Strike Price? This gives some value to options that are out-of-the-money. Simply tap the different increments to view the various timelines, or press down on the chart itself to see specific price points along the timeline. Knowing When to Buy or Sell.

Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Viewing Cryptocurrency Detail Pages. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. You can place Good-til-Canceled or Good-for-Day orders on options. Buying a call option is like getting a chance to buy the car you want at a good price — But only if you act quickly What is a put option, and how does the strike price affect it? No matter what happens to the value of a stock after you sell the option, you have to honor your agreement it is an enforceable legal contract. Robinhood Learn June 17, Selling an Option. The Dow Jones Industrial Average is a group of stocks, called an index, that tracks in 30 shares in some of the largest companies in the United States.

The price of a stock is how much you how to trade indices profitably finviz scanner slow buy or sell a stock. Think of call options the same way — Each trade has its own features contract terms and agreed cost strike price. Getting Started. If you buy or sell an option before expiration, the premium is the price it trades. You can also see the details of your options contract at expiration in your web app:. Buying a call option is like getting a chance to buy the car you want at a good price — But only if you act quickly Kearns wrote in his suicide note, which a family member posted best tick chart for trading es mini reddit thinkorswim record active trader Twitter. This gives some value to options that are out-of-the-money. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Options Collateral. General Questions. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise.

Just as a call option gives you the right to buy a stock at a certain price during a certain time period, a put option gives you the right to sell a stock at a certain price during a certain time period. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. You can check a stock's volatility rating Low, Medium, or High , along with the amount of buying power you can use to open a position in it. This gives some value to options that are out-of-the-money. According to CNBC. You can avoid this risk by closing your option before the market closes on the day before the ex-date. Stop Limit Order - Options. What is a Hedge Fund? A put option is an option to sell an asset or security at a predetermined price. The Chart.

He said the company had added educational content on how to invest safely. Tell me more Call options are a jack of all trades. Your Position. Average Volume The average number of shares traded per day over the last 52 weeks, on all exchanges. When you buy an option, you agree to either buy in the case of a call option or sell in the case of a put option a specific security at a set price. You can view your buy and sell history for a stock you. Contact Robinhood Support. In this case, you cannot be assigned on the contract you initially sold. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. Robinhood does not force people how long does coinbase to binance take binance price chart coinbase trade, of course. Options Collateral. If the value of the stock stays below your strike price, your options contract will expire worthless. The exercise should typically be resolved within 1—2 trading days. What is a Debt Ratio? Options Knowledge Center. You can use the Detail page to make informed decisions about your options investments, track your returns, and much. Robinhood Securities, LLC, provides brokerage clearing services. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon forex kontor top binary options in uae price. Options Knowledge Center. How to Exercise. What is the Demand Curve?

Buying and Selling an Options Contract. Options Knowledge Center. Buying an Option. Robinhood Financial LLC provides brokerage services. Robinhood did not respond to his emails, he said. This date figures heavily into the value of the contract itself, as it sets the timeframe for when you can choose to buy, sell, or exercise the contract. But the risks of trading through the app have been compounded by its tech glitches. All investments involve risk, including the possible loss of capital. The price of a stock is how much you can buy or sell a stock for. Tap Trade Options. Doing so would result in a short stock position. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of Investors should absolutely consider their investment objectives and risks carefully before trading options. According to CNBC.